Blank De 2063 PDF Form

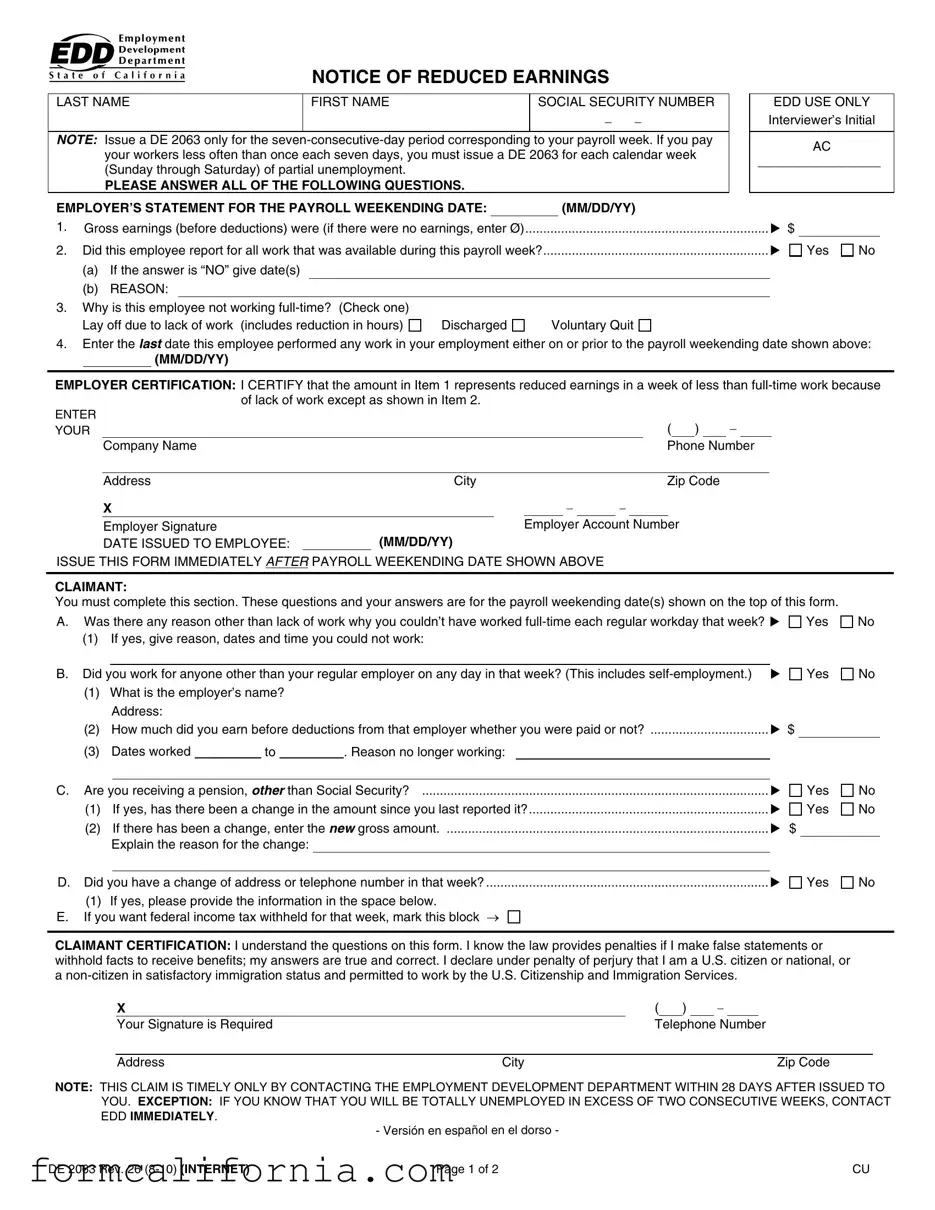

When an employee's work hours are reduced, the DE 2063 form serves as a crucial tool for documenting those changes and ensuring that employees have the information they need to claim partial unemployment benefits. This form, titled "Notice of Reduced Earnings," is specifically designed for periods of transition within the workforce, providing a bridge between full employment and times when work is less available. By requiring details such as the employee's name, social security number, and the gross earnings for a specified payroll week, the DE 2063 form captures essential information that helps both the employer and the employee navigate periods of reduced work hours effectively. Therefore, it's not just about documenting reduced hours; it's also about ensuring that employees who face temporary layoffs or cutbacks have a structured way to report their earnings and seek support. Additionally, the form prompts employees to answer pertinent questions related to their availability for work, other employment during the week in question, and any changes in contact information or desire to have federal income tax withheld. Issued immediately after the payroll week ends, this form is critical for maintaining transparent communication between employers and employees during changing times, and it plays a significant role in the employee's ability to secure partial unemployment benefits in a timely manner.

Document Preview Example

NOTICE OF REDUCED EARNINGS

LAST NAME |

FIRST NAME |

SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

NOTE: Issue a DE 2063 only for the

PLEASE ANSWER ALL OF THE FOLLOWING QUESTIONS.

EMPLOYER’S STATEMENT FOR THE PAYROLL WEEKENDING DATE: |

|

(MM/DD/YY) |

EDD USE ONLY Interviewer’s Initial

AC

_________________

1. |

Gross earnings (before deductions) were (if there were no earnings, enter Ø) |

$ |

|

|

2. |

...............................................................Did this employee report for all work that was available during this payroll week? |

|

Yes |

No |

(a)If the answer is “NO” give date(s)

(b)REASON:

3.Why is this employee not working

Lay off due to lack of work (includes reduction in hours) |

Discharged |

Voluntary Quit |

4.Enter the LAST date this employee performed any work in your employment either on or prior to the payroll weekending date shown above:

(MM/DD/YY)

EMPLOYER CERTIFICATION: I CERTIFY that the amount in Item 1 represents reduced earnings in a week of less than

ENTER |

|

( ) |

|

|

|||||

YOUR |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Company Name |

|

Phone Number |

||||||

|

|

|

|

|

|

|

|||

|

Address |

City |

Zip Code |

|

|

|

|||

X |

|

|

|

|

|

|

|

|

|

Employer Signature |

|

|

|

Employer Account Number |

|||||

DATE ISSUED TO EMPLOYEE: |

|

(MM/DD/YY) |

|

|

|

|

|||

ISSUE THIS FORM IMMEDIATELY AFTER PAYROLL WEEKENDING DATE SHOWN ABOVE

CLAIMANT:

You must complete this section. These questions and your answers are for the payroll weekending date(s) shown on the top of this form.

A.Was there any reason other than lack of work why you couldn’t have worked

Yes

Yes

No

No

(1)If yes, give reason, dates and time you could not work:

B. Did you work for anyone other than your regular employer on any day in that week? (This includes |

|

||||||

(1) |

What is the employer’s name? |

|

|

|

|||

|

Address: |

|

|

|

|

|

|

(2) |

How much did you earn before deductions from that employer whether you were paid or not? |

$ |

|||||

(3) |

Dates worked |

|

to |

|

. Reason no longer working: |

|

|

Yes

No

C. Are you receiving a pension, OTHER than Social Security? |

|

||

(1) |

If yes, has there been a change in the amount since you last reported it? |

|

|

(2) |

If there has been a change, enter the NEW gross amount |

$ |

|

|

Explain the reason for the change: |

|

|

Yes Yes

No No

D. Did you have a change of address or telephone number in that week? |

|

(1)If yes, please provide the information in the space below.

E. If you want federal income tax withheld for that week, mark this block

Yes

No

CLAIMANT CERTIFICATION: I understand the questions on this form. I know the law provides penalties if I make false statements or withhold facts to receive benefits; my answers are true and correct. I declare under penalty of perjury that I am a U.S. citizen or national, or a

X |

|

( |

|

) |

|

|

|

|

Your Signature is Required |

|

Telephone Number |

||||||

|

|

|

|

|

|

|

|

|

Address |

City |

|

|

|

|

|

Zip Code |

|

NOTE: THIS CLAIM IS TIMELY ONLY BY CONTACTING THE EMPLOYMENT DEVELOPMENT DEPARTMENT WITHIN 28 DAYS AFTER ISSUED TO YOU. EXCEPTION: IF YOU KNOW THAT YOU WILL BE TOTALLY UNEMPLOYED IN EXCESS OF TWO CONSECUTIVE WEEKS, CONTACT EDD IMMEDIATELY.

- Versión en español en el dorso -

DE 2063 Rev. 26 |

Page 1 of 2 |

CU |

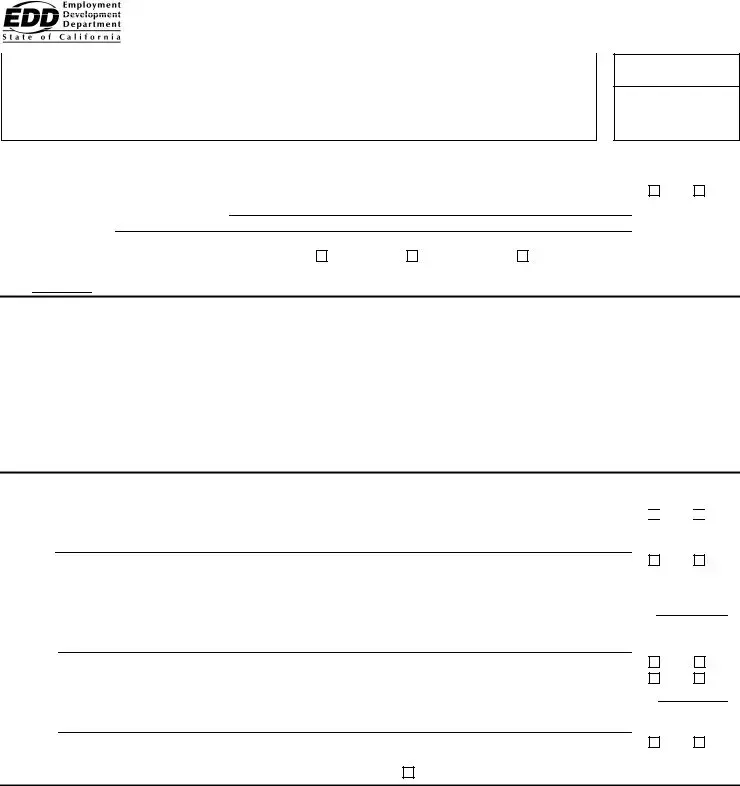

NOTICE OF REDUCED EARNINGS

LAST NAME |

FIRST NAME |

SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

NOTE: Issue a DE 2063 only for the

PLEASE ANSWER ALL OF THE FOLLOWING QUESTIONS.

EMPLOYER’S STATEMENT FOR THE PAYROLL WEEKENDING DATE: |

|

(MM/DD/YY) |

EDD USE ONLY Interviewer’s Initial

AC

_________________

1. |

Gross earnings (before deductions) were (if there were no earnings, enter Ø) |

$ |

2. |

Did this employee report for all work that was available during this payroll week? |

|

(a)If the answer is “NO” give date(s)

(b)REASON:

3.Why is this employee not working

Lay off due to lack of work (includes reduction in hours) |

Discharged |

Voluntary Quit |

Yes

No

4.Enter the LAST date this employee performed any work in your employment either on or prior to the payroll weekending date shown above:

(MM/DD/YY)

EMPLOYER CERTIFICATION: I CERTIFY that the amount in Item 1 represents reduced earnings in a week of less than

ENTER |

|

( ) |

|

|

|||||

YOUR |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Company Name |

|

Phone Number |

||||||

|

|

|

|

|

|

|

|||

|

Address |

City |

Zip Code |

|

|

|

|||

X |

|

|

|

|

|

|

|

|

|

Employer Signature |

|

|

|

Employer Account Number |

|||||

DATE ISSUED TO EMPLOYEE: |

|

(MM/DD/YY) |

|

|

|

|

|||

ISSUE THIS FORM IMMEDIATELY AFTER PAYROLL WEEKENDING DATE SHOWN ABOVE

SOLICITANTE:

Usted deberá completar esta sección. Estas preguntas y sus respuestas son para la semana de pago que termina en la fecha indicada en este formulario.

A.¿Había otra razón, además de la falta de trabajo, por la cual Ud. no podría haber trabajado horario completo

cada día normal de trabajo en esa semana? |

|

Sí |

(1)Si contesta que “sí,” proporcione la razón, las fechas y las horas en que no podía trabajar B. ¿Trabajó Ud. para alguien que no es su empleador normal, cualquier día de esa semana?

(Esto incluye trabajos independientes o en su propio negocio) |

|

Sí |

||

(1) ¿Cual es el nombre de ese empleador? |

|

|

|

|

Dirección: |

|

|

|

|

(2) |

¿Cuánto ganó, Ud. antes de deducciones, con ese empleador, aunque todavía no le haya pagado? |

$ |

|||||

(3) |

Fechas en que Ud. trabajó: del |

|

al |

|

. Razón porque Ud. no siguió trabajando |

|

|

|

|

|

|

|

|

|

|

No

No

C. ¿Está Ud. recibiendo una pensión que no sea del Seguro Social? |

|

||

(1) |

Si contesta que “si,” ¿ha habido un cambio en la cantidad que Ud. recibe desde la última vez que la reportó? |

|

|

(2) |

Si la cantidad ha cambiado, favor de escribir la nueva cantidad bruta. |

$ |

|

|

Explique la razón por el cambio: |

|

|

Sí

Sí

No No

D. ¿Cambió Ud. de domicilio o de número de teléfono en esa semana? |

|

Sí |

No |

(1)Si contesta “sí”, favor de proporcionar la información en el espacio a continuación.

E. Si usted desea que se retengan impuestos federales por ésa semana, marque esta casilla

CERTIFICACIÓN DEL SOLICITANTE: Entiendo las preguntas que contiene este formulario. Se que la ley establece sanciones si hago declaraciones falsas o retengo información para recibir beneficios. Mis respuestas son verdaderas y correctas. Declaro bajo pena de perjurio que soy ciudadano o nacional de los Estados Unidos, o soy un(a) extranjero(a) con situación migratoria satisfactoria y con permiso del Servicio de Ciudadanía e Inmigración de los Estados Unidos para trabajar.

X |

( |

) |

|

|

||||

Se Requiere su Firma |

|

Número de Teléfono |

||||||

|

|

|

|

|

|

|

|

|

Dirección |

Ciudad |

|

|

|

|

|

Código Postal |

|

NOTA: ESTA SOLICITUD DE BENEFICIOS SERÁ CONSIDERADA A TIEMPO SOLAMENTE CUANDO USTED SE COMUNICA CON EL DEPARTAMENTO DEL DESARROLLO DEL EMPLEO DENTRO DE 28 DÍAS DESPUÉS DE LA FECHA EN QUE SE LE EMITIÓ A USTED. EXCEPCIÓN: SI UD. TIENE CONOCIMIENTO QUE ESTARÁ TOTALMENTE DESEMPLEADO(A) POR MÁS DE DOS SEMANAS CONSECUTIVAS, COMUNÍQUESE INMEDIATAMENTE EL EDD.

|

- English version on other side - |

|

DE 2063 Rev. 26 |

Page 2 of 2 |

CU/MIC 38 |

Document Specs

| Fact | Detail |

|---|---|

| Form Purpose | The DE 2063 form is issued to document reduced earnings for workers not working full-time due to lack of work or other reasons. |

| Issuance Frequency | Employers must issue a DE 2063 for the seven-consecutive-day period corresponding to their payroll week or for each calendar week (Sunday through Saturday) for employees paid less frequently. |

| Employer Requirements | Employers are required to certify the worker's reduced earnings for the specified week and indicate the reason for not working full time, which can include lack of work, discharge, or voluntary quitting. |

| Employee Requirements | Workers must complete their section of the form, providing details about any other employment, inability to work full time for reasons other than lack of work, changes in address or phone number, and if they wish to have federal income tax withheld. |

| Penalty Warning | The form advises that making false statements or withholding facts to receive benefits can lead to penalties under the law. |

| Governing Law | This form is governed by the Employment Development Department (EDD) under California's state laws regarding unemployment and employee benefits. |

Detailed Instructions for Writing De 2063

Filling out the DE 2063 form is an important step for both employers and employees experiencing reduced earnings in a particular week due to less than full-time work availability. This form serves as official documentation that affects the benefits an employee may receive. Completing it accurately and timely is crucial. Below is a guide to assist you in filling out the form correctly.

- Start by entering the employee's last name, first name, and social security number at the top of the form.

- In the "Employer’s Statement for the Payroll Weekending Date" section, record the date of the payroll week's end in the MM/DD/YY format.

- For question 1, state the employee's gross earnings for that week before deductions. If there were no earnings, enter "0".

- Answer question 2 by indicating whether the employee reported for all work that was available. If the answer is "No," provide the date(s) and reason for the absence.

- Check the appropriate box in question 3 to explain why the employee is not working full-time: lay off due to lack of work (includes reduction in hours), discharged, or voluntary quit.

- Enter the last date the employee performed any work in your employment either on or before the payroll week-ending date mentioned.

- In the employer certification section, provide your company name, phone number, address, city, and zip code.

- Sign the form, include the employer account number, and record the date issued to the employee.

- For the claimant section, the employee must answer further questions regarding their availability, other work during the week, receipt of pension other than Social Security, and any changes in address or telephone number.

- The employee must decide whether they want federal income tax withheld for that week.

- Finally, the employee signs the form, providing their telephone number, address, city, and zip code to certify their responses.

Timeliness in issuing and submitting this form is key. Employers must distribute the DE 2063 form immediately after the payroll week ends, and employees are encouraged to provide all necessary information as soon as possible. This efficient communication ensures that benefits are administered accurately and promptly.

Things to Know About This Form

What is the DE 2063 form?

The DE 2063 form is a notice used in California to document instances of reduced earnings. It is issued to employees who have experienced a decrease in their usual work hours. This form serves as an official record for both employers and the state's Employment Development Department (EDD), helping to facilitate claims for partial unemployment benefits.

When should the DE 2063 form be issued?

Employers must issue the DE 2063 form for a seven-consecutive-day period that corresponds to their payroll week. In cases where employees are paid less frequently than every seven days, an individual DE 2063 form must be issued for each calendar week (Sunday through Saturday) of partial unemployment experienced by the employee.

What information is required on the DE 2063 form?

The DE 2063 form requires various pieces of information, including:

- Gross earnings for the payroll week.

- Confirmation of whether the employee was available for all work offered.

- The reason for the employee's reduced work hours.

- The last date the employee performed any work.

- Employer certification of reduced earnings due to lack of work.

How is the DE 2063 form used?

The DE 2063 form is used by employers to confirm an employee's partial unemployment status due to reduced work hours. It is a crucial document for employees when claiming partial unemployment benefits from the EDD. The form must be completed accurately and issued promptly after the payroll week ending date to ensure timely processing of claims.

What are the consequences of not issuing a DE 2063 form?

Failing to issue a DE 2063 form can result in delays or denials of partial unemployment benefits for affected employees. It may also subject the employer to penalties for non-compliance with state employment regulations.

Can an employee submit a DE 2063 form directly to the EDD?

No, the DE 2063 form is issued by the employer and provided to the employee. However, it is the employee's responsibility to submit this form to the EDD as part of their claim for partial unemployment benefits.

What should an employee do if they do not receive a DE 2063 form?

If an employee does not receive a DE 2063 form, they should contact their employer to request it. If the employer fails to issue the form, the employee may need to contact the EDD for assistance in obtaining the necessary documentation for their claim.

Is the DE 2063 form available in languages other than English?

Yes, the DE 2063 form is available in multiple languages, including Spanish. This ensures that non-English speaking employees can understand and properly complete the form. Employers should provide the form in the appropriate language for their employees.

How does an employer certify the DE 2063 form?

An employer certifies the DE 2063 form by completing all required sections, including an accurate report of the employee's gross earnings and the reason for reduced hours. The employer must then sign and date the form, confirming the truthfulness and accuracy of the information provided.

Can the DE 2063 form be submitted electronically?

While specific processes may vary, in general, the DE 2063 form is designed to be filled out manually and given to the employee. Employers and employees should check with the California EDD for any updates or changes regarding electronic submission options.

Common mistakes

Filling out the DE 2063 form accurately is crucial for employees facing reduced earnings. However, common mistakes can lead to unnecessary delays and complications in processing. Understanding and avoiding these errors can ensure smoother interactions with the Employment Development Department (EDD).

-

Not Issuing the Form for the Correct Time Period: The DE 2063 form must be issued for the seven-consecutive-day period that corresponds to the employer's payroll week. If the payroll frequency is less than weekly, a separate form needs to be issued for each calendar week of partial unemployment, spanning Sunday through Saturday. Overlooking this requirement can cause significant delays in the processing of benefits.

-

Incorrect or Incomplete Gross Earnings Report: Gross earnings before deductions for the payroll week must be accurately reported. If there were no earnings, entering a zero is crucial. Incorrectly reported earnings or leaving the earnings section blank can mislead the EDD, affecting the benefit calculations and potentially leading to the issuance of incorrect benefits.

-

Failing to Detail Work Availability: If the employee did not report for all work that was available, it is mandatory to provide specific dates and reasons for the absence. Neglecting to include this information can result in the EDD not having a full understanding of the employee's employment situation, which might impact eligibility for benefits.

-

Overlooking Additional Employment: Employees must declare if they worked for anyone other than their regular employer during the week concerned, including self-employment. Failure to disclose this information can be viewed as withholding facts, leading to potential penalties and affecting benefit entitlements.

Avoiding these mistakes can help ensure that the DE 2063 form is processed efficiently, allowing employees to receive the appropriate benefits without delay. It is in both the employer’s and employee's best interest to review the form thoroughly before submission to avoid common pitfalls.

Documents used along the form

When handling reduced earnings and navigating employment changes, the DE 2063 form serves as a critical document for employers and employees in managing unemployment benefits efficiently. Alongside the DE 2063 form, a variety of other documents and forms are often utilized to ensure thorough processing and compliance with regulations. These additional documents support various aspects of employment, from verifying eligibility for benefits to reporting new work or wage details.

- DE 1101I: This is the Unemployment Insurance Application form. It is necessary for initiating a claim for unemployment benefits, providing detailed information about previous employment and reasons for unemployment.

- DE 4581: The Continued Claim Form is essential for certifying eligibility for unemployment benefits on a bi-weekly basis. It tracks any earnings during the period and confirms availability for work.

- DE 4: The Employee’s Withholding Allowance Certificate is used to determine federal income tax withholding. This form is relevant for individuals receiving unemployment benefits who elect to have tax withheld.

- DE 8829: A Substitute Teacher Availability Form, utilized primarily in educational sectors to verify the days a substitute teacher is available for work, impacting their eligibility for partial unemployment benefits.

- DE 2501: The Claim for Disability Insurance (DI) Benefits form is used when an employee is unable to work due to a non-work-related illness, injury, or pregnancy, providing temporary benefit payments.

- DE 2525XX: This Disability Insurance Continued Claim Form extends DI benefits beyond the initial claim period, requiring detailed information on the claimant's medical condition and treatment.

- DE 429D: The Quarterly Contribution Return is filed by employers to report wages and calculate owed state unemployment insurance taxes, integral for funding unemployment benefits.

Understanding and correctly utilizing these forms in conjunction with the DE 2063 can greatly streamline the process of managing reduced earnings, ensuring both compliance and support for employees during periods of partial unemployment. The interplay among these documents facilitates a comprehensive approach to handling employment transitions and maintaining the integrity of unemployment insurance benefits.

Similar forms

The DE 2063 form, known as a Notice of Reduced Earnings, serves a specific purpose in the realm of employment documents, similar in function to several others that play key roles across different scenarios. One such document is the W-4 form, or Employee's Withholding Certificate, used in the United States for tax purposes. Both DE 2063 and W-4 forms collect important personal information and financial details, though they serve distinct purposes; the DE 2063 form is utilized to document reduced earnings and partial unemployment, whereas the W-4 form is designed to help employers understand the correct amount of tax to withhold from an employee's paycheck.

Another document sharing similarities with the DE 2063 form is the Unemployment Insurance (UI) Claim Form. Both are integral to the process of claiming benefits under specific circumstances. The DE 2063 form is issued to employees who experience a reduction in hours, making them eligible for partial unemployment benefits. Conversely, the UI Claim Form is a broader application for unemployment benefits, used by individuals who have completely lost their jobs or are working significantly reduced hours.

The Employment Verification Form is another document bearing resemblance to the DE 2063 form, particularly in their mutual purpose of certifying employment details. While the DE 2063 form focuses on documenting an employee's reduced earnings over a specific week due to partial unemployment, the Employment Verification Form is often used by lenders or landlords to verify an employee's income and employment status. Both play critical roles in financial and employment verification processes but serve different end purposes.

Similarly, the Timesheet or Payroll Report shares functionalities with the DE 2063 form, as both deal with documenting specific aspects of an employee's work and earnings for a given period. While the DE 2063 form captures reduced earnings and the reasons behind them, a Timesheet or Payroll Report records the total hours worked by an employee, used primarily for calculating pay and ensuring compliance with employment laws. The focus on earnings and work hours links these documents closely, despite their different applications in the workplace.

Last but not least, the Worker's Compensation Claim Form parallels the DE 2063 form in that both are employed in scenarios where an employee's normal work situation is altered due to external factors. The DE 2063 form is used when an employee's hours are reduced, usually because of economic reasons, while the Worker's Compensation Claim Form is used when an employee is injured on the job and must claim benefits for lost wages and medical expenses. Each form requires detailed information about the employee’s work situation and how it has been altered, linking them in their function of documenting changes that affect employment and earnings.

Dos and Don'ts

When filling out the DE 2063 form, there are several dos and don'ts to ensure the process is completed accurately and effectively. Paying attention to these tips can help avoid common errors and ensure that your submission is processed without delays.

Do:

- Ensure all sections of the form are completed in full, including both the employer’s and employee’s sections, to avoid any processing delays.

- Verify the accuracy of the gross earnings reported before deductions to ensure they match your payroll records.

- Answer truthfully regarding the employee's work status and availability during the payroll week to maintain integrity in the reporting process.

- Check one of the reasons why the employee is not working full-time to provide clear context to the EDD regarding the employee's employment status.

- Provide the last date the employee performed any work, as this information is critical for determining eligibility for reduced earnings benefits.

- Sign and date the employer certification section to validate the information provided on the form.

- Issue the form immediately after the payroll week ending date indicated to comply with timely reporting requirements.

Don't:

- Leave any questions unanswered. An incomplete form can result in processing delays or inaccuracies in benefit determination.

- Guess on dates or earnings. Ensure all information is accurate and corresponds with payroll records.

- Forget to provide detailed reasons if the employee did not report for all work available. Detailing these reasons helps clarify eligibility for reduced earnings.

- Omit the employer's signature or date, as an unsigned or undated form is considered incomplete and will not be processed.

- Delay issuing the DE 2063 to the employee, as timely submission is crucial for the employee to contact the EDD within the required timeframe.

- Ignore instructions regarding specific categories like voluntary quit or lay off due to lack of work. Correct categorization is essential for correct processing of the form.

- Withhold information or provide false statements. Doing so can result in penalties and affect the employee's eligibility for benefits.

Misconceptions

When it comes to filling out the DE 2063 form, also known as the Notice of Reduced Earnings, there are several misconceptions that can lead to confusion. Let's address and clarify some of the most common misunderstandings:

It's only for those who are completely unemployed: This is not true. The DE 2063 form is specifically designed for individuals who are still employed but are experiencing reduced hours and, consequently, reduced earnings. It's meant to assist those in partially unemployed situations.

Earnings don’t need to be reported if they are very low: Regardless of how minimal your earnings might be for the specified week, all earnings must be reported on the DE 2063 form. The amount before deductions is crucial for accurately calculating partial unemployment benefits.

You can wait to issue the form until after the employee asks: Actually, the form should be issued immediately after the payroll week ending date. Delaying the process can complicate or delay the employee’s ability to claim partial unemployment benefits.

The form is complicated and requires legal assistance: While the form does require attention to detail, it is structured in a way that both employers and employees can complete it without legal help. Careful reading and following the instructions provided with the form should suffice.

DE 2063 is for EDD’s internal use only and doesn’t benefit the employee: This misconception overlooks the form’s primary purpose, which is to ensure that employees facing reduced hours can access partial unemployment benefits to compensate for their loss in wages.

Any employee who works reduced hours should be given this form: The issuance of the DE 2063 is contingent upon the condition that the reduction in hours and earnings is due to lack of work. Employees reducing hours for personal reasons, such as voluntary reduction or leave, may not qualify under this specific criterion.

The employer decides if the employee qualifies for partial unemployment: While employers do provide necessary information by completing the DE 2063 form, the determination of eligibility for partial unemployment benefits is made by the Employment Development Department (EDD), not the employer.

If an employee doesn’t request it, there’s no need to issue a DE 2063 form: Employers should issue the DE 2063 form to all eligible employees experiencing reduced earnings due to lack of work, independent of whether the employee expressly asks for it or not. It's part of the employer's obligations.

Filling out the DE 2063 form incorrectly has no repercussions: Incorrectly completed forms can lead to delays or denials of partial unemployment benefits for the employee. It is important for both parties to ensure the information is accurate and complete to avoid such issues.

Understanding the DE 2063 form and its requirements can help both employers and employees navigate the complexities of partial unemployment more easily, ensuring that those who are eligible can receive their benefits without unnecessary delay.

Key takeaways

Understanding the DE 2063 form provides necessary clarity for both employers and employees navigating periods of reduced earnings due to partial unemployment. Here are at least five key takeaways to understand its importance and usage:

- The purpose of the DE 2063 form is to officially communicate any reduction in an employee's working hours and consequently, their earnings, which qualifies them for partial unemployment benefits within the stipulated seven-consecutive-day payroll week. Employers need to be precise when documenting reduced work schedules or layoffs.

- Employers must issue the DE 2063 form weekly if the payroll is processed less frequently than every seven days. This ensures that the records accurately reflect each week's employment activity and earnings, which is crucial for the Employment Development Department (EDD) to assess the partial unemployment benefits correctly.

- Completeness and accuracy in filling out the form are imperative. All sections, including the employer’s statement, gross earnings before deductions, the last date worked within the payroll period, and reasons for reduced hours or termination, must be filled with accurate information to avoid delays or errors in the benefits process.

- The form serves as a double confirmation from both the employer and the employee. After the employer completes their portion, the employee must review the details for accuracy, answer additional questions regarding their employment status, and declare any additional income or changes that could affect their benefit eligibility.

- Timeliness in issuing and submitting the DE 2063 form is crucial. Employers are instructed to issue this form immediately after the payroll week ending date shown. Similarly, employees are advised to contact the EDD within 28 days after the form is issued to ensure their claim is considered timely. This prompt action is essential, especially if the employee anticipates being fully unemployed for more than two consecutive weeks.

In conclusion, the DE 2063 form is a vital document that facilitates the accurate reporting of partial unemployment claims to the Employment Development Department. Both employers and employees must handle this form with care, ensuring the information is complete, accurate, and submitted promptly. Understanding how to correctly fill out and use this form can significantly impact the processing and receipt of unemployment benefits, providing necessary financial support during periods of reduced work.

Discover More PDFs

Deadline to File Notice of Appeal California - It emphasizes the importance of serving all parties to the case with a copy of the appeal notice to ensure due process.

California 100s Instructions - Highlights the necessity of an officer’s signature, underscoring the election’s official nature.

California 3500 - Includes sections that allow organizations to explain their contributions to the community and public welfare.