Legal California Employment Verification Document

In the landscape of employment in California, the Employment Verification form plays a pivotal role in ensuring that both employers and employees adhere to state and federal laws regarding work eligibility. This critical document, required by governing bodies, serves not just as a formality but as a fundamental checkpoint in the hiring process. It is designed to verify the identity and legal authorization to work of newly hired employees, reflecting compliance with the Immigration Reform and Control Act (IRCA) of 1986. While the process might seem straightforward, the implications of the form are far-reaching, impacting an employer's ability to lawfully onboard new staff and an employee's eligibility for employment. As such, this form is not merely administrative in nature but a necessary step in fostering a legally compliant work environment. It intertwines with a host of regulations and introduces both employers and employees to the first layer of legal employment verification, making its understanding and accurate completion paramount.

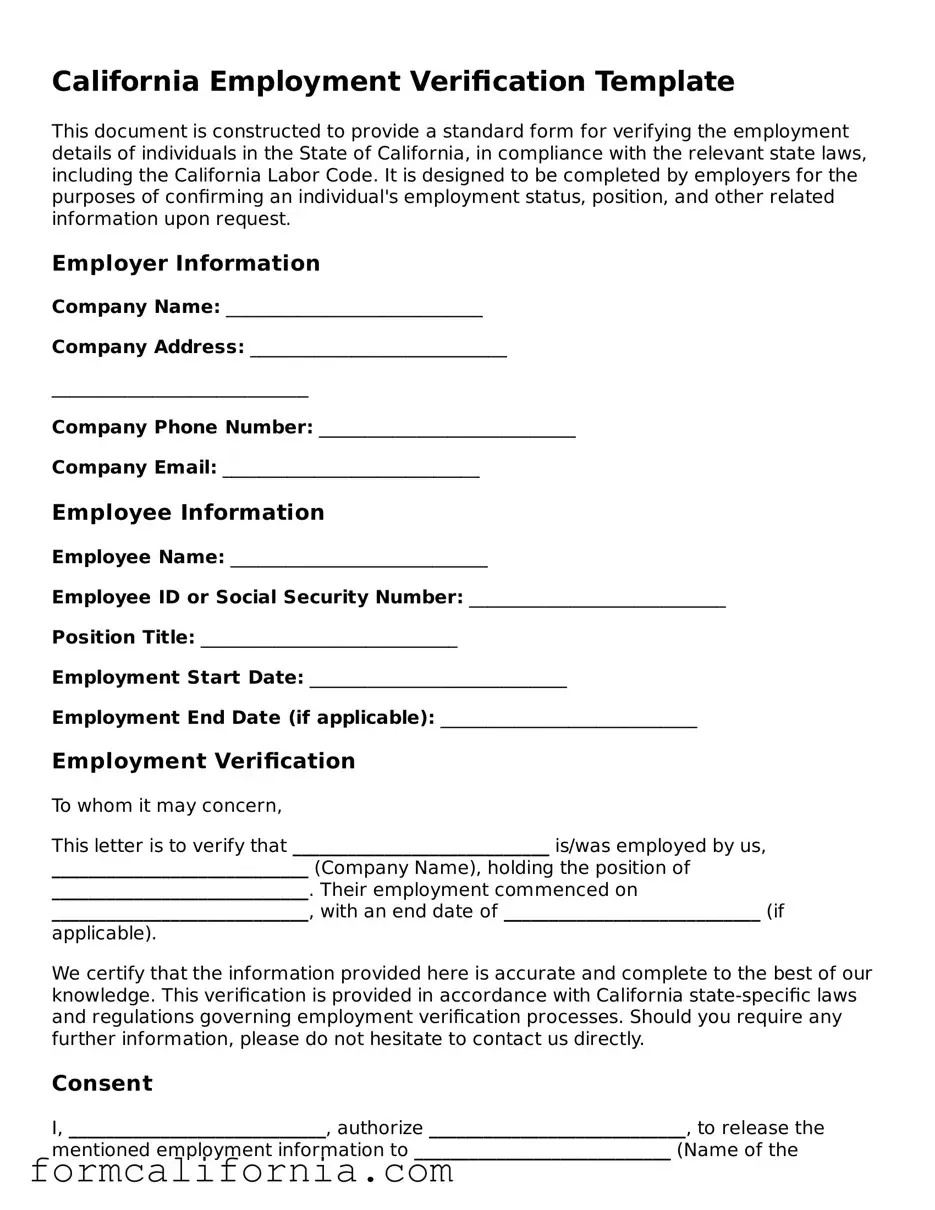

Document Preview Example

California Employment Verification Template

This document is constructed to provide a standard form for verifying the employment details of individuals in the State of California, in compliance with the relevant state laws, including the California Labor Code. It is designed to be completed by employers for the purposes of confirming an individual's employment status, position, and other related information upon request.

Employer Information

Company Name: ____________________________

Company Address: ____________________________

____________________________

Company Phone Number: ____________________________

Company Email: ____________________________

Employee Information

Employee Name: ____________________________

Employee ID or Social Security Number: ____________________________

Position Title: ____________________________

Employment Start Date: ____________________________

Employment End Date (if applicable): ____________________________

Employment Verification

To whom it may concern,

This letter is to verify that ____________________________ is/was employed by us, ____________________________ (Company Name), holding the position of ____________________________. Their employment commenced on ____________________________, with an end date of ____________________________ (if applicable).

We certify that the information provided here is accurate and complete to the best of our knowledge. This verification is provided in accordance with California state-specific laws and regulations governing employment verification processes. Should you require any further information, please do not hesitate to contact us directly.

Consent

I, ____________________________, authorize ____________________________, to release the mentioned employment information to ____________________________ (Name of the requesting party). I acknowledge that this information is to be used solely for the purpose of ____________________________.

Date: ____________________________

Signature

________________________________________________________

(Employee Signature)

________________________________________________________

(Employer/Authorized Signatory Signature)

Instructions for Completing the Form

- Fill in all the blanks with the appropriate information regarding the employer and the employee.

- Ensure that all provided information is accurate and verifiable.

- The employee should sign and date under the "Consent" section to authorize the release of their employment information.

- An employer or authorized signatory should also sign and date at the bottom of the form to validate its authenticity.

- Keep a copy of the completed form for your records.

PDF Form Characteristics

| Fact | Detail |

|---|---|

| Definition | California Employment Verification form is a document used by employers to verify the employment eligibility and identity of new employees in line with federal law. |

| Governing Law | The primary law governing the form is the Immigration Reform and Control Act (IRCA) of 1986 at the federal level, along with any pertinent California state laws and regulations. |

| Key Requirement | Employers must ensure that each employee, regardless of citizenship or national origin, completes the form at the time of hire to prove their eligibility to work in the United States. |

| Documentation | The form requires employees to present documents that establish both identity and employment authorization, such as a passport or a combination of a driver’s license and social security card. |

| Record Keeping | Employers are required to retain completed forms for all current employees and for three years after the date of hire or one year after employment ends, whichever is later. |

Detailed Instructions for Writing California Employment Verification

Filling out the California Employment Verification form is a straightforward process that requires attention to detail. This form is a critical document used by employers in California to verify the employment eligibility of their new hires. It ensures compliance with state laws surrounding employment and helps prevent unauthorized work. The form must be filled out accurately to avoid any potential legal issues or delays in the hiring process. The steps below are designed to guide you through each section of the form, ensuring that all the necessary information is provided and that the form is completed correctly.

- Start by entering the employee's full name, including first, middle, and last names, in the designated section at the top of the form.

- Next, fill in the employee's social security number in the specified field. Ensure the number is accurate to avoid issues with employment eligibility verification.

- Provide the position the employee is being hired for in the space provided. Be specific about the job title to ensure clarity.

- In the section marked for the employer's information, enter the company name, including its legal name and any dba (doing business as) if applicable.

- Fill out the company's address, including street address, city, state, and zip code, where the employee will be working.

- Indicate the hire date of the employee, ensuring it aligns with the company records and the employee's start date.

- For verification purposes, list the type of documentation provided by the employee that proves their eligibility to work in the U.S., such as a passport or a driver's license along with a social security card. Note the document's specifics, including issuing authority and expiration date if applicable.

- The employer or authorized representative must then sign and date the form, attesting to the accuracy of the information provided and their compliance with employment verification laws.

- Lastly, make sure to provide a contact number and an email address for the employer or the authorized representative in case further information is needed.

Once the California Employment Verification form is fully completed, it should be reviewed for accuracy and stored securely with the employee's records. Keeping a copy of this form is important for compliance reasons and may be required for future reference or in the event of a government audit. Taking the time to fill out the form carefully ensures that both the employer and employee are protected under the law.

Things to Know About This Form

What is the California Employment Verification form?

The California Employment Verification form is a document used by employers to verify the employment eligibility of their employees within the state. It ensures compliance with state labor laws and federal regulations, including immigration laws that require proof of an individual's legal right to work in the United States.

Who needs to fill out the California Employment Verification form?

Every employee working in California needs to have this form filled out as part of the hiring process. It's the responsibility of the employer to ensure the form is completed accurately and retained according to state and federal guidelines.

What information is required on the California Employment Verification form?

The form typically requires the following information:

- Employee's full name and address

- Employee's Social Security Number

- Type of documentation provided by the employee to prove employment eligibility (e.g., passport, driver's license, Social Security card, etc.)

- Employer's information, including company name and address

- Verification date, confirming when the employee's eligibility was verified

How does one obtain the California Employment Verification form?

This form can be downloaded from the California Department of Labor's website or acquired through HR departments that keep a stack of these forms for new hires. Some payroll and HR software systems also include the ability to fill out and store the form digitally.

Is the California Employment Verification form the same as the Form I-9?

No, the California Employment Verification form is different from Form I-9, which is a federal requirement for all employers in the United States. While both forms serve to verify an employee’s eligibility to work, the California form may contain specific state-level requirements or additional details not covered by the federal Form I-9.

How long must employers keep the California Employment Verification forms on file?

Employers are required to keep the completed forms on file for at least three years after the date of hire or one year after the employee leaves the company, whichever is later. These records should be stored securely and must be available for inspection by authorized government officials.

What happens if an employer fails to complete the California Employment Verification form for an employee?

Failure to complete and retain the California Employment Verification form can lead to penalties, including fines and legal sanctions. It shows non-compliance with state employment laws and can significantly impact an employer's ability to operate within the state.

Can an employer fill out the California Employment Verification form electronically?

Yes, employers can fill out this form electronically, provided the electronic version contains all the required information and is kept in a format that is accessible for inspection. Electronic completion and storage can simplify the process and ensure better compliance through automatic reminders and electronic signatures.

What are the common mistakes to avoid when filling out the California Employment Verification form?

Common mistakes include:

- Not checking the employee’s documents thoroughly.

- Failing to complete every field of the form.

- Not updating or revising the form when employees re-verify their employment eligibility.

- Incorrectly storing or losing completed forms.

- Not adhering to the privacy and confidentiality requirements when keeping the forms.

Common mistakes

When it comes to filling out the California Employment Verification form, careful attention to detail is crucial. Missteps can lead to processing delays or even the rejection of the application. Below are seven common mistakes people often make:

-

Not double-checking for accuracy. Individuals may overlook errors in dates, names, or numerical information. This includes misspellings or incorrect dates of employment, which can cast doubt on the validity of the information provided.

-

Leaving sections incomplete. Every question on the form serves a purpose. Failing to provide answers to all of the sections can lead to requests for additional information, thereby delaying the verification process.

-

Using unclear handwriting. In instances where the form is filled out by hand, illegible handwriting can cause significant delays. Information may be misinterpreted, resulting in incorrect employment verification.

-

Forgetting to sign or date the form. The signature and date are critical components that attest to the accuracy and acknowledgment of the information provided. An unsigned or undated form is often considered incomplete.

-

Not following specific instructions. The form may have certain requirements, such as using black ink or attaching additional documents. Ignoring these instructions can lead to processing errors.

-

Submitting outdated information. Employment circumstances change, and it's important to provide the most current details. When individuals submit outdated or irrelevant employment information, it can complicate the verification process.

-

Failure to notify the employer. Not informing the employer about the verification request in advance can result in delays. Employers need time to prepare and provide accurate employment data.

Avoiding these common mistakes will help ensure that the Employment Verification process is smooth and efficient. It's always best to review the form multiple times before submission and follow all given instructions precisely.

Documents used along the form

When managing the hiring and employment verification process, it’s important to understand that the California Employment Verification form is just one of several documents often required. This form is a crucial step in confirming the eligibility of individuals for employment in the state. However, to complete the employment process efficiently and comply with all legal obligations, employers typically need to gather additional information through various other forms and documents. Below is a list of documents frequently used alongside the California Employment Verification form, each serving a unique purpose in the employment verification process.

- W-4 Form – This form is used by employers to determine the amount of federal income tax to withhold from an employee's paycheck. It's essential for ensuring employees are taxed correctly according to their financial situation and personal allowances.

- I-9 Form – The Employment Eligibility Verification form is a mandatory document used to verify an employee's identity and eligibility to work in the United States. It requires documentation that proves the employee's legal right to work.

- State Tax Withholding Form – Similar to the W-4, but for state taxes, this form is used to determine state income tax withholdings. The form and requirements vary by state, and not all states require it.

- Direct Deposit Authorization Form – This form allows employees to provide their bank information to employers for direct deposit of paychecks. It includes account details and bank routing numbers.

- Emergency Contact Form – Collects information about who to contact in case of an employee's emergency. It includes names, relationship, and contact information of one or more individuals.

- Employee Handbook Acknowledgement Form – A document indicating that the employee has received, read, and understood the company's handbook. It ensures clarity of policies and procedures.

- Job Application Form – Used by candidates to apply for a position. It collects personal information, educational background, and employment history, providing a comprehensive view of the applicant.

- Background Check Authorization Form – This form is signed by the candidate to authorize the employer to conduct a background check, which may include criminal records, credit checks, and reference checks.

- Non-Disclosure Agreement (NDA) – An agreement between the employer and the employee to protect the confidentiality of certain information. It specifies what information is confidential and the conditions of its disclosure.

Collectively, these documents streamline the process of hiring and maintaining employment records, ensuring that both employers and employees fulfill their duties and obligations. It's important for employers to be familiar with these documents to ensure a thorough and compliant employment verification process. Employing a complete set of forms enhances the integrity of employment practices and supports the establishment of clear communications and expectations from the outset of employment.

Similar forms

The I-9 Employment Eligibility Verification form, commonly used across the United States, shares similarities with the California Employment Verification form. It requires employees to establish their identity and eligibility to work in the U.S. This process involves presenting acceptable documents that prove identity and work authorization. It serves to ensure that individuals are legally permitted to work, reflecting the aim of the California-specific verification in confirming employment eligibility within the state.

Another document similar to the California Employment Verification form is the W-4 form, or the Employee’s Withholding Certificate. While the W-4 is primarily used for tax purposes, allowing employers to withhold the correct federal income tax from employees' pay, it also requires employees to provide personal identifying information upon employment. This procedural step, like California's employment verification, involves the collection of essential employee information at the start of employment.

The Background Check Authorization form also bears resemblance to the California Employment Verification form. It requests permission from a job applicant to conduct a background check, which may include verifying the information provided in their employment application. Like the employment verification process, it is a step employers take to confirm the credibility and qualifications of potential employees, ensuring they meet the specific requirements for the job.

Similarly, the Direct Deposit Authorization form shares a procedural connection with the California Employment Verification form. While its primary purpose is to arrange for electronic payment of the employee's wages directly into a bank account, it requires employees to provide accurate personal and banking information to their employers. This step, though focused on payroll, aligns with the verification process by requiring employees to submit true and correct personal details at the onset of employment.

The Employee Handbook Acknowledgement Receipt is another document related to the California Employment Verification form in its administrative function. By signing it, employees acknowledge they have received, understood, and agreed to comply with the policies and procedures of their employer. This acknowledgment, similar to employment verification, is a formal step in the hiring process, ensuring employees understand their roles and responsibilities.

Lastly, the Non-Disclosure Agreement (NDA) can be likened to the California Employment Verification form in terms of its protective purpose. NDAs are legal contracts that prevent employees from sharing proprietary information outside the company. They require employees to formally agree to keep specific details confidential, complementing the verification process's goal of ensuring individuals are suitable and trustworthy for their roles within the company.

Dos and Don'ts

When dealing with the California Employment Verification form, approaching it with a clear and informed strategy is crucial for its success and compliance. Here’s a breakdown of essential do’s and don’ts to help you navigate the process smoothly.

Do's:

- Ensure all information you provide is accurate and up-to-date. Mistakes or outdated information can delay the verification process or lead to inaccuracies in employment records.

- Double-check the specific requirements of the form as mandated by the State of California. These requirements can vary and failure to comply can result in processing delays.

- Use a black or blue pen if you are filling out a paper version of the form. This ensures the form is legible and maintains its professionalism.

- Keep a copy of the completed form for your records. This can be very helpful if there are any disputes or if the form gets misplaced.

- Submit the form before the deadline. Late submissions can affect employment verification and potentially hurt the employee’s credibility.

Don'ts:

- Do not leave any sections blank unless specified. If a section does not apply, it’s better to note it as “N/A” (Not Applicable) rather than leaving it empty.

- Avoid using white-out or making excessive corrections. This can make the form look unprofessional and may raise questions about its validity.

- Do not guess information. If you’re unsure about a piece of information, it’s better to verify it first rather than providing incorrect details.

- Refrain from submitting the form without reviewing it for completeness and accuracy. A quick review can catch mistakes that could otherwise cause unnecessary delays.

- Do not ignore the privacy considerations. Make sure that the form is submitted through the proper channels to protect sensitive information.

Misconceptions

Understanding the nuances of the California Employment Verification form is crucial for both employers and employees. Misconceptions can lead to compliance issues and misunderstandings. Below are ten common fallacies surrounding the form and clarifications that aim to set the record straight.

It's just a formality with no legal implications. Contrary to this belief, the Employment Verification form is a critical element of the hiring process, ensuring that employees are legally authorized to work in the United States. Completing this form inaccurately or failing to do so can result in legal penalties.

Any document from the list can be used for verification. Although the form provides a list of acceptable documents, they are divided into categories, and specific combinations are required to meet the verification standards. Not just any document from the list will suffice.

Electronic copies of documents are just as good as originals. This is not always the case. Employers are required to examine the original documents, with a few exceptions for copies, to comply with regulations fully.

The form must be completed immediately after hiring. While prompt completion is necessary, the law provides a specific timeframe: the employee must fill out Section 1 by their first day of work for pay, and the employer must complete Section 2 within three business days of the employee's first day.

Employers need to file the form with the government. Unlike many other employment forms, the Employment Verification form does not need to be filed with any government agency. However, employers must retain it for a specified period and present it in case of an audit.

Only foreign workers need to fill out the form. This is a major misunderstanding. All employees, regardless of their citizenship status, must complete the form to verify their authorization to work in the United States.

The form covers the entire duration of employment. While the form verifies eligibility to work at the time of hiring, re-verification may be necessary if an employee's work authorization documents expire or their status changes.

Small businesses are exempt from this requirement. The size of a business does not exempt it from complying with the law. All employers, regardless of the number of employees, must ensure that their workforce is legally authorized to work in the U.S.

There are no updates or changes to the form. The form and its requirements have undergone several updates. Employers and employees must ensure they are using the most current version and are familiar with the latest requirements.

It's the employee's responsibility to ensure the form is correct and complete. While employees must provide accurate information and necessary documents, employers are responsible for ensuring the form is completed properly and retained according to the law. Employers face the legal repercussions of non-compliance.

Clarifying these misconceptions is crucial for maintaining compliance with employment verification laws in California. Employers and employees alike should familiarize themselves with the requirements and ensure that the process is completed accurately and in a timely manner.

Key takeaways

In California, the process of completing and utilizing an Employment Verification form is a critical step for both employers and employees. This form serves as an essential tool in confirming an individual's employment status, and it is vital in various situations including loan applications and government services access. Here, we outline seven key takeaways to guide you through the successful handling of this form.

- Accuracy is crucial: When filling out the Employment Verification form, it's vital to ensure that all information is accurate and up to date. Mistakes or inaccuracies can lead to delays or issues with the verification process.

- Understand the details required: The form typically asks for specific information about the employee, including their job position, salary, and employment history. Knowing what is needed ahead of time can streamline the process.

- Privacy matters: Protecting the employee's personal information is paramount. Only authorized individuals should have access to the form to prevent misuse of sensitive data.

- Timeliness: Respond to requests for employment verification in a timely manner. Delays can hinder an employee's ability to secure loans or government benefits.

- Know the law: Familiarize yourself with both federal and state regulations concerning employment verification. California may have specific laws that govern the use and handling of these forms.

- Written consent: Before releasing any information, make sure you have written consent from the employee. This is a legal requirement that protects both the employer and the employee's rights.

- Keep records: After completing the form, maintain a copy for your records. This can be useful for future verifications or in case of legal inquiries.

Approaching the Employment Verification process with diligence and an understanding of these key points will help ensure that the procedure is conducted smoothly and efficiently, thereby supporting the employee's endeavors while adhering to relevant legal standards.

More California Forms

Are Non Compete Agreements Enforceable in California - It provides a safeguard for businesses investing heavily in employee training and development from losing their investment to competitors.

California Commercial Lease Agreement - This document outlines the terms and conditions for renting commercial spaces, such as offices, warehouses, or retail locations.