Legal California Land Purchase Agreement Document

In the process of purchasing land in California, buyers and sellers are brought together through a vital document known as the California Land Purchase Agreement form. This legal contract outlines the terms and conditions of the sale, ensuring clarity and protection for both parties involved. It meticulously details aspects such as the purchase price, payment plan, description of the property, contingencies, and the responsibilities of each party before the closing date. Additionally, the agreement specifies what happens in the event of a breach and contains provisions for inspections, disclosures, and any other condition precedent to the final sale. By doing so, this form serves as a cornerstone for real estate transactions, smoothing the path from agreement to ownership while minimizing misunderstandings and disputes. As such, understanding the components and significance of this agreement is essential for anyone looking to navigate the complexities of buying or selling land in California.

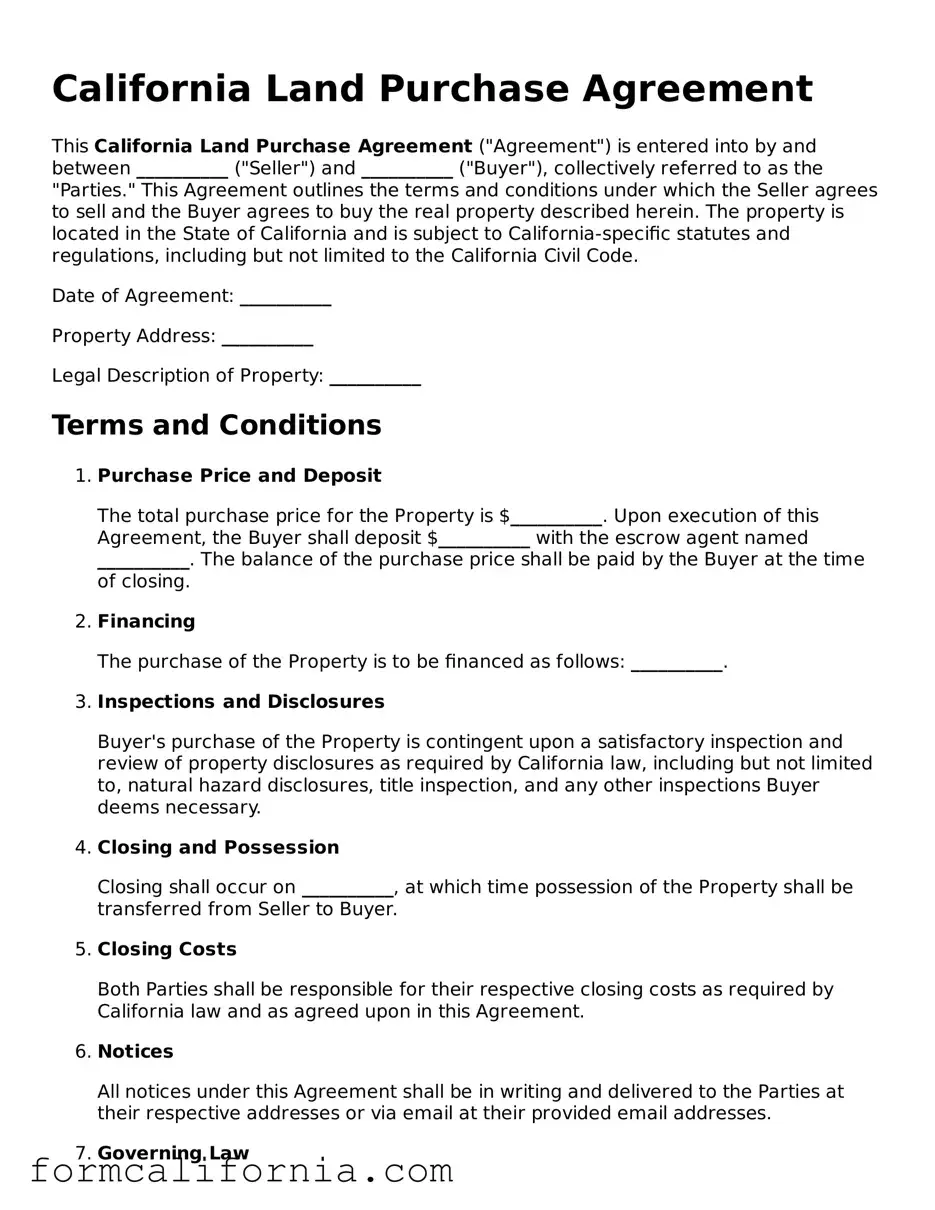

Document Preview Example

California Land Purchase Agreement

This California Land Purchase Agreement ("Agreement") is entered into by and between __________ ("Seller") and __________ ("Buyer"), collectively referred to as the "Parties." This Agreement outlines the terms and conditions under which the Seller agrees to sell and the Buyer agrees to buy the real property described herein. The property is located in the State of California and is subject to California-specific statutes and regulations, including but not limited to the California Civil Code.

Date of Agreement: __________

Property Address: __________

Legal Description of Property: __________

Terms and Conditions

- Purchase Price and Deposit

The total purchase price for the Property is $__________. Upon execution of this Agreement, the Buyer shall deposit $__________ with the escrow agent named __________. The balance of the purchase price shall be paid by the Buyer at the time of closing.

- Financing

The purchase of the Property is to be financed as follows: __________.

- Inspections and Disclosures

Buyer's purchase of the Property is contingent upon a satisfactory inspection and review of property disclosures as required by California law, including but not limited to, natural hazard disclosures, title inspection, and any other inspections Buyer deems necessary.

- Closing and Possession

Closing shall occur on __________, at which time possession of the Property shall be transferred from Seller to Buyer.

- Closing Costs

Both Parties shall be responsible for their respective closing costs as required by California law and as agreed upon in this Agreement.

- Notices

All notices under this Agreement shall be in writing and delivered to the Parties at their respective addresses or via email at their provided email addresses.

- Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of California.

- Amendments

Any amendment to this Agreement must be in writing and signed by both Parties.

- Entire Agreement

This Agreement constitutes the entire agreement between the Parties with respect to the subject matter hereof and supersedes all prior agreements, understandings, negotiations, and discussions, whether oral or written.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first written above.

Seller's Signature: __________

Seller's Name Printed: __________

Date: __________

Buyer's Signature: __________

Buyer's Name Printed: __________

Date: __________

PDF Form Characteristics

| Fact | Detail |

|---|---|

| Definition | A California Land Purchase Agreement is a legal document formalizing the purchase and sale of real property in California. |

| Governing Law | It is governed by California law, including Civil Code sections relevant to real property transactions. |

| Required Disclosures | Sellers must provide specific disclosures about the property's condition, including any known defects, as required by California law. |

| Signatures | The agreement must be signed by both the buyer and the seller to be considered legally binding. |

| Consideration | A detailed description of the purchase price, including any deposits or financing arrangements, must be clearly outlined in the agreement. |

Detailed Instructions for Writing California Land Purchase Agreement

Filling out a California Land Purchase Agreement form is a crucial step in the process of buying or selling land in California. This legally binding document outlines the terms and conditions of the sale, including price, property description, and any contingencies that must be met before the sale can proceed. It's important to complete this form accurately and thoroughly to protect both parties involved in the transaction. The following steps will guide you through completing the California Land Purchase Agreement form.

- Begin by entering the date of the agreement at the top of the form.

- Write the full names and addresses of both the buyer(s) and seller(s) in the designated spaces.

- Describe the property to be purchased. This should include the property's legal description, address, and any identifiable details such as parcel number.

- Specify the purchase price in the section provided. Also, detail the form of payment, whether it be cash, loan, or a combination of both.

- Outline any contingencies that apply to the sale, such as the buyer's ability to obtain financing or the sale being subject to the approval of a third party.

- Detail how closing costs and other expenses, like title insurance and property taxes, will be divided between the buyer and seller.

- Specify the closing date by which the transaction should be completed and ownership of the property transferred.

- Include any additional terms and conditions that are important to the buyer or seller. This could cover items like a requirement for a property inspection or specific repairs to be made before the sale.

- Have both the buyer(s) and seller(s) sign and date the form in the presence of a notary public. Be sure to also print their names for clarity.

- Attach any necessary addendums or disclosures that are required by state law or agreed upon by the parties.

After filling out the California Land Purchase Agreement form, the next step typically involves the buyer conducting due diligence, such as property inspections and obtaining financing, if applicable. Both parties may need to meet any contingencies listed in the agreement. Once all conditions are met and the closing date arrives, final documents are signed, and the property's ownership is transferred from the seller to the buyer. It is highly recommended that both parties consult with legal and real estate professionals throughout this process to ensure that their rights are protected and the transaction proceeds smoothly.

Things to Know About This Form

What is a California Land Purchase Agreement?

A California Land Purchase Agreement is a legal document that outlines the terms and conditions under which a piece of land in California will be sold and purchased. It includes details like the purchase price, description of the property, conditions of the sale, and the responsibilities of both the buyer and the seller leading up to the transfer of the title.

Who needs to sign the California Land Purchase Agreement?

The California Land Purchase Agreement must be signed by both the buyer(s) and the seller(s) of the land. If either party is a company or other legal entity, an authorized representative must sign on its behalf.

What details are included in a California Land Purchase Agreement?

In a California Land Purchase Agreement, you can expect to find several key details, including:

- The legal description of the property being sold.

- The purchase price and terms of payment.

- Any contingencies that must be satisfied before the sale is finalized, such as the buyer obtaining financing or the results of a land survey.

- Information on closing costs and who is responsible for paying them.

- Any items that are included or excluded from the sale, such as fixtures or personal property.

Is an attorney required to prepare the California Land Purchase Agreement?

While it is not legally required to have an attorney prepare a California Land Purchase Agreement, it is often recommended. An attorney can provide legal advice, ensure that all necessary details are included, and help protect your interests throughout the transaction.

How is the purchase price determined in the agreement?

The purchase price in a California Land Purchase Agreement is determined through negotiation between the buyer and the seller. Once agreed upon, it is clearly stated in the agreement along with any terms related to the payment, such as a down payment or financing arrangements.

What happens if either party wants to back out of the agreement?

If either party wishes to back out of the agreement, the consequences depend on the terms outlined in the agreement itself. Typically, there are provisions for termination of the agreement, which may include forfeiture of the buyer's deposit or other penalties. It's crucial to understand these terms before signing the agreement.

Are there any contingencies in a California Land Purchase Agreement?

Yes, contingencies are common in California Land Purchase Agreements. They are conditions that must be met for the sale to proceed. Common contingencies include:

- Financing: The buyer obtaining a loan for the purchase.

- Inspection: The land passing certain inspections or surveys.

- Legal: The title to the land being clear of liens or disputes.

Can changes be made to the agreement after it is signed?

After the California Land Purchase Agreement is signed, changes can still be made if both the buyer and the seller agree to them. Any amendments should be made in writing and signed by both parties to be legally valid.

What are the consequences if the agreement is breached?

If the California Land Purchase Agreement is breached, or broken, by either party, the consequences are outlined in the agreement. This may include forfeiture of the buyer's deposit, legal action to enforce the agreement, or other penalties agreed upon in the document.

How is the agreement finalized?

The California Land Purchase Agreement is finalized at the closing, where the transfer of the title from the seller to the buyer takes place. At this time, all payments are made, documents are signed, and any remaining conditions are met. The specific steps and requirements for closing are detailed in the agreement.

Common mistakes

Not Double-Checking Personal Information: A surprisingly common oversight is the failure to accurately review personal details. Names, addresses, and contact information must be precisely recorded. Even minor misspellings or inaccuracies can create significant hurdles in establishing clear ownership.

Skipping Legal Descriptions of the Property: Another area often glossed over is the legal description of the property being purchased. Unlike a street address, a legal description provides a definitive boundary of the property, detailing its exact dimensions and geographical placement. An incorrect description can lead to disputes concerning property lines and entitlements.

Ignoring Zoning Laws and Restrictions: Many buyers neglect to investigate the zoning laws and restrictions applicable to their new land. Such laws govern what the property can and cannot be used for, affecting everything from building commercial establishments to raising livestock. Understanding these restrictions is crucial for ensuring the land meets the buyer's needs.

Overlooking Contingency Clauses: Contingency clauses are vital safety nets in any land purchase agreement. They allow the buyer to back out under certain conditions, such as failure to secure financing or adverse findings during a property inspection. Neglecting to include or properly detail these clauses can corner buyers into unsatisfactory or unforeseen commitments.

Not Clarifying Who Pays for What: A common source of confusion and conflict arises from a lack of clarity as to who is responsible for which costs. Taxes, agent commissions, and inspection fees are just a few of the expenses that need to be clearly allocated between the buyer and seller in the agreement. Failure to do so can lead to unexpected out-of-pocket expenses.

Assuming Everything Can Be Handled Without Professional Help: Finally, the complexity of legal documentation and the nuances of real estate transactions lead many to underestimate the value of professional assistance. Whether it's a real estate agent, a lawyer, or a notary, having an expert review the agreement can prevent oversight and ensure everything is in order.

Documents used along the form

When engaging in the purchase of land in California, the Land Purchase Agreement is a crucial document. However, to ensure a thorough and legally binding transaction, several other forms and documents are often required alongside it. These documents serve to provide clarity, comply with legal statutes, and protect the interests of all parties involved. Below is a list of other forms and documents commonly used in conjunction with the California Land Purchase Agreement.

- Disclosure Statements: These are necessary to inform the buyer of any known issues or defects with the property. It includes environmental hazards, property condition, and other material facts.

- Title Report: This report provides details on the property's ownership history, outlining any easements, covenants, or liens that might affect the property. It's crucial for ensuring clear title transfer to the buyer.

- Loan Documents: If the purchase involves financing, the buyer must complete several documents, including a promissory note and deed of trust, which outline the terms of the loan and the property's use as security for the loan.

- Home Inspection Report: A professional inspector's report that details the physical condition of the property and highlights any repairs that might be necessary. This report is essential for a buyer's due diligence.

- Natural Hazard Disclosure Statement: California law requires sellers to disclose if the property is located in an area that has certain natural risks, such as flood, fire, or earthquake zones.

- Preliminary Change of Ownership Report (PCOR): This document is filed with the county recorder's office and details the change in ownership. It's crucial for the assessment of property taxes.

- Escrow Instructions: These instructions, agreed upon by both buyer and seller, guide the escrow agent in the proper disbursement of funds and the transfer of the property title. It ensures the transaction is executed according to the parties' agreement.

Together with the California Land Purchase Agreement, these documents form a comprehensive legal framework that governs the sale and purchase of land. They ensure transparency, fairness, and legality in the transaction, protecting the rights and interests of both buyer and seller. It's advisable for individuals to consult with a legal professional to understand these documents fully and ensure their interests are adequately protected in any land purchase transaction.

Similar forms

The California Land Purchase Agreement form is closely related to a Residential Purchase Agreement. Both documents serve as binding contracts between buyers and sellers, specifying the terms, conditions, and particulars of property transactions. While the Land Purchase Agreement focuses on the sale of undeveloped land, a Residential Purchase Agreement is used for transactions involving residential properties. They detail critical elements like purchase price, deposit amounts, inspection rights, and closing conditions, ensuring all parties understand their commitments.

Another similar document is the Real Estate Purchase Contract. This contract is a broader term encompassing the sale and purchase of real estate property, which may include land, residential homes, or commercial properties. It outlines the responsibilities of each party, financial details, and any contingencies that must be met before the sale is finalized. Like the Land Purchase Agreement, it is legally binding once signed by both the buyer and the seller.

The Option to Purchase Agreement shares similarities with the Land Purchase Agreement but includes a unique feature: it gives the buyer the right, but not the obligation, to purchase the property within a specified period. This agreement is often used by investors or buyers who need time to arrange financing or perform due diligence before committing to the purchase. It includes a fee for this option, and terms similar to a standard purchase agreement regarding price and conditions.

A Quitclaim Deed, while different in purpose, relates to the Land Purchase Agreement as it is often used in tandem with the sale of land to transfer any remaining interest the seller has in the property to the buyer. Unlike the Land Purchase Agreement, a Quitclaim Deed does not guarantee the seller’s ownership or title status – it simply transfers whatever ownership the seller has, if any, to the buyer.

An Earnest Money Agreement is a component often found within a Land Purchase Agreement or any real estate transaction. It requires the buyer to deposit a certain amount of money as a sign of good faith, indicating their serious intention to complete the purchase. This document outlines the amount, the holder of these funds, and conditions under which the deposit may be returned to the buyer or forfeited to the seller.

The Joint Tenancy Agreement, though specifically a title-holding and co-ownership arrangement, bears relevance to land purchase transactions. It defines the rights of each co-owner to land or real estate purchased together. This includes rights to use, profits from, or responsibilities for the property. In a land purchase, understanding how co-ownership is structured is vital for all parties involved.

A Land Lease Agreement, conversely, is about the rights to use land rather than purchase it. Similar to the Land Purchase Agreement in its structure and detail orientation, it outlines terms for leasing land, such as duration, payment, and rights of use, but does not transfer ownership. It’s relevant for buyers looking to use land without the immediate intention to buy.

The Construction Agreement is also akin to the Land Purchase Agreement when buying land for development purposes. It outlines the terms under which construction will occur on the purchased land, including timelines, costs, and specifications. Although focused on the build process post-purchase, the agreements must often align, as construction plans can affect land value and usability.

Finally, the Seller Financing Agreement has similarities with the Land Purchase Agreement, especially when the seller agrees to finance the buyer’s purchase of the land. This document specifies terms of the loan provided by the seller, including repayment schedule, interest rates, and consequences of default. It’s crucial for facilitating transactions where traditional financing options are not available or preferred by the buyer.

An Escrow Agreement is an essential adjunct to a Land Purchase Agreement, ensuring that all the conditions agreed upon by both parties are met before funds and property change hands. It involves a third party holding the buyer's funds and the property title until all agreement terms are satisfied, thereby providing a layer of protection and confidence to both the buyer and the seller during the transaction process.

Dos and Don'ts

When filling out the California Land Purchase Agreement form, it is crucial to proceed with caution and be thorough. This document is legally binding and outlines the terms of the sale and purchase of real estate. To help guide you through this process, here's a list of things you should and shouldn't do:

Do:

Read every section carefully before filling anything out. Understanding each part is key to ensuring all terms are agreed upon correctly.

Use clear and concise language. This makes it easier for all parties to understand the agreement and reduces the chances of confusion or disputes later on.

Confirm all the details about the property. This includes the legal description, parcel number, and any rights or easements associated with the land.

Specify the purchase price and terms of payment. Be explicit about amounts, deadlines, and methods of payment to avoid any misunderstandings.

Include contingencies, if any. These are conditions that must be met for the transaction to go forward, such as obtaining financing or passing a property inspection.

Sign and date the form. Both the buyer and seller must sign the agreement for it to be effective. Ensure all necessary parties are present to sign the document.

Don't:

Leave any sections blank. If a section does not apply, write "N/A" (not applicable) to show that it was considered but is not relevant to this agreement.

Rely on verbal agreements. Ensure all agreements and disclosures are written in the document since verbal agreements are difficult to enforce in real estate transactions.

Forget to specify who pays for what. Clearly outline who is responsible for closing costs, inspections, repairs, and other expenses related to the sale.

Overlook the need for legal advice. It's wise to consult with a real estate lawyer before finalizing the agreement to ensure your rights are protected and all legal requirements are met.

Ignore the timelines. Adhere strictly to the timelines specified in the agreement for actions like property inspections, loan approvals, and closing dates.

Modify the agreement without mutual consent. Any changes to the agreement after signing should be agreed upon by both parties in writing to avoid legal disputes.

Misconceptions

When purchasing land in California, understanding the Land Purchase Agreement is crucial. However, many misconceptions surround this important document. Here, we discuss nine common myths and clarify them to help potential buyers and sellers navigate the process more effectively.

It's just a standard form that doesn't need a lawyer's review. Many people believe that the California Land Purchase Agreement is a one-size-fits-all document that doesn't require legal scrutiny. However, every land purchase is unique, and professional legal advice can safeguard your interests by ensuring that all provisions are appropriate and that any necessary modifications are made.

Verbal agreements can substitute for the written agreement. While verbal agreements might seem convenient, in real estate, they carry no legal weight. The law explicitly requires a written document to enforce agreements related to real estate transactions.

It only outlines the sale price. The Land Purchase Agreement covers more than just the sale price. It includes crucial details such as the description of the property, financing conditions, inspections, disclosures, and other specific terms both parties must adhere to.

Deposits are non-refundable. The misconception that deposits are always non-refundable is widespread. In reality, the agreement outlines conditions under which a deposit may be returned, such as if certain contingencies, like financing or satisfactory inspections, aren't met.

All parties understand the terms similarly. Assuming all parties have the same understanding of the terms can lead to disputes. Clarity and the opportunity for all parties to seek clarification or legal advice before signing are crucial.

Once signed, the agreement cannot be changed. Amendments can be made to the agreement before closing if both parties agree. Significant changes may require a new agreement or addendums to the existing contract, ensuring both parties are satisfied.

It's only binding once the transaction is closed. The agreement becomes legally binding when both parties sign it. It governs the transaction until closing, outlining each party's obligations and rights during the period leading up to the transfer of property ownership.

It doesn't matter if the buyer or seller doesn't understand English well. Understanding every aspect of the agreement is essential for all parties involved. If someone isn't proficient in English, seeking a translation or legal advice in their primary language is not just helpful—it's necessary for ensuring informed consent and understanding.

Filing with a government agency finalizes the sale. While certain documents must be filed with local government agencies as part of the real estate transaction process, simply filing the Land Purchase Agreement does not finalize the sale. The transaction is considered complete when all terms of the agreement have been fulfilled and the property ownership is officially transferred.

Dispelling these misconceptions ensures that all parties are better prepared for the realities of land transactions in California. Being well-informed and seeking appropriate legal counsel can lead to a smoother, more secure real estate experience.

Key takeaways

The California Land Purchase Agreement form is a vital document that orchestrates the sale and purchase of real estate. Its correct completion and usage ensure a legally binding agreement between the buyer and the seller, safeguarding the interests of both parties. Below are several key takeaways to bear in mind when dealing with this form:

- Comprehensive Details: Ensure every part of the form is filled out with accurate and comprehensive details about the property, the terms of the sale, and the parties involved. This includes the legal description of the property, sale price, and any contingencies that are part of the agreement.

- Legal Description: The legal description of the property, as opposed to just the address, is crucial. This description should match the one used in public records to avoid any discrepancies regarding the property boundaries or size.

- Disclosure Requirements: California law requires sellers to make certain disclosures about the condition of the property, including any known defects or hazards. Ensure these disclosures are completed in full and attached to the purchase agreement.

- Contingencies: Common contingencies include the buyer obtaining suitable financing, the sale of their current home, and satisfactory property inspections. These conditions must be clearly spelled out in the agreement to protect both the buyer's and seller's interests.

- Deposit Amounts: The agreement should specify the deposit amount that the buyer needs to secure the deal. It should also outline the conditions under which the deposit is refundable or could be forfeited.

- Escrow Instructions: Often, the purchase agreement will serve as instructions to the escrow agent. It is vital to ensure these instructions are clear and precise to avoid any misunderstandings during the closing process.

- Signatures: The agreement must be signed by all parties involved in the transaction. These signatures legally bind the parties to the terms of the agreement and signify their consent to enter into the contract.

- Advisory Clauses: It’s wise to include advisory clauses that recommend both the buyer and the seller to seek legal advice before signing the agreement. This can help mitigate future legal disputes by ensuring both parties fully understand their rights and obligations.

Using the California Land Purchase Agreement form properly is not just about filling out a template—it's about ensuring a legally sound, fair, and clear transaction. Both buyers and sellers are advised to proceed with caution, paying careful attention to the completeness and accuracy of every part of the document. When in doubt, consulting with a real estate professional or legal advisor is a prudent step towards securing a successful real estate transaction.

More California Forms

How to Verify Employment - Can influence the outcome of negotiations where employment status and history play critical roles, such as in executive appointments.

Motorcycle Bill of Sale Template - Keeps the transaction transparent, making it easier for both parties to understand the sale’s specifics.

Bill of Sale Truck - It acts as a receipt for the buyer, providing peace of mind that the legal transfer of ownership has taken place.