Legal California Tractor Bill of Sale Document

When buying or selling a tractor in California, a Tractor Bill of Sale form becomes an integral document that records the transaction in a legally binding manner. This form, while simple in nature, serves multiple key purposes. It provides proof of the transfer of ownership from the seller to the buyer, outlines the specific details of the tractor being sold including make, model, and serial number, and is often required for the registration process with local authorities. Furthermore, the form acts as a receipt for the transaction, detailing the agreed price and the date of sale. For both parties involved, the form offers peace of mind and legal protection, ensuring that the terms of the sale are clearly documented and agreed upon. Given its importance, understanding the form's components, and ensuring its accurate completion, is crucial for a smooth and dispute-free transfer of ownership.

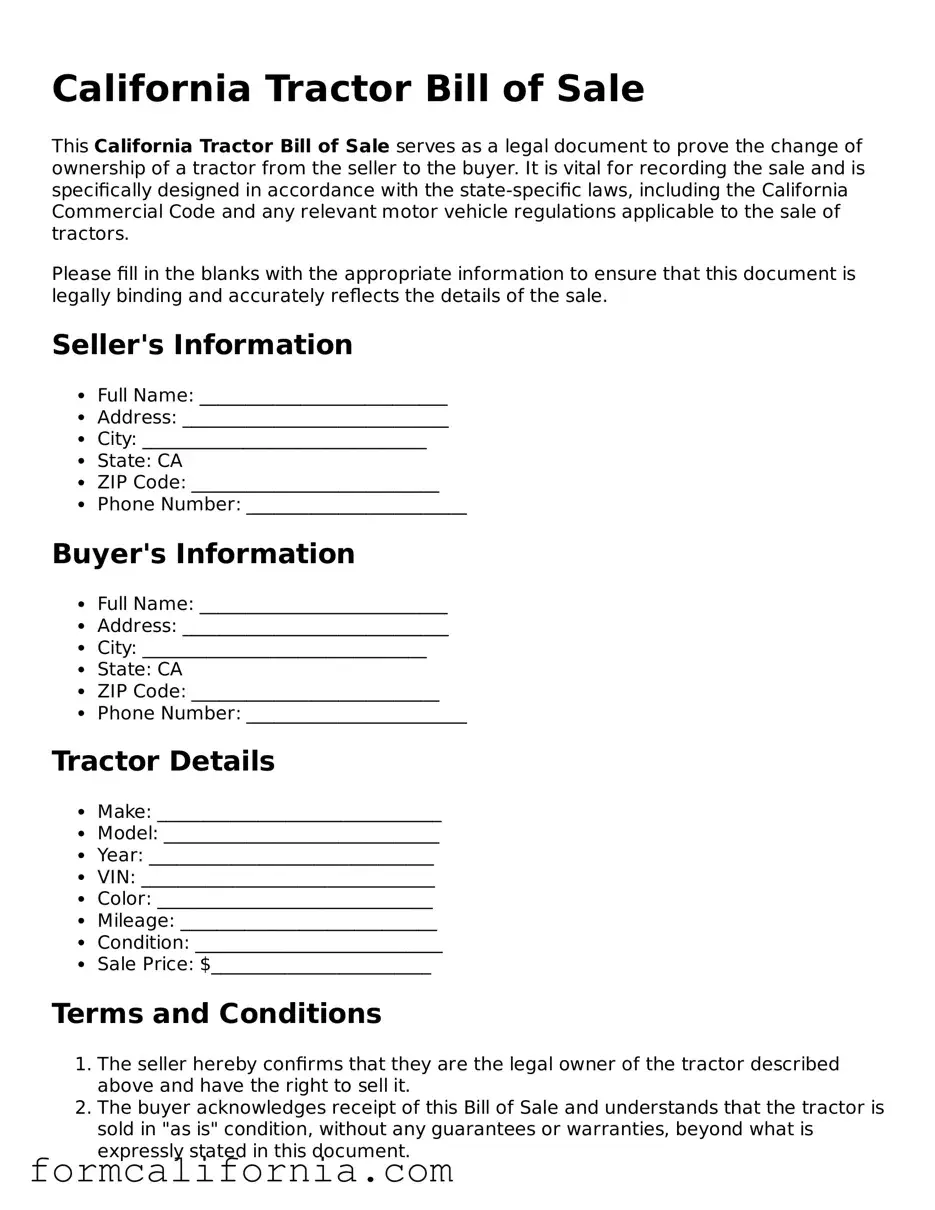

Document Preview Example

California Tractor Bill of Sale

This California Tractor Bill of Sale serves as a legal document to prove the change of ownership of a tractor from the seller to the buyer. It is vital for recording the sale and is specifically designed in accordance with the state-specific laws, including the California Commercial Code and any relevant motor vehicle regulations applicable to the sale of tractors.

Please fill in the blanks with the appropriate information to ensure that this document is legally binding and accurately reflects the details of the sale.

Seller's Information

- Full Name: ___________________________

- Address: _____________________________

- City: _______________________________

- State: CA

- ZIP Code: ___________________________

- Phone Number: ________________________

Buyer's Information

- Full Name: ___________________________

- Address: _____________________________

- City: _______________________________

- State: CA

- ZIP Code: ___________________________

- Phone Number: ________________________

Tractor Details

- Make: _______________________________

- Model: ______________________________

- Year: _______________________________

- VIN: ________________________________

- Color: ______________________________

- Mileage: ____________________________

- Condition: ___________________________

- Sale Price: $________________________

Terms and Conditions

- The seller hereby confirms that they are the legal owner of the tractor described above and have the right to sell it.

- The buyer acknowledges receipt of this Bill of Sale and understands that the tractor is sold in "as is" condition, without any guarantees or warranties, beyond what is expressly stated in this document.

- The full sale price of the tractor is as stated above, and the payment has been made by the buyer in the form of ___________________________________.

Signatures

Date: ___________________

Seller's Signature: ____________________________ Buyer's Signature: ____________________________

This document is not complete until both parties have signed.

Note: It is recommended that both parties keep a copy of this Bill of Sale for their records and to facilitate any future requirements such as registration or transfer of title.

PDF Form Characteristics

| Fact | Description |

|---|---|

| Definition | A document that records the sale of a tractor from a seller to a buyer in the state of California. |

| Primary Purpose | Serves as legal proof of the transaction and transfer of ownership. |

| Key Components | Typically includes details such as the make, model, year, serial number of the tractor, the sale date, and the sale price, along with the personal information of the buyer and seller. |

| Governing Law | Subject to California's laws and regulations concerning the sale of personal property, including the California Uniform Commercial Code (UCC). |

| Importance for Buyer and Seller | Provides a record of the sale for warranty, tax, and registration purposes. It can also protect both parties in the event of a dispute. |

| Notarization | Not mandatory in California but recommended to add legal validity and prevent fraud. |

Detailed Instructions for Writing California Tractor Bill of Sale

When completing the California Tractor Bill of Sale form, it's crucial to ensure accuracy and thoroughness. This document serves as a legal record of the sale and transfer of ownership of a tractor. By following the provided steps, both the seller and the buyer will contribute to a smooth and transparent transaction, safeguarding their rights and responsibilities. Once filled, the form should be kept by both parties as a proof of sale and for future reference.

- Begin by writing the date of the sale at the top of the form.

- Enter the full name and address of the seller in the designated area.

- Fill in the full name and address of the buyer next to the seller’s information.

- Describe the tractor being sold. Include the make, model, year, and serial number to ensure there's no confusion about the tractor in question.

- State the sale price of the tractor. This amount should be agreed upon by both the seller and buyer.

- If applicable, note any additional details or conditions of the sale. This might include information about warranty transfers, hours of operation, or specific inclusion or exclusion of accessories and tools.

- Both the seller and the buyer should sign and print their names at the bottom of the form to validate the agreement. Include the date next to the signatures.

By carefully following these steps, both parties will create a clear and effective record of their transaction. Remember, it's important for both the seller and the buyer to keep a copy of the completed California Tractor Bill of Sale form. This document acts as a receipt for the buyer, providing proof of ownership transfer, and helps the seller maintain a record of having legally sold the tractor. Ensuring that all information is correct and that the document is kept safe will offer peace of mind to both parties involved in the transaction.

Things to Know About This Form

What is a California Tractor Bill of Sale?

A California Tractor Bill of Sale is a legal document that records the sale of a tractor from one party (the seller) to another (the buyer) within the state of California. It provides proof of purchase and documents the transfer of ownership. This form typically includes details such as the tractor's description, the sale price, and the identities of both the buyer and the seller.

Why do I need a Tractor Bill of Sale in California?

There are several reasons to have a Tractor Bill of Sale in California:

- Legal Protection: It serves as a legal document that proves the ownership of the tractor.

- Registration: It may be required for the registration of the tractor with local authorities.

- Tax Purposes: It provides a record of the sale price for tax reporting purposes.

- Resolution of Disputes: It can help in resolving any future disputes over the tractor's ownership.

What information is included in a California Tractor Bill of Sale?

The form typically contains the following information:

- Seller's and buyer's names and addresses

- Description of the tractor (make, model, year, VIN)

- Date of sale

- Sale price

- Warranties or disclosures, if any

- Signatures of the seller, buyer, and a witness or notary public (if required)

Is notarization required for a Tractor Bill of Sale in California?

While notarization is not required by California law for a Tractor Bill of Sale to be considered valid, having the document notarized can add an extra layer of legal protection and authenticity to the transaction. It is recommended but not mandatory.

How can I obtain a Tractor Bill of Sale form in California?

You can obtain a Tractor Bill of Sale form by:

- Downloading a template from a reputable online legal forms provider

- Creating one yourself, as long as it contains all the necessary information

- Consulting with a legal professional to help draft a custom form tailored to your specific needs

Can I write a Tractor Bill of Sale by hand?

Yes, a hand-written Tractor Bill of Sale is legally valid in California as long as it contains all the necessary information and both parties sign it. Ensure that the writing is legible and all details are accurate to prevent any potential disputes.

What should I do after the sale is complete?

After completing the sale, both the buyer and seller should:

- Keep a copy of the Bill of Sale for their records

- The buyer should register the tractor with local authorities, if required

- Report the change of ownership to the California Department of Motor Vehicles (DMV), if applicable

Does a Tractor Bill of Sale need to be filed with any California state agencies?

While the Tractor Bill of Sale itself does not need to be filed with state agencies, it is used to facilitate the registration of the tractor or to document the change of ownership with the California DMV or similar local entities.

Can a Tractor Bill of Sale be used for other types of machinery?

While a Tractor Bill of Sale is specifically designed for tractors, similar forms can be used or adapted for the sale of other types of heavy machinery or equipment. However, it is important to ensure that any form used is suitable for the specific type of equipment and complies with any applicable California laws.

What if the tractor is being sold "as is"?

If a tractor is being sold "as is," this means that it is being sold without any warranties regarding its condition. This should be clearly stated in the Tractor Bill of Sale to ensure that the buyer understands they are accepting the tractor in its current state, and the seller will not be liable for any future issues or repairs.

Common mistakes

When filling out the California Tractor Bill of Sale form, people often rush through the process or overlook important details. This form is a crucial document that proves ownership and can protect both the buyer and the seller in a transaction. Avoiding common errors can save you from potential legal troubles or financial losses down the line. Here are five mistakes to watch out for:

- Not checking for accuracy. It's important to double-check all the information you include on the form. Mistakes in the tractor's description, such as the make, model, or serial number, can lead to issues in proving ownership or registering the tractor.

- Omitting lien information. If there's an outstanding lien on the tractor, this must be disclosed. Failing to include lien information can create legal complications for the buyer in the future.

- Skipping the buyer and seller's signatures. Both the buyer and the seller must sign the bill of sale to make it legally binding. Missing signatures can invalidate the document.

- Forgetting to specify the sale date and price. The date of the sale and the purchase price are essential details that provide proof of when the ownership was transferred and for how much. This information is also needed for tax purposes.

- Not keeping a copy. After completing the bill of sale, both the buyer and the seller should keep a copy for their records. A copy of this document can be vital for registration, tax, or legal reasons.

Avoiding these mistakes can make the transaction smoother and more secure for both parties involved. Remember, the California Tractor Bill of Sale form is not just a formality; it's a significant part of the tractor's sale and purchase process. Paying attention to detail and ensuring all the proper information and documentation is accurately and fully provided can prevent issues and misunderstandings in the future.

Documents used along the form

When it comes to purchasing or selling a tractor in California, the Bill of Sale form is a crucial document that officially records the transaction between the buyer and the seller. However, this form is often just one part of a larger packet of paperwork necessary for the sale. Various other documents may also be needed to ensure the deal complies with legal requirements, provides complete information about the sale, and protects both parties' interests. Here is a list of up to 10 other forms and documents that are frequently used alongside the California Tractor Bill of Sale form.

- Title Transfer Form: This form is necessary to legally transfer ownership of the tractor from the seller to the buyer. In California, this might include transferring the title through the Department of Motor Vehicles (DMV) or another relevant state agency.

- Sales Contract: A more detailed agreement than the Bill of Sale, a Sales Contract outlines the terms and conditions of the sale, including warranties, payment plans, and any other agreements between the buyer and seller.

- Disclosure Statements: Certain disclosures may be legally required, depending on the condition and history of the tractor. These can include any known defects or liens on the tractor.

- Loan Agreement: If the buyer is financing the purchase of the tractor, a Loan Agreement specifies the terms of the loan, including interest rates, payment schedule, and consequences of default.

- Release of Liability Form: This form releases the seller from liability for any accidents or injuries occurring with the tractor after the sale.

- Registration Forms: The buyer may need to submit specific forms to register the tractor with local or state authorities, especially if it will be used on public roads.

- Warranty Documents: If the sale includes a warranty, detailed warranty documents specify what is covered and for how long.

- Insurance Documents: Providing proof of insurance may be necessary at the time of sale, especially if the tractor is financed or will be used where insurance is legally required.

- Power of Attorney: In situations where the seller or buyer cannot be present to sign the forms, a Power of Attorney grants authority to another individual to sign on their behalf.

- Inspection Reports: An inspection report from a certified mechanic can give the buyer peace of mind about the condition of the tractor being purchased.

Each of these documents plays a role in ensuring the tractor sale is processed smoothly and legally, protecting both the buyer’s and seller’s interests. Depending on the specifics of the transaction, the situation of the seller, or the requirements of the buyer, not all these documents may be needed. However, being prepared with the right paperwork can make the process much more straightforward. Always consult with a professional if you have questions about what forms are necessary for your tractor sale in California.

Similar forms

The California Tractor Bill of Sale form is akin to the Vehicle Bill of Sale, which serves as an essential document in the process of buying and selling automobiles. Both documents act as legal proof of the transition of ownership from the seller to the buyer. They typically include comparable information such as the make, model, year, and identification number of the item being sold, as well as the names and signatures of the involved parties. Furthermore, they may contain terms of sale and acknowledge the receipt of payment, ultimately protecting both the buyer's and seller's interests in the transaction.

Similarly, the Boat Bill of Sale shares close resemblance with the Tractor Bill of Sale, as it is utilized in the sale and purchase of a boat. Despite the difference in the type of property being transferred, both documents fulfill the same legal function of recording the details of the transaction. Information such as the boat’s unique identification number, make, model, and year, alongside the sale price, and the particulars of the buyer and seller are typically recorded. This documentation is crucial not only for the immediate transfer of ownership but also for future registration and taxation purposes.

A General Bill of Sale is another document that parallels the Tractor Bill of Sale, serving as a broad instrument that can cover the sale of various items, not limited to vehicles or boats. Its versatility lies in its ability to document the sale of personal property such as furniture, electronics, or even livestock. Like the Tractor Bill of Sale, it includes critical details of the transaction, including a description of the item sold, the sale amount, and the details of the parties involved. It ensures a legally binding acknowledgment of the sale and purchase, applicable across a wide range of personal property transfers.

The Equipment Bill of Sale also bears similarity to the Tractor Bill of Sale by being specifically tailored for the sale of machinery and equipment. This can range from construction equipment to office machinery, aside from tractors. The document secures the transaction by detailing the equipment’s condition, make, model, serial number, and any other identifying characteristics, mirroring the specificity found in a Tractor Bill of Sale. By clearly defining the terms of the sale and the parties’ agreement, it provides a solid legal foundation for the transfer of ownership and helps mitigate future disputes.

Last but not least, the Livestock Bill of Sale is conceptually similar to the Tractor Bill of Sale, although it focuses on the sale of animals like cattle, horses, and other farm animals instead of inanimate objects. Both documents are pivotal in providing a clear record of the transaction, which includes the description of the sold item (or animal), the identity of the buyer and seller, the sale price, and any pertinent terms or conditions. They are crucial for legal, tax, and registration purposes, ensuring a smooth and indisputable transfer of ownership.

Dos and Don'ts

When filling out the California Tractor Bill of Sale form, it's important to ensure the document is completed correctly to avoid any issues with the sale or transfer of ownership. Here are some dos and don'ts to keep in mind:

Do:Check the form specifics for your state, ensuring the California Tractor Bill of Sale form complies with local regulations.

Include detailed information about the tractor, such as make, model, year, and serial number, to accurately describe the vehicle being sold.

Verify the accuracy of the buyer's and seller's information, including names, addresses, and contact details, to ensure everyone is properly identified.

Confirm the sale price and include it in the document to clearly state the agreement between the buyer and the seller.

Sign and date the form in front of a notary public if required by local laws, to add an extra layer of legal protection.

Keep a copy of the completed form for your records to have proof of the sale and transfer of ownership.

Review the entire form before signing to ensure all information is correct and complete.

State clearly if the tractor is being sold "as is" or with a warranty to avoid future disputes about the tractor's condition.

Provide a clear title to the buyer, if applicable, to legally transfer ownership.

Report the sale to the Department of Motor Vehicles (DMV) if required by your state’s laws, to officially document the transaction.

Leave any sections blank. If a section does not apply, mark it as "N/A" (not applicable) instead of leaving it empty.

Forget to check for any encumbrances or liens against the tractor, which can complicate the transfer of title to the buyer.

Use vague descriptions of the tractor. Specificity is key in detailing the vehicle's condition and features.

Rush through the process. Taking the time to double-check details can save you from potential legal and financial issues later on.

Omit necessary attachments or additional documents that may be required for the sale, such as service records or the original purchase agreement.

Overlook the necessity to verify the buyer's or seller's identity, as fraud can occur if identities are not properly vetted.

Assume a handshake agreement is sufficient; always get the agreement in writing with signatures to validate the sale.

Delay handing over the official documents to the buyer after the sale has been completed and the funds have transferred.

Disregard local laws and regulations about selling a tractor, which can result in fines or legal action.

Ignore the importance of a witness or notary, especially if your state requires this step for the sale to be legally binding.

Misconceptions

When it comes to the California Tractor Bill of Sale form, a flurry of misconceptions can mislead individuals navigating through the complexities of buying or selling a tractor. Clarification on these points ensures smoother transactions and legal compliance.

It's Just a Simple Form: Many believe the California Tractor Bill of Sale is merely a straightforward document requiring only basic information about the buyer and seller. However, it also mandates details about the tractor, such as make, model, year, serial number, and the sale price, ensuring a comprehensive record of the transaction.

Any Template Will Do: With the internet awash in generic forms, there's a common misconception that any bill of sale template suffices. But California may have specific requirements that generic forms don't meet, potentially invalidating your document.

Legal Representation Isn't Necessary: It's often thought that the process is so straightforward that legal advice isn't needed. While simple transactions might not require a lawyer, having one review your document can safeguard against legal pitfalls, especially in more complex sales or financing situations.

Notarization Is Mandatory: Contrary to some beliefs, notarizing a tractor bill of sale in California isn't a legal requirement. Although notarization adds a layer of authenticity, the lack thereof does not invalidate the form.

Only the Buyer or Seller Needs to Sign: Actually, both the buyer and seller should sign the bill of sale. Signatures from both parties are crucial for the document to hold legal weight, confirming the agreement has been mutually acknowledged.

It's Only Useful for Legal Disputes: While a bill of sale is indeed essential in legal disputes, its utility spans beyond. It also serves as a critical record for tax purposes, provides proof of ownership transfer, and assists in the registration process.

No Need to Mention Payment Details: Detailing the payment method and terms within the bill of sale is often overlooked. Specifying whether the payment was in cash, check, or another form, and if paid in full or installments, is vital for full transparency and financial clarity.

Once Signed, No Further Steps Are Needed: Signing the bill of sale is a significant step but not the final one. The buyer often needs to present this document for registration purposes, and both parties should retain copies for their records and potential future legal, tax, or warranty issues.

Properly understanding and executing the California Tractor Bill of Sale ensures that both parties are legally protected during and after the transaction. This document is an integral part of transferring ownership, and getting the details right can save a lot of headaches down the road.

Key takeaways

When handling the California Tractor Bill of Sale form, accuracy and thoroughness are crucial. This document serves as a legal record of the sale and transfer of ownership of a tractor. Below are key takeaways to ensure the process is completed smoothly and effectively:

- Fill in all sections completely. Leaving out information can invalidate the document. This includes details about the seller, buyer, and the tractor (make, model, year, and serial number).

- Verify the tractor's serial number. Before finalizing the sale, both parties should confirm that the serial number on the tractor matches the one listed on the bill of sale. This step is vital for ownership verification and may be required for registration purposes.

- Include the sale price and date. Accurately recording the sale price and the date of the transaction is essential for both tax purposes and future reference.

- Signatures are mandatory. The document must be signed by both the seller and the buyer. In some cases, witness signatures or notarization may be required for additional legal standing.

- Keep copies for your records. Both the seller and the buyer should keep a copy of the completed bill of sale. This document serves as proof of ownership transfer and may be needed for registration or tax purposes.

- Report the sale to the California Department of Motor Vehicles (DMV). It may be necessary to inform the DMV about the ownership transfer. Requirements vary, so checking with the local DMV can provide guidance.

- Understand it's a binding legal document. Once signed, the bill of sale becomes a legally binding agreement that confirms the sale and transfer of ownership. It's important to understand the commitments being made.

Adherenace to these guidelines ensures a smoother transaction and helps protect the rights and responsibilities of both parties involved in the sale.

More California Forms

How to Write a Cease and Desist - The letter specifies the details of the infringement or violation, making the recipient aware of their alleged wrongdoing.

Property Purchase Agreement Format - With provisions for resolving disputes and handling unexpected issues, it’s designed to streamline the property sale process and minimize risks for both parties involved.