Legal California Power of Attorney Document

In the state of California, the Power of Attorney (POA) form serves as a legal testament, enabling individuals to designate a trusted person, known as an agent, to act on their behalf in various capacities. This powerful document can cover a wide range of activities, from financial decisions, handling business transactions, to making medical choices under certain conditions. Its flexibility allows the principal—the person making the designation—to tailor the powers granted, whether for specific tasks or broad authority, and can be set to remain effective upon disability. The California POA form must adhere to state laws, requiring particular formalities for its creation, including the necessity for witnesses or a notary to validate the principal's signature. Understanding the nuances of this form is crucial, as it not only empowers someone else to act in your stead but also ensures that your affairs are managed according to your wishes, especially during unforeseen circumstances when you may not be able to do so yourself.

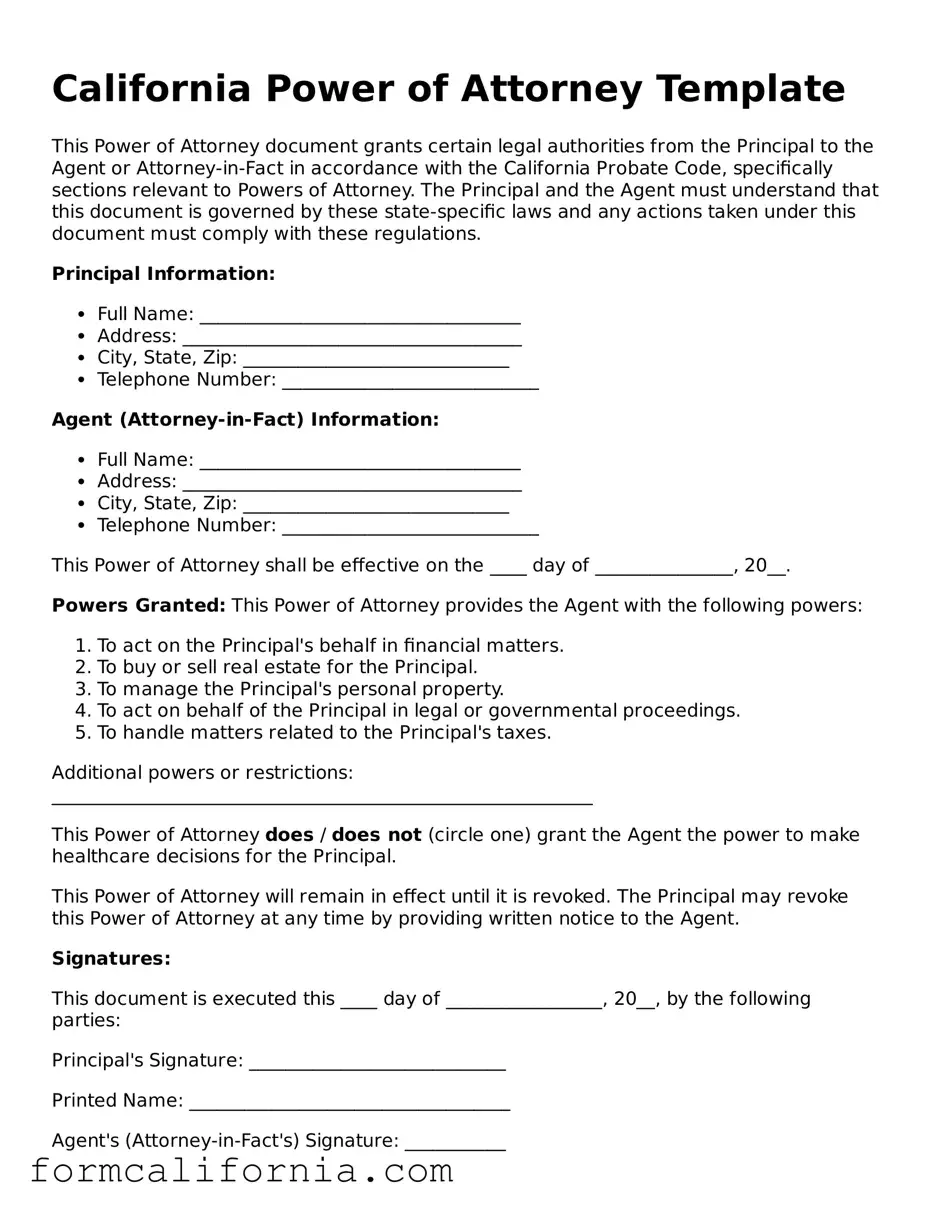

Document Preview Example

California Power of Attorney Template

This Power of Attorney document grants certain legal authorities from the Principal to the Agent or Attorney-in-Fact in accordance with the California Probate Code, specifically sections relevant to Powers of Attorney. The Principal and the Agent must understand that this document is governed by these state-specific laws and any actions taken under this document must comply with these regulations.

Principal Information:

- Full Name: ___________________________________

- Address: _____________________________________

- City, State, Zip: _____________________________

- Telephone Number: ____________________________

Agent (Attorney-in-Fact) Information:

- Full Name: ___________________________________

- Address: _____________________________________

- City, State, Zip: _____________________________

- Telephone Number: ____________________________

This Power of Attorney shall be effective on the ____ day of _______________, 20__.

Powers Granted: This Power of Attorney provides the Agent with the following powers:

- To act on the Principal's behalf in financial matters.

- To buy or sell real estate for the Principal.

- To manage the Principal's personal property.

- To act on behalf of the Principal in legal or governmental proceedings.

- To handle matters related to the Principal's taxes.

Additional powers or restrictions: ___________________________________________________________

This Power of Attorney does / does not (circle one) grant the Agent the power to make healthcare decisions for the Principal.

This Power of Attorney will remain in effect until it is revoked. The Principal may revoke this Power of Attorney at any time by providing written notice to the Agent.

Signatures:

This document is executed this ____ day of _________________, 20__, by the following parties:

Principal's Signature: ____________________________

Printed Name: ___________________________________

Agent's (Attorney-in-Fact's) Signature: ___________

Printed Name: ___________________________________

Witness Signature: _______________________________

Printed Name: ___________________________________

Note: Depending on the powers granted in this document, a notarization may be required for this Power of Attorney to be legally effective.

PDF Form Characteristics

| Fact | Detail |

|---|---|

| Function | Grants an individual or organization the authority to manage affairs on behalf of another person. |

| Types | Includes General, Durable, Limited, Medical, and Tax Powers of Attorney. |

| Principal | The person who grants authority to another. |

| Agent | The individual or organization given the authority to act. |

| Validity Requirements | Must be signed by the principal, witnessed by two individuals or notarized. |

| Governing Laws | California Probate Code, Sections 4000-4545 |

| Durability | A Durable Power of Attorney remains effective even if the principal becomes incapacitated. |

| Revocation | The principal may revoke it at any time as long as they are mentally competent. |

Detailed Instructions for Writing California Power of Attorney

Filling out a California Power of Attorney form is a straightforward process. This document enables an individual to grant another person the authority to make decisions on their behalf regarding financial or healthcare matters. It's crucial to complete this form accurately to ensure that the designated representative can act according to the principal's wishes. The following steps will guide you through the necessary parts of the form. Remember, it’s also advised to review the completed form with a legal professional before finalizing, to ensure all information is accurate and meets the principal’s needs.

- Start by entering the full legal name and address of the person who is granting the power, also known as the principal, at the top of the form.

- Enter the full legal name and address of the person who is being granted the power, known as the agent. If an alternate agent is to be designated, include their full legal name and address as well.

- Specify the powers being granted to the agent. This section requires detailed information about what the agent is allowed and not allowed to do on behalf of the principal. Make selections that reflect the principal’s wishes accurately.

- If there are specific dates when the power of attorney will begin and end, record these in the designated area. If no dates are specified, it will be considered durable and remain in effect until the principal decides to revoke it or upon the principal's death.

- There is a section on the form where you can provide detailed instructions for the agent. This might include financial limits, healthcare wishes, or any other specific directives from the principal. It’s important to be as clear and detailed as possible.

- Some forms require a notarization. If this is the case, the principal and the agent(s) must sign the form in the presence of a notary public. Ensure that all parties have a valid form of identification at the time of notarization.

- Review the completed form for accuracy and completeness. Ensure all necessary sections are filled out and that there are no mistakes or omissions.

Once the form has been completed and signed, it’s a good practice to distribute copies to relevant parties. These may include the agent, financial institutions, healthcare providers, and any other entities or individuals who may need to acknowledge the power of attorney. Keeping a copy in a safe but accessible location is also advised. This ensures that the agent can readily assume their responsibilities when needed.

Things to Know About This Form

What is a California Power of Attorney form?

A California Power of Attorney (POA) form is a legal document that grants a person, known as the agent or attorney-in-fact, the authority to make decisions and act on behalf of another person, known as the principal. This can include managing financial matters, making healthcare decisions, and handling other personal and business affairs.

Who can be named as an agent in a California POA?

Any competent adult can be named as an agent in a California POA. It's crucial for the principal to choose someone they trust deeply, as the agent will have significant power and responsibility.

What are the different types of POA available in California?

In California, there are several types of POA, each serving different purposes:

- General Power of Attorney: Grants broad powers to the agent over a wide range of actions.

- Durable Power of Attorney: Remains in effect even if the principal becomes incapacitated.

- Limited Power of Attorney: Grants the agent authority over specific actions or for a limited time.

- Medical Power of Attorney: Allows the agent to make health care decisions on behalf of the principal.

- Springing Power of Attorney: Becomes effective only under certain conditions, such as the principal's incapacitation.

How do you revoke a Power of Attorney in California?

To revoke a Power of Attorney in California, the principal must notify the agent in writing. The revocation becomes effective upon the agent's receipt of the notification. Additionally, the principal should inform any third parties who might be relying on the POA.

Does a California POA need to be notarized?

Yes, for a California POA to be legally binding, it must be notarized. Some forms, such as those dealing with real estate, may also require witnesses.

What happens if the principal becomes incapacitated and doesn't have a Durable POA?

If the principal becomes incapacitated without a Durable POA, a court might need to appoint a conservator or guardian to make decisions on their behalf. This process can be lengthy, costly, and public.

Can a POA be used to make healthcare decisions in California?

Yes, but the POA must be specifically designated as a Medical Power of Attorney or include provisions for healthcare decisions to legally allow the agent to make medical decisions on behalf of the principal.

Is a California POA valid in other states?

While a California POA is primarily governed by state law, it is generally recognized in other states. However, it's advisable to check the specific requirements of the state in question, particularly for real estate and healthcare decisions.

Common mistakes

When it comes to filling out a California Power of Attorney form, individuals often make errors that can impact the document's validity or their intentions. Understanding these common mistakes can help ensure the form is completed accurately and effectively.

-

Not specifying the type of Power of Attorney (POA): California law recognizes different kinds of POA, such as financial or healthcare. Failing to clearly state the specific type can lead to misunderstandings regarding the agent's authority.

-

Choosing an unsuitable person as the agent: The role of an agent holds significant responsibility. Designating someone without considering their reliability, competence, or willingness can lead to issues in the execution of the assigned duties.

-

Omitting alternates: If the primary agent is unable or unwilling to act, having no alternate agents can leave the principal without the necessary representation.

-

Ignoring the need for notarization or witnesses: Depending on the POA type, California law may require the document to be either notarized or signed in the presence of witnesses to be legally binding.

-

Lack of specificity in granting powers: Being too vague about the powers granted can lead to disputes or legal challenges regarding the agent's authority.

-

Not including a durability provision: Without specifying that the POA remains effective even if the principal becomes incapacitated, the document may not serve its intended purpose during critical times.

-

Improperly executed modifications: Any changes or revocations need to be made according to legal requirements, or they might not be recognized.

-

Failing to distribute copies appropriately: Banks, medical providers, and others may require a copy of the POA to act upon it. Not providing these copies can prevent the agent from acting when needed.

-

Not consulting with a legal professional: Misinterpretations of the law or form requirements can lead to errors. Consulting with a professional can help avoid these mistakes.

These common errors underline the importance of careful attention to detail and possibly seeking professional advice when filling out a California Power of Attorney form. By avoiding these mistakes, individuals can better ensure their wishes are accurately represented and legally protected.

Documents used along the form

When individuals in California opt to establish a Power of Attorney (POA), it equips another person with the capacity to make certain decisions on their behalf. This delegation of authority is significant in realms ranging from financial management to healthcare directives. However, to ensure a comprehensive approach to planning and decision-making, there are additional documents that often accompany a California Power of Attorney form. These documents each serve to clarify, enhance, or complement the authority granted by a POA, offering a wider protective net for the individual's affairs.

- Advance Health Care Directive (AHCD): This legal document allows an individual to outline their preferences for medical care and appoint a health care agent. This agent is authorized to make medical decisions on behalf of the individual if they become unable to do so themselves. The AHCD supports the POA by addressing specific health care decisions, offering clear guidance to healthcare providers.

- Living Will: While somewhat similar to the AHCD, a Living Will specifically documents an individual's wishes regarding end-of-life care, such as life support and pain management, in situations where recovery is not expected. This document can function alongside a POA by providing explicit instructions for such critical conditions, relieving the appointed agent of making these profoundly difficult decisions.

- Health Insurance Portability and Accountability Act (HIPAA) Authorization Form: This document permits healthcare providers to disclose an individual's health information to designated persons, including the agent named in a POA. It's vital for ensuring that the agent has access to the necessary medical records to make informed decisions about the individual's health care.

- Durable Financial Power of Attorney: Although a general POA might already include financial decision-making powers, a Durable Financial Power of Attorney specifically focuses on financial affairs and remains effective even if the individual becomes incapacitated. This distinction ensures that financial matters, ranging from paying bills to managing investments, are handled smoothly without interruption due to the principal's health.

Collectively, these documents form a safety network that supports an individual's wishes across a variety of situations, making the process more streamlined for those appointed to make decisions. When utilized together, they provide a solid foundation for managing one's personal, healthcare, and financial matters with confidence and certainty. It's recommended to consult with legal counsel when preparing these documents to ensure they are executed correctly and reflect the individual's wishes accurately.

Similar forms

The California Power of Attorney form is closely related to the Advance Healthcare Directive, often used for health care decisions. Both documents allow an individual, also known as the principal, to designate another person, the agent, to make certain decisions on their behalf. While the Power of Attorney can apply to a broad range of financial and legal decisions, the Advance Healthcare Directive is specifically tailored to decisions about medical care and treatments, especially those that need to be made when the principal is incapacitated.

Similarly, the Living Will is another document akin to the Power of Attorney form. It permits individuals to outline their wishes concerning end-of-life care, should they become unable to communicate their preferences themselves. Although a Living Will doesn’t grant decision-making power to another individual, it serves a complementary role to a Power of Attorney by guiding the appointed agent's decisions regarding the principal's health care preferences.

The Financial Power of Attorney document is also closely related to the California Power of Attorney form. It specifically grants the appointed agent the authority to handle financial matters on behalf of the principal. This can range from managing bank accounts to selling property. The key similarity lies in the delegation of decision-making authority, though the Financial Power of Attorney is exclusively concerned with financial decisions.

The Durable Power of Attorney is another variant, which expressly remains in effect even if the principal becomes incapacitated. This feature distinguishes it from a standard Power of Attorney, which typically ceases to be effective if the principal loses mental capacity. The durability aspect ensures that the agent can continue to act on the principal’s behalf, particularly in managing their affairs during periods of incapacity.

The Guardianship Agreement shares common ground with the California Power of Attorney as well. This document enables an individual to appoint someone to make decisions for their minor child or a dependent adult. While a Power of Attorney is generally used for financial or healthcare decisions for the principal themselves, a Guardianship Agreement extends this decision-making capacity to include the well-being of dependents under the guardian’s care.

A Trust is a legal entity created to hold assets for the benefit of certain persons or entities, with a trustee managing the assets. Similar to a Power of Attorney, a Trust involves appointing someone to manage assets, but it differs in its focus on managing assets for beneficiaries over time, possibly beyond the lifespan of the person who created the Trust. This setup is particularly useful for estate planning purposes.

Finally, the Will, or Last Will and Testament, while not a directive for appointing an agent to make decisions during the principal's lifetime, is similar in its focus on specifying instructions for after the individual's death. It designates beneficiaries and outlines how the person's assets should be distributed. In contrast, a Power of Attorney is concerned with granting authority to make decisions on the principal’s behalf during their lifetime.

Dos and Don'ts

When dealing with the California Power of Attorney form, certain guidelines ensure the process is handled efficiently and legally. Keeping these dos and don'ts in mind can safeguard the interests of all parties involved.

Things You Should Do

- Make sure that both the principal and the agent fully understand the extent of the authority being granted. Clear communication and mutual understanding are essential.

- Consult with a legal professional if there are any uncertainties or complexities in the form or the powers being granted. This can prevent legal issues down the line.

- Ensure the form is filled out completely, leaving no sections blank. Incomplete forms may lead to confusion or be considered invalid.

- Keep the original document in a safe, accessible place, and provide copies to relevant parties, such as the agent or financial institutions, to ensure that the power of attorney is recognized when needed.

Things You Shouldn't Do

- Don’t rush through the process without fully understanding each part of the form. Every section has its significance and must be treated with care.

- Avoid using vague language that could lead to misunderstandings about the extent of the agent's powers. Clarity is key in legal documents.

- Never leave the decision of choosing an agent to the last minute. The chosen individual should be trustworthy and capable of handling the responsibilities assigned.

- Do not forget to update the document as circumstances change. A power of attorney may need revision over time due to changes in the relationship, the principal’s wishes, or the agent's ability to serve.

Misconceptions

When it comes to the California Power of Attorney (POA) form, many misconceptions float around, causing confusion and potential misuse. It's essential to debunk these misunderstandings to ensure the form is used correctly and effectively. Here's a look at ten common myths:

One Size Fits All: Many believe there's a universal POA form for every situation. In reality, California provides different forms for financial, healthcare, and other specific powers, ensuring the document matches the precise needs of the individual.

No Expiry Date: It's a common misconception that once executed, POA forms last forever. However, unless the form specifies, a POA may expire if the principal becomes incapacitated, or it might have a set expiry date.

Only for the Elderly: While it's true that older adults commonly use POA forms, they are useful for anyone who wants to ensure their affairs are managed in case they're unable to do so themselves.

Full Loss of Control: Granting someone a POA doesn’t mean you lose all control over your affairs. The principal retains the right to revoke or change the POA as long as they’re competent.

Immediate Effect: Some believe a POA takes effect immediately after signing. However, California allows for "springing" powers, which means the POA only becomes effective under certain conditions, such as the incapacitation of the principal.

Limited to California Residents: There's a misconception that only California residents can grant or act as agents under a California POA. In truth, the form is for managing affairs within the state, regardless of the principal's or agent's residency.

Legally Complex: People often think creating a POA is a complex legal process requiring a lawyer. While legal advice is beneficial, especially for complicated estates, California provides resources and forms designed for straightforward situations.

Costly: The assumption that drafting a POA involves significant expense can deter people from creating one. Though costs may vary, especially with legal consultation, the base documents are readily accessible and can be executed without breaking the bank.

Notarization Always Required: While notarizing a POA can lend credibility and help with acceptance by institutions, not all forms in California require notarization. It's important to understand the specific requirements of your POA document.

Only Covers Financial Matters: A prevalent myth is that POA forms are strictly for financial decisions. California law allows for healthcare directives and other forms of decision-making authority to be granted, covering a wide range of personal and healthcare-related decisions.

Understanding the realities behind these misconceptions ensures that individuals can make informed decisions about granting and using the power of attorney in California. It can serve as a powerful tool in managing one's affairs, healthcare, and estate planning when used properly.

Key takeaways

Understanding the California Power of Attorney (POA) form is essential when planning for the future or navigating the present with a need to delegate legal authority to another person. This document allows one person, known as the principal, to grant another person, known as the agent or attorney-in-fact, the power to make decisions on their behalf. Here are key takeaways to ensure that you fill out and use the California POA form effectively and according to legal requirements:

- Select the right type of POA. California law recognizes several types of POA, including financial, healthcare, durable, and general POA. Each serves different purposes; make sure you choose the one that best suits your needs.

- Understand the role and powers of the agent. The agent's authority can range widely based on the document's specifics. Clearly define what powers the agent has, including any limitations you wish to impose.

- Durability is key for long-term planning. A durable POA remains effective even if the principal becomes incapacitated, making it vital for long-term planning. Make sure to specify if you want the POA to be durable.

- Choose an agent you trust. Given the significant responsibility and power an agent can wield, it’s crucial to choose someone who is not only trustworthy but also capable of making decisions that align with your wishes.

- Be specific about powers granted. Vague language can lead to confusion or abuse of power. Clearly outline the agent’s powers, whether it’s managing financial accounts, making healthcare decisions, or handling real estate transactions.

- Follow California's legal requirements for signing. California law may have specific requirements for signing a POA, including witness signatures and notarization. Check the most current laws to ensure your POA is legally binding.

- Inform relevant parties about the POA. Once the POA is signed, inform relevant parties, such as financial institutions and healthcare providers, about the POA and provide them with copies as necessary.

- Review and update the POA periodically. Your wishes and circumstances can change. Regularly review your POA and consider updating it to reflect your current needs and wishes.

- Revoke it if necessary. If you no longer need the POA or wish to appoint a different agent, you can revoke the existing POA. Ensure to do so in writing and inform any institutions or parties that were using the old POA.

- Consider professional advice. Given the complexities and legal implications of a POA, consulting with a legal expert can provide clarity and ensure that your POA accurately reflects your intentions and is compliant with California law.

Properly filling out and using a California Power of Attorney form involves careful consideration and understanding of your rights and obligations. Being thorough and clear in your document can protect you and your interests, ensuring that your agent acts in your best interests at all times.

More California Forms

Dmv Reg 138 - A necessary step in the process of legally safeguarding activities where the chance of injury cannot be completely eliminated.

Grant Deed California - Understanding the different types of deed forms can help individuals choose the right one for their transaction.