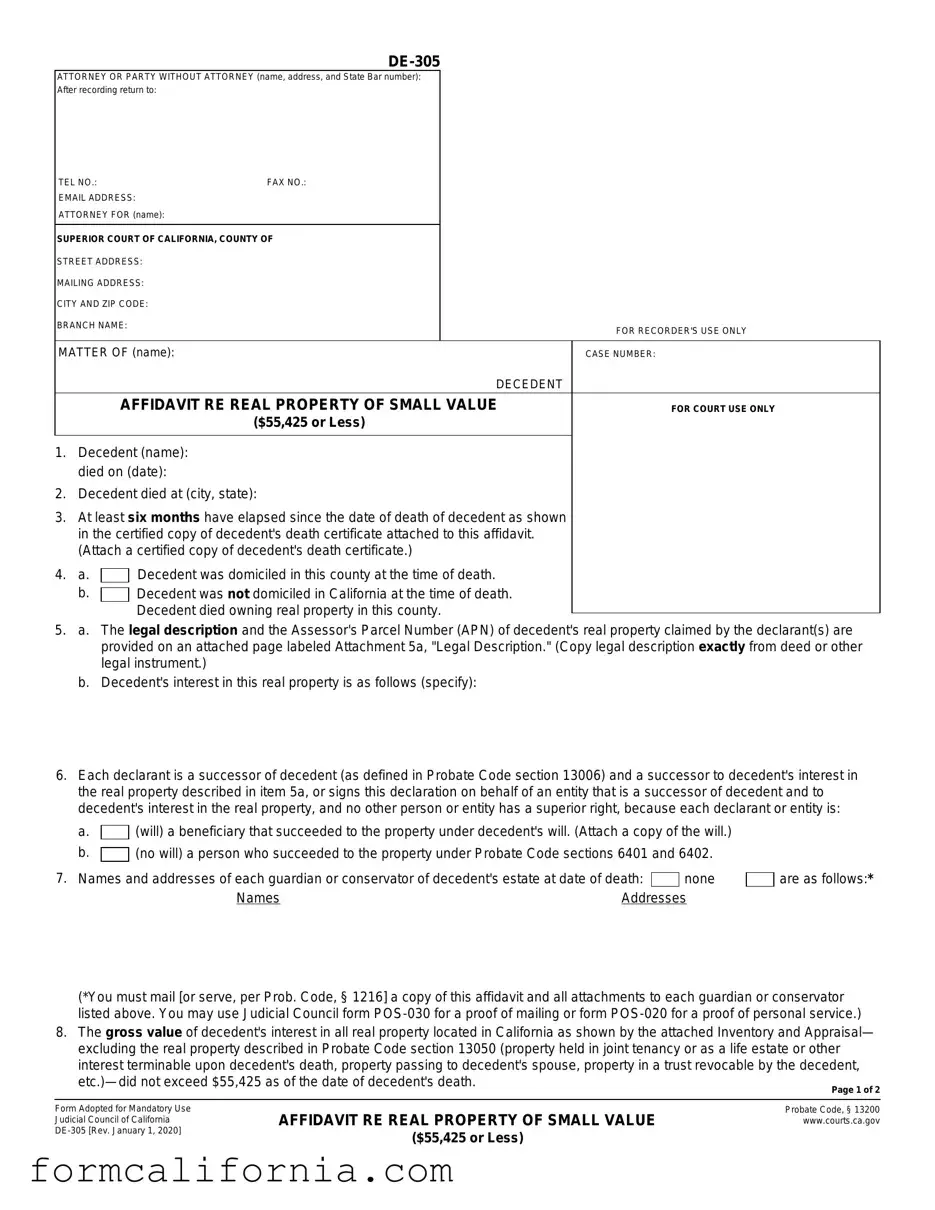

Blank California De 305 PDF Form

In the nuanced arena of probate law, the California DE-305 form emerges as a concise yet pivotal document for those navigating the complexities of transferring real property upon the death of a property owner. With its roots firmly planted in the specifications laid out by the Probate Code, specifically section 13200, this legal instrument paves the way for a streamlined procedure to claim real property of small value, defined as $55,425 or less. The form necessitates an affidavit from the declarant, who, through detailed sections, establishes their connection to the deceased (the decedent) and asserts the value and details of the property in question. Key aspects include proof of the decedent's death, domicile status at the time of death, the legal description and value of the property, along with the successor's entitlement to the property, underscoring the absence of superior claims. Additionally, the affidavit mandates affirmations regarding the absence of ongoing probate proceedings and the settlement of the decedent’s debts. Crucially, the role of a probate referee in appraising the property, aligned with the requirement of notary acknowledgment, accentuates the form’s legal rigor. By its design, the DE-305 form embodies a delicate balance between procedural formality and the practical ease for small estate affairs, illuminating the pathway for successors to affirm their claims on real property amidst the broader landscape of probate resolutions.

Document Preview Example

ATTORNEY OR PARTY WITHOUT ATTORNEY (name, address, and State Bar number):

After recording return to:

TEL NO.: |

FAX NO.: |

|

|

EMAIL ADDRESS: |

|

|

|

ATTORNEY FOR (name): |

|

|

|

|

|

|

|

SUPERIOR COURT OF CALIFORNIA, COUNTY OF |

|

||

STREET ADDRESS: |

|

|

|

MAILING ADDRESS: |

|

|

|

CITY AND ZIP CODE: |

|

|

|

BRANCH NAME: |

|

|

FOR RECORDER'S USE ONLY |

|

|

|

|

|

|

|

|

MATTER OF (name): |

|

|

CASE NUMBER: |

|

|

DECEDENT |

|

AFFIDAVIT RE REAL PROPERTY OF SMALL VALUE |

FOR COURT USE ONLY |

||

|

($55,425 or Less) |

|

|

1.Decedent (name): died on (date):

2.Decedent died at (city, state):

3.At least six months have elapsed since the date of death of decedent as shown in the certified copy of decedent's death certificate attached to this affidavit. (Attach a certified copy of decedent's death certificate.)

4.a.

Decedent was domiciled in this county at the time of death.

Decedent was domiciled in this county at the time of death.

b. Decedent was not domiciled in California at the time of death. Decedent died owning real property in this county.

Decedent was not domiciled in California at the time of death. Decedent died owning real property in this county.

5.a. The legal description and the Assessor's Parcel Number (APN) of decedent's real property claimed by the declarant(s) are provided on an attached page labeled Attachment 5a, "Legal Description." (Copy legal description exactly from deed or other legal instrument.)

b.Decedent's interest in this real property is as follows (specify):

6.Each declarant is a successor of decedent (as defined in Probate Code section 13006) and a successor to decedent's interest in the real property described in item 5a, or signs this declaration on behalf of an entity that is a successor of decedent and to decedent's interest in the real property, and no other person or entity has a superior right, because each declarant or entity is:

a. (will) a beneficiary that succeeded to the property under decedent's will. (Attach a copy of the will.)

(will) a beneficiary that succeeded to the property under decedent's will. (Attach a copy of the will.)

b. (no will) a person who succeeded to the property under Probate Code sections 6401 and 6402.

(no will) a person who succeeded to the property under Probate Code sections 6401 and 6402.

7. Names and addresses of each guardian or conservator of decedent's estate at date of death: |

|

none |

|

are as follows:* |

|

|

|

||||

Names |

Addresses |

|

|

||

(*You must mail [or serve, per Prob. Code, § 1216] a copy of this affidavit and all attachments to each guardian or conservator listed above. You may use Judicial Council form

8.The gross value of decedent's interest in all real property located in California as shown by the attached Inventory and Appraisal— excluding the real property described in Probate Code section 13050 (property held in joint tenancy or as a life estate or other interest terminable upon decedent's death, property passing to decedent's spouse, property in a trust revocable by the decedent,

Form Adopted for Mandatory Use Judicial Council of California

AFFIDAVIT RE REAL PROPERTY OF SMALL VALUE

($55,425 or Less)

MATTER OF (Name):

DECEDENT

CASE NUMBER:

9.An Inventory and Appraisal of all of decedent's interests in real property in California is attached. The appraisal was made by a probate referee appointed for the county in which the property is located. (You must prepare the Inventory on Judicial Council forms

10.No proceeding is now being or has been conducted in California for administration of decedent's estate.

11.Funeral expenses, expenses of last illness, and all known unsecured debts of the decedent have been paid. (NOTE: You may be personally liable for decedent's unsecured debts up to the fair market value of the real property and any income you receive from it.)

I declare under penalty of perjury under the laws of the State of California that the foregoing is true and correct. Date:

(TYPE OR PRINT NAME)* |

|

|

|

|

(SIGNATURE OF DECLARANT) |

Date: |

|

|

|

||

|

|

|

|

|

|

(TYPE OR PRINT NAME)* |

|

|

(SIGNATURE OF DECLARANT) |

||

|

|

|

|

|

SIGNATURE OF ADDITIONAL DECLARANTS ATTACHED |

*A declarant claiming on behalf of a trust or other entity should also state the name of the entity that is a beneficiary under the decedent's will, and declarant's capacity to sign on behalf of the entity (e.g., trustee, Chief Executive Officer, etc.).

NOTARY ACKNOWLEDGMENT |

(NOTE: No notary acknowledgment may be affixed as a rider (small strip) to this page. If addi- |

|

tional notary acknowledgments are required, they must be attached as |

||

|

||

|

|

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not the truthfulness, accuracy, or validity of that document.

STATE OF CALIFORNIA, COUNTY OF (specify):

On (date): |

, before me (name and title): |

personally appeared (name(s)): |

|

who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the instrument in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the |

|

(NOTARY SEAL) |

||

State of California that the foregoing paragraph is true and correct. |

|

|

||

WITNESS my hand and official seal. |

|

|

||

|

|

|

|

|

(SIGNATURE OF NOTARY PUBLIC) |

|

|

||

|

|

|

|

|

(SEAL) |

|

|

||

|

|

|

|

CLERK'S CERTIFICATE |

I certify that the foregoing, including any attached notary acknowledgments and any attached legal description of the property (but excluding other attachments), is a true and correct copy of the original affidavit on file in my office. (Certified copies of this affidavit do not include the

(1) death certificate, (2) will, or (3) inventory and appraisal. See Probate Code section 13202.)

Date: |

Clerk, by |

, Deputy |

|

AFFIDAVIT RE REAL PROPERTY OF SMALL VALUE

($55,425 or Less)

Page 2 of 2

For your protection and privacy, please press the Clear This Form button after you have printed the form.

Print this form

Save this form

Clear this form

Document Specs

| Fact | Detail |

|---|---|

| Form Name | DE-305 Affidavit re Real Property of Small Value ($55,425 or Less) |

| Governing Law | California Probate Code, § 13200 |

| Purpose | To transfer real property of a deceased person valued at $55,425 or less without a full probate process. |

| Eligibility | Declarant must be a successor of the decedent or acting on behalf of an entity that is a successor, and no other person or entity has a superior right. |

| Requirements | A certified copy of the decedent’s death certificate, legal description of the property, and, if applicable, a copy of the will or Inventory and Appraisal forms (DE-160, DE-161) must be attached. |

| Value Limitation | The gross value of decedent's interest in California real property must not exceed $55,425 as of the date of the decedent’s death. |

| Filing Location | Superior Court of California, in the county where the real property is located. |

Detailed Instructions for Writing California De 305

Filling out legal forms can sometimes seem daunting, especially when it pertains to matters of estate and property following a loved one's passing. The California DE-305 form serves as an affidavit for transferring real property of small value ($55,425 or less) without going through a formal probate process. This process involves a simpler procedure aimed at helping successors legally claim their inheritance with fewer hurdles. Here’s how to correctly fill out the form, step by step, ensuring that all the details are properly recorded and submitted.

- Start by including the attorney or party’s information at the top of the form, including the name, address, telephone number, fax number (if applicable), and email address. If the form is being filled out on behalf of an attorney, include their California State Bar number and the name of the person they represent.

- Provide the details on where to return the form after recording, ensuring that all sections are accurately filled with the appropriate contact information.

- In the section marked "SUPERIOR COURT OF CALIFORNIA, COUNTY OF," fill in the requested information related to the court’s address, mailing address (if different), city, zip code, and branch name.

- Enter the decedent’s (the deceased person’s) full name and case number if applicable. If you do not have a case number, consult the local county court for guidance.

- Complete items 1 through 4 with the decedent's details, including their name, date of death, the city and state where they died, and whether they were domiciled in the county at the time of death or owned property in the county despite not being domiciled in California.

- Attach a page labeled "Attachment 5a," which provides the legal description and Assessor's Parcel Number (APN) of the property, and specify the decedent’s interest in the property within sections 5a and 5b.

- Declare your relationship to the decedent and your successor status in item 6, specifying whether you are a beneficiary under the decedent's will or a successor according to the Probate Code sections 6401 and 6402.

- If applicable, list the names and addresses of any guardians or conservators of the decedent at the time of death in item 7, remembering to mail or serve a copy of this affidavit and all attachments as directed.

- Detail the gross value of the decedent’s interest in California real property in item 8, ensuring it does not exceed $55,425.

- Complete item 9 by confirming that an Inventory and Appraisal of the decedent’s real property interests is attached, noting the appraisal was completed by a probate referee appointed for the county where the property is located.

- Indicate in item 10 that no other proceeding for the administration of the decedent’s estate is being or has been conducted in California.

- Confirm in item 11 that the funeral expenses, expenses of the last illness, and all known unsecured debts of the decedent have been paid.

- Finally, sign and date the form at the bottom, printing your name clearly underneath your signature. Note that if additional declarants are involved, their signatures must be included as well.

- The notary acknowledgment section is to be completed by a notary public upon witnessing your signature(s).

- Remember to keep a copy of this form for your records and consult an attorney if you encounter any difficulties or have specific questions regarding your situation.

This diligently completed form will then be submitted according to the county's specific requirements, which may vary. In some counties, the form can be mailed, while in others, it may need to be filed in person. After submission, the form will undergo a recording process, and the real property of small value will be legally transferred to the rightful successor(s), marking an important step in the management and settlement of the decedent’s estate.

Things to Know About This Form

What is the California DE-305 form?

The California DE-305 form, also known as the "Affidavit re Real Property of Small Value ($55,425 or Less)," is a legal document used when the total gross value of a decedent’s real property in California is $55,425 or less, as of the date of the person's death. This form allows successors to claim the decedent's real property without formally administering the estate through probate court. It's a simpler and less costly process for transferring ownership of real estate under the specified value threshold.

Who can file a DE-305 form?

To file a DE-305 form, individuals must be successors of the decedent, defined under Probate Code section 13006. Successors might include beneficiaries named in a will, relatives entitled to inherit under state law if there's no will, or entities such as trusts that are named beneficiaries. The person filing must ensure no other party has a superior right to the decedent's interest in the specified real property.

What documents are required along with the DE-305 form?

- A certified copy of the decedent’s death certificate.

- If applicable, a copy of the decedent’s will.

- An Inventory and Appraisal form (DE-160 and DE-161) detailing the value of the real property, completed by a probate referee.

- Attachment 5a, providing the legal description and the Assessor's Parcel Number (APN) for the property.

How is the value of the real property determined?

The value of the real property is determined by a probate referee appointed for the county where the property is located. The appointed probate referee will complete the required Inventory and Appraisal forms (DE-160 and DE-161), providing an official valuation of the decedent’s interest in the California real property, excluding certain assets outlined in Probate Code section 13050.

What are the responsibilities of someone who files a DE-305 form?

Filers are responsible for ensuring that all funeral expenses, expenses of the decedent's last illness, and known unsecured debts of the decedent have been paid. They are also required to mail (or serve, per Probate Code, § 1216) a copy of the affidavit and all attachments to each guardian or conservator of the decedent's estate listed in the document. Importantly, filers might bear personal liability for the decedent's unsecured debts up to the fair market value of the real property and any income received from it.

Is notarization required for the DE-305 form?

Yes, once the DE-305 form has been completed and signed by the declarant(s), it must be notarized. The form includes a section for Notary Acknowledgment where a notary public or other officer will verify the identity of the individual(s) signing the document. This step is crucial as it confirms the authenticity of the signatures and the authority of those claiming the decedent's property. Additional notary acknowledgments must be attached as full-sized (8-1/2-by-11-inch) pages, not as riders.

Common mistakes

When filling out the California DE-305 form, a document designed for transferring real property of small value ($55,425 or less) without formal probate proceedings, individuals commonly make several errors. These mistakes can lead to delays, rejection of the application, or other legal complications. Recognizing and avoiding these pitfalls is essential for a smooth process.

- Not attaching a certified copy of the decedent's death certificate: This is a critical requirement that validates the death and initiates the transfer process.

- Incorrectly stating the date of death: Accuracy here is crucial for timelines, especially since at least six months must have elapsed since the date of death before filing this affidavit.

- Failing to accurately describe the decedent's domicile: Whether the decedent was domiciled in California or elsewhere affects the process significantly.

- Providing an incomplete or incorrect legal description of the property: The legal description must match exactly what is on the deed or other legal documents, failure to do so can invalidate the affidavit.

- Omission of Assessor's Parcel Number (APN) or providing an incorrect number: The APN is essential for identifying the property in public records.

- Not clearly defining the decedent’s interest in the property: The affidavit requires specific details on how the property was owned. Ambiguity or errors can cause problems.

- Inaccurate calculation of the property's value: The value must not exceed $55,425, and errors in valuation can disqualify the property from this simplified process.

- Not listing all successors or providing incomplete information about them: Every successor, whether through a will or per state laws, must be mentioned. Missing information can lead to delays.

- Forgetting to provide or incorrectly preparing the inventory and appraisal: An official appraisal must be attached, and failing to use the right forms or not choosing an appropriate probate referee can invalidate the document.

Beyond these common mistakes, there are procedural errors to avoid:

- Not mailing or serving copies of the affidavit to the required parties, such as listed guardians or conservators.

- Failure to attach additional necessary documents, like the will, if the decedent had one.

- Not obtaining or improperly completing the notary acknowledgment, a crucial step for legal validation.

- Incorrectly claiming on behalf of a trust or entity without properly indicating the capacity in which one is acting.

To ensure the DE-305 form is completed accurately, it may be advisable to consult with a legal professional specializing in estate matters. This can help avoid common pitfalls and ensure the process adheres to California legal standards.

Documents used along the form

When handling the estate of a deceased person in California, specifically regarding the management or transfer of real property valued at $55,425 or less, several forms and documents often work hand in hand with the California DE-305 form. Understanding these additional documents can streamline the process, ensuring compliance with legal requirements and smoother execution of the decedent's will or estate plan.

- Death Certificate: A certified copy of the decedent's death certificate is required for verification purposes and must be attached to the DE-305 form. This document confirms the death, providing essential details like the date and location.

- Will (if applicable): A copy of the decedent's will may need to be attached if the property is being transferred according to the decedent's expressed wishes. This document outlines the intended distribution of the decedent's assets.

- Inventory and Appraisal (DE-160 and DE-161): These forms list and provide the value of the decedent's property, including real estate, as appraised by a probate referee. Accurate appraisal is crucial for tax purposes and equitable distribution of assets.

- Probate Referee's List: Though not a form, accessing a current list of probate referees authorized in the county where the property is located is essential for selecting an appropriate referee to conduct the appraisal.

- Notice of Proposed Action (DE-165): If the executor or administrator plans to sell the property or take any action that might affect the estate's value, this form notifies interested parties, allowing them to object if necessary.

- POS-030 or POS-020 (Service or Mailing Proof): These forms serve as proof that documents related to the estate, such as the DE-305 form, have been properly served or mailed to relevant parties, like guardians or conservators if applicable.

- Change of Ownership Statement (Death of Real Property Owner): This county-specific document is filed with the local assessor's office to report a change in property ownership due to death, ensuring property taxes are accurately assessed.

- Claim for Reassessment Exclusion for Transfer Between Parent and Child (BOE-58-AH): To prevent property tax reassessment upon the transfer of property between parents and children, this document may need to be filed, depending on the situation.

Each of these documents plays a critical role in the seamless execution of the DE-305 form and the overall handling of a decedent's small-value real property in California. Whether fulfilling legal obligations, informing relevant parties, or ensuring the correct appraisal and transfer of property, these forms and documents together create a comprehensive framework for managing the estate according to the law and the wishes of the deceased.

Similar forms

The California DE-305 Affidavit re Real Property of Small Value shares similarities with the Affidavit for Collection of Personal Property, also known under California Probate Code Section 13100. Both documents allow successors to claim property without a formal probate process, but the DE-305 specifically addresses real property with a value below a certain threshold, whereas the Affidavit for Collection of Personal Property pertains to personal property. Both require the declarant to affirm their succession rights and that no other superior claims exist, streamlining the inheritance process for smaller estates.

Another document resembling the DE-305 form is the Small Estate Affidavit used in other jurisdictions for transferring assets without probate. Similar to California's DE-305, these affidavits serve to expedite the asset transfer process for estates below a specific value. However, the value threshold and the types of assets that can be transferred vary by state. The key likeness lies in the purpose: both aim to simplify the legal procedures necessary for transferring assets of smaller estates.

The Petition to Determine Succession to Real Property is akin to the DE-305 form in its function within estate management, particularly under California Probate Code sections 13150 to 13158. While the DE-305 affidavit facilitates the transfer of real property from decedents with estates valued below $55,425, the Petition for Succession involves a court process for property valued above this amount but below a higher threshold, requiring judicial confirmation of the transfer.

Transfer on Death Deeds (TODDs), authorized in many states including California, also share objectives with the DE-305 form, though they operate differently. TODDs allow property owners to designate beneficiaries for their real estate, effective upon the owner’s death, bypassing probate. Both methods aim to simplify the transfer of property upon death, but while the DE-305 is used posthumously and for small-value estates, TODDs are prepared in advance by the property owner.

The DE-305 form is similar to the Spousal (or Domestic Partner) Property Petition in that both are used to expedite the property transfer process upon a decedent's death, within California’s legal framework. The Spousal Property Petition specifically facilitates the transfer of property to a surviving spouse or domestic partner, possibly including both community and separate property. The primary similarity is the bypassing of traditional, lengthy probate proceedings.

A life estate deed, which allows a property owner to transfer their property while retaining the right to occupy it for life, shares a conceptual resemblance to the motives behind the DE-305 form. Both approaches involve planning for the eventual transfer of real property upon death without the need for probate. However, a life estate deed is proactive, while the DE-305 is reactive, applying after the property owner’s death.

The Trust Certification is another document related to the DE-305, as both involve estate planning and asset transfer without court intervention. A Trust Certification certifies the trustees' authority to act on behalf of the trust, facilitating asset transfers into or out of the trust without revealing the full trust document. Though differing in application, both forms streamline the process of transferring assets, reducing the need for formal probate.

The Joint Tenancy Grant Deed, used to create joint tenancy ownership with the right of survivorship, offers a parallel to the DE-305's purpose. Upon one owner’s death, the property immediately transfers to the surviving owner(s) without probate. While the DE-305 allows for the transfer of real property after death in small estates, a joint tenancy deed prevents the need for such a document by automatically transferring ownership.

Last, the General Assignment of Assets is akin to the DE-305 as it pertains to the transfer of asset ownership. While the General Assignment may be used within living trusts to transfer personal property into a trust, the DE-305 specifically relates to the posthumous transfer of real property under a defined value without probate. Both documents facilitate smoother transitions of ownership but differ in their specific uses and the types of assets they address.

Dos and Don'ts

When filling out the California DE-305 form, which is used to transfer real property of small value without formal probate proceedings, attention to detail and adherence to requirements are crucial. Here are some key dos and don'ts to consider:

- Do ensure that all the information you provide is accurate. Mistakes could delay the process or invalidate the filing.

- Do attach a certified copy of the decedent's death certificate as required in item 3.

- Do provide a clear legal description and the Assessor's Parcel Number (APN) of the property, as detailed under item 5a.

- Do check the appropriate box in item 4 to indicate whether the decedent was domiciled in the county at the time of death or not and if the decedent owned real property in the county.

- Do not forget to mail or serve a copy of this affidavit and all attachments to each guardian or conservator named, as required under item 7.

- Do not overlook the requirement to attach an Inventory and Appraisal of the decedent’s interest in real property located in California, as mentioned in item 9. This inventory must be prepared using Judicial Council forms DE-160 and DE-161 and appraised by a probate referee.

- Do include any required attachments, such as a copy of the will if the property is being succeeded under it, as indicated in item 6.

- Do not proceed with this form if the gross value of the decedent’s interest exceeds $55,425 as of the date of the decedent's death, or if there are ongoing proceedings for the administration of the decedent's estate in California, as stated in item 10.

Adhering to these guidelines can facilitate a smoother process in handling the real property of small value of a decedent without necessitating a court proceeding. Always double-check your entries for accuracy and completeness to avoid potential complications.

Misconceptions

There are several misconceptions about the California DE-305 form, which is used for transferring real property of small value ($55,425 or less) without going through a full probate process. Understanding these misconceptions can clarify the requirements and process involved.

- Misconception 1: This form can transfer any type of property. The DE-305 form is specifically designed for the transfer of real property of small value in California. It cannot be used for transferring personal property, vehicles, or any other type of asset not classified as real property within the specified value limit.

- Misconception 2: The form is valid immediately upon completion. There is a common misunderstanding that filling out and signing the DE-305 form instantly transfers ownership. However, this form must be filed with the court, and a certified copy of the decedent's death certificate must be attached. The process involves court verification before the transfer of ownership is official.

- Misconception 3: There is no need to notify other parties. Contrary to this belief, the DE-305 form requires the filer to mail or serve a copy of the affidavit and all attachments to each guardian or conservator of the decedent’s estate at the date of death, if any exist. This notification is an essential step in the process to ensure the legality of the transfer.

- Misconception 4: The form serves as a public record automatically. Another misconception is that once filed, the DE-305 form becomes a public record by default. While it is filed with the court, specific steps must be taken to record the document with the county recorder where the property is located. This action is necessary for the transfer to be recognized as valid against third parties.

- Misconception 5: Any value of real property can be transferred using this form. The DE-305 form has a strict value limit; it only applies to real property with a gross value of $55,425 or less as of the date of the decedent's death. This threshold is specific and excludes real property that exceeds this value, inaccurately leading some to believe they can transfer higher-valued estates with this document.

- Misconception 6: The process does not require an appraisal. There is a misconception that real property can be transferred without formal appraisal. However, an Inventory and Appraisal attachment is a critical part of the filing process. The appraisal must be conducted by a probate referee appointed for the county where the property is located, ensuring that the value of the real property is accurately stated and does not exceed the allowable limit.

Clarifying these misconceptions about the DE-305 form can help individuals navigate the process of transferring real property of small value more effectively. It's crucial to understand the form's specific requirements and legal implications to ensure compliance and the successful transfer of property.

Key takeaways

Understanding the California DE-305 Form, an affidavit regarding real property of small value ($55,425 or less), is critical for efficiently transferring property when an estate falls beneath a certain financial threshold. Here are nine key takeaways to help guide you through this process:

- Eligibility Criteria: The DE-305 form is applicable only if the decedent's real property's gross value located in California does not exceed $55,425, based on the date of the decedent's death.

- Documentation Requirement: A certified copy of the decedent's death certificate must be attached to the affidavit to validate the time of death, ensuring that at least six months have passed since that date.

- Residency Consideration: It's necessary to indicate whether the decedent was a California resident or domiciled outside the state at their time of death, as this affects the affidavit's processing.

- Property Description: Exact legal descriptions of the property and the Assessor's Parcel Number (APN) should be included in an attachment, as accuracy here is crucial for property identification.

- Successor's Claim: The claimant must affirm their status as a successor to the decedent's real property, either through a will or, in the absence of one, as per California's Probate Code sections 6401 and 6402.

- Notification of Parties: If the decedent had a guardian or conservator, the form, along with all attachments, needs to be served to them, fulfilling legal notification requirements.

- Inventory and Appraisal Attachments: An Inventory and Appraisal of the decedent's real property interests, performed by a probate referee, must be attached, explicitly excluding certain transfers like joint tenancies or property transferred to a spouse.

- No Active Administration: The affidavit asserts that no other proceedings for the administration of the decedent's estate are being or have been conducted in California.

- Financial Responsibilities: By completing the form, declarants acknowledge that funeral expenses, last illness expenses, and all known unsecured debts of the decedent have been paid; a declarant might be liable for any unpaid debts to the extent of the property's value received.

Proper completion and understanding of the DE-305 form facilitate the smooth legal transfer of real property for estates meeting specific criteria, ensuring compliance with California law. Always consider consulting a legal professional to navigate the process accurately and effectively.

Discover More PDFs

Tax Draft - Assists California corporations in complying with the deferred gain recognition rules under R&TC Section 24465 for transferred assets.

Ca Form 100 Instructions - Guidance on like-kind exchanges under California law ensures corporations are informed about tax implications of property transactions.

California Participating Practitioner Application - Features an expedited review option for urgent medical situations posing serious health threats to employees.