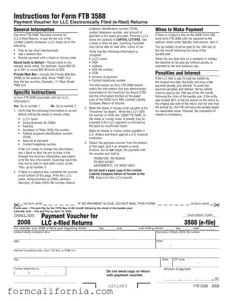

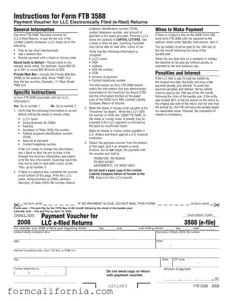

The California Form FTB 3588 is a payment voucher used by Limited Liability Companies (LLCs) to submit their tax payments electronically. Designed for LLCs that have filed their tax returns online and have a balance due, this form requires payment...

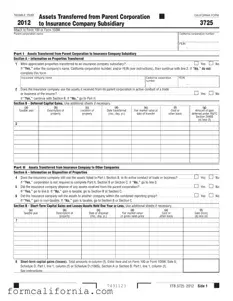

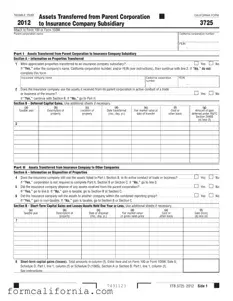

The California Form 3725 is a crucial document that businesses need to understand when they're dealing with asset transfers between a parent corporation and its insurance company subsidiary. It simplifies the process of reporting and tracking those assets, making it...

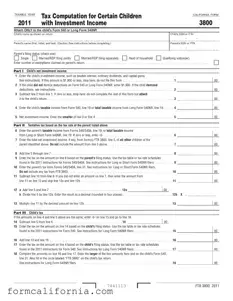

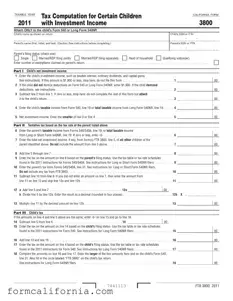

The California Form 3800, known as the "Tax Computation for Certain Children with Investment Income," is a tax form used for calculating the tax on investment income of certain children. This form is attached to the child’s Form 540 or...

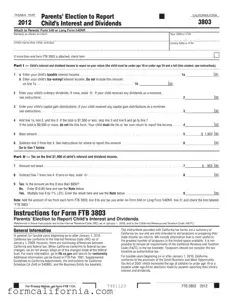

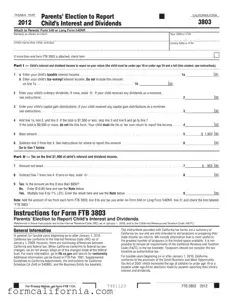

The California 3803 form, or 'Parents' Election to Report Child's Interest and Dividends,' is a state tax document used when parents choose to include their child's income from interest and dividends on their own tax return, rather than having the...

The California Form 3805Z serves as a comprehensive summary for deductions and credits related to enterprise zones, demanding attachment to a taxpayer's California tax return. It is expressly designed to facilitate various types of entities, ranging from individuals and trusts...

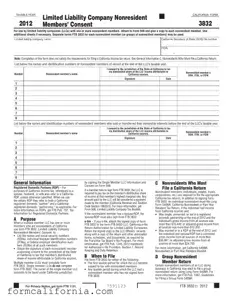

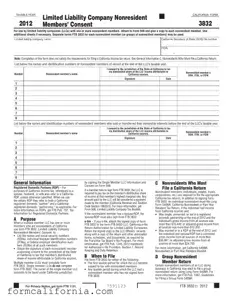

The California Form 3832, known as "Limited Liability Company Nonresident Members’ Consent," serves as a crucial document for limited liability companies (LLCs) with one or more nonresident members. It must be attached to Form 568 and distributed among each nonresident...

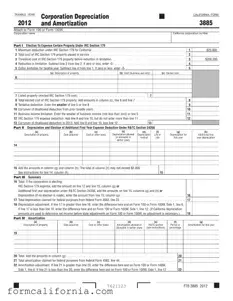

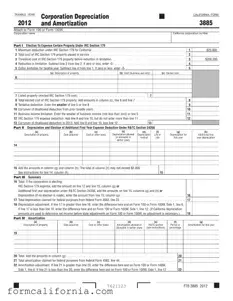

The California 3885 form, also known as the Corporation Depreciation and Amortization form, is a detailed document designed for corporations to calculate depreciation and amortization deductions on their state income tax returns. It outlines various sections including the Election To...

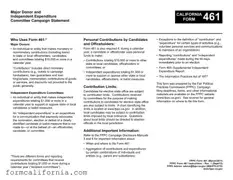

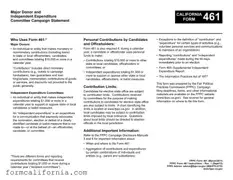

The California Form 461, known as the Major Donor and Independent Expenditure Committee Campaign Statement, is a critical document for individuals or entities engaging in significant financial contributions or expenditures within the political sphere of California. Specifically, it applies to...

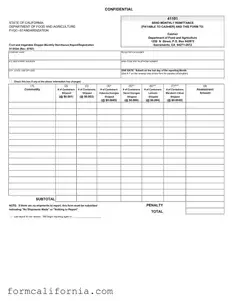

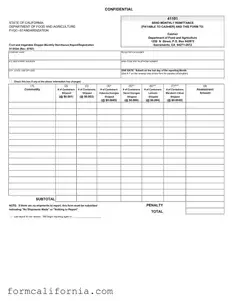

The California 51 055A form, provided by the State of California Department of Food and Agriculture, serves as a crucial document for fruit and vegetable shippers within the state. It functions as the Fruit and Vegetable Shipper Monthly Remittance Report/Registration,...

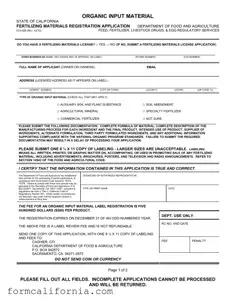

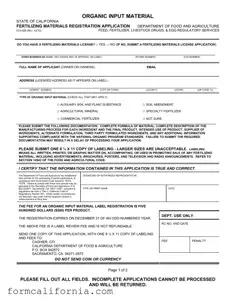

The California 513 026 form is a crucial document for anyone involved in the production and distribution of organic fertilizing materials within the state. This application, regulated by the Department of Food and Agriculture, is part of the Feed, Fertilizer,...

The California 540 C1 form is a comprehensive document used by residents for filing their state income tax return for the year 2012. It encompasses a wide range of information, from personal details to income, deductions, credits, and taxes owed...

The California 540 Schedule P form is essential for calculating the Alternative Minimum Tax (AMT) and credit limitations for residents within the state. Designed to ensure that taxpayers with significant deductions or exclusions contribute their fair share, it attaches directly...