Legal California General Power of Attorney Document

In the state of California, the General Power of Attorney form stands as a critical legal instrument that allows individuals to grant comprehensive authority to a chosen representative, permitting them to manage a wide range of financial matters in the grantor's stead. This document, significant for its broad applicability, encompasses various facets of an individual's financial life, encompassing but not limited to banking transactions, personal property dealings, and even the handling of certain legal claims and litigation. Tailored to fit the nuanced requirements of California's legal standards, this form embodies not just a delegation of financial oversight but also represents a profound trust placed in the appointed agent. The implications of this form are far-reaching, affecting not just the immediate financial transactions it directly governs, but also laying the groundwork for how an individual's financial responsibilities are managed in scenarios where they're unable to do so themselves due to incapacity or absence. Paramount in the process is a clear understanding of the form’s scope, the specific powers it grants, as well as the legal obligations and limitations it imposes on both the giver and the receiver of the power.

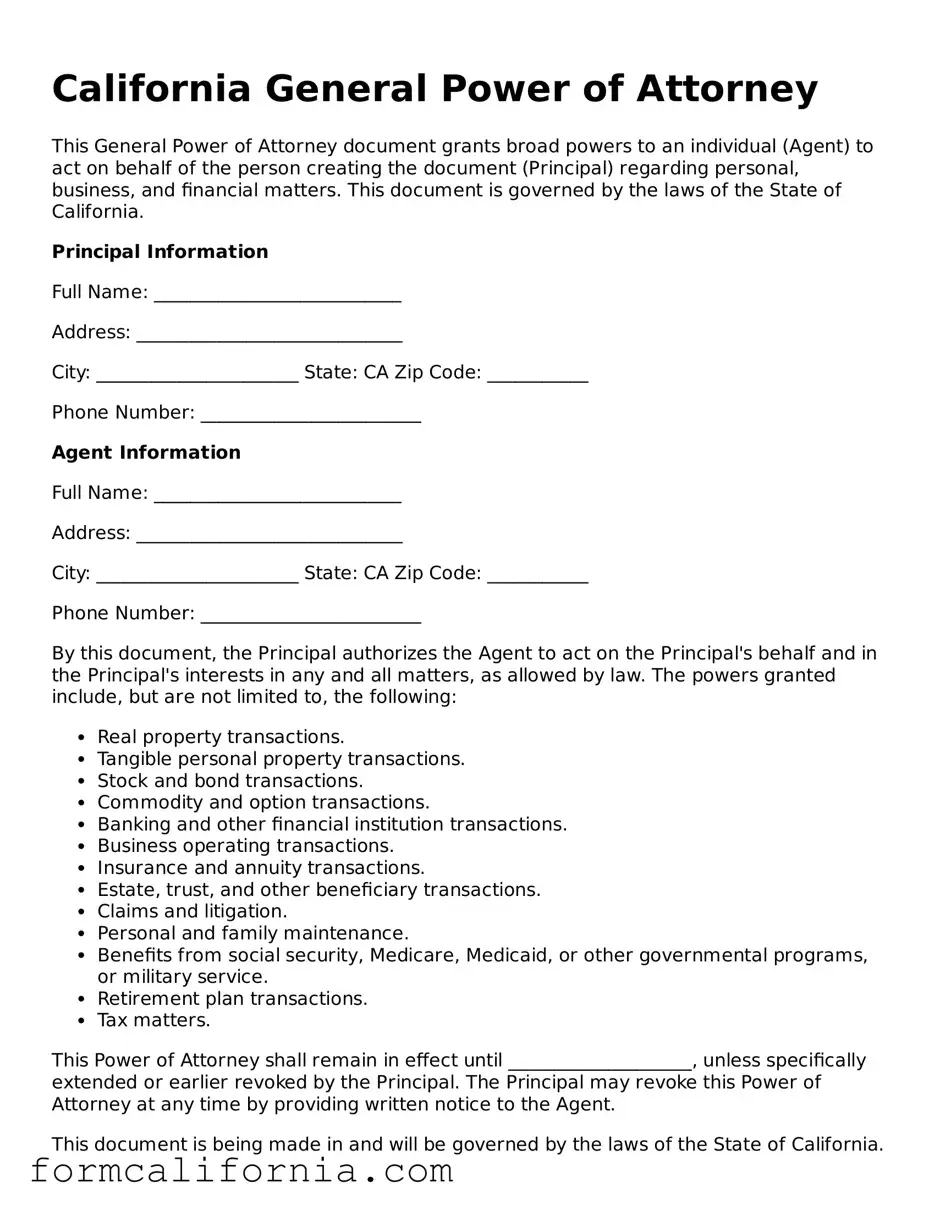

Document Preview Example

California General Power of Attorney

This General Power of Attorney document grants broad powers to an individual (Agent) to act on behalf of the person creating the document (Principal) regarding personal, business, and financial matters. This document is governed by the laws of the State of California.

Principal Information

Full Name: ___________________________

Address: _____________________________

City: ______________________ State: CA Zip Code: ___________

Phone Number: ________________________

Agent Information

Full Name: ___________________________

Address: _____________________________

City: ______________________ State: CA Zip Code: ___________

Phone Number: ________________________

By this document, the Principal authorizes the Agent to act on the Principal's behalf and in the Principal's interests in any and all matters, as allowed by law. The powers granted include, but are not limited to, the following:

- Real property transactions.

- Tangible personal property transactions.

- Stock and bond transactions.

- Commodity and option transactions.

- Banking and other financial institution transactions.

- Business operating transactions.

- Insurance and annuity transactions.

- Estate, trust, and other beneficiary transactions.

- Claims and litigation.

- Personal and family maintenance.

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service.

- Retirement plan transactions.

- Tax matters.

This Power of Attorney shall remain in effect until ____________________, unless specifically extended or earlier revoked by the Principal. The Principal may revoke this Power of Attorney at any time by providing written notice to the Agent.

This document is being made in and will be governed by the laws of the State of California.

Signature of Principal

______________________________________

Date: ________________________________

Signature of Agent

______________________________________

Date: ________________________________

Witness (1) Signature

Name: ________________________________

Signature: ____________________________

Date: ________________________________

Witness (2) Signature

Name: ________________________________

Signature: ____________________________

Date: ________________________________

This document was executed in the presence of the undersigned witnesses, who hereby certify that, to the best of their knowledge, the Principal is of sound mind and under no constraint or undue influence. We affirm that the Principal signs this document willingly and that we, in the Principal's presence, at the Principal's request, and in the presence of each other, have subscribed our names as witnesses on the date indicated above.

PDF Form Characteristics

| Fact | Details |

|---|---|

| Purpose | Allows an individual to grant broad powers to another person to manage their affairs. |

| Governing Law | California Probate Code, specifically sections starting around 4000. |

| Validity | Must be signed by the principal and acknowledged before a notary public or signed by two witnesses. |

| Powers Included | Can include managing financial matters, real estate transactions, personal property transactions, and other legal decisions. |

| Duration | Effective immediately upon signing unless stated otherwise and remains in effect unless revoked or upon the death of the principal. |

| Revocation | Can be revoked at any time by the principal as long as they are mentally competent. |

| Special Considerations | Choosing an agent whom the principal trusts is crucial, as they will have significant control over the principal's affairs. |

Detailed Instructions for Writing California General Power of Attorney

Filling out a California General Power of Attorney form is a significant step for individuals planning to legally authorize someone else to act on their behalf. It ensures that a trusted person can make decisions and undertake certain actions when one is unable to do so. This process requires attention to detail to ensure the agreement is clear, legal, and leaves no room for misinterpretation. Here are the steps to complete the form accurately, keeping in mind that precision is critical to its effectiveness.

- Start by downloading the latest version of the General Power of Attorney form specific to California from a reliable source to ensure you are using the correct document.

- Enter the full legal name and address of the individual granting the power (referred to as the "Principal") in the designated spaces at the top of the form.

- Fill in the full legal name and address of the person who will receive the power of attorney (referred to as the "Agent" or "Attorney-in-Fact").

- Review the powers listed in the form that the Principal will be granting to the Agent. These include but are not limited to, making financial decisions, buying or selling property, and managing bank accounts. Ensure you clearly understand each power.

- If there are specific powers the Principal does not wish to grant the Agent, they should be clearly crossed out or otherwise indicated as not applicable.

- Some sections of the form allow for adding any special instructions or limitations. If the Principal wishes to restrict or specify certain powers, this is where such information should be noted.

- Check the requirements for witnesses and/or notarization specific to California. Some versions of the form may require the signatures to be witnessed or the document to be notarized to be legally valid.

- The Principal must sign and date the form in the presence of any required witnesses or a notary public, depending on the legal requirements. Ensure that this step is completed as per California law to avoid any issues with validity.

- If required, have the Agent sign the form to acknowledge their acceptance of the responsibilities being given to them.

- Keep the original copy of the form in a safe place, and provide the Agent with a copy. It may also be wise to give a copy to a trusted family member or attorney for safekeeping.

Once the form is fully executed, the Agent will have the authority to act on the Principal's behalf as stipulated. It's crucial that both parties understand the extent of this authority and the responsibilities it entails. Regular reviews and updates to the document may be necessary to reflect any changes in intentions or legal requirements.

Things to Know About This Form

What is a General Power of Attorney form in California?

In California, a General Power of Attorney (POA) form is a legal document that allows an individual, known as the principal, to designate another person, referred to as the agent or attorney-in-fact, to manage their financial affairs. This authority can include handling banking transactions, managing real estate, and other financial decisions. However, it should be noted that this form does not remain effective if the principal becomes incapacitated.

How does one revoke a General Power of Attorney in California?

To revoke a General Power of Attorney in California, the principal must provide a written notice of revocation to the agent and any third parties who may be affected. The notice should be clear and unequivocal. It is advisable to also file the revocation notice with the county recorder's office if the POA had been recorded there.

Is a California General Power of Attorney form required to be notarized?

Yes, for a General Power of Attorney form to be legally valid in California, it must be notarized. Notarization confirms the principal's identity and ensures that the signature was made willingly and without coercion. This step is crucial for the document to be recognized by financial institutions and others.

Can a General Power of Attorney in California be used to make health care decisions?

No, a General Power of Attorney in California cannot be used to make health care decisions. For health care matters, a separate document, known as an Advance Health Care Directive, is required. This legal document allows individuals to outline their preferences for medical treatment and appoint someone to make decisions on their behalf if they are unable to do so themselves.

What happens if the Principal becomes incapacitated?

If the principal becomes incapacitated, a General Power of Attorney in California typically becomes invalid. For enduring authority in decisions even in the event of incapacitation, individuals need a Durable Power of Attorney, which specifies that the agent’s power remains effective even if the principal is no longer mentally competent.

Who can serve as an agent under a General Power of Attorney?

Any competent adult can serve as an agent under a General Power of Attorney in California. Most often, people choose a trusted family member or friend. However, it’s essential for the principal to select someone they trust implicitly, as the agent will have a significant degree of control over their financial matters.

Are there any limitations on the powers of an agent under a General Power of Attorney?

Yes, there are limitations on the powers granted to an agent under a General Power of Attorney in California. While the principal can tailor the document to their specific needs, certain acts, such as amending the principal’s will, cannot be delegated to an agent. Additionally, the agent is expected to act in the principal's best interest and cannot use the POA for their advantage.

How can one ensure their General Power of Attorney is effective and legal?

To ensure a General Power of Attorney in California is effective and legal, it is crucial to:

- Ensure the document is completed accurately and comprehensively.

- Have the POA notarized to confirm the principal’s identity.

- Provide copies to financial institutions and any other parties that may require it.

- Consider consulting with a legal professional to tailor the POA to the principal’s specific needs and to understand the implications fully.

Common mistakes

Filling out the California General Power of Attorney (POA) form is an important step that allows someone else to legally act on your behalf. However, it's common for people to make several mistakes during this process. Understanding these errors can help ensure the form is completed accurately, providing peace of mind and legal clarity.

Not specifying the powers granted - One of the most critical mistakes is not being clear about what the appointed person can and cannot do. It's essential to list the specific tasks or decisions you are authorizing, such as managing financial accounts or real estate transactions, to prevent any confusion.

Choosing the wrong person as an agent - The person you select to act on your behalf should be someone you trust implicitly. Not properly considering the agent's reliability or their understanding of your wishes can lead to issues down the line.

Forgetting to specify the POA's duration - A General POA can either be durable, meaning it remains in effect even if you become incapacitated, or non-durable, meaning it ends if you become incapacitated. Failing to clarify this can result in the POA not functioning as you intended if something happens to you.

Not having the form notarized - While not all states require notarization, in California, notarizing your POA can add a layer of legality and can help prevent it from being questioned by financial institutions or other entities.

Ignoring state-specific requirements - Each state has its own set of rules regarding powers of attorney. Not familiarizing yourself with or ignoring California's specific requirements can make your POA invalid or unenforceable.

Failing to provide copies to relevant parties - Once your POA is complete, it's crucial to give copies to your appointed agent and any institutions or individuals that may require it. Not doing so can lead to delays or disputes when your agent needs to act on your behalf.

Avoiding these common mistakes can greatly smooth the process both for you and the person you are trusting as your agent. Taking the time to carefully consider each part of the General Power of Attorney form, and seeking expert advice if you're uncertain about any aspect, can save a lot of complications and ensure that your interests are well-protected.

Documents used along the form

When handling affairs that involve the California General Power of Attorney form, it's common to come across various other documents. These serve to complement or enhance the powers granted, ensuring all aspects of one’s financial and legal needs are covered. Here is a list of other forms and documents often used alongside the California General Power of Attorney form, each with a brief description to clarify its purpose and significance.

- Advance Health Care Directive: Specifies preferences for medical care and appoints a health care agent if you're unable to make decisions yourself.

- Durable Power of Attorney for Health Care: Allows you to name someone to make health care decisions on your behalf, emphasizing decisions when you are incapacitated.

- Living Will: Documents your wishes regarding lifesaving treatments in situations where recovery is unlikely.

- Revocation of Power of Attorney: This document officially cancels and nullifies previously granted powers of attorney, ensuring they no longer hold legal effect.

- Special or Limited Power of Attorney: Grants someone authority to act on your behalf for specific tasks, limiting their powers to particular areas or actions.

- Financial Statement: Often used to provide a comprehensive overview of your financial situation, which can be necessary for agents to make informed decisions.

- Last Will and Testament: Dictates how you wish your assets to be distributed after your death and can complement a Power of Attorney in planning your estate.

- Trust Agreement: Establishes a trust and appoints trustees to manage your assets, potentially used alongside a Power of Attorney to handle complex estate planning needs.

Utilizing these documents strategically can provide a solid legal foundation for managing both present and future financial and health care decisions. They ensure that your wishes are respected and followed, offering peace of mind to both you and your loved ones. Always consult with a legal professional to understand the best combination of forms for your specific circumstances, ensuring your legal and personal wishes are accurately represented and protected.

Similar forms

The California Durable Power of Attorney form parallels the General Power of Attorney in that it allows someone to act on another person's behalf. However, its durability means it remains effective even if the person who grants the power becomes incapacitated. This key difference makes it similar yet distinct, focusing on long-term arrangements.

A Medical Power of Attorney, also known as an Advance Healthcare Directive in California, is also similar to a General Power of Attorney. It grants someone authority to make healthcare decisions for another person if they become unable to do so. While both documents delegate power, the Medical Power of Attorney specifically addresses healthcare decisions.

The Limited Power of Attorney form is another document similar to the General Power of Attorney. It allows a person to grant someone else the authority to perform specific acts or make decisions in certain circumstances. Unlike the General Power of Attorney, which is broad in scope, a Limited Power of Attorney is focused on particular tasks or timeframes.

The Financial Power of Attorney document closely resembles the General Power of Attorney but is specifically tailored to financial matters. It grants someone authority to manage another person's financial affairs, such as banking transactions and property management. This specialization in finances distinguishes it while maintaining the essence of granting authority.

The California Power of Attorney for the Care of Children is akin to the General Power of Attorney but focuses on childcare. It allows a parent to give someone else authority to make decisions regarding their child's care, including education and healthcare. This specificity in guardianship for children sets it apart from the broader General Power of Attorney.

The Real Estate Power of Attorney is a document that, like the General Power of Attorney, empowers another person to act on one's behalf but is specifically designated for real estate matters. This can include buying or selling property and managing real estate assets. Its specialized focus on real estate affairs differentiates it from the more general document.

A Vehicle Power of Attorney in California provides another example of a specialized form similar to the General Power of Attorney. It grants someone the authority to make decisions and take actions relating to the registration, titling, and sale of a vehicle on behalf of another. Its niche focus on vehicle matters distinguishes it within the family of power of attorney documents.

The Springing Power of Attorney is an arrangement similar to the standard General Power of Attorney but with the condition that the powers granted only become effective upon the occurrence of a specific event, typically the grantor's incapacity. This conditional activation feature separates it from the generally immediately effective General Power of Attorney.

The Tax Power of Attorney form, also known as Form 3520 in California, allows an individual to grant someone else the authority to handle their tax matters with the California Franchise Tax Board. While it shares the characteristic of permitting another to act on one’s behalf, its specific application to tax issues makes it distinct from the General Power of Attorney's broader purview.

Lastly, the Enduring Power of Attorney shares similarities with the General Power of Attorney by enabling someone to act on another's behalf. The term "enduring" specifically refers to its continued effectiveness even after the grantor loses mental capacity, emphasizing its focus on long-term arrangements, a critical point of differentiation from the typical General Power of Attorney's scope.

Dos and Don'ts

When you're filling out the California General Power of Attorney form, it's important to pay close attention to detail and follow best practices to ensure that your document is legally binding and accurately reflects your intentions. Below, you'll find a list of things you should and shouldn't do during this process.

Do:- Review the form thoroughly before filling it out to ensure you understand all the sections and terms.

- Use black ink or type your responses to ensure that the document is legible and can be photocopied or scanned without issue.

- Be specific about the powers you are granting to ensure that your attorney-in-fact has clear guidelines on what they can and cannot do on your behalf.

- Include any specific conditions or limitations to the powers being granted to protect your interests and ensure that your wishes are followed.

- Sign and date the form in the presence of a notary public to authenticate the document and satisfy legal requirements.

- Provide your attorney-in-fact with a copy of the document so they are aware of their responsibilities and the extent of their powers.

- Keep the original document in a safe place where it can be easily accessed when needed.

- Review and update the document as necessary to reflect any changes in your wishes or personal circumstances.

- Consider consulting with a legal professional to ensure that the document meets all legal requirements and adequately protects your interests.

- Inform trusted family members or friends about the existence of the Power of Attorney and where the document is stored.

- Leave any sections blank; if a section does not apply, mark it as “N/A” (Not Applicable) to indicate that you have reviewed it.

- Use vague language when describing the powers being granted; clarity is key to a legally sound document.

- Grant powers that you are not comfortable with or that you do not fully understand.

- Forget to specify the duration of the Power of Attorney, if it is not intended to be indefinite.

- Overlook the importance of having the document notarized, as failing to do so may result in it not being recognized as legally valid.

- Assume that the document will automatically expire upon your incapacity unless it is specifically designated as a durable Power of Attorney.

- Fail to notify your attorney-in-fact if you decide to revoke the Power of Attorney before its designated expiration.

- Ignore local laws and requirements, which may vary and affect the validity of your Power of Attorney.

- Allow someone to pressure you into creating a Power of Attorney or into granting powers with which you are not comfortable.

- Forget to review and update the document periodically, as laws and personal circumstances can change over time.

Misconceptions

When discussing the General Power of Attorney form in California, several misconceptions can lead to confusion and mismanagement of one's affairs. It's crucial to demystify these misunderstandings to ensure individuals are well-informed about their legal rights and the scope of authority they are granting to others.

- Misconception 1: A General Power of Attorney Grants Unlimited Powers

This is a common misunderstanding. In reality, a General Power of Attorney in California allows the person designated (the agent) to handle a broad range of financial and business transactions on behalf of the principal. However, it does not permit the agent to make healthcare decisions or handle duties not specified within the document.

- Misconception 2: It Remains in Effect After the Principal's Death

Contrary to what many believe, the authority granted through a General Power of Attorney ceases upon the death of the principal. At this point, the executor of the estate, as named in the will, or an administrator appointed by the court, takes over the responsibility of managing and distributing the deceased's estate.

- Misconception 3: It Can Only Be Revoked by the Principal's Death

Another misconception is that the General Power of Attorney is irrevocable unless the principal dies. In truth, the principal retains the right to revoke or amend this power of attorney at any time as long as they are mentally competent. This flexibility ensures that the principal can reassess and change the designation in accordance with their current needs and wishes.

- Misconception 4: A Notary Public's Signature Is Always Required

While it's advisable and often necessary to have a General Power of Attorney notarized in California to ensure its acceptance by financial institutions and other entities, the law does not universally mandate it. The requirements can vary based on the document's intended use and the discretion of the parties involved.

- Misconception 5: It Requires Legal Assistance to Create

Many people assume that drafting a General Power of Attorney requires the direct involvement of a lawyer. Although legal advice can be invaluable, especially in complex situations, individuals have the right to create their own General Power of Attorney. Various resources and templates are available to guide them through the process, ensuring the document is legally sound and reflects their intentions accurately.

Key takeaways

Understanding how to properly fill out and use the California General Power of Attorney (POA) form is crucial for effectively managing one's legal and financial affairs through a designated agent. The following key takeaways provide guidance on this process:

- In the California General Power of Attorney form, the individual granting authority is referred to as the principal, and the person receiving the authority is known as the agent or attorney-in-fact. It's essential to choose an agent who is trustworthy and capable of handling the responsibilities.

- This form allows the agent to perform a wide range of actions on behalf of the principal, including financial transactions, property management, and business dealings. However, it does not grant authority to make healthcare decisions.

- To be valid, the POA must be filled out completely, with clear designation of powers granted to the agent. Both the principal and the agent should thoroughly review the form to ensure all provided information is accurate and comprehensive.

- The POA requires the principal's signature to be either notarized or witnessed by two adults who are not named as agents in the document. This process adds a layer of verification and helps to protect against fraud.

- It's important to note that the General Power of Attorney is durable unless it specifically states otherwise. This means it remains in effect even if the principal becomes incapacitated, ensuring ongoing management of the principal's affairs without court intervention.

- If at any time the principal wishes to revoke the POA, they must do so in writing. A revocation document should be created, signed, and, in many cases, notarized, then distributed to the former agent and any institutions or parties that were relying on the original POA.

With these key points in mind, individuals can ensure they are taking the necessary steps to complete and utilize the California General Power of Attorney form effectively, safeguarding their interests and ensuring their affairs are managed according to their wishes.

More California Forms

Car Title California - Facilitates the update of registration records, ensuring they reflect the current owner accurately.

Power of Attorney California - A proactive measure for parents planning for all scenarios, including unexpected illness or injury.

How to Write a Cease and Desist - Businesses may use it to address unfair competition practices or breaches of contract.