Blank California Audit PDF Form

The California Audit Complaint Form plays a pivotal role within the framework of the state's workers' compensation system, ensuring that the process remains fair and transparent for all parties involved. It offers an avenue for raising concerns regarding the handling of workers' compensation claims, specifically targeting issues such as late payments of temporary or permanent disability, failures in payment, investigation inadequacies, or any unsupported denial of liability for claims, among others. Designed to monitor claims administrators closely, the form aids the Department of Industrial Relations, Division of Workers’ Compensation (DWC), in enforcing the law and conducting essential research to improve the system overall. Importantly, it acknowledges the privacy concerns of complainants, providing an option to keep submissions confidential unless the individual decides otherwise. This confidentiality clause emphasizes the respect for individual privacy while balancing the need for transparency in the administration of justice. As such, the form not only serves as a critical tool for compliance and oversight but also champions the rights and well-being of injured workers by ensuring their complaints are heard, validated, and addressed appropriately. Through its detailed nature, requiring specific descriptions of complaints and supporting documentation, the form ensures that issues are not just noted but thoroughly investigated, fostering a more accountable and responsive workers' compensation system.

Document Preview Example

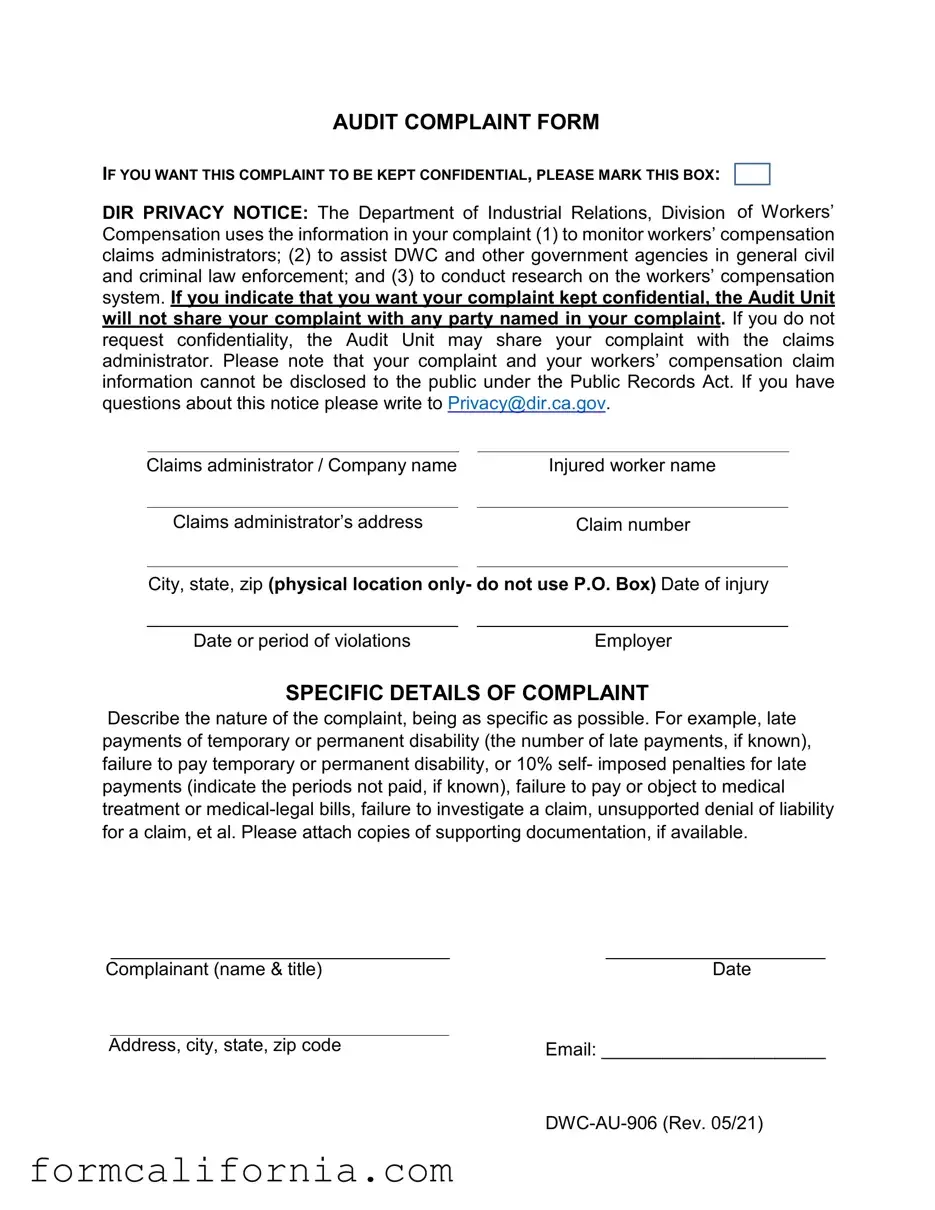

AUDIT COMPLAINT FORM

IF YOU WANT THIS COMPLAINT TO BE KEPT CONFIDENTIAL, PLEASE MARK THIS BOX:

DIR PRIVACY NOTICE: The Department of Industrial Relations, Division of Workers’ Compensation uses the information in your complaint (1) to monitor workers’ compensation claims administrators; (2) to assist DWC and other government agencies in general civil and criminal law enforcement; and (3) to conduct research on the workers’ compensation system. If you indicate that you want your complaint kept confidential, the Audit Unit will not share your complaint with any party named in your complaint. If you do not request confidentiality, the Audit Unit may share your complaint with the claims administrator. Please note that your complaint and your workers’ compensation claim information cannot be disclosed to the public under the Public Records Act. If you have questions about this notice please write to Privacy@dir.ca.gov.

Claims administrator / Company name

Claims administrator’s address

Injured worker name

Claim number

City, state, zip (physical location only- do not use P.O. Box) Date of injury

Date or period of violations |

Employer |

SPECIFIC DETAILS OF COMPLAINT

Describe the nature of the complaint, being as specific as possible. For example, late payments of temporary or permanent disability (the number of late payments, if known), failure to pay temporary or permanent disability, or 10% self- imposed penalties for late payments (indicate the periods not paid, if known), failure to pay or object to medical treatment or

Complainant (name & title) |

Date |

Address, city, state, zip code |

Email: ______________________ |

|

Document Specs

| Fact | Detail |

|---|---|

| 1. Form Purpose | This form is used to file complaints regarding workers' compensation claims administrators. |

| 2. Confidentiality Option | Complainants can request that their complaint remain confidential by marking a specific box. |

| 3. Use of Information | The Department of Industrial Relations uses the complaint information for monitoring, law enforcement assistance, and research. |

| 4. Disclosure Policy | If confidentiality is not requested, the Audit Unit may share the complaint with the claims administrator. |

| 5. Public Records Act | Complaint and workers’ compensation claim information cannot be disclosed to the public under the Public Records Act. |

| 6. Contact Information for Privacy Inquiries | Questions about the privacy notice can be directed to Privacy@dir.ca.gov. |

| 7. Required Information for Filing a Complaint | Complaint form must include information on the claims administrator, injured worker, date of injury, period of violations, employer, and specific details of the complaint. |

| 8. Nature of Complaints | The form solicits specific details on the nature of the complaint, such as late payments, failure to pay, and failure to investigate claims. |

| 9. Documentation | Complainants are encouraged to attach copies of supporting documentation with their complaint. |

| 10. Governing Law | The form is governed by the Division of Workers’ Compensation (DWC) policies and the Public Records Act. |

Detailed Instructions for Writing California Audit

Filling out the California Audit Complaint Form is an essential step for those who want to highlight concerns or report specific problems with a workers' compensation claims administrator. It's important to provide detailed information and relevant documentation to support your complaint. This process not only helps in addressing individual grievances but also aids in the improvement of the workers' compensation system overall. Below is a step-by-step guide on how to complete this form accurately.

- Start by deciding if you want your complaint to remain confidential. If so, make sure to mark the appropriate box at the beginning of the form to indicate this preference.

- Fill in the claims administrator or company name. This is the entity that is handling the workers' compensation claim and is the subject of your complaint.

- Enter the claims administrator’s address. Ensure that you use the physical location address and avoid using a P.O. Box.

- Provide the injured worker's name. This is the individual who was injured and whose claim is being administered by the company you're filing the complaint against.

- Fill in the claim number. This should be the unique identifier for the workers' compensation claim in question.

- Specify the city, state, and zip code related to the claims administrator’s address.

- Indicate the date of injury. This is the date when the injury that led to the workers' compensation claim occurred.

- Enter the date or period of violations. Specify when the actions, or lack thereof, that you're complaining about took place.

- Provide the name of the employer. This is the company or entity where the injured worker was employed at the time of the injury.

- Describe the specific details of your complaint in the designated section. Be as specific as possible, mentioning instances such as late payments, failure to pay disability benefits, or any unsupported denial of liability. The more detailed you are, the better the Audit Unit will understand the issue.

- If you have any supporting documentation, attach copies to the form. Supporting evidence could include correspondence, payment notices, or any other documents that substantiate your complaint.

- Provide your name and title in the "Complainant" section. This identifies you as the person filing the complaint.

- Fill in your address, city, state, and zip code. This information is necessary for any potential follow-up correspondence.

- Enter your email address in the appropriate field. This offers an additional way for the Audit Unit to contact you if needed.

- Finally, review the form thoroughly to ensure all information is accurate and complete. Once satisfied, submit the form to the address provided by the Division of Workers’ Compensation.

After you submit your completed Audit Complaint Form, the Audit Unit will review the information provided. They may follow up with you for additional details if necessary. Your input is valuable in monitoring and improving the administration of workers’ compensation claims, ensuring fairness and compliance with the law.

Things to Know About This Form

-

What is the purpose of the California Audit Complaint Form?

This form serves a trio of critical purposes within the realm of workers’ compensation in California. Primarily, it enables the Department of Industrial Relations, Division of Workers’ Compensation, to monitor the actions of claims administrators closely. Additionally, it provides crucial assistance to both the DWC and other government agencies in enforcing civil and criminal laws. Lastly, it facilitates research efforts aimed at enhancing the workers' compensation system.

-

Can I keep my complaint confidential?

Absolutely. If confidentiality is a concern, the form contains a specific provision that allows individuals to request that their complaint remains private. By checking the designated box, the Audit Unit is bound to refrain from sharing your complaint with any of the parties named within it. Confidentiality is taken seriously, ensuring that individuals can file complaints without fear of unwanted exposure.

-

If I don't request confidentiality, who can my complaint be shared with?

Should you opt not to request confidentiality, the Audit Unit reserves the right to share your complaint with the claims administrator involved. This sharing of information is part of the process aimed at resolving disputes and ensuring accountability. However, it's important to note that despite this, your complaint and any associated workers' compensation claim information remain protected from public disclosure under the Public Records Act.

-

How is the information in my complaint used?

Your complaint plays a vital role in several areas:

- Monitoring the activities of workers' compensation claims administrators.

- Assisting the Department of Industrial Relations and other governmental bodies in enforcing the law more effectively, whether it be through civil or criminal actions.

- Supporting research endeavors designed to improve the workers' compensation system.

-

What kind of details should I include in my complaint?

In your complaint, clarity and specificity are your allies. The form prompts you to describe the nature of your grievance in detail. This might include, but is not limited to, instances of late payments (whether temporary or permanent disability payments), outright failure to make such payments, including the specific periods affected if known. Additionally, any failure to pay or challenge medical treatments or medical-legal bills, lack of prompt investigation into a claim, or unjust denial of a claim. Attaching supporting documentation can further strengthen your case, providing concrete evidence to back your claims.

-

If I have questions about the privacy notice, what should I do?

The form encourages individuals with concerns or questions about the privacy policy to seek clarification. You can direct your inquiries to a dedicated email address, Privacy@dir.ca.gov, where you can expect to receive guidance or further information regarding how your data and privacy are handled.

-

What information about the claims administrator do I need to provide?

You are required to furnish detailed information about the claims administrator or company in question. This includes the name of the claims administrator or company, their full physical address (note that P.O. Boxes are not acceptable), and any additional pertinent information that could help in the review and processing of your complaint.

-

Who can file a complaint using this form?

The form is designed for injured workers who have concerns or grievances regarding the handling of their workers’ compensation claims. It is a means for these individuals to report issues such as delays in payments or denial of claims to the Department of Industrial Relations, ensuring that their rights are upheld and that any malpractices are addressed.

-

What information about the injured worker should be included?

When filling out the form, it's important to provide comprehensive information about the injured worker. This includes the worker's name, the claim number associated with their workers’ compensation claim, their employer's name, the date and location of the injury, as well as any specific dates or periods during which violations occurred. Such detailed information is crucial for a thorough investigation of the complaint.

-

What happens after I submit the form?

After submission, your complaint is reviewed by the Audit Unit of the Division of Workers’ Compensation. If confidentiality was requested, it will be honored throughout the process. The Audit Unit then uses the information provided to either monitor the claims administrator’s practices, assist in law enforcement activities, or conduct system-wide research. While the specifics of the follow-up process may depend on the nature of the complaint and whether confidentiality was requested, the goal is always to ensure compliance and address any grievances.

Common mistakes

When filling out the California Audit form, it’s critical to provide clear and accurate information to ensure the complaint is processed efficiently and effectively. However, individuals often encounter common mistakes that can complicate or delay the audit process. Here are nine mistakes to avoid:

- Failing to check the confidentiality request box when confidentiality is desired. Without indicating this preference, the Audit Unit may share the complaint with the claims administrator, potentially leading to unwanted disclosure.

- Providing incomplete or incorrect information about the claims administrator or company, such as an incomplete address or incorrect company name. This can cause delays in processing the complaint.

- Using a P.O. Box for the address of the physical location instead of the required physical address, which is crucial for the identification and processing of the complaint.

- Not being specific enough in the descriptions of the complaint. Vague complaints without detailed examples or specific periods of violations can hinder the effectiveness of the audit.

- Omitting the claim number, which is essential for identifying and investigating the complaint.

- Forgetting to include the date or period of violations. Specifically, dates help to clarify and frame the investigation within a specific timeframe.

- Neglecting to attach copies of supporting documentation when available. Supporting documents substantiate the complaint and provide concrete evidence of the issues raised.

- Misidentifying the nature of the complaint, such as confusing temporary and permanent disability payments or inaccurately describing the violations.

- Leaving personal contact information, such as email and address, incomplete or inaccurate, which can significantly delay follow-up or feedback regarding the complaint.

Avoiding these common mistakes can significantly enhance the clarity and effectiveness of your submission, assisting the Department of Industrial Relations in swiftly addressing your concerns. Always double-check your information, provide as much detail and supporting evidence as possible, and ensure your contact information is correct, so any necessary follow-up can be conducted without delay.

Documents used along the form

When dealing with the complexities of the workers' compensation system in California, the Audit Complaint Form plays a critical role in ensuring that complaints against claims administrators are properly documented and addressed. However, this form often works in concert with other essential documents, each serving a pivotal role in safeguarding the rights and interests of the injured worker. These documents collectively ensure that every facet of the complaint is thoroughly substantiated and legally compliant, providing a comprehensive framework for addressing and resolving issues within the workers' compensation framework.

- Notice of Representation: This formal document is used when an injured worker chooses to be represented by an attorney. It notifies all parties involved, including the claims administrator, that the worker has legal representation, which can affect how communications and negotiations are handled.

- Application for Adjudication of Claim: Filed with the Workers' Compensation Appeals Board (WCAB), this document officially initiates the legal process for resolving disputes between the injured worker and the claims administrator or employer, such as disagreements over benefits owed.

- Declaration of Readiness to Proceed: Used to request a hearing before a judge at the WCAB, this form is filed when parties are ready to resolve their dispute and need a judicial decision. It indicates that preliminary steps, such as attempting to resolve the issue outside of court, have been completed.

- Compromise and Release Agreement: Often used to settle a workers' compensation claim, this legal agreement specifies the terms of the settlement between the injured worker and the employer or insurance carrier. It typically requires approval by the WCAB to ensure the settlement is fair and in the best interest of the injured worker.

- Medical Records: Though not a form, medical records are crucial documents that support the injured worker's claims regarding the extent of injuries, treatments received, and future medical needs. These records often accompany the Audit Complaint Form to substantiate the nature and severity of the injury and the medical care required.

Together, these documents form a cohesive arsenal for individuals navigating the complexities of workers’ compensation issues, ensuring that their rights are protected and that grievances are addressed in a structured and legal manner. They complement the California Audit Form by providing a broader legal context and support, making it easier for injured workers and their representatives to navigate the legal landscape and achieve a resolution to their complaints.

Similar forms

The California Audit Form is closely resemblant to the Workers' Compensation Claims Form in its purpose of gathering details about an incident leading to an injury at work. Both forms require specific information about the injured party, the employer, and the incident itself, such as the date of injury and claim number. They are instrumental in initiating a review process, though the Audit Form specifically targets complaints regarding mishandling or oversight in the administration of claims, making it a tool for oversight and compliance.

Another document sharing similarities with the California Audit Form is the HIPAA Complaint Form, which is used for reporting violations of the Health Insurance Portability and Accountability Act. Like the Audit Form, individuals can submit complaints confidentially, with details about the alleged violation and the entities involved. Both forms serve to protect individuals' rights, the Audit Form in the realm of workers' compensation and the HIPAA Complaint Form in the protection of personal health information.

The Consumer Complaint Form, often found in consumer protection agency databases, also echoes the structure and intent of the California Audit Form. This form allows consumers to report issues with products or services, requiring detailed information about the business and nature of the complaint, similar to how the Audit Form solicits details regarding the complaint against claims administrators. Both forms are designed to initiate an investigation and potential action based on the complaints filed.

Similarly, the Equal Employment Opportunity Commission (EEOC) Charge of Discrimination Form is another document that parallels the California Audit Form. It is used to file complaints about discriminatory practices in the workplace. While focusing on discrimination, it shares the confidential reporting feature and the need for detailed incident descriptions, aiming to protect the rights of workers and ensure fair treatment, akin to the objectives of the Audit Form in the context of workers' compensation.

The OSHA Whistleblower Complaint Form, crucial for reporting violations of workplace safety and health regulations, also aligns with the California Audit Form in purpose and structure. Both forms allow for anonymous submissions to report non-compliance or misconduct by employers or administrators, emphasizing the protection of employees and the enforcement of standards and regulations pertinent to workers' safety and compensation.

Lastly, the Internal Revenue Service (IRS) Whistleblower – Informant Award Form bears resemblance to the California Audit Form, though its domain is tax-related issues. It permits the confidential reporting of tax fraud and evasion, much like the Audit Form allows for the confidential reporting of issues within the workers' compensation system. Both are integral to the enforcement of laws and the upholding of fairness and integrity within their respective systems.

Dos and Don'ts

When filling out the California Audit Form, it's essential to approach the process carefully to ensure your complaint is considered seriously and processed efficiently. Here are some guidelines to help you navigate the form correctly:

Things You Should Do:- Check the confidentiality box if you wish to keep your complaint private. This prevents your complaint from being shared with any party named in the complaint.

- Provide specific details about your complaint, including dates, numbers of late payments, periods not paid, and any failures on the part of the claims administrator.

- Include supporting documentation with your complaint to substantiate your claims. This could be correspondence, payment receipts, or medical reports.

- Fill in all required fields accurately, including your name, the claims administrator's name, address, and any other pertinent information.

- Contact Privacy@dir.ca.gov if you have questions about how your information will be used or about the confidentiality of your complaint.

- Avoid vague descriptions of your complaint. General statements without specifics can weaken your case.

- Don't use a P.O. Box for the physical location; the form requires a physical address to ensure accurate processing.

- Resist the temptation to leave sections blank. If a section doesn't apply, consider writing "N/A" to indicate you didn't overlook it.

- Don't forget to date and sign the form. An unsigned or undated complaint might not be processed.

Properly completing the California Audit Form can significantly influence the outcome of your complaint. Taking care to provide detailed, factual information will help the Department of Industrial Relations in their investigation and enforcement efforts.

Misconceptions

There are several misconceptions about the California Audit Complaint Form that need to be clarified to ensure individuals understand its purpose and how it can be used:

- Misconception 1: Confidentiality Isn't An Option.

- Misconception 2: The Audit Unit Will Automatically Take Legal Action Against the Claims Administrator.

- Misconception 3: Any Type of Complaint is Relevant.

- Misconception 4: The Form Is Only For Use By Injured Workers.

- Misconception 5: Filing The Form Will Result In Immediate Financial Compensation.

Many people believe that once they file a complaint using the California Audit Complaint Form, their information becomes public. This is not the case. The form clearly allows individuals to mark a box if they want their complaint to be kept confidential. The Audit Unit will respect this choice and not share the complaint with any party named in the complaint if confidentiality is requested.

A common misunderstanding is that filing a complaint guarantees immediate legal action toward a resolution. However, the primary goal of the Audit Unit is to monitor workers’ compensation claims administrators and assist in general law enforcement. Legal action can be taken but it is not automatic. The process involves assessment and investigation first.

The form is specific about the types of complaints it addresses, such as late payments of temporary or permanent disability, failure to pay or object to medical treatment or medical-legal bills, failure to investigate a claim, etc. It's a misconception that the form can be used for any complaint against employers or claims administrators, which is not its intended purpose.

While primarily designed for use by injured workers, anyone with specific details of a complaint regarding the mishandling of a workers’ compensation claim can file this complaint form. The person filing does not necessarily have to be the injured worker themselves.

Another misunderstanding is the expectation that submitting a complaint will result in immediate financial compensation. The purpose of the form is to report and document non-compliance or irregular activities. Any compensation would be determined through separate legal or administrative proceedings.

Key takeaways

When dealing with a California Audit form, particularly in the context of a workers' compensation complaint, it's essential to grasp the key points for filing it thoroughly and correctly. Understanding these aspects ensures that your complaint is processed effectively and in accordance with your preferences regarding confidentiality and the investigation. Here are the key takeaways to remember:

- Confidentiality Request: If you wish to keep your complaint confidential, make sure to indicate this clearly on the form. This prevents the Audit Unit from sharing your complaint with any party named in it.

- Use of Information: The Department of Industrial Relations, Division of Workers’ Compensation, uses the information you provide for monitoring claims administrators, assisting in law enforcement, and conducting research on the workers’ compensation system.

- Public Records Act: Regardless of your confidentiality preference, your workers’ compensation claim information and complaint cannot be disclosed to the public, adhering to the Public Records Act.

- Contact Information: Confirm that all your contact information, including email and physical address, is current and accurately filled out on the form to avoid delays in the process.

- Claims Administrator Details: Providing complete and accurate information about the claims administrator or company, including the name and address, is crucial for processing your complaint.

- Specific Details Required: Be as specific as possible when describing the nature of your complaint. Include details such as the date of injury, claim number, and descriptions of any violations or failures by the claims administrator.

- Supporting Documentation: Attach copies of all supporting documentation to your complaint form. This could include evidence of late payments, failure to investigate a claim, or any denials of liability that you are contesting.

- Privacy Concerns: For questions regarding the privacy of your information, or how it will be used, direct your inquiries to the provided email address, Privacy@dir.ca.gov.

- Completeness: Ensure that every section of the form is filled out completely. Incomplete forms may cause delays or problems in the processing of your complaint.

By paying attention to these key takeaways, individuals filing a California Audit form can do so more effectively, ensuring that their concerns are heard and addressed appropriately while maintaining their desired level of confidentiality.

Discover More PDFs

California Gun Permit - Learn about special considerations for U.S. Armed Forces members and their spouses for the California gun permit application.

Declaration of Non Ownership Dmv - Filling out this form is the smart way to avoid paying registration on a vehicle that you won’t be driving for a while.