Legal California Durable Power of Attorney Document

In the intricate landscape of legal documentation, the California Durable Power of Attorney form stands out as a crucial tool for ensuring an individual's affairs are handled according to their wishes, especially in times when they're incapacitated and unable to make decisions themselves. This document, robust in its capacity, allows a person (referred to as the principal) to appoint another individual (known as the agent) to manage their financial, health, and legal affairs, among others. Its 'durable' nature signifies that the agent's power remains in effect even if the principal becomes mentally incompetent or unable to communicate, distinguishing it from other forms of power of attorney that may terminate under such circumstances. The form serves as a testament to the trust and confidence the principal places in the agent, making the process of choosing an agent a decision of paramount importance. By providing a comprehensive legal framework, the document facilitates the seamless management of the principal’s assets, ensuring that personal and financial matters are addressed promptly and efficiently, thereby relieving a significant burden from the shoulders of loved ones during challenging times.

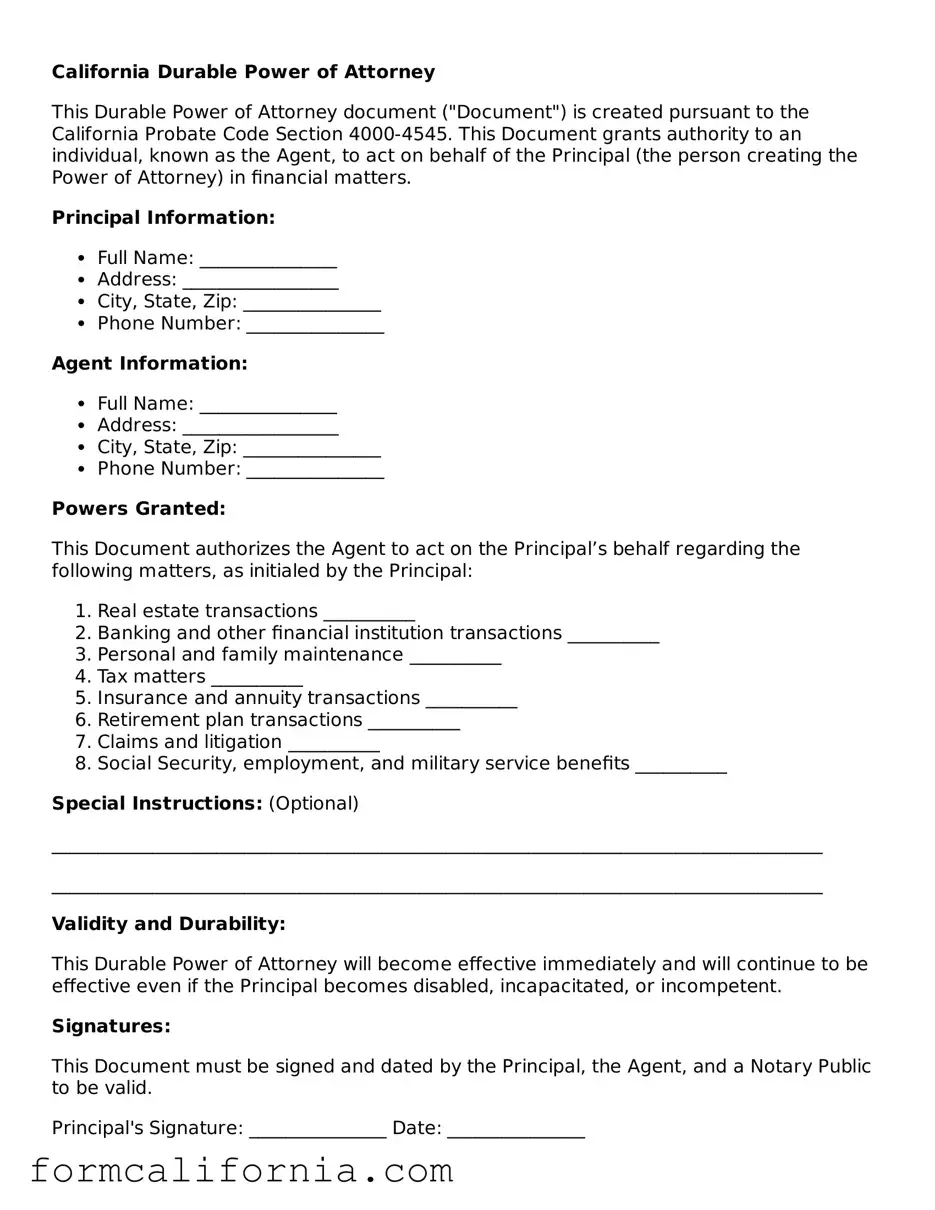

Document Preview Example

California Durable Power of Attorney

This Durable Power of Attorney document ("Document") is created pursuant to the California Probate Code Section 4000-4545. This Document grants authority to an individual, known as the Agent, to act on behalf of the Principal (the person creating the Power of Attorney) in financial matters.

Principal Information:

- Full Name: _______________

- Address: _________________

- City, State, Zip: _______________

- Phone Number: _______________

Agent Information:

- Full Name: _______________

- Address: _________________

- City, State, Zip: _______________

- Phone Number: _______________

Powers Granted:

This Document authorizes the Agent to act on the Principal’s behalf regarding the following matters, as initialed by the Principal:

- Real estate transactions __________

- Banking and other financial institution transactions __________

- Personal and family maintenance __________

- Tax matters __________

- Insurance and annuity transactions __________

- Retirement plan transactions __________

- Claims and litigation __________

- Social Security, employment, and military service benefits __________

Special Instructions: (Optional)

____________________________________________________________________________________

____________________________________________________________________________________

Validity and Durability:

This Durable Power of Attorney will become effective immediately and will continue to be effective even if the Principal becomes disabled, incapacitated, or incompetent.

Signatures:

This Document must be signed and dated by the Principal, the Agent, and a Notary Public to be valid.

Principal's Signature: _______________ Date: _______________

Agent's Signature: _______________ Date: _______________

State of California

County of _______________

On _______________, before me, __________________ (notary's name), personally appeared, _______________________, who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

Notary Public's Signature: _______________

My commission expires: _______________

PDF Form Characteristics

| # | Fact | Detail |

|---|---|---|

| 1 | Definition | A Durable Power of Attorney in California is a legal document that grants a chosen person the authority to act on another's behalf in financial matters, even if the principal becomes incapacitated. |

| 2 | Capacity | The person signing the Durable Power of Attorney, known as the principal, must be 18 years or older and mentally competent at the time of signing. |

| 3 | Governing Law | The California Probate Code sections 4000-4545 govern Durable Powers of Attorney in the state. |

| 4 | Agent's Authority | The appointed agent can handle tasks like managing bank accounts, signing checks, and buying or selling real estate, as specified in the document. |

| 5 | Duration | This power of attorney remains effective even if the principal becomes incapacitated, unless stated otherwise in the document or it is revoked. |

| 6 | Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent. |

| 7 | Witness Requirement | California requires the Durable Power of Attorney to be signed by two qualified witnesses or acknowledged by a notary public. |

| 8 | Co-Agents | The principal may appoint more than one agent to act together (jointly) or separately (severally) in making decisions. |

| 9 | Choice of Agent | The chosen agent should be someone the principal trusts deeply, as they will have significant control over financial decisions. |

| 10 | Limitations | The document must clearly state the powers granted. Some actions require specific authority to be granted in the Durable Power of Attorney. |

Detailed Instructions for Writing California Durable Power of Attorney

Filling out the California Durable Power of Attorney form is a responsible step towards ensuring your affairs can be handled according to your wishes, even if you are unable to manage them yourself. This document allows you to appoint someone you trust as an agent to make decisions and act on your behalf, especially in terms of financial matters. The process might seem daunting at first, but with clear instructions, you can complete it with confidence and ease.

Here are the steps you need to follow to fill out the California Durable Power of Attorney form:

- Start by reading the entire form carefully to understand the scope and implications of the document. This will help ensure that you're making informed decisions.

- Enter your full legal name and address in the designated sections at the top of the form. This identifies you as the principal, the person granting authority to someone else.

- Select and provide the name and contact information of the person(s) you wish to designate as your agent(s). You can choose more than one person, but you must specify whether they can act separately or must make decisions together.

- Detail the powers you are granting to your agent. The form may list various financial matters, such as managing bank accounts, real estate transactions, and personal property. If there are specific powers you do not wish to grant, you should clearly mark these exceptions.

- If you want your agent's authority to extend beyond your incapacity, make sure the form includes language that specifies the power of attorney is durable. Most forms will include this by default, but it's essential to verify.

- Indicate any special instructions or limitations regarding the powers granted to your agent. This could include temporal limits, geographical constraints, or specific directives about the management of certain assets.

- Choose a successor agent, if desired. This person would step in if your primary agent is unable or unwilling to fulfill their role.

- Review the form with your agent(s) to ensure they understand their responsibilities and are willing to accept them.

- Sign and date the form in front of a notary public. In California, notarization is usually required for the form to be legally binding.

- Have your agent(s) sign the form, if required by the document or preferred for additional legal assurance.

- Keep the original signed document in a safe place, and provide your agent(s) with a copy or let them know where it can be found in case it is needed.

Successfully completing and signing the California Durable Power of Attorney form empowers your chosen agent to act on your behalf, providing peace of mind and continuity in your financial affairs. Remember, it's always a good idea to consult with a legal professional if you have any questions or concerns about granting someone else this level of authority over your matters.

Things to Know About This Form

What is a California Durable Power of Attorney?

A California Durable Power of Attorney is a legal form that lets you appoint someone you trust to manage your financial affairs. This remains in effect even if you become unable to make decisions for yourself due to a medical condition or incapacity. The person you choose is called your agent, and they can do things like pay your bills, manage your investments, and make other financial decisions for you.

How do I choose an agent for my Durable Power of Attorney?

Choosing an agent is a significant decision. It should be someone you trust completely, as they will have a lot of control over your finances. Common choices include a spouse, relative, or close friend. Make sure the person you choose is willing to take on the responsibility and understands what will be required of them. It's also wise to have a candid conversation about your wishes and expectations.

What are the steps to complete a California Durable Power of Attorney?

Completing the form involves a few key steps:

- Choose your agent carefully.

- Fill out the form accurately, making sure to include all necessary details like the agent's contact information and the powers you are granting.

- Have the form notarized. In California, this helps to verify the authenticity of the document and the identity of the signer.

- Give copies to your agent and any financial institutions that might need it, like your bank.

Can I revoke or change my Durable Power of Attorney?

Yes, you can revoke or change your Durable Power of Attorney at any time as long as you are mentally competent. To do so, you should create a new document stating that the previous one is revoked and outline any new wishes or appoint a new agent. It's important to inform your previous agent and any institutions or parties that had a copy of the original document.

Does a Durable Power of Attorney cover medical decisions?

No, a Durable Power of Attorney in California is specifically for financial decisions. If you want to appoint someone to make healthcare decisions on your behalf, you will need a separate document known as an Advance Health Care Directive or Medical Power of Attorney. This is a crucial distinction to understand since both types of power of attorney play important roles in planning for future incapacity but cover different aspects of your life.

Common mistakes

Completing a Durable Power of Attorney form in California grants someone else the authority to act on your behalf in matters of finance and legal decisions, especially vital during times when you may be unable to do so. However, errors in filling out this form can lead to complications, delays, or even the form being considered invalid. To ensure the process goes smoothly, be aware of these common mistakes:

Not specifying powers clearly - People often fail to detail the exact powers they are granting, leading to confusion or misuse of the authority.

Forgetting to date the document - Without a date, it's challenging to determine when the powers were granted, possibly rendering the document invalid.

Choosing the wrong agent for the job - It's crucial to select an agent who is not only trustworthy but also capable of handling significant financial or legal tasks.

Not addressing alternative agents - Failing to name a successor can create a void if the original agent is unavailable or unwilling to act.

Ignoring the need for a witness or notary - Some states require witnessing or notarization for the form to be legally valid. Not adhering to this requirement can invalidate the document.

Signing without fully understanding the document - It's essential to comprehend all aspects of the form since it grants significant power over your affairs.

Mixing up with other Power of Attorney documents - Durable, Medical, and General Power of Attorney forms serve different purposes. Ensure you're filling out the right one.

Forgetting to specify when powers begin and end - Without clear directions, it might be unclear when the agent is authorized to act.

Not consulting a professional - Legal documents can be complex, and seeking professional advice can prevent errors and misunderstandings.

Lack of proper storage or sharing the document - Once completed, the document should be stored securely and shared with relevant parties to ensure it can be accessed when needed.

Avoiding these mistakes can streamline the process, making it clear and effective for everyone involved. Proper completion and understanding of the California Durable Power of Attorney form ensures that your affairs are in trusted hands, according to your wishes.

Documents used along the form

Managing one's affairs, especially in preparation for times when one may not be able to do so, involves more than just filling out a Durable Power of Attorney form. This crucial document allows an individual to appoint someone else to handle their financial matters if they become incapacitated. However, to ensure comprehensive planning and protection, several other forms and documents are often used alongside the California Durable Power of Attorney. Each plays a vital role in safeguarding a person's wishes and well-being.

- Advance Health Care Directive - This document lets individuals specify their wishes regarding medical treatment and care in situations where they can't communicate their desires themselves. It can also appoint a health care agent to make decisions on their behalf.

- Will - A will outlines how a person's assets and estate will be distributed upon their death. It's essential for preventing the state from deciding how to divide one's estate, ensuring that the individual's wishes are respected.

- Living Trust - A living trust allows individuals to manage their assets during their lifetime and stipulate how these assets should be handled after their death, often helping to avoid a lengthy probate process.

- Medical Information Release Form (HIPAA Release Form) - This legal document authorizes the release of medical records to designated individuals, ensuring that one's chosen agents have access to necessary health information.

- General Power of Attorney - Similar to a Durable Power of Attorney but not enduring in incapacity, this form allows someone else to make financial decisions on an individual's behalf, typically effective for a specific period or until revoked.

- Letter of Intent - Often used as a guiding document for executors and agents, this informal letter can detail the person’s wishes regarding the distribution of personal possessions or the management of certain tasks.

- Guardianship Designation - For individuals with minor children or dependents, this document is crucial for appointing a guardian in the event of the individual’s incapacity or death.

- Financial Records Organizer - Not an official legal document, but an organizer can be incredibly helpful for keeping track of accounts, policies, and contact information, making the agent's job easier.

- Funeral Directive - This document outlines preferences for funeral arrangements and final wishes, relieving loved ones of the burden of making these decisions during a difficult time.

- DNR (Do Not Resuscitate) Order - A medical order signed by a doctor, indicating that a person does not want to undergo CPR or advanced cardiac life support if their heart stops or they stop breathing.

In addition to the California Durable Power of Attorney, these documents form a comprehensive legal framework designed to ensure an individual's decisions regarding their estate, health care, and personal wishes are honored. Careful consideration and consultation with a legal professional can help in selecting and completing these documents to best suit each unique situation.

Similar forms

The California Durable Power of Attorney form shares similarities with the Advance Health Care Directive. Both documents allow an individual to appoint someone else to make decisions on their behalf. While the Durable Power of Attorney focuses on financial and legal matters, the Advance Health Care Directive pertains to medical decisions, including end-of-life care. This commonality of appointing a trusted agent links these documents, though their scopes are distinct.

Comparable to the Medical Power of Attorney, the Durable Power of Attorney also revolves around the concept of designated decision-making. However, the Medical Power of Attorney is specifically concerned with healthcare decisions, contrasting with the broader financial authority granted by the Durable Power of Attorney. This connection emphasizes the importance of having trusted individuals authorized to make crucial decisions in distinct areas of one’s life.

The General Power of Attorney form is another document related to the Durable Power of Attorney. Both documents empower an agent to act on the principal's behalf. The key difference lies in the durability clause; the Durable Power of Attorney remains effective even if the principal becomes incapacitated, which is not necessarily the case with a General Power of Attorney. This distinction addresses the need for sustained assistance despite the principal's health status.

The Limited Power of Attorney is similar in its basic function to the Durable Power of Attorney but with a narrower focus. While the Durable Power of Attorney can cover a wide range of actions, a Limited Power of Attorney specifies particular tasks or decisions the agent is authorized to make. This variation underscores the ability to customize the level of power granted to an agent based on the principal's needs and preferences.

Similarly, the Revocable Living Trust aligns with the Durable Power of Attorney in managing one’s affairs, particularly in avoiding probate. Both documents can ensure a smoother transition and management of the individual's assets during incapacitation or death. However, a Revocable Living Trust specifically addresses the handling and distribution of assets, whereas the Durable Power of Attorney might encompass broader financial management tasks.

The Springing Power of Attorney form is closely related to the Durable Power of Attorney with a conditional aspect. It only becomes effective upon the occurrence of a specific event, typically the principal’s incapacitation. This conditionality contrasts with the immediate effectiveness of many Durable Power of Attorney forms, providing a safeguard for those who prefer to maintain control over their affairs until incapacitation occurs.

The Financial Power of Attorney shares the Durable Power of Attorney's objective of managing an individual's financial affairs. Both grant an agent the authority to handle financial transactions on behalf of the principal. The distinction often lies in the scope of powers granted and the durability aspect, with the Durable Power of Attorney specifically designed to remain in effect even after the principal's incapacitation.

Banking and Stock Transactions Power of Attorney forms are specialized versions of the Durable Power of Attorney, focusing on financial matters pertaining specifically to banking and stock market activities. They exemplify how the broader authority of a Durable Power of Attorney can be tailored to specific types of financial transactions, allowing for a more focused approach to asset management.

Lastly, the Real Estate Power of Attorney resembles the Durable Power of Attorney by enabling an agent to manage or transact real estate on behalf of the principal. This similarity underlines the capacity to delegate broad or specific powers concerning one's property, whether for everyday management or specific transactions, thereby ensuring continuity in property affairs regardless of the principal’s capacity to manage them personally.

Dos and Don'ts

In the process of establishing a Durable Power of Attorney (DPOA) in California, individuals are empowered to appoint an agent to make legal and financial decisions on their behalf, should they become incapacitated. This document, vital in its function, demands careful attention to detail and understanding. Below are outlined several critical do's and don'ts that should be considered when completing the California Durable Power of Attorney form.

- Do thoroughly read every section of the form to ensure a comprehensive understanding of the powers being granted.

- Do choose someone you trust implicitly as your agent. This individual will have significant authority over your financial and legal matters, so it’s crucial they act in your best interest.

- Do clearly specify the scope of powers you are granting to your agent. Whether these powers are broad or limited, clarity is key to prevent any misunderstanding.

- Do consider appointing a successor agent. Life’s unpredictability means your first choice might not always be available, so having a backup ensures continuity.

- Do sign and date the form in the presence of a notary public. California law requires notarization for the Durable Power of Attorney to be legally binding.

- Do not leave any sections incomplete. An incomplete form can lead to confusion or disputes, potentially making the document unenforceable.

- Do not neglect to discuss your wishes and expectations with the person you’ve appointed as your agent. Effective communication is essential for ensuring your intentions are clearly understood and followed.

Adhering to these principles when filling out the California Durable Power of Attorney form can help in creating a clear, legally binding document that accurately reflects your wishes. Given the legal and personal complexities involved, seeking professional advice is also a wise step to ensure that all proceedings are conducted correctly, and your rights, along with those of your designated agent, are thoroughly protected.

Misconceptions

Many people have misunderstandings about the California Durable Power of Attorney form. It's essential to clear these up to ensure that your rights and intentions are properly protected and represented. Here are five common misconceptions:

All powers of attorney are the same. One common misconception is that all powers of attorney in California are identical. However, the "durable" aspect of a Power of Attorney means it remains effective even if the principal becomes incapacitated. This distinguishes it from a general power of attorney that becomes void if the person giving the power loses mental capacity.

It grants unlimited power. Another misunderstanding is the belief that the Durable Power of Attorney gives the agent absolute control over all the principal's affairs. In reality, it only grants the powers specifically listed in the document. The principal can limit or extend these powers according to their wishes.

It's effective immediately upon signing. Many assume that a Durable Power of Attorney is effective as soon as it is signed. While this can be true, the document can also be structured to only become effective upon the occurrence of a specific event, such as the incapacity of the principal, known as a "springing" Durable Power of Attorney.

Only seniors need it. Some believe that only elderly people need a Durable Power of Attorney. In reality, unforeseen circumstances such as accidents or sudden illnesses can happen at any age, making it wise for anyone to consider having a Durable Power of Attorney in place.

You can't revoke it. A widespread myth is that once a Durable Power of Attorney is signed, it cannot be revoked. However, as long as the principal is mentally competent, they can revoke or change their Durable Power of Attorney at any time.

By debunking these misconceptions, you can better understand how a Durable Power of Attorney functions in California and make informed decisions about your future and well-being.

Key takeaways

When preparing to fill out a California Durable Power of Attorney (DPOA) form, understanding its purpose and implications is crucial. This legal instrument allows you to appoint an agent, termed your "attorney-in-fact," to manage your financial and legal affairs should you become unable to do so yourself. Here are five key takeaways to consider:

- Select your agent carefully: The person you choose to act as your attorney-in-fact will have significant control over your finances and legal decisions. Ensure this person is trustworthy, willing to serve, and understands your wishes.

- Details matter: When filling out the form, clarity is key. Provide detailed information about the powers you are granting your agent. California law requires specificity, especially regarding the transactions your agent is authorized to handle on your behalf.

- Understand the powers granted: The DPOA can confer broad or limited powers, ranging from buying and selling property to managing bank accounts and filing taxes. Consider whether you want your agent to have general authority or only specific powers.

- Keep your document accessible: Once your DPOA is properly executed, keep it in a safe but accessible location. Inform your agent and any relevant financial institutions of its existence and location, so it can be used if necessary.

Executing a California Durable Power of Attorney is a responsible step in managing your affairs. It provides peace of when you know that, should the unforeseen happen, you have made provisions for a trusted individual to act in your best interests. As with any legal document, consider seeking the advice of a legal professional to ensure it fully captures your intentions and complies with California law.

More California Forms

Durable Power of Attorney Forms - This document can be tailored to fit your unique life situation, whether it's straightforward or more complex.

Ca Judicial Council Forms - In some jurisdictions, specific forms of service may be required, which should be detailed in the Affidavit of Service.