Blank California Scratchers PDF Form

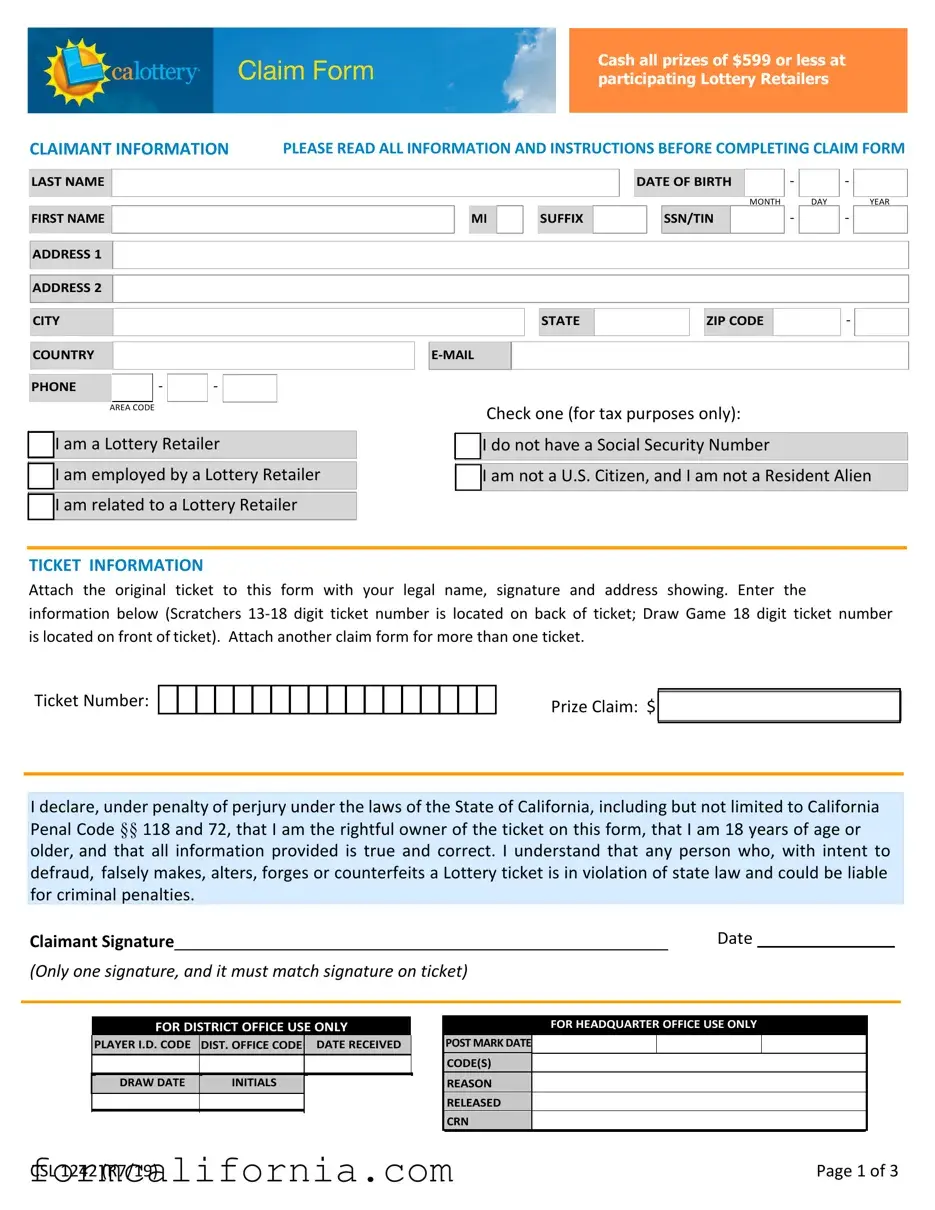

If you're fortunate enough to win a prize from a California Lottery scratcher ticket, understanding how to properly claim your prize is crucial. The California Scratchers form serves as your primary document for claiming prizes not exceeding $599 directly at participating Lottery Retailers. It requires claimants to provide detailed personal information, including their last name, first names, address, city, country, date of birth, and contact details, along with specific declarations related to their employment status with retailers and tax-related confirmations. Additionally, the form mandates attaching the winning ticket, with clear instructions on displaying your legal name, signature, and address on the ticket itself, to validate ownership and eligibility for the claimed prize. The form underscores the importance of truthful information submission, highlighting the legal implications, including perjury, for any fraudulent claims. Prize payment information outlines the processing time and the necessity of an original signed ticket for claim processing. Moreover, the form acts as a guide on how claimants should present their winning ticket and the filled-out form, either by delivering it to a Lottery District Office or mailing it, while emphasizing the role of the information provided in adherence to federal and state regulations, privacy concerns, and the collection of voluntary demographic information for internal analyses. In essence, this form is not just a claim document but a comprehensive guideline ensuring transparency, legal compliance, and security in the California Lottery's prize claim process.

Document Preview Example

Cash all prizes of $599 or less at participating Lottery Retailers

CLAIMANT INFORMATION PLEASE READ ALL INFORMATION AND INSTRUCTIONS BEFORE COMPLETING CLAIM FORM

LAST NAME

FIRST NAME

ADDRESS 1 |

ADDRESS 2

CITY

COUNTRY

|

|

|

|

|

|

DATE OF BIRTH |

|

- |

|

- |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MONTH |

|

DAY |

|

YEAR |

MI |

|

|

SUFFIX |

|

|

|

|

SSN/TIN |

|

- |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

ZIP CODE |

- |

PHONE |

|

- |

|

- |

|

|

|

|

|

|

AREA CODE |

|

|

|

I am a Lottery Retailer

I am a Lottery Retailer

I am employed by a Lottery Retailer

I am employed by a Lottery Retailer

I am related to a Lottery Retailer

I am related to a Lottery Retailer

Check one (for tax purposes only):

I do not have a Social Security Number

I do not have a Social Security Number

I am not a U.S. Citizen, and I am not a Resident Alien

I am not a U.S. Citizen, and I am not a Resident Alien

TICKET INFORMATION

Attach the original ticket to this form with your legal name, signature and address showing. Enter the

information below (Scratchers

Ticket Number:

Prize Claim: $

I declare, under penalty of perjury under the laws of the State of California, including but not limited to California Penal Code §§ 118 and 72, that I am the rightful owner of the ticket on this form, that I am 18 years of age or older, and that all information provided is true and correct. I understand that any person who, with intent to defraud, falsely makes, alters, forges or counterfeits a Lottery ticket is in violation of state law and could be liable for criminal penalties.

Claimant Signature |

|

Date |

(Only one signature, and it must match signature on ticket)

FOR DISTRICT OFFICE USE ONLY

PLAYER I.D. CODE |

DIST. OFFICE CODE |

|

DATE RECEIVED |

|

|

|

|

|

|

DRAW DATE |

|

INITIALS |

|

|

|

|

|

|

|

|

|

|

|

|

FOR HEADQUARTER OFFICE USE ONLY

POST MARK DATE

CODE(S)

REASON

RELEASED

CRN

CSL 1242 (R7/19) |

Page 1 of 3 |

PRIZE PAYMENT INFORMATION

Failure to provide your original signed ticket with date of birth, legal name, complete address (including apartment or space number, city, state, zip code), email and phone number may delay or prevent the California State Lottery (Lottery) from processing your prize claim. Claims submitted to Lottery Headquarters for processing are paid by check and mailed from the California State Controller's Office. Processing time, once claim is received and verified, is approximately 8 weeks. If you have questions, contact the Lottery at

Lottery prizes are not subject to California state income tax. The Lottery is required by federal tax law to withhold federal taxes of 24% for U.S. citizens and resident aliens.

Tickets, transactions, purchases, claims and prize payments are subject to federal and state law and California Lottery regulations, policies and procedures. Copies of regulations are available at Lottery District Offices and on our website at www.calottery.com. Tickets failing validation are void.

INSTRUCTIONS

1.Print your legal name, street address, city, state, and zip code on the back of the ticket.

2.Sign your name on the back of the original ticket.

3.Complete the Claimant Information and Ticket Information sections on the first page of thisform.

4.Sign the first page of this form with ink. (ONLY ONE SIGNATURE IS PERMITTED)

5.Staple your original ticket to the front of this form.

KEEP A COPY OF THIS FORM AND A COPY OF THE FRONT AND BACK OF THE TICKET.

Deliver the completed claim form with original ticket to any Lottery District Office. Location and directions can be found at www.calottery.com.

OR, MAIL THIS CLAIM FORM, AT YOUR OWN RISK, WITH THE ORIGINAL TICKET STAPLED ON THE FRONT, TO: California Lottery, 730 North 10th Street, Sacramento, CA

Call

PRIVACY NOTICE

The Information Practices Act of 1977 (Cal. Civ. Code

The Claimant Information requested on this form will be used to validate and process your claim in accordance with the California State Lottery Act of 1984 (Gov. Code §8880 et seq.). The Lottery requests a player's social security or

tax identification number (SSN/TIN) for tax withholding and reporting purposes, pursuant to Internal Revenue Code

§§6011, 6041, 6109, 3402, and the regulations enacted thereunder.

The Claimant Information you provide may be disclosed to various state and federal government agencies, including but not limited to: the State Controller's Office, Franchise Tax Board, Health and Welfare Agency, and the Internal Revenue Service. It will not be disclosed to members of the public.

You have the right to access your personal information maintained by the Lottery by contacting the California Lottery, 700 North 10th Street, Sacramento, CA

Purpose and Relevancy of Information Collected: Information is collected to validate and process a claim and for purposes of sales, marketing, research, security investigation, legal review, surveys, and strategic planning as related to the operations of the Lottery. By submitting this claim, you consent and agree to such use, and waive any and all legal claims, known or unknown, related to the specified uses set forth herein. The California Lottery is subject to public disclosure laws that allow access to certain governmental records. Your full name, the name and location of the retailer who sold you the winning ticket, the date you won, and the amount of your winnings, including your gross and net installment payments, are matters of public record and are subject to disclosure. The Lottery will not disclose any other personal or identifying information without your permission unless legally required to do so. No information will be collected or accepted from known minors. You may be asked to participate in a press conference.

CSL 1242 (R7/19) |

Page 2 of 3 |

VOLUNTARY DEMOGRAPHIC INFORMATION

By volunteering to answer the following questions, you will help the Lottery know more about its players. The voluntary information that you provide regarding your ethnicity, household income, gender, and household composition will be used only by the Lottery to conduct internal demographic analyses (which may be completed by agents and contractors).

Which of the following do you consider yourself to be?

(Check all that apply)

African American

African American

Asian

Asian

Hispanic

Hispanic

White

White

Other (Specify)

Other (Specify)

Annual Household Income

Under $30,000

Under $30,000

$30,000 TO $49,999

$30,000 TO $49,999  $50,000 TO $99,999

$50,000 TO $99,999

$100,000 TO $149,999

$100,000 TO $149,999

$150,000 or more

$150,000 or more

Number of People in Household

(including yourself):

Gender

Female

Female

Male

Male

Nonbinary

Nonbinary

CSL 1242 (R7/19) |

Page 3 of 3 |

Document Specs

| Fact | Detail |

|---|---|

| Claim Limit at Retailers | Prizes of $599 or less can be cashed at participating Lottery Retailers. |

| Claimant Information Required | Last Name, First Name, Addresses, City, Country, DOB, SSN/TIN, State, Zip Code, Email, Phone, Relationship to Lottery Retailer, and Citizenship Status. |

| Original Ticket Requirement | The original ticket, signed with legal name and address, must be attached to the form. |

| Under Penalty of Perjury | Claimants declare under penalty of perjury that they are the rightful owner of the ticket, information provided is true, and they meet age requirements. |

| Processing Time | About 8 weeks, once the claim is received and verified. |

| Prizes and Taxes | Lottery prizes are not subject to California state income tax, but federal taxes are withheld. |

| Governing Laws | Federal and state laws, specifically including but not limited to California Penal Code §§ 118 and 72. |

| Privacy Notice | Personal information is collected under the Information Practices Act of 1977 and other laws, used for processing and disclosed only to specific agencies. |

| Submission Instructions | Complete the form, sign it, attach the original ticket, and submit it to a Lottery District Office or by mail. |

| Voluntary Demographic Information | Players can voluntarily provide information about ethnicity, income, gender, and household, used only for internal demographic analyses. |

Detailed Instructions for Writing California Scratchers

Filling out the California Scratchers form is a straightforward process, but carefully following each step is crucial to ensure your prize claim is processed without delay. The form is designed for lottery prize claims of $599 or less, and it can be used by those who possess a winning ticket. The accuracy of the information provided on this form impacts the speed and success of the prize claim process.

- On the back of your winning ticket, print your legal name, your street address (including apartment or space number if applicable), city, state, and zip code.

- Sign your name on the back of the original ticket in the space provided.

- In the Claimant Information section of the form, fill in your last name, first name, any middle initial or suffix, address 1, address 2 (if necessary), city, country, and the state zip code. Additionally, provide your date of birth, email, and phone number, including the area code.

- Under the same section, indicate if you are a lottery retailer, are employed by a lottery retailer, or are related to a lottery retailer by checking the appropriate box. Also, specify your tax status by checking the appropriate option regading your Social Security Number (SSN) or Tax Identification Number (TIN).

- In the Ticket Information section, write down the ticket number located on the back (for Scratchers) or front (for Draw Games) of your ticket, and specify the prize claim amount in dollars.

- Carefully read the declaration section, which emphasizes the legal commitments you're making by submitting this form. Ensure all the information you’ve provided so far is accurate and true.

- Sign the claim form in the designated area with ink. Remember, only one signature is allowed, and it must match the signature on your ticket.

- Staple your original ticket to the front of the completed claim form. Ensure it is securely attached to prevent detachment or loss during processing.

- Make a copy of the completed claim form and the front and back of your winning ticket for your records.

- Submit the completed form and the attached ticket to a Lottery District Office in person, or mail it to the California Lottery at 730 North 10th Street, Sacramento, CA 95811-0336. When mailing, be aware that you are sending it at your own risk.

After submitting your form, the processing time can take up to 8 weeks once the claim is received and verified by the Lottery Headquarters. For any questions or additional assistance needed during the process, the California Lottery can be contacted at 1-800-LOTTERY (1-800-568-8379), available Monday through Friday. By following these steps, you can ensure a smooth process in claiming your lottery prize.

Things to Know About This Form

What is the process for cashing in California Scratchers?

To cash in California Scratchers, prizes of $599 or less can be cashed at participating Lottery Retailers. For prizes exceeding this amount, the original signed ticket, along with completed claimant and ticket information sections of the California Scratchers form, must be delivered to a Lottery District Office or mailed to the California Lottery at the specified address. Always keep a copy of both sides of the ticket and the completed claim form for your records.

How do I complete the California Scratchers claim form?

Completing the California Scratchers claim form involves a few key steps:

- Print your legal name, address, city, state, zip code, and sign the back of the ticket.

- Fill out the Claimant Information and Ticket Information sections with accurate details.

- Sign the first page of this form using ink. Remember, only one signature is permitted.

- Attach the original signed ticket to the front of the form.

Where can I submit my completed California Scratchers claim form?

The completed form, along with the original ticket attached, can be submitted to any Lottery District Office. The addresses and directions for these offices are available on the California Lottery website. Alternatively, you may opt to mail your claim form and ticket, at your own risk, to the California Lottery's specified mailing address. Ensure to keep copies of your claim form and ticket for record-keeping.

What should I do if I have multiple winning tickets?

If you have multiple winning tickets, you need to complete and attach a separate claim form for each ticket. Ensure that each form is filled out correctly and that the original ticket is attached to the respective form. This will help in the efficient processing of your claims.

How long does it take to process a claim?

Once your claim is received and verified by the California State Lottery, the processing time is approximately 8 weeks. Claims are paid via check and mailed from the California State Controller's Office. For any questions regarding the status of your claim, you can contact the Lottery.

Are Lottery prizes subject to California state income tax?

No, Lottery prizes are not subject to California state income tax. However, it's important to note that federal tax law requires the Lottery to withhold taxes from winnings. For U.S. citizens and resident aliens, the withholding rate is 24%, while for non-U.S. citizens, 30% of the prize amount is withheld.

How is my personal information used and protected?

The personal information collected on the California Scratchers claim form is used to validate and process your claim in line with the California State Lottery Act of 1984. While the Lottery may disclose your information to various state and federal agencies for legal and processing reasons, it will not be disclosed to the public. The Lottery adheres to the Information Practices Act of 1977 and the Federal Privacy Act, ensuring your personal information is handled with care and respect for your privacy.

Common mistakes

Filling out the California Scratchers form correctly is essential for claiming your winnings without delay. However, individuals often make mistakes that can impede this process. Here are eight common errors:

Not reading all instructions carefully before starting: This oversight can result in missing important details required for the claim.

Failing to print the legal name, address, city, state, and zip code on the back of the ticket, as instructed, which is crucial for identifying the rightful winner.

Signing the ticket with a signature that does not match the claimant's legal signature, leading to potential disputes about the ticket's ownership.

Completing the Claimant Information and Ticket Information sections inaccurately thereby providing incorrect or incomplete information.

Not using ink to sign the first page of the form, which is a specific requirement for the signature to be considered valid.

Omitting to attach the original ticket to the front of the form with a staple, which is necessary for the claim to be processed.

Forgetting to keep a copy of the form and the ticket for personal records, which is advised should there be any questions or issues with the claim.

Not delivering the completed claim form and original ticket to a Lottery District Office or mailing it to the provided address, which is the final step in submitting a claim.

Each of these mistakes can significantly delay or even prevent the processing of a prize claim. It is, therefore, paramount to follow the instructions provided carefully and ensure all information is correct and complete before submission.

Documents used along the form

When submitting a California Scratchers claim form, individuals often need to provide additional forms and documents to ensure a smooth processing of their prize claim. These documents support the claim, verify the identity of the claimant, and fulfill legal requirements. Understanding these documents can help claimants prepare their submissions accurately.

- Winner’s Claim Form: Besides the specific Scratchers form, a general Winner's Claim Form may be required for claiming prizes from various lottery games. This form captures the winner's personal information, game details, and winning ticket information.

- Copy of a Government-Issued ID: A photocopy of a valid government-issued identification card (ID) such as a driver's license or passport is often required. This helps the lottery commission verify the claimant's identity and age, ensuring they meet the minimum age requirement for claiming a prize.

- IRS Form W-9 (Request for Taxpayer Identification Number and Certification): Winners of certain prize amounts may need to fill out a W-9 form. This form is used to provide the California Lottery Commission with the taxpayer identification number (TIN) of the claimant, which is necessary for tax reporting purposes for both state and federal taxes.

- Multiple Ownership Claim Form: In cases where a winning ticket is owned by more than one person or a group, a Multiple Ownership Claim Form is required. This form outlines the division of the prize among the members and is necessary for group claims to be processed correctly.

Preparing and submitting all required forms and documents along with the California Scratchers claim form helps ensure that the claim process is completed without unnecessary delays. Claimants are encouraged to review each document's requirements carefully and to provide accurate and complete information to facilitate the validation and payment of their prize. Additionally, keeping copies of all submitted documents is a good practice for personal records.

Similar forms

The California Scratchers form closely resembles a standard tax form, like the IRS Form 1040, used to report individual income tax. Both documents require detailed personal information, including social security numbers (SSN) or taxpayer identification numbers (TIN), and both have sections that need the claimant or taxpayer to attest to the truthfulness of the information provided under penalty of perjury. The emphasis on accurately reporting personal and financial information underscores the legal importance of the documents in their respective contexts—tax reporting for the IRS and prize claiming for the California Lottery.

Another document that shares similarities with the California Scratchers form is the Uniform Residential Loan Application (URLA), utilized in the mortgage lending process. Like the Scratchers form, the URLA gathers comprehensive personal information, employment history, and financial information for assessment. Both forms serve as critical steps in a process seeking to validate the identity and eligibility of the applicant, whether for a loan approval or for claiming a lottery prize. Furthermore, each document includes a section where the applicant must sign, certifying that the information provided is accurate and acknowledging the potential legal repercussions of fraudulent claims.

Warranty registration cards for electronics or appliances also bear resemblance to the California Scratchers form. These registration cards often require purchasers to provide personal contact information, product information, and sometimes, demographic data similar to the voluntary demographic section in the Scratchers form. The purpose behind both documents is to register or claim a benefit, whether it be a warranty service or a lottery prize. The emphasis is on the individual's relationship to the item in question—a product or a lottery ticket—and the accurate account of details that facilitate processing and validation.

Employment application forms are reminiscent of the California Scratchers claim form in the way they collect detailed personal information, including past employment history, references, and, in some cases, demographic information. Like the lottery claim form, employment applications often have declarations or consent sections where the applicant must affirm the truthfulness of the information provided and consent to verification checks. These forms serve as gateways to potential benefits: employment opportunities in one case and prize money in the other, making the accuracy and honesty of the submitted information crucial.

Dos and Don'ts

Filling out the California Scratchers form requires attentiveness and completeness to ensure your prize claim is successfully processed without any delays. Here are some recommendations on what you should and shouldn't do when completing the form:

Things You Should Do:

- Double-check your information: Ensure that all the information you provide, including your name, address, and contact details, is accurate and matches the identification documents you might need to present.

- Sign the ticket and form as instructed: Sign your name on the back of the scratcher ticket and also on the claim form. Remember, only one signature is allowed, and it must match across documents.

- Attach the original ticket: Staple your original scratcher ticket to the front of the form as indicated. This is crucial for validating your claim.

- Keep copies for your records: Before submitting, make copies of both sides of the ticket and the completed form for your personal records.

- Review tax implications: Understand that while lottery prizes are not subject to California state income tax, federal taxes will apply. Knowing your responsibility can help manage expectations on the net prize amount.

Things You Shouldn't Do:

- Forget to check the box regarding your relationship to a lottery retailer: This information is required for tax purposes and failing to disclose it can complicate your claim.

- Leave sections incomplete: Filling out every section of the form is important. Missing information can lead to delays or even rejection of your prize claim.

- Submit without attaching the original ticket: A common mistake is to send in the claim form without the original scratcher ticket attached. This will prevent your claim from being processed.

- Ignore the privacy notice: It's easy to overlook the privacy notice, but understanding how your information is used and protected is important for your peace of mind.

- Use unofficial methods to submit your claim: Ensure you're sending your claim to the official mailing address or delivering it to a Lottery District Office. Using unofficial channels can risk the loss of your claim and ticket.

Misconceptions

Understanding the California Scratchers claim form involves navigating through a mix of instructions and legal requirements. Despite straightforward guidance, misconceptions often arise, misleading players about the claim process. Here are six common misconceptions explained.

- Any prize amount can be cashed out at lottery retailers. In fact, only prizes of $599 or less can be claimed directly at participating lottery retailers. Larger amounts require submission of a claim form to the California Lottery.

- Lottery winnings are exempt from taxes. While it's true that California state income tax doesn't apply to lottery winnings, federal taxes do. U.S. citizens and resident aliens have a 24% withholding rate on their winnings, and for non-U.S. citizens, this rate increases to 30%.

- Claim forms can be signed and submitted by anyone. The form stipulates that the claimant must be the actual ticket owner, at least 18 years of age, and they must sign the form themselves, affirming under penalty of perjury that all provided information is accurate.

- Personal information on the claim form is publicly accessible. While the California Lottery is subject to public disclosure laws, only specific details are made publicly available, such as the winner's name and prize amount. Other personal information provided on the claim form is protected and only disclosed to state and federal agencies as required.

- The process for claiming a prize is immediate. The guideline suggests an estimated processing time of approximately 8 weeks once the claim is received and verified. This duration is crucial for the comprehensive validation and issuance of the prize.

- Filling out the demographic section is mandatory. This section of the form is entirely voluntary and intended solely for internal demographic analyses by the California Lottery. This information is used for research and strategic planning and does not affect the claim process.

Clarifying these misconceptions ensures that claimants understand their rights, the process, and the true nature of their obligations when claiming lottery prizes in California. This knowledge can help streamline the claim process and set realistic expectations for lottery winners.

Key takeaways

Prizes $599 and under can be cashed at any participating Lottery Retailer, making it convenient to claim smaller winnings.

It's essential to fill out all sections of the claim form carefully with your correct personal details, such as your name, address, date of birth, and contact information to avoid delays in processing.

Attaching the original ticket to the form is mandatory, with your legal name, signature, and address visible, to validate your claim.

For prizes claimed via the mail, the processing time is roughly 8 weeks once the claim is received and verified, pointing to the importance of early submission.

Lottery winnings in California are not subject to state income tax, though federal taxes apply—24% for U.S. citizens and resident aliens, and 30% for non-U.S. citizens.

The information provided on the form is subject to verification against federal and state laws as well as California Lottery regulations, highlighting the critical nature of honesty in the claim process.

Claimants have rights under the Information Practices Act and the Federal Privacy Act concerning the collection, use, and access to their personal information, ensuring a level of privacy and security.

Voting to provide voluntary demographic information helps the Lottery understand its players better but is not mandatory for the claim process.

Discover More PDFs

What Is 540 Tax Form - The CA 540 form's structure systematically walks filers through each step of the tax return process.

California Depreciation Methods - Form 3885 facilitates the carryover of disallowed deductions, crucial for multi-year tax planning and strategy.

State of California Franchise Tax Board Letter - Requires detailed information to support the claim, including certificate numbers and associated entities for passed-through credits.