Legal California Prenuptial Agreement Document

In California, couples on the brink of marriage often consider a prenuptial agreement as a strategic step towards protecting their financial future. This legal document, though not the epitome of romantic preparation, empowers individuals to outline the ownership of their personal and shared assets before they enter into marriage. The California Prenuptial Agreement form allows for the clear designation of what property is considered separate property, what property will be regarded as marital property, and how potential financial issues will be resolved in the event of a divorce or separation. Additionally, the agreement can address future spousal support obligations, ensuring both parties have clarity and security regarding their financial relationship. It's important to note, however, that the form does not cover child support or custody issues, as these are determined based on the child's best interests at the time of separation. For a prenuptial agreement to be enforceable in California, it must be entered into voluntarily, with full and fair disclosure of all assets, and without any duress or undue influence. The preparation of this document often involves legal counsel to ensure that the agreement complies with California law and adequately protects the interests of both parties.

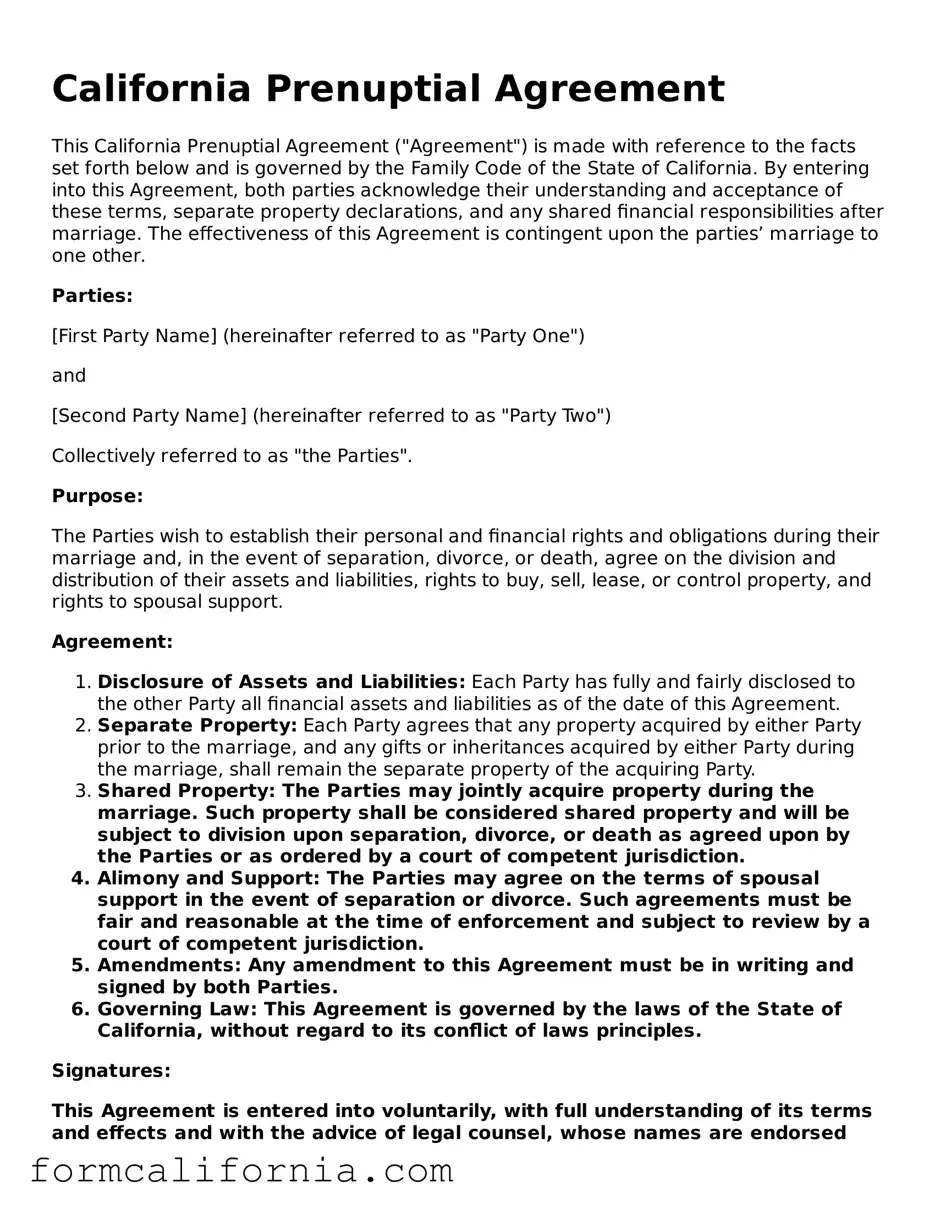

Document Preview Example

California Prenuptial Agreement

This California Prenuptial Agreement ("Agreement") is made with reference to the facts set forth below and is governed by the Family Code of the State of California. By entering into this Agreement, both parties acknowledge their understanding and acceptance of these terms, separate property declarations, and any shared financial responsibilities after marriage. The effectiveness of this Agreement is contingent upon the parties’ marriage to one other.

Parties:

[First Party Name] (hereinafter referred to as "Party One")

and

[Second Party Name] (hereinafter referred to as "Party Two")

Collectively referred to as "the Parties".

Purpose:

The Parties wish to establish their personal and financial rights and obligations during their marriage and, in the event of separation, divorce, or death, agree on the division and distribution of their assets and liabilities, rights to buy, sell, lease, or control property, and rights to spousal support.

Agreement:

- Disclosure of Assets and Liabilities: Each Party has fully and fairly disclosed to the other Party all financial assets and liabilities as of the date of this Agreement.

- Separate Property: Each Party agrees that any property acquired by either Party prior to the marriage, and any gifts or inheritances acquired by either Party during the marriage, shall remain the separate property of the acquiring Party.

- Shared Property: The Parties may jointly acquire property during the marriage. Such property shall be considered shared property and will be subject to division upon separation, divorce, or death as agreed upon by the Parties or as ordered by a court of competent jurisdiction.

- Alimony and Support: The Parties may agree on the terms of spousal support in the event of separation or divorce. Such agreements must be fair and reasonable at the time of enforcement and subject to review by a court of competent jurisdiction.

- Amendments: Any amendment to this Agreement must be in writing and signed by both Parties.

- Governing Law: This Agreement is governed by the laws of the State of California, without regard to its conflict of laws principles.

Signatures:

This Agreement is entered into voluntarily, with full understanding of its terms and effects and with the advice of legal counsel, whose names are endorsed hereon. The Parties affirm their commitment to the terms of this Agreement by their signatures below:

Party One Signature: ___________________________________ Date: _______________

Party Two Signature: ___________________________________ Date: _______________

Legal Counsel:

- Counsel for Party One: [Name] [Contact Information]

- Counsel for Party Two: [Name] [Contact Information]

PDF Form Characteristics

| Fact | Description |

|---|---|

| 1. Governing Law | The California Prenuptial Agreement form is governed by the California Family Code, specifically sections 1610 to 1617. |

| 2. Purpose | Its primary purpose is to outline the distribution of assets, debts, and define financial obligations should the marriage end in divorce or death. |

| 3. Enforcement | To be enforceable, the agreement must be in writing and signed by both parties. |

| 4. Disclosure | Full and fair disclosure of all assets and liabilities by both parties is required for the agreement to be valid. |

| 5. Independent Legal Advice | Both parties are advised to seek independent legal advice before signing the agreement to ensure understanding and voluntariness. |

| 6. Waiting Period | There is a mandatory 7-day waiting period after the parties have received the agreement and advisement before it can be signed. |

| 7. Amendments and Revocation | Any amendments or revocation of the agreement must be done in writing and signed by both parties to be valid. |

| 8. Not Just for Wealthy Couples | Although commonly associated with protecting assets, prenuptial agreements can benefit couples of all financial backgrounds by clarifying financial rights and responsibilities. |

Detailed Instructions for Writing California Prenuptial Agreement

Filling out a California Prenuptial Agreement form is a critical step for couples looking to define their financial rights and obligations before marriage. This process requires careful consideration and attention to detail to ensure that the agreement accurately reflects both parties' intentions and complies with California law. By following the steps outlined below, couples can navigate the complexities of this important legal document, securing their financial future and providing peace of mind as they enter into marriage.

- Gather all necessary financial documents, including bank statements, investment accounts, property deeds, and liabilities. This preparatory step is crucial for an accurate disclosure.

- Start by entering the full legal names of both parties entering into the agreement at the top of the form.

- Specify the date of the marriage in the space provided, ensuring accuracy as this aligns the agreement with the intended period.

- Detail each party's financial assets and liabilities in the sections designated for this purpose. Transparency and accuracy here are paramount for a valid agreement.

- If applicable, describe the terms of spousal support or the waiver thereof. Both parties must understand and agree to these terms entirely.

- Outline how property will be divided in the event of separation, divorce, or death. Consider all types of property, including real estate, personal property, and future earnings.

- Agree on how future disputes related to the agreement will be resolved, such as through mediation or arbitration, and include this in the designated section.

- Both parties should review the entire document carefully, ensuring that all terms are understood and agreed upon. Legal consultation is highly recommended to avoid future disputes and ensure the agreement is enforceable.

- Sign and date the form in the presence of a notary public. The notarization process adds a layer of legal formalization and authentication to the document.

- Make copies of the notarized agreement. Each party should keep a copy, and an additional copy may be stored in a safe place, such as a safety deposit box or with a legal advisor.

Completing a prenuptial agreement in California is a proactive step towards establishing clear financial expectations and responsibilities within a marriage. While it may seem daunting at first, taking it step by step can make the process manageable and less overwhelming. Remember, this document serves to protect both individuals, laying a foundation for open and honest communication about finances in the relationship. Ensuring the agreement is filled out thoroughly and accurately will provide security and clarity for years to come.

Things to Know About This Form

What is a California Prenuptial Agreement?

A California Prenuptial Agreement is a legal document that a couple enters into before they get married. This agreement outlines how assets and liabilities will be managed and distributed in the event of a divorce, separation, or death. It allows parties to define their financial rights and responsibilities during the marriage and set terms for the division of property.

Who should consider a Prenuptial Agreement in California?

Anyone with personal or business assets, liabilities, or children from previous relationships should consider a prenuptial agreement. It's also wise for individuals who expect to receive inheritances or have significant income changes in the future. This agreement can offer protection and clarity for both parties, regardless of their wealth.

What can be included in a California Prenuptial Agreement?

In California, a Prenuptial Agreement can include provisions for:

- The rights and obligations of each party regarding property owned or acquired individually or jointly.

- How property will be divided in the event of separation, divorce, or death.

- The establishment of a will, trust, or other arrangement to carry out the provisions of the agreement.

- The ownership and distribution of the death benefit from a life insurance policy.

- Choice of law governing the construction of the agreement.

- Any other matters, including personal rights and obligations, not in violation of public policy or a statute imposing a criminal penalty.

What cannot be included in a California Prenuptial Agreement?

Certain matters cannot be legally included in a Prenuptial Agreement in California, such as:

- Provisions that violate public policy or criminal laws.

- Decisions regarding child custody or child support that could adversely affect the child's right to support.

- Conditions that stipulate penalties for personal choices, like having children or adhering to a particular religion.

Is a California Prenuptial Agreement enforceable?

For a California Prenuptial Agreement to be enforceable, it must be:

- Entered into voluntarily by both parties.

- Accompanied by full and fair disclosure of all financial assets and liabilities by both parties.

- Free of any duress, fraud, or undue influence.

- Not unconscionable at the time of enforcement.

- Properly executed and in writing.

The couple also has the right to legal representation during the agreement process.

How can a California Prenuptial Agreement be changed or terminated?

A Prenuptial Agreement in California can be changed or terminated only if both parties agree. The modification or termination must be in writing, signed by both individuals. Oral agreements to change or terminate the prenup are not enforceable.

Do both parties need a lawyer for a California Prenuptial Agreement?

While it's not legally required for both parties to have separate lawyers, it's highly recommended. Legal representation ensures that both individuals fully understand the agreement and its implications. A lawyer can also help validate the fairness of the agreement and its adherence to California law, potentially preventing issues related to enforcement in the future.

Common mistakes

When individuals fill out the California Prenuptial Agreement form, they often make mistakes that can affect the validity or clarity of the agreement. Recognizing and avoiding these mistakes is key to ensuring that the agreement is legally sound and reflects the intentions of both parties. Here are the most common mistakes:

- Not fully disclosing assets or debts. It's vital for both parties to fully disclose their financial situation, including all assets and debts. Failing to do so can lead to the agreement being challenged or invalidated.

- Using unclear language. The language in the agreement should be clear and understandable to both parties. Legal jargon or ambiguous terms can cause confusion and future disputes.

- Skipping legal advice. Each party should seek independent legal advice. This ensures that both understand the agreement's implications and that it's fair and legally binding.

- Forgetting to include a sunset clause. Some couples want the agreement to have an expiration date or conditions under which it's no longer valid. Forgetting to include this can lead to issues in the future.

- Not addressing spousal support. Decide whether to include provisions for spousal support. Neglecting this aspect can lead to disputes and legal complications later on.

- Failure to update the agreement. It's wise to review and update the agreement as circumstances change. Failure to do so can make parts of the agreement outdated and unenforceable.

- Signing under pressure. Both parties must enter into the agreement voluntarily without any pressure or duress. Agreements signed under pressure can be invalidated.

- Lack of witness or improper notarization. Ensure the agreement is properly witnessed and notarized as required by law to be legally binding.

- Ignoring state-specific laws. The agreement must comply with California law. Ignoring state-specific requirements can lead to parts of the agreement being unenforceable.

- Mixing personal wishes with legal terms. It's important to keep personal wishes (like household chores distribution) separate from legal terms to maintain the agreement's legality and clarity.

Avoiding these mistakes can help ensure that the prenuptial agreement stands firm, reflects the wishes of both parties, and adheres to California law. By paying careful attention to detail and seeking proper advice, individuals can create a strong and enforceable prenuptial agreement.

Documents used along the form

When couples decide to marry, they often consider creating a prenuptial agreement in California. This document sets terms for the division of assets and debts, and support matters if the marriage ends. Alongside a prenuptial agreement, there are several other important forms and documents that can provide additional legal clarity and security. Here is a list of seven such documents that are frequently used.

- Financial Disclosure Statements: These forms detail each party's financial situation, including assets, debts, income, and expenses. They ensure transparency between partners when signing a prenuptial agreement.

- Will and Testament: This document outlines how a person's assets should be distributed after their death. It's crucial to update or create a will to reflect the terms of a prenuptial agreement.

- Power of Attorney: A legal document that gives one partner the authority to act on behalf of the other in specific legal or financial matters.

- Living Will: This form outlines a person's wishes regarding medical treatment if they become unable to communicate their decisions because of illness or incapacity.

- Postnuptial Agreement: Similar to a prenuptial agreement, but it's created after the marriage has occurred. It can modify or reaffirm the terms of the prenuptial agreement.

- Marriage Certificate: An official document proving that a marriage is legally recognized. It's often needed for administrative purposes, such as changing one's name or filing taxes jointly.

- Property Title Documents: These documents show ownership of assets such as real estate or vehicles. They may need to be updated to reflect any agreements made in the prenuptial agreement.

Securing these documents alongside a California prenuptial agreement can protect both parties and ensure a clear understanding of each person's rights and responsibilities. It's advisable to consult with a legal professional when preparing these documents to ensure they are correctly executed and legally binding.

Similar forms

A California Prenuptial Agreement form shares similarities with a range of documents that both precede and follow significant life events, particularly those entailing legal, financial, or partnership commitments. Each document, while distinct in purpose, overlaps in their goal to delineate rights, responsibilities, and expectations among parties.

One such document is the Postnuptial Agreement. Like its pre-marital counterpart, it outlines how assets and debts should be handled during the marriage or in the event of divorce or death. However, the key difference lies in the timing; postnuptial agreements are drawn up after the marriage has taken place, reflecting changes that may have occurred since the wedding.

Another related document is a Cohabitation Agreement, utilized by unmarried couples who live together. It serves a similar purpose in determining the ownership and division of assets and liabilities but is designed for those without a legal marriage. This agreement helps avoid potential disputes should the relationship end or one partner pass away.

The Last Will and Testament also bears resemblance, as it specifies asset distribution upon one’s death. Although it isn't limited to marital assets, it often includes provisions affected by prenuptial agreements, ensuring that personal wishes are honored in conjunction with previously agreed terms between spouses.

Partnership Agreements, used in business scenarios, outline the workings between business partners, similar to how a prenuptial agreement delineates the parameters of the marital partnership. Both aim to preemptively solve disputes regarding asset division, responsibilities, and decision-making processes.

Financial Affidavits, though generally used within the domain of legal proceedings like divorce or child support cases, share the detailed disclosure aspect of prenuptial agreements. They necessitate a full declaration of assets and liabilities to ensure fair and informed agreements are made.

A Separation Agreement, initiated when couples decide to live apart but remain legally married, closely mirrors a prenuptial agreement’s focus on the division of assets, debts, and other marital responsibilities during the separation period and potentially post-divorce.

The Buy-sell Agreement, prevalent in the context of business, is designed to determine what happens with a business share upon the occurrence of certain events, such as the death of a partner. Its essence parallels that of prenuptial agreements in managing changes in partnership dynamics, albeit in a business setting.

Lastly, Living Trusts share the premarital document's aim of asset management and distribution, allowing individuals to specify how their assets are handled during their lifetime and after death. This ensures assets are distributed directly to beneficiaries without the need for probate, similarly to how prenuptial agreements can circumvent probate disputes over marital property.

Each of these legal documents, while serving their unique purposes, intersects with the principles of a California Prenuptial Agreement in fundamental ways, highlighting the vast network of agreements and contracts that manage personal, financial, and business relations in society.

Dos and Don'ts

When filling out a California Prenuptial Agreement form, understanding the dos and don'ts can ensure that your agreement is valid, fair, and enforceable. A prenuptial agreement, commonly known as a prenup, is a legal document a couple signs before getting married to outline the division of assets and debts in the event of a divorce. Here are some important guidelines.

Things You Should Do

- Seek Independent Legal Advice: Both parties should have their own attorneys to provide legal advice and ensure that the agreement is fair and that both understand the terms and implications.

- Disclose All Assets and Liabilities: Fully and truthfully disclose all assets, liabilities, income, and expectations of gifts and inheritances. Transparency is key to a valid agreement.

- Allow Adequate Time: Do not rush the process. Both parties should have ample time to consider the agreement, seek advice, and make informed decisions without pressure or duress.

- Consider Future Changes: Include provisions for future changes in circumstances, such as the birth of children, career changes, or significant changes in finances, to ensure fairness over time.

Things You Shouldn't Do

- Do Not Include Personal Preferences: Avoid including terms about non-financial matters, such as children's upbringing, household responsibilities, or personal habits, as these are generally not enforceable.

- Do Not Coerce or Pressure: Ensure that both parties voluntarily agree to the terms. Agreements signed under duress, coercion, or undue influence can be declared invalid.

- Do Not Skimp on Details: Be specific and detailed about assets, liabilities, and how items will be divided. Vague or ambiguous terms can lead to disputes and may render parts of the agreement unenforceable.

- Do Not Wait Until the Last Minute: Giving the agreement to your partner on the eve of your wedding puts undue pressure on them and can cast doubt on the voluntary nature of their agreement, potentially making it unenforceable.

Misconceptions

Many people have misconceptions about California Prenuptial Agreement forms. These misunderstandings can affect couples' decisions regarding their marriage and financial planning. Here's a list of ten common myths and the realities behind them:

Only wealthy people need a prenuptial agreement. This isn't true. While prenuptial agreements are often associated with the wealthy, they can benefit couples at all financial levels by clarifying financial rights and responsibilities.

Prenuptial agreements are planning for divorce. Many see prenuptial agreements as planning for a marriage to fail. However, they're better understood as a form of financial planning, offering clarity and protection for both partners.

Signing a prenuptial agreement means you don't trust your partner. Trust isn't the issue; it's about having a sensible backup plan. It allows couples to enter marriage with a clear understanding of their financial rights and obligations.

You can include anything you want in a prenuptial agreement. California law does not allow prenuptial agreements to include terms that are illegal, unfair, or pertaining to child custody or support issues.

Prenuptial agreements are expensive and only for the rich. The cost of a prenuptial agreement varies but is often far less than the cost of not having one if things go awry. They are an investment in your mutual financial future.

If I don't have a prenup, I'll automatically lose half my assets in a divorce. California is a community property state, but this doesn't mean everything is split 50/50. Courts consider various factors in dividing property.

Prenuptial agreements are set in stone. Agreements can often be modified or revoked, provided both parties agree and the changes are documented in writing.

If you sign a prenup, you won't receive any spousal support. Prenuptial agreements can contain provisions for spousal support, but those provisions are subject to court review and must not lead to an unconscionable situation.

You can wait until just before the wedding to deal with a prenup. Rushing a prenuptial agreement can be a mistake. Both parties need time to fully understand the agreement, and last-minute agreements may be viewed with suspicion by the court.

A prenup makes the marriage feel more like a business transaction. While it does involve financial arrangements, a prenuptial agreement is also a tool for communication and planning, ensuring both partners are on the same page.

Key takeaways

When considering a prenuptial agreement in California, understanding the key features and legal requirements is crucial for both parties involved. A prenuptial agreement, often referred to as a "prenup," is a document that a couple signs before getting married to outline the ownership of their respective assets and how financial matters will be handled in the event of a divorce or separation. Here are nine key takeaways about filling out and using the California Prenuptial Agreement form:

- Full Disclosure is required from both parties. This means each party must provide a complete and accurate disclosure of their financial assets and liabilities. Failing to do so could result in the agreement being invalidated.

- Understand California's Community Property Laws. California is a community property state, meaning that without a prenuptial agreement, assets acquired during the marriage are generally considered jointly owned. A prenup can specify different arrangements.

- The importance of Independent Legal Advice. Each party should seek independent legal advice before signing the prenup. This ensures that both understand the agreement fully and helps protect against claims of undue influence or coercion.

- Consider the Timing of the Agreement. It's advisable not to leave the prenup until the last minute. introducing and signing a prenup well in advance of the wedding can help avoid claims of pressure to sign the agreement.

- The agreement must be Written and Signed. Oral agreements are not recognized. For a prenuptial agreement to be valid in California, it must be in writing and signed by both parties.

- Enforceability and Fairness. For a prenup to be enforceable, it must be entered into voluntarily and considered fair at the time of the signing. A court may deem a prenup invalid if it finds the agreement was signed under duress or is unconscionable.

- Ability to Waive Spousal Support. Individuals can agree to waive their rights to spousal support in the event of a divorce. However, the enforceability of such a clause will depend on the circumstances and the judge's assessment of fairness at the time of enforcement.

- Consider the need for Amendments or Revocations. Life circumstances change, and with them, so might your prenup needs. The agreement should include terms on how it can be amended or revoked to reflect changes in the couple's life or financial situation.

- Legal Representation is not mandatory but strongly recommended. While parties can draft a prenuptial agreement on their own, having an attorney review the agreement can ensure its validity and enforceability, as well as that it meets both parties’ needs and interests.

Properly understanding and utilizing the California Prenuptial Agreement form can help couples establish a clear financial understanding and plan for their future together. However, considering the legal complexities and the potential consequences of such an agreement, seeking professional advice is highly advised.

More California Forms

Durable Power of Attorney Forms - Empowers individuals to select a representative who aligns with their values and understands their wishes thoroughly.

California Commercial Lease Agreement - The lease agreement can detail rights to renew under the same terms, offering stability for the tenant's business.

Bill of Sale for Car Template - Aside from the transaction details, this form may also outline any warranties or "as-is" sale conditions, clearly stating what the buyer can expect regarding the bike's condition.