Legal California Promissory Note Document

In the dynamic world of California's lending landscape, the California Promissory Note form stands as a pivotal document, outlining the essential terms of a promise to repay a loan between parties. This critical piece of financial documentation plays a substantial role in the legal framework surrounding private loans, serving interests of both lenders and borrowers by clearly defining the amount borrowed, interest rates, repayment schedule, and the consequences of default. Ensuring clarity and mutual understanding, the promissory note safeguards the transaction, anchoring it in the legal principles governing financial agreements. Given its significance, understanding the proper use and thorough completion of the California Promissory Note form is essential for anyone involved in private lending or borrowing within the state. By navigating its components with precision, individuals can fortify their financial interactions, making certain that all parties are protected under the wide umbrella of law.

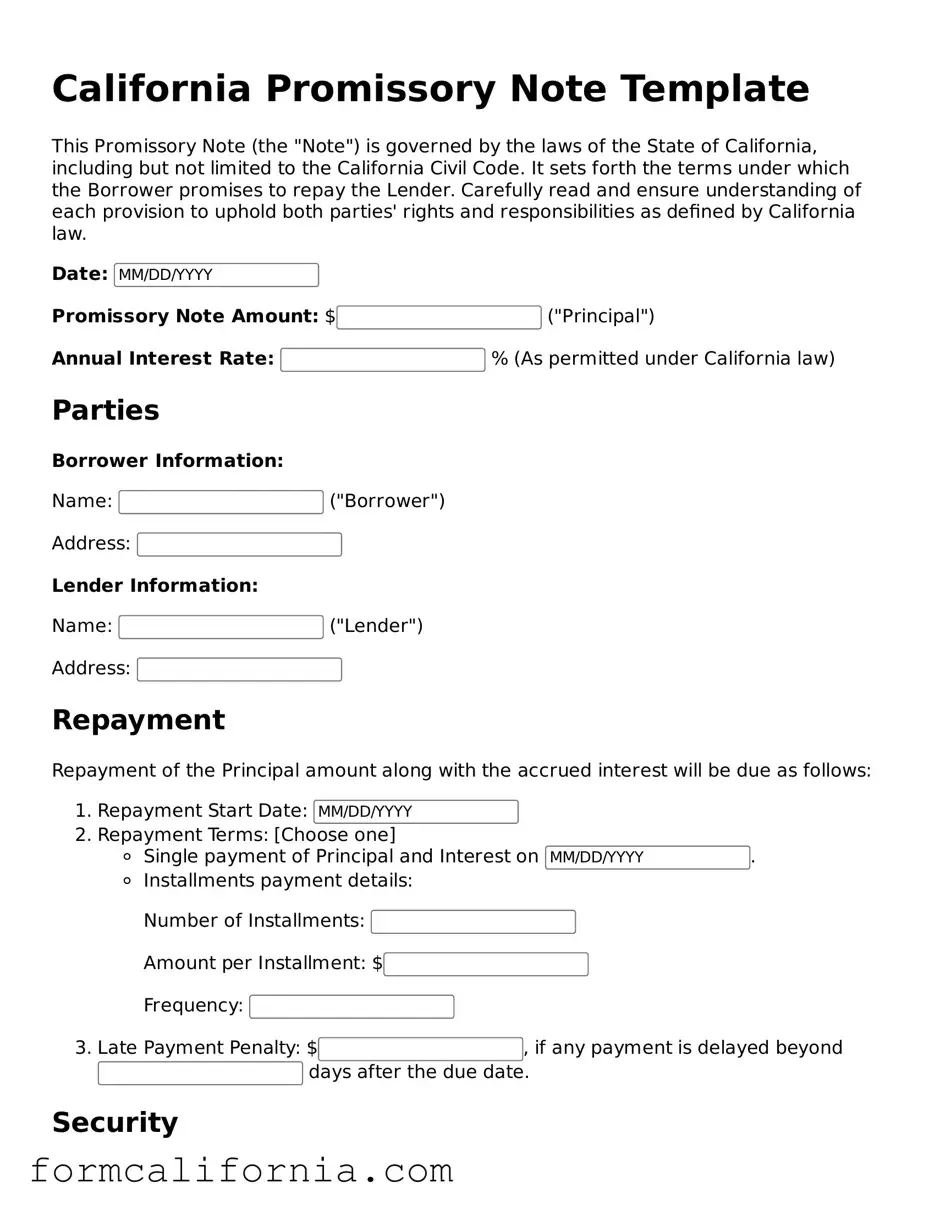

Document Preview Example

California Promissory Note Template

This Promissory Note (the "Note") is governed by the laws of the State of California, including but not limited to the California Civil Code. It sets forth the terms under which the Borrower promises to repay the Lender. Carefully read and ensure understanding of each provision to uphold both parties' rights and responsibilities as defined by California law.

Date:Promissory Note Amount: $ ("Principal")

Annual Interest Rate: % (As permitted under California law)

Parties

Borrower Information:

Name: ("Borrower")

Address:

Lender Information:

Name: ("Lender")

Address:

Repayment

Repayment of the Principal amount along with the accrued interest will be due as follows:

- Repayment Start Date:

- Repayment Terms: [Choose one]

- Single payment of Principal and Interest on .

- Installments payment details:

Number of Installments:

Amount per Installment: $

Frequency:

- Late Payment Penalty: $, if any payment is delayed beyond days after the due date.

Security

[If this Note is secured, describe the collateral. If unsecured, state "Not Applicable".]

Collateral:

Governing Law

This Note shall be governed by and construed in accordance with the laws of the State of California, without giving effect to its conflict of laws provisions.

Signatures

Both parties agree to the terms and conditions set forth in this Promissory Note by their signatures below:

Borrower's Signature: _______________________________ Date:

Lender's Signature: ________________________________ Date:

PDF Form Characteristics

| Fact | Description |

|---|---|

| Governing Law | California Civil Code Sections 1624 and following |

| Interest Rate Limit | Generally, the legal interest rate is 10% per annum for personal, family, or household purposes under the California Constitution Article XV § 1. |

| Usury Laws | California's usury statutes cap the maximum interest rate that can be charged on loans not exempt from the usury law. |

| Late Fees | Permitted, but they must be reasonable and not considered a penalty. The terms must be clearly outlined in the promissory note. |

| Security | A California promissory note can be secured or unsecured. Secured notes require collateral, while unsecured notes do not. |

Detailed Instructions for Writing California Promissory Note

In California, a Promissory Note is a legal document used when one party, known as the borrower, wants to borrow money from another party, known as the lender, and promises to repay the borrowed amount under specific terms and conditions. This written promise helps clarify the repayment schedule, interest rate, and any collateral securing the loan, providing protection and clear expectations to both the borrower and the lender. The following steps are designed to guide both parties through the process of filling out a California Promissory Note form, ensuring all necessary information is accurately captured to make the document legally binding and effective.

- Gather necessary information: Before filling out the Promissory Note, collect all relevant information, including the identities of the borrower and lender, the principal loan amount, the interest rate, and the repayment schedule.

- Identify the parties: Clearly write the legal names of the borrower and the lender at the beginning of the document, including their addresses and contact information.

- Specify the principal amount: State the amount of money being loaned (the principal) in numeric and written form to avoid any ambiguity.

- Determine the interest rate: Agree upon an interest rate that is compliant with California’s usury laws. Write this percentage in the document.

- Outline the repayment schedule: Define the terms of repayment, including the start date, the frequency of payments (e.g., monthly), and the duration of the repayment period. Specify if the payments will be interest-only followed by a balloon payment of the principal, or if they will include both principal and interest.

- Include collateral information (if applicable): If the loan is secured by collateral, describe the collateral in detail within the document. This step gives the lender a right to seize the asset if the borrower defaults on the loan.

- State the governing law: Indicate that the Promissory Note will be governed by and construed in accordance with the laws of the State of California.

- Add a co-signer (if necessary): If a co-signer is part of the agreement, include their personal information and have them sign the document to accept responsibility for the debt if the borrower defaults.

- Signatures: Have both the borrower and the lender sign and date the document. The signatures legally bind both parties to the terms of the Promissory Note. Witness or notary signatures may also be required, depending on the nature of the loan and the preferences of the parties involved.

- Copy and distribute: Make copies of the signed document for both the borrower and the lender. Keeping a copy is important for both parties' records and any future reference.

Following these steps when filling out a California Promissory Note will help ensure that the agreement is comprehensive and legally enforceable. By clearly establishing the loan's terms and conditions, both the borrower and the lender can help prevent potential misunderstandings or disputes, making the lending process smoother and more secure for everyone involved.

Things to Know About This Form

What is a California Promissory Note?

A California Promissory Note is a legal document that records a loan's details between two parties in California. It outlines the amount borrowed, interest rate, repayment schedule, and the obligations of the borrower to repay the loaned amount to the lender. Crafting this document carefully is crucial as it serves as a binding agreement that protects both the borrower's and lender's interests.

Who needs to sign the California Promissory Note?

The California Promissory Note must be signed by the borrower and the lender to make it legally binding. In some cases, if a co-signer is part of the agreement, they also need to sign the document. A witness or notary public may also sign the note, providing an extra level of legality and verification to the document, although this is not strictly required by California law.

Is a California Promissory Note legally binding?

Yes, once it is signed by all the necessary parties, a California Promissory Note becomes a legally binding document. It obligates the borrower to repay the loaned amount under the agreed-upon terms. Failure to comply with the terms of the note can lead to legal consequences, including potential legal action to recover the loaned amount.

What types of Promissory Notes are there in California?

There are primarily two types of Promissory Notes used in California:

- Secured Promissory Note: This type of note is backed by collateral. If the borrower fails to repay the loan, the lender has the right to seize the collateral to recover their losses.

- Unsecured Promissory Note: This type does not involve collateral. If the borrower defaults, the lender must seek repayment through the court system without the benefit of seizing collateral.

What should be included in a California Promissory Note?

A comprehensive California Promissory Note should include the following elements:

- The full names and contact details of the borrower and lender.

- The loan amount and currency.

- The interest rate, abiding by California's usury laws.

- Repayment schedule detailing when and how payments should be made.

- Security agreement, if it is a secured note.

- Provisions for late fees and what constitutes a default.

- Governing law clause stating that the note is subject to California law.

Can a California Promissory Note be modified?

Yes, a California Promissory Note can be modified, but any modification must be agreed upon by all parties involved and documented in writing. Both the lender and the borrower should sign the modification agreement, making it part of the original promissory note. It's essential to keep detailed records of all modifications to ensure clarity and legality.

What happens if a borrower defaults on a California Promissory Note?

In the event of a default, the lender has several options under California law, depending on whether the note is secured or unsecured. For secured notes, the lender may seize the collateral. For unsecured notes, the lender might seek repayment through the court system. It's critical for the lender to communicate the steps they intend to take and to follow California legal procedures accurately to recover the borrowed sum.

Do I need a lawyer to create a California Promissory Note?

While it is possible to create a Promissory Note on your own, consulting with a legal professional can provide valuable insights and ensure that the document complies with all relevant California laws and regulations. A lawyer can also help tailor the note to your specific situation, offering protection and clarity for all parties involved.

Common mistakes

When preparing a California Promissory Note, individuals often overlook certain elements or make common errors that could potentially impact the legal enforceability or clarity of the agreement. Being mindful of these missteps can help ensure that the promissory note serves its intended purpose without future complications. Here are ten common mistakes:

Failing to specify the exact terms of repayment. It’s critical that the note clearly outlines how repayment is to be made, including dates, amounts, and whether payments will be in installments or a lump sum.

Omitting the interest rate or not adhering to California’s usury laws. Without a clearly stated interest rate, it could lead to disputes or legal issues concerning the amount due. Moreover, charging an interest rate above legal limits could void the interest and sometimes even more.

Not including the full legal names and addresses of both the lender and the borrower. This mistake can lead to confusion about the parties bound by the note and complicate enforcement.

Skipping the inclusion of co-signers, if applicable. When a co-signer is part of the agreement, their details must be included in the note to hold them accountable.

Lack of clear consequences for late payments or default. The note should specify any late fees or actions that will be taken if the borrower does not make payments as agreed.

Forgetting to state the loan’s purpose. Though not always legally required, indicating the purpose of the loan can provide additional clarity and protection for both parties.

Not defining the terms under which the note may be prepaid. Borrowers should know whether they can pay off the loan early and if any penalties apply for doing so.

Failing to include a governing law clause. This clause indicates which state’s laws will interpret and govern the note, which is crucial should any legal disputes arise.

Improper or missing signatures. The note must be signed by all parties involved, including co-signers if applicable, to be legally binding.

Not keeping a secure copy of the signed note. Both the lender and the borrower should keep secure copies of the note to prove the terms of their agreement and to protect against future disputes.

Avoiding these common mistakes can make a promissory note clear, complete, and enforceable. It ensures that all parties are protected and understand their obligations and rights under the note. As with any legal document, consideration of professional advice to validate the form and content of a promissory note tailored to specific circumstances is often a wise approach.

Documents used along the form

When drafting a California Promissory Note, several other documents are commonly utilized to ensure a comprehensive and legally-binding agreement. These forms work in conjunction to specify the terms of the loan, protect both lender and borrower, and adhere to state laws.

- Loan Agreement: This detailed contract outlines the terms and conditions of the loan. It typically includes the interest rate, repayment schedule, and any collateral securing the loan. The Loan Agreement serves as the foundation of the lending arrangement between the parties.

- Security Agreement: For loans requiring collateral, a Security Agreement specifies the assets pledged by the borrower to secure the debt. This document protects the lender’s interests by detailing the rights to seize the collateral if the borrower defaults on the loan.

- Amortization Schedule: An Amortization Schedule breaks down each payment over the course of the loan into principal and interest. It provides a clear timeline for repayment, helping both parties understand when the loan will be fully paid off.

- Guaranty: In situations where additional assurance is needed, a Guaranty can be used. This document involves a third party, the guarantor, who agrees to repay the loan if the original borrower fails to do so. Guaranties strengthen the security of the loan for the lender.

- Late Payment Notice: This form is sent to a borrower who has missed a payment, detailing the late payment and any applicable late fees. It serves as a formal reminder of the borrower’s obligations under the terms of the agreement.

- Release of Promissory Note: Upon the full repayment of the loan, a Release of Promissory Note is issued to document that the borrower has fulfilled their payment obligations and the debt is no longer owed. This form clears the borrower of further liability regarding the loan.

Together, these documents form a comprehensive framework that governs the lending process. By covering various aspects of the loan, from the establishment of terms to the final release of liability, they provide clarity and legal safeguards for both the borrower and the lender in a promissory note arrangement in California.

Similar forms

The California Promissory Note form is closely related to the Loan Agreement. Both documents serve the purpose of delineating the terms under which money is borrowed and must be repaid. While a Promissory Note is a straightforward pledge by the borrower to repay the sum, a Loan Agreement is more comprehensive, covering additional clauses such as the rights and obligations of both parties, the interest rate, and the repayment schedule in greater detail.

Another similar document is the Mortgage Agreement. It also involves the borrowing of money, but specifically ties the loan to a piece of real estate as collateral. Similar to a Promissory Note, it outlines repayment terms but goes further, securing the loan against the property, which can be foreclosed upon if the borrower fails to comply with the terms.

A Deed of Trust operates in a fashion akin to a Promissory Note and a Mortgage Agreement combined but involves a third party, the trustee, who holds the actual title to the property until the loan is repaid. The borrower signs a Promissory Note, and the Deed of Trust serves as the security for that note, spelling out the procedure for repayment and foreclosure if necessary.

The Personal Guarantee is analogous to a Promissory Note in its function of ensuring repayment of a loan. This document involves a third party agreeing to repay the debt if the original borrower fails to do so, adding an additional layer of security for the lender similar to the commitment made in a Promissory Note.

An IOU, similar to a Promissory Note, is a simple acknowledgment of debt. However, it is more informal and typically does not specify repayment terms such as due dates or interest rates. Both serve as written promises to pay a specified sum of money to another party, but a Promissory Note is more formal and comprehensive.

The Bill of Sale is similar in that it confirms a transaction between two parties, much like a Promissory Note confirms a loan agreement. However, it is typically used for the sale of goods or personal property, indicating a transfer of ownership, without involving terms for repayment over time.

A Credit Agreement shares traits with a Promissory Note, as it outlines the terms under which credit is extended from a lender to a borrower, including repayment terms. Unlike a simple Promissory Note, a Credit Agreement often encompasses revolving credit facilities, such as credit cards or lines of credit, and includes detailed terms and conditions.

An Installment Agreement, much like a Promissory Note, involves the repayment of a loan in scheduled payments. However, it is specifically designed to structure the debt into evenly divided payments over a set period, providing more detailed scheduling compared to a typical Promissory Note.

The Secured Promissory Note is a variant that, while maintaining the essence of an unsecured Promissory Note, adds a component of collateral. This means that in addition to promising to repay the borrowed amount, the borrower also agrees to pledge specific assets as security, enhancing the lender’s assurance of repayment similar to a Mortgage Agreement.

Last but not least, the Lease Agreement, while primarily used for rental arrangements rather than lending transactions, shares conceptual ground with a Promissory Note since it outlines terms between two parties over a financial matter. In a Lease Agreement, the focus is on the payment terms for the right to use real estate or personal property, involving regular payments similar to a loan repayment structure.

Dos and Don'ts

Filling out the California Promissory Note form requires attention to detail and an understanding of what this legal document entails. To ensure it is completed accurately and effectively, here are things you should and shouldn't do:

What You Should Do:Provide complete information on the borrower and lender, including legal names, addresses, and contact details. This clarity helps prevent any confusion about who is involved in the agreement.

Be specific about the loan amount. Write the amount in numbers and words to avoid any discrepancies.

Detail the repayment plan clearly, including the frequency of payments (monthly, quarterly), the amount of each payment, and the duration of the repayment period. This ensures both parties are on the same page regarding expectations.

Include the interest rate, ensuring it complies with California's legal limits. Being precise about the interest rate prevents potential legal issues regarding usury laws.

Specify the consequences of a late payment or default. Outlining these details upfront can help mitigate misunderstanding and disputes in the future.

Insert a co-signer (if applicable). A co-signer can provide additional security for the loan, especially if the borrower has a less than ideal credit history.

Review before signing. Both parties should thoroughly read the promissory note to ensure all the details are correct and understood.

Leave sections blank. If a section does not apply, write 'N/A' (not applicable) instead of leaving it empty. This prevents unauthorized additions later.

Use vague language. The terms of the loan should be detailed and precise to prevent ambiguity.

Forget to include a governing law clause. This specifies that the note is governed by the laws of California, which is crucial for legal enforcement.

Omit signatures. Both the borrower and the lender must sign the note for it to be legally binding. Ensure these signatures are dated.

Neglect to make a copy for each party. Each party should have a signed copy of the promissory note for their records.

Overlook the necessity of witness or notary signatures, if required. While not always mandatory, having the promissory note witnessed or notarized can add a layer of legal protection.

Fail to secure the note. If the loan is secured with collateral, this should be explicitly stated in the document, along with a detailed description of the collateral.

Misconceptions

When dealing with the California Promissory Note form, several misconceptions can lead to confusion and potentially legal missteps. Understanding these common myths can help in managing loans and financial agreements more effectively.

All promissory notes are the same: Many believe that promissory notes are a one-size-fits-all document. However, the terms and conditions can vary greatly depending on the specifics of the loan, such as the repayment schedule, interest rate, and the presence of security or collateral.

Oral agreements are as binding as written ones: While oral contracts can be legally binding, proving the terms without a written record is challenging. In California, a written promissory note is crucial for enforcing the loan terms.

Interest rates can be as high as agreed upon: It's a common misconception that lenders can set any interest rate if the borrower agrees. California has usury laws that limit the maximum interest rate that can be charged in most cases.

You don't need a witness or notarization: Though not always legally required, having a witness or notarizing the promissory note can add a layer of security and authenticity to the agreement, potentially simplifying enforcement.

Promissory notes are only for banks: Individuals often think that only banks can issue promissory notes. However, private parties use promissory notes for personal loans, business deals, and other financial transactions.

A promissory note is the only document you need: While important, a promissory note is sometimes just part of the documentation needed, especially if the loan involves collateral. In such cases, security agreements and other documents may also be necessary.

Modification requires a new note: Some think that any change to a promissory note's terms necessitates drafting a new document. In fact, modifications can be made through written amendments agreed upon by all parties.

Only the borrower needs a copy: It's essential for both the lender and the borrower to keep a copy of the promissory note. This ensures that both parties have a record of the agreement for future reference or in case of disputes.

Filing with a government entity is required: Unlike deeds or titles, promissory notes do not need to be filed or registered with any government agency in California to be valid. However, proper documentation and record-keeping are still important for legal and financial reasons.

Understanding these myths about the California Promissory Note form can help individuals and businesses navigate financial transactions more effectively, ensuring that their interests are properly protected and that they comply with applicable laws.

Key takeaways

When preparing and utilizing the California Promissory Note form, individuals should approach the process with precision and comprehension. This document, essential in recording the details of a loan between two parties, mandates careful attention to legal requirements and clear communication. Below are key takeaways that should guide both lenders and borrowers in the effective handling of this form:

- Comprehend the Legal Framework: Individuals need to recognize that the California Promissory Note is governed by both federal laws and specific state laws of California, including statutes that regulate interest rates and the handling of defaults. Understanding this legal framework ensures adherence to state and federal guidelines, preventing potential legal complications.

- Accurate Details Are Crucial: It is imperative to fill out the form with precise information regarding the loan amount, interest rate, repayment schedule, and any collateral securing the loan (if applicable). These details form the backbone of the agreement and must be described accurately to avoid future disputes.

- Clarity on Interest Rates: Be conscious of California's usury laws, which limit the amount of interest that can be charged. Misunderstanding these laws can lead to unenforceable terms or legal penalties, so verifying compliance is crucial for both parties.

- Specify Repayment Terms: Clear articulation of the repayment terms—including frequency of payments, due dates, and the duration of the loan—is essential. This clarity prevents misunderstandings and sets clear expectations for repayment.

- Consideration of Collateral: If the promissory note is secured with collateral, details about the collateral must be explicitly mentioned, including a description and the conditions under which the lender can seize the asset. This not only reinforces the security of the loan but also outlines the rights and obligations of each party regarding the collateral.

- Legal and Notary Acknowledgment: Depending on the nature of the loan and the amount, it may be advisable to have the promissory note notarized or witnessed to further authenticate the document. Even though not always mandatory, this step can offer additional legal protection and credibility to the agreement.

By following these guidelines, individuals can ensure that their California Promissory Note is comprehensive, compliant with all necessary legal standards, and clearly understood by all parties involved. This is crucial in safeguarding the interests of both lenders and borrowers and in preventing potential legal issues arising from ambiguities or misunderstandings contained within the document.

More California Forms

How Long Does a Quit Claim Deed Take to Process - When looking to transfer property while avoiding the costs and delays of a traditional sale, this deed is often employed.

Affidavit of Death of Joint Tenant California - It's a foundational document in the process of dissolving the deceased's legal and financial existence.

Ca Dmv Bill of Sale Pdf - It's an invaluable document for auditing purposes, proving that a sale was conducted and reported accurately.