Legal California Deed in Lieu of Foreclosure Document

When homeowners in California find themselves unable to meet their mortgage obligations, they face a critical decision that can have long-lasting financial and legal implications. One of the pathways they might consider to avoid the often-drawn-out and credit-damaging process of foreclosure is opting for a Deed in Lieu of Foreclosure. This legal document essentially allows the borrower to transfer the ownership of their property back to the lender, effectively releasing them from their mortgage debt. While it appears to be a straightforward solution, the form and the process encompass various critical elements, including potential tax implications, the necessity for both parties' agreement, and the importance of understanding the impact on the borrower's credit score. Additionally, navigating through the legal nuances to ensure that the deed in lieu agreement clearly stipulates the terms, such as the full settlement of the debt and the handling of any junior liens on the property, requires careful consideration. This option, although not free of consequences, can be a mutually beneficial resolution for both lender and borrower under specific circumstances, making it essential for homeowners to fully grasp its major aspects.

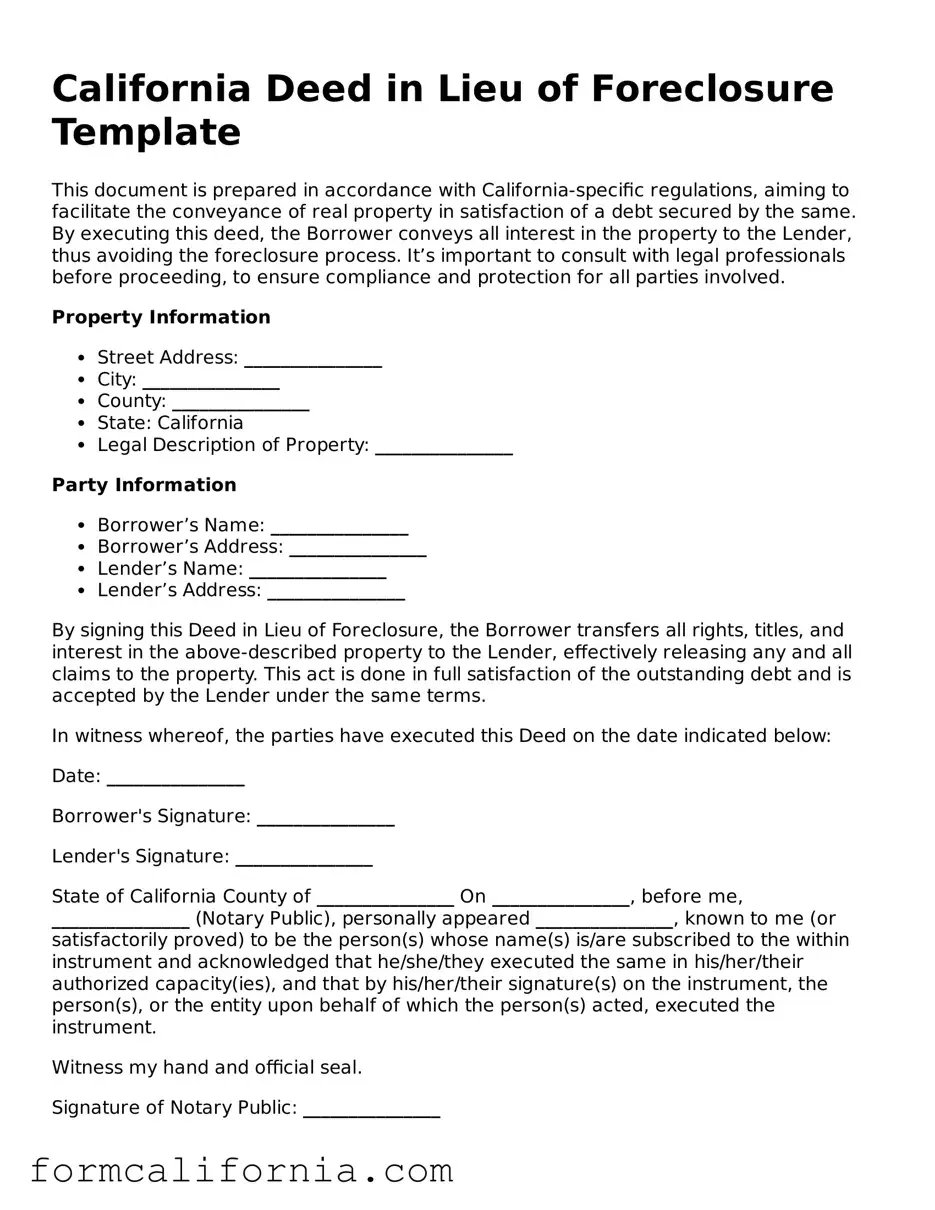

Document Preview Example

California Deed in Lieu of Foreclosure Template

This document is prepared in accordance with California-specific regulations, aiming to facilitate the conveyance of real property in satisfaction of a debt secured by the same. By executing this deed, the Borrower conveys all interest in the property to the Lender, thus avoiding the foreclosure process. It’s important to consult with legal professionals before proceeding, to ensure compliance and protection for all parties involved.

Property Information

- Street Address: _______________

- City: _______________

- County: _______________

- State: California

- Legal Description of Property: _______________

Party Information

- Borrower’s Name: _______________

- Borrower’s Address: _______________

- Lender’s Name: _______________

- Lender’s Address: _______________

By signing this Deed in Lieu of Foreclosure, the Borrower transfers all rights, titles, and interest in the above-described property to the Lender, effectively releasing any and all claims to the property. This act is done in full satisfaction of the outstanding debt and is accepted by the Lender under the same terms.

In witness whereof, the parties have executed this Deed on the date indicated below:

Date: _______________

Borrower's Signature: _______________

Lender's Signature: _______________

State of California County of _______________ On _______________, before me, _______________ (Notary Public), personally appeared _______________, known to me (or satisfactorily proved) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument, the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

Witness my hand and official seal.

Signature of Notary Public: _______________

PDF Form Characteristics

| Fact | Detail |

|---|---|

| Definition | A California Deed in Lieu of Foreclosure form is a legal document where a borrower voluntarily transfers title to the property to the lender to avoid foreclosure. |

| Governing Law | The process is governed by California Civil Code sections related to mortgage and foreclosure, primarily focusing on voluntary conveyance by the borrower to the lender. |

| Benefit to Borrower | It helps in avoiding the public notoriety and credit damage typically associated with foreclosure proceedings. |

| Benefit to Lender | The lender can save time and expense related to the foreclosure process. |

| Impact on Credit Score | While less damaging than a foreclosure, it can still negatively impact the borrower's credit score. |

| Possibility of Deficiency Judgement | Depending on the agreement, borrowers may still be liable for the difference between the loan balance and the property's sale price. |

| IRS Considerations | The borrower may face tax implications, as the cancellation of debt can be considered income by the IRS. |

| Alternative Solutions | Before proceeding, borrowers often consider loan modifications, short sales, or refinancing options. |

| Legal and Financial Advice | It is critical for both borrowers and lenders to seek legal and financial advice before entering into a deed in lieu agreement. |

Detailed Instructions for Writing California Deed in Lieu of Foreclosure

Filling out the California Deed in Lieu of Foreclosure form is a critical process that enables a homeowner to voluntarily transfer their property title to the lender to avoid the foreclosure process. It serves as an agreement that can significantly impact both the homeowner's and the lender's rights and responsibilities. Careful attention to detail and accuracy in completing the form are essential to ensure that the agreement is legally binding and reflects the true intention of the parties involved. Here are the steps needed to fill out the form effectively:

- Start by gathering all necessary information about the property, including the legal description, parcel number, and the precise names under which the property title is registered.

- Complete the top section of the form with the homeowner's full legal name(s), the current date, and the property address, including county.

- Enter the legal description of the property in the designated section. This information can usually be found on your current deed or mortgage documents.

- Specify the details of the lender (also known as the grantee) that will be receiving the property's title. Include the lender’s legal business name and address.

- If the form includes sections for representations or warranties, carefully review and fill them out according to your agreement and understanding with the lender. This may require disclosing certain conditions or aspects of the property.

- Include any additional terms or conditions that have been agreed upon between you and the lender regarding the transfer of the property. This might involve specific stipulations regarding the handling of any junior liens or other encumbrances on the property.

- Review the document thoroughly to ensure all information is accurate and complete. Misinformation or omissions can lead to legal complications down the line.

- Sign and date the form in the presence of a notary public. The presence of a notary ensures that the document is legally acknowledged and can be considered valid in the eyes of the law.

- Submit the duly completed and notarized form to the lender for review and acceptance. The lender will also need to execute the document for it to be effective.

- Once accepted by the lender, file the deed with the county recorder’s office in the county where the property is located to officially transfer the title and complete the process.

Following these steps meticulously will help ensure that the Deed in Lieu of Foreclosure is filled out correctly and efficiently, paving the way for a smoother transition and resolution to a challenging situation. It’s beneficial for homeowners to seek guidance from a legal professional to navigate this process and ensure that their rights are protected throughout.

Things to Know About This Form

What is a Deed in Lieu of Foreclosure in California?

A Deed in Lieu of Foreclosure is a legal document in California that allows a homeowner to transfer the ownership of their property back to the lender. This process is initiated to avoid the foreclosure process when the homeowner can no longer make their mortgage payments. It's an agreement that can offer a more graceful exit for borrowers facing financial hardship, potentially reducing the negative impact on their credit compared to a foreclosure.

Who can qualify for a Deed in Lieu of Foreclosure?

Typically, homeowners who are facing foreclosure due to financial hardship, such as a significant loss of income, divorce, or medical emergencies, may qualify. Lenders may require that the property is on the market for a certain period without sale and that all other loss mitigation options, like loan modification, have been exhausted before agreeing to a Deed in Lieu of Foreclosure.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

- It can decrease the homeowner's financial burden more quickly.

- It usually involves less paperwork and fewer legal proceedings compared to foreclosure.

- It may have a less severe impact on the homeowner's credit score.

- It helps avoid the public notice of foreclosure, providing a more private resolution.

Are there any potential downsides to a Deed in Lieu of Foreclosure?

While there are benefits, homeowners should also be aware of potential downsides such as possible tax implications, as the forgiven mortgage debt could be considered taxable income. Additionally, not all lenders may agree to a Deed in Lieu of Foreclosure, and it could still negatively impact credit scores, though typically less than a foreclosure.

How does the process for a Deed in Lieu of Foreclosure work in California?

- The homeowner contacts their lender to express interest in a Deed in Lieu of Foreclosure.

- The lender will then assess the homeowner's financial situation and eligibility.

- If approved, both parties will negotiate the terms and prepare the necessary paperwork.

- The homeowner formally surrenders the property by signing the Deed in Lieu of Foreclosure, transferring ownership back to the lender.

- The process is finalized through legal documentation, and the homeowner is released from their mortgage obligation.

Can a Deed in Lieu of Foreclosure cancel all debts on the property?

Not always. While a Deed in Lieu can cancel the original mortgage, any secondary liens or debts secured by the property may not be discharged. Homeowners should negotiate with all lienholders or consult with a legal professional to understand the full scope of their financial obligations.

Does a homeowner need a lawyer to complete a Deed in Lieu of Foreclosure?

While it's not legally required to have a lawyer, consulting with a legal professional can provide critical advice and ensure the process is handled correctly. An attorney can also help negotiate terms and protect the homeowner's interests, especially when addressing any potential tax implications or negotiating with lienholders.

How does a Deed in Lieu of Foreclosure affect a homeowner's credit score?

A Deed in Lieu of Foreclosure does impact a homeowner's credit score but typically less severely than a foreclosure. The exact effect can vary based on the individual's overall credit profile. It's advisable to consult with a financial advisor or credit counseling service to understand the potential impact fully.

Can a homeowner get a mortgage after completing a Deed in Lieu of Foreclosure?

Yes, homeowners can potentially secure a mortgage after a Deed in Lieu of Foreclosure, though there may be waiting periods imposed by lenders. These waiting periods can range from two to seven years, depending on the circumstances of the Deed in Lieu and the lender's policies. Improving credit scores and financial stability during this time can help qualify for future mortgages.

Common mistakes

-

Not consulting with a legal advisor can lead individuals into misunderstandings about the implications of a Deed in Lieu of Foreclosure. Without professional guidance, they might overlook important considerations, such as the impact on their credit scores and potential tax consequences. It's paramount that individuals understand the legal, financial, and tax ramifications fully before proceeding.

-

Omitting necessary documentation often stands as a stumbling block. The form requires attachments, such as proof of the current mortgage, any agreements with the lender, and a hardship letter explaining why the homeowner can no longer make payments. Failure to include these documents can delay or void the process, leaving the homeowner in a precarious position.

-

Incorrectly filling out personal information, including the legal description of the property, might seem like a minor oversight, but it can have significant repercussions. Such errors can lead to disputes about the property’s boundaries or even nullify the entire agreement. Accuracy is crucial in ensuring the deed transfer is legally binding and recognized.

-

Assuming the completion of the form absolves all debts related to the property is a common misunderstanding. In some cases, if the sale of the property doesn’t cover the mortgage balance, the lender might pursue a deficiency judgment. Hence, it is essential to have an agreement with the lender that the deed in lieu satisfies the debt in full, which should be clearly documented.

Important: This guidance provides a general overview and should not be construed as legal advice for any specific situation. Each case has unique aspects that might affect the outcome differently. Therefore, seeking personalized advice from a qualified professional is strongly advised to navigate the complexities of this process.

Documents used along the form

In the state of California, when a homeowner faces the prospect of foreclosure due to an inability to keep up with mortgage payments, one option that may be considered is a deed in lieu of foreclosure. This process involves the homeowner voluntarily transferring the ownership of their property to the lender to satisfy the loan and avoid the foreclosure process. Alongside the California Deed in Lieu of Foreclosure form, there are several key documents that are typically used to ensure the agreement is properly documented and legally binding. These documents help to clarify the terms of the agreement, provide proof of the transaction, and protect the rights of both parties involved.

- Hardship Letter: This document provides a detailed account of the homeowner’s financial difficulties and explains why they are unable to continue making payments on their mortgage. It should be honest and thorough, as it plays a critical role in the lender's decision to accept a deed in lieu of foreclosure.

- Estoppel Affidavit: This affidavit outlines the terms and conditions of the deed in lieu of foreclosure agreement. It includes statements confirming that the transaction is voluntary and that both parties understand the terms. It serves as a critical piece of evidence verifying the mutual consent for the agreement.

- Loan Payoff Statement: A loan payoff statement gives a detailed account of the total amount owed by the homeowner, including any outstanding mortgage balance, accrued interest, and other fees. It is essential for establishing the exact financial obligations being satisfied by the transfer of property.

- Property Appraisal Report: An appraisal report provides an estimate of the property's fair market value. This document is crucial for the lender to assess whether the property’s value is sufficient to cover the outstanding balance of the loan, potentially influencing the decision to accept the deed in lieu of foreclosure.

When opting for a deed in lieu of foreclosure, it is vital for the homeowner and lender to carefully prepare and review these documents. The process, while offering a way to avoid the more damaging effects of foreclosure, requires clear communication, transparency, and strict adherence to legal protocols to protect the interests of both parties. For homeowners considering this option, obtaining legal advice to fully understand the implications and the process is highly advised.

Similar forms

A Loan Modification Agreement is similar to the California Deed in Lieu of Foreclosure form, as both serve as alternatives to foreclosure for homeowners struggling to make their mortgage payments. The key difference lies in their approach: while a Deed in Lieu of Foreclosure involves transferring the property's title from the homeowner to the lender, a Loan Modification Agreement alters the original terms of the mortgage to make the payments more manageable for the borrower, without changing the ownership of the property.

Mortgage Forbearance Agreement shares parallels with the Deed in Lieu of Foreclosure, since both offer temporary relief for homeowners facing financial difficulties. In a Mortgage Forbearance Agreement, the lender agrees to reduce or suspend mortgage payments for a set period, giving the homeowner time to improve their financial situation. However, unlike a Deed in Lieu, the homeowner retains the property and must catch up on payments once the forbearance period ends.

Short Sale Agreement also presents similarities with a Deed in Lieu of Foreclosure. Both are options for homeowners who cannot afford their mortgage, allowing them to avoid foreclosure. In a short sale, the property is sold for less than the outstanding balance on the mortgage, and the proceeds go to the lender. This differs from a Deed in Lieu, where the homeowner simply transfers ownership of the property to the lender without a sale occurring.

Quitclaim Deed is related to the Deed in Lieu of Foreclosure in the sense that both involve the transfer of property rights. With a Quitclaim Deed, one party (the 'grantor') transfers their interest in a property to another party (the 'grantee') without warranties or guarantees about the title's quality. This is less formal than a Deed in Lieu, which specifically addresses settling a debt with the property and usually involves a lender as the recipient.

Assumption Agreement can be compared to a Deed in Lieu of Foreclosure, as both involve a change in responsibility for the mortgage. An Assumption Agreement allows a new borrower to take over the loan payments of the existing borrower, subject to the lender's approval, effectively transferring the debt obligation. This contrasts with a Deed in Lieu, where the homeowner gives up the property to extinguish the debt, not transferring the debt responsibility to another party.

Reinstatement Agreement bears resemblance to the Deed in Lieu of Foreclosure because it provides a way for homeowners to address default on a mortgage. It allows the homeowner to pay a lump sum by a specific date to bring the mortgage current, as opposed to transferring property ownership to the lender. This agreement seeks to remedy the default and retain homeownership, unlike the finality of a Deed in Lieu.

Release of Liability Agreement is akin to the Deed in Lieu of Foreclosure because it involves relieving a party from an obligation. In the context of a mortgage, after transferring the property through a Deed in Lieu, the borrower might seek a Release of Liability to ensure they are no longer responsible for the debt associated with the property. While Release of Liability can apply to various contexts, its principle of discharging an obligation parallels the debt resolution aspect of a Deed in Lieu.

Property Settlement Agreement in a divorce context is somewhat analogous to the Deed in Lieu of Foreclosure form. Both involve the transfer of property under specific circumstances. In a Property Settlement Agreement, assets, including real estate, are divided between spouses as part of a divorce settlement. Similar to a Deed in Lieu, it can involve transferring property titles but within the framework of dissolving a marital relationship, not settling a debt with a lender.

Dos and Don'ts

When facing the challenge of filling out the California Deed in Lieu of Foreclosure form, it's essential to approach the process with care and attention to detail. This legal document, which allows a homeowner to transfer the ownership of their property to the lender voluntarily to avoid foreclosure, requires precision and a clear understanding of the terms. Here are eight crucial do's and don'ts to consider:

- Do thoroughly read and understand the terms before signing. This document significantly impacts your financial and legal situation.

- Do ensure all the information provided is accurate and complete, including personal details and the property description.

- Do consult with a legal advisor or a professional. Their guidance can be invaluable in navigating this complex process.

- Do keep a copy of the filled-out form for your records. This document is crucial for your personal records and any future disputes or clarifications.

- Don't leave any sections blank. If a section does not apply, indicate this with “N/A” (not applicable) to show that it has been considered.

- Don't rush through the form without understanding each part. Misunderstandings can lead to errors that complicate your situation.

- Don't forget to notify all involved parties, including co-owners or lienholders, about the deed in lieu of foreclosure. Their consent may be required.

- Don't underestimate the importance of deadlines. Submitting the form in a timely manner is essential to its acceptance and to prevent potential legal complications.

Properly handling the California Deed in Lieu of Foreclosure form can provide a path away from foreclosure, but it's a path that requires careful consideration and deliberate action. By following these guidelines, individuals can navigate the process more effectively and secure a better outcome for their financial future.

Misconceptions

When it comes to the process of managing distressing mortgage situations in California, a Deed in Lieu of Foreclosure often comes up as a possible solution. However, there are numerous misconceptions about how this form works and its implications for both the borrower and the lender. Understanding these misconceptions is crucial for anyone involved in such a process.

It Completely Releases You From Financial Obligation: Many people believe that by signing a Deed in Lieu of Foreclosure, they are entirely free from any financial obligations related to the mortgage. While it can eliminate the mortgage debt, it does not necessarily release the debtor from all financial responsibilities. There may still be tax implications or recourse loans that require attention.

It’s a Quick Process: Another common misconception is that the process is quick and can resolve the issues immediately. In reality, this process involves negotiation between the borrower and the lender, which can take time. Also, the lender has to agree to accept the deed in lieu, which is not always the case.

It Has No Impact on Your Credit Score: This is a misunderstanding. While it may have a less severe impact than a foreclosure, a deed in lieu of foreclosure can still negatively affect your credit score. Lenders report it to credit bureaus as a settlement which can decrease your score.

It’s Available to All Borrowers: Not everyone facing foreclosure can take advantage of a Deed in Lieu of Foreclosure. Lenders typically consider it only when the borrower has made every effort to sell the home at market price and has been unable to do so. Additionally, the home must usually be free of any other liens or encumbrances.

All Lenders Must Offer It: There's a common belief that all lenders are required to offer a Deed in Lieu of Foreclosure as an option to struggling homeowners. However, it's at the lender's discretion to accept or deny this alternative to foreclosure based on their policies and the borrower's situation.

It Will Always Stop the Foreclosure Process: While a Deed in Lieu of Foreclosure is intended to avoid foreclosure, there are instances where the process doesn’t stop. If the agreement is not finalized or the lender decides not to go through with it, foreclosure proceedings may continue.

In conclusion, entering into a Deed in Lieu of Foreclosure agreement in California comes with complex negotiations and implications. Homeowners considering this option should thoroughly understand the process, consult with a legal advisor, and consider all possible outcomes and obligations that may arise.

Key takeaways

Understanding the California Deed in Lieu of Foreclosure form is crucial for homeowners facing financial difficulties. This process allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure. Here are key takeaways to consider:

- Eligibility is Critical: Not all homeowners qualify for a deed in lieu of foreclosure. Lenders typically require that the homeowner has explored all other options, such as loan modification or refinancing.

- Financial Implications: Homeowners should carefully assess the financial implications, including possible tax consequences. Forgiveness of debt may be considered taxable income by the IRS.

- Impact on Credit Score: While a deed in lieu of foreclosure may have a less adverse effect on a credit score compared to foreclosure, it will still negatively impact the homeowner’s credit.

- Negotiation of Terms: The terms of a deed in lieu agreement can sometimes be negotiated. Homeowners might negotiate the terms of debt forgiveness, seek a relocation allowance, or request that the lender not pursue a deficiency judgment.

Complete and Accurate Documentation : Accurately completing the form and providing all required documentation is essential. Omissions or errors can delay or derail the process.- Legal and Tax Advice: Seeking advice from legal and tax professionals is highly recommended. These professionals can provide guidance tailored to an individual’s specific circumstances.

- Consideration of Other Liens: The existence of other liens or encumbrances on the property can complicate a deed in lieu of foreclosure. All liens must be addressed before the process can proceed.

Ultimately, a deed in lieu of foreclosure is a substantial legal action that carries significant financial implications. Homeowners should approach this option with full awareness of the benefits and risks involved. The guidance of professionals in making informed decisions about this process is invaluable.

More California Forms

Affidavit of Death of Joint Tenant California - For business owners, it's crucial in facilitating the transition of ownership or control as per the deceased’s wishes.

California Apartment Rental Application - The consistency of the application process, facilitated by this form, ensures that all applicants are evaluated based on the same criteria, promoting fairness.