Legal California Operating Agreement Document

In the landscape of forming a business in California, the spotlight often lands on the Operating Agreement, a pivotal document that sets the foundational rules and procedures by which a limited liability company (LLC) operates. While California does not mandatorily require an LLC to have an Operating Agreement, the absence of one could leave the business and its members vulnerable to state default rules that may not align with the members' intentions. This document, rich with potential to steer the direction of the company's internal affairs, outlines the distribution of profits and losses, procedures for member changes, and the overall governance structure, ensuring that every member is on the same page. It spells out the rights and responsibilities of the members and managers, offering a shield of clarity against misunderstandings and potential disputes. Notably, although the form of the Operating Agreement is flexible—being able to be written or oral, though written is strongly recommended for clarity and evidentiary reasons—it acts as a critical tool for businesses to assert their autonomy by customizing their operational and financial decisions, distinguishing their structure from the one-size-fits-all approach that state law offers in its absence.

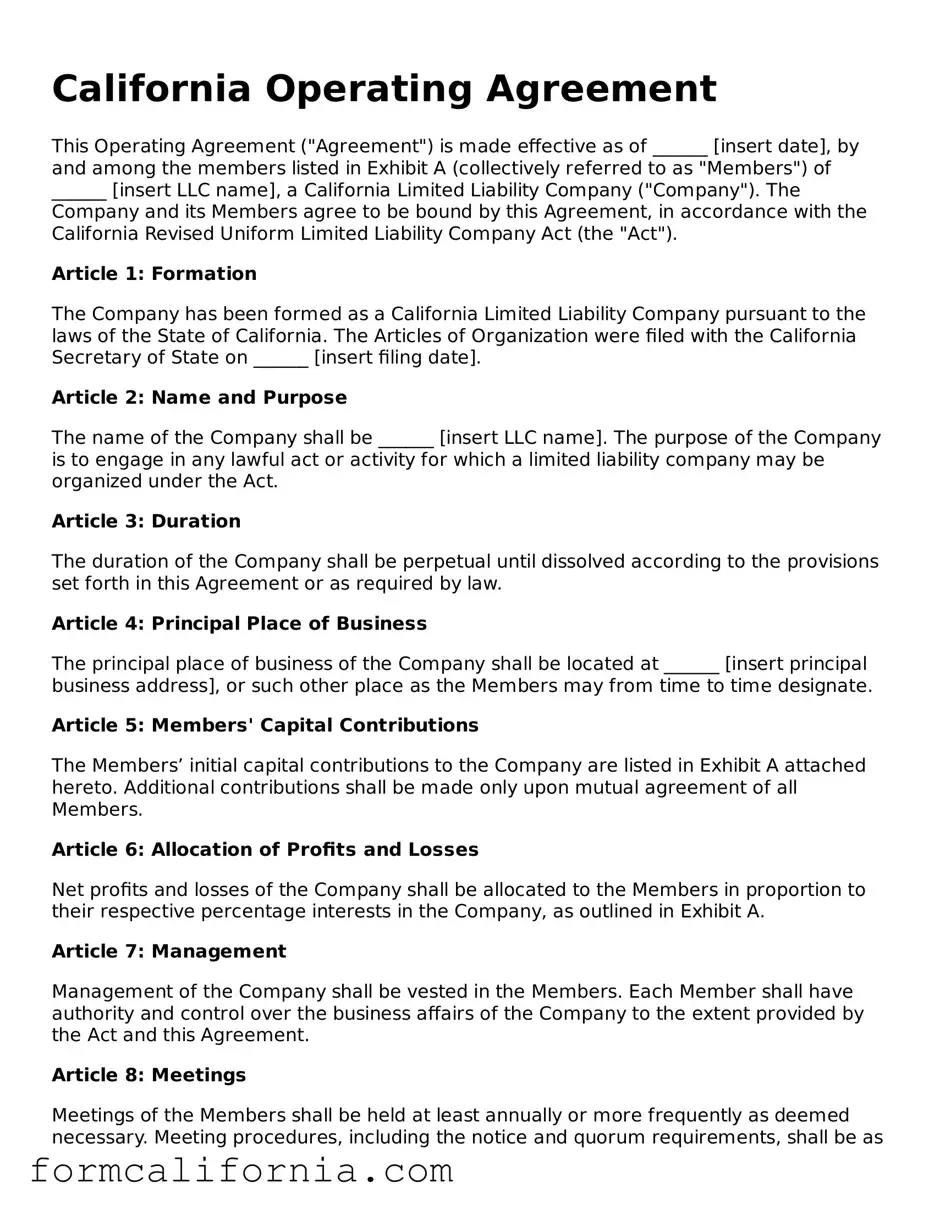

Document Preview Example

California Operating Agreement

This Operating Agreement ("Agreement") is made effective as of ______ [insert date], by and among the members listed in Exhibit A (collectively referred to as "Members") of ______ [insert LLC name], a California Limited Liability Company ("Company"). The Company and its Members agree to be bound by this Agreement, in accordance with the California Revised Uniform Limited Liability Company Act (the "Act").

Article 1: Formation

The Company has been formed as a California Limited Liability Company pursuant to the laws of the State of California. The Articles of Organization were filed with the California Secretary of State on ______ [insert filing date].

Article 2: Name and Purpose

The name of the Company shall be ______ [insert LLC name]. The purpose of the Company is to engage in any lawful act or activity for which a limited liability company may be organized under the Act.

Article 3: Duration

The duration of the Company shall be perpetual until dissolved according to the provisions set forth in this Agreement or as required by law.

Article 4: Principal Place of Business

The principal place of business of the Company shall be located at ______ [insert principal business address], or such other place as the Members may from time to time designate.

Article 5: Members' Capital Contributions

The Members’ initial capital contributions to the Company are listed in Exhibit A attached hereto. Additional contributions shall be made only upon mutual agreement of all Members.

Article 6: Allocation of Profits and Losses

Net profits and losses of the Company shall be allocated to the Members in proportion to their respective percentage interests in the Company, as outlined in Exhibit A.

Article 7: Management

Management of the Company shall be vested in the Members. Each Member shall have authority and control over the business affairs of the Company to the extent provided by the Act and this Agreement.

Article 8: Meetings

Meetings of the Members shall be held at least annually or more frequently as deemed necessary. Meeting procedures, including the notice and quorum requirements, shall be as set forth by the mutual agreement of the Members and in accordance with the Act.

Article 9: Amendments

This Agreement may be amended only by a written agreement signed by all Members.

Article 10: Dissolution

The Company may be dissolved with the consent of Members holding a majority interest in the Company or as otherwise required by law. Upon dissolution, the Company’s affairs shall be wound up in accordance with the Act.

IN WITNESS WHEREOF, the undersigned have executed this Operating Agreement as of the date first above written.

- ____________________ [Member Name]

- ____________________ [Member Name]

- ____________________ [Member Name]

Exhibit A: Members and Capital Contributions

- ____________________ [Member Name] - $__________ [Amount]

- ____________________ [Member Name] - $__________ [Amount]

- ____________________ [Member Name] - $__________ [Amount]

PDF Form Characteristics

| Fact | Detail |

|---|---|

| Definition | An Operating Agreement is a document used by Limited Liability Companies (LLCs) to outline the business' financial and functional decisions including rules, regulations, and provisions. |

| Governing Law | In California, Operating Agreements are governed by the California Revised Uniform Limited Liability Company Act (RULLCA) starting from January 1, 2014. |

| Requirement | Though not legally required in California, it is highly recommended for LLCs to adopt an Operating Agreement. |

| Formality | Can be written or oral, but a written agreement is preferred for clarity and to resolve future disputes. |

| Single-Member LLCs | Even single-member LLCs are advised to have an Operating Agreement to establish the legitimacy of the separate entity. | footer

| Amendments | Any changes to the Operating Agreement must be agreed upon by all members according to the terms of the agreement itself or as allowed by California law. |

| Key Components | Typically includes information on membership structure, management, voting rights, allocation of profits and losses, and procedures for adding or removing members. |

| Dispute Resolution | Often contains provisions for dispute resolution among members to avoid court litigations. |

Detailed Instructions for Writing California Operating Agreement

When forming an LLC in California, one of the most crucial steps is the creation of an Operating Agreement. This document sets the foundational guidelines for the internal operations of the company, delineates the financial and managerial rights of the members, and provides a framework for the LLC's day-to-day activities. Ensuring that the Operating Agreement is filled out meticulously and accurately can prevent potential conflicts among members and legal challenges in the future. Below is a step-by-step guide to assist in this process. While the content of the Operating Agreement form for California is not specified here, these generalized steps can guide most individuals through the completion process.

- Gather all necessary information about the LLC, including the official name of the LLC as registered with the California Secretary of State, the principal business address, and the names and addresses of all members.

- Decide on the ownership structure. Detail how the LLC's profits, losses, and dividends will be distributed among members. This will typically be based on the percentage of each member's investment in the LLC.

- Determine the management structure. Specify whether the LLC will be managed by its members or by appointed managers. If choosing a manager-managed structure, identify the managers and outline their duties and powers.

- Describe the process for admitting new members, including any criteria they must meet and how their admission will affect the distribution of profits and losses.

- Outline the procedures for meetings, including how often they will occur, how they will be called, what constitutes a quorum, and how decisions will be made and documented.

- Specify any contributions that members are required or expected to make to the LLC, whether in the form of cash, property, or services, and describe how additional contributions will be handled.

- Detail the process for handling the departure, whether voluntary or involuntary, of a member, including any restrictions on transfer of membership interest and how the departing member's share of profits and losses will be calculated.

- Establish dispute resolution procedures for resolving internal conflicts, which may include mediation or arbitration before seeking legal remedies.

- Clarify the dissolution process of the LLC, explaining the circumstances under which the LLC may be dissolved and the steps for winding up its affairs.

- Review the entire document carefully, making sure all information is accurate and comprehensive. All members should read the Operating Agreement in full to ensure it reflects their understanding and agreement.

- Have all members sign and date the Operating Agreement. While not all states require the Operating Agreement to be filed, keeping it on file with the LLC's records is crucial.

Once the Operating Agreement has been successfully completed and signed by all members, it serves as a legally binding document that governs the operation of the LLC. It is important for members to revisit and update the Operating Agreement as the company grows and evolves over time. This document is pivotal in ensuring that all members are aligned on the company's structure and procedures, thereby safeguarding the company's future health and success. For specific details or clauses that should be included, it may be beneficial to consult with a legal expert who specializes in business organizations within California.

Things to Know About This Form

What is a California Operating Agreement?

An Operating Agreement is a legal document that outlines the ownership structure and operating procedures of a Limited Liability Company (LLC) in California. It includes provisions on governance, financial arrangements, and roles of members, ensuring clear guidelines and expectations for the operation of the LLC.

Why is an Operating Agreement important for a California LLC?

While not legally required by the state, having an Operating Agreement is crucial for several reasons. It helps protect the personal assets of its members by reinforcing the LLC's status as a separate entity. The agreement also prevents misunderstandings by setting clear rules for financial and management operations, and it establishes procedures for resolving disputes among members.

What are the key components of a California Operating Agreement?

Key components usually include:

- Organization details, such as formation date and member names.

- Management structure, specifying whether managed by members or managers.

- Capital contributions of each member.

- Profit and loss distribution.

- Rules for meetings and votes.

- Procedures for adding or removing members.

- Buyout and buy-sell rules in case a member wants to leave the LLC.

- Dissolution process for winding up the LLC.

Is a California Operating Agreement required to be filed with the state?

No, an Operating Agreement does not need to be filed with the state of California. It is an internal document that should be kept on record by the LLC members. However, the state requires the filing of Articles of Organization to officially form your LLC.

Can an Operating Agreement be modified?

Yes, an Operating Agreement can be modified if all members agree to the changes. The agreement itself should specify the process for making amendments. It's recommended to document any amendments formally and have all members sign to avoid future disputes.

What happens if a California LLC does not have an Operating Agreement?

If an LLC does not have an Operating Agreement, the default LLC rules established by California state law will apply. These may not be in the best interest of all members or the specific needs of the LLC, potentially leading to conflicts or legal complications down the line.

How do new members affect the Operating Agreement?

When new members join an LLC, the Operating Agreement should be reviewed and, if necessary, amended to address the addition. This may include adjusting ownership percentages, capital contributions, and voting rights. Ensuring the agreement accurately reflects the current member makeup is essential for smooth operations.

Are there templates available for creating an Operating Agreement in California?

Yes, there are templates available online that can serve as a starting point for creating an Operating Agreement. However, it's beneficial to consult with a legal professional to ensure that the agreement is comprehensive and tailored to the specific needs of your LLC.

Do all members need to sign the Operating Agreement?

Yes, all members should sign the Operating Agreement to acknowledge their understanding and agreement to its terms. This is important for the enforcement of the provisions contained within the document and can serve as important evidence in the event of disputes or legal challenges.

How does a California Operating Agreement protect individual members?

It protects individual members by:

- Limiting personal liability for the debts and actions of the LLC.

- Defining roles and responsibilities to prevent disputes.

- Outlining procedures for conflict resolution.

- Specifying the process for changes in membership and valuation of ownership interests.

Common mistakes

When forming an LLC in California, drafting an Operating Agreement is a crucial step that provides a framework for the operation of the business and outlines the rights and responsibilities of its members. However, mistakes in completing this document can lead to disputes among members, legal challenges, and could affect the operation of the LLC. Here are five common mistakes people make:

Not Tailoring the Agreement to the Specific Needs of the Business: Many LLC members use generic templates without adjusting the provisions to match their business's unique needs. Each LLC operates differently, and its Operating Agreement should reflect its specific operational structure, member roles, and financial arrangements.

Failure to Clearly Define the Distribution of Profits and Losses: The Operating Agreement should clearly state how profits and losses will be distributed among members. Without clear definitions, conflicts can arise, potentially leading to litigation or dissolution of the LLC.

Omitting Buy-Sell Provisions: A critical mistake is not including buy-sell, or buyout, provisions that dictate what happens when a member leaves the LLC, dies, or files for bankruptcy. These clauses help ensure a smooth transition and continuity of the business under such circumstances.

Ignoring Dispute Resolution Mechanisms: It's essential to include provisions for dispute resolution within the Operating Agreement. Without a predetermined method for resolving disputes, members may have to resort to expensive and time-consuming litigation.

Not Updating the Agreement: An Operating Agreement is not a set-it-and-forget-it document. As the business grows and changes, the agreement should be revised to reflect new members, changes in management structure, or adjustments in profit distribution methods.

In addition, it's important to note that while the completion of the Operating Agreement is a significant step in forming an LLC, it's equally important to comply with state-specific requirements and seek professional advice to ensure that all legal aspects are appropriately addressed. Avoiding these mistakes can help ensure that the LLC operates smoothly and remains in compliance with applicable laws and regulations.

Documents used along the form

In the bustling world of starting and running a limited liability company (LLC) in California, the operating agreement holds a central place. However, it doesn't stand alone. To ensure the smooth establishment and operation of an LLC, several other forms and documents come into play alongside the operating agreement. Understanding these documents is crucial for anyone looking to navigate the complexities of business law in California with ease.

- Articles of Organization: This document is a requirement to officially form your LLC in California. It's filed with the California Secretary of State and includes vital information such as the LLC's name, purpose, the address of its principal office, and information about its agent for service of process.

- Employer Identification Number (EIN): Though not a form specific to California, this is a federal document issued by the IRS. An EIN is necessary for tax purposes, opening a bank account for the business, and hiring employees. It's akin to a social security number for your LLC.

- Statement of Information: After forming your LLC, you must file a Statement of Information with the California Secretary of State. This form, due within 90 days of filing your Articles of Organization, provides updated information on your LLC’s address, management, and agent for service of process. It must also be updated regularly thereafter.

- Business Licenses and Permits: Depending on the nature of your business and where it's located, your LLC may need various local, state, or federal licenses and permits to operate legally. The requirements can vary widely, but they are essential for compliance and avoiding penalties.

To navigate the business environment successfully, it's important to pay close attention to these documents alongside the operating agreement. They form the backbone of your LLC’s legal framework in California and ensure that your business operates within the law at all levels of government. Armed with the right documents and a clear understanding of their purposes, entrepreneurs can focus on what they do best: growing their business and serving their customers.

Similar forms

The California Operating Agreement shares similarities with the Articles of Incorporation, which also act as a foundational document for corporations. Both detail the internal governance structure and operational processes of the business entity. However, while the Operating Agreement is used by LLCs to outline member roles, responsibilities, and profit allocations, the Articles of Incorporation serve to officially form a corporation and are filed with the state.

Similarly, the Partnership Agreement is closely related to the Operating Agreement. Both documents lay the groundwork for the management and financial arrangements between the business owners. The key difference lies in the type of business structure they apply to, with the Partnership Agreement being specifically used by partnerships to dictate the terms of the partnership, including profit sharing and decision-making processes.

A Shareholder Agreement is another document that bears resemblance to the Operating Agreement. It is used by corporations to define the rights and responsibilities of shareholders and to establish the company's operating procedures. Both documents ensure that the business operations are clear to all involved parties, but the Shareholder Agreement is tailored towards corporations with shareholders, while the Operating Agreement is for LLCs.

The Bylaws of a corporation also similar to the Operating Agreement in that they establish the rules and procedures by which the corporation operates. Both documents are critical for the internal organization of the business, detailing roles, meetings, and other governance issues. The main difference is that Bylaws are used by corporations, whereas the Operating Agreement is specific to LLCs.

The Employee Stock Ownership Plan (ESOP) Agreement can also be compared with the Operating Agreement. While the ESOP Agreement focuses on the allocation of company stock to employees, it also outlines the administration of these plans, which includes certain operational aspects of the business. Both documents play a role in defining company structure and governance, but with different focuses.

Similar to the Operating Agreement, the Non-Disclosure Agreement (NDA) is used to protect sensitive business information. While the NDA is specifically designed to prevent the sharing of confidential information, both contracts are essential in setting parameters for behavior and responsibilities within a business context.

The Employment Agreement is another type of document that, while focusing on the terms of employment between an employee and the company, shares the characteristic of defining roles and expectations with the Operating Agreement. Both agreements are crucial for establishing clear relations and responsibilities, though the Employment Agreement operates at the individual level while the Operating Agreement addresses member relations within the LLC.

The Buy-Sell Agreement, like the Operating Agreement, is crucial for outlining procedures for transitional events within a business, such as the sale of the company, death, or departure of an owner. Both documents serve to protect the business and its owners by detailing how ownership interests are managed and transferred, ensuring continuity and stability.

Lastly, the Commercial Lease Agreement shares the characteristic of specifying terms and conditions relevant to a business operation with the Operating Ze Agreement. While the Commercial Lease Agreement deals with the terms of a business’s physical location rental, the Operating Agreement covers the broader internal operations and management agreements between members of an LLC. Both are essential for defining parameters within which a business operates.

Dos and Don'ts

When forming an LLC in California, an Operating Agreement isn't just a formal document—it's a critical foundation for your business's legal and operational structure. Missteps in filling out this form can lead to misunderstandings, conflicts, and even legal challenges among members. Here are seven dos and don'ts to keep in mind:

- Do ensure that all members agree on the contents of the Operating Agreement before it is finalized. This agreement outlines the LLC's financial and functional decisions, including rules, regulations, and provisions. Consensus is key to avoiding future disputes.

- Do include detailed provisions about the management of the LLC. Clearly delineate the roles, rights, and responsibilities of each member, as well as the process for making decisions.

- Do clarify the distribution of profits and losses. It's essential to detail how the LLC's earnings and losses will be shared among members to prevent financial misunderstandings.

- Do provide a plan for admitting new members or handling the departure of existing members. Life changes, and so might your LLC's composition. Having a procedure in place will simplify transitions.

- Do review and update the Operating Agreement periodically. As your business evolves, so too should your agreement to reflect any new laws, regulations, or changes in business operations.

- Don't use generic templates without customization. While templates can be a good starting point, it's important to tailor your Operating Agreement to fit the specific needs and structure of your LLC in California.

- Don't overlook the importance of having the Operating Agreement reviewed by a legal professional. Given the legal significance of this document, consulting with an attorney can help ensure that your agreement complates with California law and serves the best interests of all members.

Misconceptions

The California Operating Agreement form is an essential document for Limited Liability Companies (LLCs) in California. However, many misconceptions surround its purpose and necessity. It's important to understand the facts to ensure your business is both compliant with state laws and positioned for success. Below are eight common misconceptions about the California Operating Agreement form:

- Only multi-member LLCs need an Operating Agreement: Regardless of whether your LLC has one member or multiple members, California law advises creating an Operating Agreement. This document is vital for defining the ownership structure, operational procedures, and financial arrangements of your business.

- The Operating Agreement is not legally required: While it’s true the state does not require you to file your Operating Agreement with any California government agency, having one is strongly recommended and, in some cases, required by California law for the internal records of both single-member and multi-member LLCs.

- Any template will work: Operating Agreements should be tailored to fit the specific needs of your LLC. Utilizing a generic template without modifications may not adequately cover the unique aspects of your business or comply with specific California provisions.

- You can wait to create it: Delaying the creation of an Operating Agreement can lead to problems. It's wise to have this document in place from the outset to ensure all members are on the same page and to avoid any misunderstandings or conflicts.

- It’s only for internal use and has no real legal standing: The Operating Agreement is a binding contract between members of the LLC and can be used in legal disputes to determine the intent and agreed-upon procedures for the business. It holds significant legal weight.

- It’s too complicated to create without a lawyer: While it's advisable to consult with a legal professional, especially in complex situations, many resources are available to help draft an Operating Agreement. Careful research and due diligence can result in a valid agreement for many LLCs.

- Once it’s written, it’s set in stone: It's possible, and often necessary, to amend the Operating Agreement as your business grows and evolves. The document should be reviewed periodically and updated to reflect current operations and ownership.

- All members have an equal say regardless of investment: The Operating Agreement allows for flexibility in how decisions are made and can stipulate that some votes carry more weight based on ownership percentage or investment. This ensures that those who have invested more in the company potentially have a greater say in its operations.

Understanding these misconceptions and ensuring your Operating Agreement accurately reflects the operations and agreements of your LLC can protect your business interests and help in the smooth running of your company.

Key takeaways

An Operating Agreement is a crucial document for any Limited Liability Company (LLC) in California. It sets forth the rules and standards by which the company operates, detailing the structure of the organization, the responsibilities of its members, and how decisions are made. Though not legally required in California, having a well-drafted Operating Agreement can provide clarity and protect the members' personal assets from legal disputes. Here are key takeaways about filling out and utilizing the California Operating Agreement form:

- The Operating Agreement should be tailored to the specific needs of your LLC, reflecting the agreement among members regarding the business's operational aspects and financial arrangements.

- Although not mandatory in California, drafting an Operating Agreement is highly recommended as it can help prevent conflicts among members by setting clear expectations.

- The document should detail the percentage of ownership among members, which is essential for determining profit sharing and voting power.

- It's important to clearly outline the process for adding or removing members to ensure that the company can adapt to changes over time without confusion or conflict.

- Decision-making processes should be meticulously defined in the agreement, including the allocation of votes required to approve various actions, to streamline business operations and minimize disputes.

- Details on how profits and losses will be distributed among members must be explicitly stated to avoid misunderstandings and ensure fairness.

- Procedures for dissolving the LLC should be included, providing a clear roadmap for members if the decision to wind down the business is made.

- The Operating Agreement can also specify the roles and responsibilities of members and managers, delineating authority and expectations clearly.

- Regular updates to the Operating Agreement are advisable to reflect changes in the business structure, membership, or operational practices, ensuring the document remains relevant and accurate.

- Having a legal professional review the Operating Agreement is beneficial to ensure it complies with state laws and adequately protects the interests of all members.

In summary, a well-crafted Operating Agreement is invaluable for the smooth operation and longevity of an LLC in California. It serves not only as a guide for how the business is run but also acts as a safeguard for members' investments and interests. By considering the points listed above, you can ensure that your Operating Agreement fulfills its role effectively.

More California Forms

Dnr Document - Emergency personnel are trained to look for DNR orders and respect them during emergencies.

California Notary Acknowledgement 2023 - A verification tool that is fundamental in the notarization process, ensuring the authenticity of the signer’s acknowledgment.