Blank Schedule California 540 PDF Form

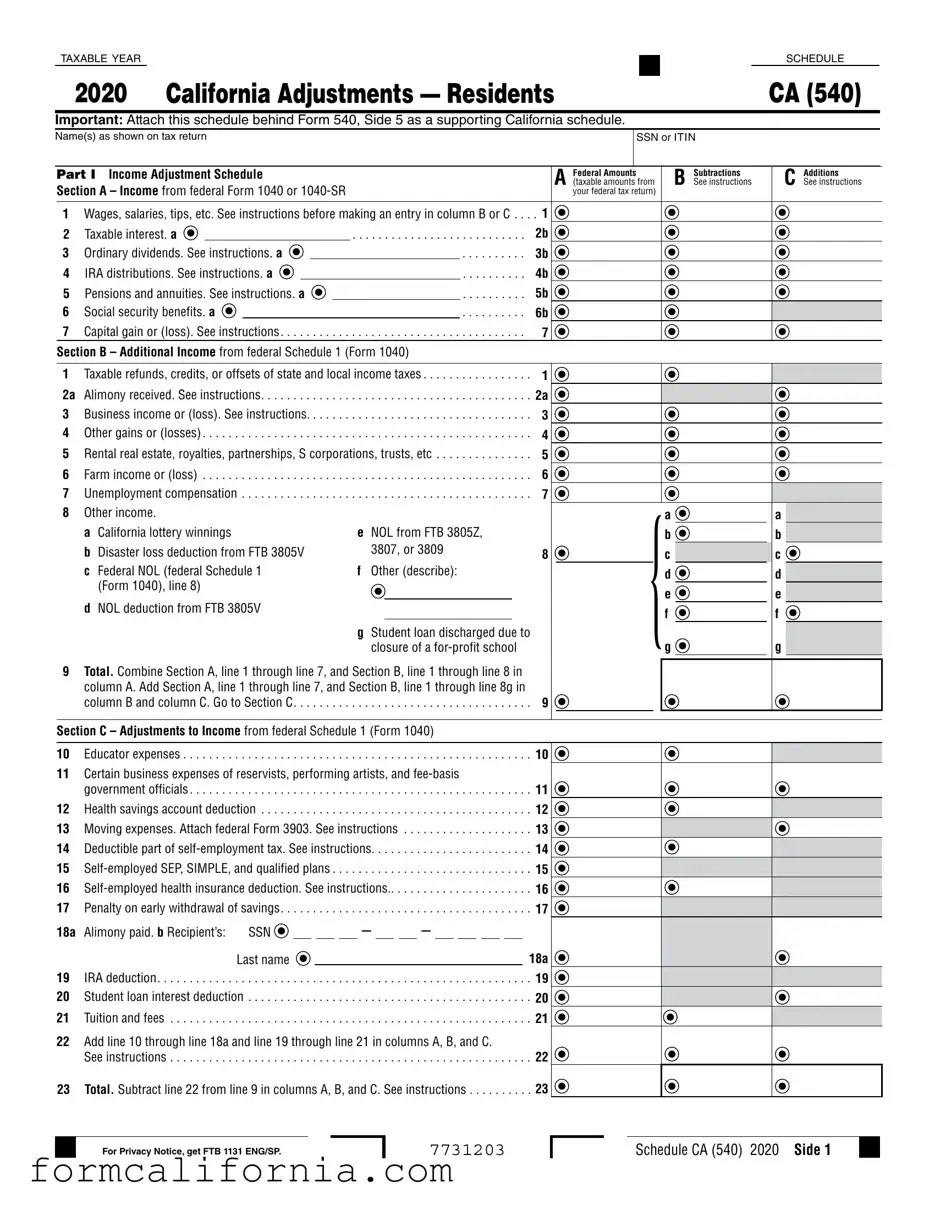

Every year, individuals residing in California navigate through the complexities of tax reporting with the aid of various forms, Schedule California 540 being a paramount example. Acting as a critical supplement to Form 540, this document is meticulously designed to reconcile federal and state tax discrepancies, ensuring Californians accurately adjust their incomes and deductions to meet state-specific requirements. With categorizations sprawling from wages and interests to more intricate financial particulars like IRA distributions, pensions, and annuities, the form delves into granular adjustments to ensure a thorough state tax calculation. Moreover, it extends to cover modifications in itemized deductions, featuring detailed sections on medical expenses, taxes paid, interests, charitable gifts, and miscellaneous deductions, thereby accommodating a broad spectrum of financial scenarios. Unique adjustments, such as those for educator expenses, business expenses for reservists, and health savings account deductions, underscore the state's consideration of varied taxpayer situations. This nuanced approach to tax adjustments exemplifies the intricate balance between federal and state tax obligations, catering to the diverse economic landscapes residents face. Through a systematic breakdown of income adjustments and deductions customization, Schedule CA (540) embodies a crucial tool in the tax preparation process, echoing the intricate tapestry of California's tax regulation framework.

Document Preview Example

TAXABLE YEAR |

|

|

SCHEDULE |

|

|

|

|

2020 California Adjustments — Residents |

CA (540) |

||

Important: Attach this schedule behind Form 540, Side 5 as a supporting California schedule.

Name(s) as shown on tax return

SSN or ITIN

|

Part I |

Income Adjustment Schedule |

|

|

|

|

|

|

A |

Federal Amounts |

B |

Subtractions |

C |

Additions |

|||||||||||

|

Section A – Income from federal Form 1040 or |

|

|

|

|

|

|

(taxable amounts from |

See instructions |

See instructions |

|||||||||||||||

|

|

|

|

|

|

|

|

|

your federal tax return) |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

1 |

Wages, salaries, tips, etc. See instructions before making an entry in column B or C . . . |

. 1 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

2 |

Taxable interest. a |

|

. . . |

. . |

. . . . . . . . . . . . |

. . . . . . . . |

. . |

2b |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

3 |

Ordinary dividends. See instructions. a |

|

|

|

|

. . . . . . . . |

. . |

3b |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

4 IRA distributions. See instructions. a |

|

|

|

|

|

|

4b |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

. . . . . . . . |

. . |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

5 Pensions and annuities. See instructions. a |

|

|

|

|

. . . . . . . . |

. . |

5b |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

6 |

Social security benefits. a |

|

|

|

|

. . . . . . . . |

. . |

6b |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

7 |

Capital gain or (loss). See instructions |

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

. . . . . . . . . . . . . . |

. . . . . . . . |

. . |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Section B – Additional Income from federal Schedule 1 (Form 1040) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

1 |

Taxable refunds, credits, or offsets of state and local income taxes |

1 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

2a |

. . . . . . . . . . . . . . . . .Alimony received. See instructions |

. . . . . . . . . . . . . . |

. . . . . . . . |

. . . |

2a |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

3 |

. . . . . . . . . .Business income or (loss). See instructions |

. . . . . . . . . . . . . . |

. . . . . . . . |

. . . |

3 |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

4 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Other gains or (losses) |

. . . . . . . . |

. . . |

4 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

5 |

. . . . . . . . . . . . . . .Rental real estate, royalties, partnerships, S corporations, trusts, etc |

5 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

6 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Farm income or (loss) |

. . . . . . . . |

. . . |

6 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

7 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Unemployment compensation |

. . . . . . . . |

. . . |

7 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

8 |

Other income. |

|

|

|

|

|

|

|

|

|

|

a |

|

|

|

a |

|

|

||||||

|

|

a |

California lottery winnings |

e |

NOL from FTB 3805Z, |

|

|

|

|

|

b |

|

|

|

b |

|

|

||||||||

|

|

b |

Disaster loss deduction from FTB 3805V |

|

3807, or 3809 |

8 |

|

|

|

|

c |

|

|

|

c |

|

|

||||||||

|

|

c |

Federal NOL (federal Schedule 1 |

f |

Other (describe): |

|

|

|

|

|

d |

|

|

|

d |

|

|

||||||||

|

|

|

(Form 1040), line 8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

e |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

d |

NOL deduction from FTB 3805V |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

f |

|

|

f |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

g |

Student loan discharged due to |

|

|

|

{g |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

closure of a |

|

|

|

|

|

g |

|

|||||||||

|

9 |

Total. Combine Section A, line 1 through line 7, and Section B, line 1 through line 8 in |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

column A. Add Section A, line 1 through line 7, and Section B, line 1 through line 8g in |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

column B and column C. Go to Section C |

. . . . . . . . . . . . . . |

. . . . . . . . |

. . . |

9 |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section C – Adjustments to Income from federal Schedule 1 (Form 1040)

10 Educator expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11Certain business expenses of reservists, performing artists, and

|

government officials |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 11 |

12 |

Health savings account deduction |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 12 |

|

13 |

Moving expenses. Attach federal Form 3903. See instructions . . . |

. . . . . . . . . . . . . . . . . 13 |

||

14 |

Deductible part of |

. . . . . . . . . . . . . . . . . 14 |

||

15 |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 15 |

||

16 |

||||

17 |

Penalty on early withdrawal of savings |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 17 |

|

18a |

Alimony paid. b Recipient’s: |

SSN |

– |

– |

|

|

Last name |

|

18a |

19 |

IRA deduction |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 19 |

20 |

Student loan interest deduction |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 20 |

|

21 |

Tuition and fees |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 21 |

22Add line 10 through line 18a and line 19 through line 21 in columns A, B, and C.

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

23 Total. Subtract line 22 from line 9 in columns A, B, and C. See instructions . . . . . . . . . . 23

For Privacy Notice, get FTB 1131 ENG/SP.

7731203

Schedule CA (540) 2020 Side 1

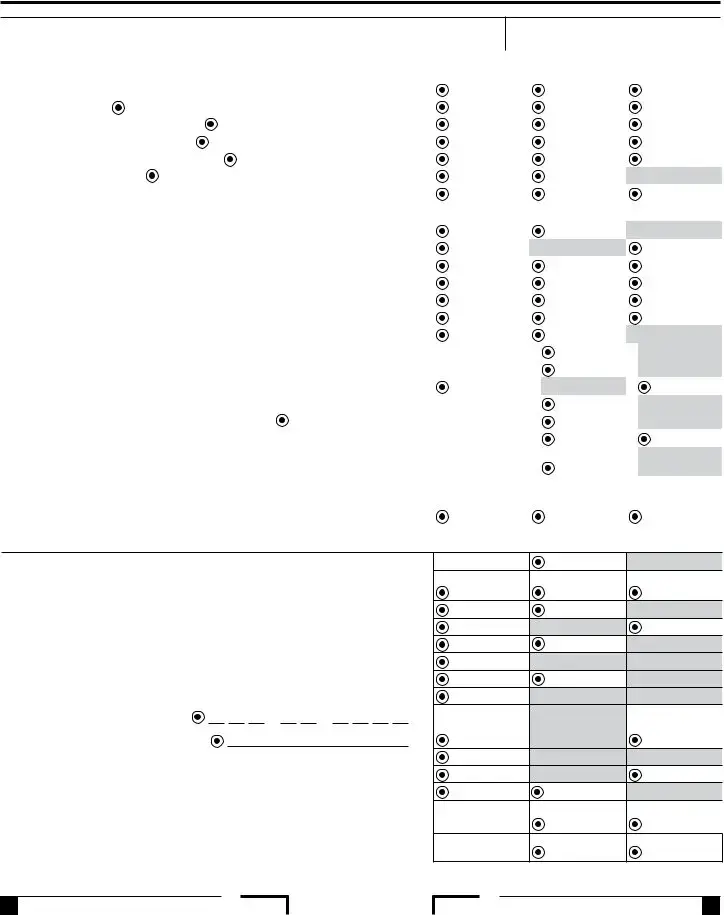

Part II Adjustments to Federal Itemized Deductions

Check the box if you did NOT itemize for federal but will itemize for California . . . . . . . . .

AFederal Amounts (from federal Schedule A (Form 1040)

BSubtractions See instructions

CAdditions

See instructions

Medical and Dental Expenses See instructions.

1 |

Medical and dental expenses |

1 |

2 |

Enter amount from federal Form 1040 or |

2 |

3 Multiply line 2 by 7.5% (0.075) |

3 |

|

4 |

Subtract line 3 from line 1. If line 3 is more than line 1, enter 0 |

. 4 |

Taxes You Paid |

|

|

5a State and local income tax or general sales taxes |

5a |

|

5b |

State and local real estate taxes |

5b |

5c |

State and local personal property taxes |

5c |

5d |

Add line 5a through line 5c |

5d |

5e |

Enter the smaller of line 5d or $10,000 ($5,000 if married filing separately) in column A . . |

|

|

Enter the amount from line 5a, column B in line 5e, column B |

|

|

Enter the difference from line 5d and line 5e, column A in line 5e, column C |

5e |

6 |

Other taxes. List type |

6 |

7 |

Add line 5e and line 6 |

7 |

Interest You Paid |

|

|

8a Home mortgage interest and points reported to you on federal Form 1098 . . . . . . . . . . . 8a  8b Home mortgage interest not reported to you on federal Form 1098. . . . . . . . . . . . . . . . . 8b

8b Home mortgage interest not reported to you on federal Form 1098. . . . . . . . . . . . . . . . . 8b  8c Points not reported to you on federal Form 1098. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8c

8c Points not reported to you on federal Form 1098. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8c  8d Mortgage insurance premiums . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8d

8d Mortgage insurance premiums . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8d  8e Add line 8a through line 8d. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8e

8e Add line 8a through line 8d. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8e  9 Investment interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

9 Investment interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9  10 Add line 8e and line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

10 Add line 8e and line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Gifts to Charity

11 Gifts by cash or check . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11  12 Other than by cash or check . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

12 Other than by cash or check . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12  13 Carryover from prior year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

13 Carryover from prior year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13  14 Add line 11 through line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

14 Add line 11 through line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Casualty and Theft Losses

15 Casualty or theft loss(es) (other than net qualified disaster losses). Attach federal |

|

Form 4684. See instructions |

15 |

Other Itemized Deductions |

|

16

17 Add lines 4, 7, 10, 14, 15, and 16 in columns A, B, and C . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Total. Combine line 17 column A less column B plus column C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  18

18

Side 2 Schedule CA (540) 2020

7732203

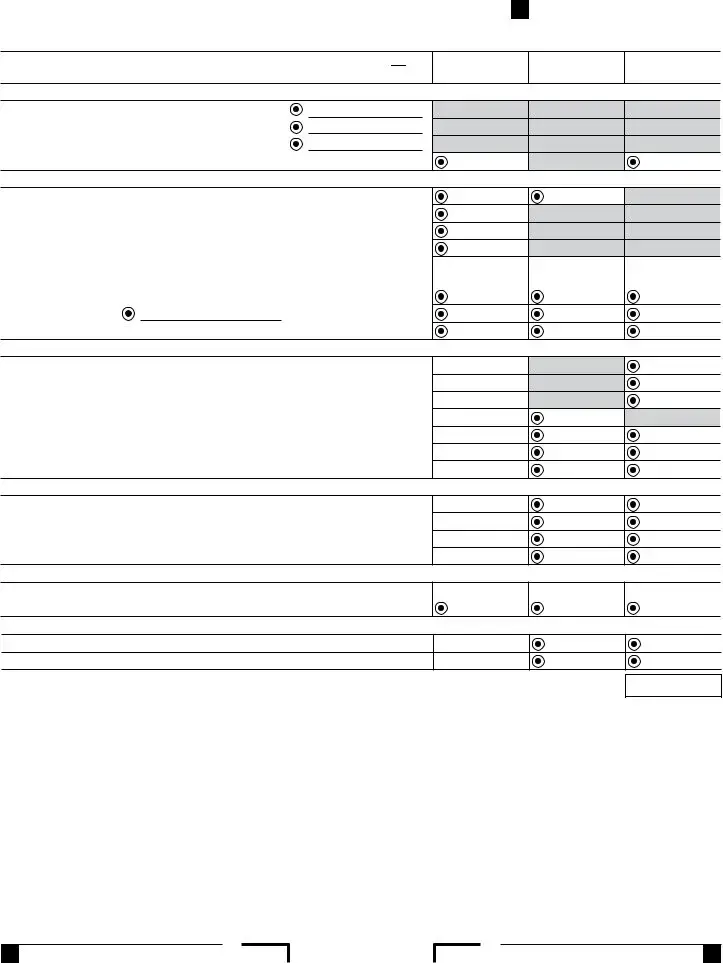

Job Expenses and Certain Miscellaneous Deductions

19Unreimbursed employee expenses - job travel, union dues, job education, etc.

Attach federal Form 2106 if required. See instructions. . . . . . . . . . . . . . . . . . . . . . . .  19

19

20 Tax preparation fees. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  20

20

21 Other expenses - investment, safe deposit box, etc. List type |

|

21 |

22 Add line 19 through line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

22

23Enter amount from federal Form 1040 or

24 Multiply line 23 by 2% (0.02). If less than zero, enter 0. . . . . . . . . . . . . . . . . . . . . . .  24

24

25 Subtract line 24 from line 22. If line 24 is more than line 22, enter 0. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  25

25

26 |

Total Itemized Deductions. Add line 18 and line 25 |

. . . . . . . |

26 |

|

27 |

Other adjustments. See instructions. Specify. |

|

. . . . . . . |

27 |

28 Combine line 26 and line 27. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  28

28

29 Is your federal AGI (Form 540, line 13) more than the amount shown below for your filing status? Single or married/RDP filing separately . . . . . . . . . . . . . . . . . . . . . . . . . . . $203,341 Head of household . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $305,016 Married/RDP filing jointly or qualifying widow(er) . . . . . . . . . . . . . . . . . . . $406,687

No. Transfer the amount on line 28 to line 29.

Yes. Complete the Itemized Deductions Worksheet in the instructions for Schedule CA (540), line 29 . . . . . . . . . . . . . . . . . . . . .  29

29

30 Enter the larger of the amount on line 29 or your standard deduction listed below

Single or married/RDP filing separately. See instructions. . . . . . . . . . . . . . . . $4,601

Married/RDP filing jointly, head of household, or qualifying widow(er) . . . . . $9,202

Transfer the amount on line 30 to Form 540, line 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  30

30

This space reserved for 2D barcode

This space reserved for 2D barcode

7733203

Schedule CA (540) 2020 Side 3

Document Specs

| Fact | Detail |

|---|---|

| 1. Form Purpose | Schedule CA (540) is used for California residents to adjust federal income to California state income. |

| 2. Tax Year | This provided example is for the tax year 2020. |

| 3. Attachment Requirement | This schedule must be attached behind Form 540, Side 5 as a supporting document. |

| 4. User Identification | Filers must provide names as shown on tax return and SSN or ITIN. |

| 5. Part I - Income Adjustment | It includes sections for reporting income adjustments from federal amounts, subtractions, and additions. |

| 6. Part II - Adjustments to Federal Itemized Deductions | This part adjusts federal itemized deductions to reflect California state regulations. |

| 7. Specific Instructions | Many lines refer to specific instructions, indicating a need for careful completion to adhere to California tax laws. |

| 8. Use of Federal Information | The form requires input from federal tax returns, emphasizing the correlation between federal and state tax calculations. |

| 9. Governing Law | The form is governed by California state tax laws and regulations. |

| 10. Accessibility | Access to the Privacy Notice, FTB 1131 ENG/SP, is recommended for information on the privacy of provided information. |

Detailed Instructions for Writing Schedule California 540

Completing the Schedule CA (540) form is an important step for residents of California when filing their taxes. This form helps you adjust amounts that you reported on your federal income tax return, ensuring that your state tax computation reflects California's laws. While filling out this form may seem daunting at first, breaking it down into manageable steps can simplify the process. Follow these steps to accurately complete the Schedule CA (540) form.

- Start with Part I - Income Adjustment Schedule. Copy the amounts from your federal income tax return (Form 1040 or 1040-SR) into column A for each line item.

- For each line in Section A (Income), refer to the specific instructions to determine if any amounts need to be subtracted in column B or added in column C. Do this for each income source listed.

- Move to Section B - Additional Income, repeating the process of copying amounts and making necessary subtractions or additions based on the California-specific instructions.

- Add up the totals of Section A and Section B in column A. Then, do the same for any amounts in columns B and C. Enter these totals on line 9.

- In Part I Section C - Adjustments to Income, fill in any applicable adjustments from federal Schedule 1 that apply to your California return. Again, you’ll copy, subtract, or add amounts as instructed for each line item.

- Total your adjustments and calculate the adjusted income according to the instructions on line 23.

- In Part II - Adjustments to Federal Itemized Deductions, if you did not itemize deductions on your federal return but will do so for California, check the indicated box. Otherwise, skip this step.

- Fill in federal amounts, subtractions, and additions for itemized deductions in columns A, B, and C as per instructions provided for medical expenses, taxes paid, interest paid, gifts to charity, casualty and theft losses, and other itemized deductions.

- Calculate the total adjustments to itemized deductions and report this on line 18.

- If you have unreimbursed employee expenses, tax preparation fees, or other miscellaneous deductions, fill these out in the Job Expenses and Certain Miscellaneous Deductions section. Calculate and fill in these amounts according to the instructions provided.

- Finally, determine if your federal AGI exceeds the threshold for your filing status and complete the rest of the schedule based on this, following any additional instructions provided for calculating and transferring the total to your Form 540.

- Remember to attach this schedule behind Form 540, Side 5 as a supporting document.

By carefully following these steps and referring to the specific instructions for each line item, you can accurately complete the Schedule CA (540) form. This will ensure that your California tax return accurately reflects your income, adjustments, and deductions, in accordance with state tax laws.

Things to Know About This Form

What is the Schedule CA (540) form used for?

The Schedule CA (540) form, specifically designed for California residents, is utilized to adjust federal income and deductions on your state tax return. This form plays a crucial role in ensuring that the income reported on your federal return is correctly adjusted for California tax purposes. These adjustments are necessary because certain items may be treated differently on your federal and state returns. For instance, some income excluded on your federal return might be taxable in California and vice versa.

How do I fill out the Income Adjustment Schedule (Part I) on Schedule CA (540)?

Filling out Part I of the Schedule CA (540) involves several steps:

- Start by reporting your federal income amounts in Column A, referring to your federal Form 1040 or 1040-SR for the taxable amounts.

- In Column B, list any subtractions that California does not tax, following specific instructions provided for each line.

- In Column C, add back any income that's not taxable federally but is taxable in California, again following the form's detailed instructions.

- Finally, calculate your total California adjustments by combining the relevant sections and lines as directed on the form.

Can I itemize deductions on Schedule CA (540) even if I didn't itemize on my federal return?

Yes, you can itemize deductions on Schedule CA (540) even if you took the standard deduction on your federal return. California offers flexibility in this aspect, allowing taxpayers to choose the deduction method that best suits their situation for state tax purposes. If you decide to itemize on your California return, ensure you check the box indicating that you did not itemize on your federal return and meticulously follow the instructions for itemized deductions on Schedule CA (540).

What are some common adjustments I might need to make on Schedule CA (540)?

On Schedule CA (540), you may need to make several common adjustments, including but not limited to:

- Adding back deductions taken federally for state taxes if you itemize deductions.

- Adjusting for differences in federal and state tax treatment of certain income types, like Social Security benefits or IRA distributions.

- Correcting for California-specific deductions not allowed at the federal level, such as certain business expenses or health savings account contributions.

- Including other income that's taxable in California but exempt or differently treated on your federal return, like California lottery winnings.

Common mistakes

When filling out the Schedule CA (540) form, individuals often make mistakes that can impact their tax calculations. Recognizing these errors can help in accurately completing the form and ensuring that the right amount of tax is paid or refunded. Here are some of the common mistakes:

- Incorrect Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN): Double-check the SSN or ITIN entered against the official document to avoid mismatches.

- Failing to attach the Schedule CA (540) behind Form 540, Side 5, as instructed, which can result in processing delays.

- Inaccurate reporting of income from federal Form 1040 or 1040-SR in the Income Adjustment Schedule, leading to incorrect taxable income calculations for California.

- Not correctly identifying and reporting additions and subtractions to income, which could result in either underpayment or overpayment of taxes.

- Omission of Additional Income from federal Schedule 1 (Form 1040) that is taxable in California, such as business income or alimony received.

- Incorrect calculations in Adjustments to Income from federal Schedule 1 (Form 1040), particularly for deductions such as educator expenses or health savings account deductions, can lead to an incorrect adjusted gross income (AGI) for California.

- Not checking the box if you did not itemize for federal but will itemize for California, which affects the allowable deductions and tax liability.

- Errors in calculating itemized deductions on Side 2, especially in the sections for Medical and Dental Expenses, Taxes You Paid, and Interest You Paid, could significantly affect the total itemized deductions claimed.

- Misunderstanding Taxable Amounts: Failing to accurately report or adjust state-specific taxable amounts, such as California lottery winnings, that are not taxed on the federal level but are taxable in California.

It's crucial for taxpayers to carefully review each section of the Schedule CA (540) form and adhere to the specific instructions provided. Ensuring accuracy in reporting income, deductions, and tax credits can help minimize errors and optimize tax outcomes.

Documents used along the form

When preparing your California state taxes, the Schedule CA (540) form plays a pivotal role for residents needing to adjust their income and deductions based on California's unique tax laws. However, completing your state tax return accurately often requires additional forms and documents. Beyond the Schedule CA (540), let's explore several key documents that are commonly used to provide a comprehensive view of an individual's tax situation.

- Form 540: The primary individual income tax return form for California residents. It's where you consolidate your income, deductions, and tax credits to calculate your state tax liability.

- Form 1040 or 1040-SR: The federal tax return form is crucial since the Schedule CA (540) adjustments are based on income and deductions reported on your federal return.

- Schedule D (540): Used for reporting California capital gains or losses. If you've sold property or assets during the tax year, this schedule is necessary to calculate the state tax impact.

- Schedule S (540): California credits for taxes paid to other states. If you've earned income in another state and paid taxes there, this form helps ensure you're not taxed twice on the same income.

- Form 3506: Child and Dependent Care Expenses Credit. For taxpayers who paid for child or dependent care, this form allows you to claim a state credit to reduce your tax liability.

- Form 3885A: Depreciation and Amortization Adjustments. If you're claiming depreciation on assets or need to adjust your amortization for California tax purposes, this form details those calculations.

- Form 3519: Payment for Automatic Extension for Individuals. For those who need extra time to file their state return, this form accompanies your payment for any estimated taxes due by the original filing deadline.

These documents ensure that various aspects of your income, deductions, and credits are accurately reported and adjusted for California's tax laws. Given the complexity of tax preparation, ensuring you have all necessary forms and understanding their purpose can significantly streamline the process and potentially improve your tax outcome.

Similar forms

The Form 1040 or 1040-SR for federal tax returns shares a foundational similarity with Schedule CA (540) as they both serve as key documents in the process of income reporting for individuals. Specifically, Schedule CA (540) acts as an adjustment form, allowing California residents to align their state tax liability with the income figures reported on their federal tax returns. This alignment is crucial because it addresses variances between federal and state taxable income, ensuring accurate state tax calculations. Both forms collect information about wages, salaries, tips, and various types of income such as interest, dividends, and pensions, underlining their role in detailing an individual’s financial income over the tax year.

Schedule 1 (Form 1040), which supplements the main Form 1040 by providing additional income and adjustments to income, mirrors a segment of Schedule CA (540) dedicated to additional income and adjustments. This includes items such as alimony received, business income, and unemployment compensation. The parallel lies in their function to report specific income types and adjustments not captured on the main tax form, providing a comprehensive view of an individual's financial landscape for accurate tax assessment.

Form 3903, which is used for reporting moving expenses on a federal level, is referenced in Schedule CA (540) concerning moving expenses adjustments. This shows a direct link in how certain federal deductions or credits have counterparts or require acknowledgment in state tax adjustments. It underlines the interplay between federal and state documentation, ensuring that all aspects of an individual's financial movements are considered in both jurisdictions.

The federal Schedule A (Form 1040), utilized for itemized deductions, bears resemblance to the part of Schedule CA (540) that deals with adjustments to federal itemized deductions for California residents. Both documents are dedicated to exploring the eligible expenditures that taxpayers can claim to reduce their taxable income. The shared concept revolves around itemizing deductions such as medical expenses, taxes paid, interest paid, and gifts to charity, albeit with adjustments to align with state-specific legislation and policy nuances.

Form 2106, which is employed by federal taxpayers to report employee business expenses, is akin to sections of Schedule CA (540) that pertain to job expenses and certain miscellaneous deductions. This correlation exists because both forms are mechanisms through which taxpayers can claim deductions for unreimbursed expenses incurred in the course of employment. These similarities underscore the broader framework of tax documentation, which seeks to provide avenues for individuals to report employment-related expenditures that might impact their taxable income.

Form 4684, used for declaring casualties and theft losses on federal tax returns, corresponds with portions of Schedule CA (540) aiming at casualty and theft loss adjustments. This linkage highlights how certain extraordinary financial events impacting a taxpayer's assets are considered in both federal and state tax calculations, ensuring that losses affecting a taxpayer's financial status are duly accounted for within the tax filing process.

The standard deduction and itemized deductions worksheet is an integral component of both federal and state tax preparations, as seen in the concluding sections of Schedule CA (540). This feature is mirrored in the federal tax filing system where taxpayers must decide between opting for a standard deduction or itemizing deductions based on which option offers the greater tax-saving benefit. The presence of a similar decision-making process in both federal and state tax contexts emphasizes the unified goal of maximizing taxpayer benefits while ensuring adherence to regulatory requirements.

Dos and Don'ts

When preparing to fill out the Schedule CA (540) for California residents, there are several important do's and don'ts to keep in mind. These guidelines can help ensure the process goes smoothly and accurately.

Do:- Double-check all entries against your federal tax return to ensure accuracy.

- Make sure to attach the schedule behind Form 540, Side 5, as it serves as a supporting document.

- Review the instructions for each section carefully before making any entries in columns B or C.

- Use the correct tax year version of the form to avoid any inconsistencies.

- Report all necessary income adjustments, including wages, tips, and any other forms of income, as specified in Part I.

- Sign and date the form if it’s a paper submission to verify that all information is true and correct.

- Forget to attach any required documentation, such as federal Form 3903 for moving expenses, if applicable.

- Overlook specific deductions that are unique to California, which might differ from federal deductions.

- Miss including additional income reported on federal Schedule 1 that needs to be adjusted for California tax purposes.

- Mistake the lines for deductions and income, as this could significantly impact your tax liability or refund.

- Ignore the Privacy Notice, which provides important information about your rights and the use of your personal information.

- Leave out any itemized deductions adjustments in Part II that can reduce your taxable income further.

Misconceptions

Understanding tax forms can often lead to confusion, and the Schedule CA (540) form for California residents is no exception. Below are four common misconceptions about this form, each accompanied by a clear explanation to improve your understanding and assist in accurate tax reporting.

- Misconception 1: All Income Reported on Federal Tax Forms Is Treated the Same on the California Tax Form

Fact: The Schedule CA (540) form requires you to adjust your federal income for specific differences recognized by California law. For example, certain types of income that are taxable at the federal level may not be taxable in California, and vice versa. It's critical to understand these distinctions to report your income correctly.

- Misconception 2: Itemized Deductions Are Handled the Same Way in California as They Are Federally

Fact: While federal itemized deductions laid out on Schedule A (Form 1040) offer a starting point, California requires modifications to these amounts. The state has different laws regarding deductions, such as for medical and dental expenses, and limits on deductions for taxes paid. Taxpayers must carefully adjust their deductions using Schedule CA (540), Part II.

- Misconception 3: California Does Not Offer Any Deductions for Personal and Dependent Exemptions

Fact: Although recent changes in federal tax law have eliminated personal and dependent exemptions, California allows them. Taxpayers can claim personal and dependent exemptions on their California tax return, which lowers the taxable income. This difference necessitates careful consideration when transitioning from federal to state tax calculations.

- Misconception 4: If You Don’t Itemize Deductions Federally, You Cannot Itemize Them on Your California Tax Return

Fact: California taxpayers have the option to itemize deductions on their state return, even if they take the standard deduction on their federal return. This flexibility can provide a tax advantage to those whose state-specific deductions exceed the federal standard deduction amount.

Correctly understanding the differences and nuances of the Schedule CA (540) form can lead to beneficial tax outcomes. It's important to carefully review each section of the form to ensure all income is reported accurately and all eligible deductions are claimed, maximizing your potential tax benefits under California law.

Key takeaways

Filling out Schedule CA (540) for California tax adjustments requires attention to both federal and state tax details to ensure accurate reporting. Here are five key takeaways to help navigate this process:

- Start with your federal return: Schedule CA (540) begins with information from your federal tax return. You'll need to have your federal Form 1040 or 1040-SR handy as it forms the basis for your state adjustments in income reported to the state of California.

- Understand your adjustments: The form is designed to adjust your federal income to meet California's tax laws. Column A lists your federal amounts, while columns B and C require you to subtract or add amounts based on specific California adjustments. These adjustments might include, but are not limited to, state tax refunds, alimony received, and business income or losses.

- Itemized deductions may differ: If you itemized deductions on your federal return, you might need to adjust these for California taxes. The state has different rules for deductions, such as medical and dental expenses, taxes paid, home mortgage interest, and charitable contributions. Be prepared to modify your federal itemized deductions as per California's instructions.

- Special income adjustments: Schedule CA (540) includes sections that account for types of income or deductions that have different treatment under California tax laws compared to federal laws. For example, California allows for certain kinds of income exclusions or deductions related to disaster loss, new home credits, or differences in state and federal law regarding pensions and annuities.

- Use the instructions: The California Franchise Tax Board provides detailed instructions for Schedule CA (540) that can help clarify how to report specific types of income or deductions. In many areas of the form, it advises you to "See instructions" before making an entry in a column, highlighting the importance of referring to these guidelines to accurately complete your adjustments.

Finally, after completing Schedule CA (540), attach it behind Form 540, Side 5 as a supporting document for your California tax return. This step is crucial for providing the necessary details about the adjustments made from your federal to your state return.

Discover More PDFs

What Is Probate in California - Also serves as a cost-effective solution for settling real property matters, bypassing more complex probate procedures.

State Attorney General Complaint - Complaint about the mishandling of patient records, leading to a breach of privacy.