Legal California Real Estate Purchase Agreement Document

In the bustling world of California real estate, buying or selling property is a significant undertaking that involves a complex process with many steps. At the heart of this process is the California Real Estate Purchase Agreement, a critical document that outlines the terms and conditions of a real estate transaction between a buyer and a seller. This legal contract specifies the purchase price, the closing date, the amount of the earnest money deposit, contingencies that must be met before the sale is finalized, and other essential details. Understanding this document is vital for both parties to ensure their interests are protected and the transaction proceeds smoothly. It serves as a roadmap for the transaction, laying the groundwork for a successful transfer of property ownership. The agreement also includes disclosures about the property's condition, which are legally required in California, providing transparency and fostering trust between the parties. Navigating through the ins and outs of this form can be daunting, but a comprehensive grasp of its contents empowers buyers and sellers to make informed decisions, mitigate risks, and anticipate any legal obligations they must fulfill.

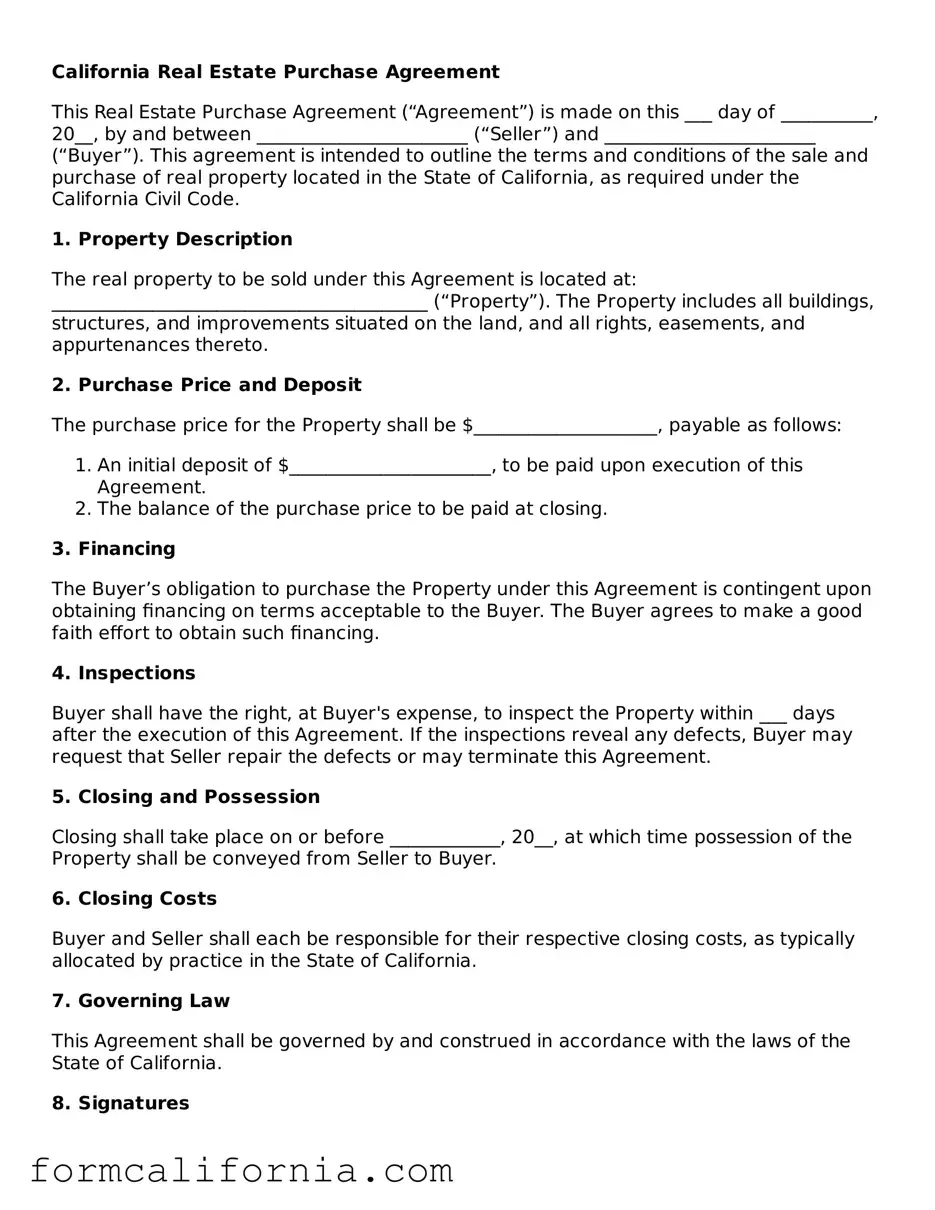

Document Preview Example

California Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is made on this ___ day of __________, 20__, by and between _______________________ (“Seller”) and _______________________ (“Buyer”). This agreement is intended to outline the terms and conditions of the sale and purchase of real property located in the State of California, as required under the California Civil Code.

1. Property Description

The real property to be sold under this Agreement is located at: _________________________________________ (“Property”). The Property includes all buildings, structures, and improvements situated on the land, and all rights, easements, and appurtenances thereto.

2. Purchase Price and Deposit

The purchase price for the Property shall be $____________________, payable as follows:

- An initial deposit of $______________________, to be paid upon execution of this Agreement.

- The balance of the purchase price to be paid at closing.

3. Financing

The Buyer’s obligation to purchase the Property under this Agreement is contingent upon obtaining financing on terms acceptable to the Buyer. The Buyer agrees to make a good faith effort to obtain such financing.

4. Inspections

Buyer shall have the right, at Buyer's expense, to inspect the Property within ___ days after the execution of this Agreement. If the inspections reveal any defects, Buyer may request that Seller repair the defects or may terminate this Agreement.

5. Closing and Possession

Closing shall take place on or before ____________, 20__, at which time possession of the Property shall be conveyed from Seller to Buyer.

6. Closing Costs

Buyer and Seller shall each be responsible for their respective closing costs, as typically allocated by practice in the State of California.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of California.

8. Signatures

This Agreement may be executed in multiple counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the parties hereto have executed this Real Estate Purchase Agreement on the date first above written.

_________________________ _________________________

Seller's Signature Buyer's Signature

_________________________ _________________________

Seller's Printed Name Buyer's Printed Name

Date: ____________

PDF Form Characteristics

| Fact # | Detail |

|---|---|

| 1 | The California Real Estate Purchase Agreement form is a legally binding document between the buyer and seller for the purchase of real estate in California. |

| 2 | It specifies the terms and conditions of the sale, including the purchase price, property description, and disclosure requirements. |

| 3 | Governing law for this form and its proceedings are based on California state law, particularly the California Civil Code. |

| 4 | California law requires sellers to disclose specific information about the condition of the property through a Natural Hazard Disclosure Statement and other disclosures. |

| 5 | The form includes contingency clauses, allowing either the buyer or seller to back out of the contract under certain conditions, such as failure to secure financing or unsatisfactory inspection results. |

| 6 | It must be completed and signed by both parties to be considered valid and enforceable. |

| 7 | Deposits made by the buyer are held in an escrow account until the closing of the sale, as outlined in the agreement. |

| 8 | Closing dates and possession details are clearly stated within the agreement to ensure a smooth transfer of property. |

| 9 | Amendments to the initial agreement must be made in writing and agreed upon by both parties, ensuring clear communication and mutual agreement throughout the sale process. |

Detailed Instructions for Writing California Real Estate Purchase Agreement

Completing the California Real Estate Purchase Agreement form is a crucial step for both buyers and sellers in the transaction process. This legal document outlines the terms and conditions of the sale, including the purchase price, closing date, and contingencies. Properly filling out this form is essential for ensuring the transaction proceeds smoothly and legally. Attention to detail and accuracy will help prevent misunderstandings and potential disputes down the road. To assist with this important task, follow these step-by-step instructions.

Steps for Filling Out the California Real Estate Purchase Agreement Form

- Identify the parties involved by writing the full legal names of both the buyer(s) and seller(s) at the top of the form.

- Specify the property address, including the city, county, and any relevant unit number, in the designated space.

- Enter the legal description of the property. This may require consulting a previous deed or property tax document to ensure accuracy.

- Determine and input the purchase price in the appropriate section. Make sure this amount is agreed upon by both parties.

- Outline the terms of the deposit, including the amount and the institution where the deposit will be held, under the contingencies section.

- Detail the financing terms, if applicable, including the loan amount, type of loan, and the timeframe for securing the financing.

- List any items that are included or excluded from the sale, such as appliances, fixtures, or personal property.

- Indicate the closing date and possession date. These are critical timelines for both the buyer and seller to agree upon.

- Review and include any additional terms or conditions that may apply to the transaction. This can range from seller concessions to home warranty plans.

- Ensure all contingency clauses are clearly stated, such as inspection periods, appraisal requirements, and loan approval contingencies.

- Have all parties review the completed form for accuracy and completeness. Any amendments should be initialed by all parties.

- Sign and date the form. The buyer(s), seller(s), and any agents involved must sign the form to make it legally binding.

Once the California Real Estate Purchase Agreement form is filled out and signed by the involved parties, the next steps involve fulfilling the contingencies stipulated in the agreement. This usually includes conducting a property inspection, securing financing, and completing any required disclosures. It’s important for both buyers and sellers to stay in close communication during this period and to work with their respective agents to navigate any challenges that arise. Successfully addressing these contingencies paves the way for a smooth closing process, culminating in the transfer of the property title from the seller to the buyer.

Things to Know About This Form

What is a California Real Estate Purchase Agreement?

A California Real Estate Purchase Agreement is a legal document executed between the seller and the buyer of real estate property. This formal agreement outlines the terms and conditions of the sale, including details such as the purchase price, closing conditions, and any contingencies that must be met before the transaction can be completed. It is a binding document that is enforceable in a court of law, ensuring both parties are committed to the terms of the sale.

Who needs to sign the California Real Estate Purchase Agreement?

The Real Estate Purchase Agreement must be signed by all parties with an interest in the transaction. This typically includes the seller of the property and the buyer. If the property is owned by more than one person, each co-owner must sign the agreement. Similarly, if the property is being bought by more than one person, each purchaser must sign. In some cases, real estate agents representing the parties might also sign the agreement, albeit this is more for acknowledgment purposes rather than being party to the agreement itself.

What are the key components of the Agreement?

- Purchase Price: The amount that the buyer agrees to pay to the seller for the property.

- Property Description: A detailed description of the property being sold, including its address and legal description.

- Contingencies: Conditions that must be met for the transaction to go forward, such as obtaining financing, the outcome of inspections, and the sale of existing property.

- Closing Details: Information on when and where the closing will take place and who is responsible for various closing costs.

- Signatures: Signatures of all parties involved, indicating their agreement to the terms outlined.

Can the Agreement be modified after signing?

Yes, the Agreement can be modified after it has been signed, but any modifications must be agreed upon by all parties involved. The changes must be documented in writing and signed by both the buyer and the seller, often in the form of an amendment or addendum to the original agreement. This ensures that all changes are legally binding and enforceable.

What happens if the buyer or seller breaches the Agreement?

If either the buyer or the seller breaches the terms of the Real Estate Purchase Agreement, several consequences may follow, depending on the specifics of the agreement and the nature of the breach. The aggrieved party may:

- Seek specific performance, compelling the breaching party to fulfill their obligations under the agreement.

- Cancel the agreement and potentially sue for any deposits or other losses incurred.

- Seek monetary damages for any financial harm suffered due to the breach.

Common mistakes

The California Real Estate Purchase Agreement form represents a pivotal moment in the purchase and sale of property, a delicate dance of negotiation and commitment between buyer and seller. Critical to the successful transfer of real estate, this document should be approached with care and attention to detail. Yet, in the flurry of excitement and anticipation, parties often overlook essential aspects of this form, leading to errors that can delay or even derail property transactions. Understanding these common pitfalls can empower participants in the real estate market to navigate this process with greater confidence and effectiveness.

-

Not fully completing every section: The form demands thoroughness. Each section, from identifying the property to outlining the terms of the sale, plays a crucial role in the legal and financial framework of the transaction. Leaving sections blank not only generates confusion but also could raise suspicions about the sincerity of the offer or the legitimacy of the transaction.

-

Overlooking contingencies: Protection is woven into the agreement through contingencies such as financial, inspection, and appraisal conditions that allow the buyer to back out under specific circumstances without losing their deposit. Neglecting to include these conditions, or failing to understand their implications, exposes both parties to unnecessary risk.

-

Failing to specify fixtures and fittings: The ambiguity surrounding which fixtures and fittings (e.g., lights, blinds, appliances) are included in the sale can be a source of conflict. Clarification within the agreement as to what remains with the property and what does not is essential to avoid misunderstandings and potential disputes.

-

Incorrect information: Details matter. The inclusion of incorrect information, from the spelling of names to the property address or the terms of the sale, can at best require additional paperwork and, at worst, invalidate the agreement or lead to legal challenges.

-

Omitting disclosures: Sellers are obligated to disclose known defects and issues with the property. Failure to include these disclosures not only jeopardizes the sale but can also lead to liability for the seller post-transaction.

-

Not seeking professional advice: The nuances of real estate transactions often escape the untrained eye. Attempting to navigate the agreement without the guidance of a real estate professional or legal advisor can lead to oversight of critical elements, misunderstandings of the terms, and errors in execution.

By addressing these common mistakes before submitting the California Real Estate Purchase Agreement form, parties can ensure a smoother, more reliable transfer of property. Diligence and attention to detail, coupled with professional advice, are key to avoiding pitfalls and moving forward successfully in the intricate landscape of real estate transactions.

Documents used along the form

When it comes to buying or selling property in California, the Real Estate Purchase Agreement form is just the starting point. This important document outlines the terms of the sale, including the purchase price, financing conditions, and inspection rights. However, to ensure a smooth transaction from initial offer to closing, several other key documents are usually involved. Here’s a brief overview of seven additional forms that often accompany the Real Estate Purchase Agreement.

- Counter Offer Form: Used when the seller wants to change the terms initially set by the buyer, such as the purchase price, closing date, or contingencies. This form becomes part of the final agreement if accepted by the buyer.

- Disclosure Statements: These are crucial for informing the buyer about the condition of the property. Common disclosures include the Transfer Disclosure Statement (TDS), which highlights any known property defects, and the Natural Hazards Disclosure Statement, indicating if the property is in an area prone to natural risks like floods or wildfires.

- Home Inspection Report: A document drafted by a professional home inspector detailing the condition of the property. It covers significant components like the roof, foundation, plumbing, and electrical systems, potentially influencing the buyer's decision or negotiation stance.

- Title Report: This report provides vital information about the property’s title, revealing any existing liens, easements, or other encumbrances that could affect the buyer’s ownership rights.

- Loan Documents: If the purchase involves a mortgage, the buyer will need to complete various loan documents. These set forth the terms of the mortgage agreement, including the loan amount, interest rate, repayment schedule, and any other conditions imposed by the lender.

- Contingency Removal Form: Used by the buyer to formally remove any contingencies outlined in the purchase agreement, such as those related to obtaining financing or the results of the home inspection. It signifies the buyer's commitment to proceed with the purchase under the agreed terms. Closing Statement: A comprehensive breakdown of the financial transaction, detailing the funds owed by the buyer and the credits to the seller, along with any adjustments. It is crucial for both parties to review this document carefully before closing to ensure all financial aspects of the deal are accurate.

Completing a real estate transaction involves a meticulous examination of multiple documents, each playing a vital role in protecting the interests of both buyer and seller. While the California Real Estate Purchase Agreement lays the foundation for the sale, the accompanying documents provide the structural integrity required for a successful and legally sound transfer of property ownership. Engaging with these documents thoughtfully ensures a clearer path toward achieving real estate goals.

Similar forms

The California Real Estate Purchase Agreement (REPA) shares similarities with the Residential Lease Agreement, primarily in how both outline the terms of a property arrangement. While the REPA facilitates the buying and selling of real estate, the Residential Lease Agreement caters to the conditions under which a property is rented. Both documents ensure the parties involved agree on the price (or rent), the duration of the agreement, and the responsibilities of each party regarding property maintenance and payment schedules. They serve to prevent future disputes by clearly stating the rights and obligations of all parties involved.

Comparable to the REPA is the Bill of Sale, a document used to transfer ownership of personal property, such as vehicles or furniture, from a seller to a buyer. Like the REPA, it details the transaction between the parties, including the description of the item sold, the sale price, and the transfer terms. Although it deals with personal property rather than real estate, the core purpose of ensuring a clear, mutual understanding of the transaction's terms aligns closely with that of the REPA.

The Loan Agreement also bears resemblance to the REPA, with both facilitating significant financial transactions. The Loan Agreement outlines the terms under which one party lends money to another, specifying repayment conditions, interest rates, and the duration of the loan. Like the REPA, it’s foundational in establishing a clear, legally binding agreement between parties to mitigate misunderstandings and conflicts over the life of the transaction.

Another document similar to the REPA is the Promissory Note. This document represents a written promise to pay a specified sum of money to another party under agreed terms. While the Promissory Note is typically used within the context of loans, elements like payment schedules, interest, and the consequences of non-payment are akin to real estate transactions where financing is involved. This parallels with how payments are structured and handled in the REPA.

The Home Inspection Report, while not a contractual agreement like the REPA, plays a critical role in real estate transactions. It provides a comprehensive assessment of the property's condition before the purchase is finalized, often influencing the final agreement's terms in the REPA. Both documents ensure that buyers are fully informed about their prospective investments and that any agreements are based on the property's true condition.

Similarly, the Title Insurance Policy complements the REPA by safeguarding the buyer’s and lender’s interests against unforeseen legal issues with the property’s title. While the REPA handles the transaction's basic terms and conditions, the Title Insurance Policy ensures that the property title is clear of liens, disputes, or other encumbrances that could affect ownership rights, adding another layer of security to the process outlined in the REPA.

An Escrow Agreement, much like the REPA, involves detailed instructions for a neutral third party to facilitate the transaction. This agreement ensures that the buyer's funds are securely held until all conditions of the purchase, as detailed in the REPA, are satisfied. It underscores the commitment both parties have towards a secure and fair transaction, mirroring the REPA’s intent to ensure a smooth transfer of property ownership.

Lastly, the Property Disclosure Statement, although not a contract, is crucial in the home buying process and therefore relevant to the discussion on the REPA. It requires sellers to disclose known defects and conditions of the property, influencing a buyer's decision to proceed with the purchase. Like the REPA, it plays a vital role in ensuring transparency and honesty in the transaction, aiming to prevent future disputes by providing buyers with a clear understanding of what they are purchasing.

Dos and Don'ts

When filling out the California Real Estate Purchase Agreement form, it's essential to approach the task with a great level of detail and understanding. This legal document is pivotal in the process of buying or selling property in California, and its accuracy is paramount. Below is a guide comprised of actions to take and avoid.

Things You Should Do:

Read the entire form carefully before filling it out to ensure you understand all the provisions and requirements.

Ensure that all the information you provide is accurate and complete. This includes names of the parties, property address, sale price, and any other pertinent details related to the transaction.

Use clear and concise language to avoid any misunderstandings or ambiguity.

Consult with a real estate professional or attorney if you have any questions or concerns about the agreement or its clauses.

Sign and date the form in all designated areas once you have double-checked all information for accuracy.

Things You Shouldn't Do:

Do not leave any fields blank. If a section does not apply, write "N/A" (not applicable) to indicate this.

Avoid making any handwritten changes or corrections on the form after it has been finalized and signed. If changes are necessary, prepare a new, amended agreement to be signed by all parties.

Do not ignore the contingency clauses. These are crucial as they can impact your rights and obligations under the agreement. Make sure you fully understand their implications.

Misconceptions

When navigating the process of buying or selling property in California, the Real Estate Purchase Agreement (REPA) serves as a central document. Misunderstandings about its purpose, requirements, and effects are common, leading to confusion and potential legal pitfalls. Below are nine common misconceptions about the California Real Estate Purchase Agreement form, clarified to assist individuals in better understanding its role and significance.

- It's just a standard form, so personalization isn't necessary.

Many believe that the California Real Estate Purchase Agreement is a one-size-fits-all document that doesn’t require customization. However, each real estate transaction is unique, and the agreement should be tailored to match the specific terms and conditions agreed upon by the buyer and seller, including any contingencies, disclosures, or special arrangements.

- Verbal agreements are as binding as the written contract.

In California, real estate purchase agreements must be in writing to be legally enforceable. While informal discussions can guide the negotiations, only the terms documented and signed in the REPA are legally binding. Verbal agreements or understandings not included in the written contract are typically not enforceable in court.

- Once signed, the agreement cannot be changed.

This misunderstanding can cause parties to rush into signing without thoroughly reviewing or negotiating the terms. In reality, the terms of the agreement can be modified, but any changes must be in writing and signed by both the buyer and seller, reflecting mutual consent to the amendments.

- The agreement only concerns the sale price.

Some parties might think the REPA solely focuses on the sale price. However, the agreement covers a wide range of important terms and conditions, such as financing, inspections, disclosures, dispute resolution methods, and timelines for each phase of the process.

- Either party can back out at any time without consequences.

Once the REPA is signed, it is a binding legal document. If either party chooses to withdraw without a contractual basis (such as an unmet contingency), they may face legal and financial consequences. These can include forfeiture of the deposit or being subjected to legal action for breach of contract.

- The seller must fix all issues discovered during the inspection.

While inspections can reveal issues that may lead to negotiations for repairs, there is no automatic obligation for the seller to fix everything identified in an inspection report. The decision over which repairs will be made is subject to negotiation between the buyer and seller, and the agreed-upon terms should be documented in the REPA.

- Deposits are always refunded if the buyer backs out.

The conditions under which a buyer can receive their deposit back depend on the contingencies outlined in the REPA. If the buyer backs out of the agreement without satisfying the conditions for a refund, as specified by the contract, they may forfeit their deposit.

- Real estate agents can draft and make legal changes to the REPA without a lawyer.

While real estate agents play a crucial role in the buying and selling process and can fill out the REPA based on standard templates, they are not authorized to provide legal advice or make unapproved alterations to the legal language of the contract. For legal advice or to make significant changes, consulting a qualified lawyer is essential.

- The closing date in the agreement is final and unchangeable.

Although the closing date is an important target, various factors — such as financing delays, appraisal issues, or inspection findings — can lead to adjustments. Both parties must agree to any changes, which should then be documented in writing.

Understanding these misconceptions can help buyers, sellers, and professionals navigate the complexities of real estate transactions with greater clarity and confidence. A well-drafted Real Estate Purchase Agreement is key to protecting the interests of both parties and ensuring a smooth path to closing.

Key takeaways

The California Real Estate Purchase Agreement form is a legally binding document used to outline the terms and conditions of a real estate transaction between a buyer and a seller. Whether you're navigating the sale of a property for the first time or are a seasoned investor, understanding the key components and implications of this form is crucial. Here are seven essential takeaways:

- The importance of accuracy cannot be overstated when filling out the California Real Estate Purchase Agreement. Every detail, from the names of the parties involved to the description of the property, must be recorded with precision to avoid legal complications down the line.

- Contingencies play a critical role in real estate transactions. These conditions, which might include loan approval, home inspections, and the sale of the buyer's current home, must be clearly stated in the agreement. They protect both the buyer and seller, allowing either party to back out of the transaction if certain conditions aren't met.

- A thorough disclosure of the property's condition is required by law. The seller must inform the buyer of any known defects or issues with the property. This transparency helps prevent disputes after the sale and is a key component of the agreement.

- The closing date is a pivotal aspect of the agreement. This is when the sale is expected to be finalized, and ownership of the property is transferred from the seller to the buyer. Both parties need to agree on a realistic timeline that allows for all contingencies to be met.

- Financial terms, including the purchase price, down payment, and financing details, must be explicitly outlined in the agreement. Clarity in this section prevents misunderstandings and ensures that both the buyer and seller have aligned expectations regarding payment.

- Legal advice is highly recommended. Given the complexity and legal significance of the California Real Estate Purchase Agreement, consultation with a real estate attorney can provide peace of mind and prevent costly mistakes.

- Finally, any amendments to the original agreement need to be made in writing. Verbal agreements or understandings are not enforceable in real estate transactions. If changes arise during the process, they must be documented and signed by both parties.

Understanding these critical aspects of the California Real Estate Purchase Agreement form can make the difference between a smooth transaction and a problematic one. Proper attention to detail, adherence to legal requirements, and open communication between all parties involved lay the groundwork for a successful real estate transaction.

More California Forms

Bill of Sale Vehicle California - It also serves as an official record for any financing companies involved in the purchase.

How to Verify Employment - Ensures that employment data is systematically captured and reported, aligning with best HR practices.

Dnr Document - It is a specific instruction about CPR and does not apply to other medical interventions.