Blank De 9 Connector PDF Form

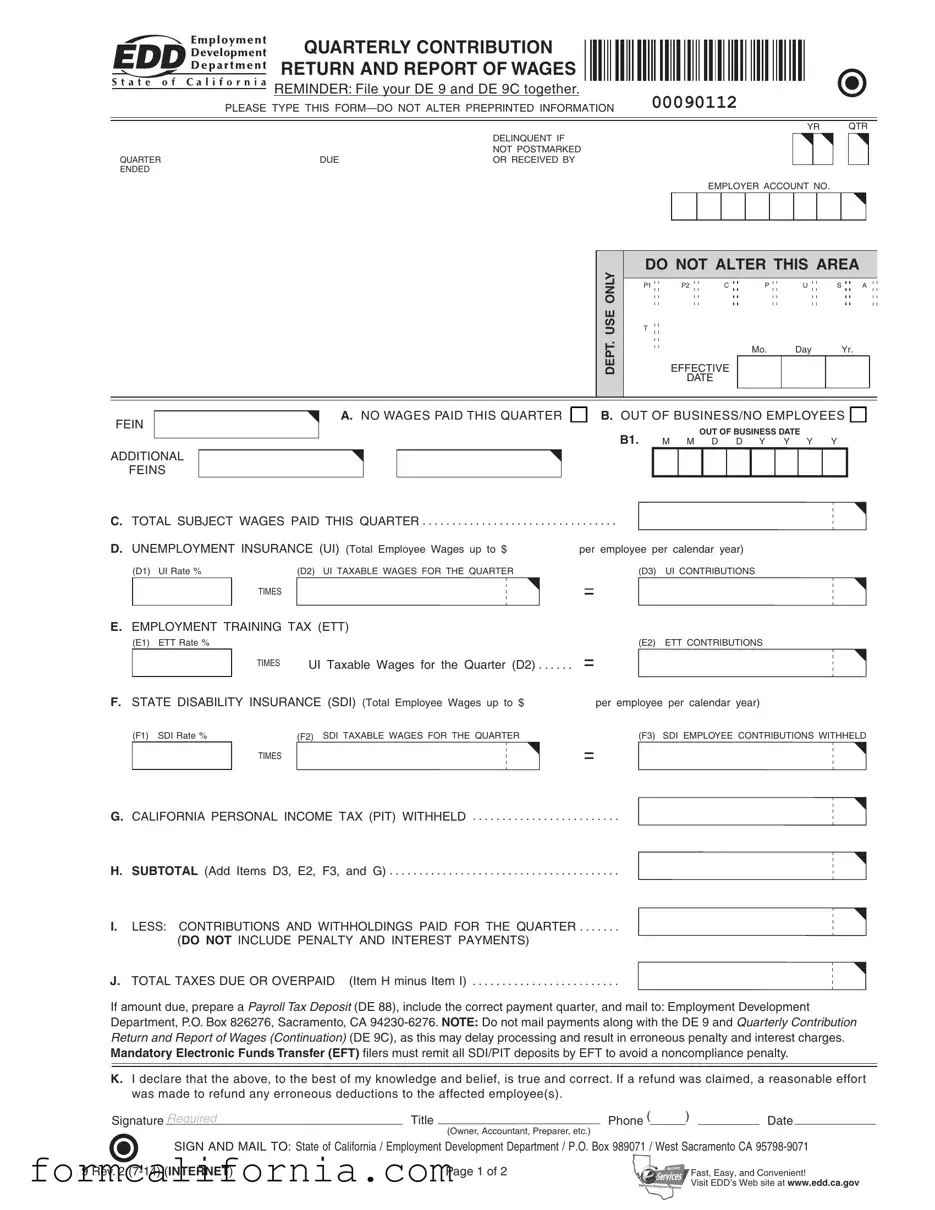

Every quarter, businesses in California face the vital task of accurately reporting their payroll taxes and wages to the state. This process is facilitated by the DE 9 form, formally known as the Quarterly Contribution Return and Report of Wages. It’s crucial for employers to file this form alongside the DE 9C, as it ensures they meet state regulations for unemployment insurance (UI), employment training tax (ETT), state disability insurance (SDI), and personal income tax withheld (PIT). Employers are reminded to type the form, refraining from altering preprinted information for clear and error-free submissions. Important sections of the DE 9 form include specifying wages paid during the quarter, indicating unemployment insurance contributions based on state-determined rates and taxable wages, and detailing any employment training taxes and state disability insurance contributions. Additionally, the form requires reporting the total California PIT withheld. It’s important to note, timely filing of this form and the accurate submission of contributions and withholdings can help avoid penalties and interest for underpayment or late reporting. For businesses that have ceased operations or have no employees for the quarter, specific sections must be completed to communicate this status to the Employment Development Department (EDD). Moreover, the convenience of online filing through the EDD’s e-Services for Business is encouraged for a more efficient reporting process. This form is not just a legal requirement but also a critical component of responsible business operation in California, reflecting an employer's commitment to contributing to the state’s economic welfare through the proper reporting and payment of payroll taxes.

Document Preview Example

QUARTERLY CONTRIBUTION

RETURN AND REPORT OF WAGES

REMINDER: File your DE 9 and DE 9C together.

|

PLEASE TYPE THIS |

00090112 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YR |

|

QTR |

||

|

|

DELINQUENT IF |

|

|

|

|

|

|

|

|

NOT POSTMARKED |

|

|

|

|

|

|

QUARTER |

DUE |

OR RECEIVED BY |

|

|

|

|

|

|

ENDED |

|

|

|

|

|

|

|

|

EMPLOYER ACCOUNT NO.

DEPT. USE ONLY

DO NOT ALTER THIS AREA

P1 |

P2 |

C |

P |

U |

S |

A |

T |

|

|

|

|

|

|

|

|

|

Mo. |

Day |

|

Yr. |

EFFECTIVE

DATE

FEIN

ADDITIONAL

FEINS

A.NO WAGES PAID THIS QUARTER

B.OUT OF BUSINESS/NO EMPLOYEES

B1. |

|

OUT OF BUSINESS DATE |

||||||

M M D D Y Y Y Y |

||||||||

|

|

|

|

|

|

|

|

|

C. TOTAL SUBJECT WAGES PAID THIS QUARTER . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

D. UNEMPLOYMENT INSURANCE (UI) (Total Employee Wages up to $ |

per employee per calendar year) |

||||

|

(D1) UI Rate % |

(D2) UI TAXABLE WAGES FOR THE QUARTER |

|

|

(D3) UI CONTRIBUTIONS |

|

|

TIMES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E.EMPLOYMENT TRAINING TAX (ETT)

|

(E1) |

ETT Rate % |

|

|

(E2) |

ETT CONTRIBUTIONS |

|

|

|

|

TIMES |

UI Taxable Wages for the Quarter (D2) |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|||

F. STATE DISABILITY INSURANCE (SDI) (Total Employee Wages up to $ |

|

per employee per calendar year) |

|||||

|

(F1) |

SDI Rate % |

(F2) SDI TAXABLE WAGES FOR THE QUARTER |

|

(F3) |

SDI EMPLOYEE CONTRIBUTIONS WITHHELD |

|

TIMES

G. CALIFORNIA PERSONAL INCOME TAX (PIT) WITHHELD . . . . . . . . . . . . . . . . . . . . . . . . .

H. SUBTOTAL (Add Items D3, E2, F3, and G) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I. LESS: CONTRIBUTIONS AND WITHHOLDINGS PAID FOR THE QUARTER . . . . . . .

(DO NOT INCLUDE PENALTY AND INTEREST PAYMENTS)

J. TOTAL TAXES DUE OR OVERPAID (Item H minus Item I) . . . . . . . . . . . . . . . . . . . . . . . . .

If amount due, prepare a Payroll Tax Deposit (DE 88), include the correct payment quarter, and mail to: Employment Development

Department, P.O. Box 826276, Sacramento, CA

K.I declare that the above, to the best of my knowledge and belief, is true and correct. If a refund was claimed, a reasonable effort was made to refund any erroneous deductions to the affected employee(s).

|

Signature Required |

Title ________________________ Phone ( |

) |

|

|

Date ____________ |

|

|

|

(Owner, Accountant, Preparer, etc.) |

|

|

|

|

|

|

SIGN AND MAIL TO: State of California / Employment Development Department / P.O. Box 989071 / West Sacramento CA |

||||||

|

|

|

|

|

|||

DE |

9 Rev. 2 |

Page 1 of 2 |

|

|

Fast, Easy, and Convenient! |

||

|

|

|

|

|

Visit EDD’s Web site at www.edd.ca.gov |

||

|

|

|

|

|

|

|

|

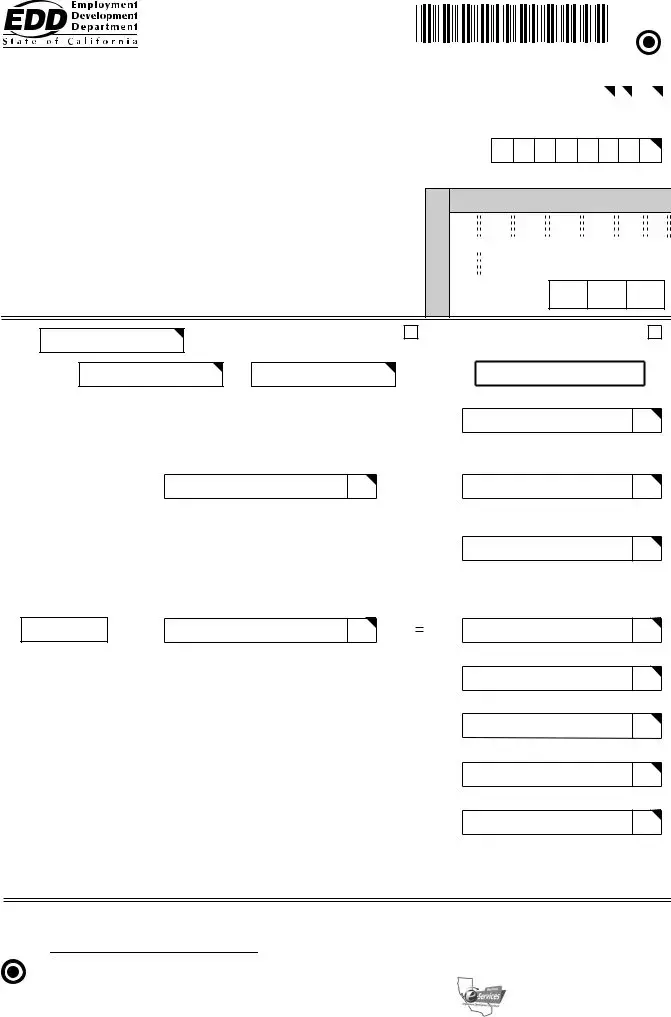

INSTRUCTIONS FOR COMPLETING THE

QUARTERLY CONTRIBUTION RETURN AND REPORT OF WAGES (DE 9)

PLEASE TYPE ALL INFORMATION

Did you know you can file this form online using the EDD’s

For a faster, easier, and more convenient method of reporting your DE 9 information, visit the EDD’s website at www.edd.ca.gov.

Contact the Taxpayer Assistance Center at (888)

reporting wages or the subject status of employees. Refer to the California Employer’s Guide (DE 44) for additional information.

If this form is not preprinted, please include your business name and address, State employer account number, the quarter ended date, and the year and quarter for which this form is being iled.

Verify/enter your Federal Employer Identiication Number (FEIN): The number should be the same as your federal account number. If the number is not correct, line it out and enter the correct number. If you have more than one FEIN relating to your State number, enter the additional FEINs in the boxes provided.

ITEM A. No Wages Paid This Quarter - You must ile this return even though you had no payroll. If you had no payroll, check

Item A and complete Item K. You must also complete a Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C) indicating no payroll for this quarter.

ITEM B. Out of Business/No Employees - Check this box if you are out of business (OB) or no longer have employees (NE) and this is your inal return. You must complete B1 if you are out of business.

NOTE: If you select the Line B Out of Business/No Employees and have No Payroll for the quarter, you must complete Item C and Item O on the DE 9C.

ITEM B1. Enter the OB/NE date where indicated and complete Line K.

NOTE: If you closed the business this quarter, you must ile the DE 9 and DE 9C within ten days of closing the business to avoid any penalties.

ITEM C. Total Subject Wages Paid This Quarter - Enter the total subject wages paid to all employees during the quarter.

ITEM D. Unemployment Insurance (UI)

D1. UI Rate - Enter the UI rate as a percentage if not already shown.

D2. UI Taxable Wages - Enter total UI taxable wages for the quarter. (Do not include exempt wages; refer to the California Employer’s Guide [DE 44] for details.)

D3. Employer’s UI Contributions - Multiply D1 by the amount entered in D2 and enter this calculated amount in D3.

ITEM E. Employment Training Tax (ETT)

E1. ETT Rate - Enter the ETT rate as a percentage if not already shown.

E2. ETT - Multiply E1 by the amount entered in D2 and enter this calculated amount in E2.

ITEM F. State Disability Insurance (SDI)

F1. SDI Rate - Enter the SDI rate as a percentage if not already shown (includes Paid Family Leave percentage).

F2. SDI Taxable Wages - Enter the total SDI taxable wages for the quarter. (Do not include exempt wages; refer to the California Employer’s Guide [DE 44] for details.)

F3. Multiply F1 by the amount entered in F2 and enter this calculated amount in F3.

ITEM G. California Personal Income Tax (PIT) Withheld - Enter total California PIT withheld during the quarter.

NOTE: If over $350 in PIT is withheld, it may be necessary to deposit more frequently. For additional information, visit the EDD’s website at www.edd.ca.gov/Payroll_Taxes.

ITEM H. Subtotal - Add Items D3, E2, F3, and G; enter the amount in the SUBTOTAL box.

ITEM I. Contributions and Withholdings Paid for the Quarter - Total of all deposits of UI, ETT, SDI, and PIT paid for the quarter. NOTE: Do not include any payments made for prior quarters or for penalty and interest.

ITEM J. Total Taxes Due or Overpaid - Item H minus Item I. If an amount is due, submit a Payroll Tax Deposit (DE 88) with your payment and mail to P.O. Box 826276, Sacramento, CA

NOTE: Mailing payments with the DE 9 form delays payment processing and may result in erroneous penalty and interest charges.

ITEM K. Signature of preparer or responsible individual, including title, telephone number, and signature date.

Employers and Payers of

INFORMATION

FILING THIS RETURN/REPORT - California law requires employers to report all UI/SDI subject California wages paid and California PIT withheld during the quarter.

A PENALTY of 15% (10% for periods prior to 3rd quarter 2014) plus interest will be charged for underpayment of contributions and California PIT withheld per Section 1112(a) of the California Unemployment Insurance Code (CUIC). In addition, a penalty of 15% (10% for periods prior to 3rd quarter 2014) of the unpaid contributions and California PIT withheld will be charged for failure to ile the return/report within 60 days of the due date pursuant to Section 1112.5 of the CUIC.

DE 9 Rev. 2 |

Page 2 of 2 |

Document Specs

| Fact | Detail |

|---|---|

| Form Name | DE 9 Quarterly Contribution Return and Report of Wages |

| Form Purpose | To report wages, contributions, and withholdings for California employers |

| Filing Requirement | Mandatory for employers, must be filed even if no payroll was processed |

| Components Reported | UI (Unemployment Insurance), ETT (Employment Training Tax), SDI (State Disability Insurance), and PIT (Personal Income Tax) withholdings |

| Submission Method | Form can be filed online or mailed, but payments should not be mailed with the DE 9 to avoid processing delays |

| Penalties | Failure to file or underpayment may result in a penalty plus interest, calculated as a percentage of the unpaid amounts |

| Governing Law | California Unemployment Insurance Code (CUIC) |

| Additional Information | Employers can file online for a faster, easier, and more convenient method of reporting |

Detailed Instructions for Writing De 9 Connector

Filling out government forms can sometimes feel like navigating through a maze. If you're preparing to complete the DE 9 Connector form, also known as the Quarterly Contribution Return and Report of Wages, it's essential to follow each step carefully to ensure accuracy and compliance. This document is crucial for reporting wages paid and contributions for unemployment insurance, state disability insurance, and more for a specific quarter. Below, you’ll find straightforward, step-by-step instructions to fill out the form without missing any critical details.

- Ensure the preprinted information on your form is correct, including the employer account number and the effective date. If there are any errors, make the necessary corrections.

- Verify your Federal Employer Identification Number (FEIN) listed on the form. If it is incorrect, line through the preprinted number and write the correct FEIN above it. If you operate with multiple FEINs under the same state employer number, list the additional FEINs in the spaces provided.

- If you had no payroll for the quarter, check Item A. Remember, you are still required to file this return even if no wages were paid.

- For businesses that have closed or no longer have employees, check Item B and complete Item B1 by entering the date your business closed or had its last employee.

- In Item C, report the total wages paid during the quarter. Only include wages that are subject to state contributions.

- Under Item D, calculate your Unemployment Insurance (UI) contributions. Enter your UI rate in D1 (if it’s not preprinted), list the total UI taxable wages for the quarter in D2, then multiply D1 by D2 to find your UI contributions and enter that amount in D3.

- Calculate your Employment Training Tax (ETT) contributions in Item E. Enter the ETT rate in E1, multiply this rate by the total UI taxable wages (from D2), and put the result in E2.

- For State Disability Insurance (SDI), find the rate in F1. In F2, enter the total SDI taxable wages. Multiply F1 by F2 to determine the SDI contributions withheld and record the result in F3.

- Enter the total California Personal Income Tax (PIT) withheld from employees during the quarter in Item G.

- Add the amounts from D3, E2, F3, and G to get your subtotal; enter this total in Item H.

- List the total contributions and withholdings paid during the quarter in Item I, excluding any payments made for penalty and interest.

- To find out if you have taxes due or overpaid, subtract Item I from Item H and record the result in Item J. If you owe money, prepare a Payroll Tax Deposit (DE 88) including the appropriate payment for the quarter and send it to the specified address.

- Finally, complete Item K by providing the signature of the preparer or responsible individual, their title, phone number, and the date of signing.

Once you have thoroughly completed the DE 9 Connector form, review it to ensure all information is accurate and complete. If everything is in order, mail the form to the State of California's Employment Development Department at the address provided on the form. Remember, timely and accurate filing is crucial to avoid any potential penalties or interest charges for late or incomplete submissions. Efficient handling of these forms not only keeps you compliant but also supports the overall well-being of your workforce. By following these detailed instructions, you can navigate the process with confidence.

Things to Know About This Form

What is the purpose of the DE 9 Connector form?

The DE 9 Connector form, officially known as the Quarterly Contribution Return and Report of Wages, serves an important administrative function for employers. Its primary use is for reporting wages paid to employees, contributions for unemployment insurance (UI), employment training tax (ETT), state disability insurance (SDI), and personal income tax (PIT) withholdings. By consolidating this information quarterly, the form facilitates the effective management of employer contributions and withholdings related to employee wages within California.

Can I file the DE 9 and DE 9C forms separately?

No, the DE 9 and DE 9C forms are designed to be filed together. While the DE 9 serves as a summary of quarterly wages and contributions, the DE 9C provides detailed individual employee wage data for the same period. Filing these forms concurrently ensures the accuracy and completeness of your wage reporting to the Employment Development Department (EDD), as isolated submissions can lead to processing delays and possibly erroneous penalty and interest charges.

Is it mandatory to type the DE 9 Connector form?

Yes, typing the DE 9 Connector form is required for clarity and to prevent errors in processing. The form clearly states, "PLEASE TYPE THIS FORM—DO NOT ALTER PREPRINTED INFORMATION." Ensuring the typed information is accurate and legible helps the Employment Development Department (EDD) efficiently process the data and accurately crediting your account with the appropriate contributions and withholdings.

How do I correct an incorrect Federal Employer Identification Number (FEIN) on the DE 9 form?

If the preprinted Federal Employer Identification Number (FEIN) on your DE 9 form is incorrect, you should line it out and enter the correct number. It’s crucial that the FEIN matches your federal account number because this identification plays a key role in linking your state and federal reporting. If your business has multiple FEINs related to your State employer account number, be sure to enter the additional FEINs in the designated areas provided on the form.

What happens if I am out of business or have no employees for the quarter?

If you are out of business (OB) or have no employees (NE) during the quarter, it is important to indicate this by selecting the appropriate box on the DE 9 form. If marking the form as your final return due to being out of business, complete the Out of Business/No Employees Date section (Item B1) and ensure you submit the DE 9 and DE 9C within ten days of closing your business. This timely filing helps avoid penalties. Remember, filing the DE 9C with "no payroll" for the quarter is still required, as it notifies the Employment Development Department (EDD) of your current status and helps maintain accurate records.

Common mistakes

Completing official forms correctly is crucial for ensuring compliance with regulations and avoiding unnecessary mistakes that could lead to penalties or delays. The DE 9 Connector form, an integral component for reporting quarterly wage and tax information, is no exception. Here are eight common mistakes to avoid:

Not filing the form on time: Procrastination or oversight can lead to your form being considered delinquent, resulting in penalties.

Entering incorrect information in the preprinted sections: Any alteration or misinterpretation of these areas can lead to incorrect processing of your submission.

Failure to correctly enter the Federal Employer Identification Number (FEIN): This number must be accurate to ensure your report is credited to the correct account.

Overlooking to report if you had no wages paid during the quarter: Even if no wages were paid, completing this section is mandatory to comply with filing requirements.

Incorrectly indicating the business status: If your business is no longer operational or if you had no employees for the quarter, this must be clearly stated and the appropriate boxes checked.

Miscalculating total subject wages or tax contributions: Accurate calculations are essential for correct payment of taxes and to avoid underpayment penalties.

Omitting signatures at the end of the form: A missing signature can delay processing since it's a critical component of the form's verification process.

Not filing electronically when required: For those mandated to use Electronic Funds Transfer (EFT) for contributions and withholdings, failure to do so can result in a noncompliance penalty.

Addressing these mistakes before submitting your DE 9 form can save considerable time and effort, ensuring compliance and fostering a smooth process for reporting your contributions and wages.

Documents used along the form

When businesses in California tackle payroll and employment tax obligations, the Quarterly Contribution Return and Report of Wages (DE 9) stands as a fundamental document. However, to effectively manage and meet state tax requirements, several other forms and documents often accompany the DE 9. These documents ensure compliance with various aspects of employment and tax law, assisting employers in thorough and accurate reporting.

- Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C): This form supplements the DE 9 by providing detailed wage information for each employee. It assists in calculating contributions for Unemployment Insurance (UI), Employment Training Tax (ETT), and State Disability Insurance (SDI).

- Payroll Tax Deposit (DE 88): Utilized for submitting payments for UI, ETT, SDI, and California Personal Income Tax (PIT) withholdings. It's crucial for timely financial reporting and avoiding penalties for late payments.

- Employer of Household Worker(s) Annual Payroll Tax Return (DE 3HW): This document is for employers who hire household staff. It outlines the annual tax duties specific to this employment type, addressing UI, SDI, and PIT obligations.

- Report of New Employee(s) (DE 34): Employers must file this form to report any new employee or rehired employee to the California Employment Development Department. It aids in ensuring all workers are appropriately documented and assists in the administration of UI benefits.

- Report of Independent Contractor(s) (DE 542): This form is required for reporting independent contractors who are paid $600 or more. It helps in distinguishing between employees and contractors, impacting the calculation and payment of payroll taxes.

- California Employer’s Guide (DE 44): Although not a form, the DE 44 is an essential document providing comprehensive information on state employment taxes, reporting requirements, and other obligations. It's a valuable resource for understanding how to comply with California's employment tax laws.

Together, these documents form a cohesive framework that supports employers in fulfilling their tax obligations. They not only ensure compliance with state laws but also help manage the workforce efficiently. By understanding and utilizing these forms along with the DE 9, businesses can maintain good standing with the California Employment Development Department and avoid penalties associated with late or incorrect reporting.

Similar forms

The Form W-2, Wage and Tax Statement, shares a close resemblance to the DE 9 Connector form in its purpose of reporting employee wages and the taxes withheld from those wages. Both documents are integral to ensuring accurate tax payments and filings. The W-2 Form, issued annually by employers, outlines the total income earned by an employee, including federal and state taxes withheld, similarly to how the DE 9 captures quarterly wage and withheld tax data for the state of California. This makes both forms critical to the tax filing process for individuals and compliance with tax regulations for employers.

Form 940, the Employer's Annual Federal Unemployment (FUTA) Tax Return, parallels the DE 9 Connector form as both involve reporting related to unemployment insurance. The Form 940 is used by employers to report their annual Federal Unemployment Tax Act contributions which is akin to the DE 9 Connector form’s section on unemployment insurance contributions at a state level. Both documents ensure that the correct amount of unemployment taxes are collected, thereby supporting programs that benefit unemployed workers.

The Quarterly Federal Tax Return, Form 941, is akin to the DE 9 Connector form as it also deals with reporting wages paid to employees, taxes withheld from these wages, and the employer's portion of social security and Medicare taxes. While Form 941 focuses on the federal aspects of employee wage reporting, the DE 9 Connector serves a similar purpose at the state level, making both forms essential for the proper accounting and submission of employment taxes.

Form DE 9C, the Quarterly Contribution Return and Report of Wages (Continuation), operates in conjunction with the DE 9 Connector form by providing detailed employee wage data to complement the summary totals on the DE 9. Both forms work together to deliver a comprehensive account of wages paid and taxes due within the state of California. Through the detailed reporting on the DE 9C, the state can accurately assess the taxes reported on the DE 9 Connector form, illustrating how interconnected these documents are in the process of state tax compliance.

The Payroll Tax Deposit (DE 88) form is directly related to the DE 9 Connector by serving as the mechanism for submitting the taxes calculated and reported on the DE 9. After determining the total taxes due from wages paid, employers use the DE 88 form to make their tax payments to the state. This direct financial transaction ensures that the amounts reported on the DE 9 Connector form are correctly remitted to the state treasury, highlighting a procedural link between reporting and payment in the tax process.

Form 1099-MISC, Miscellaneous Income, shares a similarity with the DE 9 Connector form in its focus on reporting payments, although it primarily concerns non-employee compensation. Both forms play essential roles in the broader framework of tax reporting by detailing payments that are subject to tax, but while the DE 9 focuses on employment wages and associated taxes, Form 1099-MISC captures a variety of other payments made in the course of a business. This comparison underscores the diverse sources of income and tax obligations that businesses must manage.

The New Hire Reporting form is another document related to the DE 9 Connector, as it also deals with employee information, specifically the reporting of newly hired or rehired employees. While the New Hire Reporting form helps state agencies collect data to enforce child support orders, among other purposes, the DE 9 Connector focuses on the financial aspect of employment, including wages paid and taxes owed to the state. Both forms reflect the comprehensive nature of employee reporting requirements and the state's interest in both employment status and the financial implications of hiring.

Dos and Don'ts

Filling out the DE 9 Connector form accurately is crucial to comply with the requirements set by the Employment Development Department (EDD). To ensure that this process goes smoothly, here’s a list of do’s and don’ts:

- Do ensure that all information is typed. Handwritten forms are not accepted for this process.

- Do file the DE 9 and DE 9C together, as they are part of the same filing requirement.

- Do check and verify your Federal Employer Identification Number (FEIN) to ensure accuracy.

- Do enter accurate details regarding wages paid this quarter, including total subject wages and specific taxable wages for Unemployment Insurance (UI), Employment Training Tax (ETT), and State Disability Insurance (SDI).

- Do calculate and report California Personal Income Tax (PIT) withheld accurately.

- Do remember to sign the form. The signature of the preparer or responsible individual is mandatory.

- Don't alter preprinted information on the form. This area is set for department use only.

- Don't include payments for penalties and interest in the Contributions and Withholdings Paid for the Quarter section.

- Don't mail payments with the DE 9 form. Use a separate Payroll Tax Deposit (DE 88) form for any payments due.

- Don't overlook the deadlines for filing. Submitting the form late can lead to penalties and interest charges.

By following these recommendations, employers can avoid common pitfalls and ensure their quarterly contribution returns and reports of wages are processed efficiently and accurately. Remember, maintaining compliance not only avoids penalties but also ensures a smooth operation within the requirements set by the EDD.

Misconceptions

Understanding the intricacies of the DE 9 Connector form, often referred to as the Quarterly Contribution Return and Report of Wages, is crucial for employers in managing their payroll taxes accurately. Several misconceptions surround its completion and submission, which, if not addressed, can lead to errors in reporting and potential penalties. Below are eight common misunderstandings and clarifications regarding the DE 9 Connector form.

- Misconception 1: The DE 9 form is optional for businesses without employees.

Clarification: Even if a business has not paid wages during a quarter, it is required to file the DE 9 form to report that no payroll was processed.

- Misconception 2: Employers believe they can wait until the business is officially closed before filing the DE 9 and DE 9C forms.

Clarification: If a business closes or terminates its employees, it must file the DE 9 and DE 9C forms within ten days of the closure or termination to avoid penalties.

- Misconception 3: All wages paid to employees must be reported on the DE 9 form.

Clarification: Only total subject wages that are eligible for Unemployment Insurance, State Disability Insurance, and Employment Training Tax need to be reported.

- Misconception 4: The DE 9 form is only for reporting Unemployment Insurance contributions.

Clarification: In addition to Unemployment Insurance contributions, the DE 9 form is used to report Employment Training Tax, State Disability Insurance, and California Personal Income Tax withheld.

- Misconception 5: Penalties for late filing are negligible and can be ignored.

Clarification: Late filing of the DE 9 form can result in significant penalties, including a percentage of unpaid contributions and interest charges.

- Misconception 6: Payments for taxes can be submitted with the DE 9 form.

Clarification: Tax payments should not be mailed with the DE 9 form, as this could delay processing. Instead, a Payroll Tax Deposit (DE 88) form should be used for payments to ensure they are processed accurately.

- Misconception 7: Any adjustments to incorrect deductions can be ignored if the amount is minimal.

Clarification: Employers are required to make a reasonable effort to refund any erroneous deductions to the affected employees, regardless of the amount. This ensures compliance and fairness.

- Misconception 8: Businesses must file the DE 9 form manually and via mail.

Clarification: While the DE 9 form can be submitted by mail, the Employment Development Department also accepts online filing, which is a faster and more convenient method for most businesses.

Ensuring accurate understanding and compliance with the requirements for filing the DE 9 Connector form is paramount for businesses to avoid penalties and maintain accurate records. Employers are encouraged to verify their filing procedures and consult the official documentation or seek professional advice if uncertainties arise.

Key takeaways

Filling out and using the DE 9 Connector form is essential for employers in California for reporting wages and calculating contributions to state programs. Here are key takeaways to guide you through this process:

- Always file the DE 9 and DE 9C forms together to ensure accurate reporting of wages and payroll taxes, and avoid processing delays.

- Type the form for clarity and accuracy, and make sure not to alter any preprinted information to ensure your submission is processed smoothly.

- If no wages were paid during the quarter, you must still file the return by checking Item A, indicating no payroll, and completing the form accordingly.

- In the event your business has closed or you no longer have employees, mark the appropriate box (Item B) and provide the date of business closure or when you stopped having employees (Item B1).

- Accurately report the total subject wages paid during the quarter (Item C), as this amount is crucial for determining your tax contributions and obligations.

- Calculate your contributions for Unemployment Insurance (UI), Employment Training Tax (ETT), and State Disability Insurance (SDI) based on the taxable wages and rates provided or already known. Do these calculations precisely to avoid underpayment or overpayment.

- Enter the total California Personal Income Tax (PIT) withheld during the quarter. If the amount exceeds $350, additional deposit requirements may apply.

- Item I should only include the contributions and withholdings paid for the quarter in question, excluding any payments for penalties, interest, or prior quarters to ensure your total taxes due or overpaid (Item J) are accurately reflected.

- Electronic Funds Transfer (EFT) filers must remember to remit all SDI and PIT deposits by EFT to circumvent noncompliance penalties, highlighting the importance of understanding the modalities of payment.

- Finally, the preparer or a responsible individual must sign the form, confirming the accuracy and truthfulness of the information provided, and submit it by the stipulated due date to avoid penalties and interest charges for late submissions.

By keeping these points in mind, employers can effectively manage their reporting responsibilities and contributions towards state programs, ensuring compliance with California's regulations.

Discover More PDFs

Code of Civil Procedure Section 473 - A formally submitted request for the court to reconsider a default judgment, citing reasons grounded in fairness and legal precedent.

Ca Llc 12R - Foreign LLCs operating in California under an alternate name must accurately convey this name on Form LLC-12R, aligning with how they're recognized in state records.