Legal California Last Will and Testament Document

Planning for the future involves making decisions today that will have a lasting impact on your loved ones. Among the most crucial steps in this process is preparing a Last Will and Testament, especially relevant for residents of California. This legal document allows you to outline precisely how you wish your assets to be distributed after you pass away, ensuring your wishes are respected and your loved ones are taken care of according to your desires. Beyond asset distribution, it lets you appoint an executor, the person you trust to carry out your will's instructions, and make crucial decisions about guardianship for your dependents, offering peace of mind about their well-being. Crafting a will involves understanding specific requirements unique to California, such as the need for witness signatures and considerations for notarization, making it not just a form but a pivotal element of estate planning. While the task may seem daunting, breaking down its components and implications can help demystify the process, ensuring your legacy is preserved as you envision.

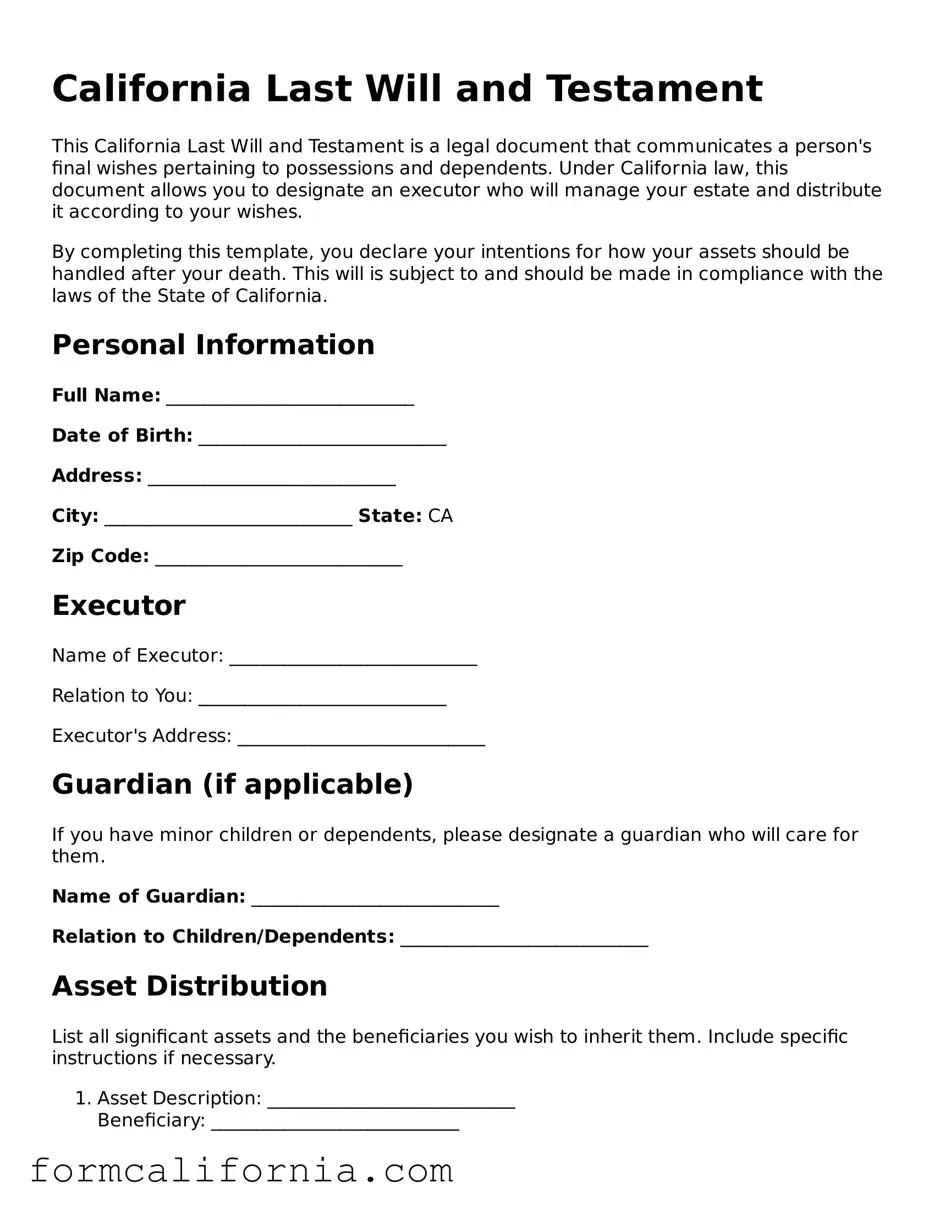

Document Preview Example

California Last Will and Testament

This California Last Will and Testament is a legal document that communicates a person's final wishes pertaining to possessions and dependents. Under California law, this document allows you to designate an executor who will manage your estate and distribute it according to your wishes.

By completing this template, you declare your intentions for how your assets should be handled after your death. This will is subject to and should be made in compliance with the laws of the State of California.

Personal Information

Full Name: ___________________________

Date of Birth: ___________________________

Address: ___________________________

City: ___________________________ State: CA

Zip Code: ___________________________

Executor

Name of Executor: ___________________________

Relation to You: ___________________________

Executor's Address: ___________________________

Guardian (if applicable)

If you have minor children or dependents, please designate a guardian who will care for them.

Name of Guardian: ___________________________

Relation to Children/Dependents: ___________________________

Asset Distribution

List all significant assets and the beneficiaries you wish to inherit them. Include specific instructions if necessary.

- Asset Description: ___________________________

Beneficiary: ___________________________ - Asset Description: ___________________________

Beneficiary: ___________________________ - Additional assets and beneficiaries can be added as needed.

Other Provisions

Include any additional instructions, such as funeral arrangements or donations to charities.

- Special Instructions: ___________________________

- Funeral Arrangements: ___________________________

- Charitable Donations: ___________________________

Signatures

To make this document legally binding, it must be signed in the presence of two witnesses, who must also sign. Witnesses should not be beneficiaries of this will.

Your Signature: ___________________________ Date: ___________________________

Witness 1 Signature: ___________________________ Date: ___________________________

Name: ___________________________

Witness 2 Signature: ___________________________ Date: ___________________________

Name: ___________________________

PDF Form Characteristics

| # | Fact | Detail |

|---|---|---|

| 1 | Definition | A California Last Will and Testament is a legal document that outlines how a person’s assets and estate will be distributed after their death. |

| 2 | Governing Law | The California Probate Code governs the creation and execution of Last Wills and Testaments in California. |

| 3 | Age Requirement | The individual creating the Will (Testator) must be at least 18 years old. |

| 4 | Capacity Requirement | The Testator must be of sound mind, understanding the nature of the Will, their assets, and their beneficiaries. |

| 5 | Written Form Requirement | The Will must be in writing to be legally valid in California. |

| 6 | Witness Requirement | California law requires at least two individuals to witness the signing of the Will. |

| 7 | Witness Qualifications | Witnesses must be competent and cannot be beneficiaries of the Will. |

| 8 | Self-Proving Wills | A notarized affidavit by the Testator and witnesses can make the Will self-proving, simplifying the probate process. |

| 9 | Holographic Wills | California recognizes holographic Wills, which are handwritten by the Testator and do not require witnesses, if the material provisions and the testamentary intent are clear. |

| 10 | Revocation Method | A Will can be revoked by a subsequent Will, destruction of the document by the Testator, or by a written declaration of revocation. |

Detailed Instructions for Writing California Last Will and Testament

Finalizing a Last Will and Testament in California is an important step in ensuring that a person’s wishes are respected and carried out after they pass away. This document allows individuals to specify how their assets and personal matters should be handled. Completing this form requires careful consideration and accuracy to ensure that all components are legally compliant and reflect the person's true intentions. Below are the steps needed to fill out the California Last Will and Testament form to help guide you through this important process.

- Begin by stating your full legal name and current residence, including city and county, to affirm your identity and where the will is being executed.

- Appoint an executor, the person you trust to carry out the instructions of your will, by providing their full name and relationship to you.

- Designate a guardian for any minor children or dependents, specifying the individual's full name and their relationship to the minors. If applicable, also name an alternate guardian as a precaution.

- Detail how your assets and property are to be distributed. Specify the names of the beneficiaries, their relationship to you, and what they are to inherit. Be as clear as possible to avoid any potential confusion or disputes.

- Include any specific instructions for the payment of debts and taxes, ensuring these obligations are settled according to your wishes.

- If desired, add special instructions for your funeral and burial arrangements, indicating preferences or the allocation of funds for these purposes.

- Have two witnesses sign the form. According to California law, witnesses must be legal adults who do not stand to benefit from the will. This is to ensure that the will is executed fairly and without conflict of interest.

- Finally, sign and date the document in front of the witnesses, confirming that the will is made voluntarily and without any undue influence or duress.

Once these steps are completed, your California Last Will and Testament is officially finalized. It's recommended to store this document in a safe place, such as a secure filing system or with an attorney, and inform the executor of its location. Regularly review and update your will as necessary to account for life changes, such as marriage, divorce, the birth of children, or significant changes in assets. This ensures that your wishes are always accurately reflected and can be carried out as you intended.

Things to Know About This Form

What is a Last Will and Testament?

A Last Will and Testament, often simply called a will, is a legal document that expresses a person's wishes about how their property is to be distributed after their death and as to which person is to manage the property until its final distribution. For residents of California, the document specifies how your assets, including money, real estate, and personal possessions, should be handled. It also can designate guardians for any minor children.

How do I create a Last Will and Testament in California?

Creating a Last Will and Testament in California involves several steps. Firstly, you must decide what property to include and who the beneficiaries of that property will be. You also need to choose an executor, who will be responsible for carrying out the instructions in your will. Once these decisions are made, the will must be written. While you can write a will yourself, it's often advisable to seek legal advice to ensure it's valid. After the will is written, California law requires that it be signed by the person making the will (the testator) in the presence of two witnesses, who must also sign the document.

Who can be a witness to a Last Will and Testament in California?

In California, witnesses to a Last Will and Testament must be adults who are mentally competent. Importantly, the witnesses should not be beneficiaries of the will. This is to avoid any conflict of interest and to help ensure that the will is executed fairly and without undue influence.

Can I change my Last Will and Testament after it's been made?

Yes, a Last Will and Testament in California can be changed at any time before the testator's death. Changes are typically made through a formal amendment called a codicil, which must be executed with the same formalities as the original will (signed by the testator in the presence of two witnesses). However, it's often simpler to create a new will if significant changes are needed. Revoking the old will and replacing it with a new one ensures clarity and helps prevent legal challenges.

What happens if I die without a Last Will and Testament in California?

If you die without a Last Will and Testament in California, your estate will be subject to intestate succession laws. These laws decide how your property will be distributed, typically to your closest relatives, starting with your spouse and children. If you have no living relatives by blood or marriage, your estate may become property of the state. Not having a will also means you forfeit the chance to choose an executor for your estate or guardians for your minor children.

Is a handwritten Last Will and Testament valid in California?

Yes, handwritten wills, also known as holographic wills, are considered valid in California provided certain requirements are met. The will must be entirely written, dated, and signed by the hand of the testator. It is not required to be witnessed, although having witnesses can help uphold its validity if contested. Despite their legality, holographic wills are more susceptible to challenges and may not be the best option for everyone. It's crucial to ensure clarity and compliance with state laws, which is why seeking legal advice is advisable.

What are the main components of a Last Will and Testament?

A Last Will and Testament in California typically includes several key components:

- Declaration: The document begins with a declaration by the testator stating that they are of legal age, of sound mind, and intending to make a will.

- Appointment of Executor: The person chosen to carry out the instructions of the will and handle the estate's affairs.

- Disposition of Property: Instructions on how the testator's property should be distributed among the beneficiaries.

- Guardianship Designations: If applicable, the will specifies the chosen guardians for any minor children or dependents.

- Signatures: The will must be signed by the testator and witnessed by at least two other individuals.

Do I need a lawyer to create a Last Will and Testament in California?

While it's not legally required to have a lawyer to create a Last Will and Testament in California, consulting with one is highly recommended. Legal counsel can provide valuable advice to ensure the will is valid, accurately expresses your wishes, and offers the best protection for your estate. Attorneys experienced in estate planning can also advise on potential tax implications and suggest strategies to minimize estate taxes and avoid probate.

How does marriage, divorce, or having children affect my Last Will and Testament?

Major life events such as marriage, divorce, or having children can have significant impacts on your Last Will and Testament. In California, a marriage automatically revokes a previous will unless the will explicitly states otherwise. Conversely, divorce can invalidate provisions in a will that favor a former spouse unless the will indicates the intention to maintain those provisions despite the divorce. Additionally, if you have children after creating your will, provisions may need to be adjusted to provide for them appropriately. Regularly reviewing and updating your will ensures it reflects your current wishes and circumstances.

Can my Last Will and Testament be challenged in court?

Yes, like in any state, a Last Will and Testament in California can be challenged in court for various reasons. Challenges may arise if someone believes the testator was not of sound mind when the will was made, if there is suspicion of fraud or undue influence, or if the will does not meet state legal requirements. To mitigate the chances of a will being contested, ensure it is clearly written, complies with California laws, and reflects the testator's true intentions. Seeking legal help can also address potential issues and reinforce the will's validity.

Common mistakes

Not adhering to California legal requirements: California law has specific requirements for a will to be considered valid. For instance, the person making the will (testator) must be of sound mind, the will must be written, and it must be signed by at least two witnesses who are not beneficiaries. Ignoring these requirements can invalidate the document.

Overlooking the need for a witness: As mentioned, California requires two witnesses who are not beneficiaries to sign the will. Some people forget to ensure these witnesses are present and legally eligible, which can lead to challenges.

Making alterations without legal guidance: It's common for individuals to think they can make handwritten changes to their will after it's been signed. However, in California, such alterations could invalidate the will or certain provisions unless done correctly and with the necessary formalities.

Leaving out a residuary clause: Many people forget to include a residuary clause, which covers any assets not specifically named in the will. Without this, any leftover assets may be distributed according to state laws rather than the person's wishes.

Naming an executor without providing alternatives: The role of the executor is vital. They manage the estate according to the will's instructions after the person's death. Not naming an alternative executor means that if the primary executor cannot serve, the court will decide who takes on this responsibility.

Not clearly identifying beneficiaries: Sometimes, names of beneficiaries are not clearly stated, leading to confusion and disputes among potential heirs. It’s crucial to be as specific as possible when naming beneficiaries to avoid this.}

Keeping the will in an undisclosed or inaccessible location: After a will has been completed, it needs to be stored in a safe yet accessible location. Failing to inform trusted individuals or the executor about where to find the will can result in unnecessary complications and delays.}

By avoiding these common mistakes, individuals can help ensure their California Last Will and Testament accurately reflects their final wishes and can be executed smoothly and effectively.

Documents used along the form

When preparing a Last Will and Testament in California, it's imperative to be aware of other documents that may complement your estate planning needs. These documents can ensure your wishes are fully understood and carried out upon your passing or if you become unable to make decisions for yourself. Each document serves a distinct purpose, and together, they provide a comprehensive approach to estate planning.

- Advance Health Care Directive - This legal document allows you to outline your preferences for medical treatment in situations where you are unable to communicate your wishes. It can also designate someone to make health care decisions on your behalf.

- Durable Power of Attorney for Finances - Through this document, you can appoint an individual to manage your financial affairs. This can include paying your bills, managing your investments, and handling other financial duties, should you become incapacitated.

- Living Trust - A Living Trust is created during your lifetime and can be used to manage your property and assets. It allows for an easier transfer of assets to beneficiaries upon your death, bypassing the potentially lengthy and costly probate process.

- Pour-Over Will - This type of will is used in conjunction with a Living Trust, ensuring that any assets not included in the trust at the time of your death are transferred into it and distributed according to your wishes.

- Guardianship Designation - If you have minor children or dependents, this document is essential for naming a guardian to care for them in the event of your incapacity or death.

- Digital Asset Trust - This is a relatively new type of document that allows you to specify how your digital assets, such as social media accounts, emails, and digital files, should be handled after your passing.

- Letter of Intent - A letter of intent is a more personal document that provides instructions and wishes that don't necessarily fit into the legal framework of a will. It can include funeral arrangements, distribution wishes for personal items, or messages to loved ones.

- Tangible Personal Property Memorandum - Often attached to a will, this document lists items of personal property (like jewelry, furniture, and collectibles) and their intended recipients, adding another layer of specificity to your estate planning.

Together, these documents form a robust estate plan that can articulate your wishes clearly and provide for the seamless management and distribution of your assets. Remember, laws and requirements can vary significantly from one state to another, so it's always advisable to consult with a professional when drafting your estate planning documents to ensure they meet all legal standards in California.

Similar forms

The California Last Will and Testament share similarities with a Living Trust in that both allow the individual to specify how their assets should be handled and distributed after death. However, while a will goes through probate, a living trust does not, streamlining the process for distributing assets according to the individual’s wishes more efficiently and with potentially less court involvement.

Similarly, a Financial Power of Attorney is a document that, while operational during an individual's lifetime unlike a will, allows one to designate another person to handle financial affairs. These affairs can range from paying bills to managing investments, which highlights the parallel in authorizing someone else to manage one's affairs, be it after death or during incapacity.

Health Care Directives, also known as medical power of attorney, share the essence of a will’s philosophy—the act of making decisions ahead of time. While a will articulates decisions about asset distribution after death, a health care directive outlines wishes regarding medical treatment and care should one become unable to communicate those decisions personally.

A Codicil to a Will serves as an amendment or addition to an existing will, demonstrating a direct relationship in modifying or clarifying an individual's last wishes about their estate. This document is particularly akin to the will, as it directly alters its stipulations or adds new instructions without necessitating the drafting of a new will entirely.

The Beneficiary Designation form often used with retirement accounts, life insurance policies, and other financial products, resemble wills in that they specify who will receive an asset after the account holder’s death. Unlike wills, these designations bypass the probate process, offering a streamlined way to transfer assets directly to named beneficiaries.

A Transfer on Death (TOD) Deed, or beneficiary deed, lets property owners name someone to inherit their property upon death without the need for probate, much like a will's function for personal property and real estate assets. The similarity lies in the direct naming of heirs or beneficiaries, but a TOD deed is specific to real estate and avoids probate court.

The Pet Trust is a document that allows for the appointment of a trustee to manage funds and care for one’s pets after the owner's death, a concept echoing the will’s aim to ensure dependents—human or animal—are cared for according to the individual's wishes. It symbolizes the detailed planning for loved ones, though specifically focuses on animals.

A Digital Asset Will is an emerging concept that, like the traditional will, helps manage and distribute one's assets after death. However, it specifically addresses digital footprints, including social media accounts, digital currencies, and online businesses, highlighting the contemporary need to handle a digital estate in line with physical and financial assets.

Letters of Instruction, while not legally binding, complement a Last Will by providing a detailed account of where to find important documents, keys, or even the nuances of personal wishes concerning one's funeral arrangements. It operates in parallel to a will’s intent by easing the execution of one's personal and final affairs.

Finally, a Special Needs Trust is designed to ensure that beneficiaries who are disabled or have special needs can receive inheritance without disqualifying them from essential government benefits. Like a will, it ensures that assets are protected and used in the beneficiary's best interest, but it addresses the unique circumstances of beneficiaries with special needs.

Dos and Don'ts

When preparing a California Last Will and Testament, individuals are tasked with critical decisions regarding their estate's distribution and care for their loved ones after they are gone. A well-prepared document ensures that one's final wishes are honored, potentially reducing conflict among survivors. Here are essential do's and don'ts to consider:

- Do make sure you meet all of California's legal requirements: The person creating a will (testator) must be at least 18 years old and of sound mind. The will must be in writing and signed by the testator or by someone else under the testator’s specific direction. It requires the presence of at least two witnesses who understand that the document is the testator’s will and who watch the testator sign.

- Do consider consulting a legal professional: While it’s possible to draft a will without a lawyer, consulting with a legal professional can provide valuable advice tailored to your particular circumstances, ensuring your will complies with California laws and reduces the chances of it being contested.

- Do be clear about your beneficiaries: Clearly identify the individuals or organizations you wish to inherit your assets. Ambiguities in beneficiary designations can lead to disputes and delays in the probate process.

- Do choose an executor you trust: This individual will manage your estate's settlement according to the instructions in your will. Consider their willingness and ability to serve, and discuss your decision with them ahead of time.

- Don't forget to update your will as needed: Life events such as marriage, divorce, the birth of a child, or significant changes in your financial situation should prompt a review and, if necessary, a revision of your will.

- Don't include conditions for inheritance based on marriage, divorce, or religious conversion: California law deems such conditions against public policy and unenforceable.

- Don't neglect to sign your document in the presence of witnesses: Your will is not valid in California unless it's signed. Ensure your witnesses are not beneficiaries of the will, as this could raise conflicts of interest.

- Don't rely solely on a digital version of your will: While digital records can be useful, California law requires a physical document. Make sure to store your will in a safe but accessible place and let your executor know where to find it.

Understanding and following these guidelines can significantly impact the effectiveness and enforceability of your Last Will and Testament in California. Creating a comprehensive and legally valid will is a crucial step in estate planning, offering peace of mind to both the testator and their loved ones.

Misconceptions

When it comes to preparing a Last Will and Testament in California, several misconceptions often mislead individuals about its legality and requirements. Understanding the truths behind these misunderstandings is crucial for ensuring that one's final wishes are honored accurately and lawfully.

Myth: A Lawyer Must Draft Your Will for It to Be Valid

Many believe that a will must be drafted by a lawyer to be considered legal in California. However, a document can be legal as long as it meets the state's requirements, which include being signed by the person making the will (the testator) and being witnessed by at least two individuals who will not inherit anything from the will.Myth: Oral Wills Are Acceptable in California

Although oral wills might be recognized in some jurisdictions, California law requires a will to be in writing to be valid. This means that any last wishes expressed verbally without a written document to support them are not legally enforceable in the state.Myth: A Will Needs to Be Notarized to Be Valid

California does not require a will to be notarized to be valid. The critical elements are the testator's signature and the presence of two impartial witnesses during the signing process. Notarization can add an extra layer of verification, but it is not a legality requirement.Myth: You Can Disinherit Your Spouse Completely with a Will

In California, a spouse has rights to a portion of the estate under the community property laws, even if the will states otherwise. Depending on specific circumstances, such as prenuptial agreements, a spouse might be entitled to half or a portion of the estate, signifying that completely disinheriting them through a will could be challenged in court.Myth: Wills Cover the Distribution of All Types of Property

While wills do outline the distribution of many types of property, not all assets are covered. For example, assets held in joint tenancy, life insurance proceeds with a named beneficiary, and retirement accounts do not pass through wills. These types of assets transfer directly to the named beneficiaries or surviving co-owners outside the will's authority.

Key takeaways

Completing a Last Will and Testament in California is a significant step in estate planning, offering peace of mind and clarity for the future. Here are seven key takeaways to ensure the process is as smooth and accurate as possible.

Understand the Requirements: In California, the person creating a will (known as the testator) must be at least 18 years old and of sound mind. The document needs to be in writing and signed by the testator or someone else in the testator’s presence and at the testator’s direction. Additionally, it needs to be witnessed by at least two people who saw the testator sign the will or acknowledge the will.

Choose Witnesses Carefully: Witnesses play a crucial role. They must be at least 18 years old and should not be beneficiaries of the will. Having beneficiaries as witnesses can lead to conflicts of interest and, potentially, challenges to the will’s validity.

Be Specific About Your Assets: When distributing your assets, clarity is key. Detail the assets you own and specify who gets what. This can include real estate, bank accounts, securities, and personal property. Being specific helps prevent disputes among heirs.

Name an Executor Wisely: The executor of your will carries out your wishes according to its terms. Choose someone who is responsible, trustworthy, and capable of handling financial matters. It’s also wise to name an alternate in case your first choice is unable or unwilling to serve.

Consider a Guardian for Minor Children: If you have minor children, it’s crucial to designate a guardian in your will. This ensures that someone you trust will care for your children if you're unable to do so.

Keep It Secure but Accessible: Once your will is completed, store it in a safe place. However, make sure that your executor and perhaps a trusted family member know where it is and how to access it when the time comes.

Update as Necessary: Life changes—marriages, divorces, births, deaths—can all affect your will. Review and update your will regularly or when significant life events occur to ensure it always reflects your current wishes.

Following these guidelines will help ensure that your California Last Will and Testament accurately reflects your wishes and provides for your loved ones as you intend. Remember, while this document is a key part of estate planning, it’s also wise to consult with a legal professional to ensure your estate plan is comprehensive and complies with California law.

More California Forms

Dnr Document - In some cases, a DNR order is included in a larger advanced directive document.

Bill of Sale for Car Template - This document can simplify the registration process for the buyer, as it provides proof of purchase and establishes their legal ownership of the dirt bike.