Blank De 161 Gc 041 PDF Form

When managing the estate of someone who has passed away, understanding the necessary legal forms is crucial. Among these forms is the DE-161, GC-041, known formally as the Inventory and Appraisal Attachment. This document plays a significant role in the probate process by listing and appraising the decedent's property, ensuring that all assets are accounted for and valued accurately. Its usage is governed by specific sections of the Probate Code, particularly focusing on the distinction between community and separate property—a critical aspect in determining how assets are distributed. Additionally, the form allows for detailed itemization, ensuring that nothing is overlooked during the estate's valuation. This document, endorsed by the Judicial Council of California, serves as a foundational component of estate management, highlighting its importance in a process aimed at honoring the decedent's wishes and ensuring a fair distribution of their belongings.

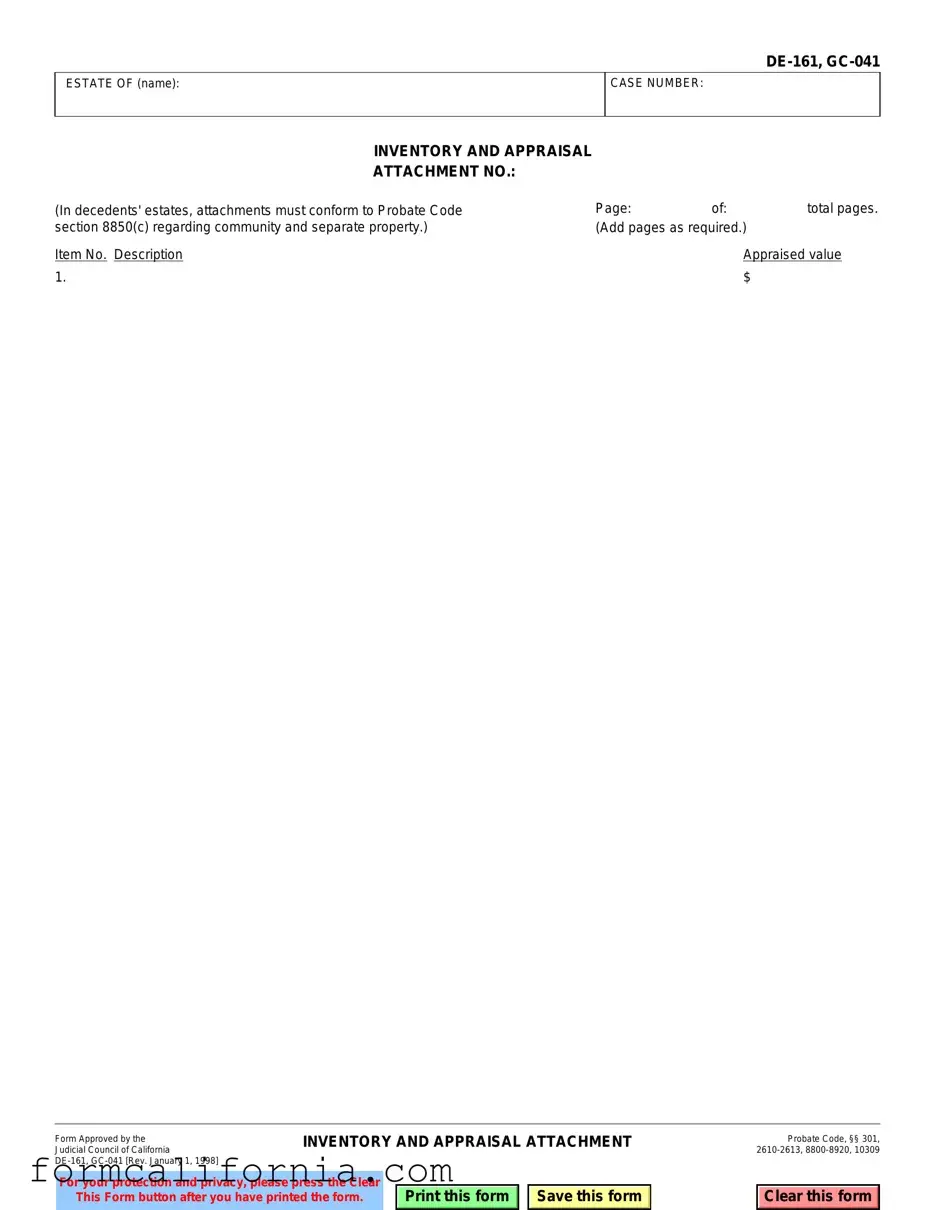

Document Preview Example

ESTATE OF (name):

CASE NUMBER:

INVENTORY AND APPRAISAL ATTACHMENT NO.:

(In decedents' estates, attachments must conform to Probate Code section 8850(c) regarding community and separate property.)

Item No. Description

1.

Page:of:total pages.

(Add pages as required.)

Appraised value

$

Judicial Council of California |

INVENTORY AND APPRAISAL ATTACHMENT |

||||

Form Approved by the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For your protection and privacy, please press the Clear |

|

|

|

|

|

This Form button after you have printed the form. |

|

Print this form |

|

Save this form |

|

|

|

|

|

|

|

Probate Code, §§ 301,

Clear this form

Document Specs

| Fact | Detail |

|---|---|

| Form Name | DE-161, GC-041 |

| Form Title | Inventory and Appraisal Attachment |

| Revision Date | January 1, 1998 |

| Purpose | To list and appraise assets within an estate in decedents' estates, conforming to specific sections regarding community and separate property. |

| Governing Law | California Probate Code sections 301, 2610-2613, 8800-8920, 10309 |

| Requirement | Attachments must conform to Probate Code section 8850(c) regarding the classification of community and separate property in decedents' estates. |

| Form Approval | Judicial Council of California |

Detailed Instructions for Writing De 161 Gc 041

When managing the estate of a decedent, accurately reporting the assets and their values is crucial. The DE-161, GC-041 form, known as the Inventory and Appraisal Attachment, is designed for this purpose. It helps ensure a clear, legal accounting of the deceased's estate to the court, which is an essential step in the probate process. Completing this form requires attention to detail and an understanding of the estate's components. Here are step-by-step instructions to guide you through the process of filling out the DE-161, GC-041 form efficiently and effectively.

- Start by entering the estate name at the top where it says "ESTATE OF (name):". Ensure you use the legal name of the deceased as listed on other official documents.

- Fill in the CASE NUMBER as assigned by the court in the space provided. This number is crucial for tracking and reference, so it must be accurate.

- Under INVENTORY AND APPRAISAL ATTACHMENT NO.:, indicate the attachment number. If you have multiple attachments, each should be numbered sequentially.

- Move to the section labeled Item No. Description. Here, you will list each item of property that needs to be appraised. For each item of property, provide a thorough description that includes any identifiable details, location, and any other pertinent information that would assist in appraisal.

- Right next to the description, in the space provided, enter the appraised value of each item listed. These values should be determined by a qualified appraiser unless the value is known and undisputed.

- If the estate's assets exceed the space provided on the first page, remember to add additional pages. Ensure each page is marked correctly at the top with "Page: of: total pages." This notation helps keep the inventory organized and ensures all assets are accounted for.

- Before concluding, review the entire form to ensure all information is complete and accurate. Mistakes or omissions could lead to delays in the probate process or impact the accurate distribution of the estate.

- Once the form is fully completed and checked for accuracy, print a copy for your records and for submission to the court.

- Lastly, as advised by the form for protection and privacy, press the "Clear This Form" button after printing to clear any personal information before leaving the website.

Completing the DE-161, GC-041 form is a step toward fulfilling your responsibility in managing the decedent's estate. It is a straightforward process, but one that requires careful attention to detail. If at any point you feel uncertain, consider consulting with a legal professional who can provide guidance specific to your situation. This ensures that the probate process moves forward smoothly and that all assets are accurately accounted for, ultimately honoring the deceased's wishes and providing clarity for the beneficiaries.

Things to Know About This Form

What is the DE-161, GC-041 form used for?

The DE-161, GC-041 form is a legal document utilized in the process of estate administration. Specifically, it's an attachment to the Inventory and Appraisal form in the context of decedents' estates. Its primary function is to detail the assets within an estate, separating them into categories of community and separate property as required by Probate Code section 8850(c). This distinction is important for properly allocating assets according to the decedent's will or state law if there's no will. By listing each asset along with its appraised value, the form assists executors and administrators in ensuring all property is accounted for and valued correctly for tax and distribution purposes.

How do you fill out the DE-161, GC-041 form?

Filling out the DE-161, GC-041 form involves a few precise steps:

- Estate of: Insert the name of the decedent whose estate is being inventoried.

- Case Number: This is the court-assigned number for the estate's probate case.

- Item No.: Number each item or group of items to be listed on the form.

- Description: For each item or group of items, provide a detailed description.

- Appraised value: Enter the value of each item as appraised by a court-appointed appraiser or as determined through another valid valuation method.

Who needs to sign the DE-161, GC-041 form?

Typically, the executor or administrator of the estate—the person responsible for managing the decedent's estate through probate—needs to sign the DE-161, GC-041 form. In certain cases, a court-appointed appraiser may also need to sign the form, particularly in the appraisal section, to verify the accuracy of the listed values. It is essential for individuals filling out the form to check with local probate court rules or consult with a legal professional to ensure all necessary signatures are collected.

Where do you file the DE-161, GC-041 form?

The DE-161, GC-041 form, once completed and signed, must be filed with the probate court handling the estate. This filing usually occurs in the county where the decedent lived at the time of death. The exact location and method of filing could vary, depending on the court's requirements and whether the case is filed electronically or requires paper submission. It's advised to contact the local probate court clerk’s office or refer to the court's website for specific filing instructions and to ensure all supporting documents are included upon submission.

What happens after the DE-161, GC-041 form is filed?

After the DE-161, GC-041 form is filed with the probate court, a few key steps typically follow:

- Review by the Court: The court reviews the submitted Inventory and Appraisal, along with its attachments, to ensure completeness and accuracy.

- Notification of Interested Parties: The executor or administrator may be required to notify heirs, beneficiaries, and creditors about the inventory and its appraised values, providing transparency in the estate administration process.

- Objection Period: There might be a specified period during which interested parties can raise objections to the inventory or the values assigned to estate assets.

- Approval and Use in Distribution: Once approved, the inventory serves as a basis for paying debts, taxes, and eventually distributing assets to beneficiaries according to the will or state law.

Common mistakes

Filling out the DE-161, GC-041 form, known as the Inventory and Appraisal Attachment, is crucial in probate proceedings. However, some common mistakes can lead to unnecessary delays or complications. It's important for individuals to be careful and thorough when completing this document to ensure smooth legal proceedings. Here are four common mistakes to avoid:

-

Overlooking Item Details: Many people mistakenly provide insufficient details about the items listed. It’s vital to describe each item of the estate thoroughly, including any identifying features or conditions that affect the item's value. This detail is crucial for accurate appraisal and legal assessment.

-

Incorrect Value Estimates: Sometimes, values are either underestimated or overestimated. Appraised values should be as accurate as possible. If unsure, it’s worth consulting with an expert appraiser to get a fair market value that reflects the true worth of the estate's assets.

-

Omitting Attachments: The form requires that attachments conform to Probate Code section 8850(c) regarding distinguishing between community and separate property. Some individuals fail to include necessary attachments that provide a complete picture of the estate, leading to incomplete submissions.

-

Forgetting to Clear the Form: For security reasons, the form includes a ‘Clear This Form’ button that should be used after printing. This step ensures your personal information is not exposed or accidentally used by others. Neglecting this final step can compromise personal information security.

To sum up, when dealing with the DE-161, GC-041 form, attention to detail, proper valuation, including all necessary attachments, and safeguarding your information are steps that cannot be overlooked. Making these considerations will help in avoiding common pitfalls and contribute towards a more efficient probate process.

Documents used along the form

When managing an estate, especially after a person has passed away, a variety of forms and documents are needed to ensure that the process meets legal standards and is completed efficiently. The DE-161, GC-041 form, known as an Inventory and Appraisal Attachment, is a crucial piece of documentation in this process. However, this document does not stand alone. There are several other forms and records frequently used alongside the DE-161, GC-041 to facilitate the comprehensive management and settlement of an estate.

- DE-111 Petition for Probate: This form is used to start the probate process, where a court oversees the distribution of the deceased's estate. It gathers essential details about the deceased, their assets, and their beneficiaries.

- DE-140 Notice of Petition to Administer Estate: Required to inform interested parties about the probate petition and gives them a chance to contest the will or the appointment of the executor/administrator.

- DE-160 Inventory and Appraisal: Complements the DE-161, GC-041 form and is a detailed list of the decedent’s estate that has been appraised by a probate referee.

- DE-120 Notice of Hearing: This form notifies all interested parties about a scheduled court hearing related to the estate. This ensures transparency and allows for objections to be heard.

- DE-285 Affidavit for Collection of Personal Property: Allows for the transfer of smaller, non-real estate assets without formal probate. It’s used for estates under a certain value threshold.

- GC-400(PET) Petition for Appointment of Conservator: In cases where the deceased had a conservatorship, this form might have been used to appoint a conservator to manage their affairs prior to death.

- DE-310 Petition to Determine Succession to Real Property: Utilized for transferring real property from the deceased to their heirs or beneficiaries under certain conditions, bypassing formal probate for smaller estates.

These forms, when used in conjunction with the DE-161, GC-041, help to facilitate the smooth execution of the probate process or transfer of the decedent's property. The proper completion and filing of these documents are essential for protecting the rights of heirs and beneficiaries and ensuring that the estate is settled in accordance with the law. Estate planning and administration can be complex, and understanding the purpose of each document can aid significantly in navigating this process.

Similar forms

The DE-161, GC-041 form, while unique in its specifics, shares similarities with several other legal documents. One such document is the Schedule of Assets in a trust administration. Both documents are integral for detailing and valuing property within an estate, albeit in different legal contexts. The DE-161, GC-041 form is used in probate for deceased estates to inventory assets and appraise their values, ensuring proper distribution in accordance with the decedent's wishes or state law. Similarly, the Schedule of Assets for a trust outlines all assets held within the trust, providing a clear valuation and description. Each serves to create transparency and inform beneficiaries and courts about the nature and extent of an estate or trust's assets.

Another comparable document is the Financial Affidavit often used in divorce proceedings. This affidavit requires a comprehensive listing of one's assets, liabilities, income, and expenses, much like the Inventory and Appraisal form that demands a detailed account and valuation of estate assets. Both documents aim to disclose financial information for fair adjudication — the former in the context of equitably dividing assets between divorcing parties, and the latter for appropriately distributing assets of a deceased's estate among heirs and creditors.

Similarly, the Personal Property Memorandum, which can accompany a will, has parallels to the DE-161, GC-041 form. This memorandum typically lists personal items and their desired recipients as stated by the will's creator, serving a purpose akin to that of detailing personal property within an estate for inventory and appraisal. While the Personal Property Memorandum might not always include valuations as the DE-161, GC-041 form does, both documents facilitate the deliberate distribution of assets in accordance with documented wishes.

Lastly, the Business Inventory and Appraisal form often used in business sales or valuations shares a resemblance with the DE-161, GC-041 form, as both provide a systematic method for listing and valuing assets. In a business context, this type of document is crucial for understanding the value of a business's assets during a sale, purchase, or merger. Likewise, the DE-161, GC-041 form serves a similar purpose within the probate process, ensuring that the estate is accurately appraised and inventoried for proper processing and distribution.

Dos and Don'ts

Filling out the DE-161, GC-041 form, an Inventory and Appraisal Attachment, is a crucial step in managing the estate of a deceased person. It demands attention to detail and a clear understanding of the assets involved. To help navigate this process, here are essential dos and don'ts to consider:

Do:

- Double-check the estate's name and case number for accuracy. These details are fundamental to ensuring that the document is correctly filed and processed.

- Provide a comprehensive item description for each asset. This detail is critical for a clear understanding and valuation of the estate's components.

- Be thorough when calculating and entering the appraised value of each item. Accuracy in these figures is key to a proper estate valuation.

- Include all necessary additional pages, clearly marked with the estate's name and case number, to accommodate the complete list of assets.

- Highlight whether items are community or separate property, adhering to Probate Code section 8850(c) requirements. This distinction is crucial for the correct legal treatment of each asset.

- After completing the form, press the "Clear This Form" button for your protection and privacy if you are filling out a digital version.

Don't:

- Overlook the need to press the “Clear This Form” button after printing, to prevent unauthorized access to sensitive information.

- Forget to conform to the Probate Code section 8850(c) concerning the classification of community and separate property if applicable. This oversight could lead to legal complications.

- Misstate the number of pages included in the attachment. Consistency and transparency in documentation are essential.

- Leave blank spaces for item descriptions or values. Incomplete records can delay the probate process and may raise questions about the estate's inventory.

- Omit any necessary attachments that detail additional estate assets. Every item contributes to the total estate value and must be accounted for.

- Rush through filling out the form without verifying all entries for accuracy and completeness. Mistakes or omissions can cause significant setbacks.

Adhering to these guidelines will ensure that the DE-161, GC-041 form is completed accurately and effectively, facilitating a smoother probate process.

Misconceptions

When dealing with the DE-161, GC-041 form, which serves as an Inventory and Appraisal Attachment in decedents' estates, several misconceptions commonly arise. Understanding and clarifying these misconceptions is crucial for individuals navigating through estate management and probate proceedings.

- Misconception 1: The form is only for use in very large estates.

In reality, the DE-161, GC-041 form is applicable to estates of varying sizes, not just those considered large. It facilitates a detailed inventory and appraisal of an estate’s assets, irrespective of the estate's total value.

- Misconception 2: It is necessary to list every single item individually.

While the form requires detailed listing, items of similar kind and value can sometimes be grouped together, based on the guidance of legal counsel or a probate referee.

- Misconception 3: Appraisals for the form can be conducted by the executor or administrator.

Appraisals listed on the DE-161, GC-041 must be conducted by a professional appraiser or a probate referee authorized by the state, not by the estate's executor or administrator.

- Misconception 4: The form covers the appraisal of assets nationwide.

While the form is a legal document within California, governed by the state's Probate Code, its process and the involvement of a probate referee are specific to California. Assets located outside of California may require separate appraisal processes compliant with the respective state’s laws.

- Misconception 5: Real estate requires no separate appraisal.

Contrary to this belief, real estate assets must be appraised and listed on the DE-161, GC-041 form. This appraisal often requires a separate process due to the nature of real estate valuation.

- Misconception 6: Once filed, the form cannot be amended.

If an estate’s inventory changes or if initial appraisals need updating, amendments to the form are permissible, following proper legal procedures and notification to the court and interested parties.

- Misconception 7: The form is only a formality and has no legal significance.

On the contrary, completing and filing the DE-161, GC-041 form is a critical step in the probate process. It provides a legal basis for the decedent's asset valuation and is crucial for accurate estate distribution.

- Misconception 8: Personal and community property do not need to be distinguished.

Probate Code section 8850(c) requires that attachments to the DE-161, GC-041 form distinguish between decedent's community property and separate property, impacting how the estate is appraised and ultimately distributed.

- Misconception 9: Digital assets do not need to be included.

The evolving nature of assets necessitates the inclusion of digital assets in the inventory, given their potential value. Although not traditionally considered, digital assets are increasingly recognized as part of an individual’s estate.

By addressing these misconceptions, individuals involved in managing or administering an estate can navigate the process more effectively, ensuring compliance with legal requirements and facilitating a smoother probate process.

Key takeaways

Understanding the DE-161, GC-041 form, or the Inventory and Appraisal Attachment, is essential in the management and settlement of decedents' estates. This document plays a crucial role in the probate process, ensuring a clear and organized evaluation of the deceased's estate. Here are five key takeaways for effectively filling out and using this form:

- Follow Probate Code requirements: This form must be completed in accordance with specific sections of the Probate Code, particularly sections 301, 2610-2613, 8800-8920, and 10309. Understanding these sections can provide guidance on legal requirements and the proper listing and appraisal of estate assets.

- Identify community and separate property: In decedents' estates, it is critical to distinguish between community property (assets acquired during marriage and jointly owned by spouses) and separate property (assets owned individually by the deceased). The form requires adherence to Probate Code section 8850(c), which outlines how these assets should be identified and listed.

- Detailed itemization: Each asset within the estate must be carefully itemized and described in detail. This includes providing a clear and accurate description of each item and its appraised value. Adding pages as necessary ensures that all assets are accounted for and appropriately evaluated.

- Accuracy is paramount: The form serves as an official record of the estate's assets and their values, which means accuracy is essential. Incorrectly listing assets or their values can lead to significant issues in the probate process, potentially causing delays or disputes among beneficiaries.

- Protect privacy and security: After filling out the form, users are advised to press the "Clear This Form" button if the form was filled out electronically. This step is important for protecting sensitive information and preventing unauthorized access to private data related to the estate.

Filling out and using the DE-161, GC-041 form correctly is a step toward ensuring the smooth execution of a decedent's estate through the probate process. It allows for a transparent, organized, and lawful appraisal and report of the estate's assets, facilitating fair distribution according to the decedent's wishes or the law.

Discover More PDFs

California Tax Efile - Interest and penalties related to underestimated tax payments can be calculated and reported.

What Is Probate in California - Form availability and mandatory use as directed by the Judicial Council of California underline its legal significance.