Blank California Dhcs PDF Form

In the State of California, driven by the mission to uphold the integrity of its Health and Human Services, the Department of Health Care Services mandates that all applicants or providers aiming to enroll, continue enrollment, or certify as a Medi-Cal provider must meticulously complete and submit the Medi-Cal Disclosure Statement (DHCS 6207). This form serves as a pivotal document, ensuring that a comprehensive application package is submitted. The DHCS 6207 form underscores the critical need for disclosing complete and accurate information. New applicants are cautioned that any failure in providing such information might not only result in the denial of enrollment but also trigger a three-year prohibition against reapplication. Similarly, currently enrolled applicants face potential denial or deactivation of business addresses, along with a similar three-year reapplication bar, underlining the gravity of full disclosure. Highlighted within this procedural requirement is the mandate for these disclosures to be reported to the Centers for Medicare and Medicaid Services and correspondingly to other states' Medicaid and Children’s Health Insurance Programs, adhering to federal regulations. The form emphasizes the methodical nature of its completion, advising against the use of staples and correction fluid, and requiring any corrections to be initialed and dated by the applicant or provider. Moreover, it extends beyond mere applicant information, delving into detailed sections that cover unincorporated sole-proprietor or individual rendering provider additions to a group, ownership interest and/or managing control information for both entities and individuals, subcontractor details, significant business transactions, incontinence supplies, and specific instructions for pharmacy applicants or providers. Conclusively, it intricately lays down the declaration and signature page requirements, which include a matching legal name on the application package and the necessity of an original signature by an authorized individual, underscoring the thoroughness and legal adherence expected in the Medi-Cal provider enrollment or certification process.

Document Preview Example

State of |

Department of Health Care Services |

Every applicant or provider must complete and submit a current

Important:

•FOR NEW APPLICANTS: Failure to disclose complete and accurate information may result in a denial of enrollment and imposition of a

•FOR CURRENTLY ENROLLED APPLICANTS: Failure to disclose complete and accurate information may result in denial, deactivation of all business addresses and the imposition of a

The Department is required to report the termination of your participation in the

•Submitting a complete and accurate

•Read all instructions when completing the

•Type or print clearly in ink.

•DO NOT USE staples on this form or on any attachments.

•If applicant/provider must make corrections, please line through, date, and initial in ink. Do not use correction fluid.

•Return this completed statement with the complete application package to the address listed on the application form.

Overall Authority: Code of Federal Regulations, Title 42, Part 455; California Code of Regulations, Title 22, Sections

DHCS 6207 (Rev. 7/14)

TABLE OF CONTENTS

GENERAL INSTRUCTIONS |

ii |

I. APPLICANT/PROVIDER INFORMATION |

1 |

II.UNINCORPORATED

|

ADDING TO A GROUP |

4 |

III. |

OWNERSHIP INTEREST AND/OR MANAGING CONTROL INFORMATION (ENTITIES) |

5 |

IV. |

OWNERSHIP INTEREST AND/OR MANAGING CONTROL INFORMATION (INDIVIDUALS) |

7 |

V. |

SUBCONTRACTOR |

10 |

VI. |

INCONTINENCE SUPPLIES |

13 |

VII. |

PHARMACY APPLICANTS OR PROVIDERS |

14 |

VIII. |

DECLARATION AND SIGNATURE PAGE |

15 |

DHCS 6207 (Rev. 7/14) |

i |

2.Rendering providers joining a group who are not eligible to use the

3.If applicant leases the location where services are being rendered or provided, please attach a copy of a current signed lease agreement.

4.In California, a domestic or foreign limited liability company is not permitted to render professional services, as defined in Corporations Code Sections 13401, subdivision (a) and 13401.3. See California Corporations Code Section 17375.

Section II: Unincorporated

Section III: Ownership Interest and/or Managing Control Information (Entities)

1.To determine percentage of ownership, mortgage, deed of trust, note or other obligation, the percentage of interest owned in the obligation is multiplied by the percentage of the disclosing entity’s assets used to secure the obligation. For example, if A owns 10 percent of a note secured by 60 percent of the applicant’s or provider’s assets, A’s interest in the provider’s assets equates to 6 percent and shall be reported pursuant to California Code of Regulations, Title 22, Section 51000.35. Conversely, if B owns 40 percent of a note secured by 10 percent of the applicant’s or provider’s assets, B’s interest in the provider’s assets equates to 4 percent and need not be reported.

2.“Indirect ownership interest” means an ownership interest in any entity that has an ownership interest in the applicant or provider. This term includes an ownership interest in any entity that has an indirect ownership interest in the applicant or provider. The amount of indirect ownership interest is determined by multiplying the percentages of ownership in each entity. For example, if A owns 10 percent of the stock in a corporation which owns 80 percent of the stock of the applicant or provider, A’s interest equates to an 8 percent indirect ownership interest in the applicant or provider and s hall be reported pursuant to California Code of Regulations, Title 22, Section 51000.35. Conversely, if B owns 80 percent of the stock of a corporation, which owns 5 percent of the stock of the applicant or provider, B’s interest equates to a 4 percent indirect ownership interest in the applicant or provider and need not be reported.

3.“Ownership interest” means the possession of equity in the capital, the stock, or the profits of the applicant or provider.

4.All entities with managing control of applicant/provider must be listed in this Section.

5.List the National Provider Identifier (NPI) of each listed corporation, unincorporated association, partnership, or similar entity having 5% or more (direct or indirect) ownership or control interest, or any partnership interest, in the applicant/provider identified in Section I.

6.Corporations with ownership or control interest in the applicant or provider must provide all corporate business addresses and the corporation Taxpayer Identification Number issued by the IRS. For verification, a legible copy of the IRS Form 941, Form

Section IV: Ownership Interest and/or Managing Control Information (Individuals)

1.Refer to Section III instructions and definitions.

2.“Person with an ownership or control interest” means a person that:

a.Has an ownership interest of 5 percent or more in an applicant or provider;

b.Has an indirect ownership interest equal to 5 percent;

DHCS 6207 (Rev. 7/14) |

ii |

c.Has a combination of direct and indirect ownership interest equal to 5 percent or more in an applicant or provider;

d.Owns an interest of 5 percent or more in any mortgage, deed of trust, note, or other obligation secured by the applicant or provider if that interest equals at least 5 percent of the value of the property or assets of the applicant or provider;

e.Is an officer or director of an applicant or provider that is organized as a corporation;

f.Is a partner in an applicant or provider that is organized as a partnership.

3. “Agent” means a person who has been delegated the authority to obligate or act on behalf of an applicant or provider.

4. “Managing employee” means a general manager, business manager, administrator, director, or other individual who exercises operational or managerial control over, or who directly or indirectly conducts the

5.List the National Provider Identifier (NPI) of each individual with ownership or control interest or any partnership interest, in the applicant/provider identified in Section I. In addition, all officers of the corporation, directors, agents and managing employees of the applicant/provider must be reported in this section.

6.Disclosure of social security number is mandatory. (See Privacy Statement at bottom of page 15)

Section V: Subcontractor and Significant Business Transactions

1.“Subcontractor” means an individual, agency, or organization:

a.To which an applicant or provider has contracted or delegated some of its management functions or responsibilities of providing healthcare services, equipment, or supplies to its patients.

b.With whom an applicant or provider has entered into a contract, agreement, purchase order, lease, or leases of real property, to obtain space, supplies, equipment, or services provided under the

2.“Significant business transaction” means any business transaction or series of transactions that involve health care services, goods, supplies, or merchandise related to the provision of services to

Section VI: Incontinence Supplies

1.Applicant or provider must check “Yes” or “No.”

2.If “Yes,” complete

Section VII: Pharmacy Applicants or Providers

All pharmacy applicants or providers must complete this Section.

Section VIII: Declaration and Signature Page

1.All applicants or providers must complete this Section.

2.Legal name of applicant/provider must match name listed on associated application package.

3.The signature must be an individual who is the sole proprietor, partner, corporate officer, or an official representative of a governmental entity or nonprofit organization who has the authority to legally bind the applicant or provider. See Title 22, CCR Section 51000.30(a)(2)(B).

4.An original signature is required. Stamped, faxed, and/or photocopied signatures are not acceptable.

5.Disclosure Statement must be notarized by a Notary Public except for those applicants and providers licensed pursuant to Business and Professions Code, Division 2, beginning with Section 500. For example: Physicians, Pharmacy providers, Chiropractors, Osteopaths, Certified Nurse Midwives, Nurse Practitioners and Dentists do not need to notarize this form. Durable Medical Equipment (DME) providers, Prosthetics, Orthotics, Medical Transportation providers, etc., must notarize this form.

FOR MORE INFORMATION, PLEASE VISIT THE

AND CLICK THE “PROVIDER ENROLLMENT” LINK.

DHCS 6207 (Rev. 7/14) |

iii |

State of |

Department of Health Care Services |

Do not leave any questions, boxes, lines, etc., blank. Check or enter N/A if not applicable to you.

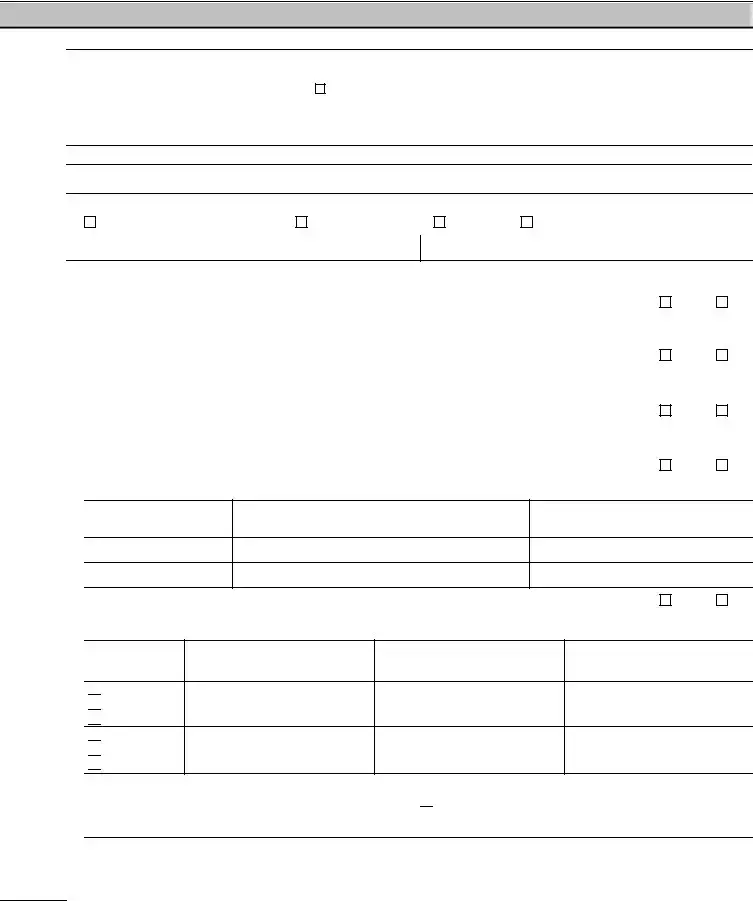

I.APPLICANT/PROVIDER INFORMATION

A. Legal name of applicant/provider as reported to the IRS

B. Legal name of applicant/provider as it appears on professional license |

IF NOT APPLICABLE, CHECK THE BOX |

N/A |

||||

C. Existing provider numbers (NPI or |

N/A |

|||||

D. If applying as a rendering provider to a provider group, check here |

and proceed to Part I. (marked with *asterisk below) |

|

||||

|

|

|

|

|

|

|

E. Fictitious business name |

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

F. “Doing Business As” name |

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

G. Address where services are rendered or provided (number, street) |

(City) |

|

(State) |

|||

|

|

|

|

|

|

|

|

1. Does applicant/provider lease this location? |

Yes |

No |

|

|

|

2.If YES, complete the following information regarding the Lessor and enclose a copy of the current signed Lease Agreement, including any sublease agreements entered into by the applicant provider at the business address on the Application.

a. Lessor name

b. Lessor address (number, street) |

(City) |

(State) |

c. Lessor telephone number

d. Term of lease

e. Amount of lease

3. If no, does applicant/provider own this location? |

Yes |

No |

4. If applicant/provider does not lease or own this location, explain below:

H.Type of Entity (must check one):

General Partnership |

Limited Partnership |

|

|

|

Limited Liability Partnership |

|

(Enclose Partnership Agreement) |

(Enclose Partnership Agreement) |

(Enclose Partnership Agreement) |

||||

Sole Proprietor (Unincorporated) |

Limited Liability Company: |

|

|

Governmental |

||

Corporation |

State of formation: |

|

|

|

|

|

|

|

|

State incorporated: |

|||

(Enclose Articles of Incorporation and |

Corporate number: |

|

||||

Statement of Information) |

|

|

|

_____________________ |

||

Nonprofit: |

|

|

|

|

|

|

Check one: |

Check one: |

|

|

|

|

|

Corporation |

Charitable |

Other (specify): |

|

|||

Unincorporated Association |

Religious |

|

|

|

|

|

*I. List below fines/debts due and owing by applicant/provider to any federal, state, or local government that relate to Medicare, Medicaid and all other federal and state health care programs that have not been paid and what arrangements have been made to fulfill the obligation(s). Submit copies of all documents pertaining to the arrangements including terms and conditions. See

California Code of Regulations (CCR), Title 22, Section 51000.50(a)(6).

N/A

FINE/DEBT

$

$

AGENCY

DATE ISSUED

DATE TO BE PAID IN FULL

Do not leave any questions, boxes, lines, etc., blank.

DHCS 6207 (rev. 7/14) |

Page 1 of 15 |

I.APPLICANT/PROVIDER INFORMATION (Continued)

J. List the name and DGdress of all health care providers, participating or not participating in

applicant/provider, listed in Part A, also has an ownership or control interest. If none, check N/A. If additional space is needed,

attach additional page (label “Additional Section I, Part J”). |

N/A |

|

|

|

|

|

|

1. |

Full legal name of health care provider |

|

|

|

|

|

|

2. |

Address (number, street) |

(City) |

(State) |

K.Respond to the following questions:

1. |

Within ten years of the date of this statement, have you, the applicant/provider, been convicted |

|

|

|

|

of any felony or misdemeanor involving fraud or abuse in any government program? |

Yes |

No |

|

|

If yes, provide the date of the conviction (mm/dd/yyyy): |

|

|

|

2. |

Within ten years of the date of this statement, have you, the applicant/provider, been found liable |

|

|

|

|

for fraud or abuse involving a government program in any civil proceeding? |

Yes |

No |

|

|

If yes, provide the date of final judgment (mm/dd/yyyy): |

|

|

|

3. |

Within ten years of the date of this statement, have you, the applicant/provider, entered into a |

|

|

|

|

settlement in lieu of conviction for fraud or abuse involving a government program? |

Yes |

No |

|

|

If yes, provide the date of the settlement (mm/dd/yyyy): |

|

|

|

4. |

Do you, the applicant/provider, currently participate or have you ever participated as a provider in |

|

|

|

|

the |

Yes |

No |

|

If yes, provide the following information:

STATE

NAME(S)

(LEGAL AND DBA)

NPI AND/OR

PROVIDER NUMBER(S)

5. Have you, the applicant/provider, ever been suspended from a M edicare, Medicaid, or |

|

||||

|

program? |

|

|

Yes |

No |

|

If yes, attach verification of reinstatement and provide the following information: |

|

|

||

|

|

|

|

|

|

|

CHECK |

|

|

|

|

|

APPLICABLE |

NPI AND/OR |

EFFECTIVE DATE(S) OF |

DATE(S) OF REINSTATEMENT(S), |

|

|

|

||||

|

PROGRAM |

PROVIDER NUMBER(S) |

SUSPENSION |

AS APPLICABLE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicaid |

|

|

|

|

|

Medicare |

|

|

|

|

|

|

|

|

|

|

|

Medicaid |

|

|

|

|

|

Medicare |

|

|

|

|

6. Has the individual license, certificate, or other approval to provide health care of the applicant/provider |

|

||||

|

ever been suspended or revoked? |

|

Yes |

No |

|

If yes, include copies of licensing authority decision(s) for each decision and written confirmation from them that your professional privileges have been restored and provide the following information:

WHERE ACTION(S) WAS

TAKEN

ACTION(S) TAKEN

EFFECTIVE DATE(S) OF

LICENSING AUTHORITY’S ACTION(S)

DHCS 6207 (rev. 7/14)

Do not leave any questions, boxes, lines, etc., blank.

Page 2 of 15

I. APPLICANT/PROVIDER INFORMATION (Continued)

7. |

Have you, the applicant/provider, ever lost or surrendered your license, certificate, or other approval |

Yes |

No |

|

to provide health care while a disciplinary hearing was pending? |

||

|

|

|

|

|

If yes, attach a copy of the written confirmation from the licensing authority that your professional |

|

|

|

privileges have been restored and provide the following information: |

|

|

WHERE ACTION(S) WAS

TAKEN

ACTION(S) TAKEN

EFFECTIVE DATE(S) OF

LICENSING AUTHORITY’S ACTION(S)

8. Has the license, certificate, or other approval to provide health care of the applicant/provider ever |

|

|

been disciplined by any licensing authority? |

Yes |

No |

If yes, include copies of licensing authority decision(s) including any terms and conditions for each decision and provide the following information:

WHERE ACTION(S) WAS

TAKEN

ACTION(S) TAKEN

EFFECTIVE DATE(S) OF

LICENSING AUTHORITY’S ACTION(S)

•If you, the applicant/provider, are an unincorporated

OR

•If you, the applicant/provider, are a partnership, corporation, governmental entity, or nonprofit organization, proceed to Section III.

DHCS 6207 (rev. 7/14)

Do not leave any questions, boxes, lines, etc., blank.

Page 3 of 15

II.UNINCORPORATED  GROUP

GROUP

|

A. |

Full legal name (Last) (Jr., Sr., etc.) |

(First) |

(Middle) |

|

|

|

|

|

|

B. |

Residence address (number, street) |

(City) |

(State) |

C.Social security number (required)

D.Date of birth

E.Driver’s license number or

•If you, the applicant/provider, are an unincorporated

OR

•If you, the applicant/provider, are a rendering provider adding to a group, proceed to Section VIII.

DHCS 6207 (rev. 7/14)

Do not leave any questions, boxes, lines, etc., blank.

Page 4 of 15

III.OWNERSHIP INTEREST AND/OR MANAGING CONTROL INFORMATION (ENTITIES)

A.In the table below, list all corporations, unincorporated associations, partnerships, or similar entities having 5% or more (direct or indirect) ownership or control interest, or any partnership interest, in the applicant/provider identified in Section I. Attach a separate Section III, Part B and C for each entity listed below. Number of pages attached: ______

Check here if this section does not apply and proceed to Section IV.

Check here if this section does not apply and proceed to Section IV.

ENTITY LEGAL BUSINESS NAME

PERCENT (%) OF |

|

OWNERSHIP OR |

NPI NUMBER |

|

|

CONTROL |

(IF APPLICABLE) |

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

DHCS 6207 (rev. 7/14)

Do not leave any questions, boxes, lines, etc., blank.

Page 5 of 15

III.OWNERSHIP INTEREST AND/OR MANAGING CONTROL INFORMATION (ENTITIES) (Continued)

B. Entity with (Direct or Indirect) Ownership Interest and/or Managing

1. Legal business name

2. |

Doing Business As (DBA) name (if applicable) |

N/A |

|

|

|

|

|

3. |

Primary Business Address (number, street) * |

(City) |

(State) |

*If this entity is a corporation, attach a list of ALL business location addresses and P. O. Box addresses of the corporation.

4.If this entity is a corporation, list the Taxpayer Identification Number issued by the IRS and attach a legible copy of the IRS form.

5.Check all that apply:

5% or more ownership interest |

Managing control |

Partner |

Other (specify): |

||

|

|

|

|

|

|

6. Effective date of ownership (mm/dd/yyyy) |

|

7. Effective date of control (mm/dd/yyyy) |

|||

C.Respond to the following questions:

1.Within ten years from the date of this statement, has this entity been convicted of any felony or

misdemeanor involving fraud or abuse in any government program? |

Yes |

No |

|

If yes, provide the date of the conviction (mm/dd/yyyy): |

|

|

|

2.Within ten years from the date of this statement, has this entity been found liable for fraud or

|

abuse involving any government program in any civil proceeding? |

Yes |

No |

||

|

If yes, provide the date of final judgment (mm/dd/yyyy): |

|

|

|

|

3. |

Within ten years from the date of this statement, has this entity entered into a settlement in lieu of |

|

|

||

|

conviction for fraud or abuse involving any government program? |

Yes |

No |

||

|

If yes, provide the date of the settlement (mm/dd/yyyy): |

|

|

|

|

4. |

Does this entity currently participate, or has this entity ever participated, as a provider in the |

Yes |

No |

||

|

program or in another state’s Medicaid program? If yes, provide the following information: |

|

|

||

STATE

NAME(S)

(LEGAL AND DBA)

NPI AND/OR

PROVIDER NUMBER(S)

5. Has this entity ever been suspended from a Medicare, Medicaid, or |

Yes |

No |

If yes, attach verification of reinstatement and provide the following information:

CHECK |

NPI AND/OR |

|

|

|

APPLICABLE |

EFFECTIVE DATE(S) OF |

DATE(S) OF REINSTATEMENT(S), |

||

|

||||

|

|

|

||

PROGRAM |

PROVIDER NUMBER(S) |

SUSPENSION |

AS APPLICABLE |

|

|

|

|

Medicaid

Medicaid

Medicare

Medicare

Medicaid

Medicaid

Medicare

Medicare

6. List the name and address of all health care providers, participating or not participating in

If additional space is needed, attach additional page (label “Additional Section III, Part C, Item 6”). Number of pages attached:____

a. Full legal name of health care provider (include any fictitious business names)

|

b. Address (number, street) |

(City) |

(State) |

|

|

|

|

DHCS 6207 (rev. 7/14)

Do not leave any questions, boxes, lines, etc., blank.

Page 6 of 15

Document Specs

| Fact | Description |

|---|---|

| Governing Laws | The form is under the jurisdiction of the Code of Federal Regulations, Title 42, Part 455, California Code of Regulations, Title 22, Sections 51000–51451, and Welfare and Institutions Code, Sections 14043–14043.75. |

| Requirements | All applicants or providers must submit a complete and accurate Medi-Cal Disclosure Statement (DHCS 6207) for enrollment, continued enrollment, or certification. |

| Consequences of Incomplete or Inaccurate Information | Providing incomplete or inaccurate information can lead to enrollment denial, deactivation, and a three-year reapplication bar. |

| Submission Instructions | Instructions include typing or printing in ink, avoiding staples, making corrections in ink without using correction fluid, and returning the completed statement with the application package. |

Detailed Instructions for Writing California Dhcs

After completing the Medi-Cal Disclosure Statement (DHCS 6207) form, you'll have satisfied an important step towards enrolling, re-enrolling, or continuing enrollment as a provider in California's Medi-Cal program. This is a necessary process for new applicants and current providers, ensuring compliance with regulations and facilitating seamless operation within the Medi-Cal system. Proper and accurate completion of this form is crucial, as it impacts your eligibility and participation in the program. To avoid any mistakes or misinterpretations, follow each step carefully, paying close attention to the details required in every section of the form.

- Ensure you have the latest version of the Medi-Cal Disclosure Statement (DHCS 6207).

- Read the entire form carefully before filling it out. This includes the general instructions provided in the document.

- Type or print clearly in ink. Avoid using staples, correction fluid, highlighters, and pencil.

- If a correction is necessary, cross out the incorrect information, then write the correct information, date, and initial the change.

- Under Section I, fill out the "Applicant/Provider Information." Make sure not to leave any fields blank. If a field is not applicable, write “N/A.”

- For providers applying to join a group and are not using form DHCS 6216 or DHCS 6219, skip to the required sections as instructed in the form.

- If you lease the location where services are provided, attach a current signed lease agreement.

- For Sections II to VII, complete each section as it applies to your status or entity type, providing detailed information as requested for sole proprietors, entities, individuals, subcontractors, incontinence supplies, and pharmacy providers.

- In each section that asks for ownership or controlling interest information, provide clear details about the parties involved, including percentages of ownership or management control as required.

- Ensure all required attachments are included, such as copies of lease agreements, partnership agreements, the IRS documentation, and any other requested documents.

- Upon reaching Section VIII, the Declaration and Signature Page, review your entries to ensure all information is complete and accurate.

- Sign and date the form as required. Remember, an original signature is needed; stamped, faxed, or photocopied signatures will not be accepted.

- If necessary, depending on your provider category, ensure the form is notarized.

- Double-check the entire form and attachments for completeness and accuracy.

- Submit the completed form along with your complete application package to the address provided in your application instructions.

By completing these steps meticulously, you can ensure the successful submission of your Medi-Cal Disclosure Statement, advancing towards compliance and participation in the Medi-Cal program. Given the importance of this document in the enrollment process, take the time to confirm every detail is correct to prevent any delays or complications.

Things to Know About This Form

What is the purpose of the California DHCS 6207 form?

The California DHCS 6207 form, also known as the Medi-Cal Disclosure Statement, is an essential document that must be completed and submitted by all applicants and current providers seeking enrollment, continued enrollment, or certification as a Medi-Cal provider. Its primary purpose is to disclose complete and accurate information to the Department of Health Care Services (DHCS) as a condition for participation in the Medi-Cal program. Complete and accurate disclosure helps ensure compliance with state and federal regulations, facilitating a transparent and reliable healthcare system.

Who is required to fill out the DHCS 6207 form?

All applicants and providers aiming to enroll or re-enroll as a Medi-Cal provider must fill out the DHCS 6207 form. This includes individuals and entities applying for initial enrollment, those seeking re-enrollment or continued participation in the Medi-Cal program, and already-enrolled providers required to update their enrollment information. Certain professionals, such as rendering providers joining a group and pharmacy applicants or providers, have specific sections within the form dedicated to their roles.

What are the consequences of failing to provide complete and accurate information on the DHCS 6207 form?

The DHCS 6207 form clearly states the importance of providing complete and accurate information. Failure to do so can result in several consequences, including:

- Denial of enrollment for new applicants.

- Deactivation of all business addresses for currently enrolled providers.

- Imposition of a three-year reapplication bar, preventing the applicant or provider from reapplying for participation in the Medi-Cal program during that period.

- Mandatory reporting of the termination of participation to the Centers for Medicare and Medicaid Services and other states' Medicaid and Children’s Health Insurance Programs.

How should corrections be made to the DHCS 6207 form if a mistake is identified?

If an applicant or provider finds an error on their submitted DHCS 6207 form, they are instructed to make corrections directly on the form by lining through the incorrect information, then dating and initialing the correction in ink. The use of correction fluid is strictly prohibited to maintain the legibility and integrity of the document. This procedure helps ensure that all information remains clear and verifiable.

What documentation must accompany the Medi-Cal Disclosure Statement?

The Medi-Cal Disclosure Statement requires various pieces of supporting documentation, depending on the section being completed. Common requirements include:

- For applicants leasing the location where services are rendered, a copy of the current signed lease agreement.

- Proof of partnership agreements or Articles of Incorporation for entities.

- Verification of corporate business addresses and Taxpayer Identification Numbers for corporations with ownership or managing control.

- For subcontractor and significant business transactions sections, relevant contracts, agreements, or lease documents.

Is the DHCS 6207 form the same for all types of providers?

No, while the DHCS 6207 form serves as a general Medi-Cal Disclosure Statement, there are specific sections relevant to different types of providers, such as unincorporated sole proprietors, entities with ownership interest and/or managing control, subcontractors, and pharmacy applicants. Additionally, some providers might be eligible to use alternative forms, like the DHCS 6216 or DHCS 6219, aimed specifically at rendering providers joining groups or ordering/referring/prescribing providers. It is crucial for each applicant or provider to thoroughly review the form and complete the sections relevant to their specific situation.

Where can one find more information or assistance with the DHCS 6207 form?

For more detailed instructions, information, or assistance with completing the DHCS 6207 form, applicants and providers are encouraged to visit the Medi-Cal website (www.medi-cal.ca.gov) and navigate to the "Provider Enrollment" link. The website offers comprehensive resources, guidelines, and contact information for obtaining further support, ensuring that providers can comply with the enrollment requirements successfully.

Common mistakes

Filling out the California DHCS form accurately is crucial for Medi-Cal providers and applicants. However, common mistakes can lead to processing delays or application denials. Below are nine errors frequently made during the application process:

- Leaving questions, boxes, or lines blank instead of checking or writing "N/A" if the question does not apply, which can cause delays in processing the form.

- Using correction fluid, tape, pencils, or highlighters on the form, which is not allowed. Corrections should be made by lining through the mistake, then initialing and dating the change in ink.

- Attaching documents with staples, which is explicitly stated as not allowed in the instructions but is often overlooked.

- Not providing a current signed lease agreement if the applicant or provider leases the location where services are rendered, which is a required document for processing the application.

- Not accurately disclosing ownership interests and/or managing control information as detailed in sections pertaining to ownership interest calculations and the proper listing of all entities and individuals with significant control or ownership stakes.

- Omitting to disclose indirect ownership interests correctly, which involves calculating the percentage of ownership interests across entities that own interests in the applicant or provider.

- Failing to list all managing employees in the required section, which includes anyone with significant managerial or operational control over the provider or applicant.

- Not providing all necessary National Provider Identifier (NPI) numbers for all listed corporations, associations, partnerships, or individuals as required in specific sections of the form.

- Submitting the form without the required original signature that must legally bind the applicant or provider to the declaration, often overlooked in cases where a stamped, faxed, or photocopied signature is wrongly considered sufficient.

It is essential to read and follow all instructions carefully, to avoid these mistakes and ensure the application process goes smoothly.

Documents used along the form

When processing or updating the California DHCS form, a critical component of provider enrollment or continuous participation in the Medi-Cal program, several other forms and documents often accompany the primary submission. These supplementary documents are essential to ensure the completeness and accuracy of the provider's enrollment package. They range from basic identification and qualification verification to more complex disclosures about the provider's operations and affiliations.

- IRS Form W-9, Request for Taxpayer Identification Number and Certification: This form is necessary for identifying the taxpayer and verifying their Tax Identification Number (TIN) or Social Security Number (SSN). It is crucial for processing payments and for tax purposes.

- Business License/Professional License Proof: A copy of the current business or professional license provides verification that the provider is legally authorized to operate or practice in their field within the state.

- Lease Agreement or Proof of Property Ownership: If the provider operates from a leased space, a current signed lease agreement must be included. For providers who own their business location, proof of ownership is required. This documentation helps verify the physical location of the practice.

- National Provider Identifier (NPI) Confirmation: Providers must submit evidence of their NPI, which is a unique identifier for covered healthcare providers. This could be a confirmation document from the NPPES or a printout from the NPI Registry.

- Background Check Authorization Form: In some cases, providers and their managing employees may need to undergo background checks. This form authorizes the DHCS or its designated agencies to conduct such investigations, ensuring the provider meets all safety and reliability standards.

- Provider Agreement: This document outlines the terms and conditions under which the provider will participate in the Medi-Cal program. Signing this agreement indicates the provider's commitment to adhere to program policies, billing regulations, and quality standards.

Together, these documents play a pivotal role in the enrollment process, complementing the California DHCS form by providing a comprehensive profile of the provider. Ensuring each piece of information is accurately provided and up-to-date facilitates a smoother verification process, ultimately aiding in maintaining the integrity and efficiency of the Medi-Cal program.

Similar forms

The California Department of Health Care Services (DHCS) form bears significant resemblance to various other forms and documents mandated in health care and other regulated fields, reflecting the necessity for thorough disclosure and accuracy in professional and regulatory environments. Among these analogous documents, each serves a unique purpose while emphasizing the importance of comprehensive, accurate information provision, often to ensure eligibility, compliance, or for record-keeping purposes.

Firstly, the IRS Form W-9, "Request for Taxpayer Identification Number and Certification," is quite similar to the DHCS form in that it requires accurate disclosure of the applicant's legal name, Taxpayer Identification Number (TIN), and certification that the information provided is correct. Both forms are integral for legal and financial compliance, although the W-9 focuses more on tax reporting and the DHCS form on health care provider information.

Another document akin to the DHCS form is the CMS-855A, "Medicare Enrollment Application for Institutional Providers." This form requires detailed information about ownership, managing control, operational jurisdiction, and adherence to Medicare standards. Both forms are crucial for enrollment and continued participation in government-funded healthcare programs, stressing the need for transparency in operational and ownership details.

The "Business License Application" forms that many cities and states require for operational authorization also share similarities with the DHCS form. They request detailed information about the business, including ownership, location, and the nature of the services provided, to ensure compliance with local laws and regulations. Both sets of documents underscore the requirement for accurate business information and legal compliance.

The OPM Form 1647-B, "Health Benefits Registration Form" for federal employees, parallels the DHCS form in its requirement for personal and eligibility information to ensure proper enrollment in health benefits programs. Though one is for healthcare providers and the other for healthcare beneficiaries, both emphasize accurate and complete disclosures for eligibility and enrollment purposes.

Another correlated document is the "HIPAA Business Associate Agreement" (BAA). While not a form for initial completion like the DHCS document, it requires detailed information about the parties involved and their roles and responsibilities in protecting health information. Both documents deal with sensitive information and mandate strict adherence to privacy and security standards.

The "Accreditation Application" forms used by health care accreditation organizations, such as The Joint Commission or the Commission on Accreditation of Rehabilitation Facilities (CARF), also necessitate comprehensive organizational and operational disclosures, much like the DHCS form. Both types of documents are vital for ensuring that entities meet specific standards before being granted operational legitimacy or accreditation.

Lastly, the "Employment Eligibility Verification Form I-9" shares the DHCS form's commitment to verification and accuracy but focuses on confirming an individual's eligibility to work in the United States. Both forms play critical roles in compliance and verification processes, albeit in different contexts.

In every case, these documents—much like the California DHCS form—serve as crucial links between organizations or individuals and regulatory or accrediting bodies, ensuring that standards, regulations, and eligibility criteria are met. The emphasis on detailed, accurate information across these forms underscores the collective goal of upholding quality, compliance, and integrity in various professional and regulatory landscapes.

Dos and Don'ts

When filling out the California DHCS form, attention to detail and thoroughness are imperative for a successful submission. The guidelines provided ensure that applicants and providers disclose the required information accurately to the Department of Health Care Services. Compliance with these instructions not only facilitates the processing of your application but also minimizes the potential for errors that could delay or adversely affect enrollment and certification processes.

Do:

- Ensure that every question, box, or line is filled out; if a question is not applicable, mark it with "N/A" to indicate this.

- For corrections, strike through the incorrect entry, then write the correction alongside, dating and initialing it in ink. This maintains the integrity of the document and highlights any amendments made after the initial completion.

- Attach a current signed lease agreement if you lease the location where services are being rendered, as this is a requirement for validating your operational premise.

- Include all necessary documentation such as the IRS Form 941, Form 8109-C, Letter 147-C, or Form SS-4 (Confirmation Notification) for corporations with ownership or control interest, to provide verification and ensure compliance.

Don't:

- Leave any sections blank unless you are specifically instructed to or if they are not applicable to your situation, in which case, "N/A" should be entered to actively indicate this.

- Use staples on the form or any attachments, as this can cause issues with processing and document handling.

- Make corrections using correction fluid or tape, pencil, highlighter pen, etc., as corrections must be clear and permanently recorded in ink for accuracy and tracking purposes.

- Submit the form without the original signature of an authorized individual, as stamped, faxed, or photocopied signatures are not accepted. This requirement ensures authenticity and accountability.

Adhering to these dos and don'ts will facilitate a smoother application process and help avoid the common pitfalls that can accompany the submission of important documents. By following these guidelines closely, applicants and providers can more effectively navigate the requirements set forth by the Department of Health Care Services, ultimately supporting their goal of providing or continuing to provide healthcare services under the Medi-Cal program.

Misconceptions

Understanding the California Department of Health Care Services (DHCS) form, particularly the Medi-Cal Disclosure Statement (DHCS 6207), can seem daunting at first. However, many concerns and myths about this form are based on misinformation. Let’s clear up some of the most common misconceptions:

- Filling out the DHCS form is optional for Medi-Cal providers. This statement is incorrect. Every applicant or provider must complete and submit a current Medi-Cal Disclosure Statement as part of a complete application package for enrollment, continued enrollment, or certification as a Medi-Cal provider. Failing to do so may result in a denial of enrollment or even deactivation of existing enrollments.

- The form can be submitted with missing information with the intent to update it later. This is a dangerous misconception. The form must be filled out completely and accurately before submission. Any missing or inaccurate information can lead to the denial of the enrollment application or the deactivation of the provider’s enrollment. If information is not applicable, marking it as "N/A" is necessary.

- Corrections on the form can be made with correction fluid or tape. It’s important to note that if an applicant or provider needs to make corrections on the form, they must line through the incorrect information, date, and initial in ink. The use of correction fluid, tape, or any similar method is strictly prohibited.

- A digital or electronic signature is acceptable for the declaration and signature page. The DHCS form requires an original signature. Stamped, faxed, or photocopied signatures will not be accepted. This ensures the authenticity and commitment of the application.

- Any official representative can sign the declaration and signature page. The form must be signed by an individual with the authority to legally bind the applicant or provider. This includes roles such as a sole proprietor, partner, corporate officer, or an official representative of a governmental entity or nonprofit organization.

- The form does not need to be notarized for certain provider types. While this is true for providers licensed under specific sections of the Business and Professions Code (like physicians and dentists), other providers, such as Durable Medical Equipment (DME) providers, must have the Disclosure Statement notarized. Understanding the specific requirements applicable to your provider type is crucial.

- Once submitted, the DHCS form doesn’t need to be updated unless reapplying for Medi-Cal enrollment. This is misleading. Providers must ensure all their information remains current and accurate, including any changes that might occur after the initial submission. It is the provider's responsibility to notify DHCS of any changes to ensure compliance and continuation of enrollment.

Thoroughly reviewing, accurately completing, and timely submitting the Medi-Cal Disclosure Statement is a vital step in the enrollment and reenrollment process for Medi-Cal providers. It is essential to dispel these misconceptions and approach the task with the seriousness and attention to detail it requires.

Key takeaways

Completing the California Department of Health Care Services (DHCS) form carefully is crucial for all applicants or providers seeking to enroll, continue enrollment, or certify as a Medi-Cal provider. Here are key takeaways that should be considered:

- It is mandatory to submit a current and complete Medi-Cal Disclosure Statement (DHCS 6207) as part of the application package. This requirement ensures transparency and compliance with state and federal regulations.

- Accuracy and completeness are of utmost importance. New applicants should be aware that failing to provide complete and accurate information can lead to a denial of enrollment and a three-year reapplication bar. Similarly, current providers can face deactivation and the same reapplication bar for inaccuracies.

- All sections of the form must be filled out diligently. Do not leave any questions, boxes, or lines blank; if a section does not apply, mark it with “N/A.”

- Corrections to the form must be made by lining through the error, dating, and initialing the change in ink. Avoid using correction fluid, correction tape, pencils, and staple on the form or attachments.

- The form requires specific details about the applicant/provider, including ownership interests, managing control information for both entities and individuals, subcontractor and significant business transactions, and, if applicable, information pertaining to pharmacy providers and incontinence supplies.

- Detailed instructions are provided for leasing information. If the location where services are rendered is leased, a current signed lease agreement must be attached to the application.

- The declaration and signature page must be completed with an original signature by someone with the legal authority to bind the applicant or provider. This signature verifies the accuracy and completeness of the information provided.

Each section of the DHCS form plays a critical role in the application process for Medi-Cal providers. By adhering to these key takeaways, applicants and providers can ensure their application is processed efficiently and complies with the necessary regulations. For further guidance and specific instructions, visiting the Medi-Cal website and reviewing the provider enrollment section is recommended.

Discover More PDFs

Registry of Charitable Trusts - The RRF-1 form aids in early detection of mismanagement or unlawful use of charitable assets.

Ca Court Forms Fillable - A submission to the court requesting a specific decision, ruling, or action in a case, detailing the legal basis and desired outcome.