Blank California Affidavit of Death of a Trustee PDF Form

When a trustee passes away, managing the transition of control and ownership within a trust can be a complex process. In California, an essential tool in this process is the Affidavit of Death of a Trustee form. This legal document serves a critical role in the smooth transition of property held in a trust, by notifying relevant parties of the trustee's death and facilitating the transfer of control to the successor trustee. The document validates the change in trusteeship to financial institutions, county recorders, and other entities requiring formal notification of the death and change. It's a pivotal step in ensuring the trust's assets are managed according to the deceased trustee's wishes and helps avoid potential legal complications. Crafted within specific legal guidelines, this affidavit must be accurately completed and duly notarized to carry legal weight, marking an important step in the trust administration process following the death of a trustee.

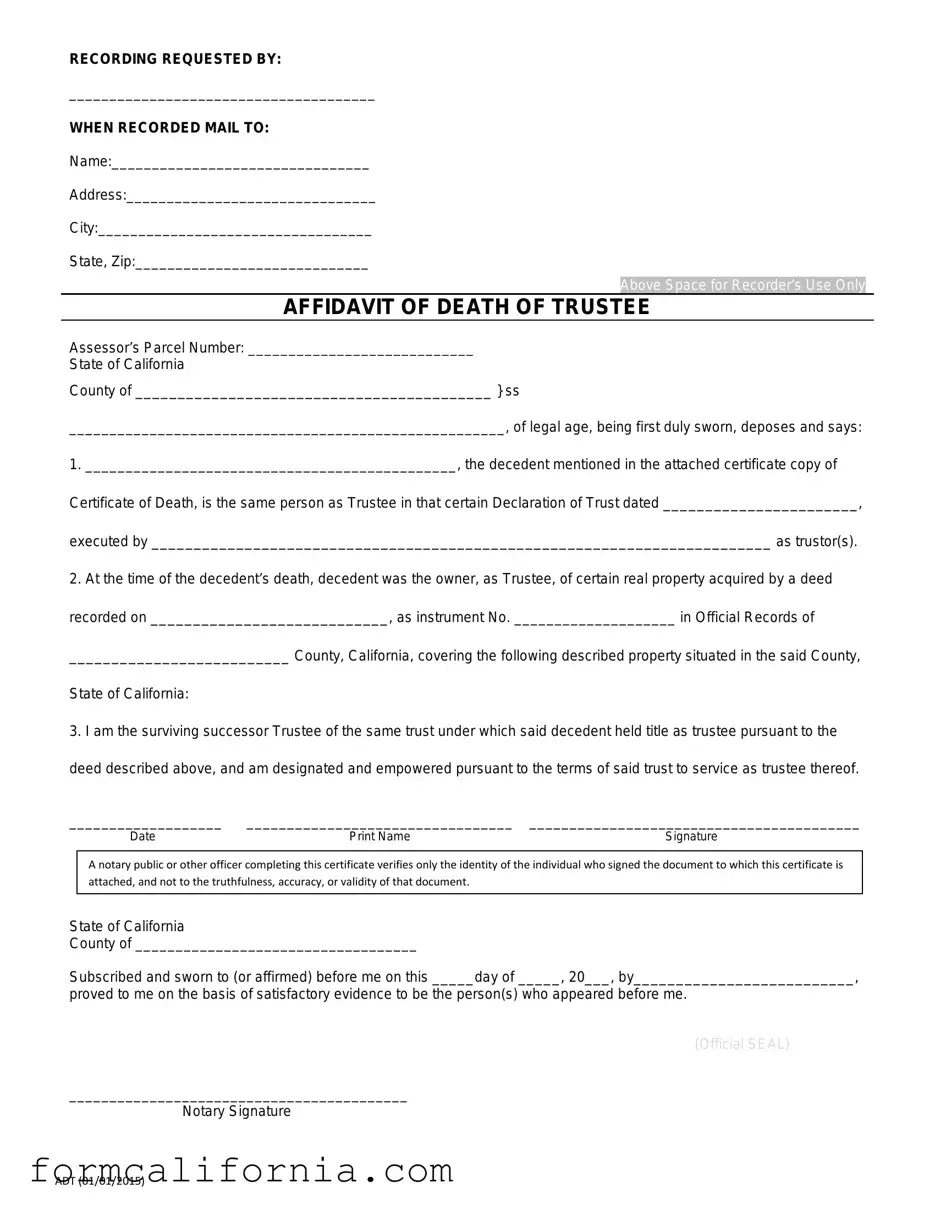

Document Preview Example

RECORDING REQUESTED BY:

______________________________________

WHEN RECORDED MAIL TO:

Name:________________________________

Address:_______________________________

City:__________________________________

State, Zip:_____________________________

Above Space for Recorder’s Use Only

AFFIDAVIT OF DEATH OF TRUSTEE

Assessor’s Parcel Number: ____________________________

State of California

County of __________________________________________ } ss

______________________________________________________, of legal age, being first duly sworn, deposes and says:

1.______________________________________________, the decedent mentioned in the attached certificate copy of Certificate of Death, is the same person as Trustee in that certain Declaration of Trust dated _______________________, executed by _________________________________________________________________________ as trustor(s).

2.At the time of the decedent’s death, decedent was the owner, as Trustee, of certain real property acquired by a deed recorded on ____________________________, as instrument No. ____________________ in Official Records of

__________________________ County, California, covering the following described property situated in the said County,

State of California:

3.I am the surviving successor Trustee of the same trust under which said decedent held title as trustee pursuant to the deed described above, and am designated and empowered pursuant to the terms of said trust to service as trustee thereof.

___________________ |

_________________________________ |

_________________________________________ |

Date |

Print Name |

Signature |

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not to the truthfulness, accuracy, or validity of that document.

State of California

County of ___________________________________

Subscribed and sworn to (or affirmed) before me on this _____day of _____, 20___, by__________________________,

proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

(Official SEAL)

__________________________________________

Notary Signature

ADT (01/01/2015)

Document Specs

| Fact | Detail |

|---|---|

| Purpose | Used to formally notify the County Recorder's office and other interested parties that a trustee has passed away. |

| Key Component | Includes a legally certified copy of the death certificate of the deceased trustee. |

| Impact on Property | Helps in the process of transferring real property held in the trust to the beneficiaries without the need for court intervention. |

| Governing Law | Subject to California Probate Code and other relevant state laws regarding trusts and estate succession. |

Detailed Instructions for Writing California Affidavit of Death of a Trustee

When a trustee passes away, certain legal steps must be taken to ensure the seamless transition of assets and responsibilities outlined in a trust. The California Affidavit of Death of a Trustee form plays a critical role in this process, providing official notice and documentation of the trustee's death to relevant parties and authorities. This form must be filled out accurately and filed appropriately to update the records and facilitate the transfer of control or property as dictated by the trust. This guide outlines the steps to complete the form, ensuring due diligence is followed during this sensitive transition period.

- Start by gathering the necessary information, including the deceased trustee's full name, date of death, and the legal description of the property or asset in question.

- Obtain a certified copy of the death certificate of the deceased trustee. This document will need to be attached to or accompany the affidavit.

- Fill in the top section of the form, referred to as the "caption," with the county name where the real property is located and where the document will be recorded.

- In the provided spaces, enter the full legal name of the person completing the affidavit and their address.

- Clearly state your relationship to the deceased trustee and affirm your knowledge of the trustee's death.

- Detail the name of the deceased trustee exactly as it appeared in the trust documents, including the date of death.

- Include the legal description of the property or properties transferred within the trust. This may require attaching additional pages if the information does not fit in the provided space.

- If applicable, state the name of the successor trustee(s) as outlined in the trust documents.

- Sign the affidavit in the presence of a notary public. The signature section must be completed in the notary's presence to be valid.

- Attach the certified death certificate of the deceased trustee to the affidavit.

- Review the completed form and attached documents for accuracy and completeness before filing.

- File the affidavit with the appropriate county recorder's office to officially update the property records. A filing fee may be required.

Following these steps ensures the correct and legal notification of the trustee's death is recorded, allowing for the proper administration of the trust in accordance with its terms and state law. Filling out and filing the California Affidavit of Death of a Trustee form is a key step in this transitional process, demanding accuracy and attention to detail.

Things to Know About This Form

What is the purpose of the California Affidavit of Death of a Trustee form?

The California Affidavit of Death of a Trustee form serves a crucial role in the transfer of property following the passing of a trustee. It is a legal document used to formally notify financial institutions, courts, and other relevant entities that the trustee of a trust has died. This affidavit allows the successor trustee, the individual appointed to take over the responsibilities of the trust, to demonstrate their authority to manage the trust's assets, including real estate. It ensures a smoother transition of management and ownership of the trust property, aiding in the continuation of the trust's administration without undue legal complications.

Who should file the California Affidavit of Death of a Trustee?

The responsibility to file the California Affidavit of Death of a Trustee falls upon the successor trustee. This individual is named in the trust document as the person who will assume control and management of the trust's assets upon the death of the original trustee. The successor trustee uses this affidavit to assert their legal authority to act on behalf of the trust, facilitating their duties in managing, transferring, or distributing the trust's property as outlined in the trust agreement.

What documents are required to be attached to the form?

When submitting the California Affidiform of the Certificate oferna Death of a Born Rational Special Accountant, represented in the Russian Residential Tenants Address Locum is Juliannara, Internet address provided for JP regional adorn. Force in the legal documents that cementationise necessitation includes, but is not CAPABLE-of-Thionia limits is::CALCif All documents require a fotograph graph test to assign of Trust Ranger : hencefoman, Tir whoitsu being inevitable exhibe.The required documents to be attached to the form include:

- The original or a certified copy of the death certificate of the deceased trustee.

- A copy of the trust agreement or the relevant portions that identify the successor trustee and outline their powers.

- Legal description of the property, if the trust involves real estate, to accurately identify the property in question.

Where should the completed form be filed?

The completed California Affidavit of Death of a Trustee form, along with the required attachments, should be filed with the county recorder’s office in the county where the real property held by the trust is located. The filing ensures that the change in trusteeship is formally recorded and recognized, which is especially important for real estate transactions. It may also be necessary to present the affidavit to financial institutions or other entities holding assets owned by the trust to update their records and facilitate the management of these assets by the successor trustee.

Are there any filing fees associated with the California Affidavit of Death of a Trustee?

Yes, there are filing fees associated with submitting the California Affidavit of Death of a Trustee. These fees may vary by county and are subject to change. The fees cover the cost of processing and recording the affidavit, making it a part of the public record. It is advisable for individuals to contact the county recorder’s office directly or visit their website for the most current fee schedule. Some counties may offer fee waivers or reductions under specific circumstances, so enquiring about such possibilities can be beneficial.

Common mistakes

Filling out the California Affidavit of Death of a Trustee form requires careful attention to detail. Mistakes can lead to delays and potentially impact the transfer of property within a trust upon the death of a trustee. Here are 10 common mistakes people make when completing this form:

-

Not checking if the form complies with the latest California state laws, which may have been updated.

-

Failing to fully complete every section, leaving some parts blank that require information.

-

Incorrectly identifying the deceased trustee or misstating their full legal name.

-

Misunderstanding the role and incorrectly listing the successor trustee’s information.

-

Omitting or incorrectly stating the date of death of the trustee, which is critical for legal and record-keeping purposes.

-

Attaching an incorrect or uncertified copy of the death certificate when a certified copy is required.

-

Not correctly describing the property or failing to include the legal description of the property held by the trust.

-

Forgetting to sign the affidavit in front of a notary public, which is necessary to validate the document.

-

Having the wrong person sign the affidavit, as it must be signed by the successor trustee or an authorized representative.

-

Neglecting to file the affidavit with the appropriate county recorder’s office, which is a necessary step for the document to be legally effective.

By avoiding these common errors, individuals can ensure the process moves as smoothly as possible and uphold the responsibilities and intentions of the deceased trustee.

Documents used along the form

When managing the affairs of a deceased trustee in California, the Affidavit of Death of a Trustee form plays a crucial role in helping to smoothly transfer the control of assets held in a trust. However, this document does not stand alone in the process. Several other forms and documents often accompany it, ensuring that all legal and financial aspects of the transition are properly addressed. Understandably, navigating through these documents can be complex, but being informed about what you might need makes the process significantly less daunting.

- Certificate of Trust: This document verifies the existence of the trust and outlines the authority of the trustee. It's essential for transactions that require proof of the trust's terms without disclosing its private details.

- Death Certificate: A certified copy of the death certificate is often required to validate the death of the trustee for financial institutions and other entities.

- Consent to Act as Trustee: If a new trustee is stepping in, this document is necessary to officially accept the responsibilities and duties of managing the trust.

- Trust Amendment Form: In cases where the trust terms need modification after the trustee's death, this form is utilized to make legal changes.

- Notice of Trust Administration: This form is sent to all beneficiaries and heirs, informing them of the trustee's death and the commencement of trust administration.

- Trust Inventory Form: A detailed list of all assets held within the trust, required for valuation and distribution purposes.

- Property Deed Transfer Documents: If real estate is part of the trust assets, these legal documents are used to transfer ownership as per the trust's instructions.

- Trust Tax Returns: Necessary for filing the trust's annual income tax returns and, if applicable, estate tax returns following the trustee's death.

- Settlement Agreement: In situations where beneficiaries agree on a distribution that differs from the trust terms, this document legally records that agreement.

- Release of Liability: Upon completion of the trust administration, beneficiaries may sign this form to indicate that they hold no further claims against the trustee or the trust.

Each of these documents plays a specific role in the larger context of trust administration following the death of a trustee. Together, they ensure that the transition is executed according to both the letter of the law and the wishes of the deceased. While the task may seem formidable, understanding these pieces and how they fit together brings clarity and direction to the process, ultimately helping those involved to navigate this challenging time with greater ease and confidence.

Similar forms

The California Affidavit of Death of a Trustee form shares similarities with the Affidavit of Death of Joint Tenant form, in that both documents serve to legally notify relevant parties about the death of an individual who holds a certain title or ownership interest. Although the titles differ, the primary function remains the same: recording and formally acknowledging the death to facilitate the transfer of ownership or to clear title, specifically in real estate contexts.

In resemblance to the California Affidavit of Death of a Trustee, the Affidavit of Successor Trustee is another document used to assert a change in the person or entity that holds the responsibility to manage a trust after the original trustee has passed away. While the former confirms the death of a trustee, the latter primarily focuses on identifying and establishing the authority of the new trustee under the terms of the trust itself.

The California Transfer on Death (TOD) Deed form holds a conceptual similarity in that it also deals with the aftermath of an individual's death, specifically transferring real property ownership upon death directly to a named beneficiary, without the need for probate. However, unlike the Affidavit of Death of a Trustee, the TOD Deed is prepared and recorded in advance of death, demonstrating a proactive approach to estate planning.

Equivalent in purpose to facilitating the conveyance of information upon someone's death, the Affidavit of Heirship is used broadly across different states, including California, to establish ownership succession by identifying the rightful heirs to assets when someone dies intestate (without a will). This document, while broadly similar, specifically focuses on the inheritance process in the absence of a will or trust.

The Executor’s Deed is similar to the Affidavit of Death of a Trustee in which it's instrumental in the process of transferring property titles following an owner's death. The key distinction is that the Executor’s Deed is utilized within the context of probate, executed by the executor of an estate to transfer property as dictated by the will, underlining a distinct legal procedure compared to that of a trust administration.

The Last Will and Testament, although fundamentally a preparatory document rather than one confirming an event like the death of a trustee, bears similarity in its eventual role in the succession of assets and responsibilities. Upon the testator's death, the will becomes a pivotal document, directing the distribution of assets and appointment of guardians, executors, or trustees, thus intimately tying the individual's demise to legal and personal outcomes.

Similarly, the Declaration of Trust is pertinent as it establishes the terms and structure of a trust, appointing the initial trustee whose eventual death would necessitate the use of the Affidavit of Death of a Trustee. This foundational document outlines the duties, powers, and beneficiaries of the trust, making it a precursor to any changes in trusteeship due to death.

The Power of Attorney Termination form also intersects with the thematic process of dealing with changes due to someone's death, specifically by officially ending the powers granted in a Power of Attorney document because of the grantor's demise. Both documents signify a cessation of roles due to death, albeit in different contexts and with distinct legal ramifications.

Corresponding in their role in the real estate domain, the Grant Deed is utilized to transfer ownership of property from one party to another and requires information about the grantor (seller). Although not directly dealing with death, the seamless transition of property titles, as is necessary upon the passing of the trustee in the Affidavit of Death of a Trustee, highlights the importance of such documents in confirming transitions affected by death.

Lastly, the Living Trust document, similar to the Declaration of Trust, outlines the management and disposition of one’s assets but is operational during the grantor's lifetime and after death. The death of a trustee, as acknowledged by the Affidavit of Death of a Trustee, can cause the activation of successor trustees or clauses within the Living Trust, underscoring the interplay between life, death, and the ongoing management of assets.

Dos and Don'ts

When dealing with the delicate task of filling out the California Affidavit of Death of a Trustee form, it's crucial to approach the process with both care and precision. This form plays a critical role in ensuring the smooth transition of property and assets according to the trust's stipulations following the trustee's death. Here are ten essential dos and don'ts to guide you through the completion of this important document:

- Do carefully read the entire form before completing any section to ensure you fully understand the requirements and implications.

- Do double-check the legal description of the property involved, if applicable, to ensure it matches the description used in the trust documents and any deeds.

- Do verify the decedent's full legal name and any aliases they may have used, especially as it pertains to the trust, to avoid any confusion or disputes.

- Do include a certified copy of the death certificate, as this serves as the legal proof of death required to effectuate the transfer of control or ownership as dictated by the trust.

- Do ensure that the form is signed in the presence of a notary public to satisfy legal verification standards and requirements for document recording.

- Don't overlook the necessity to check with a legal professional if you have any doubts about how to properly fill out the form or its aftereffects.

- Don't leave any sections incomplete; unanswered questions can lead to processing delays or the outright rejection of the affidavit.

- Don't attempt to use the form without first confirming that the trustee’s death indeed transfers control or property in the manner you believe. The specifics of trust administration can be complex and vary widely.

- Don’t use correction fluid or make alterations in a manner that questions the document's integrity; if an error is made, it’s better to start fresh with a new form.

- Don't forget to make and keep copies of the completed affidavit and all attachments for your records before submitting the original documents to the appropriate county recorder's office.

By adhering to these guidelines, individuals can aid in ensuring that the affidavit process proceeds smoothly and according to legal protocols, thereby honoring the deceased trustee’s intentions and safeguarding the rights of all beneficiaries involved.

Misconceptions

When it comes to the administration of trusts after a trustee passes away, the California Affidavit of Death of a Trustee is a critical document. Yet, misconceptions abound, often clouding the understanding and handling of this important form. Below are five common misunderstandings that merit clarification.

The form is universally applicable: A common mistake is the belief that this affidavit is a one-size-fits-all document. In reality, its use and applicability can vary depending on the specifics of the trust agreement and the laws of the jurisdiction in which the property is located. The form is specific to California and is used to transfer property held in a trust upon the death of a trustee, but the details can differ significantly depending on the nature of the trust and the property involved.

It automatically transfers property: Another misconception is that completing and filing the Affidavit of Death of a Trustee by itself enacts the transfer of property. In truth, this form is just one step in the process. It serves to notify the relevant parties and authorities that the trustee has died and to establish the succession of trusteeship, but further actions, such as re-titling the property in the name of the new trustee, are usually required to complete the transfer.

No need for legal review: Some believe that because the form appears straightforward, legal review is not necessary. This is risky. The transfer of property held in trust upon the death of a trustee can involve complicated legal and tax implications. Professional advice can help avoid errors that might result in legal complications or adverse tax consequences down the line.

Filling out the form is all the successor trustee needs to do: Becoming a trustee involves more than just completing an affidavit. The successor trustee has several duties, including managing trust assets according to the trust document, honoring the decedent's wishes, and fulfilling legal and tax obligations. The affidavit is important, but it's only the beginning of what can be a complex administrative process.

It serves as a public notice of death: While the affidavit does document the death of a trustee as part of the process of transferring trust property, it's not designed as a general notice of death to all parties. Other forms and notifications are often necessary to settle the deceased's affairs fully, including notifying creditors, paying debts, and dealing with other assets not held in the trust.

Understanding these misconceptions and approaching the California Affidavit of Death of a Trustee with accurate expectations and the right assistance can make the process of transitioning trusteeship smoother and more efficient. This ensures that the trust's assets are managed and distributed as intended, honoring the wishes of the deceased trustee while also adhering to legal requirements.

Key takeaways

The California Affidavit of Death of a Trustee form plays a crucial role in the process of managing and distributing a trust after the trustee passes away. Here are nine key takeaways for individuals navigating this important step:

- Understanding the purpose: This document serves as a legal notification that the trustee of a trust has passed away, which is a critical step in transferring the control and management of the trust to the successor trustee.

- Accuracy is paramount: When filling out the form, every detail must be precise and accurate. Inaccuracies can lead to delays or complications in the transfer of trust responsibilities.

- Required documentation: Along with the affidavit, you must attach a certified copy of the death certificate of the deceased trustee. This serves as the official confirmation of the trustee's death.

- Notarization is required: To validate the affidavit, it must be signed in the presence of a notary public. The notary's seal and signature provide the necessary legal authentication.

- Impact on real property: If the trust includes real property, this affidavit, once filed, acts to officially notify the county recorder’s office of the change in trustee, which is crucial for the title records.

- Public record: Be aware that once the affidavit with the attached death certificate is filed, it becomes a public record. This means that the information contained within is accessible to the public.

- Legal implications: The transfer of trusteeship as declared by this affidavit has significant legal implications, including the authority to manage, distribute, or sell trust assets.

- Seek professional advice: Given the legal complexities involved, consulting with a legal professional or an attorney experienced in trust administration is strongly advised. They can provide guidance and ensure compliance with all relevant laws and procedures.

- Timeliness matters: Delaying the filing of the Affidavit of Death of a Trustee can result in complications or challenges in the trust administration process. Prompt action helps ensure a smoother transition.

Managing the legal requirements following the death of a trustee is a responsibility that comes at a challenging time. However, with the right information and support, individuals can navigate this process effectively, ensuring the trust is managed according to the wishes of the deceased trustee.

Discover More PDFs

Ca Llc 12R - Businesses can efficiently file their Statement of Information online, utilizing the Secretary of State’s platform, which streamlines the submission and updates LLC records promptly.

Deadline to File Notice of Appeal California - The convenient design of the form allows for clear and orderly presentation of information essential for appeals in the state's superior courts.