Legal California Commercial Lease Agreement Document

Navigating the terrain of commercial real estate in California requires a clear and thorough understanding of the California Commercial Lease Agreement form. This document is pivotal for landlords and tenants alike, setting the stage for a professional relationship and the terms under which a property will be rented for business purposes. Within its pages, the agreement covers essential topics such as the duration of the lease term, rent amount, security deposits, and responsibilities for repairs and maintenance. Furthermore, it addresses compliance with state and local laws, insurance requirements, and conditions under which the agreement may be terminated. Crafting a well-considered lease agreement is not just about legal compliance; it's also about foreseeing possible scenarios and providing clear guidance for resolving disputes. Thus, this form serves not only as a contract but as a roadmap for a successful landlord-tenant partnership in California's dynamic commercial property market.

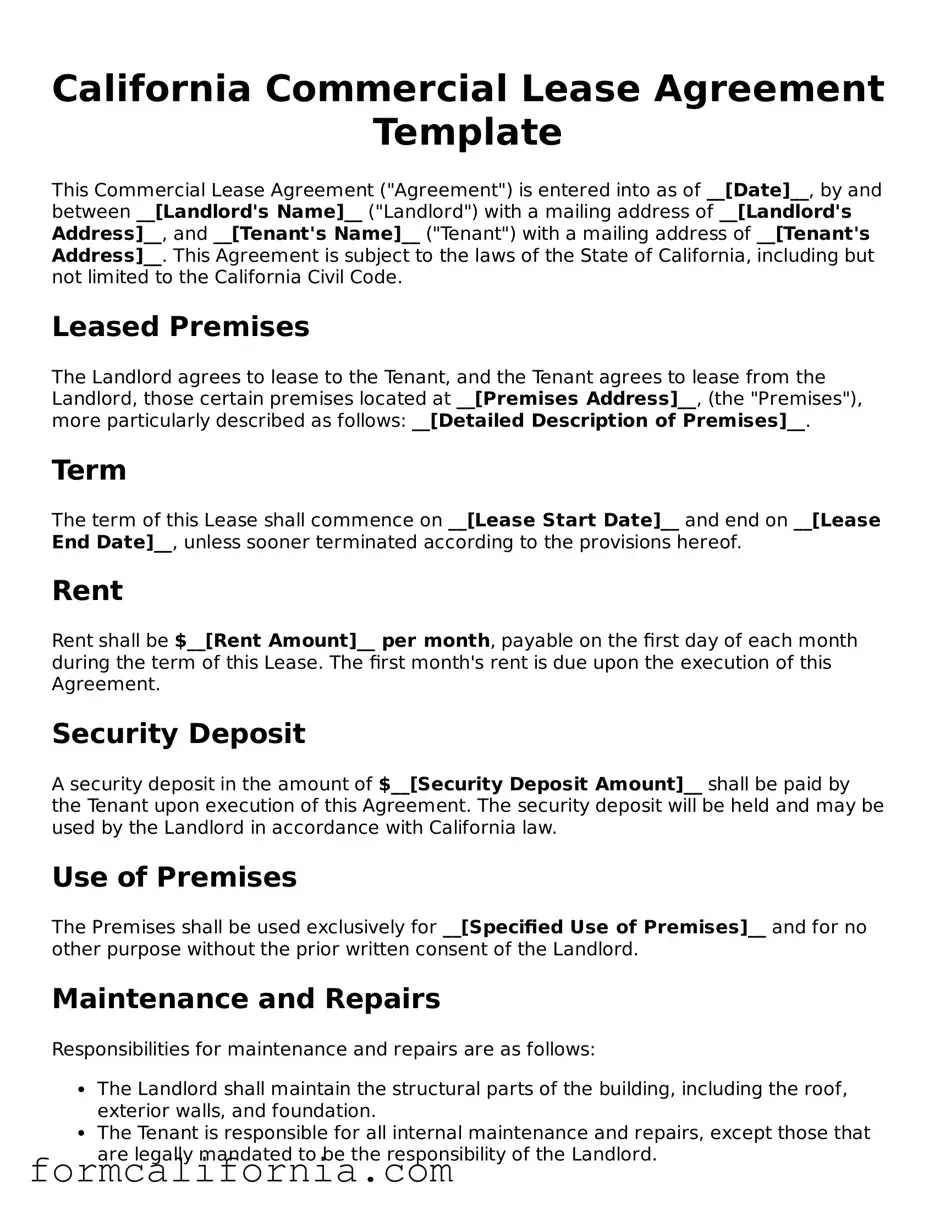

Document Preview Example

California Commercial Lease Agreement Template

This Commercial Lease Agreement ("Agreement") is entered into as of __[Date]__, by and between __[Landlord's Name]__ ("Landlord") with a mailing address of __[Landlord's Address]__, and __[Tenant's Name]__ ("Tenant") with a mailing address of __[Tenant's Address]__. This Agreement is subject to the laws of the State of California, including but not limited to the California Civil Code.

Leased Premises

The Landlord agrees to lease to the Tenant, and the Tenant agrees to lease from the Landlord, those certain premises located at __[Premises Address]__, (the "Premises"), more particularly described as follows: __[Detailed Description of Premises]__.

Term

The term of this Lease shall commence on __[Lease Start Date]__ and end on __[Lease End Date]__, unless sooner terminated according to the provisions hereof.

Rent

Rent shall be $__[Rent Amount]__ per month, payable on the first day of each month during the term of this Lease. The first month's rent is due upon the execution of this Agreement.

Security Deposit

A security deposit in the amount of $__[Security Deposit Amount]__ shall be paid by the Tenant upon execution of this Agreement. The security deposit will be held and may be used by the Landlord in accordance with California law.

Use of Premises

The Premises shall be used exclusively for __[Specified Use of Premises]__ and for no other purpose without the prior written consent of the Landlord.

Maintenance and Repairs

Responsibilities for maintenance and repairs are as follows:

- The Landlord shall maintain the structural parts of the building, including the roof, exterior walls, and foundation.

- The Tenant is responsible for all internal maintenance and repairs, except those that are legally mandated to be the responsibility of the Landlord.

Modifications to the Premises

No alterations, additions, or improvements shall be made by the Tenant to the Premises without the prior written consent of the Landlord.

Insurance

The Tenant shall maintain at its own expense a comprehensive general liability insurance policy. The policy shall name the Landlord as an additional insured.

Compliance with Laws

The Tenant agrees to conduct business in the Premises in compliance with all applicable laws, ordinances, rules, and regulations of the State of California and any other relevant authorities.

Termination

This Lease may be terminated by either party with written notice given __[Notice Period]__ days in advance. In case of breach of any lease terms by either party, the other shall have the right to terminate the Lease immediately in accordance with California law.

Signature

IN WITNESS WHEREOF, the parties have executed this Lease as of the date first above written.

_______________________

Landlord's Signature

_______________________

Tenant's Signature

PDF Form Characteristics

| Fact | Detail |

|---|---|

| Governing Law | The California Commercial Lease Agreement is governed by the laws of the State of California. |

| Purpose | Used for leasing commercial property to a tenant, not residential property. |

| Type of Properties | Includes office buildings, retail spaces, warehouses, industrial sites, and other non-residential properties. |

| Lease Types | Can be structured as gross, triple net (NNN), or modified gross leases, depending on the agreement between the landlord and tenant. |

| Duration | Lease term can be fixed or periodic, with the duration agreed upon by the landlord and tenant. |

| Security Deposits | The agreement may require a security deposit, the amount of which is negotiated between the parties. |

| Rent Adjustments | Rent may be subject to adjustments or escalations, as agreed upon in the lease. |

| Use of Property | The agreement specifies the permitted uses of the leased property by the tenant. |

| Maintenance and Repairs | Responsibilities for maintenance and repairs are usually negotiated and outlined in the lease. |

| Termination and Renewal | The conditions under which the lease may be terminated or renewed are specified in the agreement. |

Detailed Instructions for Writing California Commercial Lease Agreement

Filling out a California Commercial Lease Agreement is a crucial step for both landlords and tenants before commencing a lease for commercial property use. This document outlines the terms, conditions, responsibilities, and rights of both parties during the lease period. With careful completion, it ensures that both sides are on the same page and can help prevent misunderstandings and disputes down the line. Following a step-by-step process will make this procedure smoother and ensure that all necessary details are accurately captured.

- Begin by entering the full name of the landlord (or the leasing company) and the tenant (the business or individual leasing the property).

- Specify the address of the commercial property to be leased, including suite numbers if applicable and the city, county, and state where the property is located.

- Detail the term of the lease including the commencement date and the expiration date. Be clear whether any renewal options exist.

- Enter the agreed-upon rent amount, the frequency of payments (e.g., monthly, quarterly), and the method of payment.

- Describe in detail the permitted use of the property, specifying what the tenant may and may not do within the premises.

- Outline the security deposit amount and the conditions under which it may be retained by the landlord or returned to the tenant.

- Include any additional terms and conditions related to property maintenance, modifications, and insurance obligations. Make sure to specify which party is responsible for specific types of maintenance or repair.

- Detail the process for lease termination, including notice requirements and any penalties for early termination.

- List all the attachments or addendums to the lease, such as a property inspection report, rules and regulations for the property use, or any other agreements made between the landlord and tenant.

- Finally, have the lease agreement signed and dated by both the landlord and the tenant. Ensure that there are witnesses or a notary public present, if required by state law.

Once completed, it’s important for both the landlord and tenant to keep a copy of the signed California Commercial Lease Agreement. This will serve as a reference throughout the lease term and can be crucial for resolving any future disagreements or misunderstandings. Regular communication and adherence to the terms laid out in the agreement will contribute to a successful and mutually beneficial leasing arrangement.

Things to Know About This Form

What is a California Commercial Lease Agreement?

A California Commercial Lease Agreement is a legally binding document between a landlord and a commercial tenant. This agreement outlines the terms and conditions under which the tenant can rent property from the landlord for business purposes. These purposes can range from office space to retail stores and industrial sites. It includes details such as rent amount, lease duration, property use guidelines, and responsibilities of both parties.

Who needs a California Commercial Lease Agreement?

Any landlord looking to rent out commercial property in the state of California and any business entity or individual planning to lease commercial space for their business operations need a California Commercial Lease Agreement. This form is essential to ensure that both parties understand and agree to the terms of the lease.

What are the key components of a California Commercial Lease Agreement?

The key components of a California Commercial Lease Agreement include:

- Parties involved: Names and contact information of the landlord and tenant.

- Rental space description: Detailed description of the property being leased.

- Rent details: Amount of rent, payment schedule, security deposit, and any late payment penalties.

- Lease duration: Start date and expiration date of the lease term.

- Use of premises: Specifics on how the tenant can use the leased property.

- Maintenance and repairs: Responsibilities for upkeep and repairs of the property.

- Renewal and termination conditions: Terms under which the lease can be renewed or terminated.

How long can a commercial lease term be in California?

In California, the duration of a commercial lease can vary greatly depending on the negotiation between the landlord and the tenant. Common lease terms are anywhere from one to ten years, with options for renewal. It's crucial for both parties to agree on a term that suits their needs and future plans.

Are there different types of commercial leases?

Yes, there are several types of commercial leases, and each comes with its own set of conditions regarding the payment of rent, insurance, taxes, and maintenance. The most common types include:

- Gross Lease: The tenant pays a flat rental fee, and the landlord is responsible for most or all of the property expenses.

- Net Lease: The tenant is responsible for rent plus certain costs, such as taxes, insurance, and maintenance.

- Modified Gross Lease: A mix between a gross and net lease, where the responsibilities for expenses are divided in various ways.

Is it possible to terminate a California Commercial Lease Agreement early?

Yes, it is possible to terminate a California Commercial Lease Agreement early, but the conditions for such termination must be detailed in the agreement itself. Both parties may negotiate terms under which the lease can be ended before its expiration date, such as penalties for early termination, or the obligation to find a replacement tenant. It's important to have these details clearly outlined in the agreement to avoid disputes.

Can a tenant sublease the commercial property in California?

A tenant can sublease the commercial property if the lease agreement specifically allows for it. The terms under which subleasing is permitted should be clearly outlined in the lease agreement, including any requirements for landlord approval. It's vital for tenants to review their lease agreement carefully before proceeding with a sublease.

What happens if there is a breach of the lease agreement?

If there is a breach of the lease agreement, the party not at fault has the right to seek remedies as provided by California law and the specific terms of the lease agreement. This could include terminating the lease, seeking damages, or pursuing specific performance of the lease terms. It's advisable for parties to attempt to resolve disputes amicably but legal action may be necessary if a resolution cannot be reached.

Common mistakes

Not fully identifying the parties involved is a common error. The lease should clearly list the full legal names of the landlord (or property owner) and the tenant (business entity). This provides clarity on who is legally responsible for fulfilling the terms of the lease. Omitting the business type, such as LLC or Inc., may lead to potential legal ambiguities regarding liability and responsibility.

Failing to specify the premises details accurately can lead to disputes. The lease should include a comprehensive description of the property being leased, such as the address, square footage, and any specific areas like parking spaces or common areas. Neglecting to include exact details can result in misunderstandings about what areas the tenant is entitled to use.

Omitting critical dates is another mistake. Specifically, the lease start date and the end date are essential for defining the term of the lease. Without these, it could be challenging to enforce the lease’s duration, potentially leading to disputes over when the tenant is required to vacate the premises or renew the lease terms.

Overlooking the rent details, including the amount and payment schedule, undermines the lease's clarity. The document should spell out the monthly rent, any due dates for payment, and acceptable payment methods. Additionally, it should be clear about any penalties for late payments. This information helps prevent conflicts over financial arrangements.

Ignoring clauses related to modifications and repairs. Tenants and landlords sometimes forget to negotiate terms regarding who is responsible for maintenance and alterations to the leased property. It should be explicitly stated who bears responsibility for repairs and under what conditions the tenant may alter the property. Lack of clarity in this area can lead to disputes over property condition and maintenance responsibilities.

Documents used along the form

When negotiating and finalizing a commercial lease in California, various additional documents and forms often accompany the Commercial Lease Agreement form. These documents serve to clarify, detail, and legally bind specific aspects of the lease agreement, ensuring both parties have a clear understanding of their rights and responsibilities. Below is a list of documents commonly used alongside the Commercial Lease Agreement to facilitate this process.

- Personal Guarantee: This document is signed by an individual who agrees to be personally responsible for the lease obligations should the business fail to meet them. It is often required by landlords to ensure rent and other costs will be covered regardless of the business's performance.

- Amenity Addendum: Detailing the use and rules concerning the amenities provided with the leased space—such as parking, shared conference rooms, or gym facilities—this addendum ensures both parties understand what is included and how it can be used. It serves to prevent misunderstandings related to amenity access and maintenance responsibilities.

- Leasehold Improvement Agreement: This document outlines the specifics regarding any changes or improvements a tenant is authorized to make to the rental property. It includes details about who will perform the improvements, how costs will be covered, and the timeline for the work. It ensures that modifications to the property are agreed upon and comply with the landlord’s requirements.

- Rules and Regulations: A set of guidelines provided by the landlord that outlines acceptable and unacceptable uses of the leased property, as well as general conduct expectations for the tenant. This document helps to maintain the property’s environment and ensures that all tenants adhere to a consistent set of rules.

The use of these documents in conjunction with a Commercial Lease Agreement ensures a thorough and clear contractual relationship between the landlord and tenant. By covering various contingencies and clarifying responsibilities, these forms help in creating a strong foundation for the business operations that will take place on the leased premises.

Similar forms

The California Commercial Lease Agreement form shares similarities with the Residential Lease Agreement, primarily in function, as both establish a legal relationship between landlords and tenants. While the Residential Lease Agreement is used for housing purposes, the Commercial Lease Agreement sets the terms for renting commercial properties, specifying details like lease duration, rent amount, and the rights and responsibilities of both parties. Both documents protect the interests of the involved parties by clearly outlining expectations and legal obligations.

Another document akin to the California Commercial Lease Agreement is the Sublease Agreement. This agreement is used when an existing tenant wants to rent out their leased premises to a third party. Like the commercial lease, the sublease agreement includes terms about rent, utility payments, and other conditions concerning the use of the property. However, it operates under the umbrella of an original lease, making it crucial for subleases to adhere to the primary lease's conditions.

The Lease Amendment is closely related to the Commercial Lease Agreement, serving as a tool for modifying the original terms of a lease once both parties agree to the changes. It might adjust rent, extend the lease duration, or alter other conditions initially agreed upon. Utilizing a Lease Amendment helps in ensuring that any modifications are legally binding, just as the original commercial lease sets the foundational terms of the tenant-landlord relationship.

A Property Management Agreement shows similarities with the Commercial Lease Agreement in its foundational goal of defining roles and responsibilities, albeit between property owners and management companies rather than landlords and tenants. This document outlines the scope of responsibilities a manager assumes for operating the property, including leasing efforts, maintenance, and financial management, akin to how a Commercial Lease Agreement outlines tenant obligations.

The Commercial Real Estate Purchase Agreement parallels the Commercial Lease Agreement in its relation to commercial property transactions. However, it differs in that it governs the sale and purchase of the property rather than leasing arrangements. Essential terms covered include purchase price, closing conditions, and contingencies, providing a security and clarity in negotiations and agreements similar to what a lease offers to lesingers and leasers.

A Letter of Intent (LOI) for commercial leasing, though not a binding agreement, serves a similar preliminary role as the initial step in drafting a Commercial Lease Agreement. The LOI outlines the basic terms and conditions for a future lease, indicating the parties' intention to enter into a formal agreement. This helps to streamline negotiations and sets a foundation for the comprehensive, legally binding lease document that follows.

The Guaranty of Lease is a document that complements the Commercial Lease Agreement by ensuring that the lease terms are fulfilled. It involves a third party, usually a guarantor, who agrees to fulfill the obligations of the tenant if they fail to do so. This inclusion provides an additional layer of security for landlords, addressing potential concerns over lease compliance and financial obligations closely associated with the terms outlined in the commercial lease itself.

The Commercial Triple Net (NNN) Lease Agreement is a variant of the general Commercial Lease Agreement, specifying that the tenant is responsible not just for the rent but also for the property's taxes, insurance, and maintenance expenses. This detailed delineation of financial responsibilities is akin to how the Commercial Lease Agreement allocates roles and costs, though the NNN Lease places a greater financial burden on the tenant, reflecting a more specific arrangement.

Lastly, the Lease Termination Agreement shares a link with the Commercial Lease Agreement, as it formally ends the lease relationship agreed upon in the original document. This agreement outlines the terms under which the lease is concluded, possibly including conditions for early termination, remaining payments, or the return of the leased premises. Effectively, it acts as the closure of the commitments established at the beginning of the commercial leasing period, ensuring that the dissolution of the agreement is handled with clarity and mutual consent.

Dos and Don'ts

When filling out a California Commercial Lease Agreement form, it's important to approach the process with care and due diligence. This document is legally binding and outlines the responsibilities and rights of both the landlord and tenant. Here are key dos and don'ts to keep in mind:

Do:- Read the entire lease agreement carefully before signing. Ensure you understand all the terms and conditions.

- Verify all information included in the form, such as names, addresses, and descriptions of the property, to ensure accuracy.

- Clarify the lease duration, specifying the start and end dates, to avoid any misunderstandings about lease length.

- Discuss and agree upon the rent amount, including any increases, and explicitly state these in the lease agreement.

- Include a detailed description of who is responsible for utilities, maintenance, and repairs.

- Sign the lease without reviewing all the terms and conditions. Rushing through this process can lead to overlook crucial details.

- Forget to negotiate terms that may be unfavorable or too vague. It's essential to have clear, mutually beneficial terms.

- Overlook the need for obtaining permission for alterations or improvements to the property. Specify what is allowed and under what conditions.

- Omit details regarding the security deposit, such as the amount, the conditions for its return, and how it will be stored.

By following these guidelines, you can help ensure the commercial lease agreement is comprehensive, clear, and fair for both parties involved. This process requires careful attention to detail and, in some cases, consultation with a legal professional to navigate complex legal provisions and ensure your rights are protected..

Misconceptions

When it comes to the California Commercial Lease Agreement, a few misconceptions often arise. Understanding these false impressions can help both landlords and tenants navigate their leasing process more effectively.

- All commercial leases are the same. This is far from true. California commercial leases can vary significantly in terms of length, provisions for rent increases, responsibilities for repairs and maintenance, and options for renewal. Each lease is unique and should be reviewed carefully.

- The lease agreement does not have to be in writing to be enforceable. While oral agreements can be legally binding in California, having a written lease provides clarity and helps avoid misunderstandings. For commercial properties, a written lease is crucial as it details complex agreements that oral contracts cannot sufficiently cover.

- Security deposits are limited like in residential leases. Unlike residential leases, where California law limits the amount a landlord can charge for a security deposit, there are no such limits for commercial leases. The amount is often negotiated between the landlord and the tenant.

- Tenants can't negotiate terms in a standard commercial lease agreement. Although landlords present a standard lease agreement, tenants have the right to negotiate terms. This can include rent prices, the length of the lease, renewal options, and allowances for property improvements.

Key takeaways

The California Commercial Lease Agreement form is a crucial document for both landlords and tenants entering into a commercial property rental situation. Here are key takeaways to help navigate the process of filling out and using this form effectively:

- Understanding the Type of Lease: It's important to identify whether the lease will be a gross lease, where the landlord bears all property costs, or a net lease, in which the tenant is responsible for certain expenses. Each type affects how costs are calculated and responsibilities are delineated.

- Specifying the Premises: The agreement must clearly describe the rented space. This includes not only the address but also specific details about the portion of the property being leased and any common areas the tenant may access.

- Rent and Payment Terms: Detailing the amount of rent, when it is due, and acceptable payment methods ensures clarity. Including specifics on late fees, grace periods, and rent adjustments can prevent future disputes.

- Term of the Lease: Both parties need to agree on the start date and duration of the lease. Options for renewal and conditions for early termination should also be explicitly stated to avoid misunderstandings.

- Security Deposit: The form should outline the amount of the security deposit, its use, and the conditions under which it will be returned to ensure both parties are on the same page.

- Use of Premises: The agreement must specify what activities the tenant is allowed to conduct on the property. This ensures the tenant's business activities are compatible with the landlord’s expectations and property zoning laws.

- Modifications and Improvements: If the tenant is permitted to make changes to the leased space, the lease should detail what alterations are allowed, how they should be executed, and how they should be handled at the end of the lease term.

- Responsibility for Repairs and Maintenance: Clearly defining which party is responsible for specific maintenance tasks and repairs helps prevent disputes during the lease term. This includes routine upkeep as well as major repair responsibilities.

- Insurance Requirements: The lease must outline the types and amounts of insurance each party must carry, such as property, liability, and casualty insurance, to protect against potential liability and property damage.

- Default and Remedies: Defining what constitutes a default on the lease and what remedies are available to both parties can help manage potential conflicts and provide clear pathways for resolution.

- Dispute Resolution: Including a provision for handling disagreements through mediation or arbitration can offer a less costly and more amicable solution than litigation.

- Signatures: Ensuring that all parties involved sign the lease agreement solidifies the commitments made and provides legal documentation of the agreement.

By paying close attention to these key aspects when completing the California Commercial Lease Agreement, landlords and tenants can create a solid foundation for their business relationship, minimizing potential legal issues and disputes in the future.

More California Forms

Durable Power of Attorney Forms - A springing Power of Attorney only takes effect under certain conditions, such as a medical emergency.

Dmv Reg 138 - A compact, yet powerful document that delineates the relinquishment of one's right to pursue legal recourse.

How to Verify Employment - Provides a basis for creating a reliable professional background check for potential hires in sensitive positions.