Blank California Death of a Joint Tenant Affidavit PDF Form

In the state of California, handling the affairs of a deceased individual's property can become streamlined with the aid of a specific legal document, known as the Death of a Joint Tenant Affidavit form. This form plays a crucial role in the process of property transfer, enabling the surviving joint tenant or tenants to officially remove the deceased individual's name from the property title without the need for a lengthy probate process. Crafted to simplify the legal transition of real estate ownership following the death of a joint tenant, the form requires detailed documentation and evidence of the deceased's passing, typically including a certified copy of the death certificate. As it facilitates a smoother transition of assets, the Death of a Joint Tenant Affidavit form underscores the importance of understanding state-specific legal procedures in the aftermath of a joint tenant's death. Ensuring accuracy and compliance with California law is essential for the surviving tenant to navigate the complexities of property rights and ownership successfully.

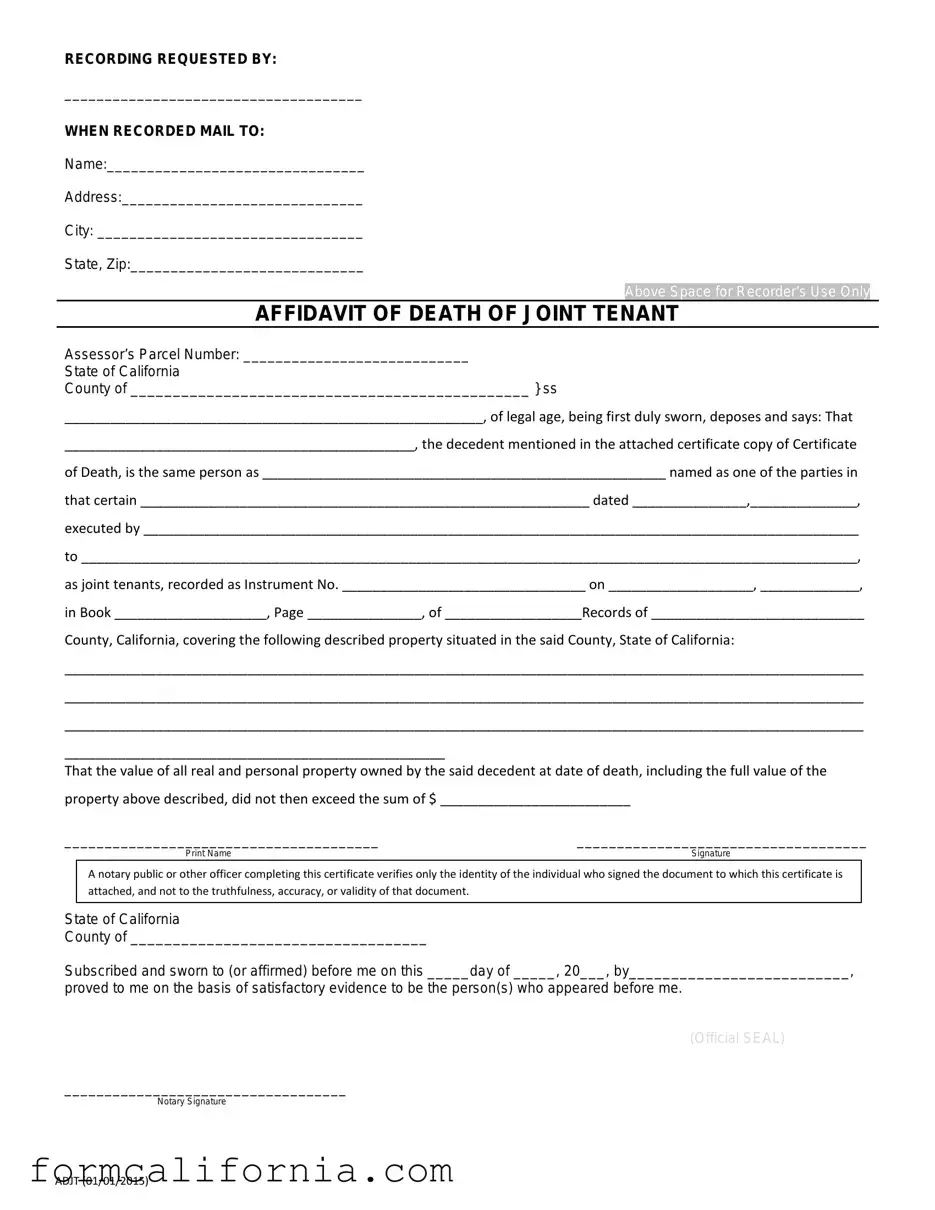

Document Preview Example

RECORDING REQUESTED BY:

_____________________________________

WHEN RECORDED MAIL TO:

Name:________________________________

Address:______________________________

City: _________________________________

State, Zip:_____________________________

Above Space for Recorder’s Use Only

AFFIDAVIT OF DEATH OF JOINT TENANT

Assessor’s Parcel Number: ____________________________

State of California

County of _______________________________________________ } ss

_______________________________________________________, of legal age, being first duly sworn, deposes and says: That

______________________________________________, the decedent mentioned in the attached certificate copy of Certificate

of Death, is the same person as _____________________________________________________ named as one of the parties in

that certain ___________________________________________________________ dated _______________,______________,

executed by ______________________________________________________________________________________________

to ______________________________________________________________________________________________________,

as joint tenants, recorded as Instrument No. ________________________________ on ___________________, _____________,

in Book ____________________, Page _______________, of __________________Records of ____________________________

County, California, covering the following described property situated in the said County, State of California:

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

__________________________________________________

That the value of all real and personal property owned by the said decedent at date of death, including the full value of the property above described, did not then exceed the sum of $ _________________________

_______________________________________ |

____________________________________ |

Print Name |

Signature |

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not to the truthfulness, accuracy, or validity of that document.

State of California

County of ___________________________________

Subscribed and sworn to (or affirmed) before me on this _____day of _____, 20___, by__________________________,

proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

(Official SEAL)

___________________________________

Notary Signature

ADJT (01/01/2015)

Document Specs

| Fact | Description |

|---|---|

| 1. Purpose | This form is used to remove the name of a deceased joint tenant from the title of the property, effectively transferring ownership solely to the surviving joint tenant(s). |

| 2. Governing Law | The process is governed by the California Probate Code, specifically starting around Section 5600, which details the procedures for transferring property upon death without a will. |

| 3. Required Information | To complete the form, information needed includes the deceased joint tenant's death certificate, the legal description of the property, and details about the surviving joint tenant(s). |

| 4. Affidavit Filing | Once completed, the affidavit, along with a certified copy of the death certificate, must be filed with the county recorder's office in the county where the property is located. |

| 5. Legal Effect | Filing the affidavit serves to legally transfer the property title from joint tenancy to the surviving tenant(s), removing the deceased from the property's title. |

| 6. Cost Considerations | While there may be a nominal filing fee required by the county recorder's office, using this affidavit avoids the much larger costs and time associated with probate court proceedings. |

| 7. No Probate Required | This process allows for the transfer of property ownership without the need for probate, simplifying and expediting the transfer after the death of a joint tenant. |

Detailed Instructions for Writing California Death of a Joint Tenant Affidavit

When an individual holding property in joint tenancy passes away, the surviving joint tenant(s) must legally notify the transfer of property interest. A California Death of a Joint Tenant Affidavit is a vital document utilized to facilitate this process, ensuring that the deceased's share of the property rightfully transfers to the surviving joint tenant without necessitating probate court proceedings. This guide provides step-by-step instructions for filling out the form accurately so that the transfer is recognized legally and efficiently.

- Locate a blank California Death of a Joint Tenant Affidavit form. This can typically be obtained online from a legal forms website, the county recorder's office, or an attorney.

- Read the entire form carefully before filling it out. This ensures you understand what information and documentation are required.

- Fill in the property details. This includes the assessor's parcel number (APN), legal description of the property, and the street address. These details must match the current deed exactly.

- Provide information about the deceased joint tenant. Enter the full legal name of the deceased, the date of their death, and the city and county where the death occurred. Attach a certified copy of the death certificate to the affidavit.

- Include the surviving joint tenant’s information. This section requires the full legal name and address of the surviving joint tenant filing the affidavit.

- Sign the affidavit before a notary public. The form must be signed by the surviving joint tenant in the presence of a notary public to be valid. The notary will also need to sign, date, and affix their official seal on the document.

- Record the affidavit. Submit the completed affidavit along with the death certificate and any required recording fee to the county recorder’s office where the property is located. Once recorded, the property will officially be in the name(s) of the surviving joint tenant(s).

After successfully submitting the California Death of a Joint Tenant Affidavit, the document will be reviewed and processed by the county recorder's office. It's essential to follow up to ensure that the document has been recorded properly and that the property records reflect the change. This legal step confirms that the surviving joint tenant(s) hold the deceased's interest in the property, allowing them to proceed with any decisions regarding the property's future without dispute or the need for probate court proceedings. Keeping a copy of the recorded affidavit and any correspondence from the county recorder’s office is recommended for personal records and future reference.

Things to Know About This Form

What is the purpose of the California Death of a Joint Tenant Affidavit form?

The California Death of a Joint Tenant Affidavit form serves a critical role in the process of transferring property ownership. When a property is held in joint tenancy and one of the owners passes away, this legal document helps to remove the deceased's name from the property title. It facilitates the clear and uncontested transfer of the deceased joint tenant's interest in the property to the surviving joint tenant(s), ensuring the smooth continuation of ownership without the need for probate court proceedings.

Who should fill out the California Death of a Joint Tenant Affidavit form?

This form should be completed by the surviving joint tenant(s) after the death of another joint tenant. It is essential for the surviving owner(s) who wish to have the property title accurately reflect the current ownership status, thereby officially recognizing their full rights to the property.

What documents are required to complete the California Death of a Joint Tenant Affidavit form?

To ensure the successful completion and filing of the California Death of a Joint Tenant Affidavit form, several documents are typically required:

- A certified copy of the death certificate of the deceased joint tenant.

- The original deed to the property, showing the joint tenancy.

- Any relevant supporting documentation that might be requested by the county recorder's office.

It's advised to check with the local county recorder's office for any additional requirements specific to the locality.

Where should the California Death of a Joint Tenant Affidavit form be filed?

Once completed and notarized, the California Death of a Joint Tenant Affidavit form needs to be filed with the county recorder's office in the county where the property is located. This step is vital for the legal recognition of the transfer of the deceased joint tenant's property interest to the surviving joint tenant(s).

Is there a deadline for filing the California Death of a Joint Tenant Affidavit form?

While there isn’t a statewide, legally mandated deadline for filing this affidavit, it is highly advisable to file it as soon as reasonably possible after the death of the joint tenant. Prompt filing helps to avoid complications or disputes regarding property ownership and ensures that the property records accurately reflect the current status of ownership.

What are the consequences of not filing the California Death of a Joint Tenant Affidavit form?

Failing to file the California Death of a Joint Tenant Affidavit form can lead to significant legal and financial implications for the surviving joint tenant(s). These may include:

- Complications in the clear title of the property, potentially affecting the ability to sell or refinance the property.

- Possible disputes with heirs of the deceased joint tenant.

- Increased vulnerability to claims against the property.

Therefore, it is crucial for the surviving joint tenant(s) to complete and file the affidavit promptly to avoid these potential problems.

Common mistakes

Filling out legal documents often requires a careful attention to detail to ensure accuracy and compliance with specific requirements. The California Death of a Joint Tenant Affidavit form is no exception. This document is essential in the process of transferring property ownership after the death of a joint tenant. Unfortunately, errors can occur during the completion of this affidavit that may cause delays or complications. Here are six common mistakes people make:

- Not providing a certified copy of the death certificate. This document is critical to prove the death of the joint tenant. Failing to attach a certified copy can lead to the rejection of the affidavit.

- Incorrectly identifying the property. The legal description of the property must match public records exactly. Misidentifications can cause significant issues in the property transfer process.

- Missing signatures. All required parties must sign the affidavit. Missing signatures can invalidate the document.

- Failing to notarize the document. Notarization is a crucial step in the validation of the affidavit. It is a common oversight that can render the paperwork legally ineffective.

- Incomplete information. Every section of the affidavit needs to be filled out accurately. Incomplete information can lead to processing delays or outright rejection.

- Forgetting to include necessary attachments. Depending on the situation, additional documentation may be required beyond the death certificate. Overlooking these can lead to incomplete submission.

While preparing the California Death of a Joint Tenant Affidavit form, it's also beneficial to avoid certain pitfalls that are more procedural or contextual in nature:

- Assuming one size fits all. Each county might have specific additional requirements or forms.

- Omitting to seek legal advice when unsure. Given the legal complexities and the importance of the affidavit in property succession, professional guidance is often necessary.

- Relying solely on templates found online without verifying their current validity or applicability to a specific situation.

Being meticulous and ensuring all stated requirements are met will streamline the process of transferring property after the passing of a joint tenant. When in doubt, it's advisable to consult a professional who can provide guidance tailored to the specific circumstances.

Documents used along the form

When managing the death of a joint tenant in California, a specific set of forms and documents often accompany the California Death of a Joint Tenant Affidavit to ensure a smooth transfer of property and to comply with legal procedures. These documents are essential for various reasons, including verifying the death, determining the property value, and ensuring the property taxes are updated. Understanding each document's purpose can facilitate the process during a challenging time.

- Certified Copy of the Death Certificate: This document serves as official proof of death, verifying the decedent’s identity and the fact of death. It is required by various agencies and organizations to process changes in ownership and update records.

- Preliminary Change of Ownership Report: Filed with the county recorder’s office, this document provides information on the property and the change in ownership. It helps the assessor's office determine if a reassessment of the property value is necessary and update the property tax records accordingly.

- Affidavit of Real Property Value: This affidavit is often used to give a sworn statement regarding the value of the real property involved. It might be necessary for tax purposes and to ensure the correct amount of transfer tax is assessed and collected.

- Property Tax Statement: While not always directly tied to the change in ownership, the most recent property tax statement may be required during the process to ensure all taxes are paid up to date. This document can provide a basis for any proration of property taxes and ensure tax compliance.

Together with the California Death of a Joint Tenant Affidavit, these documents form a comprehensive package that addresses the legal and tax implications of transferring property after a joint tenant's death. By gathering and completing these forms, individuals can efficiently manage the transfer process, ensuring all legal responsibilities are met and making the transition as smooth as possible for all parties involved.

Similar forms

The California Death of a Joint Tenant Affidavit form is closely related to the Affidavit of Death of Trustee. Both documents serve the purpose of notifying relevant parties about the death of an individual holding significant titles or interests. While the Joint Tenant Affidavit is used specifically for property held in joint tenancy, signaling the transfer of the deceased's interest to the surviving tenant(s), the Affidavit of Death of Trustee alerts institutions and individuals that the person managing a trust has passed away, paving the way for a successor to assume control.

Similarly, the Transfer on Death Deed (TODD) operates in the same realm of post-death property management, much like the California Death of a Joint Tenant Affidavit. The Transfer on Death Deed allows property owners to name a beneficiary who will receive the property upon the owner's death, bypassing the probate process. Although the TODD comes into effect without the need for a surviving joint tenant's declaration, both documents facilitate the transition of property upon death, avoiding lengthy court procedures.

The Small Estate Affidavit is another document that intersects in purpose with the California Death of a Joint Tenant Affidavit, albeit for estates under a certain value threshold. This document enables the transfer of assets without a formal probate process, which can include money in bank accounts, vehicles, and personal property. While the Joint Tenant Affidavit specifically addresses real property held in joint tenancy, both are geared towards simplifying the asset transfer process following death.

Joint Tenancy Grant Deed plays a pivotal role in property co-ownership, similar to the foundations of the California Death of a Joint Tenant Affidavit. This deed establishes the joint tenancy, creating the right of survivorship that the affidavit later acts upon following one tenant's death. Both documents are essential for the seamless transfer of property rights and interests among co-owners in the context of joint tenancy.

The Life Estate Deed is another document that involves property transfer mechanisms, although it differs in operation from the California Death of a Joint Tenant Affidavit. With a Life Estate Deed, the property owner transfers their property to a recipient but retains the right to use the property during their lifetime. Upon the owner’s death, the property automatically transfers to the named remainderman, akin to how the joint tenant affidavit transfers property interest to the surviving tenant.

Affidavit of Heirship also deals with the aftermath of an individual's death, particularly in the absence of a will. It identifies the heirs to the deceased's assets, enabling the transfer of assets without probate court involvement. Although focused more broadly on all assets rather than exclusively on real property, its goal aligns with the California Death of a Joint Tenant Affidavit in facilitating asset transfer following death.

The Executor's Deed is used when a property is being transferred from a decedent's estate under the direction of the estate's executor. This parallels the result aimed for by the California Death of a Joint Tenant Affidavit, though the context differs; the Executor's Deed requires the existence of a will and an appointed executor. Both documents, however, are integral in transferring property titles after death.

The Quitclaim Deed is a simple way to transfer property interest with no guarantees about the title's clearness. While it is used in various circumstances, including during a living individual's life, it can be utilized in scenarios resembling those calling for a California Death of a Joint Tenant Affidavit, especially in settling matters between joint tenants or in estate planning contexts.

A Spousal Property Petition can also be compared to the California Death of a Joint Tenant Affidavit, as it is another California-specific document used to transfer assets between spouses after death. It simplifies the transfer process in cases where the deceased spouse did not include certain assets in a will, much like the affidavit aims to simplify the transfer of real property held in joint tenancy to the surviving tenant.

Finally, the Revocable Living Trust parallels the objective of the California Death of a Joint Tenant Affidavit, though it operates within the broader estate planning arena. A living trust allows for the management of the grantor's assets during their lifetime and the distribution of these assets after death, bypassing the probate process. Like the affidavit, a living trust is designed to facilitate a smoother transition of assets upon death.

Dos and Don'ts

Filling out the California Death of a Joint Tenant Affidavit form is a step that requires attention to detail and an understanding of its elements. Here are some essential dos and don'ts to guide you through the process:

Do:

- Ensure all personal information of the deceased joint tenant is accurate, including full name, date of birth, and date of death.

- Provide a certified copy of the death certificate of the deceased joint tenant with the form.

- Double-check the legal description of the property to ensure it matches the one on the title exactly.

- Sign the affidavit in the presence of a notary public to authenticate the document.

- Have the form recorded at the local county recorder’s office where the property is located.

- Keep a copy of the filed document for your records once it is recorded.

- Seek legal advice if you encounter any confusion or questions while filling out the form.

Don't:

- Fill out the form without having the death certificate of the deceased joint tenant.

- Leave any fields incomplete, as this could delay the process or cause the document to be rejected.

- Misstate your relationship to the deceased joint tenant or provide inaccurate information.

- Forget to check for any specific filing requirements or fees specific to the county where the property is located.

- Attempt to use the form for any property that is not held in joint tenancy.

- Sign the document without a notary public present, as this could invalidate the affidavit.

- Ignore county-specific forms or attachments that may be required in addition to the affidavit.

Misconceptions

Dealing with property after a loved one has passed can be a daunting task. Complications seem to arise not just from the emotional toll but also from the misunderstandings about the legal forms involved. One such form, the California Death of a Joint Tenant Affidavit, is often surrounded by misconceptions. Here, we aim to clarify some of those for a smoother process in these tough times.

- Misconception 1: The form automatically transfers property ownership.

Many believe that filling out the California Death of a Joint Tenant Affidavit instantly transfers the deceased's property ownership to the surviving joint tenant. In reality, this affidavit is a declaration used to remove the deceased's name from the property title, not an automatic transfer deed.

- Misconception 2: It’s a public document that anyone can file.

Contrary to popular belief, not just anyone can submit this affidavit. It must be filed by the surviving joint tenant or an authorized representative to ensure the integrity of the property transfer.

- Misconception 3: You need a lawyer to file it.

While legal advice is beneficial, especially in complex situations, it is not a requirement to have a lawyer to fill out and file the affidavit. However, understanding the proper filling procedure and ensuring accuracy is crucial.

- Misconception 4: It clears all debts on the property.

Filing this affidavit does not affect the property's debts or encumbrances. The surviving tenant takes the property subject to any existing debts or claims against it.

- Misconception 5: It can transfer any kind of property.

This form specifically pertains to real property held in joint tenancy and does not apply to personal property, bank accounts, or vehicles held in joint tenancy.

- Misconception 6: It’s only for married couples.

Joint tenancy is not limited to married couples. Any two or more parties owning property together with rights of survivorship can use this form when one of the owners passes away.

- Misconception 7: It must be filed immediately after death.

While it's important to handle estate matters in a timely manner, there is no strict deadline for filing this affidavit. However, delaying can complicate transferring the property title and other legal proceedings.

Understanding the actual process and requirements can alleviate some of the stress during these challenging times. Accurate knowledge helps in making informed decisions about estate planning and management.

Key takeaways

Filling out the California Death of a Joint Tenant Affidavit form is an important step in managing property ownership after a joint tenant passes away. Below are key takeaways to assist with the process:

- The form is necessary to transfer real estate owned in joint tenancy to the surviving owner(s) without going through probate.

- It should be filed in the county where the property is located immediately after the death of a joint tenant.

- You must attach a certified copy of the death certificate of the deceased joint tenant to the affidavit.

- Ensure all information is accurate and complete, including the legal description of the property. Mistakes can delay the process or invalidate the document.

- The surviving joint tenant(s) must sign the affidavit in front of a notary public to validate their identity and signature.

- The document requires recording with the county recorder's office, often involving a small fee.

- Once the affidavit is filed, the property title is officially updated to reflect the surviving joint tenant(s) as the sole owner(s).

- This process is specific to properties held in joint tenancy, which includes the right of survivorship, and does not apply to tenants in common or other forms of property ownership.

- Consult with a legal professional if you have questions or if the ownership situation is complicated. They can provide guidance tailored to your specific circumstance.

- Keep a copy of the recorded affidavit and any related documents for your records and future reference.

Taking these steps can simplify the ownership transfer process, providing peace of mind during what can be a difficult time. It's always best to be prepared and knowledgeable about the necessary legal proceedings involved in transferring property ownership after the loss of a loved one.

Discover More PDFs

California Participating Practitioner Application - Allows for the indication of treatment requests previously denied, focusing on new evidence or changes in the patient’s condition.

How to Change Business Address in California - Reflects the importance of precision in tax-related matters, facilitating state correspondence.