Legal California Small Estate Affidavit Document

In the realm of estate management, the California Small Estate Affidavit form provides a streamlined route for asset transfer when a loved one passes without a will or with a modest estate. This legal document allows eligible individuals to claim assets of the deceased without the necessity of a prolonged probate process. Typically applicable to estates valued below a certain threshold, it presents an efficient manner to navigate the distribution of personal property, bank balances, and possibly real estate, under specific conditions. The form, requiring detailed information about the deceased and their assets, underscores the significance of accuracy and honesty in declarations. For those navigating the mourning process, understanding the eligibility criteria, the required documentation, and the procedural steps can lighten the bureaucratic load, making the California Small Estate Affidavit an invaluable tool in these trying times.

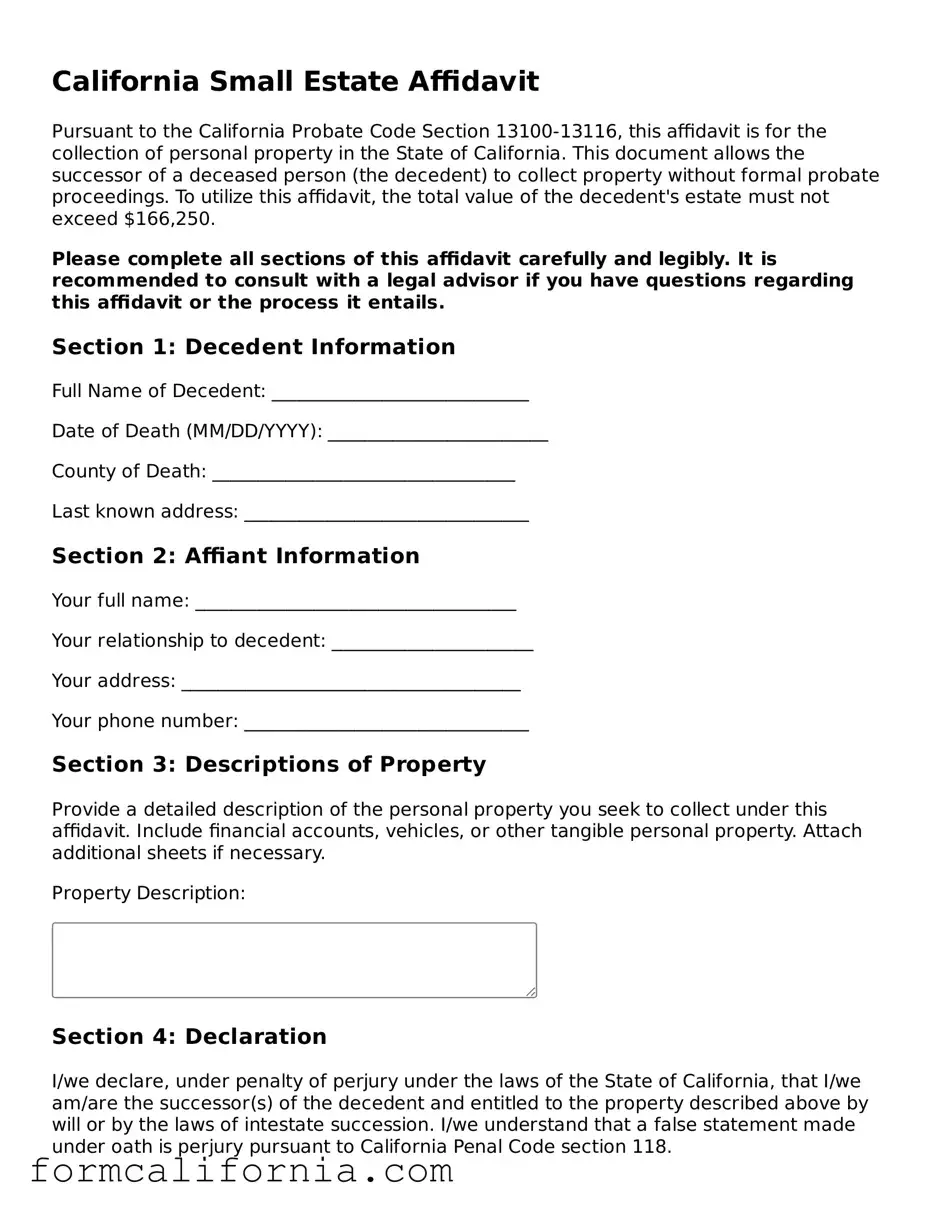

Document Preview Example

California Small Estate Affidavit

Pursuant to the California Probate Code Section 13100-13116, this affidavit is for the collection of personal property in the State of California. This document allows the successor of a deceased person (the decedent) to collect property without formal probate proceedings. To utilize this affidavit, the total value of the decedent's estate must not exceed $166,250.

Please complete all sections of this affidavit carefully and legibly. It is recommended to consult with a legal advisor if you have questions regarding this affidavit or the process it entails.

Section 1: Decedent Information

Full Name of Decedent: ____________________________

Date of Death (MM/DD/YYYY): ________________________

County of Death: _________________________________

Last known address: _______________________________

Section 2: Affiant Information

Your full name: ___________________________________

Your relationship to decedent: ______________________

Your address: _____________________________________

Your phone number: _______________________________

Section 3: Descriptions of Property

Provide a detailed description of the personal property you seek to collect under this affidavit. Include financial accounts, vehicles, or other tangible personal property. Attach additional sheets if necessary.

Property Description:

Section 4: Declaration

I/we declare, under penalty of perjury under the laws of the State of California, that I/we am/are the successor(s) of the decedent and entitled to the property described above by will or by the laws of intestate succession. I/we understand that a false statement made under oath is perjury pursuant to California Penal Code section 118.

Section 5: Signature

Date: ________________ Signature: _______________________________

Affiant's Printed Name: _________________________________________

Instructions for Use:

- Complete all sections of this affidavit with accurate information.

- Obtain the death certificate of the decedent.

- Prepare a detailed list of the personal property.

- If applicable, attach legal proof of your right to the property (e.g., will, trust document).

- Sign the affidavit in front of a notary public.

- Present this affidavit, along with the death certificate and any other required documents, to the holder of the property (e.g., bank, DMV).

This document does not require court approval but must be presented with all required attachments to the entity holding the decedent's property. Entities may require additional documentation or information before releasing any property.

It is vital to understand that this affidavit cannot be used until 40 days have elapsed since the death of the decedent. Ensure all information provided is truthful and accurate to avoid legal penalties.

PDF Form Characteristics

| Fact | Detail |

|---|---|

| Eligibility Criteria | The total value of the estate must not exceed $166,250 to use this form. |

| Waiting Period | There is a mandatory 40-day waiting period after the decedent’s death before the form can be filed. |

| Applicable Law | California Probate Code sections 13100-13116 govern the Small Estate Affidavit process. |

| Asset Types | This form can be used for personal property but not for real estate transactions. |

| Signatory Requirements | The affidavit must be signed by the successor of the decedent or a legally authorized representative. |

| Witness Policy | No witness signatures are required, but the form must be notarized. |

| No Court Involvement | If all requirements are met, transferring property can be done without court involvement. |

Detailed Instructions for Writing California Small Estate Affidavit

When a loved one passes away with a small estate in California, managing their assets without a formal probate can be simpler using the Small Estate Affidavit. This legal document allows the transfer of property to the rightful heirs without going through the lengthy probate process, provided the total value of the estate does not exceed certain limits defined by California law. Below, you'll find step-by-step instructions on how to properly fill out this form, ensuring the process is both efficient and compliant with legal requirements.

- Gather Required Information: Before starting, compile all necessary details about the deceased’s estate, including asset values, debtor information, and heir identities.

- Verify Eligibility: Confirm that the total value of the estate assets qualifies under the California Small Estate limit, which periodically changes. As of the last update, total asset value must be $166,250 or less.

- Identify the Form: Locate the correct Small Estate Affidavit form. California may have various forms depending on the asset type (e.g., personal property, real estate). Ensure you have the right one for your situation.

- Fill in Deceased Information: Enter the full name and date of death of the deceased, as well as any other identifying information the form requires.

- List the Assets: Detail each asset being transferred under the affidavit, including the asset’s description and fair market value. Make sure to adhere strictly to what is permissible under the law.

- Heir Information: Clearly identify all legal heirs, their relationship to the deceased, and the portion of the estate each is entitled to receive.

- Debts and Obligations: Disclose any outstanding debts or financial obligations of the deceased that may affect the estate’s assets.

- Sign and Notarize: After carefully reviewing the affidavit, all claimants must sign the document in the presence of a notary public. The notary will then notarize the form, making it legally binding.

- File with Relevant Entities: Finally, submit the completed and notarized affidavit to the institution holding the asset (e.g., bank, brokerage firm) or, if applicable, to the county recorder’s office for real estate assets.

Once the form is properly filled out and submitted, the assets covered by the Small Estate Affiliation can be transferred to the heirs. This process significantly simplifies estate management in qualifying cases, bypassing the need for more complex probate procedures. It’s worth noting, however, that this form does not circumvent the need to address and settle any outstanding debts the deceased may have had. Assets transferred using this affidavit may still be subject to claims by creditors, consistent with California law.

Things to Know About This Form

What is a California Small Estate Affidavit?

A California Small Estate Affidavit is a legal document used to manage and distribute a deceased person's estate without going through formal probate, if the total value of the estate does not exceed a certain amount. This process is designed to be a simpler, quicker alternative to probate for small estates.

Who is eligible to use a California Small Estate Affidavit?

Eligibility to use a California Small Estate Affidavit is generally determined by the total value of the deceased person's estate. As of the latest update, the estate must be valued at $166,250 or less. Potential claimants can be heirs, such as spouses or children, or designated beneficiaries on certain accounts.

What assets can be transferred using a California Small Estate Affidavit?

Various assets can be transferred using this affidavit, including:

- Personal property

- Bank accounts

- Securities

- Certain types of real estate under specific conditions

What steps are involved in using the California Small Estate Affidavit?

To use the affidavit, the claimant must:

- Ensure the estate's value qualifies under the threshold.

- Complete the Small Estate Affidavit form, providing detailed information about the deceased person’s assets.

- Sign the form in front of a notary public.

- Present the affidavit to the entity holding the asset (for example, a bank) to transfer ownership.

Are there any limitations to the California Small Estate Affididavit process?

Yes, there are limitations. Real estate transactions, for instance, may have additional requirements. Also, if the estate’s value exceeds the legal threshold or if there is a dispute among heirs, the affidavit cannot be used, and a formal probate process may be necessary.

Do I need an attorney to fill out a California Small Estate Affidavit?

While an attorney is not required to fill out a Small Estate Affidavit, consulting with one may be beneficial, especially if the estate includes complex assets or if there is potential for disputes among the heirs or beneficiaries. Legal advice can help avoid errors and ensure the process is handled correctly.

How does a California Small Estate Affidavit affect taxes?

The use of a Small Estate Affidavit itself does not directly affect taxes. However, the transfer of assets may have tax implications for the heirs or beneficiaries. It is important to consult with a tax professional to understand any potential tax liabilities that may arise from the transfer of estate assets.

Can a Small Estate Affidavit be contested?

Yes, a Small Estate Affidavit can be contested by anyone who has a legitimate interest in the estate, such as an omitted heir or creditor. If a dispute arises, it may be necessary to resolve the matter in court, which could lead to a more complicated and time-consuming process than initially anticipated.

Common mistakes

Filling out the California Small Estate Affidavit form can be a crucial step in managing a deceased person's assets without going through formal probate. However, even with the best intentions, people often make mistakes that can complicate the process. Here are nine common errors to avoid:

Not Waiting the Required Period: The form should not be filed until at least 40 days have passed since the death. People often rush to submit it earlier, which can invalidate the process.

Incorrectly Assessing the Value of the Estate: The total value of the decedent’s assets must not exceed the threshold defined by California law. Miscalculating this value can lead to the rejection of the affidavit.

Leaving Sections Blank: Every question and section on the form provides vital information. Skipping parts can lead to delays or outright dismissal of the affidavit.

Failing to Attach Necessary Documentation: Proper documentation, such as a certified copy of the death certificate and proof of the asset's value, must accompany the affidavit. Neglecting this step undermines the affidavit’s validity.

Misunderstanding Who Can File: Not everyone is eligible to file a Small Estate Affidavit. Only certain relations or parties with a valid claim can legally submit this form on behalf of the estate.

Incorrectly Identifying the Assets: Assets must be clearly and accurately described. Failing to do so can confuse or mislead financial institutions, potentially freezing the assets.

Mixing Separate and Community Property: Understanding and correctly identifying what constitutes separate versus community property under California law is essential. Incorrect classifications can affect the accuracy and legality of the affidavit.

Forgetting to Sign in the Presence of a Notary Public: The affidavit requires notarization. Signing the document without a notary present is a mistake that renders the document unofficial and invalid.

Lacking Witnesses When Applicable: In some cases, witness signatures may be necessary. Overlooking this requirement can invalidate the affidavit.

Avoiding these mistakes can streamline the process, ensuring the assets are distributed as smoothly and quickly as possible. When in doubt, consulting with a legal professional familiar with California law can provide clarity and direction, helping to navigate the complexities of the Small Estate Affidavit form.

Documents used along the form

When navigating the aftermath of a loved one's passing, handling their estate with care and legality is paramount. In California, small estates may be processed using an affidavit, simplifying the probate process. However, the California Small Estate Affidavit form is often just one part of a larger packet of documents that may be required or helpful in these circumstances. The following documents are commonly used in conjunction with this form, each serving a specific role in the estate management process.

- Death Certificate: This official document certifies the death, showing the date, location, and cause. It's often required to prove the death has occurred legally, allowing for the transfer of assets.

- Will: If the deceased left a will, it outlines their wishes regarding the distribution of their assets. While a small estate affidavit can bypass formal probate, a will can specify particular distributions that might need to be considered.

- Trust Documents: For estates involving a trust, these documents are vital. They delineate the terms of the trust, identify beneficiaries, and provide instructions for the distribution of assets contained within the trust.

- Inventory and Appraisal Form: An itemized list and appraisal of the deceased's assets may be required. This includes real estate, vehicles, stocks, and personal belongings, aiding in the valuation of the estate.

- Property Title or Deed: For real estate or vehicles owned by the deceased, the title or deed proves ownership. Transferring these assets to beneficiaries or legally selling them necessitates these documents.

- Bank Statements: To access or distribute the deceased's financial accounts, recent bank statements may be needed. They provide a snapshot of the estate's assets at the time of death.

- Outstanding Bills or Debt Statements: Understanding the deceased's outstanding debts is crucial. These statements help ensure that valid debts are paid from the estate before distribution to beneficiaries.

- Beneficiary Designation Forms: These forms indicate who the deceased designated as beneficiaries on specific accounts (like retirement accounts) or insurance policies, potentially outside the terms of a will or trust.

While dealing with loss is never easy, having a comprehensive understanding and gathering of important documents can streamline the necessary legal processes. Each document plays a crucial role in ensuring that the estate is settled appropriately and in accordance with the deceased's wishes and legal requirements. Proper preparation and knowledge can help bring peace of mind during a difficult time.

Similar forms

The California Small Estate Affidavit is closely related to a Transfer on Death Deed (TODD). Both serve as instruments to expedite the transfer of property upon the death of the property owner. While the Small Estate Affidavit is used for the general assets of a deceased individual, the TODD specifically applies to real estate. This document allows homeowners to name beneficiaries who will inherit the property without going through the probate process, mirroring the simplification intent of the Small Estate Affidavit.

A Life Insurance Beneficiary Designation form is another document that shares commonalities with the California Small Estate Affidavit. This form enables an individual to designate beneficiaries who will receive the life insurance proceeds upon their death. Like the Small Estate Affidavit, it bypasses the probate court, facilitating a direct transfer of assets (in this case, life insurance proceeds) to the named beneficiaries.

The Payable on Death (POD) account designation is akin to the Small Estate Affidavit in its function of passing assets directly to beneficiaries, thereby avoiding probate. Often used with bank accounts, a POD designation allows account holders to specify individuals who will receive the funds in the account upon the holder's death. The simplicity and directness of this transfer method mirror those of the Small Estate Affidavit in managing estate affairs outside of probate court.

A Joint Tenancy with Right of Survivorship (JTWROS) agreement provides a parallel to the California Small Estate Affidavit regarding real estate and certain types of personal property. In a JTWROS, co-owners hold an equal share of the property, and upon the death of one owner, their share automatically transfers to the surviving co-owner(s), excluding it from probate. This mechanism of bypassing the probate process shares the same goal as the Small Estate Affidavit, aiming for a direct and straightforward transfer of assets.

The Revocable Living Trust is another document that has similarities with the California Small Estate Affidavit. It is a legal arrangement where assets are placed in a trust for the benefit of the beneficiaries, to be transferred upon the trust maker’s death. This avoids the probate process altogether, paralleling the objective of the Small Estate Affidavit with its design to simplify and speed up the transfer of the decedent's assets.

The Gift Deed is a legal instrument used to give away assets or property to another person without any consideration or payment. Like the Small Estate Affidavit, it can transfer property rights efficiently and quickly, albeit under different circumstances. While the Affidavit is utilized after death, the Gift Deed operates during the lifetime of the giver, but both streamline the process of transferring property rights without the need for probate proceedings.

The Durable Power of Attorney for Finances is akin to the Small Estate Affidavit in that it addresses the management and distribution of an individual's assets, but it does so during the individual's lifetime. It grants a designated person the authority to handle financial affairs should the individual become incapacitated. Similar to how the Small Estate Affidavit streamlines asset transfer after death, the Durable Power of Attorney simplifies the management of one's estate during their lifetime, potentially reducing the estate's complexity at the time of death.

Lastly, the Advance Health Care Directive has parallels with the California Small Estate Affidavit in its preemptive approach to managing aspects of an individual’s affairs. While the Advance Health Care Directive focuses on health care decisions rather than asset transfer, it similarly seeks to bypass prolonged deliberation processes—in this case, medical rather than probate—by directly detailing the individual's wishes regarding life-sustaining treatment and end-of-life care. Both documents aim to clarify intentions and streamline processes relevant to life’s pivotal moments.

Dos and Don'ts

Completing the California Small Estate Affidavit form requires a careful approach to ensure compliance with state laws and regulations. This form is often used to streamline the process of transferring property from a deceased person's estate to their rightful heirs without formal probate. Below are essential do's and don'ts to consider when filling out this document.

- Do thoroughly read the entire form before starting to ensure a clear understanding of all requirements and instructions.

- Do verify eligibility for using the Small Estate Affidavit procedure in California, taking into account the total value of the estate and the specific assets involved.

- Do gather all necessary documents, such as death certificates and asset statements, before beginning to fill out the form to ensure accuracy and consistency in the reported information.

- Do include detailed descriptions of the property being transferred, including account numbers, vehicle identification numbers (VINs), and physical addresses, to avoid any ambiguity.

- Do ensure that all heirs or beneficiaries required to sign the affidavit have done so, and their signatures are notarized, as this is often a requirement for the form to be considered valid.

- Don't attempt to use the Small Estate Affidavit form for property that must go through formal probate in California, such as estates exceeding the current monetary threshold established by state law.

- Don't provide inaccurate or incomplete information about the deceased's assets, as this could lead to legal challenges or delays in transferring property.

- Don't forget to file the completed affidavit with the appropriate court or entity, such as a bank or the Department of Motor Vehicles, depending on the type of property being transferred.

- Don't overlook the necessity of keeping copies of the completed affidavit and any correspondence or documents submitted with it for personal records and future reference.

Adhering to these guidelines can help simplify the process of utilizing the Small Estate Affidavit in California, ensuring a smoother transfer of assets and minimizing potential legal complications.

Misconceptions

When it comes to the California Small Estate Affidavit form, several misconceptions can lead to confusion or errors in its use. Understanding these misconceptions is crucial for managing estates efficiently and accurately.

All assets can bypass probate with a Small Estate Affidavit. Not all assets are eligible for transfer through this affidavit. The form is designed for estates valued at $166,250 or less, not including certain assets such as those held in joint tenancy, payable-on-death accounts, or those already in trust.

There is no waiting period to use the affidavit. In California, a 40-day waiting period is required after the death before the Small Estate Affidavit can be used. This wait ensures all claims and debts are accounted for and that no other probate process is necessary.

Using a Small Estate Affidavit transfers assets immediately. While this procedure is typically faster than formal probate, it does not result in immediate transfer. Financial institutions and other entities may require additional documentation or their own processing time after receiving the affidavit.

Any family member can complete the affidavit. California law specifies who can file a Small Estate Affidavit, prioritizing spouses and registered domestic partners. If neither is available, other next of kin may be eligible, but not all family members have the right to use this form.

There’s no need for a lawyer when using a Small Estate Affidavit. While it's true that the process is designed to be straightforward, legal complexities can still arise. Issues such as disputes over asset distribution, deciphering eligibility, or handling debts often require professional legal advice to navigate effectively.

Key takeaways

When dealing with the estate of someone who has passed away, you might consider using the California Small Estate Affidavit form. This document can simplify the process significantly. Here are eight key takeaways to help guide you through filling out and using this form effectively:

- Make sure the estate qualifies by ensuring its total value doesn't exceed $166,250. This includes most personal property but excludes property outside of California, some types of joint tenancy property, and other assets passing directly to beneficiaries.

- The deceased must have passed away at least 40 days before you can use the affidavit to claim property. This waiting period allows for all claims against the estate to be accounted for.

- Gather all necessary information before you begin, such as a certified copy of the death certificate, a detailed list of the estate's assets, and any debts. This will streamline the process.

- The affidavit requires you to swear under oath to your relationship to the deceased and your rightful claim to the property. Accurate representation is critical to avoid legal repercussions.

- You must notify other potential heirs when you intend to use the affidavit. This notification process is important to prevent disputes and is legally required.

- There's no need for a formal probate proceeding with the affidavit, making it a quicker and less expensive way to settle small estates. However, understand that this process is limited to estates within the specified value range.

- Once completed, the affidavit must be presented to the institution holding the property (such as a bank) along with a death certificate. You might also need an Inventory and Appraisal form for certain types of property.

- Real estate transactions cannot typically be handled using the small estate affidavit. There are other procedures for transferring real estate without formal probate in California, so be sure to research or consult with a professional if this applies.

Ultimately, utilizing the California Small Estate Affidavit form can expedite access to the deceased's assets, reducing the time and financial burden often associated with estate settlement. Careful preparation and adherence to the rules ensure the process goes smoothly for all involved.

More California Forms

Free Lease Agreement California - Specifies occupancy limits, ensuring that only individuals stated in the agreement reside in the property, maintaining its security and condition.

Durable Power of Attorney Forms - It allows you to choose a trusted person, known as an agent or attorney-in-fact, to act in your place.