Blank De 1 Edd PDF Form

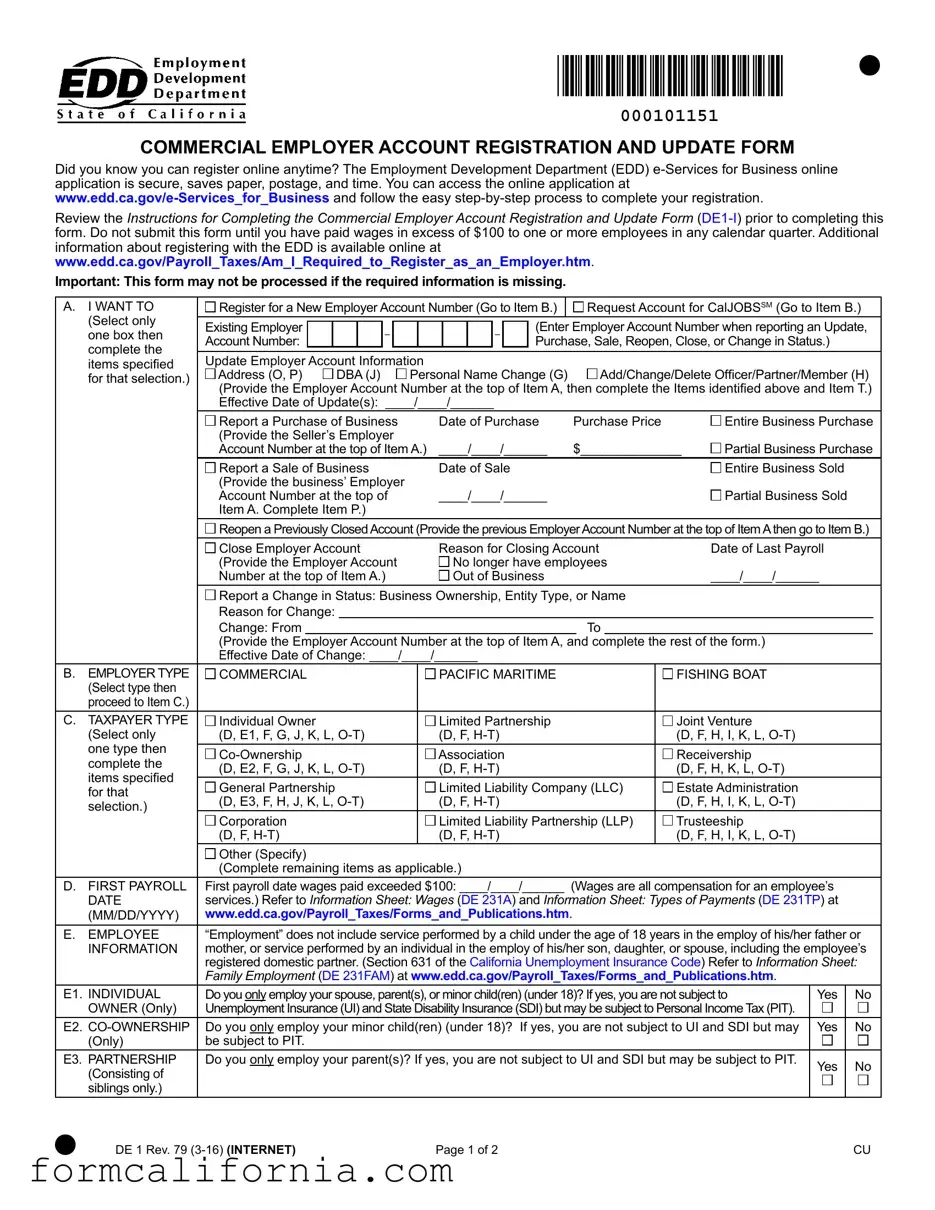

The De 1 Edd form serves as a crucial document for businesses in managing employment-related administrative tasks. Designed by the Employment Development Department (EDD), this form simplifies the complexities of registering a commercial employer account or updating existing account information. A seamless online registration process is highlighted, promoting an environment-friendly and efficient method through the EDD e-Services for Business portal. Among the various updates and registrations possible with this form, businesses can report changes in officer or partner information, address updates, and much more. The form carefully delineates the necessary steps for employers who have paid wages exceeding $100 within any calendar quarter, emphasizing its focus on both new and existing business entities. Additionally, it includes specific instructions for different taxpayer types, from individual owners to partnerships, ensuring that each entity is accounted for accurately. The importance of accurate and complete information is underscored to avoid processing delays, showcasing the form's role in facilitating employer compliance with state requirements.

Document Preview Example

000101151

COMMERCIAL EMPLOYER ACCOUNT REGISTRATION AND UPDATE FORM

Did you know you can register online anytime? The Employment Development Department (EDD)

Review the Instructions for Completing the Commercial Employer Account Registration and Update Form

www.edd.ca.gov/Payroll_Taxes/Am_I_Required_to_Register_as_an_Employer.htm.

Important: This form may not be processed if the required information is missing.

A. |

I WANT TO |

Register for a New Employer Account Number (Go to Item B.) |

|

|

Request Account for CalJOBSSM (Go to Item B.) |

||||||||||||||||||||||||

|

(Select only |

Existing Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Enter Employer Account Number when reporting an Update, |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

one box then |

|

|

|

|

|

– |

|

|

|

|

|

|

– |

|

||||||||||||||

|

Account Number: |

|

|

|

|

|

|

|

|

|

|

|

|

Purchase, Sale, Reopen, Close, or Change in Status.) |

|

|

|||||||||||||

|

complete the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Update Employer Account Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

items speciied |

|

|

|

|

|

|

|

|

Add/Change/Delete Oficer/Partner/Member (H) |

|||||||||||||||||||

|

for that selection.) |

Address (O, P) |

DBA (J) |

Personal Name Change (G) |

|

||||||||||||||||||||||||

|

|

(Provide the Employer Account Number at the top of Item A, then complete the Items identiied above and Item T.) |

|||||||||||||||||||||||||||

|

|

Effective Date of Update(s): ____/____/______ |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

Report a Purchase of Business |

|

|

Date of Purchase |

Purchase Price |

|

Entire Business Purchase |

|||||||||||||||||||||

|

|

(Provide the Seller’s Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Account Number at the top of Item A.) |

____/____/______ |

|

$______________ |

Partial Business Purchase |

|||||||||||||||||||||||

|

|

Report a Sale of Business |

|

|

Date of Sale |

|

|

|

|

|

|

|

Entire Business Sold |

|

|

||||||||||||||

|

|

(Provide the business’ Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Account Number at the top of |

|

|

____/____/______ |

|

|

|

|

|

|

Partial Business Sold |

|

|

|||||||||||||||

|

|

Item A. Complete Item P.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Reopen a Previously ClosedAccount (Provide the previous EmployerAccount Number at the top of ItemAthen go to Item B.) |

|||||||||||||||||||||||||||

|

|

Close Employer Account |

|

|

Reason for Closing Account |

|

Date of Last Payroll |

|

|

||||||||||||||||||||

|

|

(Provide the Employer Account |

|

|

|

No longer have employees |

|

|

|

|

|

|

|||||||||||||||||

|

|

Number at the top of Item A.) |

|

|

|

Out of Business |

|

|

|

|

|

____/____/______ |

|

|

|

||||||||||||||

|

|

Report a Change in Status: Business Ownership, Entity Type, or Name |

|

|

|

|

|

|

|||||||||||||||||||||

|

|

Reason for Change: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Change: From |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To |

|

|

|

|

|

|

|

|||

|

|

(Provide the Employer Account Number at the top of Item A, and complete the rest of the form.) |

|

|

|

|

|||||||||||||||||||||||

|

|

Effective Date of Change: ____/____/______ |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

B. |

EMPLOYER TYPE |

COMMERCIAL |

|

|

|

|

|

|

|

PACIFIC MARITIME |

|

|

|

|

FISHING BOAT |

|

|

|

|

||||||||||

|

(Select type then |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

proceed to Item C.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. |

TAXPAYER TYPE |

Individual Owner |

|

|

|

|

|

|

|

Limited Partnership |

|

|

|

|

Joint Venture |

|

|

|

|

||||||||||

|

(Select only |

(D, E1, F, G, J, K, L, |

|

|

(D, F, |

|

|

|

|

|

|

(D, F, H, I, K, L, |

|

|

|

|

|||||||||||||

|

one type then |

|

|

|

|

|

|

|

Association |

|

|

|

|

|

|

Receivership |

|

|

|

|

|||||||||

|

complete the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

(D, E2, F, G, J, K, L, |

|

|

(D, F, |

|

|

|

|

|

|

(D, F, H, K, L, |

|

|

|

|

||||||||||||||

|

items speciied |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

General Partnership |

|

|

|

|

|

|

|

Limited Liability Company (LLC) |

|

Estate Administration |

|

|

|

|

||||||||||||||

|

for that |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

(D, E3, F, H, J, K, L, |

|

|

(D, F, |

|

|

|

|

|

|

(D, F, H, I, K, L, |

|

|

|

|

||||||||||||||

|

selection.) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

Corporation |

|

|

|

|

|

|

|

Limited Liability Partnership (LLP) |

|

Trusteeship |

|

|

|

|

|||||||||||||

|

|

(D, F, |

|

|

|

|

|

|

|

(D, F, |

|

|

|

|

|

|

(D, F, H, I, K, L, |

|

|

|

|

||||||||

|

|

Other (Specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

(Complete remaining items as applicable.) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

D. |

FIRST PAYROLL |

First payroll date wages paid exceeded $100: ____/____/______ (Wages are all compensation for an employee’s |

|

|

|||||||||||||||||||||||||

|

DATE |

services.) Refer to Information Sheet: Wages (DE 231A) and Information Sheet: Types of Payments (DE 231TP) at |

|

|

|||||||||||||||||||||||||

|

(MM/DD/YYYY) |

www.edd.ca.gov/Payroll_Taxes/Forms_and_Publications.htm. |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

E. |

EMPLOYEE |

“Employment” does not include service performed by a child under the age of 18 years in the employ of his/her father or |

|||||||||||||||||||||||||||

|

INFORMATION |

mother, or service performed by an individual in the employ of his/her son, daughter, or spouse, including the employee’s |

|||||||||||||||||||||||||||

|

|

registered domestic partner. (Section 631 of the California Unemployment Insurance Code) Refer to Information Sheet: |

|||||||||||||||||||||||||||

|

|

Family Employment (DE 231FAM) at www.edd.ca.gov/Payroll_Taxes/Forms_and_Publications.htm. |

|

|

|

|

|||||||||||||||||||||||

E1. |

INDIVIDUAL |

Do you only employ your spouse, parent(s), or minor child(ren) (under 18)? If yes, you are not subject to |

Yes |

|

No |

||||||||||||||||||||||||

|

OWNER (Only) |

Unemployment Insurance (UI) and State Disability Insurance (SDI) but may be subject to Personal Income Tax (PIT). |

|

|

|

|

|||||||||||||||||||||||

E2. |

Do you only employ your minor child(ren) (under 18)? If yes, you are not subject to UI and SDI but may |

Yes |

|

No |

|||||||||||||||||||||||||

|

(Only) |

be subject to PIT. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

E3. |

PARTNERSHIP |

Do you only employ your parent(s)? If yes, you are not subject to UI and SDI but may be subject to PIT. |

Yes |

|

No |

||||||||||||||||||||||||

|

(Consisting of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

siblings only.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DE 1 Rev. 79 |

Page 1 of 2 |

CU |

COMMERCIAL EMPLOYER ACCOUNT

REGISTRATION AND UPDATE FORM

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

000101152 |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F. |

LOCATION OF |

|

Do you have employees working in California? |

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|||||

|

EMPLOYEE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SERVICES |

|

Do you have employees residing in California that are working outside of California? |

|

|

|

|

|

Yes |

No |

|||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G. |

INDIVIDUAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CA Driver |

|

|

|

|||

|

OWNER/ |

|

|

NAME |

|

|

TITLE |

|

|

|

SSN |

|

License |

Add |

Chg. |

Del. |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number |

|

|

|

||||

|

INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(If applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H. CORPORATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CA Driver |

Add |

Chg. |

Del. |

||||

|

OFFICER(S), |

|

|

NAME |

|

|

TITLE |

|

|

|

SSN |

|

License |

||||||||||

|

PARTNERS, OR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number |

|

|

|

|||

|

LLC MEMBER(S), |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MANAGER(S), |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AND/OR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OFFICER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

I. |

LEGAL NAME OF ORGANIZATION (Corporation/LLC/LLP/LP: Enter exactly as it appears on your oficial registration documents.) |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

J. |

DOING BUSINESS AS (DBA) (If applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

K. |

FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN) |

|

L. DATE OWNERSHIP BEGAN (MM/DD/YYYY) |

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____/____/______ |

|

|

|

|||||

M. STATE OR PROVINCE OF INCORPORATION/ORGANIZATION |

|

N. CALIFORNIA SECRETARY OF STATE ENTITY NUMBER |

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

O. |

PHYSICAL BUSINESS |

Street Number |

|

|

Street Name |

|

|

|

|

|

Unit Number (If applicable) |

||||||||||||

|

LOCATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(PO Box or Private |

|

City |

|

|

State/Province |

|

ZIP Code |

|

|

Country |

|

|

|

|||||||||

|

Mail Box will not be |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

accepted.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Phone Number |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

P. |

MAILING ADDRESS |

|

Street Number |

|

|

Street Name |

|

|

|

|

|

Unit Number (If applicable) |

|||||||||||

|

(PO Box or Private Mail |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Box is acceptable.) |

|

City |

|

|

State/Province |

|

ZIP Code |

|

|

Country |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Same as above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone Number |

|

|

|

|

|

|

|

|

|

|

||||||

Q. |

|

Valid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Check to allow |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

R. |

INDUSTRY ACTIVITY |

Describe in detail your speciic product/services: |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

Select your business industry |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

Services |

Retail |

Wholesale |

|

Manufacturing |

|

Temporary Services |

|

|

|

||||||||||

|

|

|

|

Leasing Employer |

Professional Employer Organization |

Other (Specify) _____________________ |

|||||||||||||||||

S. |

CONTACT PERSON |

|

Name |

|

|

|

|

|

|

Contact Phone Number |

|

|

|

|

|||||||||

|

(Complete a Power of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attorney [POA] Declaration |

Relation |

|

|

Address |

|

|

|

|

|

|

|

|

|

|

||||||||

|

[DE 48], if applicable.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

T. |

DECLARATION |

|

I certify under penalty of perjury that the above information is true, correct, and complete, and that |

||||||||||||||||||||

|

|

|

|

these actions are not being taken to receive a more favorable Unemployment Insurance rate. I further |

|||||||||||||||||||

|

|

|

|

certify that I have the authority to sign on behalf of the above business. |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

Name |

|

|

|

|

|

Title |

|

|

|

|

|

|

Phone Number |

|

|||||

|

|

|

|

|

|

|

|||||||||||||||||

|

MAIL TO: EDD, Account Services Group, MIC 28, PO Box 826880, Sacramento, CA |

|

|

||||||||||||||||||||

|

DE 1 Rev. 79 |

|

|

Page 2 of 2 |

|

|

|

|

|

|

|

|

|

|

|||||||||

Document Specs

| Fact | Detail |

|---|---|

| Form Title | Commercial Employer Account Registration and Update Form |

| Form Number | DE 1 EDD |

| Online Registration | Available at www.edd.ca.gov/e-Services_for_Business |

| Requirement for Submission | Submitting after paying over $100 to one or more employees in any calendar quarter |

| Important Section | Instructions for Completing the Commercial Employer Account Registration and Update Form (DE1-I) |

| Features | Allows for registering a new account, updating, adding/changing/deleting officer/partner/member information, and reporting purchase or sale of business |

| Governing Law | California Unemployment Insurance Code |

| Submit To | EDD, Account Services Group, MIC 28, PO Box 826880, Sacramento, CA 94280-0001 |

| Special Notices | May not be processed if required information is missing |

Detailed Instructions for Writing De 1 Edd

Filling out the DE 1 EDD form is a critical step for commercial employers to ensure their compliance with the Employment Development Department's requirements. This process not only helps in registering for a new employer account number but also facilitates updates like ownership changes or business information modifications. Immediately after the wages paid to one or more employees in any quarter exceed $100, this registration should be completed. The instructions outlined below aim to streamline the process, breaking down the necessary steps to ensure the accuracy and completeness of your submission, thereby minimizing delays in processing.

- Begin by reading the Instructions for Completing the Commercial Employer Account Registration and Update Form (DE1-I) available online to familiarize yourself with the form.

- If registering for a new employer account number, proceed to Item B. To request changes or updates, provide the current Employer Account Number at the top of Item A and specify the updates needed.

- For updates, identify the effective date for the changes under “Effective Date of Update(s)” and specify the nature of the update (i.e., Purchase, Sale, Reopen, Close, Change in Status, etc.)

- Select the type of business under “Employer Type” and continue to Item C.

- Choose the taxpayer type that applies to your organization, which will determine the corresponding sections of the form you need to complete.

- Fill in the “First Payroll” date when wages exceeding $100 were first paid.

- In the “Employee Information” section, answer the questions regarding employment of family members, if applicable.

- Indicate whether you have employees working or residing in California, catering to both in-state and out-of-state operations.

- Provide details about the Individual Owner/Co-Owner or Corporate Officer(s) as applicable, including name, title, social security number, and driver’s license number if relevant.

- Enter the legal name of your organization exactly as it appears on official registration documents.

- Specify your “Doing Business As” (DBA) name if different from the legal name.

- Record your Federal Employer Identification Number (FEIN).

- Fill in the date ownership began, state or province of incorporation, and your California Secretary of State Entity Number, if applicable.

- Specify your physical business location, ensuring that a P.O. Box is not provided as it will not be accepted.

- For the mailing address, a P.O. Box is acceptable. Indicate whether it's the same as the physical address or provide an alternative if it's different.

- Supply a valid email address and indicate whether you consent to email contact.

- Detail your industry activity, specifying the product or services provided, and select the relevant business industry.

- Provide the name, phone number, and email address of the contact person, including their relationship to the organization and address, if necessary.

- Complete the declaration section by certifying the accuracy of the provided information, your authority to sign on behalf of the business, and your understanding of the obligations it entails.

- Sign and date the form. Provide your name, title, and phone number below the signature.

- Mail the completed form to EDD, Account Services Group, MIC 28, PO Box 826880, Sacramento, CA 94280-0001.

The completion and submission of the DE 1 EDD form are the first steps in ensuring your business complies with state employment registration requirements. Once submitted, be prepared for possible follow-up requests for additional information or clarification from the EDD. It's essential to respond promptly to these inquiries to finalize your registration or updates without delay.

Things to Know About This Form

What is the DE 1 EDD form used for?

The DE 1 EDD form is a Commercial Employer Account Registration and Update Form, which serves multiple purposes. Primarily, it is used by employers in California to register for a new employer account number with the Employment Development Department (EDD). Additionally, it can be used for updating information about an existing employer account, such as reporting a business purchase or sale, reopening a previously closed account, closing an employer account, or updating details like the business address or legal name.

Can I register for an employer account online instead of using the DE 1 form?

Yes, employers have the option to register online using the EDD's e-Services for Business. This online application is secure and offers a paperless way to register, saving both time and postage. The step-by-step process is designed to be user-friendly and can be accessed at any time at www.edd.ca.gov/e-Services_for_Business .

When should the DE 1 form be submitted to the EDD?

The DE 1 form should not be submitted until you have paid wages in excess of $100 to one or more employees in any calendar quarter. This threshold is important for determining when an employer is required to register with the EDD.

What information is required on the DE 1 form?

The form requires detailed information depending on the action being taken or the update being reported. Generally, it requests data about the employer type, taxpayer type, information about employees, individual owner or corporate officer details, the legal name of the organization, business addresses, the Federal Employer Identification Number (FEIN), and the nature of the business. Additionally, certain actions like reporting a purchase or sale of a business require specific details related to those transactions.

Is there an instance where employment is not included on the DE 1 form?

Yes, the form specifies that "employment" does not include service performed by a child under the age of 18 in the employ of his/her parent(s), or service performed by an individual in the employ of his/her son, daughter, or spouse, including the employee's registered domestic partner. This is in compliance with Section 631 of the California Unemployment Insurance Code.

Are there any exclusions to Unemployment Insurance (UI) and State Disability Insurance (SDI) based on the type of employees?

Employers who only employ their spouse, parent(s), or minor child(ren) under 18 are not subject to Unemployment Insurance (UI) and State Disability Insurance (SDI) taxes. However, they may still be subject to Personal Income Tax (PIT) withholding for these employees.

What should be done if part of the form is not applicable to my business situation?

You should only complete the sections of the DE 1 form applicable to your particular business situation, as directed by the instructions on the form. If certain sections or items are not relevant to your business or the specific update you are reporting, they can be left blank.

How do I update officer, partner, or member information using the DE 1 form?

To update information regarding an officer, partner, or member of your business, you must provide the employer account number at the top of the form and complete the sections specified for adding, changing, or deleting officer/partner/member information. This includes providing the effective date of the update(s).

Where do I send the completed DE 1 form?

The completed DE 1 form should be mailed to the EDD at the following address: EDD, Account Services Group, MIC 28, PO Box 826880, Sacramento, CA 94280-0001. Ensure that all required sections are completed and the information provided is accurate to prevent delays in processing.

Common mistakes

When people fill out the DE 1 EDD form for commercial employer account registration and update, some common mistakes can lead to delays or errors in processing. Here’s a list to help avoid these pitfalls:

- Not reviewing the instructions (DE1-I) prior to completing the form, which can cause misunderstandings about the required information.

- Submitting the form before actually paying wages exceeding $100 to one or more employees in any calendar quarter, as this is a prerequisite for form submission.

- Failing to check only one box under section A when indicating the purpose of the form (e.g., registering for a new employer account number, requesting account for CalJOBSSM, updating employer account information, etc.), which can lead to processing delays.

- Omitting the employer account number when reporting an update, which is crucial for identifying the account that needs changes.

- Not providing specific dates (MM/DD/YYYY) for key events, such as the effective date of updates, date of the first payroll, purchase or sale of business, which are essential for timely and accurate recording.

- Selecting the wrong employer or taxpayer type, or not specifying one at all, which could result in incorrect categorization and possible legal and tax implications.

- Skipping the section about whether one has employees working in or outside of California, which affects state tax obligations.

- Providing incomplete or inaccurate information about owners, partners, members, or corporate officers, which can create issues with legal liability and contact information.

- Neglecting to list the physical business location correctly (PO Boxes are not accepted for this purpose), leading to potential issues with state labor and tax departments.

- Forgetting to sign and date the declaration at the end of the form, which is a common mistake that can render the submission invalid.

To ensure that the DE 1 form is filled out correctly and completely:

- Double-check all sections for accuracy.

- Review instructions carefully before starting.

- Ensure all applicable sections are filled out.

- Verify that dates and numbers are correct.

- Confirm that you have the authority to submit the form.

By avoiding these common mistakes, you can help ensure a smoother process for registering or updating your commercial employer account with the EDD.

Documents used along the form

When navigating the complexities of employer responsibilities and tax obligations, understanding the range of forms and documents that may accompany the DE 1 EDD (Commercial Employer Account Registration and Update Form) is crucial. These documents facilitate compliance with various state regulations and ensure the accurate reporting and management of employee information, wages, and tax contributions.

- DE 231A - Information Sheet: Wages: Provides detailed definitions and explanations about what constitutes wages for the purpose of tax reporting and payments to the Employment Development Department.

- DE 231TP - Information Sheet: Types of Payments: Offers clarification on different types of payments and how they are treated for tax purposes, helping employers distinguish taxable from non-taxable payments.

- DE 231FAM - Information Sheet: Family Employment: Outlines the special tax considerations and exemptions applicable to individuals employing family members, such as spouses, parents, or children under 18.

- DE 48 - Power of Attorney (POA) Declaration: Enables an employer to authorize another individual or entity to act on their behalf in matters related to the EDD, allowing for the delegation of tax filing and communication responsibilities.

- Payroll Tax Registration (PTR-1 Form): Required for new businesses to register for payroll taxes, this form initiates the process of establishing an account with the EDD to report and pay payroll taxes.

- Quarterly Wage and Withholding Report (DE 9 and DE 9C): These forms are essential for reporting the wages paid to employees and the taxes withheld from those wages each quarter, ensuring compliance with state tax requirements.

Together, these forms and documents support a comprehensive approach to managing employer obligations under California law. By staying informed and utilizing the appropriate resources, employers can navigate the complexities of payroll tax reporting and contribute to a compliant and efficient business operation.

Similar forms

The Form SS-4, Application for Employer Identification Number (EIN), issued by the Internal Revenue Service (IRS), shares similarities with the DE 1 EDD form concerning its purpose in employer registration. Just as the DE 1 form enables businesses to register with the California Employment Development Department for state payroll tax purposes, the SS-4 form is used by entities to obtain an EIN, necessary for federal tax reporting. Both forms require details about the business, including legal name, type of entity, and principal activity, thus serving foundational roles in the regulatory compliance landscape for new and existing businesses.

The Business License Application forms used by various city or county governments often parallel the DE 1 EDD form in their objective to collect information from businesses operating within their jurisdictions. These applications generally gather data about business ownership, location, and type of activities performed, which are also crucial elements of the DE 1 form. The principal purpose here, much like with the EDD's requirement, is to ensure regulatory compliance and proper tax collection, tailored to the specific needs and regulations of local governments.

The I-9, Employment Eligibility Verification form, while primarily focused on verifying an employee's eligibility to work in the United States, shares a common theme with the DE 1 form in terms of employment regulation. Both forms are integral in the employment process, with the DE 1 form facilitating state tax registration and the I-9 ensuring compliance with federal immigration laws. Each form thus contributes to a comprehensive regulatory framework that employers must navigate to adhere to government standards.

The New Hire Reporting Form, mandated by both federal and state governments, is similar to the DE 1 form in its role in the employment process, specifically in the context of reporting new or rehired employees. While the DE 1 form registers a business as an employer with the EDD for state tax purposes, the New Hire Reporting Form enables state agencies to track newly hired employees for purposes such as enforcing child support orders. Both forms are essential links in the chain of employment compliance and government oversight.

The Workers' Compensation Insurance Application shares a certain alignment with the DE 1 form in terms of providing for employee welfare and compliance with state regulations. Where the DE 1 EDD form is a precursor for an employer's state tax obligations, the Workers' Compensation Insurance Application is critical for ensuring that businesses provide coverage for their employees in case of workplace injuries. This insurance application underscores the responsibility of employers to safeguard employee interests, akin to the DE 1 form’s role in establishing a legal framework for employment.

The DBA (Doing Business As) Filing Form, required for businesses operating under a fictitious name, parallels the DE 1 form in its foundational role for businesses within the regulatory environment. Just like the DE 1 enables an employer to register for tax purposes, the DBA form legally establishes the name under which a business operates, which is crucial for branding, banking, and legal actions. Both forms are essential steps in formalizing aspects of a business's operations in compliance with state regulations.

Dos and Don'ts

When completing the DE 1 EDD form for Commercial Employer Account Registration and Update, several practices should be followed to ensure accurate and timely processing. Adhering to these guidelines can help avoid common errors and delays.

Do:- Review the Instructions for Completing the Commercial Employer Account Registration and Update Form (DE1-I) thoroughly before filling out the form. This ensures a clear understanding of the requirements and how to correctly complete the form.

- Make sure to register online when possible. Using the EDD's e-Services for Business online application is secure and can save time, paper, and postage. It offers a step-by-step process that simplifies the registration.

- Wait until you have paid wages in excess of $100 to one or more employees in any calendar quarter before submitting this form. This is a prerequisite for registration.

- Provide accurate and complete information for every field required. Missing or incorrect information can result in the form not being processed.

- Consult the Information Sheets provided by the EDD, such as Wages (DE 231A) and Types of Payments (DE 231TP), for clarifications on specific terms and requirements.

- Ensure that the legal name of your organization and any Doing Business As (DBA) names are entered exactly as they appear on your official registration documents.

- Sign and date the declaration section, certifying under penalty of perjury that the information provided is true, correct, and complete.

- Do not submit the DE 1 form before you are legally required to do so. You must first meet the criteria of having paid over $100 in wages within a calendar quarter.

- Do not leave any required fields blank. Incomplete forms may not be processed, causing delays in your registration or update request.

- Do not provide inaccurate information. Double-check details like your Federal Employer Identification Number (FEIN), the date ownership began, and the physical business location to ensure they are correct.

- Do not use P.O. Boxes for the physical business location. A legitimate street address is required, though P.O. Boxes can be used for the mailing address if necessary.

- Do not overlook the need for a Power of Attorney (POA) Declaration (DE 48) if another person is completing or submitting the form on behalf of the business.

- Do not forget to check the option to allow email contact if you wish to receive communications from EDD electronically.

- Do not disregard the importance of consulting additional resources available online regarding payroll taxes and employer obligations in California. This can provide valuable information and prevent potential issues.

Misconceptions

Understanding the DE 1 EDD form and its requirements can sometimes be confusing, leading to common misconceptions. Here, we demystify these misunderstandings to provide a clearer picture of the DE 1 EDD form’s purpose and process.

Misconception 1: Registration on the DE 1 EDD form is optional for businesses.

This is incorrect. Any business that has paid over $100 in wages within a calendar quarter must register using the DE 1 EDD form. This registration is a mandatory step to ensure compliance with state payroll tax obligations.

Misconception 2: You can only register for an employer account number after hiring employees.

Actually, the form stipulates you should not submit it until you have paid over $100 in wages to one or more employees in any calendar quarter. It’s about wage payment, not just the act of hiring.

Misconception 3: The DE 1 form is the only way to register for an employer account number with the EDD.

Contrary to this belief, the Employment Development Department (EDT) offers an online registration process through the e-Services for Business, which is secure and can save time and resources.

Misconception 4: Filling out the DE 1 EDD form is complicated and requires legal assistance.

While the form is detailed, it comes with a set of instructions (DE1-I) designed to guide employers through the process, making it possible to complete without legal help. However, seeking advice can be beneficial if you have specific concerns or a complex situation.

Misconception 5: Personal information changes of officers or partners do not need to be reported on the DE 1 EDD form.

This is not the case. The form explicitly provides the option to add, change, or delete information related to officers, partners, or members, indicating that the EDD requires up-to-date information on these individuals.

Misconception 6: You need a new DE 1 form for each major business event like a purchase, sale, or reopening.

While it’s true that these events must be reported to the EDD, the DE 1 form allows for reporting various updates, including business purchases, sales, reopening, closings, and changes in business status, all in one place.

Misconception 7: Email contact is mandatory when filling out the DE 1 form.

On the contrary, providing an email address is optional, as noted on the form by the option to check to allow email contact. This flexibility allows businesses to choose their preferred method of communication with the EDD.

Dispelling these misconceptions ensures that businesses have a clear understanding of the requirements and options available for registering and updating employer account information with California's EDD.

Key takeaways

Understanding how to accurately complete and use the DE 1 EDD form is crucial for employers in navigating the registration process with the Employment Development Department (EDD). Here are six key takeaways to guide you through this process:

- Online Registration Option: Employers have the option to register online through the EDD e-Services for Business, a secure platform that simplifies the process, saving time, paper, and postage.

- When to Submit the Form: The DE 1 form should only be submitted after you have paid wages exceeding $100 to one or more employees in any calendar quarter. This is a crucial threshold for determining when you are required to register.

- Required Information: It is important to review the Instructions for Completing the Commercial Employer Account Registration and Update Form (DE1-I) carefully before filling out the DE 1 form to ensure all required information is accurately provided. Incomplete forms may not be processed.

- Updating Employer Account Information: The form is not only for registering a new employer account but also for requesting updates such as changes in address, business name (DBA), ownership, or the closing of an account.

- Choosing the Correct Taxpayer and Employer Type: Employers must select the appropriate taxpayer type (Individual Owner, Limited Partnership, Corporation, etc.) and employer type (Commercial, Pacific Maritime, etc.) as it affects the information and documentation required for registration.

- Declaration and Signing: By signing the DE 1 form, employers certify under penalty of perjury that the information provided is true, correct, and complete. It also confirms that actions are not being taken to receive a more favorable Unemployment Insurance rate without proper cause.

Making sure each section of the DE 1 form is filled out correctly will streamline the registration process with the EDD, ensuring compliance with state payroll tax obligations. Always keep updated records and promptly report any changes in your business status to avoid penalties and ensure your business runs smoothly.

Discover More PDFs

How Many Allowances Should I Claim Single - Employees have the right to challenge the FTB's decision regarding their withholding allowance by providing evidence for reevaluation.

California Forms - It considers various factors that might necessitate the modification of how support payments are handled, including full payment of arrears.