Legal California Independent Contractor Agreement Document

In the vast and vibrant state of California, the realm of employment law introduces a critical instrument known as the Independent Contractor Agreement form, designed to delineate the boundaries and obligations between a contractor and their client. This pivotal document serves not just as a formal handshake, but as a legal cornerstone ensuring clarity, compliance, and protection for both parties. It meticulously outlines the scope of work to be undertaken, payment terms, confidentiality clauses, and termination conditions, among other stipulations. Given California's stringently regulated labor landscape, underscored by laws such as Assembly Bill 5 (AB5), understanding and properly executing this agreement has become indispensable for those navigating the gig economy, freelance assignments, or any engagement outside traditional employment bounds. The agreement stands as a testament to the professional relationship, preempting potential disputes by providing a clear framework for responsibilities, timelines, and legal rights, ensuring that independent contractors can pursue their ventures with confidence, backed by a well-structured legal agreement.

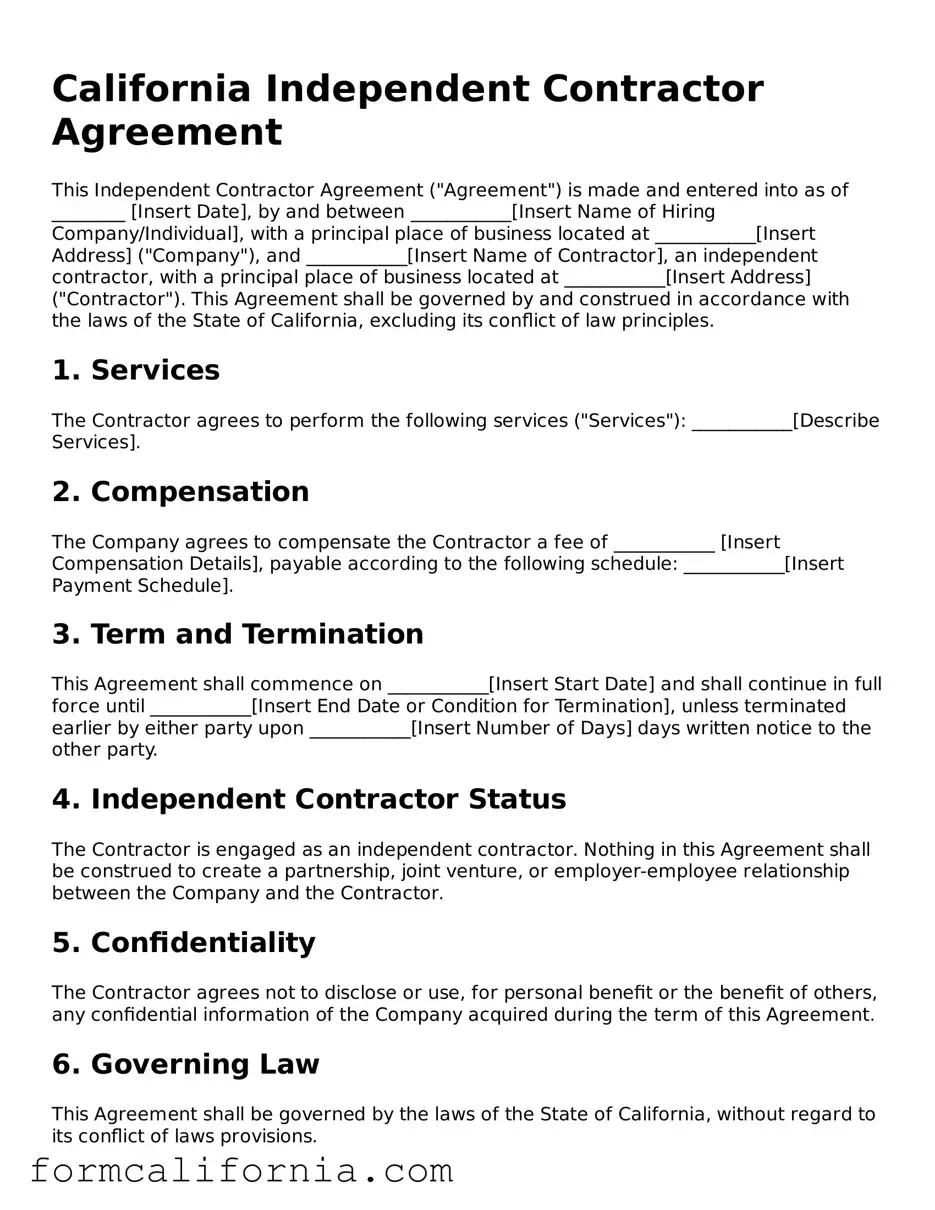

Document Preview Example

California Independent Contractor Agreement

This Independent Contractor Agreement ("Agreement") is made and entered into as of ________ [Insert Date], by and between ___________[Insert Name of Hiring Company/Individual], with a principal place of business located at ___________[Insert Address] ("Company"), and ___________[Insert Name of Contractor], an independent contractor, with a principal place of business located at ___________[Insert Address] ("Contractor"). This Agreement shall be governed by and construed in accordance with the laws of the State of California, excluding its conflict of law principles.

1. Services

The Contractor agrees to perform the following services ("Services"): ___________[Describe Services].

2. Compensation

The Company agrees to compensate the Contractor a fee of ___________ [Insert Compensation Details], payable according to the following schedule: ___________[Insert Payment Schedule].

3. Term and Termination

This Agreement shall commence on ___________[Insert Start Date] and shall continue in full force until ___________[Insert End Date or Condition for Termination], unless terminated earlier by either party upon ___________[Insert Number of Days] days written notice to the other party.

4. Independent Contractor Status

The Contractor is engaged as an independent contractor. Nothing in this Agreement shall be construed to create a partnership, joint venture, or employer-employee relationship between the Company and the Contractor.

5. Confidentiality

The Contractor agrees not to disclose or use, for personal benefit or the benefit of others, any confidential information of the Company acquired during the term of this Agreement.

6. Governing Law

This Agreement shall be governed by the laws of the State of California, without regard to its conflict of laws provisions.

7. Entire Agreement

This Agreement constitutes the entire agreement between the parties with respect to the subject matter herein and supersedes all prior or contemporaneous agreements, understandings, and negotiations, both written and oral.

8. Signature

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

Company: ___________[Insert Name]

Signature: ___________ [Insert Signature]

Date: ___________[Insert Date]

Contractor: ___________[Insert Name]

Signature: ___________ [Insert Signature]

Date: ___________[Insert Date]

PDF Form Characteristics

| # | Fact | Details |

|---|---|---|

| 1 | Definition | An agreement that establishes a working relationship between a service provider (independent contractor) and a client, rather than an employer-employee relationship. |

| 2 | Governing Law | California law, including Assembly Bill 5 (AB 5), and subsequent amendments, dictate the classification of workers and the use of independent contractor agreements. |

| 3 | ABC Test | Under AB 5, a three-part test (known as the ABC test) is used to determine if a worker is an independent contractor or an employee. |

| 4 | Flexibility | These agreements often highlight that the contractor has the freedom to set their own hours and choose how the work is performed, within the agreement's terms. | =

| 5 | Tax Implications | Unlike employees, independent contractors are responsible for their own payroll taxes and withholdings. |

| 6 | Duration of Agreement | Specifies the duration of the contract, whether it’s for a specific term or on an at-will basis, which can be terminated by either party at any time, given proper notice. |

| 7 | Often includes clauses to protect sensitive information and outline the ownership of any work product created during the term of the agreement. |

Detailed Instructions for Writing California Independent Contractor Agreement

Entering into an Independent Contractor Agreement in California is a straightforward process that formalizes the relationship between a contractor and a client, ensuring clarity and mutual understanding on both sides. This contract plays a crucial role in defining the scope of work, payment terms, confidentiality, and the terms that govern the termination of the agreement. It's essential for both parties to diligently fill out the agreement to prevent potential disputes and ensure a smooth collaboration. The following steps are designed to guide you through the process of completing the California Independent Contractor Agreement form.

- Begin by specifying the date on which the agreement is being entered into.

- Insert the legal names and addresses of both the contractor and the client in the designated sections.

- Describe in detail the services that the independent contractor will provide. Be as specific as possible to avoid ambiguity.

- State the duration of the contract, including the start date and, if applicable, the end date.

- Detail the compensation structure, including payment amounts and schedules. Specify if payment is contingent on the completion of certain milestones or tasks.

- Include any terms related to expenses, specifying which party is responsible for covering them.

- Clarify the terms of confidentiality to protect both parties' proprietary information and trade secrets.

- Outline the conditions under which the agreement can be terminated by either party.

- Add any additional clauses that are relevant to the specific engagement, such as non-compete or non-solicitation agreements, if necessary.

- Both the independent contractor and the client should sign and date the agreement. Optionally, a witness or notary public can also sign, providing an additional layer of validation.

Once completed, this agreement creates a binding legal contract between the contractor and the client. It's recommended for both parties to keep a copy of the signed document for their records. Should questions or disputes arise in the future, the agreement serves as a point of reference that can help to resolve issues more efficiently. Filling out the form carefully and in its entirety is key to establishing a successful and mutually beneficial working relationship.

Things to Know About This Form

What is an Independent Contractor Agreement in California?

An Independent Contractor Agreement in California is a legal document that outlines the terms and conditions between a contractor and a client. It specifies the services to be provided, the compensation, and the terms that govern the working relationship. This agreement ensures that both parties understand their rights and responsibilities, and it helps to protect their interests.

Who needs an Independent Contractor Agreement in California?

Any individual or business entity in California that intends to hire an independent contractor to perform services should use an Independent Contractor Agreement. Similarly, contractors who provide services to clients should ensure that an agreement is in place to clarify the terms of the engagement.

What are the key components of an Independent Contractor Agreement?

The key components of an Independent Contractor Agreement include:

- Identification of the parties involved

- Description of the services to be provided

- Payment terms including rates, invoicing, and deadlines

- Terms regarding confidentiality, non-disclosure, and ownership of work

- Duration of the agreement and terms of termination

- Legal provisions for dispute resolution

- Signatures of both parties

How does one ensure the agreement complies with California law?

To ensure compliance with California law, it’s advisable to refer to the latest statutes and legal guidelines regarding independent contractors. Additionally, consulting with a legal professional experienced in California labor laws can help customize the agreement to meet state-specific requirements.

What distinguishes an independent contractor from an employee in California?

In California, the distinction between an independent contractor and an employee largely depends on the degree of control and independence in the working relationship. Key factors include the nature of the work, the method of payment, who provides tools and materials, and whether the work performed is part of the regular business of the hiring entity. California’s ABC test, established by the California Supreme Court, further clarifies these distinctions.

Can an Independent Contractor Agreement be modified?

Yes, an Independent Contractor Agreement can be modified if both parties agree to the changes. Any modifications should be made in writing and signed by both parties to ensure the amendments are legally binding.

What happens if there's a dispute under the Agreement?

In the event of a dispute under the Independent Contractor Agreement, the parties should first refer to the dispute resolution clause specified in the agreement. This may outline procedures for mediation or arbitration. If the dispute cannot be resolved through these mechanisms, legal action may be necessary, and the parties may seek resolution through the courts.

Are there any specific requirements for terminating the Agreement?

The Independent Contractor Agreement should specify the conditions under which the agreement can be terminated by either party. Common conditions include completion of the specified services, breach of agreement terms, or by providing a written notice of termination within a specified period.

How does a California Independent Contractor Agreement protect both parties?

This agreement protects both parties by clearly defining the scope of work, payment arrangements, and responsibilities. It helps to prevent misunderstandings and disputes by providing a legal framework for the relationship. For the contractor, it confirms the nature of their independent status, helping to avoid unintended employment obligations. For the client, it helps to ensure that the services will be provided as agreed upon.

Where can one find a template for an Independent Contractor Agreement in California?

Templates for an Independent Contractor Agreement in California can be found online through legal resources and services. Additionally, legal professionals specializing in employment law can provide customized agreements that are tailored to specific requirements and compliant with state laws.

Common mistakes

When filling out the California Independent Contractor Agreement form, individuals commonly make a few critical errors. Awareness and avoidance of these mistakes can ensure a more lawful and clear relationship between the hiring entity and the independent contractor. It's essential for both parties involved to meticulously review and correctly fill in the agreement to prevent misunderstandings, legal disputes, or unintended consequences.

Not Clearly Defining the Scope of Work: One of the major mistakes is failing to clearly define the scope of work. This part of the agreement should comprehensively describe the contractor's duties, project deadlines, and deliverables. A vague or incomplete description can lead to disputes about the contractor's responsibilities and the extent of work expected.

Omitting the Payment Terms: Another common error is not specifying the payment terms, including the rate, schedule, and method of payment. This omission can cause confusion and disagreements over compensation. The agreement should explicitly state how and when the contractor will be paid, whether it's hourly, per project, or through another arrangement.

Ignoring the Confidential Information and Intellectual Property Clauses: Often, individuals overlook the importance of including clauses on confidential information and intellectual property rights. These sections protect the hiring entity's proprietary information and specify the ownership of any creations resulting from the contractor's work. Failure to include these provisions can lead to unintended sharing of sensitive information and disputes over intellectual property ownership.

Not Including Termination Conditions: Not specifying the conditions under which the agreement can be terminated is another mistake to avoid. Without a clear termination clause, ending the agreement can become complicated and contentious. This clause should outline how either party can terminate the agreement and under what circumstances, providing a clear exit strategy for both the contractor and the hiring entity.

Attention to detail and precision in drafting the California Independent Contractor Agreement form are crucial to establishing a successful and legally sound working relationship. Avoiding these common mistakes can help ensure that both parties are protected and clear about their expectations, responsibilities, and the nature of their agreement.

Documents used along the form

When engaging independent contractors in California, various documents are used in conjunction to establish clear, lawful, and efficient working arrangements. These documents complement the Independent Contractor Agreement form, ensuring both parties—businesses and contractors—are well-informed, compliant with state labor laws, and have outlined clear terms of engagement. Described below are five important forms and documents that are often utilized alongside the Independent Contractor Agreement form.

- W-9 Form: This IRS form is used to gather information from contractors, such as their Tax Identification Number (TIN) or Social Security Number (SSN), to facilitate tax reporting and withholding. It is crucial for businesses to collect a completed W-9 form from each contractor to comply with tax laws.

- Confidentiality Agreement: To protect proprietary information, businesses often require independent contractors to sign a Confidentiality Agreement. This document ensures that sensitive business data, trade secrets, and other confidential information are safeguarded during and after the service period.

- Statement of Work (SOW): This document outlines the specific services, deliverables, timelines, and expectations for a project. It functions as a detailed extension of the Independent Contractor Agreement, providing clarity and structure to the working relationship between the contractor and the business.

- 1099-NEC Form: At the end of the tax year, businesses must issue the 1099-NEC form to any independent contractor they have paid $600 or more. This form reports the total amount of nonemployee compensation paid, which is necessary for both the contractor's and the business's tax filings.

- Intellectual Property Assignment Agreement: When a contractor creates something that qualifies as intellectual property (IP) in the course of their work for a business, this agreement ensures that ownership rights of the created IP are transferred to the business. It clearly delineates the rights of both parties regarding created works.

In summary, these documents play pivotal roles in clarifying terms, protecting interests, and ensuring compliance with legal requirements in arrangements with independent contractors. By utilizing these forms together with the California Independent Contractor Agreement, businesses and contractors can establish transparent, structured, and legally sound working relationships.

Similar forms

The California Independent Contractor Agreement shares similarities with the Employment Agreement, primarily in defining the relationship between two parties. While the Independent Contractor Agreement outlines the terms for a contractor's services, distinguishing them as not an employee, the Employment Agreement sets forth conditions for employment, including roles, responsibilities, and benefits. Both documents are vital in clarifying the nature of the relationship, scope of work, compensation, and conditions under which the parties will interact. However, the critical difference rests in the employment status they confer, with distinct implications for taxes, benefits, and liabilities.

Another document akin to the California Independent Contractor Agreement is the Service Agreement. This document also governs the relationship between a service provider and the recipient of the service but is broader in scope, encompassing various sectors and not limited to a contractor-client dynamic. What binds these two types of agreements is their focus on the specifics of the services to be provided, including scope, duration, compensation, and expectations. Both serve as a legal framework to ensure clear communication and agreement on services exchanged, although they differ in their specificity to the independent contractor status.

The Non-Disclosure Agreement (NDA) bears resemblance to the California Independent Contractor Agreement in terms of its protective features. An NDA is designed to safeguard sensitive information, stipulating that the receiving party cannot share the specified knowledge with third parties. Independent Contractor Agreements often incorporate confidentiality clauses that impose similar obligations on contractors to protect the client’s proprietary information. While an NDA can be a standalone document or part of broader agreements, its inclusion in an Independent Contractor Agreement underscores the significance of maintaining confidentiality in professional engagements.

Similar to the California Independent Contractor Agreement, a Consulting Agreement outlines the terms under which specialized expertise is provided to a business or individual. Consulting Agreements detail the nature of the consulting services, timeframe, compensation, and expected outcomes, closely aligning with how Independent Contractor Agreements structure the provision of services by a contractor. The distinction primarily lies in the context of the service provided—consulting agreements specifically cater to professional advice and expertise, whereas independent contractor agreements can cover a broader range of services and industries.

The California Independent Contractor Agreement is also parallel to a Freelance Contract, with both serving as legal foundations for service-based work undertaken by self-employed individuals. Freelance Contracts, much like Independent Contractor Agreements, enumerate the project or service details, deadlines, payment schedules, and intellectual property rights, aiming to protect both the freelancer's and the client's interests. These documents are fundamental in defining the relationship as one of service provision rather than employment, ensuring compliance with legal standards and clarifying expectations on both sides.

Dos and Don'ts

When filling out the California Independent Contractor Agreement form, it's important to ensure that everything is clear, accurate, and legally compliant. Here are some do's and don'ts to help guide you through the process.

Do's:

- Read the entire form carefully before you start filling it out. Understand every section to make sure you're providing the correct information.

- Use clear and concise language to avoid any confusion. The aim is to make sure both parties understand the terms completely.

- Double-check for errors. Once you've filled out the form, review it for any mistakes. This includes checking for typos, incorrect dates, or misspelled names.

- Specify the scope of the work clearly. Include detailed descriptions of the services the contractor will provide to ensure clarity and prevent misunderstandings.

- Outline payment terms explicitly. Make sure to detail how much, how often, and by what method the independent contractor will be paid.

- Include a termination clause. It's crucial to specify under what conditions the agreement can be terminated by either party.

- Sign the document. Ensure that both parties sign the agreement to make it legally binding. Digital signatures may be accepted, but verify this based on current California law.

Don'ts:

- Don't leave any sections blank. If a section doesn't apply, mark it as "N/A" (not applicable) instead of leaving it empty.

- Don't use vague language. Avoid subjective or unclear terms that might lead to disputes down the line.

- Don't forget to specify the duration of the contract, whether it's for a fixed term or ongoing.

- Don't ignore the need for confidentiality agreements, if applicable, to protect sensitive information.

- Don't skip over indemnity clauses. These are important to determine liability and protect both parties.

- Don't rely solely on verbal agreements. Make sure all agreements and terms are documented in writing within the contract.

- Don't hesitate to seek legal advice. If there are sections or terms you're unsure about, consulting with a legal professional can prevent potential legal issues.

Misconceptions

In understanding the California Independent Contractor Agreement form, several misconceptions frequently arise. These misunderstandings can significantly impact how both the hiring entities and the independent contractors approach these agreements. Clarifying these misconceptions is crucial for ensuring that both parties enter into these arrangements with clear expectations and a solid understanding of their legal implications.

- Misconception 1: Independent Contractor Agreements Are Not as Legally Binding as Employment Contracts

Many believe that Independent Contractor Agreements are less formal or legally binding compared to traditional employment contracts. However, these agreements are fully enforceable contracts in California, outlining the rights and obligations of both parties. They establish the nature of the working relationship, payment arrangements, confidentiality obligations, and more. Failure to adhere to these agreements can lead to legal disputes and liabilities. - Misconception 2: If It's in the Agreement, It Must Be Legal

Just because a provision is included in an Independent Contractor Agreement does not ensure its legality. All terms within the agreement must comply with state and federal laws. For example, non-compete clauses in California are generally unenforceable against independent contractors. If an illegal term is included in an agreement, it can render the entire contract void or lead to legal penalties. - Misconception 3: Independent Contractors Automatically Own the Rights to Their Work

There's a common belief that independent contractors retain ownership of the intellectual property they create while under contract. However, ownership of intellectual property is determined by the specific terms of the Independent Contractor Agreement. Without a clear agreement to the contrary, the hiring party may retain ownership over the work product. It's imperative to explicitly address this issue in the contract. - Misconception 4: The Agreement Guarantees the Contractor's Independence

While the title "Independent Contractor Agreement" suggests a degree of autonomy, simply having such an agreement in place does not guarantee that the worker is legally considered an independent contractor. The actual working relationship and the degree of control the hiring entity has over the worker are critical factors. California’s ABC test, applied in certain contexts, outlines criteria for determining contractor status. Misclassification can result in significant penalties. - Misconception 5: A Single Agreement Is Sufficient for All Projects with the Same Contractor

Entities often assume that one Independent Contractor Agreement can cover multiple projects with the same contractor. However, it is advisable to execute a new agreement or an addendum for each project. This approach ensures that the terms accurately reflect the scope, duration, payment, and other specific details relevant to each project. Relying on a single, generic agreement can lead to misunderstandings and legal complications.

Addressing these misconceptions is vital for anyone engaging in or considering an Independent Contractor Agreement in California. Clear, lawful, and specific agreements not only protect the rights of both parties but also lay down a foundation for a successful professional relationship.

Key takeaways

When it comes to engaging an independent contractor in California, the Independent Contractor Agreement plays a critical role. This document helps to ensure that both the hiring entity and the contractor are on the same page regarding the specifics of the work to be done, how and when payment will be made, and other key details. Here are ten fundamental takeaways for filling out and using this important form:

- Understand the definition of an independent contractor: It’s crucial to ensure that the working relationship qualifies under California's definition of an independent contractor. This distinction impacts taxation, benefits, and legal responsibilities.

- Clearly describe the services to be provided: The agreement should specify in clear terms what services the contractor is expected to deliver. This helps prevent misunderstandings and establishes a clear framework for the working relationship.

- Detail payment terms: The document must outline how and when the contractor will be paid. This includes the rate, payment schedule, and any conditions related to payment.

- Address expenses: If the contractor will incur expenses as part of the work, the agreement should state who is responsible for these costs.

- Include a term of agreement: The agreement should specify its duration, including start and end dates, and any conditions for renewal.

- Outline termination conditions: Both parties should understand under what circumstances the agreement can be terminated.

- Clarify intellectual property ownership: If the work involves the creation of intellectual property, the agreement should state who owns the resulting IP.

- Include confidentiality and non-disclosure agreements (NDA): To protect sensitive information, it’s often wise to include confidentiality clauses or a full NDA within the agreement.

- Understand that an independent contractor is not an employee: It’s important to remember that independent contractors do not have the same rights and benefits as employees, such as minimum wage, overtime, and unemployment insurance.

- Consult a professional for complex agreements: For agreements involving substantial amounts of money or complex projects, consulting with a professional can help to avoid future legal issues.

Making sure that the Independent Contractor Agreement is carefully prepared and fully understood by both parties can help pave the way for a successful and productive working relationship. It not only protects the interests of both the hiring entity and the contractor but also clarifies expectations, helping to ensure that the project goes smoothly.

More California Forms

Durable Power of Attorney Forms - Protects against the potential for abuse or neglect by enabling the principal to choose their own advocate ahead of time.

Homeschool Letter of Intent Template - Providing peace of mind for families, this form highlights the legitimacy of their decision to homeschool, ensuring educational freedom within legal confines.

Rental Agreement Form California - As market conditions and laws change, the adaptable nature of the Lease Agreement allows it to be updated as necessary, ensuring it remains relevant and effective.