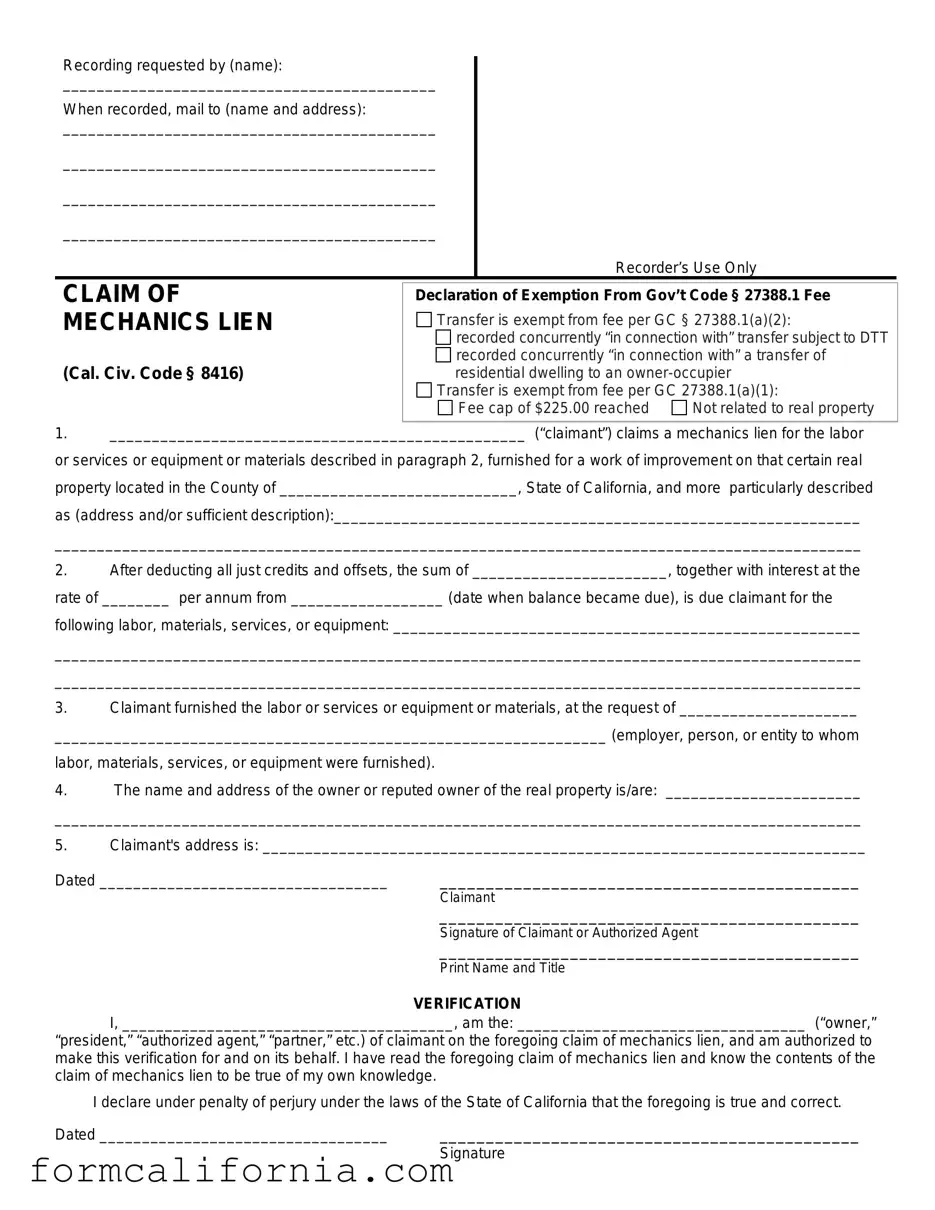

Blank Mechanics Lien California PDF Form

In California, the process of securing payment for work performed or materials provided on a construction project is significantly influenced by the Mechanics Lien form. This legal document serves as a powerful tool for contractors, subcontractors, laborers, and suppliers, ensuring their right to payment is protected under state law. It essentially places a hold or lien on the property where the work was done until payment is made. Understanding how to properly complete and file this form is critical, as any error can invalidate the claim. The intricate details of the form include specifying the amount due, the services provided, and the property involved, along with adhering to strict deadlines for filing and enforcing the lien. For individuals and companies involved in the construction industry, navigating the complexities of this form and its surrounding legal process is paramount in safeguarding their financial interests and ensuring their hard work is compensated fairly.

Document Preview Example

Recording requested by (name):

____________________________________________

When recorded, mail to (name and address):

____________________________________________

____________________________________________

____________________________________________

____________________________________________

Recorder’s Use Only

CLAIM OF MECHANICS LIEN

(Cal. Civ. Code § 8416)

Declaration of Exemption From Gov’t Code § 27388.1 Fee

Transfer is exempt from fee per GC § 27388.1(a)(2):

Transfer is exempt from fee per GC § 27388.1(a)(2):

recorded concurrently “in connection with” transfer subject to DTT

recorded concurrently “in connection with” transfer subject to DTT

recorded concurrently “in connection with” a transfer of residential dwelling to an

recorded concurrently “in connection with” a transfer of residential dwelling to an

Transfer is exempt from fee per GC 27388.1(a)(1):

Fee cap of $225.00 reached |

Not related to real property |

1._________________________________________________ (“claimant”) claims a mechanics lien for the labor or services or equipment or materials described in paragraph 2, furnished for a work of improvement on that certain real property located in the County of ____________________________, State of California, and more particularly described as (address and/or sufficient description):______________________________________________________________

_______________________________________________________________________________________________

2.After deducting all just credits and offsets, the sum of _______________________, together with interest at the rate of ________ per annum from __________________ (date when balance became due), is due claimant for the following labor, materials, services, or equipment: _______________________________________________________

_______________________________________________________________________________________________

_______________________________________________________________________________________________

3.Claimant furnished the labor or services or equipment or materials, at the request of _____________________

_________________________________________________________________ (employer, person, or entity to whom labor, materials, services, or equipment were furnished).

4.The name and address of the owner or reputed owner of the real property is/are: _______________________

_______________________________________________________________________________________________

5.Claimant's address is: _______________________________________________________________________

Dated __________________________________ _____________________________________________

Claimant

_____________________________________________

Signature of Claimant or Authorized Agent

_____________________________________________

Print Name and Title

VERIFICATION

I, _______________________________________, am the: __________________________________ (“owner,”

“president,” “authorized agent,” “partner,” etc.) of claimant on the foregoing claim of mechanics lien, and am authorized to make this verification for and on its behalf. I have read the foregoing claim of mechanics lien and know the contents of the claim of mechanics lien to be true of my own knowledge.

I declare under penalty of perjury under the laws of the State of California that the foregoing is true and correct.

Dated __________________________________ _____________________________________________

Signature

NOTICE OF MECHANICS LIEN CLAIM

ATTENTION!

Upon the recording of the enclosed MECHANICS LIEN with the county recorder's office of the county where the property is located, your property is subject to the filing of a legal action seeking a

The party identified in the enclosed mechanics lien may have provided labor or materials for improvements to your property and may not have been paid for these items. You are receiving this notice because it is a required step in filing a mechanics lien foreclosure action against your property. The foreclosure action will seek to pay for unpaid labor, materials, or improvements provided to your property. This may affect your ability to borrow against, refinance, or sell the property until the mechanics lien is release.

BECAUSE THE LIEN AFFECTS YOUR PROPERTY, YOU MAY WISH TO SPEAK WITH YOUR CONTRACTOR IMMEDIATELY, OR CONTACT AN ATTORNEY, OR FOR MORE INFORMATION ON MECHANICS LIENS GO TO THE CONTRACTORS' STATE LICENSE BOARD WEB SITE AT www.cslb.ca.gov.

PROOF OF SERVICE AFFIDAVIT

California Civil Code section 8416

Failure to serve the Mechanic’s Lien and Notice of Mechanic’s Lien on the owner, or alternatively if the owner cannot be served on the lender or direct contractor, shall cause the Mechanic’s Lien to be unenforceable as a matter of law (Civil Code Section 8024(d)). Service of the Mechanic’s Lien and Notice of Mechanic’s Lien must be by (1) registered mail, (2) certified mail, or (3)

PROOF OF SERVICE AFFIDAVIT (ON OWNER)

California Civil Code section 8416(a)(7) and (c)(1)

I, ______________________________ (name), declare that I served a copy of this Mechanic’s Lien and

Notice of Mechanic’s Lien by registered mail, certified mail, or

Company/Person Served: ________________________________________________________________

Title or capacity of person served (if appropriate): ______________________________________________

Service address: ________________________________________________________________________

Said service address is the owner’s residence, place of business, or address showed by the building permit on file with the permitting authority for the work.

Executed on ___________, 20_____ (date) at __________________ (city), _____________________

(county), California.

By: _____________________________________

(Signature of person making service)

ALTERNATE PROOF OF SERVICE AFFIDAVIT (ON LENDER OR DIRECT CONTRACTOR)

California Civil Code Section 8416(a)(7) and (c)(2)

I, ____________________________________________________ (name), declare that the owner or

reputed owner cannot be served with a copy of this Mechanic’s Lien and Notice of Mechanic’s Lien by registered mail, certified mail, or

Company/Person Served: ________________________________________________________________

Title or capacity of person served (if appropriate): ______________________________________________

Service address: ________________________________________________________________________

Executed on ___________, 20_____ (date) at __________________ (city), _____________________

(county), California.

By: _____________________________________

(Signature of person making service)

Document Specs

| Fact | Detail |

|---|---|

| Governing Law | The mechanics lien process in California is governed by the California Civil Code, Sections 8400 through 8494. |

| Purpose | A Mechanics Lien, often utilized by contractors, subcontractors, and suppliers, secures their right to be paid for labor and materials provided on a construction project. |

| Who Can File | Direct contractors, subcontractors, material suppliers, equipment lessors, laborers, and design professionals who have contributed to the improvement of real property. |

| Pre-Lien Notice | Most claimants are required to serve a 20-day Preliminary Notice to preserve their right to file a lien. This must be served on the property owner, prime contractor, and lender, if applicable. |

| Deadline to File | The deadline to record a mechanics lien is 90 days after the completion of the work, or 60 days after the owner files a notice of completion or cessation. |

| Enforcement Deadline | A filed mechanics lien must be enforced through a lawsuit within 90 days of its recording. If not enforced, the lien becomes void. |

| Release Requirement | When a mechanics lien is paid, the claimant is required to file a lien release form with the county recorder’s office. |

| Electronic Filing | Some California counties allow for the electronic recording of mechanics liens, though requirements vary by county. |

| Notice of Non-Responsibility | Property owners can protect themselves from liens |

Detailed Instructions for Writing Mechanics Lien California

Filing a Mechanics Lien in California is a crucial step for a contractor, subcontractor, or supplier seeking to secure payment for services rendered or materials provided on a construction project. This legal document, once recorded with the county recorder's office, places a lien on the property until the disputed amount is paid or settled in court. A correctly filled-out Mechanics Lien form is key to ensuring that your rights are protected. Following a precise, step-by-step guide can simplify the process and aid in completing the form accurately.

- Start by collecting all necessary information, including the legal property description, the name and address of the property owner, the name of the person who hired you, and a detailed list of the services or materials provided.

- Obtain the correct Mechanics Lien form for California. Ensure that the form is the most current version as laws and requirements may have changed.

- Fill in the date on which you first supplied labor or materials to the project. This date is critical for determining the lien's validity period.

- Include a detailed description of the type of labor, services, equipment, or materials provided. Be as specific as possible to leave no room for ambiguity.

- Enter the total amount due, highlighting any payment already received and subtracting it from the total claim. If no payment has been received, indicate the full amount owed.

- Insert the name and address of the legal property owner. If the property is owned by more than one person, include the names and addresses of all owners.

- Detail the name and address of the employer or contractor who hired your services. This information helps to clarify the chain of responsibility for your payment.

- Add the legal description of the property. This can usually be found in the deed or obtained from the county recorder's office. It might include lot, tract, or parcel numbers and is essential for properly identifying the property in question.

- Sign the form in the presence of a notary public. Notarization certifies the authenticity of the signature and the document.

- Record the lien with the county recorder's office where the property is located. There might be fees associated with filing the lien, so prepare to cover these costs.

- Finally, after the lien is filed, send a copy of the recorded lien to the property owner and the party who hired you. This step is not only a legal requirement in some jurisdictions but also serves as a notice that the lien has been officially recorded.

Upon completion of these steps, the Mechanics Lien will be in effect, providing legal recourse to claim unpaid amounts. It’s important to follow up and ensure that all parties involved are aware of the lien. Keep in mind that a Mechanics Lien has a limited duration and must be acted upon within the timeline specified by California law, typically by filing a lawsuit to foreclose on the lien should payment not be received. Consulting with a legal expert can provide additional guidance tailored to your specific situation.

Things to Know About This Form

What is a Mechanics Lien in California?

A Mechanics Lien in California is a legal tool used by contractors, subcontractors, laborers, and material suppliers to secure payment for labor or materials provided in improving a property. This lien attaches to the property's title, making it difficult for the owner to sell or refinance until the debt is settled.

Who can file a Mechanics Lien in California?

Generally, those who contribute to the improvement of a property through labor, services, equipment, or materials can file a Mechanics Lien. This includes:

- General contractors

- Subcontractors

- Laborers

- Material suppliers

- Equipment rental companies

How soon must I file a Mechanics Lien in California?

Timing is crucial for filing a Mechanics Lien. The time varies depending on your role in the project:

- General contractors must file within 90 days after completion of the project.

- Subcontractors and material suppliers have 90 days after the last day of providing labor, services, or materials to file, provided a Notice of Completion hasn’t been filed. If a Notice of Completion or Cessation has been recorded, then the timeline is reduced to 30 days for subcontractors and material suppliers.

What steps should I take before filing a Mechanics Lien in California?

Before filing, take these essential steps:

- Provide preliminary notice within 20 days of beginning work or delivering materials to preserve the right to file a lien.

- Ensure you have documented all work done and materials supplied, including dates and amounts.

- Determine the correct deadline for filing your lien to avoid missing the filing window.

How do I file a Mechanics Lien in California?

To file a Mechanics Lien, you must:

- Complete the Mechanics Lien form accurately, including all required information such as the property description, claim amount, and services provided.

- File the lien with the county recorder's office where the property is located, ensuring you meet the specific county's requirements and deadlines.

- After filing, serve a copy of the lien on the property owner, typically within 30 days of recording the lien. The service method should follow California's legal requirements.

What information is needed to fill out a Mechanics Lien form in California?

The Mechanics Lien form requires specific details, including:

- The claimant's name and address

- The name and address of the property owner

- A description of the labor or materials provided

- The amount of the claim

- A legal description of the property

- The date the labor or materials were last provided

What happens after filing a Mechanics Lien in California?

After a Mechanics Lien is filed, several outcomes can occur:

- The property owner may pay the outstanding debt, allowing for the release of the lien.

- If payment is not received, the claimant may need to enforce the lien through legal action within 90 days of its filing.

- If the lien is not enforced within this timeframe, it becomes void, and the claimant could lose the secured interest in the property.

Can a Mechanics Lien be contested in California?

Yes, a property owner has the right to contest a Mechanics Lien. This can be done by filing a petition in the court asking for the lien's removal on grounds such as improper filing or satisfaction of the claim. The court then determines the lien's validity and may order its removal if deemed unjustified.

How can I release a Mechanics Lien once it is paid?

Upon payment, the claimant is responsible for releasing the lien. This involves:

- Filing a Release of Mechanics Lien form with the county recorder's office where the original lien was recorded.

- Serving a copy of the release to the property owner.

This step is crucial as it clears the property title, removing the encumbrance created by the lien.

Are there any fees associated with filing or releasing a Mechanics Lien in California?

Yes, both filing and releasing a Mechanics Lien in California involve fees. These fees vary by county and are subject to change. Commonly, they include:

- Filing fees for recording the lien with the county recorder.

- Service fees for serving the lien on the property owner.

- Release fees for recording the release of the lien.

It's recommended to check with the local county recorder's office for the most current fee structure.

Common mistakes

When dealing with the intricacies of filing a Mechanics Lien in California, people often stumble over the same hurdles. Here's a breakdown of nine common mistakes that can happen when filling out this form:

Not checking the deadline: Timing is crucial. Mechanics Liens must be filed within a specific period after work is completed. Missing this deadline can render your lien invalid.

Incorrect property description: Providing an inaccurate or incomplete legal description of the property can lead to the rejection of your lien. It's vital to get this information right.

Omitting the hire date: Failing to include the date you were hired for the project can cause issues. This date helps to establish the timeline of the work performed.

Underestimating the amount due: It's important to accurately calculate what is owed, including both labor and materials. An incorrect amount can affect the enforceability of the lien.

Not serving the lien properly: There are specific requirements for serving the lien to the property owner. Incorrect service might mean your lien won't be upheld.

Forgetting to sign the document: An unsigned lien is like a ship without a sail. It simply won't move forward. Always double-check that you've signed before submitting.

Misidentifying the property owner: Knowing the property owner and listing their correct information is key. Mistakes here can lead to significant delays or invalidation of your lien.

Lack of detail in the work description: Vague descriptions of the work or services provided can weaken your position. Be as specific and detailed as possible to clearly communicate your contribution.

Failure to notarize the form: California requires that a Mechanics Lien be notarized to be considered valid. Skipping this step can be a fatal error.

In summary, accuracy, thoroughness, and adherence to legal requirements are paramount when completing a Mechanics Lien form in California. Keeping these pitfalls in mind can help steer you clear of common mistakes and move your lien toward successful filing.

Documents used along the form

In the realm of construction and home improvement in California, understanding the paperwork essential for protecting rights and ensuring payment is critical. Most are familiar with the Mechanics Lien, a powerful tool that grants those who supply labor, services, or materials to a project a right to encumbrance on the property until paid. However, several other forms and documents are often used in tandem with the Mechanics Lien to bolster one's position and streamline the process. Let's explore some of these essential documents.

- Preliminary Notice - This document is pivotal and must be served within 20 days of beginning work or supplying materials. It notifies the property owner, the general contractor, and the lender that you are contributing to the project and preserves your right to file a Mechanics Lien should payments not be received.

- Waiver and Release on Progress Payment - This form is used when receiving a progress payment. It signifies that you waive your right to file a Mechanics Lien for the amount specified in the payment, but not for future payments.

- Waiver and Release on Final Payment - Similar to the progress payment release, this document is used upon receiving the final payment, effectively relinquishing all future rights to place a lien on the property for work performed under the contract.

- Conditional Waiver and Release - This form is essential when a payment is promised but not yet received. By signing it, you agree to waive your right to a Mechanics Lien upon receipt of the payment, safeguarding your rights if the payment is not made.

- Notice of Completion - This document is filed by the property owner with the county recorder’s office to announce the completion of the project. It significantly reduces the time frame in which a contractor or supplier can file a Mechanics Lien, making it crucial to act swiftly upon seeing this notice.

- Stop Payment Notice - This serves as a notification to the property owner or lender that the claimant has not been paid, effectively freezing a portion of the project’s financing until the issue is resolved. It's an additional measure to secure payment without immediately resorting to a Mechanics Lien.

Understanding and utilizing these documents effectively can significantly enhance one’s ability to secure payment on construction projects in California. Each plays a role in a comprehensive strategy to ensure that contractors, subcontractors, suppliers, and laborers receive the compensation they are due. Consider these tools as part of a broader arsenal to protect your financial interests and navigate the complexities of construction law with confidence.

Similar forms

A Notice of Intent to Lien is quite similar to the Mechanics Lien California form as both serve as preliminary steps before taking more drastic legal action regarding property disputes. While the Mechanics Lien directly places a hold on the property until debts for services or materials are settled, the Notice of Intent to Lien acts as a warning to the property owner. This gives them a chance to resolve the debt before the lien is officially placed, offering a path to negotiation and settlement without immediate legal entanglement.

Claim of Lien documents closely resemble the Mechanics Lien California form because they both establish a legal claim against a property due to unpaid debts stemming from construction work or materials provided. The Claim of Lien is essentially the formal filing that puts the Mechanics Lien into effect, making the property's title encumbered. Both documents serve as leverage for the person or entity owed the money, ensuring they cannot be easily ignored by the property owner.

The Release of Lien form is essentially the counterpart to the Mechanics Lien California form. While the Mechanics Lien places a restriction on the property, the Release of Lien removes it, usually after the debts prompting the lien have been paid. This document is critical in the process, as it formally clears the title of the property, allowing for sales or refinancing to proceed without issues related to unresolved debts for services or materials provided.

The Lien Waiver is another document similar to the Mechanics Lien California form but acts preemptively to prevent a lien from being filed. Contractors or suppliers typically sign Lien Waivers in exchange for payment, acknowledging receipt and waiving their right to file a lien against the property. This document is vital in maintaining clear financial dealings between property owners and those providing services or materials, ensuring all parties are protected and aware of their rights and obligations.

A Stop Notice is somewhat akin to the Mechanics Lien California form but differs in its operation. Whereas a Mechanics Lien secures the claimant's interest directly against the property, a Stop Notice freezes funds on a construction project until disputes are resolved. This indirect approach can pressure property owners by interrupting the flow of funds necessary to complete a project, providing a strong incentive for resolving any outstanding financial issues promptly.

The Preliminary Notice, much like the Mechanics Lien California form, is part of the pre-lien process in many states. It's a document that must be served to the property owner, prime contractor, and other parties to inform them of the sender's involvement in the project and to preserve the sender’s right to file a Mechanics Lien should payment issues arise. Serving this notice is often a required step before a Mechanics Lien can be lawfully filed, making it a critical component of lien law compliance.

Construction Contracts bear resemblance to the Mechanics Lien California form in that they outline the scope of work, terms, and conditions of a construction project, including payment terms. This foundational agreement between the property owner and contractor or service provider is what underpins the legal justification for filing a Mechanics Lien should there be a breach such as non-payment for services rendered or materials supplied. Without a clear contract, enforcing a Mechanics Lien can be significantly more challenging.

The Bond Claim document is related to the Mechanics Lien California form in scenarios where a bond substitutes for a property lien. When a payment bond covers a construction project, claimants file a Bond Claim instead of a Mechanics Lien if they're unpaid. This shifts the claim from the property itself to the bond issued by the surety company, offering a different avenue for financial recourse while still based on the fundamental principles of ensuring payment for services or materials provided.

Dos and Don'ts

Filling out the Mechanics Lien form in California requires attention to detail and an understanding of the legal process. To help navigate these waters, here’s a list of dos and don'ts:

Do:

Ensure you have the legal right to file a lien. In California, contractors, subcontractors, laborers, and material suppliers can file if they’ve contributed to a property but haven't been paid.

Gather all necessary details before starting the form. This includes your information, the property owner’s details, a description of the services provided, and the amount unpaid.

Include a detailed description of the labor or materials provided. Specificity can prevent ambiguity and strengthen your claim.

Verify the property description. A mistake here can invalidate your lien. County property records are a reliable source for accurate descriptions.

File the lien within the prescribed timeline. In California, you have 90 days after the completion of work to file. Missing this deadline can result in the loss of lien rights.

Sign the form in front of a notary. A notarized signature is required for the lien to be legally binding.

Send a copy of the lien to the property owner. California law mandates that the property owner must be notified of the lien. This can be done via certified mail, with return receipt requested.

Don’t:

Skip sending a preliminary notice. In many cases, California requires parties to send a preliminary notice within 20 days of beginning work. Failing to do this can jeopardize your right to file a lien.

Overstate the amount you're owed. Claiming more than the actual unpaid amount can lead to penalties, including potential felony charges for lien fraud.

Ignore local regulations and requirements. The specifics of lien laws can vary by county, so make sure to adhere to the local guidelines as well.

Attempt to lien property for work not tied to actual improvement. Only work that directly improves the property is lien-able.

Fill out the form without checking for updates. Forms and filing requirements can change, so use the most current version of the Mechanics Lien form.

Omit any required attachments or documents. This could be contracts, work orders, or written agreements pertaining to the job.

Assume filing a lien will automatically result in payment. While a lien is a powerful tool to encourage payment, it does not guarantee immediate compensation. Be prepared for further legal action if necessary.

Misconceptions

In California, a mechanic's lien is a powerful tool used by contractors, subcontractors, and material suppliers to secure payment for work performed or materials provided on a property. However, there are several misconceptions about the mechanic's lien process and the form itself. Let's clarify some of these common misunderstandings:

- Misconception 1: Anyone can file a mechanic's lien for any type of work done or materials provided. In reality, to qualify for a mechanic's lien in California, the work performed or materials provided must be part of an improvement to the property. This means routine maintenance or repairs might not always qualify. Furthermore, the claimant must have a direct contractual relationship with the property owner, or the claimant must have provided a preliminary 20-day notice if they are a subcontractor or material supplier.

- Misconception 2: The mechanic's lien form is complicated and requires a lawyer to fill out. While it's always a good idea to seek legal advice when dealing with legal documents, the California mechanic's lien form is designed to be straightforward. The state provides resources and guidelines to help individuals fill out and file the form properly. That said, attention to detail is critical to avoid any mistakes that could invalidate the lien.

- Misconception 3: Filing a mechanic's lien means you'll get paid immediately. Filing a mechanic's lien does not guarantee immediate payment. It serves as a claim against the property's title, making it difficult for the property owner to sell, refinance, or obtain a loan against the property without first addressing the lien. This can motivate the property owner to settle the debt, but it doesn't ensure instant payment. In some cases, enforcing the lien through a foreclosure sale of the property may be necessary.

- Misconception 4: A mechanic's lien can be filed at any time after the work is completed or the materials are provided. California law sets specific time frames within which a mechanic's lien must be filed. Generally, the lien must be filed within 90 days from when the work was completed or the materials were provided. However, if a Notice of Completion or Cessation is recorded, the period to file can be significantly shortened. This emphasizes the importance of being cognizant of the project's status and any filed notices.

- Misconception 5: Once filed, a mechanic's lien will remain on the property until the debt is paid. A common misconception is that once a mechanic's lien is filed, it lasts indefinitely until the debt it secures is paid. However, in California, a mechanic's lien expires 90 days after it’s filed unless the claimant initiates legal proceedings to enforce the lien. This means that if action isn't taken within the 90-day period, the lien automatically becomes null and void, liberating the property from the claim.

Understanding the specifics of the mechanic's lien process in California is crucial for anyone in the construction industry or individuals providing materials or labor to a construction project. Dispelling these common misconceptions can help ensure that the rights and interests of both the property owners and those providing services or materials are protected and respected.

Key takeaways

Filling out and using the Mechanics Lien form in California involves understanding crucial details to ensure your rights to payment are legally protected on construction projects. When a contractor, subcontractor, or supplier has not been paid for services rendered or materials supplied, a Mechanics Lien may be a necessary step. Here are key takeaways to ensure this process is handled correctly:

- Eligibility is the first step: Before filing a lien, confirm that you are eligible to do so. In California, contractors, subcontractors, laborers, equipment suppliers, and some design professionals can file a Mechanics Lien if they have not been paid for their work or supplies.

- Preliminary Notice is Mandatory: California law requires that you send a Preliminary 20-Day Notice to the property owner, general contractor, and the lender (if applicable) within 20 days of beginning work or delivering materials. This notice is essential for maintaining the right to file a Mechanics Lien.

- Accuracy is Critical: When filling out the Mechanics Lien form, ensure all information is accurate and complete. This includes the legal property description, names of owners, and the amount due. Mistakes can invalidate your lien.

- Timely Filing is Required: After completing your work, you have a specific timeframe to file your Mechanics Lien. For most projects, the lien must be recorded within 90 days. However, if a Notice of Completion or Cessation has been recorded by the property owner, the timeframe may be reduced to as little as 30 days.

- Recording the Lien: The Mechanics Lien must be recorded with the county recorder's office in the county where the property is located. This involves paying a filing fee and ensuring the form meets all local recording requirements.

- Notification is Important: Once the lien has been recorded, California law requires you to provide a copy of the recorded lien to the property owner. Failure to do this within a specific timeframe can affect the enforceability of the lien.

- Enforcement Through Foreclosure: If payment is still not received after filing a Mechanics Lien, the next step may be to enforce the lien through a foreclosure lawsuit. In California, this action must be initiated within 90 days of recording the lien. If this timeframe lapses without action, the lien automatically becomes unenforceable.

- Release After Payment: Once payment is received, it's important to release the lien promptly. This is done by recording a Lien Release form in the same county office where the original lien was recorded. This step clears the property title and acknowledges that the debt has been satisfied.

Navigating the process of filing a Mechanics Lien in California requires attention to detail and adherence to legal statutes. By understanding these key takeaways, individuals and businesses in the construction industry can better protect their rights and ensure they are compensated for their work.

Discover More PDFs

California Identification Card - The renewal form emphasizes compliance with traffic sign and signal comprehension as part of its conditions for issuing a driver's license or identification card.

California Pardon List - Completion requires detailed explanations and supporting documents to substantiate the request for clemency.