Legal California Transfer-on-Death Deed Document

In California, individuals have the option to pass on real estate properties to their loved ones without the complexities of traditional methods, thanks to the Transfer-on-Death (TOD) Deed form. This legal instrument allows property owners to designate beneficiaries who will inherit their property upon the owner's death, bypassing the lengthy and often expensive probate process. The TOD Deed form must be completed correctly and recorded in the county where the property is located before the owner’s death to be effective. It offers the flexibility to revoke the deed or change beneficiaries at any point during the property owner's lifetime, provided the changes are formalized with the same level of formality as the initial deed. The TOD Deed stands out for its simplicity and cost-effectiveness, offering a straightforward path for property transfer that is an attractive option for many. However, understanding the specific requirements and potential implications of this estate planning tool is crucial for anyone considering its use.

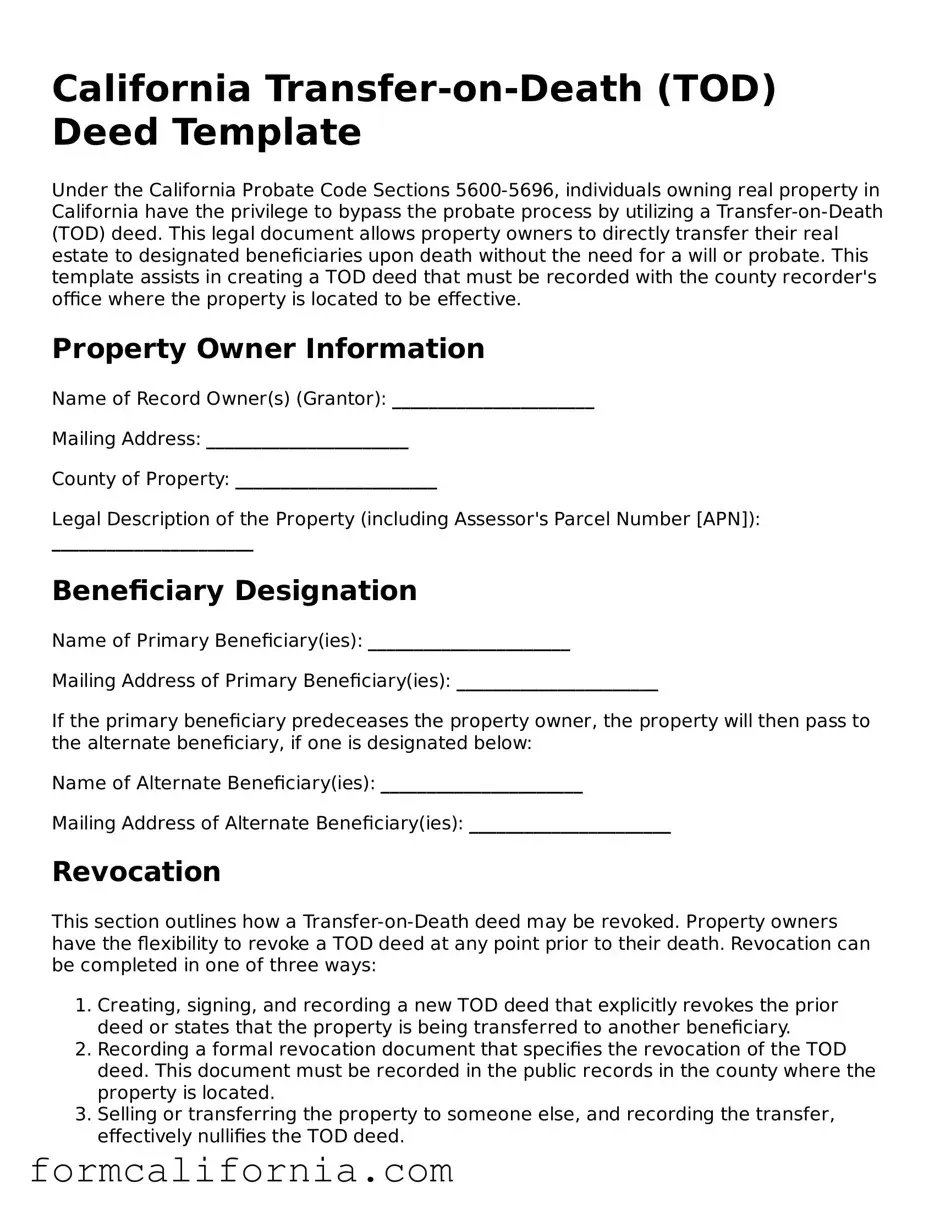

Document Preview Example

California Transfer-on-Death (TOD) Deed Template

Under the California Probate Code Sections 5600-5696, individuals owning real property in California have the privilege to bypass the probate process by utilizing a Transfer-on-Death (TOD) deed. This legal document allows property owners to directly transfer their real estate to designated beneficiaries upon death without the need for a will or probate. This template assists in creating a TOD deed that must be recorded with the county recorder's office where the property is located to be effective.

Property Owner Information

Name of Record Owner(s) (Grantor): ______________________

Mailing Address: ______________________

County of Property: ______________________

Legal Description of the Property (including Assessor's Parcel Number [APN]): ______________________

Beneficiary Designation

Name of Primary Beneficiary(ies): ______________________

Mailing Address of Primary Beneficiary(ies): ______________________

If the primary beneficiary predeceases the property owner, the property will then pass to the alternate beneficiary, if one is designated below:

Name of Alternate Beneficiary(ies): ______________________

Mailing Address of Alternate Beneficiary(ies): ______________________

Revocation

This section outlines how a Transfer-on-Death deed may be revoked. Property owners have the flexibility to revoke a TOD deed at any point prior to their death. Revocation can be completed in one of three ways:

- Creating, signing, and recording a new TOD deed that explicitly revokes the prior deed or states that the property is being transferred to another beneficiary.

- Recording a formal revocation document that specifies the revocation of the TOD deed. This document must be recorded in the public records in the county where the property is located.

- Selling or transferring the property to someone else, and recording the transfer, effectively nullifies the TOD deed.

Signature and Acknowledgement

By signing below, the record owner(s) affirm(s) that they intend to create a Transfer-on-Death deed as described above. It is understood that this deed does not take effect until the death of the owner(s) and that the owner(s) retains the right to revoke it at any time.

Date: ______________________

Signature: ______________________

State of California

County of ______________________

On ______________________ before me, ______________________, Notary Public, personally appeared ______________________, who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

PDF Form Characteristics

| Fact | Description |

|---|---|

| Legal Foundation | The California Transfer-on-Death (TOD) Deed is governed by California Probate Code sections 5600-5696, which allow property owners to bypass probate by directly transferring property to a beneficiary upon the owner's death. |

| Property Types Allowed | This deed can be used for real property in California, including single-family homes, condominiums, and certain types of agricultural land, but it cannot be used for commercial properties. |

| Revocability | The TOD deed is revocable, meaning the property owner can change their mind and revoke the deed at any time before their death without the beneficiary’s consent. |

| Effectiveness and Expiration | The deed only takes effect upon the death of the property owner, ensuring that the owner retains full control over the property during their lifetime. The deed automatically expires if not used within 60 days of execution. |

Detailed Instructions for Writing California Transfer-on-Death Deed

When life's certainties unfold, preparing for the future becomes paramount. One such preparation involves the transfer of one's real estate properties without the complexities of traditional legal processes. In California, this is where a Transfer-on-Death (TOD) deed comes into play. It's a legal document that allows property owners to name beneficiaries who will receive the property upon the owner's death, bypassing the need for probate. To ensure this crucial document serves its intended purpose, filling it out correctly is key. Follow the steps below to complete the California Transfer-on-Death Deed form accurately and with ease.

- Gather Required Information: Start by collecting all necessary details, including the legal description of the property, and the full names and addresses of all beneficiaries.

- Complete the Form: Fill in every section of the form, starting with your name as the property owner. Make sure to use the legal name that's on the current deed to the property.

- Describe the Property: Accurately describe the property as stated in the legal description. This information can be found on your current property deed or tax bill.

- Name Beneficiaries: Clearly print the full legal names of the beneficiaries who will inherit the property. Specify their relationship to you, and clarify how ownership is to be shared if there are multiple beneficiaries.

- Sign and Notarize the Deed: Sign the deed in the presence of a notary public. The notarization process is crucial as it validates the document.

- File the Deed: Once notarized, file the deed with the county recorder's office where the property is located. Be mindful of any filing fees required by your local office.

Once completed, the Transfer-on-Death deed silently waits, holding no effect during the property owner's life, allowing them full control over the property. Upon the unfortunate event of the owner's passing, this document springs into action, guiding the transfer of the property to the designated beneficiaries smoothly and without the need for probate court proceedings. This simple yet profound legal tool aids immensely in estate planning, providing peace of mind to property owners and their loved ones.

Things to Know About This Form

What is a Transfer-on-Death (TOD) Deed in California?

A Transfer-on-Death (TOD) Deed in California allows property owners to pass on their real estate property to a designated beneficiary upon their death, without the need for the property to go through probate. This legal document is effective upon the death of the property owner, making the transfer process quicker and less expensive for the beneficiary.

Who can use a TOD Deed in California?

Any individual who is of sound mind and owns real estate property in California can use a TOD Deed. This includes sole owners, joint tenants, and in some cases, trustees of a trust owning residential property that doesn’t exceed four housing units or agricultural land that does not exceed 40 acres.

How does one create a TOD Deed in California?

To create a TOD Deed in California, the property owner must complete a valid TOD Deed form that includes the legal description of the property, the name of the designated beneficiary, and must be signed by the property owner in the presence of a notary public. After notarization, the deed needs to be recorded with the county recorder's office where the property is located before the owner's death.

Can a TOD Deed be revoked or changed?

Yes, a TOD Deed can be revoked or changed at any time before the death of the property owner. There are several ways to revoke a TOD Deed, including:

- Creating and recording a new TOD Deed that states the revocation of the prior deed or names a new beneficiary.

- Selling or transferring the property to someone else, which automatically canciles the TOD Deed.

- Filing a formal revocation form with the county recorder's office where the original TOD Deed was filed.

What happens if the beneficiary predeceases the property owner?

If the beneficiary named in the TOD Deed dies before the property owner, the deed becomes ineffective unless an alternate beneficiary is named. In such cases, it is as if the TOD Deed was never created, and the property may be subjected to probate or pass according to the property owner’s will or California’s intestacy laws.

Is a TOD Deed the same as a will?

No, a TOD Deed is not the same as a will. A will is a document that outlines how a person wants their estate to be distributed after their death, which can include various assets. A TOD Deed, on the other hand, only applies to the specific piece of real estate property named in the deed and takes effect without going through probate. However, a will can override a TOD Deed if the property is mentioned specifically in the will.

What types of property can be transferred using a TOD Deed in California?

In California, a TOD Deed can be used to transfer:

- Single-family homes and condominium units

- Residential buildings with no more than four housing units

- Agricultural land not exceeding 40 acres that includes a single-family residence

Are there any fees associated with filing a TOD Deed?

Yes, there are fees associated with recording a TOD Deed with the county recorder's office. These fees vary by county and are subject to change. Property owners are encouraged to contact their local county recorder's office for the current fee schedule.

What are the tax implications of transferring property using a TOD Deed?

Transferring property using a TOD Deed may have certain tax implications for the beneficiary, including potential capital gains tax based on the property’s value at the time of the owner’s death. Property owners and beneficiaries should consult with a tax professional to understand the specific tax implications in their situation.

Does a TOD Deed protect the property from the owner's creditors?

No, a TOD Deed does not protect the property from the owner's creditors. Debts owed by the property owner at the time of their death must be settled, which could potentially involve the sale of the property despite the presence of a TOD Deed.

Common mistakes

When individuals attempt to navigate the process of transferring real estate upon their demise without the help of a professional, they frequently make errors. This is particularly true with the California Transfer-on-Death (TOD) Deed form. The purpose of the TOD deed is to allow property owners in California to pass on their real estate directly to beneficiaries without the need for a court-supervised probate process. Despite its intentions to simplify the transfer of property, there are common oversights that can complicate or invalidate the transfer. Here are six mistakes to avoid:

Not adhering to the specific form requirements: California law requires the use of a statutory form for the TOD deed to be valid. Filling out an incorrect form or missing required fields can invalidate the entire document.

Failing to describe the property accurately: The legal description of the property must match public records. An inaccurate or incomplete description can lead to disputes and potentially void the deed.

Overlooking the need for witness or notarization: While many documents can be completed without formal witnessing, the TOD deed must be notarized to be considered valid under California law. Some people forget this crucial step.

Not updating the deed after significant life changes: Beneficiary designations should be reviewed and updated following significant life events such as marriage, divorce, or the birth of a child. Failure to update can result in the property passing to an unintended party.

Assuming the TOD deed overrides other legal documents: A TOD deed does not supersede other forms of estate planning documents, such as a will or a trust. It's essential to ensure all documents are consistent to avoid conflict.

Incomplete or incorrect beneficiary designations: Names must be clearly identified without ambiguity. Using vague terms like "my children" without specifying names can lead to legal challenges.

It's always advisable to consult with an estate planning attorney or a professional experienced in California property law when preparing a Transfer-on-Death Deed. This can help ensure all legal requirements are met and that the property will transfer according to the owner's wishes.

Documents used along the form

When managing estate planning in California, employing a Transfer-on-Death Deed (TODD) can be a strategic tool for a smooth transition of property ownership upon the property owner's death, without the need for probate court processes. This document allows the property owner to designate a beneficiary who will receive the property upon the owner's death, streamlining the process significantly. However, ensuring a comprehensive estate plan often requires the use of additional forms and documents in conjunction with the TODD to address various aspects of an individual's assets and desires. Below are five such forms and documents commonly used alongside a Transfer-on-Death Deed in California.

- Last Will and Testament: This foundational estate planning document allows an individual to specify their wishes regarding the distribution of their assets, appointment of an executor, and guardians for any minor children. Even with a TODD in place, a Last Will and Testament covers assets not included in the TODD and clarifies the property owner's overall intentions.

- Financial Power of Attorney: This legal document grants a trusted person the authority to handle financial matters on behalf of the principal, should the principal become incapacitated. This can cover a wide range of tasks, from paying bills to managing investments, but it does not cover decisions regarding the transfer of real property upon death.

- Advance Health Care Directive: Also known as a medical power of attorney, this document allows an individual to designate a health care agent to make medical decisions on their behalf if they become unable to do so. Additionally, it can outline an individual’s preferences for medical treatments, end-of-life care, and organ donation.

- Proof of Death Certificate: Not necessarily a document prepared in advance like the others, a certified copy of the death certificate is often required to record the change of property ownership following the death of the property owner under a TODD. It is a crucial document for executing the intended transfer smoothly.

- Revocation of Transfer-on-Death Deed: If an individual decides to change or nullify the beneficiary designation made in a TODD, a Revocation of Transfer-on-Death Deed form must be completed and recorded. It allows property owners to maintain flexibility and control over their estate plans as circumstances change.

Together, these documents complement the California Transfer-on-Death Deed by providing a comprehensive approach to estate planning. They ensure that not only the property covered by the TODD but also other assets and personal wishes are carefully considered and addressed. The combination of these documents can offer peace of mind to property owners by knowing that their affairs are in order, their health care preferences are documented, and their financial responsibilities are managed, ensuring a clearer path for their beneficiaries and loved ones following their passing.

Similar forms

The California Transfer-on-Death Deed form shares similarities with a Living Trust, as both allow for the transfer of property to beneficiaries without the need for probate. A Living Trust provides a mechanism for managing one's assets during their lifetime and distributing them upon death, thus bypassing lengthy and costly probate proceedings, similar to the effect of a Transfer-on-Death Deed. However, a Living Trust offers more comprehensive control over various assets and can include detailed instructions for their management and distribution.

Comparable to the Transfer-on-Death (TOD) deed, a Last Will and Testament is a document used to designate beneficiaries for one's assets upon death. Both serve to specify heirs and distribute assets according to the deceased's wishes. The key difference lies in the probate process; while a Last Will necessitates probate to transfer assets, the TOD deed allows for the direct transfer of real property to a beneficiary, avoiding probate entirely.

A Joint Tenancy with Right of Survivorship agreement closely resembles a Transfer-on-Death Deed in the sense that both allow property to bypass probate and pass directly to the surviving owner(s) or designated beneficiary upon the death of the property owner. The main distinction is that Joint Tenancy involves shared ownership of property during the owner's lifetime, while a TOD deed does not become effective until the owner's death.

A Beneficiary Deed, much like the Transfer-on-Death Deed, is designed to transfer property to a beneficiary upon the death of the property owner, circumventing the probate process. These deeds are specifically used in certain states that recognize them, including California's TOD deed, and they both operate under the principle of allowing property owners to name beneficiaries directly within the deed.

The Payable-on-Death (POD) account is a financial tool that, while typically used for bank accounts and similar assets, shares the principle of bypassing probate with the Transfer-on-Death Deed. By naming a beneficiary to a POD account, the account’s assets are transferred directly to the named individual upon the account holder's death, analogous to how property is directly transferred through a TOD deed.

A Life Estate Deed facilitates the transfer of property upon death much like a Transfer-on-Death Deed, but with a notable distinction. It grants an individual the right to use, occupy, or gain income from the property during their lifetime, while designating a remainderman to inherit the property upon their death. This arrangement mirrors the TOD deed’s intent to bypass probate while incorporating a provision for the property's use during the owner’s life.

Similar to a Transfer-on-Death Deed, the Lady Bird Deed allows property owners to retain control over their property during their lifetime, including the ability to sell or mortgage, while still designating beneficiaries to inherit the property upon their death without going through probate. This type of deed is employed in some states as an estate planning tool, paralleling the TOD deed’s functionality while offering further control to the property owner during their lifetime.

The Revocable Transfer on Death (TOD) Deed is a specific variant similar in essence to the standard Transfer-on-Death Deed. It enables homeowners to name beneficiaries for their real estate, ensuring the property passes outside of probate upon their death. Both documents allow for the easy transfer of real estate to a designated beneficiary, but the revocable TOD deed underscores the owner's ability to alter or revoke the designation at any time prior to death, emphasizing flexibility in estate planning.

Dos and Don'ts

Navigating the California Transfer-on-Death (TOD) Deed form can be straightforward if you keep some important dos and don'ts in mind. This document allows property owners to pass their real estate directly to a beneficiary upon their death, bypassing the often lengthy and costly probate process. To ensure everything goes smoothly, here is a list of what you should and shouldn't do:

Do:

- Review the form and instructions thoroughly before filling anything out. Understanding each part can help prevent common mistakes that may cause delays or issues later on.

- Provide complete and accurate information about the property and the beneficiary. This includes the full legal description of the property and the correct legal names of all beneficiaries.

- Sign the deed in the presence of a notary public. In California, notarization is a legal requirement for the deed to be valid.

- Record the deed with the county recorder’s office in the county where the property is located. Filing the deed is crucial as it is not effective until it is officially recorded.

Don't:

- Attempt to use the TOD deed to transfer property that is held in joint tenancy or as community property with right of survivorship without consulting a legal professional. This could inadvertently affect the rights of the surviving owner.

- Forget to consider how the TOD deed fits into your broader estate plan. Ensure it aligns with your will and other estate planning documents to avoid any conflicts.

- Fill out the form without seeking advice if you have any doubts or specific questions. Consulting with an attorney who specializes in estate planning can provide tailored advice based on your unique situation.

- Ignore the need to update the deed if your circumstances change, such as if the beneficiary predeceases you or you acquire additional property. Keeping your TOD deed current ensures that your estate plan reflects your wishes.

Misconceptions

There are several misconceptions surrounding the California Transfer-on-Death (TOD) Deed form. It's important to clarify these misunderstandings to help individuals make informed decisions when considering their estate planning options:

All assets can be transferred using a TOD deed. This is a common misconception. In reality, the TOD deed can only be used to transfer specific types of real property, such as a home or building, and cannot be used to transfer personal property such as cars or bank account contents.

A TOD deed avoids probate for all your assets. While it is true that a TOD deed can help avoid probate for the particular piece of real property it covers, it does not avoid probate for other assets in the estate that do not have designated beneficiaries.

Creating a TOD deed is complicated. Many people believe that creating a TOD deed requires extensive legal help. However, California has made the process relatively straightforward by providing a statutory form that can be completed without the need for complex legal assistance. It is crucial, though, to follow the instructions carefully and ensure proper recording.

Once executed, a TOD deed cannot be revoked. This is not the case. The property owner retains the right to revoke a TOD deed at any time before their death, provided the revocation is done according to legal procedures.

The beneficiary needs to sign the TOD deed. There is no requirement for the beneficiary to sign the TOD deed. The deed becomes effective upon the death of the property owner, and the beneficiary's acceptance is not required for the deed to be executed.

A TOD deed protects the property from the owner’s creditors. Some people mistakenly believe that a TOD deed shields the property from any creditors the owner may have. In fact, the property can still be subject to claims by the owner's creditors after their death during the administration of their estate.

The TOD deed allows the beneficiary immediate access to the property upon the owner's death. While it is true that the TOD deed facilitates the transfer of property ownership without the need for probate, the beneficiary may still need to take certain legal steps, such as filing a change of ownership report, before assuming full control over the property.

Property transferred by a TOD deed receives a step-up in basis. Real property that transfers upon death generally receives a step-up in basis to the property's market value at the owner’s death. This misconception is partially correct but can vary depending on the specific circumstances and tax laws in effect at the time of the owner's death.

Married individuals must execute a TOD deed together. While spouses often plan their estates together, a TOD deed does not require both spouses to sign if the property is owned by one spouse as their separate property. For community property or property held in joint tenancy, the laws and requirements may differ, suggesting consultation with a legal professional.

Understanding these misconceptions can guide property owners in making informed decisions about their estate planning and the use of Transfer-on-Death Deeds in California.

Key takeaways

The California Transfer-on-Death (TOD) Deed form is a legal document that allows homeowners to pass on their property to a beneficiary without the property having to go through probate. When filled out correctly and recorded, it serves as a straightforward method to transfer real estate upon the passing of the property owner. Here are four key takeaways regarding filling out and using the California TOD Deed form:

- Accuracy is critical: Every detail on the TOD Deed form must be accurate, including the legal description of the property, the names of the beneficiaries, and the owner's signature. Even minor mistakes can invalidate the document, potentially leading to legal battles or the property having to go through probate after all.

- Notarization is a must: As with many legal documents related to property and estate planning, the TOD Deed must be notarized to be valid. This step confirms the identity of the person signing the document and their understanding of its contents.

- Recording is essential for validity: Merely filling out and notarizing the TOD Deed does not complete the process. For the deed to be effective and to actually transfer the property upon death, it must be recorded with the county recorder's office in the county where the property is located. If this step is overlooked, the deed will not be valid.

- Revocability offers flexibility: One of the benefits of a TOD Deed is its revocability. The property owner can change their mind at any time prior to their death. This can be done by filling out a new TOD Deed, recording a revocation form, or transferring the property to someone else during the owner’s lifetime. This flexibility allows property owners to adjust their estate planning as their wishes or circumstances change.

Understanding these key points about the California Transfer-on-Death Deed form can empower property owners to make informed decisions about managing their real estate assets and planning for the future. It is a powerful tool that, when used correctly, simplifies the process of transferring property to beneficiaries without the need for probate, saving time, money, and potential conflict.

More California Forms

Power of Attorney Form Los Angeles - A General Power of Attorney form allows someone to act on your behalf in various financial and business matters.

California Apartment Rental Application - The information collected helps landlords to predict the reliability and stability of applicants as tenants, safeguarding their property investment.