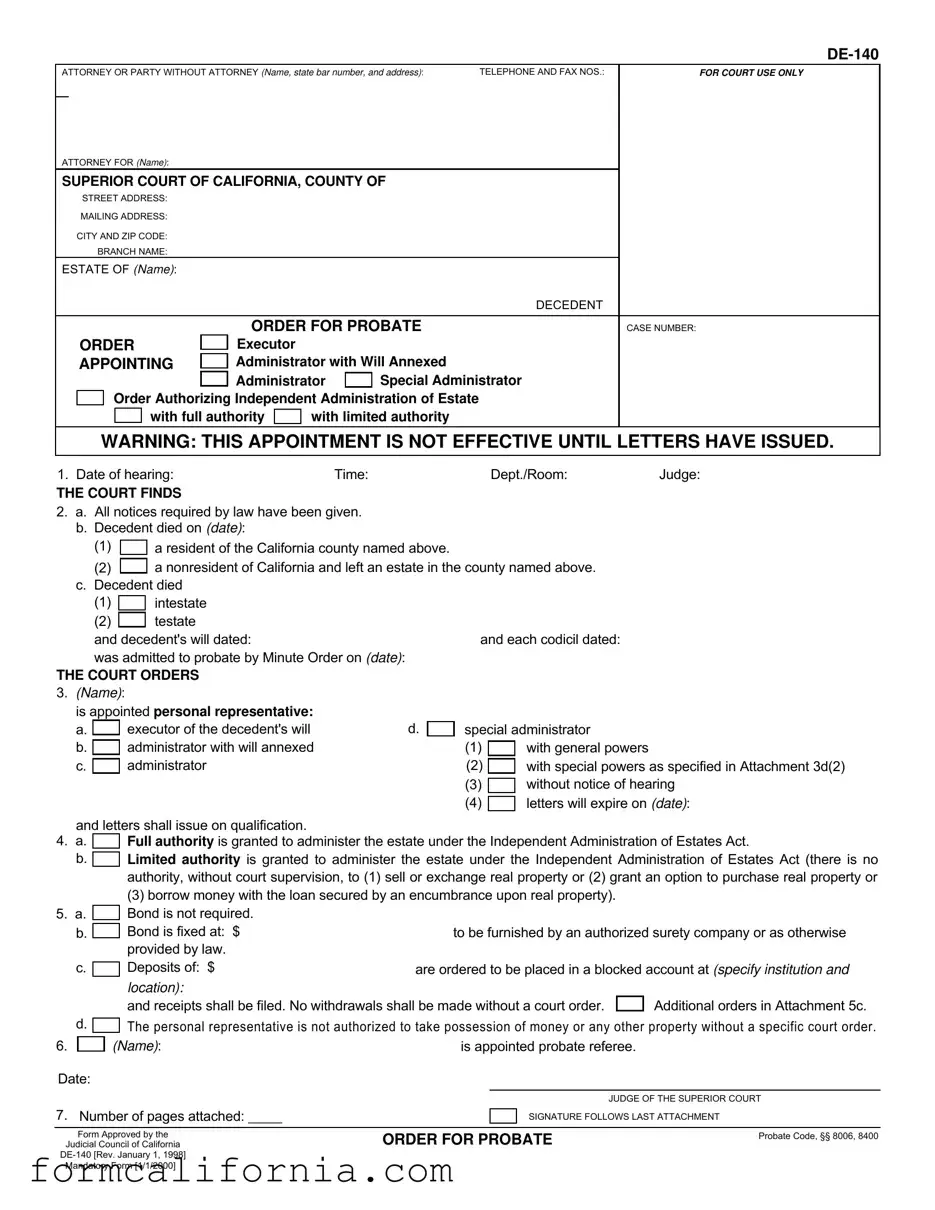

Blank De 140 PDF Form

Navigating through the complexities of settling an estate after a loved one's passing can indeed be a challenging venture. At the heart of this process, in the state of California, is the DE-140 form, an essential document that plays a pivotal role in the probate court proceedings. Serving as the official Order for Probate, this form not only designates the appointment of a personal representative but also outlines their authority levels in the administration of the deceased's estate. With sections dedicated to identifying the appointed executor, administrator with will annexed, special administrator, and more, it captures critical decisions made by the court regarding the estate's management. Furthermore, the form touches upon significant topics such as notice requirements, the decedent’s residency status, and whether the decedent had a will or died intestate. Aspects such as the granting of full or limited authority under the Independent Administration of Estates Act and the requirements regarding bond, blocked accounts, and the role of the probate referee are concisely detailed. The DE-140 form acts as a launchpad for the broader probate proceedings, encapsulating key findings and orders that shape the path forward for estate administration. It stands not only as a procedural necessity but as a cornerstone document that ensures the legal and orderly transition of the decedent's assets in accordance with both their wishes and California law.

Document Preview Example

ATTORNEY OR PARTY WITHOUT ATTORNEY (Name, state bar number, and address): |

TELEPHONE AND FAX NOS.: |

FOR COURT USE ONLY |

ATTORNEY FOR (Name):

SUPERIOR COURT OF CALIFORNIA, COUNTY OF

|

STREET ADDRESS: |

|

|

|

|

|

|

|

|

|||

|

MAILING ADDRESS: |

|

|

|

|

|

|

|

|

|||

|

CITY AND ZIP CODE: |

|

|

|

|

|

|

|

|

|||

|

BRANCH NAME: |

|

|

|

|

|

|

|

|

|||

ESTATE OF (Name): |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

DECEDENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ORDER FOR PROBATE |

|

CASE NUMBER: |

||||

|

ORDER |

|

Executor |

|

|

|

|

|

||||

|

|

|

|

|

|

|||||||

|

APPOINTING |

|

Administrator with Will Annexed |

|

|

|||||||

|

|

|

||||||||||

|

|

|

|

|

|

Administrator |

|

Special Administrator |

|

|

||

|

|

Order Authorizing Independent Administration of Estate |

|

|

||||||||

|

|

|

|

|||||||||

|

|

|

|

with full authority |

|

with limited authority |

|

|

||||

|

|

|

|

|

|

|

||||||

WARNING: THIS APPOINTMENT IS NOT EFFECTIVE UNTIL LETTERS HAVE ISSUED.

1. Date of hearing: |

Time: |

Dept./Room: |

Judge: |

THE COURT FINDS

2.a. All notices required by law have been given. b. Decedent died on (date):

(1) |

|

a resident of the California county named above. |

|

(2) |

|

a nonresident of California and left an estate in the county named above. |

|

|

|||

c. Decedent died |

|

||

(1) |

|

intestate |

|

|

|

||

(2) |

|

testate |

|

|

|

||

and decedent's will dated: |

and each codicil dated: |

||

was admitted to probate by Minute Order on (date): |

|

||

THE COURT ORDERS

3.(Name):

is appointed personal representative: |

|

||

a. |

|

executor of the decedent's will |

d. |

b. |

|

administrator with will annexed |

|

|

|

||

|

|

administrator |

|

c. |

|

|

|

special administrator

(1) |

|

with general powers |

(2) |

|

with special powers as specified in Attachment 3d(2) |

|

||

(3) |

|

without notice of hearing |

|

||

(4) |

|

letters will expire on (date): |

|

and letters shall issue on qualification.

4. a. |

|

Full authority is granted to administer the estate under the Independent Administration of Estates Act. |

|

|

|

b. |

|

Limited authority is granted to administer the estate under the Independent Administration of Estates Act (there is no |

5.a.

b.

c.

d.

6.

Date:

authority, without court supervision, to (1) sell or exchange real property or (2) grant an option to purchase real property or

(3) borrow money with the loan secured by an encumbrance upon real property).

Bond is not required. |

|

|

|

Bond is fixed at: $ |

to be furnished by an authorized surety company or as otherwise |

||

provided by law. |

|

|

|

Deposits of: $ |

are ordered to be placed in a blocked account at (specify institution and |

||

location): |

|

|

|

and receipts shall be filed. No withdrawals shall be made without a court order. |

|

Additional orders in Attachment 5c. |

|

The personal representative is not authorized to take possession of money or any other property without a specific court order.

The personal representative is not authorized to take possession of money or any other property without a specific court order.

(Name): |

is appointed probate referee. |

|

|

|

|

|

|

JUDGE OF THE SUPERIOR COURT |

7. Number of pages attached: _____ |

|

|

SIGNATURE FOLLOWS LAST ATTACHMENT |

|

|

|

|

|

|

Form Approved by the |

ORDER FOR PROBATE |

Probate Code, §§ 8006, 8400 |

||

Judicial Council of California |

|

|||

Mandatory Form [1/1/2000]

Document Specs

| # | Fact |

|---|---|

| 1 | The DE-140 form is used within the Superior Court of California. |

| 2 | It is specifically designed for the order of probate concerning an estate. |

| 3 | The form appoints a personal representative to administer an estate. |

| 4 | It distinguishes between different types of administrators: executor, administrator with will annexed, and special administrator. |

| 5 | The DE-140 includes a section where the court grants full or limited authority under the Independent Administration of Estates Act. |

| 6 | It requires a summary of the decedent's death details, including date of death and resident status. |

| 7 | The form mandates notification of a hearing with details such as date, time, and department. |

| 8 | A section is dedicated to bond requirements or exemptions, deposit orders, and restrictions on asset withdrawal. |

| 9 | The appointment of a probate referee is specified within the document. |

| 10 | Governing laws for the DE-140 form include Probate Code sections 8006 and 8400. |

Detailed Instructions for Writing De 140

Filling out the DE-140 form is a necessary step in the probate process, which deals with managing the estate of someone who has passed away. The form is used to officially appoint an individual or entity to manage the deceased's estate, detailing the level of authority they will have. Below are the steps needed to correctly fill out the form, ensuring all the required information is accurately represented.

- Start by entering the name, state bar number (if applicable), and address of the attorney or party without an attorney at the top of the form, along with telephone and fax numbers.

- Fill in the attorney's name for whom you are acting if applicable.

- Provide details of the Superior Court of California, including the county, street address, mailing address, city and zip code, and branch name.

- Enter the name of the decedent (the person who has passed away) and the case number in the designated spots.

- Under "Order For Probate," mark the appropriate box to indicate the type of appointment being sought: Executor, Administrator with Will Annexed, Administrator, Special Administrator, or Order Authorizing Independent Administration of Estate with full or limited authority.

- Fill in the date of the hearing, time, department/room, and judge's name in section 1.

- In section 2, tick the appropriate boxes to confirm that all required notices have been given, provide the deceased's date of death, residency status, and whether they died intestate (without a will) or testate (with a will), including the dates of the will and any codicils (amendments to the will).

- In section 3, write the name of the individual or entity being appointed to manage the estate and specify the type of appointment and any limitations or special powers granted.

- In sections 4 and 5, indicate whether full or limited authority is granted for estate administration under the Independent Administration of Estates Act, whether a bond is required, and the amount. Also, specify any ordered deposits into a blocked account, including the institution's name and location.

- Enter any additional orders provided by the court in the space provided.

- Fill in the name of the appointed probate referee and complete the form with the judge's signature.

- Don't forget to indicate the number of pages attached at the bottom of the form.

Once the form is filled out, review all the details for accuracy before submitting it to the court. A careful review ensures that all the necessary information is communicated clearly and precisely, helping to avoid any potential delays in the probate process.

Things to Know About This Form

What is the DE-140 form?

The DE-140 form, titled "Order for Probate," is a legal document used in the California Superior Court. It's essential in the process of probate, which deals with the administration of a deceased person's estate. The form officially appoints a personal representative to manage the decedent's estate. This representative might be named as an executor, administrator with will annexed, administrator, or special administrator. The form also specifies the type of authority granted to the personal representative, whether they will operate under full or limited authority as outlined in the Independent Administration of Estates Act.

Who needs to fill out the DE-140 form?

The DE-140 form is typically filled out by an attorney or the person applying to be appointed as the personal representative of the decedent's estate. This includes anyone who wishes to serve as an executor if the decedent had a will, or as an administrator if the decedent did not have a will. After the necessary hearings and upon court approval, this form is completed to officially appoint the personal representative and outline the scope of their duties and powers.

What information is needed to complete the DE-140 form?

- The full name and contact information of the attorney or party without an attorney.

- The name of the attorney's client, if applicable.

- Details of the Superior Court of California where the probate case is filed, including county, street, and mailing addresses, and branch name.

- The name of the decedent and the case number.

- Details regarding the decedent's status and estate, including date of death, residency, and whether they died testate (with a will) or intestate (without a will).

- The type of personal representative being appointed and the authority granted to manage the estate.

- Any bond requirements, blocked account details, and additional orders relevant to the administration of the estate.

How does the DE-140 form impact the probate process?

The DE-140 form plays a crucial role in the probate process by officially appointing the personal representative who will manage the decedent's estate. The designation of this representative and the extent of their authority—whether full or limited—directly influences how the estate is administered. For example, a representative granted full authority under the Independent Administration of Estates Act can sell real property without court supervision, streamlining the process. Conversely, limited authority necessitates court approval for such actions, ensuring an additional layer of oversight. Additionally, the form underscores the judicial finding that all legal notices have been properly issued, establishing a formal record for the probate case.

Common mistakes

Not adequately reviewing and understanding the various roles for which a person can be appointed, such as executor, administrator with will annexed, and special administrator, leads to confusion and incorrect selections being made on the form. This misunderstanding can significantly delay the probate process.

Failure to provide accurate and complete information about the decedent’s residence and whether they died intestate (without a will) or testate (with a will) can invalidate the form. Accurate details are crucial for the court to make informed findings and orders.

Ignoring the section that specifies the type of authority granted to the personal representative (full authority or limited authority under the Independent Administration of Estates Act) can lead to legal complications. Understanding the extent of the authority granted is essential for the proper administration of the estate.

Omitting information or making errors in the section about the bond, including whether a bond is required and the amount fixed, can cause unnecessary delays. A bond is crucial for the protection of the estate’s assets, and the court needs accurate information to make a decision.

Incorrectly affirming or neglecting to affirm the requirement for a probate referee’s appointment or the details surrounding deposits into a blocked account can have significant repercussions on the management of the estate. It is imperative to carefully review and provide complete details in these sections to ensure compliance with the court’s mandates.

Documents used along the form

When dealing with the administration of an estate, a variety of forms and documents are necessary to ensure that the process adheres to the legal requirements. The DE-140 form, which is an order for probate, plays a crucial role in this process. It appoints the personal representative and outlines the extent of their authority over the estate. Alongside the DE-140, several other forms are often required to complete the probate process effectively. Here is a look at some of these essential documents.

- Petition for Probate (DE-111): This form initiates the probate process by requesting the court to validate the deceased’s will, if any, and to appoint an executor or administrator for the estate.

- Notice of Petition to Administer Estate (DE-121): Used to notify interested parties about the probate petition and the upcoming court hearing. It ensures all potential heirs and claimants are informed.

- Proof of Service of Notice of Petition (DE-120): This document proves that the Notice of Petition to Administer Estate was served on all interested persons as required by law.

- Will and Testament: The original will of the decedent (if applicable), which outlines the distribution of their assets. It is a critical document that accompanies the petition for probate.

- Inventory and Appraisal (DE-160): Lists all the assets in the estate and their appraised value. It is essential for determining the total worth of the estate assets.

- Creditor’s Claims (DE-172): Allows creditors to file claims against the estate for debts owed by the decedent. It’s crucial for settling outstanding debts before asset distribution.

- Letters Testamentary or Letters of Administration (DE-150): Official documents that give the executor or administrator the authority to act on behalf of the estate, including managing and distributing the estate’s assets.

Each of these documents serves a specific purpose in the probate process, contributing to the organized and lawful administration of the deceased's estate. Navigating through the probate process can be complex, requiring attention to detail and strict adherence to legal procedures. It’s often beneficial to seek professional legal assistance to ensure that all necessary documentation is correctly prepared and submitted.

Similar forms

The DE-164 Petition for Probate form shares similarities with the DE-140 in that it initiates the formal process in the probate court by requesting to probate a decedent's estate. This form lays out the groundwork for the probate process by providing the deceased's information, details on the executor or administrator, and the type of authority they're asking for, just like the DE-140 specifies the appointment and authority of the personal representative.

Similar to the DE-140, the Judicial Council Form DE-111 (Petition for Probate) is also utilized in the probate process to begin the formal proceedings. It helps in officially presenting the will (if any) to the court and requesting the appointment of a particular person as the executor or administrator. Both forms are crucial steps in legally establishing the management and distribution of the deceased's estate, detailing the type of administration the petitioner is seeking.

The MC-030 Declaration form is often used alongside the DE-140 in probate cases to provide detailed statements or explanations that support the information or requests made in the DE-140. While the DE-140 is specific to the appointment and orders related to the estate's administration, the MC-030 can be utilized to elaborate on any aspect, providing necessary additional context or evidence required by the court during the probate proceedings.

The DE-120 (Notice of Hearing—Probate) form, like the DE-140, is part of the suite of documents used in the probate process. It serves the purpose of informing interested parties about the time and place of the probate hearing. While the DE-140 lays out the court's findings and orders regarding the estate's administration, the DE-120 ensures that all relevant individuals are aware of and can attend the hearing, potentially to contest or support the orders mentioned in the DE-140.

The Judicial Council Form DE-147 (Duties and Liabilities of the Personal Representative) complements the DE-140 by outlining the responsibilities and potential risks assumed by the person appointed as the estate's administrator or executor. While the DE-140 is focused on the appointment itself and the scope of the authority granted, the DE-147 provides a roadmap of what is expected next, emphasizing the gravity and breadth of the appointed individual's role.

The Request for Special Notice (DE-154) form in probate cases is related to the DE-140 in that it is used by parties who have an interest in the estate to ensure they are kept informed about filings and orders in the probate case, such as the appointment of an executor or administrator detailed in the DE-140. This form ensures transparency and communication among all parties involved in the probate process.

The Inventory and Appraisal (DE-160) form is a necessary step that follows the appointment actions outlined in DE-140. After someone is appointed as a personal representative of the estate, they must inventory the estate's assets and complete this form. It directly relates to the administration authority granted in DE-140, dictating how the executor or administrator will handle and report the estate's assets.

The Ex Parte Petition for Authority to Sell Securities (DE-250) is another document with a procedural connection to the DE-140. After the appointment of an administrator or executor, as authorized in DE-140, the representative may need to obtain further court permissions to manage the estate's assets effectively, including selling securities. This form, like DE-140, requires judicial approval for specific actions concerning the estate’s assets.

Creditor's Claim (DE-172) form is indirectly connected to the DE-140 as it is a means for creditors to file claims against the decedent's estate, overseen by the appointed executor or administrator. The processing and approval of such claims are part of the estate's administration process, initiated by the appointment detailed in DE-140. It underscores the financial responsibilities and powers of the personal representative in managing the estate's obligations.

Lastly, the Petition for Final Distribution (DE-260) shares its end goal with DE-140, serving as a bookend to the probate process. Where DE-140 appoints an individual to start administering the estate, DE-260 is used to conclude the process by distributing the estate's assets to rightful heirs or beneficiaries. Both forms are pivotal, marking the commencement and conclusion of estate administration through the court.

Dos and Don'ts

When approaching the DE-140 form, a critical document within the probate process, guidance can ensure accuracy and compliance. This outline will steer you through the necessary dos and don'ts, facilitating a smoother journey through the legal intricacies of probate administration.

Do:

- Ensure all personal details filled out on the DE-140 form are accurate and up to date. This includes verifying the correctness of names, addresses, and all court-related information to prevent delays or complications.

- Complete every section that applies to your specific situation, without leaving out necessary information that the court requires to process the form correctly.

- Obtain and carefully read through all the instructions for filling out the form. Understanding every requirement can minimize mistakes and increase the likelihood of your form being accepted on the first submission.

- Use blue or black ink if completing the form by hand. This is crucial as it ensures the form is legible and withstands the copying process without issue.

- Consult with a probate attorney if there is any confusion or uncertainty. Given the complexities of probate law, seeking professional advice can prevent legal mishaps.

Don't:

- Rush through the form without checking for errors or omissions. Every piece of information is vital and must be thoroughly reviewed before submission.

- Assume all sections apply to your situation. The DE-140 form covers various circumstances and appointing different types of administrators or executors; not all may be relevant to your case.

- Forget to sign and date the form where required. An unsigned form is akin to an incomplete submission and will be returned or lead to delays in the probate process.

- Overlook the need for supporting documents. The DE-140 often requires attachment of additional papers, such as the decedent’s will or codicils, which must be accurately referenced and included.

- Ignore court deadlines for submission. Timeliness is essential in probate matters, and failing to submit the form within the designated period can result in unnecessary complications.

Misconceptions

Understanding the DE-140 form is crucial in the process of probate administration in California. However, several misconceptions surround this document, often leading to confusion. Here’s a clear explanation of the most common misunderstandings:

Misconception 1: The DE-140 form instantly grants the power to administer an estate.

Contrary to popular belief, the DE-140, or the Order for Probate, does not immediately empower the appointed representative to manage the decedent's estate. The form signifies the court's decision, but its authority is only activated once the court issues the letters of administration or letters testamentary.

Misconception 2: A bond is always required for the personal representative.

The DE-140 form does provide information on whether a bond is required, but it’s not a given for every case. The court may decide to waive the bond requirement based on the specifics of the estate or the qualifications of the appointed representative.

Misconception 3: The form grants blanket authority to handle all estate matters.

Another common misunderstanding is that the form grants unrestricted authority. In reality, the DE-140 specifies the extent of the authority granted to the personal representative, which can be either full or limited under the Independent Administration of Estates Act.

Misconception 4: The DE-140 form is only for appointing executors.

The form actually allows for the appointment of various types of personal representatives including executors, administrators with will annexed, special administrators, and administrators. Each has different roles and responsibilities based on the details of the decedent's estate and whether there was a will.

Misconception 5: The form is effective upon signing by a judge.

While a judge’s signature is required, the DE-140's orders only become effective once the letters mandated by the court have officially been issued. This critical step is often overlooked, leading to the false assumption that a signed order is all that’s needed to proceed.

Misconception 6: All assets can be immediately accessed and distributed by the personal representative.

In fact, the DE-140 form, specifically when it limits authority or requires bonds or blocked accounts, puts controls on the personal representative’s ability to access and distribute assets. Often, a court order is required for transactions involving the estate's assets.

Misconception 7: The appointment is permanent and unchangeable.

The court sets the term for the appointment, which can be extended, reduced, or terminated under various circumstances. The DE-140 mentions that letters will expire on a specific date, indicating the non-permanent nature of the appointment.

Misconception 8: Probate referees are always appointed.

While the DE-140 form includes provision for the appointment of a probate referee, it’s not a mandatory step for all estates. The appointment depends on the complexity and needs of the estate in question.

In sum, the DE-140, or Order for Probate, is a document of substantial legal importance in the administration of an estate in California, but it is often misunderstood. Keeping these clarifications in mind can help in navigating the probate process more effectively.

Key takeaways

Filling out and using the DE-140 form, known as the Order for Probate, is a crucial step in administering an estate in California. Here are key takeaways to consider:

- Accuracy is key: Make sure every detail entered on the DE-140 form matches official documents and court records. Incorrect information can delay the probate process.

- Understanding the form's sections is crucial: Each section of the DE-140 plays a vital role in the appointment of a personal representative and the authority granted to them. It’s essential to understand what each section means to fill out the form correctly.

- Notice requirements: The form indicates that all legal notices required by law must be given before the appointment becomes effective. This ensures that interested parties are informed and have the opportunity to participate or object.

- Authority granted: The DE-140 specifies whether the personal representative is granted full or limited authority under the Independent Administration of Estates Act. Understanding the extent of this authority is important for managing the estate’s assets correctly.

- Court supervision: Depending on the authority granted, certain actions may require court approval. Selling real property, for instance, might need court supervision if only limited authority is granted. This highlights the importance of knowing the boundaries of your authorization.

Efficiently managing the DE-140 form is a critical component of the probate process. By paying close attention to the details and understanding the legal requirements, personal representatives can fulfill their duties more effectively and ensure a smoother administration of the estate.

Discover More PDFs

California Jv 445 - This form is a vital component of the judicial process, ensuring all parties are informed of the court's decisions and the expectations for the child's future welfare.

How to Change a Name on a Birth Certificate - Simplify the birth certificate completion process with a free, adaptable form tailored to California's requirements.