Legal California Quitclaim Deed Document

In California, property ownership can be transferred in various ways, one of the simplest being through the use of a Quitclaim Deed form. This particular document is instrumental for those looking to change the ownership of property quickly and without the warranties typically associated with more comprehensive deed forms. It is often utilized among family members or close associates, facilitating the process of transferring property rights with minimal complication. The form, while straightforward, requires attention to detail to ensure that all necessary information is accurately represented, including the legal description of the property and the particulars of the grantor and grantee. Moreover, understanding the implications of its use is crucial as it offers no guarantees regarding the title, making it a unique and sometimes risky tool for transaction or ownership adjustment purposes. Recognized by California law, these deeds must be properly executed and submitted to the relevant county recorder’s office to effectuate the transfer, highlighting the importance of following the prescribed legal and procedural guidelines.

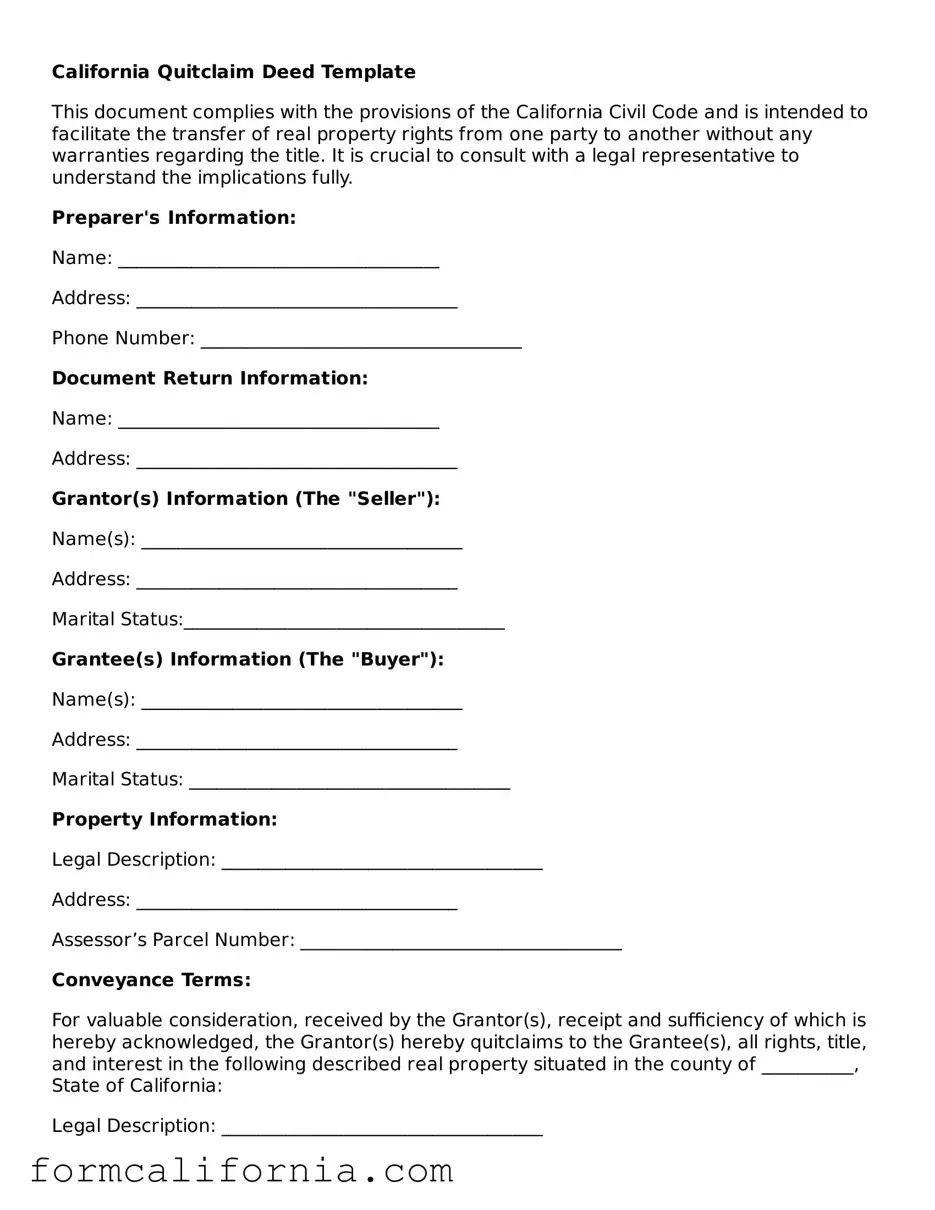

Document Preview Example

California Quitclaim Deed Template

This document complies with the provisions of the California Civil Code and is intended to facilitate the transfer of real property rights from one party to another without any warranties regarding the title. It is crucial to consult with a legal representative to understand the implications fully.

Preparer's Information:

Name: ___________________________________

Address: ___________________________________

Phone Number: ___________________________________

Document Return Information:

Name: ___________________________________

Address: ___________________________________

Grantor(s) Information (The "Seller"):

Name(s): ___________________________________

Address: ___________________________________

Marital Status:___________________________________

Grantee(s) Information (The "Buyer"):

Name(s): ___________________________________

Address: ___________________________________

Marital Status: ___________________________________

Property Information:

Legal Description: ___________________________________

Address: ___________________________________

Assessor’s Parcel Number: ___________________________________

Conveyance Terms:

For valuable consideration, received by the Grantor(s), receipt and sufficiency of which is hereby acknowledged, the Grantor(s) hereby quitclaims to the Grantee(s), all rights, title, and interest in the following described real property situated in the county of __________, State of California:

Legal Description: ___________________________________

(Attach additional pages if necessary)

The Grantor(s) declares that the property transferred by this deed is not subject to a documentary transfer tax under the California Revenue and Taxation Code or is exempt because ___________________________________.

Signatures:

The Grantor(s) has/have executed this deed on ____________________ (date).

Grantor’s Signature: ___________________________________

Printed Name: ___________________________________

Grantor’s Signature: ___________________________________

Printed Name: ___________________________________

This document must be acknowledged before a Notary Public and filed with the County Recorder’s office in the county where the property is located to be effective.

State of California

County of ____________________

On ____________________ before me, _______________________________ (insert name and title of the officer), personally appeared _______________________________, who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument, the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

WITNESS my hand and official seal.

Signature _______________________________

(Seal)

This template is provided as a general guide and does not constitute legal advice. Parties to a quitclaim deed should seek the advice of a licensed attorney to ensure that their rights and interests are adequately protected.

PDF Form Characteristics

| Fact | Description |

|---|---|

| Definition | A Quitclaim Deed in California is a legal document used to transfer interest in real estate from one person (the grantor) to another (the grantee) without any warranty of title. |

| Governing Law | It is governed by California Civil Code sections 1092, 1105, 1113, and others, which outline the requirements for a valid conveyance of real property. |

| Recording Requirement | The deed must be recorded with the County Recorder’s Office in the county where the property is located to be effective against third parties. |

| Formal Requirements | The deed must be in writing, contain the grantor’s signature, and be acknowledged before a notary public to be legally effective. |

| No Guarantees | Unlike a Warranty Deed, the Quitclaim Deed does not guarantee that the grantor holds clear title to the property; it only transfers whatever interest the grantor may have. |

Detailed Instructions for Writing California Quitclaim Deed

Filling out a California Quitclaim Deed form is a critical step for anyone looking to transfer interest in a property without any warranty regarding the title. This process ensures the legal change of ownership is documented and recognized by the state. It's crucial for the parties involved to carefully complete the form to avoid any future disputes or legal complications. Below is a simplified guide to navigate through this form.

- Start by entering the name and address of the person preparing the document. This ensures any correspondence or legal documents related to the deed can be correctly directed.

- Next, specify the name and mailing address of the person to whom the document will be returned after recording. This is often the grantee but could be a legal representative.

- Identify the county where the property is located, as the deed needs to be recorded in the same county to be legally binding.

- The Assessor’s Parcel Number (APN) is then required. This unique number helps to identify the property in county records.

- It’s time to detail the grantor’s information (the person transferring the interest) - include full legal names and how they hold title to the property.

- Include the grantee’s information (the person receiving the interest). As with the grantor, full legal names and the intended title holding method are necessary.

- Clearly state the legal description of the property. This often includes the lot number, tract, and any other details that uniquely identify the property.

- Most importantly, the grantor must sign the deed in the presence of a notary public. The notary will then fill out the remaining part of the form, which validates the grantor’s signature.

- Finally, the completed form must be filed with the county recorder’s office. There’s usually a fee associated with recording the deed, which varies by county.

Once these steps are completed, the transfer of interest in the property will be officially recognized. It's important to keep a copy of the recorded deed for personal records. This document serves as proof of the transfer and might be needed for future legal or financial transactions related to the property.

Things to Know About This Form

What is a California Quitclaim Deed?

A California Quitclaim Deed is a legal document used to transfer interest in real estate from one person (the grantor) to another (the grantee) without any warranties of ownership. Essentially, it clears the title of the property in the name of the grantor and gives whatever interest they have in the property to the grantee. This type of deed is often used among family members or to clear up titles.

When should you use a Quitclaim Deed?

Quitclaim Deeds are best used when transferring property:

- Between family members, such as adding or removing a spouse’s name from the title

- When gifting property to another person

- In divorce settlements, to award property to one spouse

- To clear up a cloud on the title (a potential claim or lien)

What information is needed for a California Quitclaim Deed?

To complete a California Quitclaim Deed, you need the following information:

- Full name and mailing address of the grantor and the grantee

- Legal description of the property

- Amount of consideration (if any)

- Assessor's Parcel Number (APN) of the property

- Signatures from both the grantor and grantee

- Notarization of the grantor's signature

Does a Quitclaim Deed guarantee clear title to the property?

No, a Quitclaim Deed does not guarantee clear title to the property. It only transfers the interest the grantor has at the time of the transfer, without any promises or guarantees about the property's history or encumbrances. This is why they are primarily used among those who trust each other, like family members.

Is a Quitclaim Deed in California revocable?

Once a Quitclaim Deed has been signed, notarized, and filed with the county recorder's office, it is generally not revocable. The grantee obtains whatever interest the grantor had in the property at the time of the transfer. If a change needs to be made, both parties must agree to execute a new deed.

How do you file a Quitclaim Deed in California?

To file a Quitclaim Deed in California, follow these steps:

- Ensure the deed is completed accurately and all required information is included.

- Have the grantor sign the deed in front of a notary public.

- Take the notarized deed to the county recorder’s office where the property is located.

- Pay the required filing fee. Fees vary by county.

After these steps are completed, the deed becomes part of the public record, transferring ownership as described.

Are there any fees associated with filing a Quitclaim Deed in California?

Yes, there are fees associated with filing a Quitclaim Deed in California. These fees can vary depending on the county where the property is located. Generally, there is a base fee for the first page of the document and an additional, smaller fee for each subsequent page. Additional charges may apply for indexing multiple titles or releasing and waiving liens. It's best to contact the local county recorder’s office to get the most accurate and up-to-date information on filing fees.

Common mistakes

When transferring property in California, using a Quitclaim Deed is a common method. However, mistakes can easily occur if the form is not completed correctly. Here are ten common errors to avoid:

Not checking the accuracy of the grantor's and grantee's names: It's crucial to ensure that the names are spelled correctly and match the names on the property's current deed.

Omitting the Assessor’s Parcel Number (APN): The APN is a unique number assigned to each parcel of property by the local tax assessor's office, and it must be included in the deed.

Failing to provide a complete property description: The legal description of the property, which may include lot number, subdivision, and boundaries, should be included in full to avoid any confusion.

Ignoring the need for witness signatures: Though California does not require witnesses for the Quitclaim Deed, it’s wise to have the document witnessed to support the validity of the signatures, if ever questioned.

Forgetting to notarize the document: A notarized Quitclaim Deed is necessary for the document to be considered legal and recordable.

Leaving out pertinent attachments: If the legal description of the property is too long or complex, it should be attached on a separate sheet. This attachment becomes part of the official deed.

Using incorrect deed terminology or language: Specific language is required to convey property correctly; using informal or incorrect terms can invalidate the deed.

Not properly recording the deed with the county recorder's office: After completing the Quitclaim Deed, it must be filed with the local county recorder to be valid.

Assuming taxes and mortgages transfer with the deed: A Quitclaim Deed transfers only the owner's interest in the property, not any responsibility for existing mortgages or taxes unless specifically agreed upon.

Completing the deed without understanding the legal implications: Transferring property rights can have significant legal, tax, and financial implications. Professional advice is strongly recommended to avoid unintended consequences.

By paying attention to these details, individuals can avoid common pitfalls and ensure that their Quitclaim Deed accurately reflects their intentions and complies with California law.

Documents used along the form

When handling property transactions in California, the Quitclaim Deed form is just one piece of the puzzle. This document transfers ownership rights of a property from one party to another without any warranties. However, to complete the process smoothly and ensure all aspects of the property transfer are properly documented and legally sound, several other forms and documents are often used in conjunction. Here's a look at some of them.

- Title Search Report: This report provides a detailed history of the property, including previous ownership, existing liens, and any encumbrances on the property. It's essential for ensuring clear title before the transfer.

- Preliminary Change of Ownership Report (PCOR): A form required by the county assessor's office, the PCOR provides details about the property and the nature of the ownership transfer. It helps in updating the property tax records.

- Transfer Tax Declarations: Many counties require a declaration form for transfer tax purposes, outlining the transfer's details and calculating the tax due.

- Grant Deed Form: Compared to a Quitclaim Deed, a Grant Deed provides some warrant that the grantor has not already conveyed the property to someone else and that it is free from undisclosed encumbrances.

- Warranty Deed Form: Unlike a Quitclaim Deed, a Warranty Deed guarantees that the title is clear and the seller has the right to sell the property. This form provides the highest level of protection for the buyer.

- Property Disclosure Statement: This document outlines the condition of the property and any known defects. Though not always legally required, it's a good practice to disclose such information to the buyer.

- Loan Documents: If the property purchase involves financing, a set of loan documents including the note and mortgage or deed of trust will be necessary.

- Escrow Instructions: These documents outline the terms and conditions under which the escrow holder is authorized to distribute funds and transfer the title.

- Homeowners' Association (HOA) Documents: For properties in an HOA, these documents, including the CC&Rs (Covenants, Conditions, & Restrictions), must be reviewed and understood because they outline the association's rules and the new owner's obligations.

- Insurance Policies: Property insurance and title insurance policies protect against losses due to damage to the property and title defects, respectively.

Each of these documents plays a vital role in ensuring the real estate transaction is conducted accurately and legally. While the Quitclaim Deed may be the document that facilitates the actual transfer of interest in property, these additional documents help secure the legality of the transaction, protect the interests of all parties involved, and ensure compliance with local regulations and requirements. Engaging with these forms thoughtfully is crucial for a smooth property transfer process.

Similar forms

The California Quitclaim Deed form shares similarities with the Warranty Deed form. While both are legal documents used to transfer property title from one person to another, their levels of protection for the buyer differ significantly. The Warranty Deed comes with a guarantee that the seller holds a clear title to the property, free of any liens or claims, offering greater protection to the purchaser. On the other hand, the Quitclaim Deed makes no such guarantees about the title's status, transferring only the rights the seller has, if any, to the buyer.

Another document closely related to the Quitclaim Deed is the Grant Deed form. This document, like the Quitclaim Deed, is used to transfer property rights from the seller (grantor) to the buyer (grantee). However, the Grant Deed includes a promise that the property has not been sold to anyone else and is free of undisclosed encumbrances. This represents a middle ground in terms of buyer protection between the Quitclaim Deed, which offers the least amount of protection, and the Warranty Deed, which offers the most.

The Deed of Trust is also similar to the Quitclaim Deed in that it involves property transfer. However, the purpose and function of the Deed of Trust differ. It serves as a security instrument in states that use deeds of trust instead of mortgages, involving three parties: the borrower (trustor), the lender (beneficiary), and the trustee. The borrower transfers the property's title to the trustee, who holds it as security for the loan between the borrower and the lender. Unlike the Quitclaim Deed, this document is primarily used in financing transactions.

Finally, the Interspousal Transfer Deed shares a specific resemblance with the Quitclaim Deed form. Used between spouses, this instrument facilitates the transfer of property interest from one spouse to another, often in conjunction with a divorce settlement or for estate planning purposes. Like the Quitclaim Deed, the Interspousal Transfer Deed does not provide any warranties about the property's title. Its uniqueness lies in its tax advantages and exemption from reassessment under certain California property tax rules, specifically tailored for transfers between spouses.

Dos and Don'ts

When filling out the California Quitclaim Deed form, it's crucial to ensure that the process is handled correctly to avoid future disputes or legal issues. Here's a list of dos and don'ts that should guide you through the completion of this important document.

- Do gather all necessary information before you start, including the legal description of the property, the assessor's parcel number (APN), and the full names and addresses of the grantor and grantee.

- Do ensure that the names of the grantor and grantee are spelled correctly and match any existing records to avoid confusion or disputes about the property's ownership.

- Do include a complete and accurate legal description of the property being transferred, as this is critical for the deed's validity and enforceability.

- Do sign the Quitclaim Deed form in the presence of a notary public. This step is essential for the document to be legally binding.

- Do file the completed and notarized Quitclaim Deed with the local county recorder's office to make the transfer of ownership public record, which is necessary for the transfer to be fully recognized and effective.

- Don't leave any blanks on the form. If a section does not apply, write "N/A" (not applicable) to indicate that it has been considered and intentionally left blank.

- Don't guess on any details. If you’re unsure about specific information, such as the legal description of the property, take the time to verify it. Incorrect information can void the deed.

- Don't use the Quitclaim Deed to transfer property if there are doubts about the title or if warranties are desired. Unlike other types of deeds, the Quitclaim Deed does not guarantee the grantor holds a clear title.

Misconceptions

When it comes to understanding the California Quitclaim Deed form, several misconceptions can mislead individuals about its use and implications. It's important to clear up these misunderstandings for anyone considering this legal tool as part of managing real estate assets.

- Misconception 1: A Quitclaim Deed guarantees a clear title. One common misconception is that submitting a Quitclaim Deed assures the recipient that the property title is clear of any liens or encumbrances. However, a Quitclaim Deed merely transfers whatever interest the grantor has in the property—if any—without warranties regarding the title's validity or freedom from claims.

- Misconception 2: Quitclaim Deeds are only for transactions without payment. While it’s often used in transferring property between family members or into a trust where no money changes hands, a Quitclaim Deed can also be used in transactions where the property is sold. The key difference from warranty deeds is not about the presence of payment but the lack of any guarantees on the property’s title.

- Misconception 3: The use of a Quitclaim Deed avoids property taxes. Some people mistakenly believe that transferring property via a Quitclaim Deed allows them to avoid property taxes. In reality, the transfer of property ownership, regardless of the method, can trigger reassessment and possibly change property tax obligations, subject to local tax laws.

- Misconception 4: Quitclaim Deeds settle property disputes. There's a belief that a Quitclaim Deed can resolve disputes over property ownership. While a Quitwork is used Deed to transfer whatever interest a person may have in a property, it doesn't in itself settle disputes or establish legal ownership in the eyes of the court. Proper legal advice and, in some cases, a court decision may be required to resolve property disputes conclusively.

Understanding these misconceptions about the California Quitclaim Deed form can help individuals navigate their real estate transactions more effectively, ensuring they make informed decisions based on accurate information.

Key takeaways

When handling a California Quitclaim Deed form, several important aspects should be kept in mind to ensure the process is completed correctly and effectively. This form is essential for transferring property rights without warranties, which means the grantor does not guarantee clear title to the property. Here are seven key takeaways:

- Ensure all information is complete and accurate: It's crucial to double-check all entered details, including the legal description of the property, the names of the grantor (seller) and grantee (buyer), and the parcel number, to prevent any potential legal issues in the future.

- Legal description of the property is a must: A quitclaim deed requires the legal description of the property being transferred, not just its address. This may include lot, block, and tract number and must match the description on the official property records.

- Sign in the presence of a notary public: The grantor must sign the quitclaim deed in the presence of a notary public for it to be legally valid. The notarization process authenticates the identities of the signing parties.

- Understand the lack of guarantees: By using a quitclaim deed, the grantor makes no guarantees about the property title's status. It's important to understand that this type of deed transfers only the grantor's interest in the property, if any, at the time of transfer.

- Recording is essential: After the quitclaim deed is signed and notarized, it must be recorded with the county recorder's office where the property is located. This step is vital for the document to be recognized as valid and to put the public on notice of the transfer.

- Consider tax implications: Transferring property using a quitclaim deed may have tax consequences for both the grantor and the grantee. It's advisable to consult with a tax professional to understand any potential liabilities or exemptions.

- Professional advice is recommended: Given the legal and financial nuances associated with quitclaim deeds, seeking advice from a real estate attorney or a legal professional can provide clarity and guidance throughout the process, ensuring compliance with California law and addressing any specific concerns.

By keeping these key points in mind, individuals can navigate the process of completing and using a California Quitclaim Deed form more effectively, ensuring a smoother property transfer process.

More California Forms

California Bill of Sale - An agreement that often includes contact information, making future correspondence easier.

Contract to Sell Land - This agreement serves as a roadmap for the transaction, detailing timelines and conditions for the sale of the land.