Legal California Loan Agreement Document

When individuals or businesses in California embark on the journey of lending or borrowing money, the importance of documenting the agreement in a solid, legally binding manner cannot be overstated. This is where the California Loan Agreement form comes into play, serving as a crucial tool to outline the specifics of the financial transaction. The form encompasses several major aspects including the identification of the lender and borrower, the amount of money being loaned, interest rates if any, repayment schedules, and conditions under which the loan must be repaid. It also includes clauses about the governing law, which in this case is the state of California, ensuring all parties are aware of the legal framework within which they are operating. Additionally, it addresses what happens in case of a default by the borrower, providing a clear path forward for resolution. By meticulously covering these areas, the California Loan Agreement form not only facilitates a smooth lending and borrowing process but also minimizes potential disputes by providing a comprehensive roadmap for all parties involved.

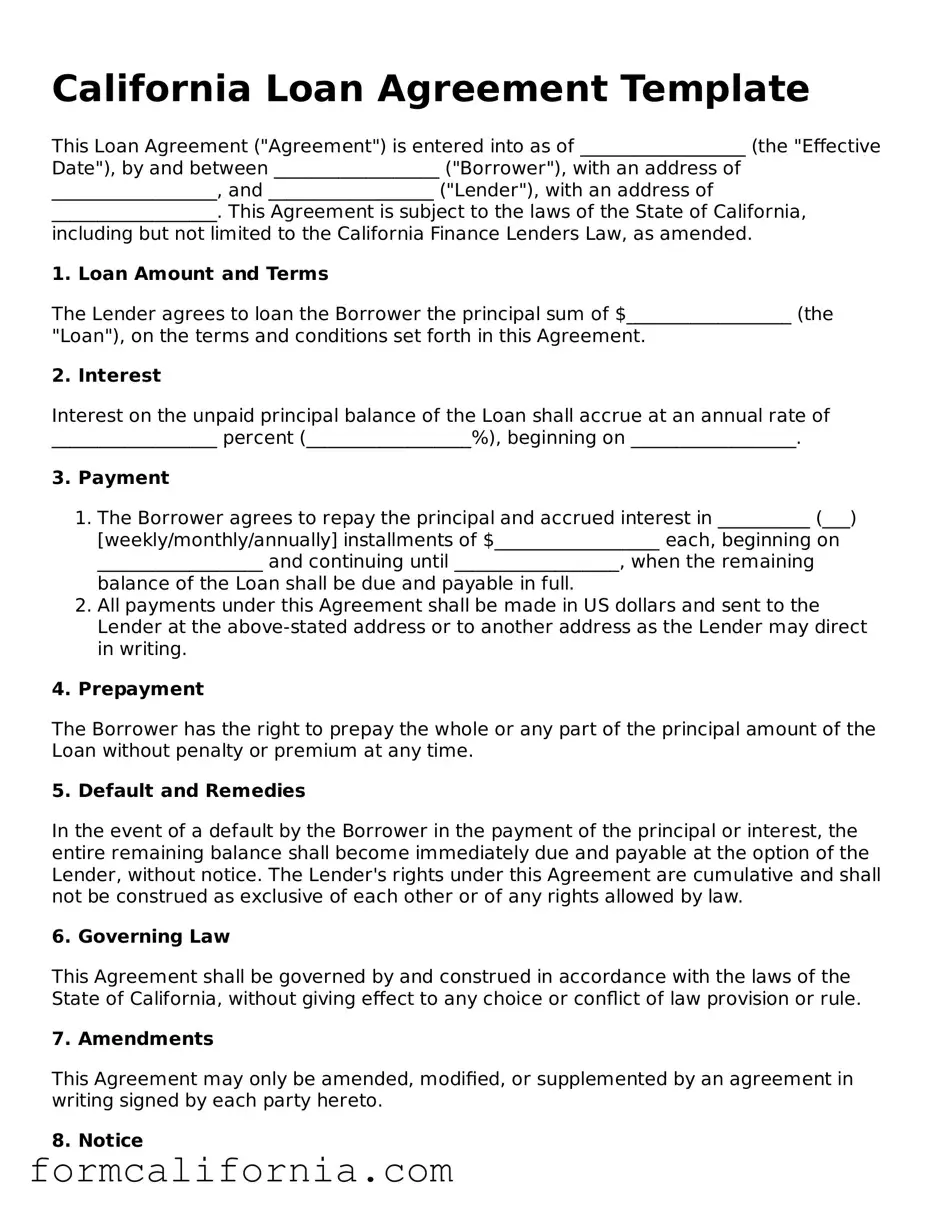

Document Preview Example

California Loan Agreement Template

This Loan Agreement ("Agreement") is entered into as of __________________ (the "Effective Date"), by and between __________________ ("Borrower"), with an address of __________________, and __________________ ("Lender"), with an address of __________________. This Agreement is subject to the laws of the State of California, including but not limited to the California Finance Lenders Law, as amended.

1. Loan Amount and Terms

The Lender agrees to loan the Borrower the principal sum of $__________________ (the "Loan"), on the terms and conditions set forth in this Agreement.

2. Interest

Interest on the unpaid principal balance of the Loan shall accrue at an annual rate of __________________ percent (__________________%), beginning on __________________.

3. Payment

- The Borrower agrees to repay the principal and accrued interest in __________ (___) [weekly/monthly/annually] installments of $__________________ each, beginning on __________________ and continuing until __________________, when the remaining balance of the Loan shall be due and payable in full.

- All payments under this Agreement shall be made in US dollars and sent to the Lender at the above-stated address or to another address as the Lender may direct in writing.

4. Prepayment

The Borrower has the right to prepay the whole or any part of the principal amount of the Loan without penalty or premium at any time.

5. Default and Remedies

In the event of a default by the Borrower in the payment of the principal or interest, the entire remaining balance shall become immediately due and payable at the option of the Lender, without notice. The Lender's rights under this Agreement are cumulative and shall not be construed as exclusive of each other or of any rights allowed by law.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of California, without giving effect to any choice or conflict of law provision or rule.

7. Amendments

This Agreement may only be amended, modified, or supplemented by an agreement in writing signed by each party hereto.

8. Notice

All notices, requests, claims, demands, and other communications hereunder shall be in writing and shall be given (and shall be deemed to have been duly given if given) by personal delivery, email, or registered or certified mail (postage prepaid, return receipt requested) to the respective parties at the address as specified in this Agreement or to such other address as either party may specify in writing to the other party.

9. Signatures

This Agreement shall be executed by both parties as an indication of their agreement to the terms herein and may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the Effective Date first above written.

__________________________________

Borrower: __________________________

Date: ______________________________

__________________________________

Lender: ____________________________

Date: ______________________________

PDF Form Characteristics

| # | Fact |

|---|---|

| 1 | The California Loan Agreement form is specific to the state of California. |

| 2 | It must comply with California's state laws and regulations regarding loans and lending practices. |

| 3 | The California Civil Code is one of the primary governing laws for loan agreements in California. |

| 4 | Interest rates on loans must not violate California's usury laws, as outlined in the Civil Code. |

| 5 | Lenders are required to provide clear and understandable terms to borrowers, ensuring transparency. |

| 6 | Personal and security information must be handled in accordance with California's privacy laws. |

| 7 | The form should outline the repayment schedule, interest rates, and any fees or penalties. |

| 8 | In cases of dispute, California law stipulates that the matter be resolved within the state's jurisdiction. |

Detailed Instructions for Writing California Loan Agreement

Having all the right information at your fingertips makes completing the California Loan Agreement form a breeze. This document is essential when setting up a loan between two parties, laying out the terms, repayment schedule, interest rate, and any collateral involved. The agreement serves to protect both the lender and the borrower by clearly stating their rights and responsibilities. To make sure every detail is accounted for and the agreement is ironclad, follow these step-by-step instructions.

- Start by entering the date the agreement is being made at the top of the form.

- Fill in the legal names of both the borrower and the lender in the designated spaces.

- Specify the loan amount in words and numbers to avoid any confusion.

- Detail the loan’s purpose, clearly explaining how the borrowed funds will be used.

- Enter the interest rate. This should be an annual rate, unless specified otherwise.

- Describe the repayment schedule. Include the number of payments, the amount of each payment, and due dates.

- List any collateral that will secure the loan, if applicable. Clearly identify the property or assets being used as security.

- Include a clause about late fees and the consequences of default to ensure the borrower understands the penalties.

- Both the lender and the borrower should sign and date the form. If witnesses or a notary are required by law or agreed upon, make sure they sign the form as well.

Once completed and signed, the California Loan Agreement form solidifies the commitment between the lender and borrower. It's a crucial step in formalizing the loan and ensuring that both parties are on the same page. Keeping a copy of the signed agreement for personal records is always a good practice. Safeguarding this document can provide peace of mind and serve as a reference throughout the loan period.

Things to Know About This Form

What is a California Loan Agreement form?

A California Loan Agreement form is a legally binding document between a lender and a borrower, where the lender agrees to loan a specific amount of money, and the borrower agrees to repay this amount under the terms outlined in the agreement. This form includes details such as the loan amount, interest rate, repayment schedule, and any collateral securing the loan.

Who needs to sign the California Loan Agreement form?

The California Loan Agreement form must be signed by both the lender and the borrower to be considered valid. Witnesses or a notary public may also need to sign the form, depending on the complexity of the agreement and the preference of the parties involved.

What information is required to fill out the California Loan Agreement form?

To properly fill out the California Loan Agreement form, the following information is required:

- Full names and contact information of both the lender and the borrower.

- The total loan amount being provided.

- Interest rate, if applicable.

- Repayment terms, including the schedule and any late fees.

- Securities or collateral, if any are being used to secure the loan.

- Signatures of both parties and the date the agreement is made.

Is a notary required for a California Loan Agreement form?

While not always required, having the California Loan Agreement form notarized can add an extra layer of legal protection for both parties involved. It confirms that the signatures on the form are genuine and can help prevent disputes about the agreement's validity.

How does one enforce a California Loan Agreement?

To enforce a California Loan Agreement, the lender should first attempt to resolve any issues directly with the borrower. If repayment terms are not met and an agreement cannot be reached, the lender might need to initiate legal action to recover the loaned amount. This could involve filing a lawsuit against the borrower for breach of contract.

Can amendments be made to the California Loan Agreement form?

Yes, amendments to the California Loan Agreement form can be made if both the lender and the borrower agree to the changes. It is recommended that any amendments be documented in writing and signed by both parties to ensure the modifications are legally binding.

What happens if a borrower defaults on a loan under the California Loan Agreement?

If a borrower defaults on a loan, the lender has the right to take legal action to recover the debt. This could include seizing the collateral listed in the agreement, if applicable. The lender may also charge late fees or report the default to credit agencies, negatively impacting the borrower's credit score.

Are digital signatures valid on a California Loan Agreement form?

Yes, digital signatures are considered valid on a California Loan.Security Agreement form, as long as they comply with state laws regarding electronic signatures. Both parties should ensure that the digital signing method used provides a secure and verifiable way to capture their consent.

Common mistakes

Failing to accurately identify the parties involved: Both the lender and borrower must be correctly identified by their full legal names to prevent any issues with enforcement or legal clarity.

Not specifying the loan amount in clear terms: The exact loan amount must be explicitly stated to avoid any ambiguities about the financial obligations of the borrower.

Omitting the loan's purpose: Clearly stating the purpose of the loan helps in specifying its terms and ensures that the funds are used appropriately.

Ignoring the repayment schedule: A detailed repayment plan, including dates and amounts for each installment, is essential to outline the expectations and obligations of the borrower and to avoid future disputes.

Vagueness about interest rates: The interest rate should be clearly defined, whether it is fixed or variable, to prevent confusion over the cost of borrowing.

Skipping clauses on late fees and default: It’s vital to outline the consequences of late payments or default, including any fees or penalties, to protect the interests of the lender and to inform the borrower of the repercussions of failing to meet the agreed terms.

Forgetting to include the governing law: Specifying which state law governs the agreement is crucial, especially in cases of dispute. In California, it’s important to mention that California law applies.

Leaving out amendment procedures: It should be clear how the agreement can be modified, ensuring that any changes are mutually agreed upon in writing.

Not delineating the dispute resolution process: A process for resolving any disputes, such as arbitration or mediation, should be defined to avoid costly and prolonged litigation.

Omitting signatures and dates: The agreement must be signed and dated by all parties to be legally binding. Missing signatures or dates can invalidate the document.

When completing the California Loan Agreement form, attention to detail and clarity on these elements can prevent many common legal issues that arise from poorly drafted agreements.

Documents used along the form

When engaging in lending transactions in California, the Loan Agreement form is a fundamental document that outlines the terms, conditions, and obligations of both the borrower and the lender. However, to effectively manage and protect the interests of both parties, additional forms and documents are often utilized in conjunction with the Loan Agreement. These complementary documents serve various purposes, including securing the loan, clarifying the terms of the deal, and meeting legal requirements. Below is a list of up to eight other forms and documents that are frequently used alongside the California Loan Agreement form.

- Promissory Note: A written promise by the borrower to pay back a specified amount of money to the lender by a certain date. It includes details such as the interest rate and repayment schedule.

- Security Agreement: Identifies the collateral that the borrower offers to secure the loan, ensuring that the lender has a claim to this property if the borrower defaults on the loan.

- Guaranty: A separate agreement where a third party (the guarantor) agrees to fulfill the borrower’s obligations if the borrower fails to do so. It provides an additional layer of security for the lender.

- Amortization Schedule: A table detailing each periodic payment on a loan (typically a mortgage) over time, breaking down the amounts going toward the principal and the interest.

- UCC-1 Financing Statement: A legal form filed with state agencies to perfect a security interest in named collateral, alerting other creditors to a lender's rights to the property.

- Mortgage Deed: If real estate is used as collateral, this document transfers the legal title of the property to the lender until the debt is paid off.

- Personal Financial Statement: A document provided by the borrower detailing their financial status, including assets, liabilities, income, and expenses. It helps the lender assess the borrower’s creditworthiness.

- Compliance Agreement: Ensures that all the information provided by the borrower is accurate and that the borrower agrees to comply with all relevant laws and regulations.

The use of these documents, in addition to the California Loan Agreement form, helps in creating a transparent and legally binding agreement between the borrower and the lender. It lays the groundwork for a successful financial relationship while minimizing risks and misunderstandings. For individuals navigating these transactions, understanding the purpose and content of each form is crucial for a smooth lending process.

Similar forms

A promissory note is one document similar to the California Loan Agreement form. Like a loan agreement, a promissory note serves as a written promise by the borrower to repay a specified sum of money to the lender. However, a promissory note is typically less detailed and doesn't include extensive terms and conditions, focusing instead on the repayment amount, interest rate, and due date. Both documents establish a legally binding relationship between two parties regarding a loan.

Mortgage agreements also share similarities with the California Loan Agreement form, emphasizing the borrowing of money to purchase real estate. These agreements include the loan's terms, the interest rate, and the repayment schedule. Additionally, mortgage agreements use the purchased property as collateral, distinguishing them from unsecured loan agreements. Like loan agreements, they are legally binding and detail the obligations of both borrower and lender regarding the property financing.

Deed of trust documents are akin to the California Loan Agreement form when real estate transactions involve borrowing. Unlike a traditional loan agreement, which involves two parties, a deed of trust involves three: the borrower, the lender, and a trustee. The trustee holds the property title until the loan is repaid. This arrangement provides security for the loan, functioning similarly to a mortgage, but involves different legal structures and processes depending on the state.

Lines of credit agreements resemble the California Loan Agreement form in that they establish terms under which funds can be borrowed. However, a line of credit agreement differs by offering a revolving fund that the borrower can draw upon, repay, and then draw from again up to a maximum limit over a set period. Interest is typically charged on the outstanding balance, and while both documents outline repayment conditions, lines of credit provide more flexibility in borrowing and repayment.

Business Loan Agreements, while specific to commercial contexts, share core components with the California Loan Agreement form, dictating terms under which a business may borrow funds. These agreements detail the loan amount, interest rate, repayment schedule, and any collateral. The primary difference lies in their use; business loan agreements are tailored to the financial needs and structures of businesses, encompassing a wider range of provisions related to business operations and assets.

Credit agreements are broader in scope but fundamentally similar to the California Loan Agreement form. They outline the terms and conditions under which credit is extended to the borrower by the lender for various purposes. Credit agreements can range from simple loans to complex financing arrangements and include details about repayment terms, interest rates, and collateral. Both are formal agreements that legally bind the borrower to repay the borrowed funds under agreed-upon terms.

Personal Guarantee forms often accompany loan agreements, including the California Loan Agreement, adding an additional layer of security for the lender. In a personal guarantee, a third party agrees to repay the loan if the original borrower defaults. This document shares the foundational commitment to repay a debt that is core to loan agreements but shifts some financial responsibility to someone other than the primary borrower. While it is an ancillary document, it is crucial in providing lenders with assurance of repayment.

Dos and Don'ts

When entering into a financial agreement, paying attention to detail is crucial. A California Loan Agreement form is a binding document between a lender and a borrower. It outlines the terms and conditions of a loan, including repayment schedule, interest rate, and collateral requirements, if applicable. To ensure clarity and legal compliance, here are ten dos and don'ts for filling out the California Loan Agreement form:

- Do thoroughly review the entire form before starting to ensure understanding of all requirements and sections.

- Do use clear and precise language to avoid any ambiguity or misunderstandings.

- Do include detailed information about the loan amount, interest rate, repayment schedule, and any collateral securing the loan.

- Do verify the accuracy of both parties' personal and contact information to prevent future disputes or issues.

- Do ensure that all involved parties sign the form and include the date to validate the agreement.

- Don't leave any sections blank. If a section does not apply, mark it as "N/A" (not applicable) to show that it was considered.

- Don't rely solely on verbal agreements or promises. Make sure every aspect of the loan is documented in the form.

Don't sign the form without ensuring that both the lender and the borrower fully understand and agree to its terms.- Don't omit key financial details, such as late fees or penalties for early repayment, which could lead to legal issues down the line.

- Don't hesitate to consult a legal professional if there are any doubts or questions about the terms of the agreement or how to complete the form correctly.

Misconceptions

When discussing the California Loan Agreement form, several misconceptions frequently arise. These misunderstandings can lead to confusion and mismanagement of expectations regarding the loan process in California. It's imperative to dispel these inaccuracies to ensure all parties involved have a clear and accurate understanding of the document and its implications.

Only for Business Loans: A common misconception is that the California Loan Agreement form is exclusively used for business-related financial transactions. In reality, this document is versatile and can be utilized for various types of loans including personal loans, mortgages, and auto loans, among others, provided they comply with state laws.

Legal Representation Not Required: Many assume that completing and executing a loan agreement in California does not necessitate legal counsel. While it's true that parties can draft and sign a loan agreement without a lawyer, obtaining legal advice is highly advisable to ensure that the agreement complies with state laws and adequately protects all parties' interests.

Standardized Form: There's a misconception that there is a single, standardized California Loan Agreement form that all parties use for every loan. The reality is that while templates exist, loan agreements should be tailored to the specific terms and conditions of the individual loan, including interest rates, repayment schedule, and collateral, if any.

No Need for Witnesses or Notarization: Some believe that loan agreements in California do not require witnesses or notarization. While not all loans require these steps, having a loan agreement witnessed or notarized can add a layer of authenticity and can be crucial in the enforcement of the agreement.

Oral Agreements are Just as Valid: While oral contracts can be legally binding in certain situations, relying on an oral agreement for a loan can lead to significant issues with proof and enforcement. California law prefers and, in certain circumstances, requires written agreements for loans to ensure clarity and enforceability.

Interest Rates are Unregulated: There's a notion that lenders can charge any interest rate they wish under a California loan agreement. However, California has usury laws that cap interest rates to protect borrowers from excessively high charges, and violating these laws can result in severe penalties.

Immediate Foreclosure on Collateral: Some people mistakenly believe that if a borrower defaults under a California Loan Agreement, lenders can immediately seize or foreclose on the collateral. In reality, the process is not immediate. Lenders must follow specific procedural steps, which often includes providing notice to the borrower and allowing them time to cure the default, before taking such actions.

Understanding these misconceptions is crucial for both lenders and borrowers entering into a loan agreement in California. Clarifying these points before drafting or signing can prevent future disputes and ensure that the loan process is conducted smoothly for all involved parties.

Key takeaways

When entering into a financial agreement as significant as a loan in the bustling and legally meticulous state of California, understanding the nuances of a Loan Agreement form cannot be overstated. Drafting and executing this document carefully ensures that both lender and borrower clearly comprehend their obligations, rights, and the specifics of the loan arrangement. Here are eight key takeaways you should be aware of regarding the California Loan Agreement form.

- Complete Details Are Crucial: In the California Loan Agreement form, every party involved should ensure their information is accurately and completely listed. This includes full legal names, addresses, and contact details, which help in avoiding any disputes related to the parties' identities.

- Clarify Loan Terms: The specific terms of the loan, including the loan amount, interest rate, repayment schedule, and maturity date, must be clearly defined within the document. Ambiguities can lead to misunderstandings or legal disputes, which can be costly and time-consuming for all parties involved.

- Interest Rate Disclosure: California law requires the disclosure of the interest rate in the Loan Agreement. It is essential to ensure that the interest rate complies with California's usury laws to prevent the agreement from being considered void or the lender from facing penalties.

- Secured or Unsecured: Clearly indicate whether the loan is secured or unsecured. If secured, the agreement should detail the collateral that will be used to secure the loan. This distinction affects the lender's remedies in the event of default.

- Default and Remedies: The conditions under which a loan is considered in default should be explicitly mentioned, along with the remedies available to the lender. This can include acceleration of debt repayment, legal action, or seizing collateral in the case of secured loans.

- Governing Law: The agreement should specify that California law governs the document. This ensures that any legal disputes will be settled according to California’s statutes and regulations, providing a clear legal framework for resolution.

- Signatures: For the agreement to be legally binding, it must be signed by all parties involved. Consider having the signatures notarized to add an additional layer of authenticity and protection against claims of forgery.

- Amendments: Any changes to the loan agreement after its initial execution should be made in writing and signed by all parties. This formalizes any adjustments and reduces the risk of disputes related to verbal agreements or understandings.

Creating and executing a California Loan Agreement form with attention to these details can significantly reduce the risk of misunderstandings and conflicts. It’s a step towards ensuring that all parties are on the same page, fostering a smoother financial transaction and relationship between the lender and borrower.

More California Forms

Free Lease Agreement California - Includes clauses on legal compliance, ensuring that activities on the property do not violate local ordinances or laws.

California Apartment Rental Application - For renters, understanding the importance and components of the rental application form can significantly improve their chances of securing a desired lease, making it a crucial step in the rental process.