Blank De 24 PDF Form

In the intricate landscape of business operations, adapting to changes is a constant necessity, encompassing a variety of aspects ranging from ownership structures to banking details. The De 24 form serves as a critical tool for businesses navigating through such transitions, specifically tailored for communicating with California's Employment Development Department (EDD). This document is ingeniously designed to cover a broad spectrum of modifications including changes in employer account information, alterations in personal, business, or corporate names, adjustments in ownership, and even shifts in the personnel makeup of a corporation. Given its comprehensive nature, the form facilitates businesses in maintaining accurate and current records with the EDD, ensuring that the administration of payroll taxes reflects the latest status of the business. Whether it's a change in address, a switch in banking institutions, a business sale or a significant transformation in the operational structure, the De 24 form stands as a pivotal resource. Moreover, it extends its utility to instances where businesses cease operations or discontinue wage payments, requiring meticulous documentation for a smooth transition or closure process. Thus, the form not only aids in the administrative aspects of running a business but also plays a protective role by ensuring compliance with state regulations, thereby preventing potential legal and financial ramifications.

Document Preview Example

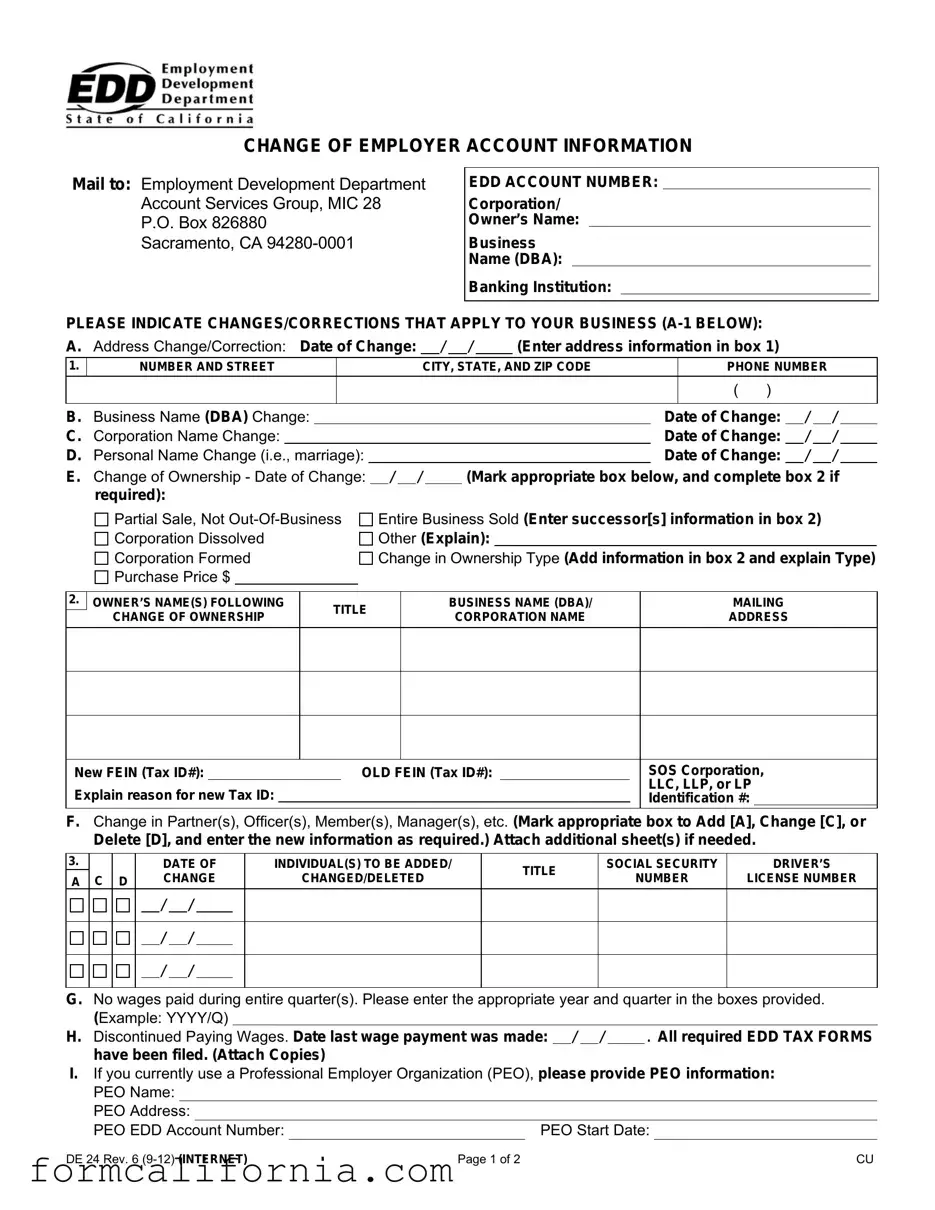

CHANGE OF EMPLOYER ACCOUNT INFORMATION

Mail to: Employment Development Department Account Services Group, MIC 28 P.O. Box 826880

Sacramento, CA

EDD ACCOUNT NUMBER:

Corporation/

Owner’s Name:

Business

Name (DBA):

Banking Institution:

PLEASE INDICATE CHANGES/CORRECTIONS THAT APPLY TO YOUR BUSINESS

A. Address Change/Correction: Date of Change: / / |

|

(Enter address information in box 1) |

1.

NUMBER AND STREET |

CITY, STATE, AND ZIP CODE |

PHONE NUMBER |

|

|

|

( |

) |

|

|

|

|

B. |

Business Name (DBA) Change: |

|

|

|

|

Date of Change: |

/ |

/ |

||

C. |

Corporation Name Change: |

|

|

|

|

Date of Change: |

/ |

/ |

||

D. |

Personal Name Change (i.e., marriage): |

|

|

|

|

Date of Change: |

/ |

/ |

||

E. |

Change of Ownership - Date of Change: / / |

|

(Mark appropriate box below, and complete box 2 if |

|||||||

|

required): |

|

|

|

|

|

|

|||

Partial Sale, Not

Partial Sale, Not

Corporation Dissolved

Corporation Dissolved

Corporation Formed

Corporation Formed

Purchase Price $

Purchase Price $

Entire Business Sold (Enter successor[s] information in box 2)

Entire Business Sold (Enter successor[s] information in box 2)

Other (Explain):

Other (Explain):

Change in Ownership Type (Add information in box 2 and explain Type)

Change in Ownership Type (Add information in box 2 and explain Type)

2. |

OWNER’S NAME(S) FOLLOWING |

TITLE |

BUSINESS NAME (DBA)/ |

MAILING |

|

CHANGE OF OWNERSHIP |

CORPORATION NAME |

ADDRESS |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New FEIN (Tax ID#): |

|

OLD FEIN (Tax ID#): |

|

|

SOS Corporation, |

|

Explain reason for new Tax ID: |

|

|

|

|

LLC, LLP, or LP |

|

|

|

|

|

Identification #: |

||

|

|

|

|

|||

F. Change in Partner(s), Officer(s), Member(s), Manager(s), etc. (Mark appropriate box to Add [A], Change [C], or

Delete [D], and enter the new information as required.) Attach additional sheet(s) if needed.

3. |

|

|

DATE OF |

|

INDIVIDUAL(S) TO BE ADDED/ |

TITLE |

SOCIAL SECURITY |

DRIVER’S |

||

A |

C |

D |

CHANGE |

|

CHANGED/DELETED |

NUMBER |

LICENSE NUMBER |

|||

|

|

|||||||||

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G.No wages paid during entire quarter(s). Please enter the appropriate year and quarter in the boxes provided. (Example: YYYY/Q)

|

|

|

|

H. Discontinued Paying Wages. Date last wage payment was made: / / |

. All required EDD TAX FORMS |

||

have been filed. (Attach Copies) |

|

|

|

I.If you currently use a Professional Employer Organization (PEO), please provide PEO information: PEO Name:

PEO Address:

|

|

|

|

|

PEO EDD Account Number: |

|

PEO Start Date: |

||

DE 24 Rev. 6 |

Page 1 of 2 |

|

CU |

|

J. Out of Business (Without a Successor) on: / / |

|

. (Provide forwarding address in box |

Note: If business corporation/owner is represented by an authorized agent for employment tax purposes, the agent may sign below. A signed and properly executed power of attorney must be attached or on file. THE SIGNATURE OF ANY OTHER PERSON/THIRD PARTY WILL NOT BE ACCEPTED.

“I certify under penalty of perjury that the above information is true and correct, and that these actions are not being taken to receive a more favorable Unemployment Insurance rate. I further certify that I have the authority to sign on behalf of the above business.”

|

|

( |

) |

/ / |

|

|

Signature |

|

Phone Number |

Date |

|

||

|

|

|

|

|||

Print Name |

|

Title (Officer, Owner, Member, GP, or Authorized Agent) |

|

|||

Manage your payroll tax account online!

File reports, make deposits, update addresses, and much more.

Enroll now for

DE 24 Rev. 6 |

Page 2 of 2 |

CU |

Document Specs

| Fact Number | Fact Detail |

|---|---|

| 1 | The DE 24 form is used for notifying changes of employer account information. |

| 2 | Changes can include address, business name (DBA), corporation name, personal name due to events like marriage, and more. |

| 3 | It also covers changes in ownership type, such as a partial sale or complete sale of the business. |

| 4 | Change in partner(s), officer(s), member(s), manager(s), etc., is facilitated through this form by adding, changing, or deleting information as needed. |

| 5 | Reporting if no wages were paid during an entire quarter(s) or discontinuation of wage payment is also a function of the DE 24 form. |

| 6 | The form allows employers to update their Professional Employer Organization (PEO) information. |

| 7 | The DE 24 form must be mailed to the Employment Development Department Account Services Group in Sacramento, CA. |

| 8 | The form is governed by California state laws due to its submission to a California state department. |

| 9 | A signature certifying the truth and correctness of the information, under penalty of perjury, is required at the end of the form. |

| 10 | Users are encouraged to manage their payroll tax account online via e-Services for Business, as mentioned at the end of the DE 24 form. |

Detailed Instructions for Writing De 24

Filing out the DE 24 form is a crucial task for businesses undergoing changes, such as updates to address, name, or ownership. Ensuring accurate and timely submission is essential to keep your business in good standing and maintain compliance with state regulations. This detailed guide walks through each step to accurately complete the form and what to expect next in the process. Remember, the clarity of the information you provide here directly impacts the accuracy of your business records with the Employment Development Department (EDD).

- Start by entering your EDD ACCOUNT NUMBER at the top of the form.

- Fill in the Corporation/Owner's Name and Business Name (DBA).

- Provide the name of your Banking Institution.

- Under the section marked "PLEASE INDICATE CHANGES/CORRECTIONS THAT APPLY TO YOUR BUSINESS (A-1 BELOW):", tick the appropriate box(es) that represent the change(s) being reported.

- For an Address Change/Correction, enter the effective date of change and the new address details, including phone number, in box 1.

- If reporting a Business Name (DBA) Change, Corporation Name Change, or Personal Name Change (i.e., marriage), enter the date of change for each applicable section.

- To report a Change of Ownership, select the appropriate description of the change and fill in box 2 with the successor’s or new owner’s information, including the new and old FEIN (Tax ID#).

- For changes in Partner(s), Officer(s), Member(s), Manager(s), etc., mark the appropriate action box (Add, Change, or Delete) and provide the date of the change along with the individual’s details and role in box 3.

- If your business had no wages paid during an entire quarter(s), specify the year and quarter.

- If your business has Discontinued Paying Wages, indicate the date the last wage payment was made and confirm all required EDD TAX FORMS have been filed, attaching copies as necessary.

- For those using a Professional Employer Organization (PEO), provide the PEO’s details.

- If your business is Out of Business (Without a Successor), enter the effective date and provide a forwarding address in box A-1.

- Finally, sign and date the form at the bottom, ensuring to print your name and title clearly. Only an officer, owner, member, general partner, or authorized agent can sign. If signed by an authorized agent, a power of attorney must be attached or on file.

Once you've completed and reviewed the form for accuracy, mail it to the provided address to the Employment Development Department Account Services Group. Filing this form promptly ensures your records are updated without delay, maintaining your business's compliance and helping to avoid potential complications with state employment and tax matters. After submission, if further information or clarification is needed, the EDD will contact you directly. Stay proactive in managing your business's information and records to ensure smooth operational continuity.

Things to Know About This Form

What is the DE 24 form used for?

The DE 24 form is a document designed for businesses to communicate any changes or corrections about their employer account information to the Employment Development Department (EDD) in California. It covers a range of updates, including address and name changes, alterations in ownership or corporation details, and updates on officers or partners among other information.

How can I submit a DE 24 form?

Submissions of the DE 24 form should be mailed directly to the Employment Development Department Account Services Group at the provided address: P.O. Box 826880, Sacramento, CA 94280-0001. It's important to ensure that all information is accurate and complete to avoid any processing delays.

What types of changes can be reported with the DE 24 form?

The DE 24 form allows businesses to report various types of changes, such as:

- Address updates or corrections

- Business name (DBA) changes

- Corporation or ownership name changes

- Changes due to personal events like marriage

- Changes in ownership, including partial sales or the dissolution of a corporation

- Updates on partners, officers, members, or managers

- Any period where no wages were paid

What if my business has discontinued paying wages?

If your business has stopped paying wages, you'll need to indicate the date the last wage payment was made on the DE 24 form. Additionally, confirm that all required EDD tax forms have been filed up to the period of wage discontinuation, attaching copies of these documents with your submission.

Can changes be reported online instead of mailing the DE 24 form?

While the DE 24 form itself must be mailed for processing, businesses are encouraged to manage their payroll tax accounts online through e-Services for Business. This platform allows you to file reports, make deposits, update addresses, and much more, offering a convenient alternative for many other tax-related tasks.

What should I do if I am using a Professional Employer Organization (PEO)?

If your business is utilizing the services of a Professional Employer Organization, it's required to provide the name, address, and EDD account number of the PEO. Additionally, the starting date of the PEO arrangement should be included on the form. This information helps ensure that your business's employment tax responsibilities are accurately accounted for.

Common mistakes

When filling out the DE 24 form for Change of Employer Account Information, individuals often encounter mistakes that can lead to delays or errors in processing. Here are six common mistakes made:

- Not updating all necessary information: When changes in business occur, it is crucial to update all related information on the form, such as address, business name, and banking institution. Neglecting any section may result in incomplete records.

- Inaccurate Date of Change entries: The specific dates when changes took effect are important for accurate records. Failing to provide the correct date for each change can cause confusion and inaccuracies in the employment account.

- Omitting new FEIN or old FEIN: A change in ownership often requires a new Federal Employer Identification Number (FEIN). Not providing the new or old FEIN when there has been a change in ownership can lead to issues with tax identification.

- Failure to attach required documents: For certain changes, like discontinuing wage payments or changes in partnership or officers, attaching all required documents is necessary. Missing attachments can halt the processing of the form.

- Incomplete marking of boxes for changes in ownership type: Indicating the type of change in ownership with complete information is necessary for clear communication. Partially filled boxes or vague explanations can create ambiguity.

- Signing issues: The form requires the signature of an authorized agent or representative who has the power of attorney if applicable. Signatures from unauthorized individuals are not accepted, and a lack of proper authorization or a missing signature can invalidate the submission.

To ensure the smooth processing of the DE 24 form, it's advisable to:

- Review each section thoroughly before submission.

- Ensure all dates and figures are accurate and reflect the most recent changes.

- Attach all necessary documentation as required by the form's instructions.

- Verify that the authorized individual or agent signs the form.

Attending to these details can help avoid common mistakes and facilitate a more efficient update to Employer Account Information with fewer complications..

Documents used along the form

When managing or updating employer account information, particularly with forms like the DE 24, it's crucial to be knowledgeable about other forms and documents that may be required or used in conjunction. These documents ensure that all changes are adequately reported and in compliance with the relevant rules and regulations. Understanding each document's purpose can streamline the process, ensuring that all necessary steps are covered efficiently.

- DE 9: Quarterly Contribution Return and Report of Wages - This form is used to report wages and payroll taxes to the state for each quarter.

- DE 9C: Quarterly Contribution Return and Report of Wages (Continuation) - Provides detailed wage data for each employee, complementing the DE 9 form.

- DE 34: Report of New Employee(s) - Required for reporting newly hired or rehired employees to the state agency.

- DE 542: Report of Independent Contractor(s) - Used for reporting the hiring of independent contractors who are paid $600 or more.

- DE 1: Registration Form for Commercial Employers - A necessary form for newly established businesses to register with the state for payroll tax purposes.

- DE 4: Employee's Withholding Allowance Certificate - Completed by employees to determine the correct state income tax withholding.

- IRS Form W-4: Employee's Withholding Certificate for Federal Taxes - Similar to DE 4 but used for federal tax withholding purposes.

- IRS Form W-9: Request for Taxpayer Identification Number and Certification - Used to provide a Taxpayer Identification Number (TIN) to the party reporting income to the IRS, such as for independent contractors.

- IRS Form 940: Employer's Annual Federal Unemployment (FUTA) Tax Return - Required annually for reporting federal unemployment tax liabilities.

- IRS Form 941: Employer's Quarterly Federal Tax Return - Used to report federal withholdings from employee wages, including income tax, Social Security, and Medicare taxes.

Each of these documents plays a vital role in the employer's responsibility towards accurate and timely reporting of wages, taxes, and employee information. Familiarity with these forms not only ensures compliance but also helps avoid potential penalties and fines. Always make sure to stay updated on any changes or updates to these forms, as state and federal guidelines can evolve.

Similar forms

The W-9 form, Request for Taxpayer Identification Number and Certification, shares similarities with the DE 24 form in its emphasis on accurate tax-related information. Both forms are crucial for ensuring that businesses accurately report their tax responsibilities, particularly concerning changes in ownership or company details which could affect their tax obligations. The W-9 is often used by businesses to request the correct taxpayer identification number (TIN) from individuals or entities they engage with financially, ensuring proper reporting to the IRS. Like the DE 24 form, it deals with the identification and updating of vital tax-related information to maintain compliance with tax regulations.

The IRS Form 8822-B, Change of Address or Responsible Party — Business, is designed to inform the IRS about changes in address or the responsible party for a business, much like the section of the DE 24 form that covers address changes and updates in ownership or responsible persons. This parallel ensures both state (for the DE 24 form) and federal (for Form 8822-B) agencies are kept informed of current contact information and key personnels, facilitating proper tax administration and correspondence. These updates are critical for maintaining accurate records and ensuring compliance with tax obligations.

The I-9 Form, Employment Eligibility Verification, while not directly tax-related, similarly requires up-to-date personal information and documentation verification for new hires, akin to the DE 24 form's need for accurate individual details for tax purposes. Both forms are integral to the onboarding process in different contexts — the DE 24 form for tax account changes and the I-9 for verification of employment eligibility in the U.S. Each form plays a key role in ensuring employers comply with federal and state regulations, respectively.

The SS-4 Form, Application for Employer Identification Number (EIN), is akin to the DE 24 in matters concerning the establishment or change in a business's identifying information. Where the DE 24 form might be used to update business details with the state's employment department, the SS-4 is used to apply for or update the EIN with the IRS. Both forms facilitate the proper identification of businesses for tax and employment responsibilities, ensuring that entities are correctly cataloged for regulatory compliance and tax purposes.

The BOC-3, Designation of Agents for Service of Process, is related to the DE 24 form in that both involve the identification and updating of critical business information. While the BOC-3 pertains to the transportation industry, requiring motor carriers to designate agents in each state they operate, for legal service purposes, the DE 24 addresses various changes, including business name and ownership changes, ensuring that state employment and tax agencies have accurate records. Both forms play essential roles in regulatory compliance within their respective areas.

The Durable Power of Attorney form allows individuals to appoint someone to act on their behalf in various matters, which echoes the provision in the DE 24 form for representation by an authorized agent. Although serving different purposes — one for personal affairs and the other for employment tax issues — both documents highlight the importance of officially recognizing individuals who have the authority to make binding decisions or updates, ensuring that such actions are conducted within legal and regulatory frameworks.

Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return, and the DE 24 form both contribute to the administration of unemployment insurance, albeit from different angles. The DE 24 form's updates can influence an employer's state tax obligations and details, while Form 940 deals with reporting and paying federal unemployment taxes. Timely and accurate completion of both forms ensures employers meet their unemployment tax responsibilities at both the state and federal levels.

The Change of Registration Information (CRI) form for updating business details with state agencies is similar to parts of the DE 24 form focused on changes in ownership, DBA names, or address corrections. Both documents serve to keep official records up to date, which is essential for regulatory compliance, communication, and the administration of taxes or benefits. The need for such updates underscores the fluid nature of business operations and the importance of maintaining current information across various government databases.

The Articles of Amendment document, used to officially record changes to a corporation's charter documents, parallels the DE 24 form in its function to document significant changes affecting a business's legal or operational status. Both types of documentation are necessary for validating and recognizing alterations within the structure, ownership, or core details of a business entity, reflecting these changes within relevant state or federal records to ensure legal compliance and accurate representation of the business's current standing.

Dos and Don'ts

When it comes to updating employer account information with the Employment Development Department (EDD) by filling out the DE 24 form, paying attention to detail is crucial. Here are seven do’s and don’ts to keep in mind:

- Do review the entire form before you start filling it out. This will give you a comprehensive view of the information required.

- Do ensure you have all the necessary information at hand, including current and new business details, before beginning to fill out the form.

- Do use black or blue ink if filling out the form by hand, as these colors are most legible and officially accepted.

- Do double-check the form for accuracy. This includes reviewing dates, numbers, and spelling to avoid any mistakes.

- Do attach additional sheets if needed. If the space provided is insufficient, attach extra pages ensuring all information is clear and properly referenced.

- Don't leave any section that applies to you incomplete. If a change doesn't apply, simply move to the next relevant section.

- Don't forget to sign and date the form. An unsigned or undated form won't be processed, potentially delaying your account update.

Accurately completing the DE 24 form is important for ensuring that your business's records with the EDD are up to date. Failing to do so not only can lead to administrative headaches but might also impact your obligations and rights under various state regulations. Always take the time to review your submission and confirm that all changes are properly documented and justified, aligning with the provided instructions. Keeping abreast of any correspondence from the EDD after submission is also key to promptly addressing any queries or requirements they might have, ensuring a smooth update process.

Misconceptions

Managing employer account information with the Employment Development Department (EDD) is crucial for business operations, yet there are several misconceptions regarding the DE 24 form. Understanding these can help ensure compliance and facilitate smoother updates to your business records.

Only for Address Changes: While the form prominently features address updates, it's also essential for reporting changes in business name, ownership, partnership details, and more. Each section provides a structured way to communicate various significant alterations about your business to the EDD.

Not Necessary for DBA Changes: Actually, one of the critical functions of the DE 24 form is to report changes in your Doing Business As (DBA) name. It is a common misconception that such updates are informal or can be communicated verbally; however, formalizing the change through the DE 24 form ensures your business name is correctly updated on all EDD records.

Changing Ownership Details Is Complicated: Though it might seem daunting, the DE 24 form simplifies the process of notifying the EDD about ownership transitions. Whether it's a partial sale, entire business sale, or a change in the corporation's structure, the form guides you through declaring these shifts succinctly.

Only for Large Businesses: All sizes of businesses must report the relevant changes outlined in the DE 24 form. It’s a common mistake to think that small businesses or sole proprietorships are exempt from these updates. Whether you're a large corporation or a small business owner, keeping your account information current is essential.

No Need to Update for Dissolved Corporations: If a corporation is dissolved, updating EDD with this change is necessary to close the EDD account associated with the business properly. Failing to do so can lead to unnecessary complications, such as being expected to file reports or pay taxes for a non-existent business.

Accurately completing and submitting the DE 24 form ensures the Employment Development Department has the most current information about your business, which helps in managing your payroll tax account effectively. Remember, keeping your information up-to-date is not just about compliance; it facilitates a smoother operation of your business in relation to state requirements.

Key takeaways

The DE 24 form is an essential document for businesses in adjusting employer account information with the Employment Development Department (EDD) in California. Below are seven key takeaways for correctly filling out and using the DE 24 form.

- Addressing Changes: The form allows businesses to report various changes, including address, business name (DBA), corporation name, personal name changes due to reasons such as marriage, a change of ownership, and updates in partners, officers, members, or managers.

- Effective Date of Changes: For every change reported on the DE 24 form, it's crucial to specify the effective date. This ensures that records are accurately updated from the correct point in time.

- Documentation for Change of Ownership: In cases of partial or entire business sale, dissolution, formation of a corporation, or any other change in ownership type, specific details including the new owner's information and explanations for a new Tax ID are required.

- Updating Officer and Partner Information: The form provides options to add, change, or delete information regarding partners, officers, members, managers, etc. This ensures that the EDD has the latest data on who is responsible for the business.

- Reporting No Wage Periods: Businesses can use the DE 24 form to report quarters in which no wages were paid. This is crucial for maintaining accurate unemployment insurance records.

- Discontinuing Wage Payments: If a business stops paying wages, it must report the date the last wage payment was made and confirm that all required EDD tax forms have been filed. This information is vital for closing or updating an employer's account.

- e-Services for Business: The form encourages businesses to manage their payroll tax accounts online via e-Services for Business. This platform offers a convenient way to file reports, make deposits, update addresses, and more, facilitating smoother interaction with the EDD.

The correct completion and submission of the DE 24 form are critical for businesses to ensure their employer account information with the EDD is current and accurate. This aids in compliance with state requirements and helps prevent issues related to payroll tax reporting and unemployment insurance rates.

Discover More PDFs

Declaration of Non Ownership Dmv - Perfect for college students or anyone leaving town for a while, this form keeps your parked vehicle from accruing registration fees.

California 461 - Major donors and independent expenditure committees must stay informed about their reporting obligations under California law.