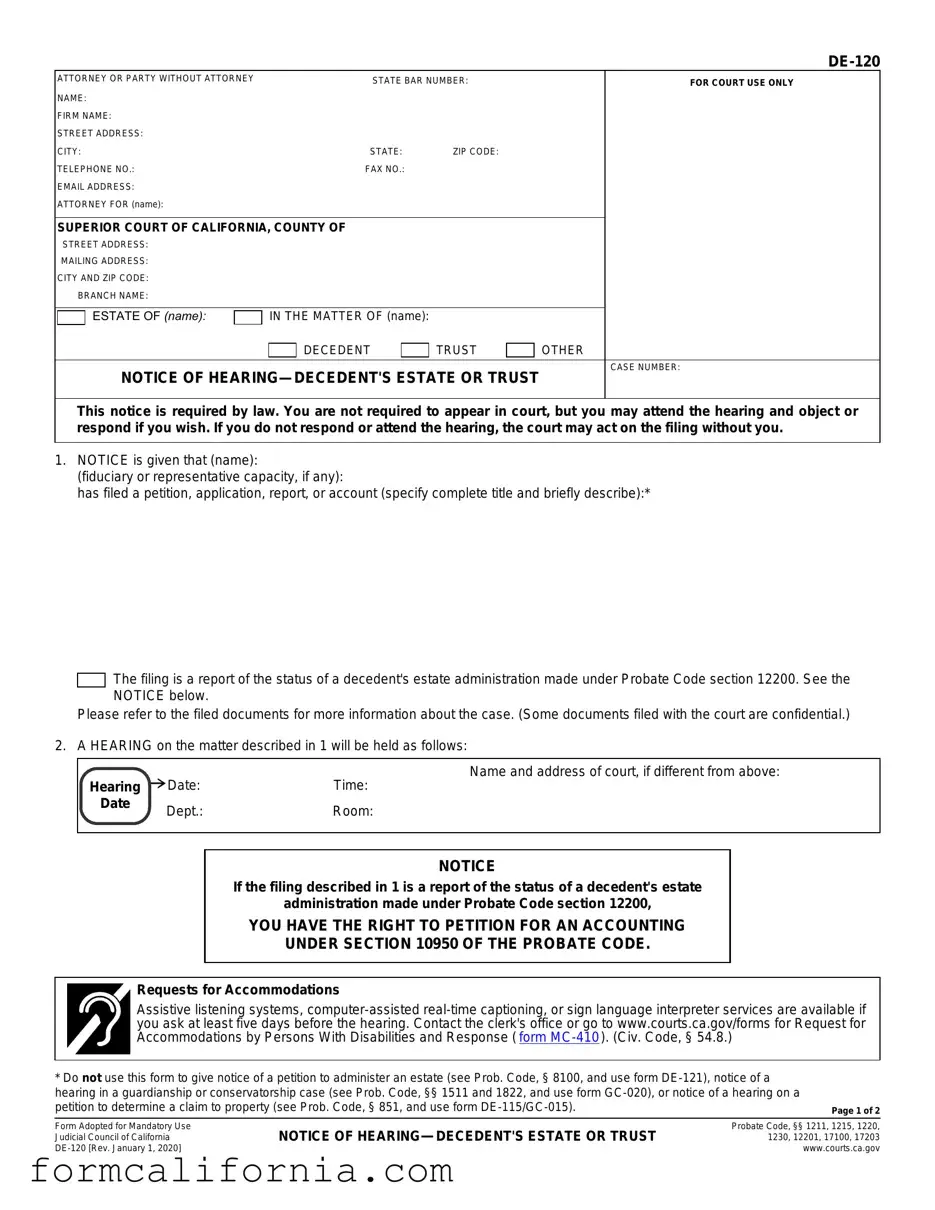

Blank De 120 PDF Form

The DE-120 form plays a crucial role in the legal proceedings of decedent's estate or trust matters within the Superior Court of California, serving as a formal Notice of Hearing for involved parties. It mandates a standardized way for attorneys or individuals without legal representation to communicate critical information about hearings related to the estate or trust of a deceased person. This notice informs recipients about the filing of petitions, applications, reports, or accounts concerning the decedent's estate or trust administration, specifically noting any action required by Probate Code section 12200. Furthermore, it outlines the rights of individuals to petition for an accounting under section 10950 of the Probate Code, emphasizing the importance of participation in these hearings to safeguard their interests. The DE-120 form also provides essential details on the hearing's scheduling, including date, time, and location, and instructs on accommodations for persons with disabilities, ensuring accessibility to all parties. Importantly, it includes a section for proof of service by mail, verifying that all relevant parties have been notified of the hearing, which is a critical step in the process to ensure fairness and transparency. This form, therefore, not only facilitates communication but also upholds the rights of individuals to participate in the legal process concerning the administration of a decedent's estate or trust.

Document Preview Example

ATTORNEY OR PARTY WITHOUT ATTORNEY |

STATE BAR NUMBER: |

FOR COURT USE ONLY |

|

NAME: |

|

|

|

FIRM NAME: |

|

|

|

STREET ADDRESS: |

|

|

|

CITY: |

STATE: |

ZIP CODE: |

|

TELEPHONE NO.: |

FAX NO.: |

|

|

EMAIL ADDRESS: |

|

|

|

ATTORNEY FOR (name): |

|

|

|

|

SUPERIOR COURT OF CALIFORNIA, COUNTY OF |

|

|

|

|

|

||||||

|

STREET ADDRESS: |

|

|

|

|

|

|

|

|

|

|

|

|

MAILING ADDRESS: |

|

|

|

|

|

|

|

|

|

|

|

|

CITY AND ZIP CODE: |

|

|

|

|

|

|

|

|

|

|

|

|

BRANCH NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ESTATE OF (name): |

|

|

IN THE MATTER OF (name): |

|

|

|

|

|

||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

DECEDENT |

|

TRUST |

|

|

OTHER |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTICE OF |

|

CASE NUMBER: |

||||||||

|

|

|

|

|||||||||

This notice is required by law. You are not required to appear in court, but you may attend the hearing and object or respond if you wish. If you do not respond or attend the hearing, the court may act on the filing without you.

1.NOTICE is given that (name):

(fiduciary or representative capacity, if any):

has filed a petition, application, report, or account (specify complete title and briefly describe):*

The filing is a report of the status of a decedent's estate administration made under Probate Code section 12200. See the NOTICE below.

Please refer to the filed documents for more information about the case. (Some documents filed with the court are confidential.)

2. A HEARING on the matter described in 1 will be held as follows:

Hearing Date: |

Name and address of court, if different from above: |

|

Time: |

||

Date |

Dept.: |

Room: |

|

||

|

|

|

NOTICE

If the filing described in 1 is a report of the status of a decedent's estate

administration made under Probate Code section 12200,

YOU HAVE THE RIGHT TO PETITION FOR AN ACCOUNTING

UNDER SECTION 10950 OF THE PROBATE CODE.

Requests for Accommodations

Assistive listening systems,

*Do not use this form to give notice of a petition to administer an estate (see Prob. Code, § 8100, and use form

Page 1 of 2

Form Adopted for Mandatory Use Judicial Council of California

NOTICE OF

Probate Code, §§ 1211, 1215, 1220, 1230, 12201, 17100, 17203

www.courts.ca.gov

|

|

ESTATE OF (name): |

|

IN THE MATTER OF (name): |

CASE NUMBER: |

DECEDENT TRUST OTHER

CLERK'S CERTIFICATE OF POSTING

1.I certify that I am not a party to this cause.

2.A copy of the foregoing Notice of

a.was posted at (address):

b.was posted on (date):

Date: |

Clerk, by |

|

, Deputy |

|

|

|

|

|

|

|

|

PROOF OF SERVICE BY MAIL*

1.I am over the age of 18 and not a party to this cause. I am a resident of or employed in the county where the mailing occurred.

2.My residence or business address is (specify):

3.I served the foregoing Notice of

a. depositing the sealed envelope on the date and at the place shown in item 4 with the U.S. Postal Service with the postage fully prepaid.

depositing the sealed envelope on the date and at the place shown in item 4 with the U.S. Postal Service with the postage fully prepaid.

b. placing the envelope for collection and mailing on the date and at the place shown in item 4 following our ordinary business practices. I am readily familiar with this business's practice for collecting and processing correspondence for mailing. On the same day that correspondence is placed for collection and mailing, it is deposited in the ordinary course of business with the U.S. Postal Service in a sealed envelope with postage fully prepaid.

placing the envelope for collection and mailing on the date and at the place shown in item 4 following our ordinary business practices. I am readily familiar with this business's practice for collecting and processing correspondence for mailing. On the same day that correspondence is placed for collection and mailing, it is deposited in the ordinary course of business with the U.S. Postal Service in a sealed envelope with postage fully prepaid.

4.a. Date mailed:

5.

b.Place mailed (city, state):

I served with the Notice of

I declare under penalty of perjury under the laws of the State of California that the foregoing is true and correct. Date:

(TYPE OR PRINT NAME) |

(SIGNATURE) |

1.

2.

3.

4.

5.

|

NAME AND ADDRESS OF EACH PERSON TO WHOM NOTICE WAS MAILED |

||

Name |

|

|

Address (street & number, city, state, zip code) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continued on an attachment. (You may use Attachment to Notice of Hearing Proof of Service by Mail, form

* Do not use this form for proof of personal service. You may use form

NOTICE OF

For your protection and privacy, please press the Clear |

Print this form |

Save this form |

This Form button after you have printed the form. |

Page 2 of 2

Clear this form

Document Specs

| Fact | Detail |

|---|---|

| Form Purpose | The DE-120 form is used to notify interested parties about a hearing related to a decedent's estate or trust. |

| Legal Reference | Governed by California Probate Code sections 1211, 1215, 1220, 1230, 12201, 17100, and 17203. |

| Attendance Rights | While not required, recipients of the notice are allowed to attend the hearing and may object or respond to the matters at hand. |

| Filing Requirements | It is mandatory for representatives to file this notice when reporting the status of estate administration under Probate Code section 12200, which also provides rights for petitioning an accounting under section 10950. |

Detailed Instructions for Writing De 120

Filling out the DE-120 form is a significant step in legal proceedings related to the estate of a deceased person or trust. This form serves as a notice of a hearing—helping to ensure all interested parties are aware of when and where the hearing will take place, and what will be discussed. It's critical that this form is filled out accurately to prevent any delays or misunderstandings in the legal process. Below are detailed instructions to guide you through each necessary step.

- Attorney or Party Without Attorney: Fill in your state bar number if applicable, your name or the name of the attorney handling the case, the firm's name, and the complete mailing address, including the street address, city, state, and zip code. Also, provide a telephone number, fax number (if any), and email address.

- Attorney For (Name): Specify the name of the person you represent. This could be the estate, a beneficiary, or any other interested person or entity.

- In the section labeled “Superior Court of California, County of”, fill in the required court details: the street address, mailing address, city and zip code, and the branch name. If this information is not known, it can be found on the court's website or by contacting the court directly.

- Under the section marked “Estate Of (Name): In The Matter Of (Name):”, enter the name of the decedent for an estate, or the name of the trust, and check the appropriate box to indicate whether the proceedings concern a decedent, a trust, or another matter.

- Fill in the case number as assigned by the court.

- In the section beginning with “1. NOTICE is given that (name):”, enter the name of the fiduciary or representative and their capacity, if any. Specify the complete title and provide a brief description of the petition, application, report, or account being filed.

- Under item 2, "A HEARING on the matter described in 1 will be held as follows:", fill in the hearing date, time, department, and room number. If the hearing location is different from the court address provided earlier, include this new address as well.

- If the filing is a report under Probate Code section 12200, the notice provided explains the rights of parties to petition for an accounting under section 10950 of the Probate Code. No action is needed here other than to ensure the recipient of the notice understands their rights.

- Requests for Accommodations: Note the provided options for requesting accommodations. This is for informational purposes and does not require action unless accommodations are needed.

- For the CLERK'S CERTIFICATE OF POSTING and PROOF OF SERVICE BY MAIL sections, these will be filled out and completed by the court clerk and the person serving the notice, respectively. Ensure all service and posting requirements are correctly followed and documented.

- Under the PROOF OF SERVICE BY MAIL section, the server must list the name and address of each person to whom notice was mailed. If more space is needed, an attachment can be used.

After completing the mentioned steps, review the form to ensure all information is accurate and complete. Remember to sign and date the form where required. The completed form must then be filed with the court, and copies must be served on all interested parties as required by law, following the proper service procedures. This ensures that everyone involved has the opportunity to participate or object during the hearing, a cornerstone of the legal process in estate and trust matters.

Things to Know About This Form

What is a DE-120 form?

The DE-120 form, also known as the Notice of Hearing—Decedent's Estate or Trust, is a legal document used in California. It notifies interested parties about a hearing related to the administration of a decedent's estate or trust. This includes details about the hearing date, time, and location, along with a brief description of the matter being considered by the court.

Who needs to file a DE-120 form?

Typically, a fiduciary or representative, such as an executor or administrator of an estate, or a trustee of a trust, must file the DE-120 form. This filing notifies all interested parties about upcoming court proceedings concerning the estate or trust in question.

When should the DE-120 form be filed?

The DE-120 form should be filed well in advance of the hearing date to ensure all interested parties receive adequate notice. The specific timeline may vary by court, but generally, it should be filed at least 15 to 30 days before the hearing.

What information is required on the DE-120 form?

The form requires detailed information, including:

- The name and contact information of the person filing the form.

- The case number and details about the estate or trust.

- A description of the document filed (e.g., petition, application) that prompted the hearing.

- The date, time, and location of the hearing.

- Any rights the respondents have, such as the right to petition for an accounting under specific sections of the Probate Code.

How is the DE-120 form served?

The DE-120 form must be served to all interested parties, typically through mail. Proof of service must be documented and filed with the court to show that all parties have been properly notified.

What is the purpose of the clerk's certificate of posting?

The clerk's certificate of posting, found on the DE-120 form, certifies that the notice has been publicly posted in a specified location, ensuring broader awareness of the hearing. This is an additional measure to notify interested parties, especially those who may not be known or easily contacted directly.

What should you do if you receive a DE-120 form?

If you receive a DE-120 form, it means a hearing that might affect your interests in a decedent's estate or trust is scheduled. Review the document carefully to understand the matter at hand. You may attend the hearing to object or respond to the filings. Ignoring the notice may result in the court deciding without considering your interests.

Can modifications to the DE-120 form be made after filing?

Any significant changes to the information originally provided on the DE-120 form, such as a change in the hearing date or time, require an amended notice to be filed and served upon all interested parties. Always check with the court or seek legal advice to ensure compliance with specific procedural requirements.

Common mistakes

Completing the DE-120 form, a critical document related to decedent's estate or trust notifications, requires careful attention to detail. Avoiding common mistakes can streamline legal processes and ensure compliance. Below are six frequent errors encountered:

- Incomplete or incorrect attorney or party information: It's essential to provide complete and accurate details in the section reserved for the attorney or party without an attorney, including the state bar number, if applicable.

- Failure to specify the representative capacity accurately: When filling out information about the fiduciary or representative capacity, being precise is crucial. Any vagueness or mistakes can lead to misunderstandings or delays.

- Misidentifying the type of filing: The DE-120 form requires a specific identification of the document being filed, such as a petition, application, report, or account. Mislabeling or not providing enough description can cause processing issues.

- Omitting or inaccurately listing the case number: Ensuring the correct case number is listed on the form is fundamental for tying the notice to the correct case, especially in matters of estate or trust.

- Inaccurate or incomplete details about the hearing: The date, time, and location of the hearing are critical for all involved parties. Failing to provide this information accurately can result in parties missing important hearings.

- Improper proof of service: Completing the proof of service section accurately ensures that all parties are correctly notified. Incorrectly filling out this part, such as the date mailed or the place mailed, can invalidate the notice.

Addressing these common errors can improve the efficacy of legal notifications related to a decedent's estate or trust. Proper completion of the DE-120 form is vital for the smooth operation of legal proceedings and ensuring all parties are duly informed.

Documents used along the form

When dealing with the complexities of managing a decedent's estate or a trust, several other forms and documents typically accompany the DE-120 form (Notice of Hearing—Decedent's Estate or Trust). Understanding what each of these forms represents and how they function within the legal process can facilitate a smoother navigation through what can be an emotionally and legally challenging time.

- DE-121 (Petition for Probate): This form is a formal request to the court to open a probate case for a decedent’s estate. It includes vital details about the decedent, their assets, the proposed personal representative, and the heirs or beneficiaries. It kicks off the legal process for administering the decedent's estate in accordance with their will or, if no will exists, under state law.

- GC-020 (Notice of Hearing—Guardianship or Conservatorship): Similar to the DE-120, this form serves to notify interested parties about a hearing in guardianship or conservatorship cases. It is essential when someone is seeking legal authority to act on behalf of a minor child or an incapacitated adult, discussing the need for such appointments, and informing about the time and place of the hearing.

- DE-115/GC-015 (Petition to Determine Claim to Property): This document is used when there’s a dispute over the ownership of property within an estate or trust. It triggers a legal process to assess and determine rightful ownership among claimants pursuant to the decedent’s wishes or relevant laws.

- MC-410 (Request for Accommodations by Persons With Disabilities): This crucial form ensures accessibility to court proceedings for individuals with disabilities. By requesting accommodations, such as assistive listening devices or sign language interpreters, it ensures that all participants can fully engage in the legal process, underscoring the court's commitment to inclusivity.

- DE-120(MA)/GC-020(MA) (Attachment to Notice of Hearing Proof of Service by Mail): This attachment is used alongside the DE-120 or GC-020 forms to provide detailed proof of service by mail. It is essential for maintaining a transparent record that all interested parties have been duly notified of upcoming hearings, as required by law.

Understanding these forms helps to demystify the legal processes involved in estate and trust management. Each document plays a role in ensuring that the decedent's wishes are respected, beneficiaries are protected, and legal requirements are met. While the paperwork might seem daunting, each form contributes to the comprehensive and lawful administration of estates and trusts, aiming for clarity, fairness, and accessibility for all involved.

Similar forms

The DE-121 form, also known as the Petition to Administer Estate, is quite similar to the DE-120 form in its function within probate proceedings. Both forms are integral parts of the estate administration process in California, with the DE-121 being used to commence probate by requesting the court's permission to administer a decedent's estate. Like the DE-120, it necessitates detailed information about the estate and the petitioner but is specifically aimed at the initial stage of probate, seeking appointment of an executor or administrator. Although each serves a different role, both forms facilitate the orderly management of a decedent's affairs within the court system.

The GC-020 form, or the Notice of Hearing - Guardianship or Conservatorship, shares similarities with the DE-120 form, particularly in its objective to notify involved parties of an upcoming court hearing. While the DE-120 form notifies about hearings related to decedents' estates or trusts, the GC-020 is used within the context of guardianship or conservatorship cases. Both forms require providing notice to interested parties, ensuring they are informed of their right to appear and participate in the judicial proceeding. This common purpose underscores the importance of transparency and involvement in legal matters that significantly affect individuals' lives and rights.

The DE-115/GC-015 form, which pertains to a hearing on a petition to determine a claim to property, parallels the DE-120 form in its procedural role. This form is another variant used in the probate court to address specific issues regarding property claims within an estate or conservatorship. Much like the DE-120, it serves to notify parties of a scheduled hearing where matters such as entitlement to estate or trust property are determined. Both forms play a crucial part in the adjudication of rights, whether it be the general administration of an estate or trust, or the more particular resolution of property claims.

Another related document is the Request for Accommodations by Persons With Disabilities and Response (form MC-410), which, while distinctly different in purpose from the DE-120, shares the overarching goal of facilitating access to the legal process. The MC-410 ensures that individuals with disabilities can fully participate in hearings, much like the DE-120 provides notice to interested or affected parties about a hearing. This ensures that all individuals, regardless of physical ability, are afforded the opportunity to be heard and represented in court matters, reinforcing the judicial system’s commitment to fairness and equality.

Dos and Don'ts

When preparing the DE-120 form for a notice of hearing regarding a decedent's estate or trust, there are critical dos and don'ts to follow for accuracy and compliance:

- Do ensure all the required information is filled out completely. Omitting details can delay the process.

- Do double-check the case number and the names of individuals involved for accuracy. Errors can lead to miscommunication or misfiling.

- Do provide clear and concise information about the hearing, including the date, time, and location, to prevent any confusion.

- Do make sure to describe the purpose of the hearing and any specific motions or petitions being considered.

- Do use the correct form version; outdated forms may not be accepted by the court.

- Do ask for accommodations if needed, well in advance of the hearing date.

- Do verify that all persons entitled to notice are listed and their contact information is current.

- Don't use the DE-120 form for other types of notices, such as a petition to administer an estate or notices related to guardianship or conservatorship cases.

- Don't forget to include your contact information, as the court may need to reach you for further information or clarification.

- Don't neglect to sign and date the form; an unsigned form may be considered invalid.

- Don't serve the notice improperly; follow the court's requirements for service closely to ensure compliance.

- Don't overlook the necessity of attaching additional documents referenced in the notice, as they are part of the complete notice package.

- Don't press the "Clear this form" button until after you've successfully printed the form if you're filling it in online. This erases all entered information.

Misconceptions

Understanding the complexities of legal notices and forms is crucial, especially when dealing with matters of decedent estates or trusts. One form that often provokes misunderstandings is the DE-120, or the Notice of Hearing—Decedent's Estate or Trust form. Here, we aim to clarify some common misconceptions about this form to ensure that involved parties can navigate the process with a clearer understanding.

Misconception 1: The DE-120 form is only for notifying about the decedent's estate administration. While primarily used to give notice of hearing related to a decedent's estate or trust, the DE-120 form also encompasses matters like reports of the estate's status under Probate Code section 12200.

Misconception 2: Anyone can file a DE-120 form. In truth, the form must be filed by someone acting in a fiduciary or representative capacity, such as an executor or administrator of the estate, which is specified within the form itself.

Misconception 3: Filing the DE-120 form automatically grants a petition. Filing the form merely notifies interested parties of a hearing; the court's decision at the hearing will determine the outcome of any petitions or applications.

Misconception 4: You must attend the court hearing if you receive a DE-120 notice. The notice explicitly states that attendance is not obligatory, though individuals may attend to object or respond to the petition if they wish.

Misconception 5: The DE-120 form can be used for any notice of hearing within probate matters. This form has specific uses, like notifying parties of hearings related to decedent estates or trusts. It should not be used for other types of probate notices, such as petitions to administer an estate or hearings in guardianship cases.

Misconception 6: The DE-120 form includes a request for accommodations for people with disabilities. While the form mentions the availability of accommodations, requests must be made through a different form, specifically the Request for Accommodations by Persons With Disabilities and Response (form MC-410).

Misconception 7: All documents filed with the court are publically accessible. Some documents may be confidential, and the DE-120 form advises parties to refer to filed documents for more case information, highlighting that not everything may be available for public inspection.

Misconception 8: The DE-120 form is valid for notifying about a change in property claims. This form is not to be used for petitions related to property claims, which are governed under different probate code sections requiring their specific forms.

Misconception 9: The filing of a DE-120 form is a complex and lengthy process. While the form requires attention to detail, it is structured to guide the filer through providing all necessary information for the court and other parties efficiently.

Misconception 10: Once a DE-120 form is filed, no further action is needed. Filing the form is a step in the process, but it may lead to additional actions based on the court’s decision or further filings required by the proceedings.

Key takeaways

Filling out and using the DE-120 form, officially known as the Notice of Hearing—Decedent's Estate or Trust, is a crucial step in legal proceedings related to estates and trusts. Here are key takeaways to ensure clarity and compliance throughout the process:

- The DE-120 form is mandatory for notifying interested parties about a hearing concerning a decedent's estate or trust. This formal notice is a critical step within the legal framework to ensure all parties are informed and have the opportunity to participate in the process.

- It informs recipients that they have the right to petition for an accounting under section 10950 of the Probate Code if the filing is a report of the status of a decedent's estate administration.

- This form must not be used for giving notice of a petition to administer an estate, notice of a hearing in guardianship or conservatorship cases, or notice of a hearing on a petition to determine a claim to property. Specific forms exist for those purposes.

- The form requires details such as the attorney or party’s contact information, the case number, and information about the estate or trust. Providing accurate and complete information is necessary for effective communication and legal process.

- Understanding that attendance at the hearing is not compulsory but recommended. Parties may attend to object or respond to the matter at hand, ensuring their views and concerns are heard.

- Requests for accommodations, such as assistive listening systems or sign language interpreter services, can be made for those who require them, emphasizing the court’s commitment to accessibility.

- The proof of service section on the back of the form is essential for verifying that all interested parties have been notified. The form outlines specific requirements for mailing, including the date mailed and the address, thereby ensuring the process is carried out correctly and legally.

- The Clerk's Certificate of Posting and the Proof of Service by Mail sections are vital for official record-keeping and legal integrity. These sections confirm the posting and service of the notice, essential steps in adhering to due process.

- For those filling out the form, understanding the significance of each section and accurately completing it is crucial. Mistakes or omissions can delay the legal process or affect the hearing’s outcome.

Adhering to the requirements and understanding the purpose of the DE-120 form will facilitate smoother legal proceedings regarding decedent's estates or trusts. Parties are encouraged to review the completed form carefully and consult legal professionals if there are uncertainties or questions.

Discover More PDFs

Ca Cosmetology License Lookup - Instructions for documenting a name change are clearly provided, ensuring applicants know how to verify their identity to the Board.

Application to Rent California - Designed to streamline the tenant selection in California, this form collects vital data for landlords on rental history, employment, and financial health.