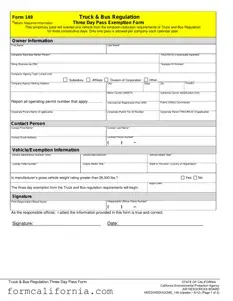

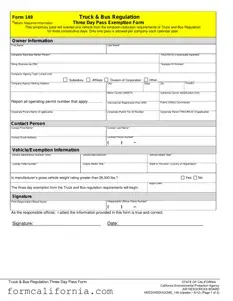

The California 149 form, also known as the Truck & Bus Regulation Three Day Pass Exemption Form, provides a temporary solution for fleet owners. It allows for the operation of one vehicle that does not meet the emission reduction requirements...

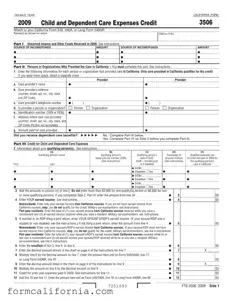

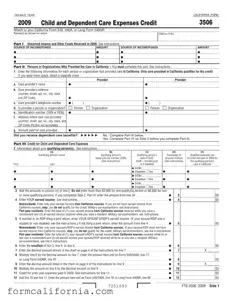

The California Form 3506, known as the Child and Dependent Care Expenses Credit form, is designed for residents to attach to their California Form 540, 540A, or Long Form 540NR. It assists individuals and families in claiming credit for child...

The California Form 3523, known as the Research Credit form, is a key document for businesses and individuals looking to claim tax credits for qualified research expenses incurred within the taxable year. It’s attached directly to the California tax return...

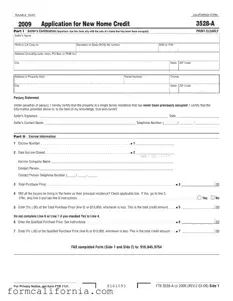

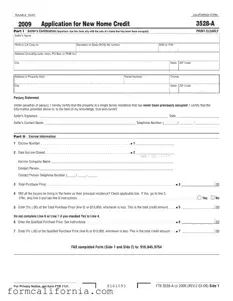

The California 3528 A form, officially titled "Application for New Home Credit," is designed for use in specific transactions involving the sale of homes in California that have not previously been occupied. Intended for the taxable year 2009, it facilitates...

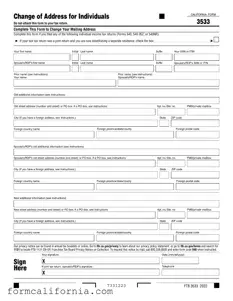

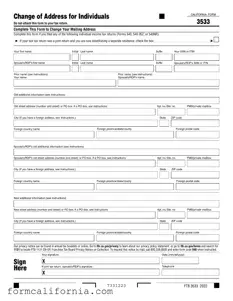

The California 3533 form is specifically designed for individuals needing to update their mailing address with the state's tax agency. It is required if you have previously filed California individual income tax returns using Forms 540, 540 2EZ, or 540NR...

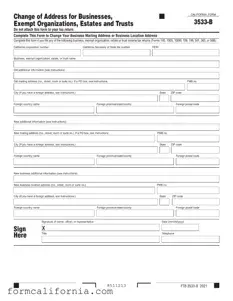

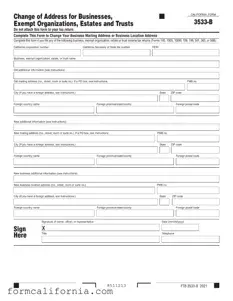

The California 3533 B form is designed for businesses, exempt organizations, estates, and trusts that need to report a change in either their business mailing address or location. This crucial form applies to a range of tax returns including Forms...

The California Form 3539 provides an automatic extension for corporations and exempt organizations unable to file their California tax returns by the original due date, ensuring they remain in compliance while managing their tax obligations. This extension allows entities to...

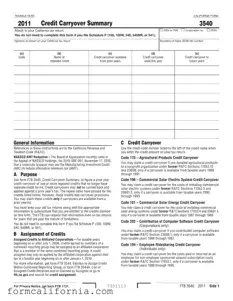

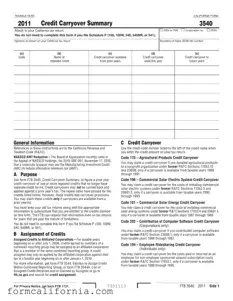

The California Form 3540, also known as the Credit Carryover Summary, plays a crucial role for individuals and entities looking to figure their prior year credit carryovers for specific repealed credits not covered by other forms. Essentially, it serves as...

The California Form 3541 is a crucial document for participants in the motion picture and television industry aiming to apply for the California Motion Picture and Television Production Credit. This form, attached to the tax return, serves as a comprehensive...

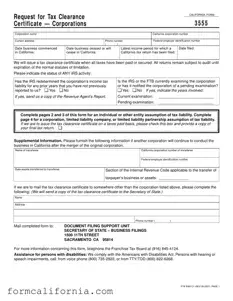

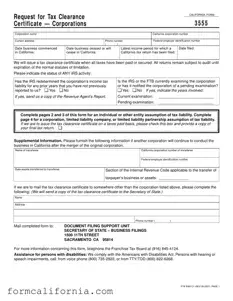

The California Form 3555, or the Request for Tax Clearance Certificate, is a crucial document for corporations in California. It is used when a corporation needs to obtain a certificate proving all state taxes have been paid or are secured...

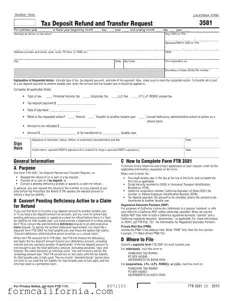

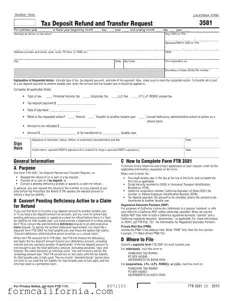

The California Form 3581 is designed for individuals and entities who need to request a refund or transfer of their tax deposit with the Franchise Tax Board (FTB). This form serves multiple purposes: requesting the refund of a tax deposit...

The California 3582 form is a payment voucher for individuals who file their tax returns electronically and have a balance due. Its purpose is to streamline the payment process, ensuring that electronic filers can easily pay any tax owed to...