Legal California Gift Deed Document

Transferring property in California can be achieved through various legal documents, one of which is the Gift Deed form. This unique method of property transfer allows an individual, known as the donor, to give real estate or other assets to another person, the recipient, without any payment or consideration in return. Unlike traditional sales, where a financial transaction is central, a Gift Deed operates on the principle of generosity, intended to benefit the recipient without financial remuneration for the donor. The California Gift Deed form must adhere to specific state regulations to ensure its validity, including the need for precise language that signals the donor's intent, acknowledgment of the deed by a notary public, and proper recording with local county officials. These steps are pivotal in safeguarding the transfer for both parties, ensuring the recipient gains legal title to the property without future legal disputes or complications related to ownership or tax obligations. Understanding the critical aspects of this form is essential for anyone considering this generous act of transferring property to a loved one, friend, or charity.

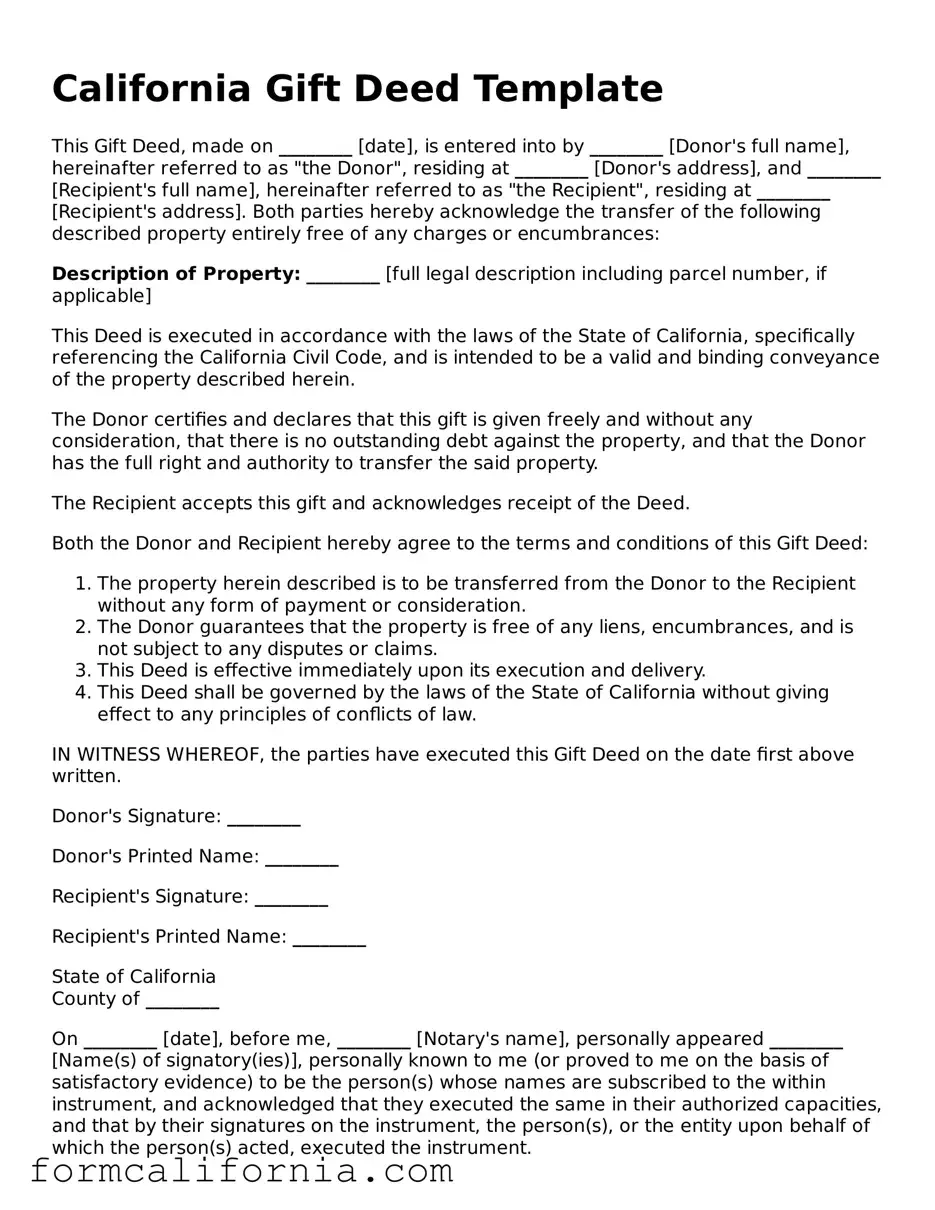

Document Preview Example

California Gift Deed Template

This Gift Deed, made on ________ [date], is entered into by ________ [Donor's full name], hereinafter referred to as "the Donor", residing at ________ [Donor's address], and ________ [Recipient's full name], hereinafter referred to as "the Recipient", residing at ________ [Recipient's address]. Both parties hereby acknowledge the transfer of the following described property entirely free of any charges or encumbrances:

Description of Property: ________ [full legal description including parcel number, if applicable]

This Deed is executed in accordance with the laws of the State of California, specifically referencing the California Civil Code, and is intended to be a valid and binding conveyance of the property described herein.

The Donor certifies and declares that this gift is given freely and without any consideration, that there is no outstanding debt against the property, and that the Donor has the full right and authority to transfer the said property.

The Recipient accepts this gift and acknowledges receipt of the Deed.

Both the Donor and Recipient hereby agree to the terms and conditions of this Gift Deed:

- The property herein described is to be transferred from the Donor to the Recipient without any form of payment or consideration.

- The Donor guarantees that the property is free of any liens, encumbrances, and is not subject to any disputes or claims.

- This Deed is effective immediately upon its execution and delivery.

- This Deed shall be governed by the laws of the State of California without giving effect to any principles of conflicts of law.

IN WITNESS WHEREOF, the parties have executed this Gift Deed on the date first above written.

Donor's Signature: ________

Donor's Printed Name: ________

Recipient's Signature: ________

Recipient's Printed Name: ________

State of California

County of ________

On ________ [date], before me, ________ [Notary's name], personally appeared ________ [Name(s) of signatory(ies)], personally known to me (or proved to me on the basis of satisfactory evidence) to be the person(s) whose names are subscribed to the within instrument, and acknowledged that they executed the same in their authorized capacities, and that by their signatures on the instrument, the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

WITNESS my hand and official seal.

Signature of Notary: ________

Printed Name of Notary: ________

Commission Number: ________

My commission expires: ________

PDF Form Characteristics

| Fact Number | Detail |

|---|---|

| 1 | The California Gift Deed allows individuals to give property to others without expecting anything in return. |

| 2 | This form needs to be properly filled out and signed by the donor to be considered valid. |

| 3 | To ensure the gift is legally effective, the deed must be recorded with the local county recorder’s office where the property is located. |

| 4 | The California Gift Deed is governed by the California Civil Code. |

| 5 | Gift Deeds are often used to transfer ownership of real estate, vehicles, or other valuable assets as a gift. |

| 6 | Detailed descriptions of the gift property and any conditions or restrictions must be clearly stated in the deed. |

Detailed Instructions for Writing California Gift Deed

Filling out a California Gift Deed form is a straightforward process that allows individuals to transfer property to another person without any exchange of money. It's a generous way to give, but it requires careful completion to ensure the gift is legally binding and properly recorded. By following the necessary steps, one can effectively transfer property, adhering to California's legal requirements. This will prevent any future disputes or misunderstandings regarding the transfer. Therefore, having clear, step-by-step guidance simplifies this procedure, making it accessible for everyone involved.

- Identify the preparer of the document. This should be the person conducting the transfer or a legal representative.

- State the name and mailing address of the individual who will receive the recorded document after the county recorder's office processes it.

- Include the Assessor’s Parcel Number (APN) of the property. This unique number is essential for property identification and is usually found on property tax statements.

- List the full names and mailing addresses of the grantor (the person giving the gift) and the grantee (the person receiving the gift). It’s crucial to ensure these details are accurate to avoid any legal complications.

- Write a complete and detailed legal description of the property being gifted. This description should match the one on the property’s current deed to ensure clarity and avoid any disputes about what is being transferred.

- State the relationship between the grantor and grantee if applicable. Although not mandatory, this information can sometimes be required for tax purposes.

- Have the grantor(s) sign the deed in the presence of a notary public. This step is vital, as the notary public must officially witness the signing for the document to be legally binding.

- Record the deed with the county recorder’s office in the county where the property is located. There may be a recording fee, so it’s advisable to check the current rates and necessary paperwork with the county recorder’s office beforehand.

After completing these steps, the gift deed will be processed and recorded, officially transferring the property to the grantee. It's crucial to keep a copy of the recorded deed for personal records. While the process might seem daunting at first, it becomes manageable when broken down. Should any questions or concerns arise during the process, consulting with a legal professional can provide guidance and peace of mind.

Things to Know About This Form

What is a California Gift Deed form?

A California Gift Deed form is a legal document used to transfer ownership of personal property or real estate from one person (the donor) to another (the recipient) without any exchange of money or consideration. This form is specifically tailored to comply with California state laws and must be properly executed to be effective.

Who can use a California Gift Deed to transfer property?

Any individual who legally owns property in California and wishes to gift that property to another person can use a California Gift Deed. Both the donor and the recipient must be competent to contract and must agree to the transfer willingly.

Is a California Gift Deed form legally binding?

Yes, once properly executed, notarized, and, if applicable, recorded at the county recorder's office, a California Gift Deed becomes a legally binding document that effectively transfers ownership of the property to the recipient.

What types of property can be transferred using a California Gift Deed?

The types of property that can be transferred include, but are not limited to:

- Real estate

- Vehicles

- Stocks and bonds

- Jewelry

- Artwork

Are there any tax implications for using a California Gift Deed?

Yes, there can be tax implications for both the donor and recipient when transferring property using a Gift Deed. The donor may have to file a federal gift tax return if the value of the gift exceeds the annual federal gift tax exclusion amount. It's recommended to consult with a tax professional to understand any potential tax liability.

What steps are involved in completing a California Gift Deed?

Completing a California Gift Deed involves several steps including:

- Filling out the Gift Deed form accurately, including the legal description of the property.

- Having the donor sign the form in the presence of a notary public.

- Delivering the executed deed to the recipient to accept the gift.

- Recording the deed with the local county recorder’s office if the gift involves real estate.

Does the recipient need to do anything to accept the gift?

Yes, the recipient must acknowledge the receipt of the gift and may have to take additional steps to ensure the transfer is recognized legally, especially if the gift involves real estate. For real estate, this typically involves recording the deed with the local county recorder’s office.

Can a California Gift Deed be revoked?

Once a gift has been effectively transferred and accepted by the recipient, the California Gift Deed cannot be revoked without the recipient's consent. Before completion, however, the donor retains the right to revoke the deed.

What if the gift involves a mortgage or other lien?

If the gifted property is encumbered by a mortgage or other lien, the responsibility for these debts may transfer with the property. It’s important for both the donor and recipient to understand the financial obligations associated with the property. Consulting a legal or financial advisor is recommended.

Where can I find a California Gift Deed form?

California Gift Deed forms are available online through legal services websites, at law libraries, or from a legal professional who specializes in property law. Ensure that the form you use is up-to-date and specific to California to comply with state law requirements.

Common mistakes

Filling out the California Gift Deed form requires attention to detail. Errors can lead to delays or even the invalidation of the document. Understanding common mistakes can help individuals avoid these pitfalls. Here are nine mistakes frequently made:

-

Not verifying the accuracy of names: All names should match official identification documents exactly. Misspellings or using nicknames can invalidate the deed.

-

Leaving blanks: Every field in the form needs to be completed. Unfilled sections can lead to misunderstandings or suggest that the deed is incomplete.

-

Failing to describe the property correctly: The legal description of the property must be accurate. Relying on a street address alone is insufficient and often leads to confusion.

-

Omitting or incorrectly stating the relationship between the donor and the recipient: This information may be relevant for tax purposes or for clarifying the intent behind the gift.

-

Ignoring notarization requirements: California law requires the gift deed to be notarized. Skipping this step can render the document legally ineffective.

-

Forgetting to include a Marital Declaration (when applicable): If the property is a marital asset, the spouse's consent may be necessary. Neglecting this can lead to future legal complications.

-

Not dating the document: Though it might seem minor, the date on the deed is critical for establishing when the transfer took effect.

-

Confusing a Gift Deed with a Quitclaim Deed: Although both can be used to transfer property rights without payment, they serve different purposes and are treated differently under the law.

-

Not consulting with a legal professional: Perhaps the most significant mistake is attempting to complete the gift deed without legal advice, risking oversights that could affect the deed’s validity or the parties' intentions.

Understanding these mistakes and taking care to avoid them can greatly enhance the effectiveness and reliability of a California Gift Deed. When in doubt, it's always wise to seek professional guidance.

Documents used along the form

In the realm of transferring property rights in California, a Gift Deed is a critical document that facilitates the process of gifting real estate from one person to another without monetary exchange. While the Gift Deed itself is vital, it often requires the company of additional documents to ensure a smooth, legally sound transfer and to address any circumstances that may arise. The following documents frequently accompany a Gift Deed, each serving a unique and significant role in the process.

- Preliminary Change of Ownership Report (PCOR): This form is filed with the county recorder alongside the Gift Deed. It provides the county with details about the transaction, helping to assess property taxes accordingly.

- Grant Deed: Sometimes used in conjunction with a Gift Dead, a Grant Deed transfers ownership with explicit warranties against prior conveyances or encumbrances not disclosed in the deed.

- Quitclaim Deed: Unlike a Grant Deed, a Quitclaim Deed transfers any interest the grantor has in the property without any guarantees. It's often used to clear up title issues.

- Notary Acknowledgement: This document is a declaration by a notary public that verifies the identity of the parties signing the Gift Deed and confirms that they signed under their free will.

- Warranty Deed: While less common in gift transactions, a Warranty Deed can be used to transfer property with a full warranty of clear title, protecting the grantee against any future claims.

- Revocable Living Trust: Property transferred through a Gift Deed can also be placed into a revocable living trust, which specifies how the property is to be managed or distributed by the trustee.

- Gift Letter: If the property transfer involves a mortgage, lenders may require a Gift Letter to confirm that the transfer is indeed a gift and not a loan.

- Property Tax Statement: Essential for understanding the current property tax obligations, which the new owner will be responsible for after the transfer.

- Title Insurance Policy: Protects the new owner from potential future legal claims against the property's title, ensuring peace of mind.

- Death Certificate: In the event that the Gift Deed is part of the estate planning or transfer upon death, a Death Certificate may be necessary.

Together, these documents encompass a broad range of legal, administrative, and financial aspects vital to the property transfer process. Each document has its function, from establishing the legality of the transfer to ensuring the new owner's protection against future claims. With the proper completion and filing of these documents, individuals can rest assured that the property gift will meet all legal standards and the intended outcome will be achieved.

Similar forms

The California Gift Deed form shares similarities with a Last Will and Testament. Both are integral for planning your estate, determining what happens to your property. While the Gift Deed allows you to transfer ownership of property to someone else without any exchange of money during your lifetime, a Last Will and Testament specifies your wishes for distributing your property after your death. They both ensure that your property is passed on according to your wishes, but they operate at different times.

Similarly, it aligns with a Revocable Living Trust in purpose and function. Both documents facilitate the process of transferring assets, but they do so in unique ways. A Revocable Living Trust is created to hold ownership of your assets during your lifetime, with instructions for managing and distributing them after your death, offering a bypass to the often lengthy and costly probate process. The Gift Deed, on the other hand, transfers the ownership immediately, and once given, the donor relinquishes control over the asset.

A Quitclaim Deed also shares characteristics with the California Gift Deed form. Both are used to transfer property quickly without the seller providing any warranties to the buyer about the quality of the title. However, a Quitclaim Deed can be used in various transactions, not only gifting, such as selling or resolving a dispute. Despite their functional similarities, the context in which they are used distinguishes one from the other.

A General Warranty Deed is another document that, while serving a fundamentally different purpose, has its parallels with a Gift Deed. Whereas a General Warranty Deed is often used in sales, offering the buyer guarantees about the title's quality and protection against future claims, a Gift Deed provides no such assurances. Both, however, are involved in the process of transferring property from one party to another. The main difference lies in the level of protection and guarantees offered to the recipient.

The California Gift Deed form is closely related to a Promissory Note, although they serve different functionalities in the realm of property and asset transactions. While a Promissory Note is a written promise to pay a specified sum of money to someone at a determined time, a Gift Deed is an immediate transfer of property with no expectation of payment. They both deal with the transfer or promise of transferring assets, but the conditions and expectations surrounding the transfer are what set them apart.

Lastly, a Deed of Trust bears resemblance to the Gift Deed in the sense that both involve the transfer of property. A Deed of Trust is used in real estate transactions as a method of securing a loan on a property, involving three parties—the borrower, the lender, and the trustee, while a Gift Deed involves a straightforward transfer without the complexities of a loan. Each plays a crucial role in property transactions, facilitating transfers under different circumstances.

Underlying each of these comparable documents is the central theme of transferring property or assets, though the conditions, protections, and intentions vary. From ensuring the care of loved ones after one's passing to the immediate transfer of property without financial exchange, these documents collectively cover a broad spectrum of property transfer methods. Understanding the specific purposes and nuances of each can provide clarity and direction in estate planning and property transactions.

Dos and Don'ts

When filling out the California Gift Deed form, it's crucial to adhere to specific guidelines to ensure the process is completed correctly and legally. Below are four important dos and don'ts to keep in mind:

Do:

Verify the accuracy of all the information provided in the form. This includes the full legal names of both the giver (donor) and the receiver (donee), the legal description of the property, and any other necessary details.

Ensure that the gift deed is signed in the presence of a notary public. California law requires notarization for the document to be legally binding.

Check that the form complies with local and state laws. This might include specific requirements about language, format, or additional documentation needed for a valid transfer.

Record the gift deed with the county recorder’s office where the property is located. Filing the document officially records the transaction and changes the property’s title.

Don't:

Leave any sections of the form blank. If a section does not apply, clearly indicate with "N/A" (not applicable) or "none" to ensure there are no ambiguities or questions about incomplete sections.

Forget to review the document for errors before notarization. Once notarized, corrections become more complicated and may require additional documentation or a new gift deed entirely.

Assume a gift deed transfers the property free of any obligations. Confirm that there are no existing mortgages or liens against the property that could affect the transfer.

Overlook the need for witness signatures if required. While California does not generally mandate witnesses for a gift deed, other jurisdictions or specific circumstances might require them.

Misconceptions

When handling a California Gift Deed form, several misconceptions can arise, leading to misunderstandings and potential legal problems. Here are nine common misconceptions and the explanations to correct them:

A Gift Deed is not necessary if the giver verbally promises the gift. In reality, for real estate transactions, California law requires a written document to validate the transfer. A verbal agreement isn’t sufficient to change ownership of real property.

Creating a Gift Deed automatically transfers the property. However, simply creating the deed does not complete the process. The deed must be properly signed, notarized, and recorded with the county recorder’s office where the property is located to be effective.

Gift Deeds are only for transferring real estate. While often used for real estate, Gift Deeds can also be used to gift personal property of significant value that requires a formal transfer process.

Only family members can receive property through a Gift Deed. Actually, the donor can choose anyone they wish to gift property to, not just family members.

Gift Deeds cannot be revoked. Contrary to this belief, a Gift Deed can include a revocation clause, although once the deed is recorded, revoking it can be complex and usually requires the recipient's consent or a legal action.

A Gift Deed avoids probate. While it's true that property transferred via a Gift Deed before death will generally not go through probate, this does not completely avoid the potential for estate taxes or other legal implications.

There are no tax implications for the giver or receiver. In fact, both may face tax implications. For the giver, there can be federal gift tax considerations. For the receiver, while there is no immediate income tax, there could be capital gains tax implications upon eventual sale.

The Gift Deed must state the property’s exact monetary value. This is incorrect; the deed needs to describe the property being gifted clearly but does not need to specify its value.

Any form of Gift Deed is acceptable in California. In truth, to be legally valid, the form must meet specific requirements as set by California law, including being in writing, describing the property, and being delivered and accepted during the giver's lifetime.

It's crucial for individuals to understand these aspects of the California Gift Deed form to ensure the process is carried out legally and effectively. Consulting with a legal professional can provide guidance tailored to specific situations.

Key takeaways

The California Gift Deed form is a crucial document for individuals wanting to transfer ownership of property without financial compensation. Understanding the key aspects of this form is important for both the giver and the receiver. Here are some significant takeaways to consider when filling out and using this form:

- The California Gift Deed must include a complete and accurate description of the property being gifted. This ensures that there is no ambiguity regarding what is being transferred.

- Both the giver (donor) and the receiver (donee) need to provide their full legal names to confirm their identities and roles in the transaction.

- It is compulsory for the donor to sign the Gift Deed in front of a notary public to validate the deed. This formalizes the document, making it legally binding.

- The document must be filed with the local county recorder’s office where the property is located. This public recording is a necessary step for the deed to be acknowledged officially.

- Consideration of the federal gift tax implications is important. While the Gift Deed transfers ownership without payment, the donor might still be responsible for federal gift taxes if the value of the gift exceeds the annual exclusion amount set by the IRS.

- A Gift Deed cannot be reversed once completed and recorded. Therefore, both parties must be certain of their decision before proceeding.

By paying attention to these key points, individuals can ensure that the process of transferring property through a California Gift Deed is executed properly and effectively. This provides peace of mind to all parties involved, knowing that the transfer adheres to legal standards and requirements.

More California Forms

California Notary Acknowledgement 2023 - Serves as incontrovertible evidence that a signer was properly identified and willingly signed the document.

California Apartment Rental Application - This form may also inquire about pets or dependents to ensure the property can accommodate the needs of potential tenants.