Blank California 541 T PDF Form

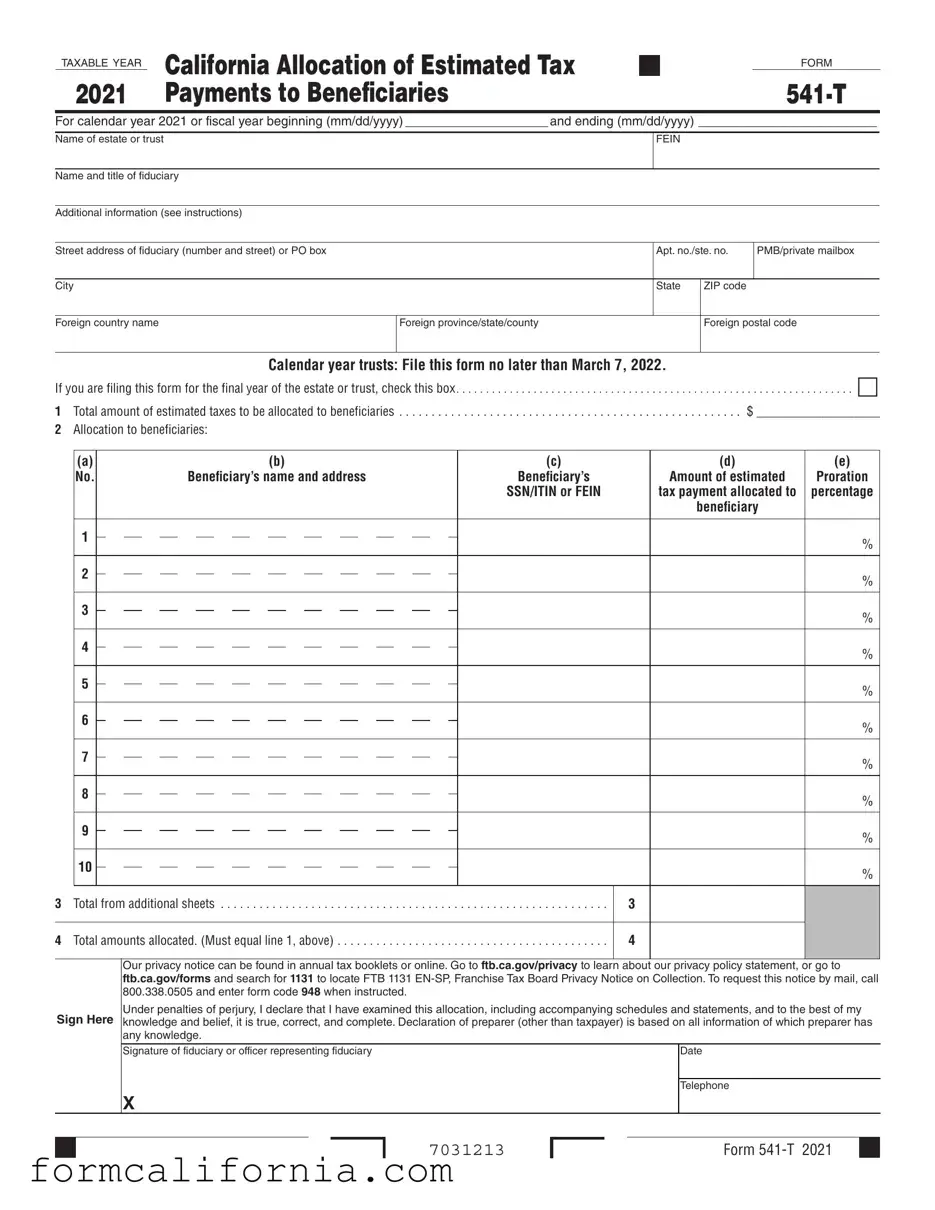

In today's complex fiscal environment, entities such as estates and trusts navigate a multitude of tax obligations, including the allocation of estimated tax payments to beneficiaries. The California Form 541-T emerges as a critical document in this landscape, facilitating a mechanism whereby a trust or, in its final year, a decedent’s estate can elect to have portions of its estimated tax payments attributed to beneficiaries, as codified under Revenue and Taxation Code Section 17731 and Internal Revenue Code Section 643(g)(1)(B). This form, specifically designed for either the calendar year 2002 or fiscal years beginning within 2002, requires detailed input including the estate or trust's identifying information, the total amount of estimated taxes to be allocated, and precise beneficiary designations. Notably, the election made via Form 541-T is irrevocable, and as such, warrants meticulous attention from fiduciaries to ensure accuracy in reporting and compliance with the stipulated timeline—no later than the 65th day following the close of the tax year. Moreover, it separates itself by requiring filing independent of Form 541, the California Fiduciary Income Tax Return. This delineation underscores the importance of understanding both the procedural and substantive nuances associated with Form 541-T to effectively manage the allocation of estimated tax payments, ultimately impacting the financial rights and obligations of the beneficiaries involved.

Document Preview Example

TAXABLE YEAR |

CALIFORNIA ALLOCATION OF ESTIMATED TAX |

■ |

|

FORM |

|

|

|

||

2021 |

Payments to Beneficiaries |

|

|

For calendar year 2021 or fiscal year beginning (mm/dd/yyyy) ____________________ and ending (mm/dd/yyyy) _________________________

Name of estate or trust

FEIN

Name and title of fiduciary

Additional information (see instructions)

Street address of fiduciary (number and street) or PO box |

|

Apt. no./ste. no. |

PMB/private mailbox |

|

|

|

|

|

I |

City |

|

State |

ZIP code |

|

|

|

|

|

|

Foreign country name |

Foreign province/state/county |

Foreign postal code |

||

|

I |

|

|

|

Calendar year trusts: File this form no later than March 7, 2022.

If you are filing this form for the final year of the estate or trust, check this box. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . • |

|||||

1 Total amount of estimated taxes to be allocated to beneficiaries |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . $ ___________________ |

||||||

2 |

Allocation to beneficiaries: |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

(a) |

|

(b) |

(c) |

(d) |

(e) |

|

|

|

No. |

|

Beneficiary’s name and address |

Beneficiary’s |

Amount of estimated |

Proration |

|

|

|

|

|

|

|

SSN/ITIN or FEIN |

tax payment allocated to |

percentage |

|

|

|

|

|

|

|

beneficiary |

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Total from additional sheets |

3 |

|

|||||

4 Total amounts allocated. (Must equal line 1, above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

Sign Here

Our privacy notice can be found in annual tax booklets or online. Go to ftb.ca.gov/privacy to learn about our privacy policy statement, or go to ftb.ca.gov/forms and search for 1131 to locate FTB 1131

Under penalties of perjury, I declare that I have examined this allocation, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Signature of fiduciary or officer representing fiduciary |

Date |

Telephone

X

■

7031213

FORM |

■ |

Document Specs

| Fact | Detail | ||

|---|---|---|---|

| Purpose | Form 541-T lets a trust or, in its final year, a decedent's estate, elect to have part of its estimated tax payments treated as made by its beneficiaries. This election follows Revenue and Taxation Code Section 17731 and Internal Revenue Code Section 643(g)(1)(B). | ||

| Filing Separation | The form must be filed separately from Form 541, California Fiduciary Income Tax Return, and should not be attached to it. | ||

| Filing Destination | It should be mailed to the FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA 94240-0002. | ||

| Due Date | The form must be filed by the 65th day after the close of the tax year. If that day is a Saturday, Sunday, or legal holiday, it's due the next business day. | Eligibility for Filing | This form applies to both calendar year 2002 and fiscal years beginning in 2002. If the form is for a fiscal year or a short year, the specific tax year should be noted at the top of the form. |

Detailed Instructions for Writing California 541 T

Filling out the California 541-T form is a precise process that demands attention to detail. This form allows a trust, or an estate in its final year, to allocate estimated tax payments to beneficiaries. The allocation, once elected, cannot be changed. It is separate from the fiduciary income tax return, requiring specific information about the tax year, fiduciary, beneficiaries, and the allocation of estimated payments. Carefully following the steps below ensures accurate completion and submission of the form.

- Determine the tax year for the form. If it is a calendar year, write "2002". If it's a fiscal year, enter the start and end dates in the spaces provided at the top of the form.

- Fill in the estate or trust's name, the fiduciary's name and title, and the Federal Employer Identification Number (FEIN) in the designated areas.

- Provide the address of the fiduciary, including the number and street or PO Box, Suite no., PMB no. (if applicable), city, state, and ZIP Code.

- If this form represents the final year of the estate or trust, make sure to check the box indicating so.

- On line 1, enter the total amount of estimated taxes you wish to allocate to beneficiaries.

- For line 2, allocate the estimated tax payments to each beneficiary:

- Fill in the beneficiary's name and address in column (a).

- In column (b), enter the beneficiary’s social security number (SSN) or federal employer identification number (FEIN).

- In column (c), indicate the amount of estimated tax payment allocated to each beneficiary.

- Calculate and enter the proration percentage for each beneficiary in column (d), based on the amount allocated versus the total estimated payment.

- If more than 10 beneficiaries are involved, continue listing them on an additional sheet mirroring the format of line 2. Summarize the additional allocations on line 3.

- Ensure the total amounts allocated in line 4 match the total entered in line 1.

- The fiduciary must sign and date the form at the bottom, certifying the accuracy and completeness of the information provided under penalties of perjury.

- Review the form for accuracy and completeness before mailing it to the Franchise Tax Board at the specified address: FRANCHISE TAX BOARD PO BOX 942840 SACRAMENTO CA 94240-0002.

- Form 541-T must be filed by the 65th day following the close of the tax year. If this date falls on a weekend or legal holiday, file by the next business day.

Once the form is submitted, the allocation of estimated tax payments to beneficiaries is finalized and cannot be adjusted. This process is vital for the correct distribution of estimated tax responsibilities and benefits among beneficiaries, in line with the trust or estate's financial activities and decisions.

Things to Know About This Form

What is Form 541-T?

Form 541-T, also known as the California Allocation of Estimated Tax Payments to Beneficiaries, is a document used by trusts or decedent's estates in their final year to elect part of its estimated tax payments to be treated as if made by its beneficiary or beneficiaries. This election, once made, is irrevocable and should not include withholding distributed to beneficiaries.

How and where do you file Form 541-T?

To file Form 541-T, it must be filed separately from Form 541, California Fiduciary Income Tax Return, and should not be attached to Form 541. The completed form should be mailed to the FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO, CA 94240-0002.

What is the deadline for filing Form 541-T?

The form must be filed by the 65th day after the close of the tax year of the trust or decedent’s estate. If this date falls on a Saturday, Sunday, or legal holiday, the form should be filed on the next business day. For example, for a calendar year trust, the deadline would be on or before March 6, 2003.

Who needs to use Form 541-T?

Form 541-T is used by trusts or, in its final year, a decedent’s estate, that chooses to allocate any portion of its estimated tax payments to its beneficiaries. This form is pertinent for those wishing to treat estimated tax payments as made by the beneficiaries rather than the estate or trust itself.

How is the allocation of estimated tax payments to beneficiaries determined?

Estimated tax payments allocated to beneficiaries are detailed on Form 541-T. Allocation involves:

- Listing each beneficiary’s name and address.

- Providing each beneficiary's Social Security Number (SSN) or Federal Employer Identification Number (FEIN).

- Specifying the amount of the estimated tax payment allocated to each beneficiary.

- Calculating each beneficiary's proration percentage, by dividing the amount allocated to them by the total estimated payments and expressing it as a percentage.

What should be done if there are more than 10 beneficiaries?

If payments of estimated taxes are being allocated to more than 10 beneficiaries, the additional beneficiaries should be listed on an attached sheet that follows the format of line 2 on Form 541-T. You must include the total from the attached sheet(s) on line 3, and clearly mark the fiduciary's name and FEIN on the attached sheet.

Common mistakes

When completing the California 541-T form, which is used for allocating estimated tax payments to beneficiaries, there are some common mistakes that need to be avoided to ensure accurate and timely processing. Being aware of these pitfalls can save both time and potential complications with the California Franchise Tax Board. Here are four common errors:

Incorrect Beneficiary Information: One of the most frequent mistakes is entering incorrect or incomplete information for beneficiaries. This includes misspellings of names, inaccurate Social Security Numbers (SSNs) or Federal Employer Identification Numbers (FEINs), and incomplete addresses. Precise beneficiary information is critical for proper allocation of payments and to avoid delays or penalties.

Failing to Group Beneficiaries Correctly: Beneficiaries should be grouped into two categories: individuals with SSNs and other entities with FEINs. Misgrouping or failing to categorize beneficiaries can result in processing delays. It’s important to ensure each beneficiary is listed in the correct category to expedite processing.

Allocation Errors: Another common mistake is incorrect allocation of estimated tax payments among beneficiaries. This includes both the amount of estimated tax payment allocated to each beneficiary and the proration percentage. The amount allocated to each beneficiary must correctly reflect what is intended, and the proration percentage must accurately represent the beneficiary's share of the total estimated payment.

Missing Attachments for Additional Beneficiaries: If there are more than 10 beneficiaries, the additional beneficiaries must be listed on an attached sheet that follows the format of line 2. Sometimes, filers forget to include these attachments or fail to provide the required information in the proper format. Ensure that any additional sheets include the fiduciary name and FEIN at the top.

Avoiding these errors requires careful review and attention to detail. Being meticulous in filling out the form, double-checking beneficiary information, correctly grouping beneficiaries, ensuring accurate allocations, and including all necessary attachments will help in the smooth processing of the 541-T form.

Documents used along the form

When managing or settling an estate or trust in California, the Form 541-T, California Allocation of Estimated Tax Payments to Beneficiaries, is one among several important documents that may need to be filed. This form allows a fiduciary to allocate any part of its estimated tax payments to one or more beneficiaries. However, to facilitate the processing of this allocation and fulfill other related financial and legal obligations, other forms and documents are often required in conjunction with Form 541-T. These additional forms support a comprehensive approach to estate and trust management and tax filing.

- Form 541, California Fiduciary Income Tax Return - This is a crucial document for reporting income received by the estate or trust. It details the income, deductions, and credits of the entity for the tax year, and it’s necessary for calculating the tax liability of the estate or trust.

- Schedule K-1 (541), Beneficiary’s Share of Income, Deductions, Credits, etc. - Schedule K-1 (541) is used to report each beneficiary's share of the estate's or trust’s income, as well as deductions and credits. It’s vital for beneficiaries to accurately report their share of the estate or trust income on their personal tax returns.

- Form 1041, U.S. Income Tax Return for Estates and Trusts - While this is a federal form, it is essential for reporting the income, gains, losses, deductions, and credits of the estate or trust. It also shows the income distribution to beneficiaries that is necessary for the correct allocation of federal tax responsibilities.

- Form 593, Real Estate Withholding Tax Statement - In situations where the estate or trust involves the sale of California real property, Form 593 is required for reporting and remitting withholding from the sale proceeds. This form helps ensure that capital gains taxes are appropriately collected at the time of the sale.

- Form 3520, Power of Attorney Declaration - To authorize another individual, such as an accountant or attorney, to receive confidential information and represent the estate or trust before the California Franchise Tax Board, Form 3520 must be filed. This form is critical for estates or trusts that rely on professionals for tax preparation and representation.

In completing and filing Form 541-T and the associated documents, fiduciaries ensure the proper management and tax compliance of the estate or trust. These forms collectively provide a framework for the transparent and efficient distribution of the estate’s or trust’s assets, while meeting both state and federal legal requirements. Ensuring accuracy and timeliness in the filing of these documents is key to fulfilling fiduciary duties and facilitating the smooth administration of the entity involved.

Similar forms

The California Form 541, Fiduciary Income Tax Return, is closely related to the Form 541-T as it is the primary tax document filed by estates or trusts to report their income, deductions, gains, losses, and tax liability for a tax year. Form 541-T allows the income and deductions to be allocated to the beneficiaries, which is crucial for accurately completing Form 541, ensuring that the tax responsibilities are correctly reported and distributed among the involved parties.

Form 1041, U.S. Income Tax Return for Estates and Trusts, shares significant similarities with California Form 541-T, as it is the federal counterpart used to report the income, deductions, and credits of estates and trusts on a national level. Both forms facilitate the process of allocating estimated tax payments to beneficiaries, maintaining consistency in taxation principles across federal and state levels, but Form 541-T specifically adheres to California's tax codes and regulations.

The Schedule K-1 (541), Beneficiary’s Share of Income, Deductions, Credits, etc., is intricately connected to Form 541-T because it itemizes the distributions of income and deductions reported on Form 541-T to individual beneficiaries. This document ensures that beneficiaries are aware of their tax obligations based on the distributions they receive, enabling precise and accurate tax reporting from each beneficiary's side.

Form 541-B, California Income Tax Return for Trust Beneficiaries, although not identically structured, complements the information reported on Form 541-T. It focuses on detailing the income received by beneficiaries from a trust, further emphasizing the necessity of accurate allocation of estimated tax payments to beneficiaries as determined in Form 541-T.

The Estimated Tax for Individuals, Form 540-ES, while primarily for individuals, connects to Form 541-T through the allocation of estimated tax payments. If a trust elects to allocate such payments to beneficiaries, those individuals might need to adjust their own estimated payments using Form 540-ES based on the additional income reported from trusts or estates, highlighting the interdependence between personal and fiduciary tax responsibilities.

Form 1099-DIV, Dividends and Distributions, is indirectly related to Form 541-T as it reports dividends and distributions received, which may be part of a trust or estate's income distribution to beneficiaries. When a beneficiary receives a distribution that has been reported on Form 1099-DIV, this could affect the amounts reported on Form 541-T, showcasing the flow of income through various reporting forms.

The California Estimated Tax for Corporations, Form 100-ES, parallels the individual estimated tax form and Form 541-T in its functionality for corporations. Corporations, like trusts, might allocate estimated tax payments to shareholders, similar to how trusts allocate payments to beneficiaries. Although the recipients and entities differ, the principle of allocating estimated taxes is a shared concept among these forms.

Lastly, Form 1040-ES, Estimated Tax for Individuals, at the federal level, echoes the purpose of Form 541-T and 540-ES for California individuals. Beneficiaries who receive income from trusts or estates may need to adjust their estimated tax payments at both the state and federal levels using Form 1040-ES, reflecting the wider impact of allocations made on Form 541-T on an individual’s total tax obligations.

Dos and Don'ts

When managing the Form 541-T for California Allocation of Estimated Tax Payments to Beneficiaries, accurately and efficiently completing the document is crucial for both the trust or estate and its beneficiaries. Below are key do's and don'ts to consider:

- Do make sure to file Form 541-T separately from Form 541. These forms have different submission destinations and should not be attached.

- Do mail the completed Form 541-T to the Franchise Tax Board at the address provided in the instructions, ensuring proper delivery to the correct office.

- Do file Form 541-T by the 65th day after the close of the tax year to ensure the election to allocate estimated tax payments to beneficiaries is valid.

- Don't distribute withholding to beneficiaries on Form 541-T. This form is for the allocation of estimated tax payments only.

- Don't forget to include crucial details such as the fiduciary’s street address, suite number, or PMB number, if applicable, to avoid processing delays.

- Don't neglect to accurately fill out both the amount of the estimated tax payment allocated to each beneficiary and the correct proration percentage. Errors can lead to delays or penalties.

By following these guidelines, fiduciaries can complete Form 541-T with greater accuracy, contributing to a smoother tax process for all parties involved.

Misconceptions

Understanding the nuances of tax forms can be challenging, and Form 541-T, the California Allocation of Estimated Tax Payments to Beneficiaries, is no exception. There are common misunderstandings about this form that need clarifying to ensure that trusts and estates manage their tax obligations effectively. Below are eight misconceptions about the Form 541-T and explanations to clear up any confusion.

- Form 541-T can be filed with the California Fiduciary Income Tax Return (Form 541). This is a mistake; Form 541-T must be filed separately from Form 541 and should not be attached to it under any circumstances.

- Estates or trusts can distribute withholding to beneficiaries using Form 541-T. This is incorrect. The purpose of Form 541-T is specifically for the allocation of estimated tax payments, not withholdings, to beneficiaries.

- The beneficiary's social security number or federal employer identification number is optional. Actually, it's crucial to provide this information on Form 541-T. Failure to include a valid SSN or FEIN could lead to processing delays and impose penalties on the beneficiary.

- Form 541-T is only for estates and cannot be used by trusts. This is not true. Both trusts and, for their final year, decedent's estates can use Form 541-T to allocate estimated tax payments to beneficiaries.

- Filing Form 541-T is optional for handling estimated tax payments. Once an election is made to allocate estimated tax payments to beneficiaries through Form 541-T, it is irrevocable and becomes a binding action for that tax year.

- The election to allocate estimated taxes to beneficiaries can be changed later. Incorrect. Once made, the election to allocate estimated taxes to beneficiaries through Form 541-T is irrevocable and cannot be altered.

- Any beneficiary’s share can be determined without regard to the overall tax payment made by the trust or estate. This is a misunderstanding. The allocation of estimated tax payments to each beneficiary must be proportionate to the total amount paid by the trust or estate, as specified in the proration percentage column of Form 541-T.

- Form 541-T is filed at the same time as the annual tax return. Actually, to be valid, Form 541-T must be filed by the 65th day after the close of the tax year. This deadline is specific and separate from the timeline for filing annual tax returns.

Correcting these misconceptions is vital for the accurate completion and filing of Form 541-T, ensuring that trusts and estates comply with California's tax laws while efficiently managing their beneficiaries' estimated tax payments.

Key takeaways

Understanding the California 541-T Form for Estate and Trust Tax Payments:

- The California 541-T form allows trusts or decedent's estates in their final year to allocate estimated tax payments made by the entity to individual beneficiaries. This allocation is considered an election under specific revenue and taxation codes and, once made, it cannot be revoked.

- To file a 541-T form, it must be submitted separately from the California Fiduciary Income Tax Return (Form 541). This ensures that the documentation is correctly processed and that the estimated payments are properly allocated to the beneficiaries.

- Timing is crucial when filing the 541-T form. It must be sent to the Franchise Tax Board by the 65th day after the tax year's close to be considered valid. If this deadline falls on a weekend or legal holiday, the next business day becomes the deadline.

- Both the trust or estate’s total estimated tax payments that are being allocated to beneficiaries and the details of those allocations must be clearly listed on the form. This includes each beneficiary's name, address, identifying number (SSN or FEIN), the allocated amount, and the proration percentage.

- It is important to use the correct mailing address when sending the 541-T form to the Franchise Tax Board to avoid delays in processing. The specific PO Box in Sacramento, CA, is designated for these submissions.

- If a trust or decedent's estate has more than ten beneficiaries to allocate payments to, additional sheets that follow the format of the main form can be attached. These sheets must include the allocation details for each additional beneficiary, ensuring the total allocated amount matches the total estimated tax payment of the estate or trust.

By adhering to these key takeaways, fiduciaries can effectively manage the allocation of estimated tax payments to beneficiaries, ensuring compliance with California tax laws.

Discover More PDFs

What Is Form 100 - Keep track of your credit entitlement from previous years with California Form 3540, focusing on carryovers from repealed credits.

How to File State Tax Extension - It delineates a streamlined approach for corporations, REITs, REMICs, RICs, LLCs, and exempt organizations to manage their tax extension and payment.

California Fl 145 - This form serves as a comprehensive tool for gathering detailed responses related to personal history, financial assets, debts, and support arrangements in family law disputes.