Legal California Deed Document

In the realm of property transactions within California, the deed form stands as a pivotal document, encapsulating the essentials of real estate transfers. This instrument, serving both as a proof and a vehicle of property ownership change, embodies the legalities necessary to ensure a smooth transition from one owner to another. It encompasses a variety of key details such as the identification of the parties involved, a precise description of the property, and the terms under which the property is transferred. Given the diversity of property types and the intricacies of real estate law in California, the deed form adopts several forms to cater to specific needs — whether it be a warranty deed, granting broad guarantees about the property's title, or a quitclaim deed, offering no assurances but merely transferring whatever interest the grantor has in the property. By thoroughly understanding the significance and the proper use of these forms, parties in a real estate transaction can navigate the transfer process with greater confidence and legal protection.

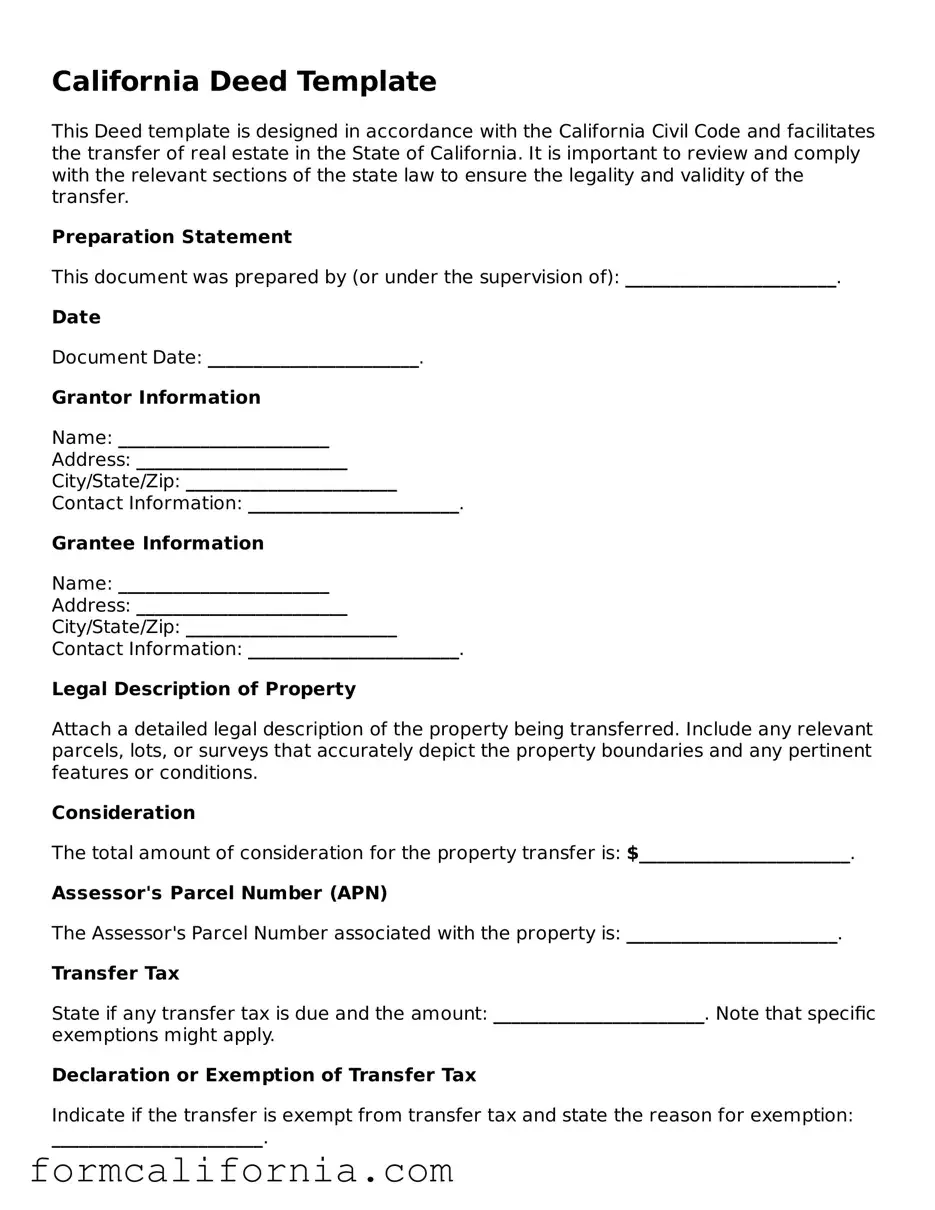

Document Preview Example

California Deed Template

This Deed template is designed in accordance with the California Civil Code and facilitates the transfer of real estate in the State of California. It is important to review and comply with the relevant sections of the state law to ensure the legality and validity of the transfer.

Preparation Statement

This document was prepared by (or under the supervision of): _______________________.

Date

Document Date: _______________________.

Grantor Information

Name: _______________________

Address: _______________________

City/State/Zip: _______________________

Contact Information: _______________________.

Grantee Information

Name: _______________________

Address: _______________________

City/State/Zip: _______________________

Contact Information: _______________________.

Legal Description of Property

Attach a detailed legal description of the property being transferred. Include any relevant parcels, lots, or surveys that accurately depict the property boundaries and any pertinent features or conditions.

Consideration

The total amount of consideration for the property transfer is: $_______________________.

Assessor's Parcel Number (APN)

The Assessor's Parcel Number associated with the property is: _______________________.

Transfer Tax

State if any transfer tax is due and the amount: _______________________. Note that specific exemptions might apply.

Declaration or Exemption of Transfer Tax

Indicate if the transfer is exempt from transfer tax and state the reason for exemption: _______________________.

Signature of Parties

The Grantor(s) and Grantee(s) need to sign the Deed in the presence of a Notary Public to validate the document.

Notary Acknowledgment

A Notary Public must acknowledge the signing of this document. This includes:

- The date of acknowledgment.

- The notary's name and seal.

- A statement that the Grantor(s) appeared before them and signed the Deed.

Recording

After the completion and signing of the Deed, it must be recorded with the County Recorder's Office in the county where the property is located. Recording fees will apply, and the document must meet specific county standards for recording.

Witness Clause

The document should be witnessed by two individuals who are not parties to the transfer. Their names, addresses, and signatures should be included.

PDF Form Characteristics

| # | Fact About California Deed Forms | Governing Law(s) |

|---|---|---|

| 1 | California deed forms are legal documents used to transfer real estate ownership from the seller (grantor) to the buyer (grantee). | California Civil Code Sections 1091-1093 |

| 2 | There are several types of deeds in California, including General Warranty Deed, Grant Deed, and Quitclaim Deed, each serving different purposes. | California Civil Code Section 1113 |

| 3 | To be legally effective, a California deed must be in writing, contain a legal description of the property, and be signed by the grantor. | California Civil Code Sections 1624, 1091 |

| 4 | Deed forms in California require a notary public's acknowledgment to be recorded in the county where the property is located. | California Government Code Section 27201 |

| 5 | California law mandates that all deeds must be recorded with the county recorder to provide public notice of the property transfer and protect the grantee's title. | California Government Code Section 27280 |

| 6 | The California Documentary Transfer Tax Act requires payment of a tax upon recording a deed, with tax amounts varying by locality. | California Revenue and Taxation Code Section 11901-11934 |

Detailed Instructions for Writing California Deed

When it comes to transferring property ownership in California, the process is formalized through a document known as a deed. This guide offers step-by-step directions for correctly filling out the California Deed form, ensuring the transition is smooth and legally binding. Completing this form is a crucial step in the process, requiring attention to detail to avoid any errors that might complicate or invalidate the property transfer.

- Firstly, identify the type of deed required for your situation. California offers several types, including a Warranty Deed, Grant Deed, and Quitclaim Deed. Each serves a different purpose, so selecting the correct type is crucial.

- Enter the name(s) of the current property owner(s) as the grantor(s) in the designated section. Make sure to use the full legal name(s) as recorded in previous property documents.

- Specify the grantee(s), or the person(s) receiving the property, including their full legal name(s) and mailing address(es). The correct identification of parties is essential for the legal transfer.

- Include the legal description of the property. This description goes beyond the street address, outlining the precise boundaries and details as recorded in the county’s official records. You may need to consult previous property documents or a professional to accurately complete this section.

- State the monetary consideration, if applicable. This refers to the amount of money being exchanged for the property. If the property is a gift, you should state that as the consideration.

- Have the grantor(s) sign the deed. Depending on the type of deed and local regulations, you may need a notary public to witness the signing. Ensuring the deed is properly signed is key to its validity.

- Finally, file the completed deed with the local county recorder’s office. This step is critical, as it officially records and recognizes the transfer, making it a matter of public record. There may be a filing fee, so it’s wise to check in advance.

After filling out the form and submitting it to the county recorder’s office, the property transfer process is nearly complete. What follows is a waiting period during which the office processes your submission, culminating in the official recording of the deed. This is a crucial legal step, confirming the change in ownership and protecting the rights of all parties involved. Properly completing and submitting the deed form is a significant milestone in the property transfer process, paving the way for a successful transition.

Things to Know About This Form

What is a California Deed form?

A California Deed form is a legal document used to transfer ownership of real property from one party (the grantor) to another (the grantee). It is a crucial document in the process of buying or selling property in California and must include specific information to be valid under state law.

What are the different types of Deed forms available in California?

There are several types of Deed forms used in California, each serving different purposes:

- Grant Deed - A commonly used deed that transfers ownership with implied warranties about the title.

- Warranty Deed - Similar to a Grant Deed, but with express warranties about the title, providing greater protection to the buyer.

- Quitclaim Deed - Transfers any interest the grantor has in the property without any title warranty, often used amongst family members or to clear title issues.

- Trustee's Deed - Used when property is transferred from a trust.

- Deed of Trust - Essentially a security instrument for a loan on real property, involving a borrower, lender, and trustee.

What information must be included on a California Deed form?

To ensure a Deed form is legally valid in California, it must include several key pieces of information, such as:

- The names and addresses of the grantor and grantee.

- A legal description of the property being transferred.

- The signature of the grantor, notarized to verify its authenticity.

- A statement of consideration, indicating the value exchanged for the property.

How is a California Deed form legally validated?

For a Deed to be legally effective in California, the grantor must sign the Deed, and this signature must be acknowledged before a notary public. Additionally, the Deed must be filed with the county recorder in the county where the property is located. This process of recording gives constructive notice to the public of the transfer and is essential for the protection of all parties involved.

Can I prepare a California Deed form myself?

While individuals can prepare their own Deed forms, it is highly recommended to seek professional legal assistance. This is due to the complexity of real estate laws and the specific requirements needed to ensure the Deed is valid. A mistake in the form or the filing process can have significant legal consequences, potentially affecting the validity of the property transfer.

What common mistakes should be avoided when preparing a California Deed form?

Several common errors can jeopardize the validity of a Deed form, such as:

- Leaving out mandatory information or providing incorrect details.

- Failing to properly acknowledge the signature before a notary.

- Using the wrong type of Deed for the transaction.

- Not recording the Deed with the appropriate county recorder.

Where can I find a California Deed form?

California Deed forms can be obtained from several sources, including legal stationery stores, online legal forms websites, and the county recorder's office. It's important to ensure that the form is current and complies with California law. Considering the importance of this legal document, consulting with a real estate lawyer to obtain or review a Deed form is advised for most individuals.

Common mistakes

When filling out a California Deed form, attention to detail is crucial. However, many people tend to overlook certain aspects or commit errors that could potentially affect the document's effectiveness or legal standing. Here are eight common mistakes:

Not using the correct Deed form: California has different types of deeds for various purposes, including Grant Deeds, Warranty Deeds, and Quitclaim Deeds. Selecting the wrong form can lead to unintended legal consequences.

Failing to provide complete information for all parties involved: Every person or entity part of the transaction, whether they are granting or receiving the property, needs to have their full legal name and address accurately listed.

Omitting the assessor's parcel number (APN): This specific number is essential for identifying the property in county records, and its absence can delay or complicate the recording process.

Leaving out the legal description of the property: Besides the property's address, a detailed legal description is required. This description often includes lot, block, and tract numbers and must match the description used in previous deeds.

Incorrectly stating the conveyance terms: The deed form should clearly state the terms under which the property is being transferred, including any conditions or warranties. Misstating these terms can affect the recipient's rights.

Not having the deed signed in the presence of a notary public: For a deed to be legally valid, it must be signed by the grantor(s) (the person(s) transferring the property) in the presence of a notary public.

Forgetting to record the deed with the County Recorder's Office: After the deed is signed and notarized, it must be officially recorded to be legally effective. Failure to record the deed can lead to disputes and challenges to property ownership.

Ignoring tax implications: Transfer of property ownership can have tax ramifications. It's important to understand and address any potential property or capital gains taxes that could be due as a result of the transfer.

By avoiding these mistakes, individuals can ensure their property transfer proceeds more smoothly and is acknowledged appropriately by California legal standards.

Documents used along the form

In the process of transferring property in California, a deed form is a crucial document, but it's rarely the only paper you'll need. Several other forms and documents typically accompany the deed form to complete the transaction thoroughly and ensure all legal bases are covered. Understanding these documents can simplify the process, making it more straightforward for everyone involved.

- Preliminary Change of Ownership Report (PCOR): This form is filled out by the buyer or the transferee and is required by the county assessor's office. It provides details about the new owner and the sale, helping the office assess property taxes correctly.

- Transfer Tax Declarations: When transferring property, many jurisdictions require a declaration of the transfer tax, which is based on the property’s sale price. This document calculates and records the applicable taxes.

- Grant Deed: A specific type of deed that is often used in California to transfer real property. It includes a promise that the seller hasn’t transferred the property to someone else and that the property is free from hidden encumbrances.

- Quitclaim Deed: Used to transfer any interest in real property that the grantor may have, without any promise or guarantee about the extent of the interest being transferred or even if such an interest exists.

- Notice of Completion: After any construction or significant renovation on the property, this document can be filed to start the clock on any mechanic's liens, providing a clear timeline for contractors to claim any unpaid dues.

- Title Insurance Policy: While not always required, buyers often obtain title insurance as a protective measure. This policy insures against financial loss from defects in title to real property and from the invalidity or unenforceability of mortgage loans.

Completing a real estate transaction involves careful coordination and submission of the appropriate documentation. The California Deed form is just the starting point. The additional documents listed ensure that property rights are accurately recorded and transferred, protecting all parties involved in the transaction. Familiarity with these forms can facilitate a smoother transfer process, contributing to an efficient and lawful conclusion.

Similar forms

The California Grant Deed form shares similarities with the Warranty Deed found in other states. Both documents serve the purpose of transferring property ownership with some level of guarantee about the property's title. Specifically, the Grant Deed ensures that the property has not been sold to someone else and is free from specific encumbrances, except those noted on the deed. Meanwhile, the Warranty Deed goes a step further by offering broader assurances, including protection against any title defects, even if these were unknown to the seller.

Another document similar to the California Deed form is the Quit Claim Deed. This form is used to transfer whatever interest someone might have in a property without making any promises about the property's title. It is often used between family members or to clear up a title issue. Unlike the Grant Deed, which provides certain assurances about the title, the Quit Claim Deed offers no guarantees, making it a quicker but riskier option for property transfer.

The Trust Transfer Deed is also related to the California Deed form but is specifically used in the context of transferring property to or from a trust. Like a Grant Deed, it can be used to ensure that a property is transferred with certain protections regarding title claims. However, its use is more specialized, focusing on the needs of estate planning and ensuring the smooth transition of property ownership according to the trust's terms.

The California Deed of Trust represents yet another document with similarities. This document acts as a security for a loan on real estate, where the property is technically transferred to a trustee. Unlike the simple property transfer envisioned by a Grant Deed, a Deed of Trust involves three parties and serves a specific function related to financing. It does not transfer property ownership in the traditional sense but places a lien on the property as collateral for a loan.

The Reconveyance Deed is related to the Deed of Trust and comes into play once a loan secured by a Deed of Trust is paid off. It transfers the property title from the trustee back to the property owner, effectively clearing the lien created by the Deed of Trust. While it does not transfer property between sellers and buyers, it is a crucial step in fully restoring clear property ownership after a loan has been satisfied.

Lastly, the Easement Deed bears resemblance to the California Deed form in that it involves the transfer of a property interest. However, rather than transferring full ownership, an Easement Deed grants a right to use a portion of the property for a specific purpose, such as installing utilities or accessing a public road. While it changes the property's title to reflect this right, the actual ownership and control of the property remain largely with the original owner, differentiating it from the broader transfer of rights envisioned by a Grant Deed.

Dos and Don'ts

When filling out the California Deed form, there are specific actions that individuals should either ensure they do or avoid. Being aware of these can help streamline the process, making it more straightforward and less susceptible to errors or delays. Below are lists of what you should and shouldn't do.

Do:

- Verify the legal description of the property. Ensure it matches exactly with the description in the current deed or title report.

- Use the correct deed form for your transaction, as different situations require different forms.

- Print or type the information clearly in black ink to ensure legibility.

- Include all necessary parties in the deed. Both the grantor(s) (seller) and grantee(s) (buyer) must be correctly identified.

- Have the deed signed in the presence of a notary public. The notary must acknowledge the signing for it to be valid.

- Check if county-specific requirements exist. Some counties have additional filing requirements or forms.

- Double-check all entered information for accuracy before signing. Mistakes can lead to legal complications or the need for correction deeds.

- Consider consulting with a real estate attorney if the transaction is complex or if you have legal questions.

- Record the deed with the county recorder’s office where the property is located to make it official and public record.

Don't:

- Forget to include the Assessor’s Parcel Number (APN) when completing the form. This number is crucial for property identification.

- Leave blank spaces. If a section does not apply, fill in with “N/A” or “Not Applicable”.

- Overlook the need for witness signatures if required by local law or custom aside from the notary acknowledgment.

- Mistake the grantee’s mailing address for the property address. Ensure that both addresses are accurately provided where required.

- Delay in recording the deed. Once the deed is signed and notarized, promptly record it to protect against claims from others.

- Use correction fluid or tape on the deed form. If you make a mistake, start a new form to keep the document clear and unaltered.

- Assume you understand all the legal implications without seeking proper advice. Real estate laws can be complex.

- Rely solely on generic forms found online without verifying their compliance with California laws.

- Ignore the potential for tax implications. Transferring real property can have significant tax consequences for both parties.

Misconceptions

When it comes to transferring property, the California Deed form plays an essential role. However, misunderstandings about its use and requirements are common. Here are 10 common misconceptions about the California Deed form explained.

All property transfers require the same type of deed: In California, various types of deeds are used, depending on the circumstances of the transfer. These include, but are not limited to, grant deeds, quitclaim deeds, and warranty deeds, each serving different purposes and offering varying levels of protection to the buyer.

Filling out a deed form is enough to complete the transfer: Completing the deed form is only one step in the property transfer process. The deed must also be signed, notarized, and, most importantly, recorded with the county recorder's office where the property is located to be legally effective.

Notarization is optional: Notarization is a mandatory step in California for a deed to be considered valid. This process verifies the identity of the signatories and confirms that signatures were made willingly and without duress.

A deed must be recorded immediately to be valid: While prompt recording of a deed is highly recommended to ensure the transfer is documented and to protect against conflicting claims, the validity of the deed itself is not dependent upon immediate recording.

The information on a deed cannot be changed once recorded: Errors or changes in circumstances can necessitate amendments to a recorded deed. This is typically achieved by recording a new deed with the corrected or updated information.

Only property owners can complete and sign a deed: While property owners are most commonly involved in signing the deed, representatives or agents authorized through a power of attorney or similar legal authority may also execute deeds on behalf of the owners.

The deed form is the same across all California counties: While the overall content required on deeds is consistent, certain counties may have specific requirements or forms. Always verify with the local county recorder to ensure compliance with local regulations.

A lawyer is not necessary to complete a deed: Although it is possible to complete a deed without legal assistance, consulting with a lawyer can greatly benefit individuals unfamiliar with real estate law and the deed transfer process. Lawyers can provide crucial advice, prevent errors, and ensure that the transfer aligns with the individual's broader legal and financial interests.

Electronic signatures are not permitted on California deeds: As of the latest information available, California does allow for electronic signatures on deeds under specific conditions. However, the acceptance and requirements for electronic signing can vary, so it is important to verify current standards and practices with the county recorder.

Deeds only apply to real estate: While deeds are primarily used to transfer real estate, they can also be utilized in transferring other types of real property, such as certain types of tangible personal property that are significant in nature. However, real estate transfers are by far the most common use for deeds.

Understanding the nuances of California's deed forms can simplify the property transfer process and help avoid common pitfalls. Always ensure that you are working with the most current forms and requirements, and consider seeking professional advice when needed.

Key takeaways

Filling out and using the California Deed form is a critical process in the transfer of property ownership within the state. Whether you’re a seller transferring property to a buyer or a property owner transferring ownership to a family member, understanding the key aspects of this form is essential to ensure a smooth and legally compliant transaction. Here are ten key takeaways to keep in mind:

- Choose the Right Type of Deed: California offers several types of deeds including General Warranty, Grant, and Quitclaim Deeds. Select the one that best suits your transaction based on the level of protection and guarantees about the title you want to provide.

- Complete All Required Information Accurately: The form must include detailed information about the grantor (seller), grantee (buyer), and the legal description of the property. Errors can lead to significant legal complications.

- Understand the Legal Description: The legal description of the property is more detailed than its street address, often including lot number, tract number, and other specific details. This description must match the one on the official records.

- Signatures Are Crucial: The deed must be signed by the grantor in the presence of a notary public to be valid. Some types of deeds may require the grantee’s signature as well.

- Notarization Is a Must: The presence of a notary public to acknowledge the signature of the grantor(s) is required for the deed to be legally binding.

- Consider the Need for Witnesses: While California does not generally require witnesses for the signing of the deed, consulting with a legal professional to ensure compliance with all local requirements is advisable.

- Understand Transfer Tax Implications: The transfer of property may be subject to transfer tax. Certain transactions might be exempt, so it’s important to research or consult a professional to understand your obligations.

- Record the Deed: After signing, the deed must be recorded with the county recorder’s office where the property is located. This step is critical to make the transfer public record and protect the grantee’s interests.

- Retain Copies for Your Records: Always keep a copy of the fully executed and recorded deed for your personal records. This document serves as proof of ownership and is essential for resolving any future disputes.

- Seek Legal Advice When Unsure: Considering the legal and financial significance of transferring property, consulting with a legal professional to navigate the process is highly recommended, especially in complex situations.

Properly executing and understanding the California Deed form is paramount for a legally sound transfer of property. By paying close attention to the requirements and seeking professional advice when necessary, parties involved can ensure a smooth and compliant property transaction process.

More California Forms

Simple Promissory Note Template California - By defining the legal obligations and rights of each party, it helps prevent potential conflicts.

Durable Power of Attorney Forms - Without a Power of Attorney, your loved ones may face lengthy and costly court processes to manage your affairs if you're unable to.