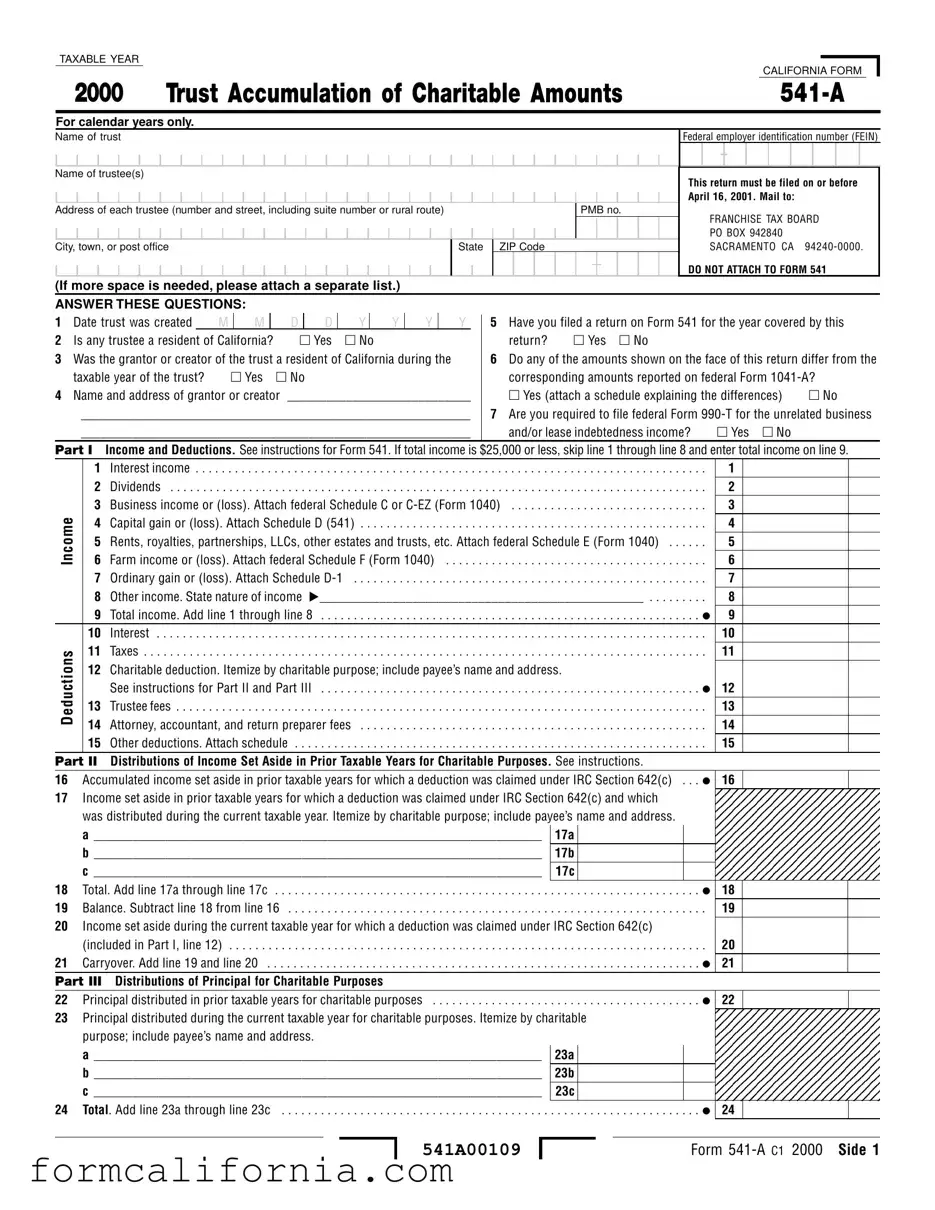

Blank California 541 A PDF Form

The California 541-A form is a critical document for trusts engaged in charitable giving, designed to report the accumulation of charitable amounts for a specific taxable year. It's exclusively for calendar years and must be filed by April 16 following the reporting year, addressed to the Franchise Tax Board in Sacramento. The form is meticulously constructed to capture the essential information regarding the trust, including the trust's name, the Federal Employer Identification Number (FEIN), trustee details, and comprehensive income and deduction figures. It serves a pivotal role for trustees who claim charitable or other deductions under IRC Section 642(c) or oversee a charitable or split-interest trust, stipulating detailed reporting on income set aside for charitable purposes in prior years, as well as principal distributions for charitable causes within the reported year. Furthermore, the form distinguishes between various income types and dedicates sections to explain differences in amounts shown on this return compared to those on federal Form 1041-A and necessitates the disclosure of whether the trust engages in unrelated business and/or lease indebtedness income requiring a federal Form 990-T filing. The California 541-A form embodies the intersection of state tax obligations and philanthropic endeavors, facilitating contributions to charitable causes while ensuring compliance with state tax laws, which often diverge from federal regulations.

Document Preview Example

TAXABLE YEAR

|

|

CALIFORNIA FORM |

2000 |

TRUST ACCUMULATION OF CHARITABLE AMOUNTS |

For calendar years only.

Name of trust

Federal employer identification number (FEIN)

-

Name of trustee(s)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of each trustee (number and street, including suite number or rural route) |

|

|

|

|

|

|

PMB no. |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, town, or post office |

State |

ZIP Code |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This return must be filed on or before April 16, 2001. Mail to:

FRANCHISE TAX BOARD PO BOX 942840 SACRAMENTO CA

DO NOT ATTACH TO FORM 541

(If more space is needed, please attach a separate list.)

ANSWER THESE QUESTIONS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

1 Date trust was created |

|

M |

M |

|

D |

|

D |

|

Y |

|

Y |

Y |

|

Y |

|

5 |

Have you filed a return on Form 541 for the year covered by this |

||||||||||

2 Is any trustee a resident of California? |

|

|

Yes |

No |

|

|

|

|

|

|

return? |

Yes |

No |

|

|

|

|

|

|||||||||

3 Was the grantor or creator of the trust a resident of California during the |

|

|

6 |

Do any of the amounts shown on the face of this return differ from the |

|||||||||||||||||||||||

|

taxable year of the trust? |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

corresponding amounts reported on federal Form |

|

|

||||||||||

4 Name and address of grantor or creator |

____________________________ |

|

Yes (attach a schedule explaining the differences) |

No |

|||||||||||||||||||||||

|

____________________________________________________________ |

|

7 |

Are you required to file federal Form |

|||||||||||||||||||||||

|

____________________________________________________________ |

|

|

and/or lease indebtedness income? |

Yes |

No |

|

|

|||||||||||||||||||

PART I |

Income and Deductions. See instructions for Form 541. If total income is $25,000 or less, skip line 1 through line 8 and enter total income on line 9. |

||||||||||||||||||||||||||

|

|

1 |

Interest income |

. . . . . . |

. . |

. . . |

. |

. . . . |

. . . |

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

1 |

|

|

|

|

||

|

|

2 |

. . .Dividends . . . . |

. . . |

. . . . . . |

. . |

. . . |

. |

. . . . |

. . . |

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

2 |

|

|

|

|

|

|

|

3 |

Business income or (loss). Attach federal Schedule C or |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

3 |

|

|

|

|

||||||||||||||||

Income |

|

4 |

Capital gain or (loss). Attach Schedule D (541) |

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

4 |

|

|

|

|

||||||||

|

5 |

. . . . . .Rents, royalties, partnerships, LLCs, other estates and trusts, etc. Attach federal Schedule E (Form 1040) |

5 |

|

|

|

|

||||||||||||||||||||

|

6 |

. .Farm income or (loss). Attach federal Schedule F (Form 1040) |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

6 |

|

|

|

|

||||||||||||||

|

|

7 |

.Ordinary gain or (loss). Attach Schedule |

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

7 |

|

|

|

|

||||||||

|

|

8 |

Other income. State nature of income |

. . . . . . . . ._________________________________________________ |

8 |

|

|

|

|

||||||||||||||||||

|

|

9 |

Total income. Add line 1 through line 8 |

. . . |

. . . |

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . |

9 |

|

|

|

|

||||||

|

|

10 |

Interest |

. . . |

. . . . . . |

. . |

. . . |

. |

. . . . |

. . . |

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

10 |

|

|

|

|

|

Deductions |

|

11 |

. . .Taxes |

. . . |

. . . . . . |

. . |

. . . |

. |

. . . . |

. . . |

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

11 |

|

|

|

|

|

|

12 |

Charitable deduction. Itemize by charitable purpose; include payee’s name and address. |

|

|

|

|

|

|

|

||||||||||||||||||

|

|

See instructions for Part II and Part III |

. . . |

. . . |

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . |

12 |

|

|

|

|

|||||||

|

13 |

. . .Trustee fees . . . |

. . . |

. . . . . . |

. . |

. . . |

. |

. . . . |

. . . |

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

13 |

|

|

|

|

||

|

14 |

Attorney, accountant, and return preparer fees |

|

|

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|||||||||

|

|

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

|

|

|

|

|||||||||||

|

|

15 |

. . . . . . .Other deductions. Attach schedule |

. . . |

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

15 |

|

|

|

|

|||||||

PART II Distributions of Income Set Aside in Prior Taxable Years for Charitable Purposes. See instructions. |

|

|

|

|

|

||||||||||||||||||||||

16 |

|

Accumulated income set aside in prior taxable years for which a deduction was claimed under IRC Section 642(c) . . . |

16 |

|

|

|

|

||||||||||||||||||||

17Income set aside in prior taxable years for which a deduction was claimed under IRC Section 642(c) and which

|

was distributed during the current taxable year. Itemize by charitable purpose; include payee’s name and address. |

|

|

a _____________________________________________________________________ |

17a |

|

b _____________________________________________________________________ |

17b |

|

c _____________________________________________________________________ |

17c |

18 |

Total. Add line 17a through line 17c |

. . . . . . . . . . . . . . . . . . . . . . 18 |

19 |

Balance. Subtract line 18 from line 16 |

. . . . . . . . . . . . . . . . . . . . . . . 19 |

20 |

Income set aside during the current taxable year for which a deduction was claimed under IRC Section 642(c) |

|

|

(included in Part I, line 12) |

. . . . . . . . . . . . . . . . . . . . . . . 20 |

21 |

Carryover. Add line 19 and line 20 |

. . . . . . . . . . . . . . . . . . . . . . 21 |

PART III Distributions of Principal for Charitable Purposes |

|

|

22 |

Principal distributed in prior taxable years for charitable purposes |

. . . . . . . . . . . . . . . . . . . . . . 22 |

23 |

Principal distributed during the current taxable year for charitable purposes. Itemize by charitable |

|

|

purpose; include payee’s name and address. |

|

|

a _____________________________________________________________________ |

23a |

|

b _____________________________________________________________________ |

23b |

|

c _____________________________________________________________________ |

23c |

24 |

Total. Add line 23a through line 23c |

. . . . . . . . . . . . . . . . . . . . . . 24 |

|

541A00109 |

|

PART IV |

Balance Sheet. If line 9 is $25,000 or less, complete only line 38, line 42, and line 45. If books of account do not agree, please reconcile all differences. |

|

|

|

|||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|

|

|

|

ASSETS |

|

|

|

|

|

(a) |

(b) |

|

||||||||||||

|

Cash — |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

25 |

. . . . |

. . . . . . . |

. . . . . . . . . . |

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

26 |

. . . . . . . . . . . . . . . . . . . .Savings and temporary cash investments |

. . . . |

. . . . . . . |

. . . . . . . . . . |

26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

27 |

a |

. . . . . . . . . . .Accounts receivable |

. . . . . . . . . . . . . . . . . . . . . . |

27a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

. . . . . . . . . . . . . . . . . .b Less: allowance for doubtful accounts |

27b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

28 |

. . . . . . . . . . . . . . . . . . . . . . . . . . .a Notes and loans receivable |

28a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

. . . . . . . . . . . . . . . . . .b Less: allowance for doubtful accounts |

28b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

29 |

Inventories for sale or use |

. . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

. . . . |

. . . . . . . |

. . . . . . . . . . |

29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

30 |

. . . . . . . . . . . . . . . . . . . . .Prepaid expenses and deferred charges |

. . . . |

. . . . . . . |

. . . . . . . . . . |

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

31 |

. . . . . . . . . . . . . . . . .Investments — U.S. and state government obligations. Attach schedule |

31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Investments — corporate stock. Attach schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

32 |

. . . . |

. . . . . . . |

. . . . . . . . . . |

32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

33 |

. . . . . . . . . . . . .Investments — corporate bonds. Attach schedule |

. . . . |

. . . . . . . |

. . . . . . . . . . |

33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

34 |

a |

Investments — land, buildings, and equipment: basis |

34a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

b |

. . . . . . . . . . . . . . . . . . . . . . .Less: accumulated depreciation |

34b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Investments — other. Attach schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

35 |

. . . . |

. . . . . . . |

. . . . . . . . . . |

35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

36 |

a |

Land, buildings, and equipment (trade or business): basis . . |

36a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

b |

. . . . . . . . . . . . . . . . . . . . . . .Less: accumulated depreciation |

36b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37 |

Other assets. Describe. |

_____________________________________________________ |

37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

38 |

. . . . . . . . . . . . . . . . . . .Total assets. Add line 25 through line 37 |

. . . . |

. . . . . . . |

. . . . . . . . . . |

38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

39 |

Accounts payable and accrued expenses |

. . . . . |

. . . . . . |

. . . . . . . . . . |

39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

40 |

. . . . . . . . . . .Mortgages and other notes payable. Attach schedule |

. . . . |

. . . . . . . |

. . . . . . . . . . |

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

41 |

Other liabilities. Describe. |

___________________________________________________ |

41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

42 |

. . . . . . . . . . . . . . . . .Total liabilities. Add line 39 through line 41 |

. . . . |

. . . . . . . |

. . . . . . . . . . |

42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

NET ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43 Trust principal or corpus |

. . . . . . . . . . . . . . . . . . . . . . . |

. . . . |

. . . . . . . |

. . . . . . . . . . |

43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

. . . . . . . . . . . . . . . . . . . . . . . . . .44 Undistributed income and profits |

. . . . |

. . . . . . . |

. . . . . . . . . . |

44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

. . . . . . . . . . . . . . . . . . . .45 Total net assets. Add line 43 and line 44 |

. . . . |

. . . . . . . |

. . . . . . . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

. . . . . . . .46 Total liabilities and net assets. Add line 42 and line 45 |

. . . . |

. . . . . . . |

. . . . . . . . . . |

46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is |

|

|||||||||||||||||||||

Please |

|

true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. |

|

||||||||||||||||||||||

Sign |

|

|

|

|

|

|

|

|

|

|

Date |

Trustee’s SSN/FEIN |

|

||||||||||||

Here |

|

|

___________________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Signature of trustee or officer representing trustee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Date |

|

|

|

Paid preparer’s SSN/PTIN |

|

||||||||||||

Paid |

|

|

Preparer’s |

|

|

|

|

|

|

|

Check if self- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

employed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Preparer’s |

signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Use Only |

Firm’s name (or yours, if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Side 2 Form

541A00209

For Privacy Act Notice, get form FTB 1131.

Instructions for FTB Form

Trust Accumulation of Charitable Amounts

General Information

In general, California tax law conforms to the Internal Revenue Code (IRC) as of

January 1, 1998. However, there are continuing differences between California and federal tax law. California has not conformed to most of the changes made to the IRC by the federal Internal Revenue Service Restructuring and Reform Act of 1998 (Public Law

Law

A Purpose

Use Form

BWho Must File

A trustee must file a calendar year Form

A charitable trust is a trust which:

•Is not exempt from taxation under R&TC Section 23701d; and

•Has all the unexpired interests devoted to charitable purposes described in IRC Section 170(c); and

•Had a charitable contribution deduction allowed for all the unexpired interests under the R&TC.

A

•Is not exempt from taxation under R&TC Section 23701d; and

•Has some of the unexpired interests devoted to one or more charitable purposes described in IRC Section 170(c); and

•Has amounts in trust for which a chari- table contributions deduction was allowed under the R&TC. Pooled income funds (IRC Section 642(c)(5)), charitable remainder annuity trusts (IRC

Section 664(d)(1)), and remainder unitrusts (IRC Section 664(d)(2)), are considered

Simple trusts which received a letter from the Franchise Tax Board (FTB) granting exemption from tax under R&TC Section 23701d are considered to be corporations for tax purposes. They may be required to file Form 199, California Exempt Organization Annual Information Return. See the instructions for that form.

Nonexempt charitable trusts, described in IRC Section 4947(a)(1), must file Form 199.

Private Mailbox (PMB) No.

If you lease a mailbox from a private business rather than a PO box from the United States Postal Service, enter your PMB number in the field labeled “PMB no.”

CWhen to File

File Form

DWhere to File

Mail Form

FRANCHISE TAX BOARD PO BOX 942840 SACRAMENTO CA

Specific Instructions

Part II and Part III

Describe in detail on an attached statement the purpose for which charitable disburse- ments were made from income set aside in prior taxable years and amounts which were paid out of principal for charitable purposes. Examples of appropriate descriptions are: payments for nursing service, laboratory construction, fellowships, or assistance to indigent families (not simply charitable, educational, religious, or scientific).

Part IV

If the balance sheet does not agree with the books of account, all differences must be reconciled in an attached statement.

Form

Document Specs

| Fact | Details |

|---|---|

| Form Title | California Form 541-A |

| Purpose | Report charitable information required by R&TC Section 18635 |

| Who Must File | Trustees of trusts claiming deductions under IRC Section 642(c) or charitable/split-interest trusts |

| Exemption Criteria | Not required if all income must be distributed currently by terms of the governing instrument and applicable local law |

| Applicable Trusts | Charitable trusts, split-interest trusts, pooled income funds, charitable remainder annuity trusts, and remainder unitrusts |

| Governing Law | California Revenue and Taxation Code (R&TC) Section 18635 and specific IRC sections |

| Filing Deadline | On or before April 16, following the taxable year |

| Filing Address | FRANCHISE TAX BOARD PO BOX 942840 SACRAMENTO CA 94240-0000 |

Detailed Instructions for Writing California 541 A

Filing the California Form 541-A is a process that trust administrators or trustees undertake to report charitable amounts associated with a trust. This endeavor is important for maintaining compliance with state regulations and ensuring proper oversight of charitable contributions and distributions. The form itself is detailed, requiring careful attention to accurately report income, deductions, distributions, and the balance sheet for the trust. Below are the steps needed to fill out the form correctly.

- Begin by entering the tax year the form will cover at the top of the page.

- Fill in the Name of the trust and the Federal employer identification number (FEIN).

- List the Name of trustee(s) and provide the Address of each trustee including the number and street, suite number or rural route, PMB number, city, town or post office, state, and ZIP Code.

- Answer the preliminary questions regarding the trust details, including the date the trust was created, residency of the trustees, and whether the grantor was a resident of California during the taxable year. Also, include details if a Form 541 has been filed for the year covered by this return, if there are differences from federal Form 1041-A, and if filing federal Form 990-T is required.

- In Part I - Income and Deductions, enter all sources of income like interest, dividends, business income, and others as instructed. Following, calculate and enter deductions such as taxes, charitable deductions, trustee fees, and any other deductions.

- Part II - Distributions of Income Set Aside in Prior Taxable Years for Charitable Purposes requires detailing income previously set aside for charity that was distributed in the current tax year, itemized by charitable purpose.

- For Part III - Distributions of Principal for Charitable Purposes, itemize principal amounts distributed for charitable purposes during the current tax year, including the payee’s name and address.

- In Part IV - Balance Sheet, provide the beginning and end-of-year book values for various asset categories, detail liabilities, and calculate net assets. Reconcile any differences between the balance sheet and books of accounts in an attached statement.

- Sign and date the form, ensuring that both the trustee and the preparer (if applicable) provide their signatures, SSN/FEIN, and PTIN as required.

Once filled out, the form should be mailed to the address specified on the form by the deadline to avoid potential penalties. This submission is crucial for trustees managing trusts with charitable contributions or distributions, ensuring compliance with California tax laws and regulations.

Things to Know About This Form

What is California Form 541-A, and who needs to file it?

California Form 541-A, titled "Trust Accumulation of Charitable Amounts," is designed for trustees to report specific charitable information as required by the Revenue and Taxation Code (R&TC) Section 18635. Trustees must file this form for a trust claiming a charitable or other deduction under IRC Section 642(c) or for trusts that are either charitable or split-interest trusts. The requirement to file, however, does not apply for any taxable year if the trust is mandated by the governing instrument and applicable law to distribute all of its income for that year currently. Special rules apply to pooled income funds, charitable remainder annuity trusts, charitable remainder unitrusts, simple trusts with tax exemption status under R&TC Section 23701d, and nonexempt charitable trusts.

When is California Form 541-A due?

The due date for filing Form 541-A is April 16, 2001, for trusts operating on a calendar year basis. California allows an automatic six-month extension to file this form, so a formal request for an extension isn't necessary. However, it's important for trustees to be aware of this deadline to ensure compliance and avoid potential penalties.

What are the key sections of California Form 541-A?

Form 541-A is divided into several parts:

- Income and Deductions: This section requires information on various types of income and deductions related to the trust's operations.

- Distributions of Income Set Aside in Prior Taxable Years for Charitable Purposes: Details about income previously set aside for charitable purposes and distributed during the current taxable year must be reported here.

- Distributions of Principal for Charitable Purposes: This part focuses on principal amounts distributed for charitable activities during the taxable year.

- Balance Sheet: A snapshot of the trust's financial status at the beginning and end of the taxable year is required if the total income is above a certain threshold.

Where should California Form 541-A be filed?

Completed Form 541-A should be mailed to the FRANCHISE TAX BOARD, P.O. BOX 942840, SACRAMENTO, CA 94240-0000. This ensures the information is directly submitted to the relevant state tax authorities responsible for processing the form.

What should I do if I discover differences between the balance sheet and my trust’s books of account?

Should there be discrepancies between the balance sheet figures and the trust's book of accounts, trustees are required to reconcile these differences. This reconciliation should be described in detail in a separate attachment accompanying Form 541-A. The attachment should explain each difference, ensuring clarity and accuracy in the trust's financial reporting to the tax authorities.

Common mistakes

-

Not providing the full and accurate name of the trust and Federal employer identification number (FEIN) at the beginning of the form. The form requires the precise identification of the trust, including its FEIN, to ensure that the California Franchise Tax Board (FTB) correctly applies the submitted information. Omitting or inaccurately reporting these details can lead to processing delays or misattribution of the form.

-

Failing to answer all questions in the mandatory questionnaire section. Each question, from the date the trust was created to whether the return on Form 541 has been filed for the year covered, is crucial. Incorrect or incomplete responses can affect the trust’s tax obligations and benefits.

-

Misinterpreting income and deduction sections. The segments that call for detailing the trust's income types and deductions require careful attention. Often, errors occur when trustees inaccurately classify income or overlook allowable deductions, impacting the calculation of the trust's taxable income adversely.

-

Omitting attachments for certain income and deductions, such as federal Schedules C, D, E, and F or other relevant schedules. When the form instructs to attach federal schedules or other documentation for specific types of income or deductions, compliance is not optional. This documentation is vital for verifying the trust's financial activities and justifying the reported amounts.

-

Incorrectly calculating charitable distributions. Part II and III of the form require detailed descriptions and specific amounts regarding distributions for charitable purposes. Errors in this area not only affect the tax treatment of these distributions but can also impact the trust’s fulfillment of its charitable mission.

-

Reconciliation issues in the Balance Sheet section, Part IV. The requirement to reconcile differences if the balance sheet does not agree with the books of account is a significant area where mistakes can occur. Failing to accurately reconcile or explain any discrepancies can result in questions from the FTB, potential audits, and adjustment of the trust's reported financial position.

-

Neglecting to sign and date the form, or if applicable, not providing the preparer’s information. The declaration section at the end of the form acts as a legal certification of the information provided. Incomplete or missing signatures can invalidate the filing, delaying processing and potentially leading to penalties.

Attention to detail and thorough understanding of the trust’s financial and operational activities are paramount when completing California Form 541-A. Trustees must ensure they accurately report all required information and append necessary documentation to avoid the common pitfalls outlined above.

Documents used along the form

When preparing or dealing with the California Form 541-A, which is crucial for reporting trust accumulation of charitable amounts, individuals may often find themselves in need of additional documentation. This comprehensive list highlights other forms and documents that are typically used alongside Form 541-A to ensure accurate and complete financial and charitable reporting for trusts.

- Form 541: California Fiduciary Income Tax Return, necessary for reporting the income, deductions, gains, losses, etc., of estates and trusts.

- Form 1041-A: U.S. Information Return Trust Accumulation of Charitable Amounts, a federal form that parallels California's 541-A, reporting accumulations of income set aside for charity.

- Form 990-T: Exempt Organization Business Income Tax Return, used by trusts to report unrelated business income and possible tax liabilities.

- Schedule D (541): Capital Gain or Loss, attached to Form 541 to detail capital gains and losses incurred by the trust.

- Schedule E (Form 1040): Supplemental Income and Loss, to report income from rents, royalties, partnerships, and other such sources on a federal level.

- Schedule C or C-EZ (Form 1040): Profit or Loss From Business, for detailing any business income or losses attributable to the trust.

- Form 199: California Exempt Organization Annual Information Return, for charitable trusts exempt under California law, detailing their annual financial activities.

- Schedule K-1 (541): Beneficiary's Share of Income, Deductions, Credits, etc., providing each beneficiary with a record of their share of the trust's income and deductions.

- Form 1040: U.S. Individual Income Tax Return, which may be required if the trust generates income that is distributed and reported by individual beneficiaries.

These documents collectively enable comprehensive reporting and compliance with both state and federal tax obligations. Not only do they provide mechanisms for reporting income and charitable contributions, but they also ensure proper communication of financial activities to beneficiaries and tax authorities. As such, understanding each document's role and the information it requires can significantly streamline the administrative tasks associated with trust management and tax preparation.

Similar forms

The California Form 541, California Fiduciary Income Tax Return, shares similarities with the 541-A, particularly in its basic function of reporting income, deductions, and taxes for trusts and estates. Both forms are essential for fiduciaries managing trusts within California, addressing different aspects of tax reporting and compliance. While Form 541 covers broader fiduciary income tax obligations, Form 541-A specifically deals with the reporting of charitable amounts accumulated by a trust, emphasizing the trust's charitable giving aspects.

Form 990, Return of Organization Exempt from Income Tax, is akin to Form 541-A in that both serve entities focused on beneficence, though their target filers differ. Form 990 is for tax-exempt organizations, detailing their financial activities, including income, expenditures, and charitable activities, much like how Form 541-A reports charitable distributions by trusts. The emphasis on transparency in charitable activities and financial accountability is a strong common thread between these forms.

Form 1041, U.S. Income Tax Return for Estates and Trusts, is the federal counterpart to California's Form 541 and indirectly relates to Form 541-A through its provision for reporting income and charitable deductions at the national level. Form 541-A complements Form 1041 by tracking the specific use of charitable distributions within California, ensuring that trusts comply with both state and federal tax obligations related to their charitable activities.

Form 990-T, Exempt Organization Business Income Tax Return, and Form 541-A are similar because they both involve specific instances where tax-exempt entities, including trusts with charitable purposes, must report income. While Form 990-T focuses on taxable business income earned by tax-exempt entities, Form 541-A deals with the accumulation of charitable amounts, showing the specific rules that apply to income related to charitable activities, even within tax-exempt operations.

Form 1041-A, U.S. Information Return Trust Accumulation of Charitable Amounts, directly parallels Form 541-A, serving a similar purpose at the federal level. It reports on the accumulation and distribution of charitable amounts by trusts, offering a federal perspective on the activities that Form 541-A covers for California. This connection underscores the dual layer of reporting - state and federal - required for trusts engaged in charitable efforts.

The Schedule K-1 (Form 1041), Beneficiary’s Share of Income, Deductions, Credits, etc., while technically a part of Form 1041, shares a functional similarity with Form 541-A in terms of disclosing how distributions, including those for charitable purposes, affect the tax obligations of trust beneficiaries. This linkage highlights the importance of transparency in how trusts manage and distribute funds for charitable and non-charitable purposes alike.

Form 199, California Exempt Organization Annual Information Return, and Form 541-A intersect in their focus on organizations and entities that undertake charitable work. Though Form 199 is for tax-exempt organizations reporting their annual financial information, and Form 541-A is specifically for trusts reporting charitable accumulations, both ensure these entities adhere to regulations governing their tax-privileged operations, emphasizing accountability in their fiscal management.

Form 5227, Split-Interest Trust Information Return, is a federal form for trusts that have both charitable and non-charitable beneficiaries, similar to the purpose of California's Form 541-A in focusing on charitable aspects. It details income, deductions, and distributions of such trusts. The similarity lies in their shared goal of monitoring how split-interest trusts manage their dual obligations to both charitable causes and private beneficiaries.

Dos and Don'ts

Filling out the California 541-A form, a trust accumulation of charitable amounts, requires precision and understanding of the specific requirements and information needed. To ensure accuracy and compliance, here are key dos and don'ts:

- Do thoroughly review the instructions provided by the California Franchise Tax Board before starting to fill out the form to understand the form's purpose and assess the need for filing it.

- Do ensure that all the information about the trust, including the name of the trust, Federal employer identification number (FEIN), and the names and addresses of trustee(s), is current and correct.

- Do accurately report all income and deductions in Part I, following the instructions for Form 541 to determine which lines to complete based on total income.

- Do attach all required schedules and statements, such as federal Schedules C, C-EZ, D, E, F, and Schedule D-1, or any other documentation that supports the numbers entered on the form.

- Do itemize and describe charitable distributions in detail in Part II and Part III, including the purpose of the disbursements and the names and addresses of the payees, for both income set aside in previous years and principal distributed in the current year for charitable purposes.

- Do reconcile any differences between the balance sheet in Part IV and the books of account by attaching a statement explaining the variances, to ensure transparency and accuracy.

- Do sign and date the form, thereby certifying under penalty of perjury that the information provided is true, correct, and complete to the best of one's knowledge.

- Don't overlook the requirement to file Form 541-A by April 16, 2001, for the given taxable year. Missing this deadline can lead to penalties and interest.

- Don't neglect the need to attach a separate list if more space is needed. Failing to provide complete information may result in processing delays or questions from the Franchise Tax Board.

- Don't assume California tax laws align perfectly with federal tax laws. Although Form 541-A instructions note some level of conformity with the Internal Revenue Code as of January 1, 1998, recognize that discrepancies may exist and affect reporting requirements.

- Don't forget to attach a schedule explaining any differences if the amounts shown on the form differ from those reported on federal Form 1041-A, to avoid processing delays or audits.

- Don't use a post office box number when a private mailbox (PMB) number is required. Ensure correct and complete mailing addresses for all trustees.

- Don't ignore the automatic six-month extension to file Form 541-A if more time is needed, but remember that this extension does not negate the requirement to eventually file the form.

- Don't leave any required fields blank. Incomplete forms may be returned or may lead to misinterpretation of the trust's charitable activities and financial situation.

Misconceptions

When it comes to the California Form 541-A, several misconceptions can lead to confusion among trustees or those involved in managing trusts. Understanding the form's actual purpose and requirements can help clear up many of these misunderstandings.

- Misconception 1: The Form 541-A is optional for all trusts.

This is incorrect because Form 541-A is specifically required for trusts that claim a charitable or other deduction under IRC Section 642(c) or for a charitable or split-interest trust. It's not optional for these entities.

- Misconception 2: You need to file Form 541-A for any charitable trust, regardless of its activities during the year.

Actually, Form 541-A is not required for any taxable year if the trustee is required by the governing instrument and applicable local law to distribute currently all the income of the trust for such year.

- Misconception 3: Form 541-A applies to fiscal years as well as calendar years.

The form is specifically for calendar years only, as clearly stated in its heading.

- Misconception 4: There's no deadline for submitting Form 541-A.

Form 541-A must be filed on or before April 16, following the close of the taxable year. California does grant an automatic six-month extension, but the original deadline is April 16.

- Misconception 5: Digital submissions of Form 541-A are acceptable.

As of the information provided, Form 541-A must be mailed to the specified Franchise Tax Board address in Sacramento, California, implying that electronic filing is not an option.

- Misconception 6: All trusts must attach their balance sheet to Form 541-A.

Only trusts with total income over $25,000 are required to complete the full balance sheet section (Part IV). Others complete only selected lines.

- Misconception 7: Trusts exempt under R&TC Section 23701d are not required to file Form 541-A.

This is misleading because simple trusts that received an exemption letter from the Franchise Tax Board are considered corporations for tax purposes and might still need to file Form 541-A if they claim deductions under IRC Section 642(c).

- Misconception 8: The trustee's personal information is not required on Form 541-A.

The form requires significant details about the trustee, including their name, address, and the federal employer identification number (FEIN) of the trust, demonstrating the importance of the trustee's information.

- Misconception 9: Discrepancies in the balance sheet and books of account are acceptable without explanation.

If there are differences between the balance sheet and the books of account, these must be reconciled in an attached statement, indicating that discrepancies are not acceptable without proper explanation.

- Misconception 10: Form 541-A is the same as federal Form 1041-A.

While both forms deal with trusts, Form 541-A is specific to California and has different requirements from federal Form 1041-A, particularly in terms of conforming to the state's adaptation of federal tax laws.

Understanding these key points helps in navigating the complexities of trust taxation in California accurately and ensures that trusts comply with state-specific filing requirements.

Key takeaways

When working with the California Form 541-A, it's crucial to understand its components and requirements to ensure accurate and timely filing. Here are key takeaways:

- The Form 541-A is specifically designed for reporting the accumulation of charitable amounts by trusts within the state of California for calendar years only.

- It is required for trusts that claim a charitable or other deductions under Internal Revenue Code (IRC) Section 642(c) or for charitable or split-interest trusts, with some exceptions based on income distribution obligations.

- The due date for filing Form 541-A is April 16 following the taxable year, but there's an automatic six-month extension available without the need to file a request form.

- Trustees must complete and mail the form to the FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA 94240-0000, ensuring all the applicable parts of the form are filled out based on the trust's activities and financials.

- Trusts that are not exempt from taxation and have their unexpired interests devoted to charitable purposes as described in IRC Section 170(c) are required to file this form.

- In cases where the balance sheet on Form 541-A does not align with the books of account, trustees are required to reconcile all differences and attach a statement explaining these reconciliations.

- If the total income is $25,000 or less, certain sections of the form can be skipped, simplifying the filing process for smaller trusts.

- It is crucial for the name of the trust, the Federal employer identification number (FEIN), and the information about the trustee(s), including their address, to be accurately provided to avoid processing delays or issues.

Understanding these key points helps trustees and preparers ensure that the Form 541-A is completed and filed correctly, aiding in the smooth operation of the trust's charitable activities and compliance with California state law.

Discover More PDFs

Pre Lien Form - This notice is part of California's mechanics lien law, designed to keep property owners informed about who is providing labor, services, or materials to their property, potentially affecting their property title.

Request for Entry of Default - Can be used by process servers, sheriff, or marshall to certify service of legal documents.

Duties and Liabilities of Personal Representative - Details the review process by the court for financial accounting of the estate.