Blank California Earthquake Authority PDF Form

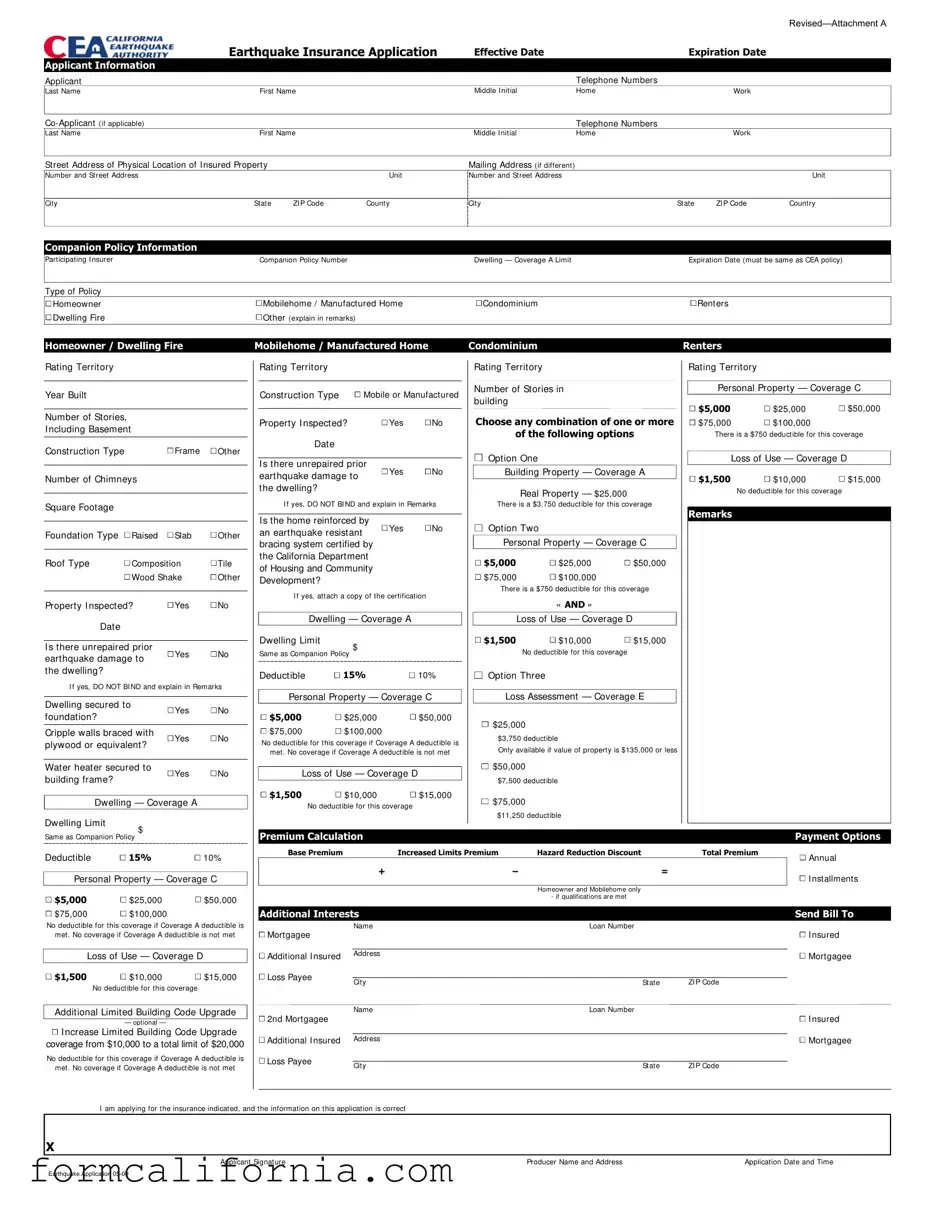

In the wake of a natural disaster, securing one's home and finances becomes a paramount concern, particularly in seismically active regions like California. The California Earthquake Authority (CEA) Earthquake Insurance Application, a critical document in this context, offers residents a structured way to apply for earthquake insurance coverage, providing a layer of financial security against such unpredictable events. This comprehensive form caters to various facets of applying for insurance, from specifying personal details of the applicant and co-applicant, if applicable, to the physical and mailing addresses of the insured property. It meticulously outlines the requirements for companion policy information, dwelling coverage, personal property and loss of use coverage options, among others. The form also details options for deductibles and additional coverages like the limited building code upgrade, emphasizing its role in facilitating tailored insurance solutions that meet individual needs and circumstances. With sections dedicated to premium calculation and payment options, the application process is streamlined, underscoring the CEA’s commitment to accessibility and ease of use. Notably, the form requires a thorough inspection to note any unrepaired earthquake damage and assessments on whether the dwelling has adequate seismic reinforcements, ensuring that applicants are fully aware of the condition and security of their properties. This effort to combine detailed policy application procedures with an emphasis on property safety standards reflects the dual focus on financial and physical preparedness that is essential for California residents living in earthquake-prone areas.

Document Preview Example

|

Earthquake Insurance Application |

Effective Date |

|

Expiration Date |

|

|||

Applicant Information |

|

|

|

|

|

|

|

|

Applicant |

|

|

|

|

Telephone Numbers |

|

|

|

Last Name |

First Name |

|

Middle I nitial |

Home |

|

Work |

|

|

|

|

|

|

Telephone Numbers |

|

|

|

|

Last Name |

First Name |

|

Middle I nitial |

Home |

|

Work |

|

|

Street Address of Physical Location of I nsured Property |

|

|

Mailing Address (if different) |

|

|

|

|

|

Number and Street Address |

|

|

Unit |

Number and Street Address |

|

|

|

Unit |

City |

State |

ZI P Code |

County |

City |

|

State |

ZI P Code |

Country |

|

|

|

|

|

|

|

|

|

Companion Policy Information |

|

|

|

|

|

|

|

|

Participating I nsurer |

Companion Policy Number |

|

Dwelling — Coverage A Limit |

|

Expiration Date (must be same as CEA policy) |

|||

Type of Policy |

|

|

|

|

|

|

|

|

Homeowner |

Mobilehome / Manufactured Home |

Condominium |

|

|

Renters |

|

||

Dwelling Fire |

Other (explain in remarks) |

|

|

|

|

|

|

|

Homeowner / Dwelling Fire

Mobilehome / Manufactured Home

CondominiumRenters

Rating Territory

Year Built

Number of Stories,

I ncluding Basement

Construction Type |

|

Frame |

Other |

|

|

|

|

||

Number of Chimneys |

|

|

||

|

|

|

|

|

Square Footage |

|

|

|

|

|

|

|

|

|

Foundation Type |

Raised |

Slab |

Other |

|

|

|

|

||

Roof Type |

Composition |

Tile |

||

|

Wood Shake |

Other |

||

|

|

|

||

Property I nspected? |

Yes |

No |

||

Date |

|

|

|

|

|

|

|

||

I s there unrepaired prior |

Yes |

No |

||

earthquake damage to |

||||

|

|

|||

the dwelling? |

|

|

|

|

I f yes, DO NOT BI ND and explain in Remarks |

||||

|

|

|

|

|

Dwelling secured to |

|

Yes |

No |

|

foundation? |

|

|||

|

|

|

||

|

|

|

||

Cripple walls braced with |

Yes |

No |

||

plywood or equivalent? |

||||

|

|

|||

|

|

|

||

Water heater secured to |

Yes |

No |

||

building frame? |

|

|||

|

|

|

||

Dwelling — Coverage A |

|

|||

Dwelling Limit |

$ |

|

|

|

|

|

|

||

Rating Territory

Construction Type |

Mobile or Manufactured |

|||

|

|

|

||

Property I nspected? |

Yes |

No |

||

Date |

|

|

|

|

|

|

|

||

I s there unrepaired prior |

Yes |

No |

||

earthquake damage to |

||||

|

|

|||

the dwelling? |

|

|

|

|

I f yes, DO NOT BI ND and explain in Remarks |

||||

|

|

|

||

Is the home reinforced by |

Yes |

No |

||

an earthquake resistant |

||||

|

|

|||

bracing system certified by |

|

|

||

the California Department |

|

|

||

of Housing and Community |

|

|

||

Development? |

|

|

|

|

I f yes, attach a copy of the certification |

||||

Dwelling — Coverage A |

|

|||

Dwelling Limit |

$ |

|

|

|

|

|

|

||

Same as Companion Policy |

|

|

||

Deductible |

15% |

|

10% |

|

Personal Property — Coverage C |

||||

$5,000 |

$25,000 |

|

$50,000 |

|

$75,000 |

$100,000 |

|

|

|

No deductible for this coverage if Coverage A deductible is met. No coverage if Coverage A deductible is not met

Loss of Use — Coverage D

$1,500 |

$10,000 |

$15,000 |

|

No deductible for this coverage |

|

Rating Territory

Number of Stories in building

Choose any combination of one or more

of the following options

Option One

Building Property — Coverage A

Real Property — $25,000

There is a $3,750 deductible for this coverage

Option Two

Personal Property — Coverage C

$5,000 |

$25,000 |

$50,000 |

$75,000 |

$100,000 |

|

There is a $750 deductible for this coverage

«AND »

Loss of Use — Coverage D

$1,500 |

$10,000 |

$15,000 |

No deductible for this coverage

Option Three

Loss Assessment — Coverage E

$25,000

$3,750 deductible

Only available if value of property is $135,000 or less

$50,000

$7,500 deductible

$75,000

$11,250 deductible

Rating Territory

Personal Property — Coverage C

$5,000 |

$25,000 |

$50,000 |

$75,000 |

$100,000 |

|

There is a $750 deductible for this coverage

Loss of Use — Coverage D

$1,500 |

$10,000 |

$15,000 |

|

No deductible for this coverage |

|

Remarks

Same as Companion Policy |

|

|

Deductible |

15% |

10% |

Personal Property — Coverage C |

||

$5,000 |

$25,000 |

$50,000 |

$75,000 |

$100,000 |

|

No deductible for this coverage if Coverage A deductible is met. No coverage if Coverage A deductible is not met

Loss of Use — Coverage D

$1,500 |

$10,000 |

$15,000 |

No deductible for this coverage

Additional Limited Building Code Upgrade

— optional —

I ncrease Limited Building Code Upgrade coverage from $10,000 to a total limit of $20,000

I ncrease Limited Building Code Upgrade coverage from $10,000 to a total limit of $20,000

No deductible for this coverage if Coverage A deductible is met. No coverage if Coverage A deductible is not met

Premium Calculation |

|

|

|

Payment Options |

Base Premium |

Increased Limits Premium |

Hazard Reduction Discount |

Total Premium |

Annual |

|

|

|

|

|

+ |

|

− |

= |

I nstallments |

|

|

|

|

|

|

|

Homeowner and Mobilehome only |

|

|

|

|

- if qualifications are met |

|

|

Additional Interests |

|

|

Send Bill To |

||

|

Name |

Loan Number |

|

|

|

Mortgagee |

|

|

|

I nsured |

|

|

|

|

|

|

|

Additional I nsured |

Address |

|

|

Mortgagee |

|

|

|

|

|||

Loss Payee |

|

|

|

|

|

City |

State |

ZI P Code |

|||

|

|||||

|

Name |

Loan Number |

|

|

|

2nd Mortgagee |

|

|

|

I nsured |

|

|

|

|

|

|

|

Additional I nsured Address |

|

|

Mortgagee |

||

Loss Payee |

|

|

|

|

|

City |

State |

ZI P Code |

|||

|

|||||

I am applying for the insurance indicated, and the information on this application is correct

X

Applicant Signature |

Producer Name and Address |

Application Date and Time |

Earthquake Application

Attachment A – Page 2

CALIFORNIA EARTHQUAKE AUTHORITY

EARTHQUAKE INSURANCE APPLICATION – 05/09 Edition

INSTRUCTIONS

POLICY EFFECTIVE DATE AND EXPIRATION DATE

Provide CEA policy effective date and expiration date. Expiration date MUST be the same as the expiration date of the companion policy.

APPLICANT

Complete all requested information for applicant(s) including: Name(s)

Telephone number(s)

Street address of physical location of insured property

Mailing address (if different from street address of property’s physical location)

COMPANION POLICY INFORMATION

Complete all requested information for companion policy including: Name of Participating Insurer

Policy number of companion policy

Dwelling limit (i.e., Coverage A) of companion policy (if companion policy has dwelling limit) Expiration date of companion policy

Type of companion policy

POLICY TYPE

•Homeowner (Companion policy must be either a Homeowners

O MOBILEHOME/MANUFACTURED HOME (Written on CEA Homeowner Policy form; however, requires unique rating information.)

Condominium (i.e. Common Interest Development) (Companion policy must be a Condominium Unit Owners

Renters (Companion policy must be a Renters

Complete all information requested under the applicable CEA policy type. Answer all questions and select desired CEA policy limits and coverage options.

PREMIUM CALCULATION

Provide premium calculations.

PAYMENT OPTIONS

Select payment option:

Annual; or

Installments

SEND BILL TO

Select who should receive the bill:

Insured; or

Mortgagee

ADDITIONAL INTERESTS

Complete information requested for each additional interest, including:

Type:

OMortgagee;

OAdditional insured; or

OLoss payee

Name and address

Loan number (if applicable)

REMARKS

Include any additional remarks as needed.

SIGNATURE

Secure the applicant’s signature on the application.

Provide the producer’s name and address.

Provide the date and time the application is completed.

Document Specs

| Fact | Description |

|---|---|

| Document Type and Edition | California Earthquake Authority Earthquake Insurance Application, 05/09 Edition |

| Policy Dates | Includes sections for policy effective date and expiration date, which must match the companion policy. |

| Applicant and Co-Applicant Information | Requests detailed personal information including names, telephone numbers, and addresses. |

| Property Information | Requires the physical and mailing addresses of the insured property, year built, number of stories, construction type, square footage, and other specific details. |

| Coverage Options | Includes selections for dwelling coverage, personal property coverage, and additional options like Loss of Use, Loss Assessment, and Building Code Upgrade coverage. |

| Premium Calculation and Payment | Details the formula for calculating premiums and offers payment options including annual and installment methods. |

| Governing Law | Subject to regulations and oversight by the California Department of Insurance. |

Detailed Instructions for Writing California Earthquake Authority

Preparing the California Earthquake Authority (CEA) Earthquake Insurance Application requires attention to detail and accuracy to ensure proper coverage. This document is vital for securing financial protection against potential earthquake damage. The following steps have been simplified to guide you through the process of completing the form thoroughly and accurately.

- Policy Effective Date And Expiration Date: Enter the policy effective date and ensure the expiration date matches the expiration date of the companion policy.

- Applicant Information: Fill in all necessary details for the applicant(s), including names, telephone numbers, and both the physical and mailing addresses of the insured property.

- Companion Policy Information: Provide details of the companion policy, including the name of the participating insurer, companion policy number, dwelling limit of the companion policy, expiration date, and type of companion policy.

- Policy Type – Rating And Coverage Information: Identify the type of CEA policy based on the companion policy, and complete all requested information under the appropriate CEA policy type. Make sure to answer all the questions and select the desired policy limits and coverage options.

- Premium Calculation: Calculate the premium based on the selected coverages and provide the total premium amount.

- Payment Options: Choose the preferred payment option, whether annual or installments, for the premium.

- Send Bill To: Indicate the recipient of the bill, either the insured or the mortgagee.

- Additional Interests: If applicable, fill in the details for each additional interest, including type (mortgagee, additional insured, or loss payee), name, address, and loan number.

- Remarks: Use this section to include any additional remarks that are necessary for the application.

- Signature: Ensure the applicant signs the application. Also, provide the producer’s name and address, along with the date and time the application was completed.

Once the form is filled out and reviewed for accuracy, it represents a vital step toward securing earthquake insurance. This document, once processed, will provide a foundation for financial recovery in the event of earthquake damage, underscoring the importance of correctness and completeness in its preparation.

Things to Know About This Form

What is the Earthquake Insurance Application from the California Earthquake Authority?

The Earthquake Insurance Application from the California Earthquake Authority (CEA) is a form that applicants fill out to apply for earthquake insurance coverage. It includes sections for applicant information, details about the insured property, companion policy information, and choices regarding coverage and deductibles. This application is vital for California residents seeking financial protection against earthquake damage.

What details are required in the Applicant Information section?

In the Applicant Information section, you need to provide your full name, including last, first, and middle initial, along with telephone numbers for both home and work. If there's a co-applicant, their information is also required. Additionally, the physical location of the insured property and, if different, the mailing address must be included.

What is meant by Companion Policy Information?

Companion Policy Information refers to details about an existing insurance policy that the applicant has, which is related to the property needing earthquake insurance. It includes the name of the participating insurer, the policy number, dwelling coverage limit, and the expiration date, which must align with the CEA policy's expiration. This section helps in determining the type and extent of coverage the applicant is eligible for under the CEA.

How do I choose the right coverage options?

Choosing the right coverage options involves:

- Identifying the type of dwelling — like homeowner, mobile home, condominium, renters, etc.

- Deciding on the dwelling coverage limit based on your companion policy's dwelling limit.

- Selecting the desired deductible for your policy, typically 10% or 15%.

- Opting for personal property coverage and deciding on the coverage limit.

- Choosing loss of use coverage to cover additional living expenses if your home is uninhabitable after an earthquake.

What are the Premium Calculation and Payment Options about?

Premium Calculation section helps you determine the total cost of your earthquake insurance policy based on the base premium, additional coverage limits selected, and any applicable discounts. Payment Options allow you to choose how you want to pay for your policy — either in one annual payment or in installments. This section makes understanding and planning for your policy's financial aspects easier.

Can you explain the Additional Interests section?

In the Additional Interests section, you're asked to provide details about other parties with a financial interest in your property, such as mortgagees or loss payees. This includes their name, address, and loan number if applicable. Including this information ensures that those who have a stake in your property are properly notified and protected in the event of a claim.

What happens if there is unrepaired prior earthquake damage to the dwelling?

If there is unrepaired prior earthquake damage to the dwelling, you must indicate "Yes" to the relevant question and not proceed with binding the insurance (DO NOT BIND) until further clarification and instructions are given. It's crucial to provide an explanation in the remarks section. This step is necessary to assess the risk accurately and determine the appropriate coverage.

What are the necessary steps to complete and submit the application?

To complete and submit the application, follow these steps:

- Fill out each section of the form accurately, providing all the required information.

- Review your coverage options and choose those that best fit your needs.

- Calculate your premium and decide on your payment preference.

- Include information for any additional interests.

- Add any remarks or additional information needed.

- Sign the application to indicate that the information provided is correct and complete.

- Contact the producer listed on the form for any questions and submit the application as directed.

Common mistakes

When filling out the California Earthquake Authority form, attention to detail is paramount. Common mistakes can hinder the processing of an application and affect the accuracy of the policy issued. Below are nine typical errors applicants make:

- Not providing both the policy effective and expiration dates, or failing to ensure that the expiration date matches that of the companion policy. This alignment is critical for continuous coverage.

- Omitting details in the Applicant Information section, such as complete telephone numbers or accurately listing the first, middle, and last names. Precise information ensures the policy correctly identifies the insured.

- In the Physical location and Mailing Address sections, applicants sometimes input incomplete addresses or do not specify a different mailing address if applicable. Correct addresses prevent documentation or billing issues.

- Failing to completely fill out the Companion Policy Information, including the name of the Participating Insurer or the companion policy number. This information is necessary to confirm eligibility and coordinate coverages.

- Incorrect selection of the Type of Policy under the companion policy information or not specifying the dwelling limit. This mistake can lead to improper rate calculations or coverage mismatches.

- Overlooking details on the dwelling such as the year built, number of stories, construction type, or square footage. Accurate descriptions of the property are essential for determining the appropriate premium and coverage limits.

- Neglecting to disclose pre-existing damage or failing to confirm the dwelling is secured to the foundation. Undisclosed information can lead to issues in the event of a claim.

- Choosing incorrect deductibles or coverages under the Dwelling — Coverage A, Personal Property — Coverage C, or Loss of Use — Coverage D sections. Clear understanding and selection of coverages prevent potential underinsurance.

- In the Premium Calculation section, errors in addition or selecting the wrong payment options can lead to financial misunderstandings. Ensuring the accuracy of this section guarantees the policyholder is aware of their payment obligations.

Avoiding these mistakes requires careful review of the application before submission. Applicants are advised to double-check all information, ensure completeness, and confirm details like address accuracy and policy dates. Such diligence helps in securing accurate and effective earthquake insurance coverage.

Documents used along the form

When applying for coverage with the California Earthquake Authority, it's essential to have all your paperwork in order to ensure a smooth process. Apart from the primary Earthquake Insurance Application, there are several other documents and forms that can complement your application or are often required for complete coverage and protection of your property. Understanding these documents will help you prepare better for the uncertainties posed by earthquakes.

- Homeowner's Insurance Policy: This is a comprehensive form of property insurance that covers losses and damages to an individual's house and assets in the home. It provides financial protection against disasters such as fire, theft, and, in some cases, flooding. It's imperative since the Earthquake Insurance often requires a companion homeowner's policy.

- Proof of Property Ownership: This can include a property deed or a recent mortgage statement. It's crucial to establish the applicant's legal ownership or financial interest in the property to be insured against earthquake damage.

- Building Code Upgrade Coverage Endorsement: This optional coverage can be added to your earthquake policy to cover the costs associated with bringing your home up to code during repairs after an earthquake. It's especially relevant for older homes that may not meet current building standards.

- Earthquake Retrofitting Documentation: If your home has undergone seismic retrofitting, providing documentation or certification of the upgrades can be beneficial. This may influence the terms of your earthquake insurance, potentially leading to lower premiums.

- List of Personal Property: For coverage that extends to personal belongings, a detailed inventory of personal property, including valuations, can help ensure that coverage limits are adequate and can facilitate claims processing after a loss.

- Mortgagee Clause: If there's a mortgage on the property, the mortgage lender will likely require a mortgagee clause to be added to the insurance policy. This clause ensures that the lender is notified of any changes to the policy and is listed as a loss payee in the event of a claim.

Collecting these documents and keeping them updated enhances your readiness for any unforeseen events. Together with the California Earthquake Authority form, they form a shield that keeps your property and financial stability protected against the unique risks posed by earthquakes. Being prepared with the right documentation can significantly ease the application process, helping secure your peace of mind in earthquake-prone areas.

Similar forms

The California Earthquake Authority (CEA) form closely resembles a standard Homeowners Insurance Policy application. Both documents require detailed information about the insured property, including its address, type of dwelling, construction details, and whether there has been previous damage. Each form also asks for personal information about the applicant(s), such as names and contact details, and outlines coverage options with associated limits and deductibles. The essence of gathering comprehensive details in both forms is to accurately assess the risk and calculate the appropriate premium.

Similar to an Auto Insurance Application, the CEA form collects basic information about the "insured" item, albeit focusing on a residence rather than a vehicle. Both forms inquire about prior damage (in the auto form, this would relate to accidents or previous claims) and safety features (comparable to earthquake retrofitting details on the CEA form). Furthermore, each document details coverage options that are customizable based on the applicant’s needs and the specifics of the policy, such as liability limits in auto insurance versus dwelling and personal property coverage in earthquake insurance.

The form also shares similarities with a Life Insurance Application, particularly in the necessity for the applicant to provide truthful and comprehensive information that directly impacts the underwriting process and premium calculations. While one focuses on personal health and lifestyle information and the other on property details and earthquake preparedness, both forms contribute to evaluating the level of risk associated with issuing the policy. Additionally, selections regarding different coverage options and beneficiaries (or in the case of property insurance, additional insured parties or mortgagees) are integral parts of both applications.

Like a Renters Insurance Application, the CEA form addresses the needs of individuals who do not own their homes but still require protection for personal property and liability. Both documents include sections for personal property coverage with various limits and detail the optionality of coverage based on the chosen deductibles. They also inquire about prior claims history, which can affect the applicant's risk profile and the cost of the policy. Although the CEA specifically covers earthquake damage, the general structure of gathering information and outlining coverage aligns closely with the renters' insurance application process.

Lastly, the CEA form has parallels with a Commercial Property Insurance Application used by businesses. Both types of applications collect detailed information on the physical characteristics of the insured property, including the year built, construction type, and any safety features or modifications. These details are crucial for assessing the insurance premium based on the risk profile of the property. Additionally, both forms offer options for additional coverages, such as loss of use or business interruption, which provide financial protection beyond the basic coverage for damage to the structure itself.

Dos and Don'ts

When filling out the California Earthquake Authority (CEA) form, it's important to pay attention to details and follow some best practices to ensure the process goes smoothly and accurately. Here are seven things you should do and seven things you shouldn't:

What You Should Do:

- Double-check the policy effective date and expiration date to ensure they match with the expiration date of your companion policy.

- Fill out all requested applicant information completely, including names, telephone numbers, and addresses.

- Provide accurate companion policy information, including the name of the insurer, policy number, and dwelling limit.

- Correctly identify the CEA policy type based on the companion policy to ensure proper coverage and rating.

- Answer all questions truthfully and select the desired policy limits and coverage options that best fit your needs.

- Carefully calculate your premium based on the selections made in the form.

- Sign the form and secure the signature of the applicant to validate the application.

What You Shouldn't Do:

- Do not leave any required fields blank; incomplete applications can result in delays.

- Avoid guessing on any answers or premium calculations; ensure all information is accurate.

- Do not ignore the companion policy details; these are crucial for determining eligibility and coverage limits.

- Do not skip the inspection and unrepaired damage sections; failing to disclose this information can affect your coverage.

- Avoid choosing policy limits or deductibles without considering the potential cost of repairs or replacements after an earthquake.

- Do not forget to include any additional interests, such as mortgagees or additional insureds, as required.

- Do not submit the application without reviewing all the information for accuracy and completeness.

By following these dos and don'ts, you can help ensure your CEA form is accurately filled out, leading to a smoother application process and better ensuring that you have the right coverage for your needs.

Misconceptions

When it comes to the California Earthquake Authority (CEA) and earthquake insurance, several misconceptions can lead to confusion. By dispelling these myths, individuals seeking protection from seismic events can make more informed decisions. Here are seven common misconceptions about the CEA form:

- The CEA policies are only available for homeowners. The truth is the CEA offers a variety of policies, not just for homeowners, but also for renters, condo-unit owners, and mobile home owners. Each type of policy is tailored to meet the specific needs of these varied living situations.

- CEA policies are prohibitively expensive. Premiums for CEA policies vary widely based on several factors, including the location, age, and construction type of the insured dwelling, as well as the chosen coverages and deductibles. There are also discounts available for homes retrofitted to withstand earthquakes, making insurance more affordable than many people think.

- Earthquake insurance is only needed in California. While California is known for its seismic activity, earthquakes can and do happen in other parts of the United States. However, the CEA specifically provides policies for California properties. Property owners in other states should look into their local options for earthquake coverage.

- If you have homeowners insurance, you don't need earthquake insurance. Most standard homeowners' policies do not cover earthquake damage. Earthquake insurance must typically be purchased as a separate policy or as an endorsement from an insurer that offers it, like the CEA for California residents.

- You cannot customize CEA policies. CEA policies offer various coverage options and deductibles, allowing policyholders to customize their coverage to fit their needs and budget. From setting personal property limits to choosing deductibles for structural damage, policyholders have flexibility in designing their coverage.

- CEA policies only cover major damage. While it's true that there are deductibles, CEA policies offer coverage for a range of damages, including minor structural repairs, personal property loss, and additional living expenses if the insured property is uninhabitable. The notion that only catastrophic damages are covered is incorrect.

- Applying for CEA coverage is a complex process. The application process for obtaining CEA coverage is straightforward. The form requires basic information about the applicant, the insured property, and any companion policy information. It's designed to be user-friendly, and insurance agents can assist with any questions.

Understanding the reality behind these misconceptions can help California residents better assess their earthquake insurance needs. With accurate information, individuals can choose the right coverage for their homes, providing peace of mind in the event of a seismic disaster.

Key takeaways

Filling out the California Earthquake Authority (CEA) form requires attention to detail and an understanding of your insurance needs. Here are some key takeaways to help guide you through the process:

- Ensure the policy effective date and expiration date on the CEA form match those of your companion policy. This alignment is crucial for maintaining continuous coverage.

- Fill out applicant information comprehensively, including all required fields like name, telephone numbers, and addresses. This ensures the policy is accurately tied to the right individual or individuals.

- Provide detailed companion policy information, including the insurer's name and the policy number. The limits and type of your companion policy directly influence your earthquake coverage options.

- Select the appropriate CEA policy type based on your companion policy. The type of structure you're insuring (homeowner, mobile home, condominium, or renter) affects the coverage and options available to you.

- Answer all questions related to the physical condition and safety features of the insured property, such as if there is unrepaired earthquake damage or if the water heater is secured. This information impacts your eligibility and premium.

- Choose your coverage limits and deductibles wisely. Decisions on dwelling coverage, personal property coverage, and loss of use coverage affect your protection level and out-of-pocket costs after an earthquake.

- Understand the premium calculation, including how base premiums, increased limits, and discounts for hazard reduction contribute to your total premium. This helps in budgeting for the cost of earthquake insurance.

- Decide on a payment option (annual or installments) that suits your financial situation, and indicate who (insured or mortgagee) should receive the bill.

Don't forget to include any relevant additional interests, such as mortgagees or loss payees, to ensure all parties with a financial stake in the property are properly notified. Lastly, reviewing and signing the application verifies that all provided information is correct and complete. Accurate and thorough completion of the CEA form is essential for securing the right earthquake insurance coverage for your needs.

Discover More PDFs

California Tax Form - The instructions provided on the Form 540-V are straightforward and designed to make the payment process uncomplicated for the average taxpayer.

De 160 Form - Assists in the proper documentation and valuation of assets for efficient probate proceedings.