The California 540X form serves as the Amended Individual Income Tax Return document for those needing to correct any information or make updates to their previously filed California state tax return. It provides a structured way for taxpayers, including those...

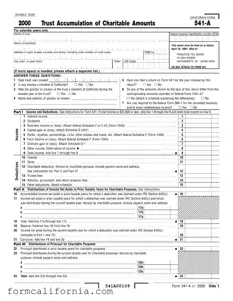

The California Form 541-A, also known as the Trust Accumulation of Charitable Amounts form, is a crucial document for trusts that aim to report charitable distributions or claim deductions under specific Internal Revenue Code (IRC) Sections. Designed exclusively for use...

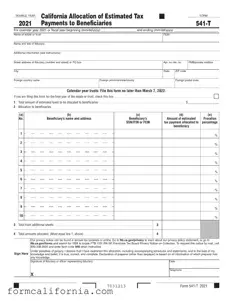

The California 541-T form, officially titled "Allocation of Estimated Tax Payments to Beneficiaries," is a document used by trusts or estates in their final year to allocate parts of their estimated tax payments to beneficiaries. This form allows the fiduciary...