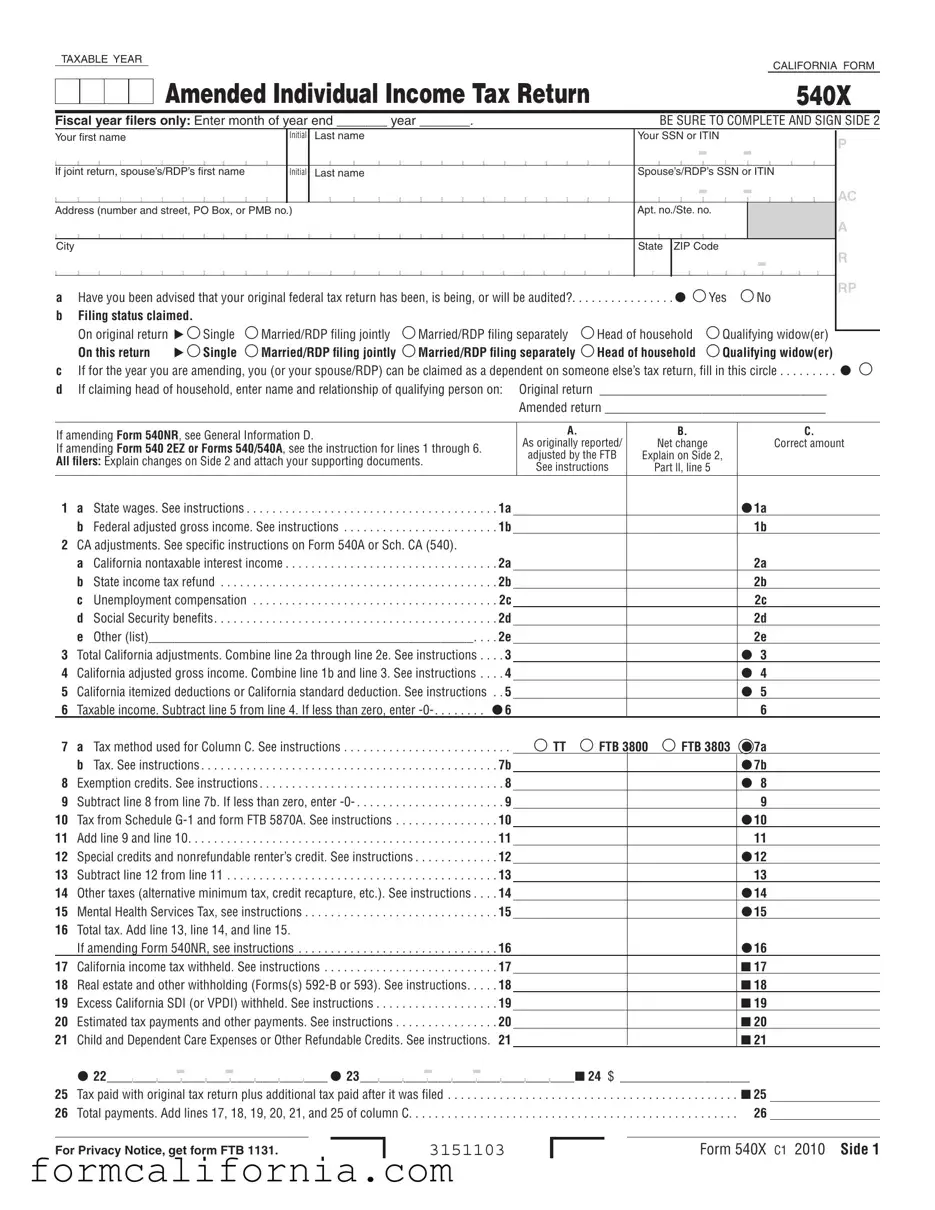

Blank California 540X PDF Form

Filing an amended tax return in California often involves using the California Form 540X, officially known as the Amended Individual Income Tax Return. This form serves as a crucial resource for taxpayers who need to correct or update information on their previously filed state tax return. It allows for adjustments to various sections of one's income, deductions, tax credits, or filing status that were originally reported. Whether changes stem from a reassessment of one's financial situation, errors caught after filing, or adjustments following an audit, the 540X form provides a pathway to set the record straight. Importantly, the form also includes sections for explaining the reasons behind the amendments and attaching any supporting documents to substantiate the changes made. Understanding when and how to properly complete and submit this form can ensure taxpayers stay compliant with the state's tax requirements, potentially avoiding penalties while securing any additional refunds owed.

Document Preview Example

TAXABLE YEAR

CALIFORNIA FORM

|

|

|

|

Amended Individual Income Tax Return |

540X |

|

|

|

|

||

Fiscal year ilers only: Enter month of year end _______ year _______. |

BE SURE TO COMPLETE AND SIGN SIDE 2 |

||||

Your first name |

|

Initial |

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your SSN or ITIN |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If joint return, spouse’s/RDP’s first name |

|

Initial |

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s SSN or ITIN |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (number and street, PO Box, or PMB no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt. no./Ste. no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

ZIP Code |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

a Have you been advised that your original federal tax return has been, is being, or will be audited?. . . . . . . . . . . . . . . . Yes |

No |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

bFiling status claimed.

On original return |

Single |

Married/RDP filing jointly |

Married/RDP filing separately Head of household |

Qualifying widow(er) |

On this return |

Single |

Married/RDP filing jointly |

Married/RDP filing separately Head of household |

Qualifying widow(er) |

cIf for the year you are amending, you (or your spouse/RDP) can be claimed as a dependent on someone else’s tax return, fill in this circle . . . . . . . . .

d If claiming head of household, enter name and relationship of qualifying person on: Original return ___________________________________

Amended return __________________________________

P

AC

A

R

RP

If amending Form 540NR, see General Information D. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. |

|

B. |

|

C. |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As originally reported/ |

Net change |

|

Correct amount |

|||||||||||||||||||||

If amending Form 540 2EZ or Forms 540/540A, see the instruction for lines 1 through 6. |

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

adjusted by the FTB |

Explain on Side 2, |

|

|

||||||||||||||||||||||||||||||

All filers: Explain changes on Side 2 and attach your supporting documents. |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

See instructions |

Part ll, line 5 |

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

1 |

a State wages. See instructions |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 1a |

|

|

|

|

1a |

|||||||||||||||||||||||||

|

. . .b Federal adjusted gross income. See instructions |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 1b |

|

|

|

1b |

|||||||||||||||||||||||||

2 |

CA adjustments. See specific instructions on Form 540A or Sch. CA (540). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

a California nontaxable interest income |

. . . . . |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 2a |

|

|

|

|

2a |

|||||||||||||||||||||||

|

b |

.State income tax refund |

. |

. . . . |

. . . |

. . . . |

|

. . . . |

. . . . . |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 2b |

|

|

|

|

2b |

||||||||||||||||

|

c |

. . . . . . . . . . . . . . . . . . . .Unemployment compensation |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 2c |

|

|

|

|

2c |

||||||||||||||||||||||||

|

d |

. .Social Security benefits |

. |

. . . . |

. . . |

. . . . |

|

. . . . |

. . . . . |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 2d |

|

|

|

|

2d |

||||||||||||||||

|

e |

. . .Other (list)__________________________________________________ |

. 2e |

|

|

|

|

2e |

||||||||||||||||||||||||||||||

3 |

Total California adjustments. Combine line 2a through line 2e. See instructions . . |

. . 3 |

|

|

|

|

|

|

|

|

|

3 |

||||||||||||||||||||||||||

4 |

California adjusted gross income. Combine line 1b and line 3. See instructions . . |

. . 4 |

|

|

|

|

|

|

|

|

|

4 |

||||||||||||||||||||||||||

5 |

California itemized deductions or California standard deduction. See instructions |

. . 5 |

|

|

|

|

|

|

|

|

5 |

|||||||||||||||||||||||||||

6 |

. . . . . .Taxable income. Subtract line 5 from line 4. If less than zero, enter |

. |

. |

6 |

|

|

|

|

|

|

|

|

6 |

|

||||||||||||||||||||||||

7 |

a Tax method used for Column C. See instructions . . . |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . . . |

. |

|

|

|

TT |

FTB 3800 FTB 3803 |

7a |

|||||||||||||||||||||||

|

b |

Tax. See instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

. 7b |

|

|

|

|

7b |

||||||||||||

|

. |

. . . . |

. . . |

. . . . |

|

. . . . |

. . . . . |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. |

|

|

|

|||||||||||||||||||||

8 |

Exemption credits. See instructions |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. . 8 |

|

|

|

|

|

|

|

|

|

8 |

|||||||||||||||||||

9 |

.Subtract line 8 from line 7b. If less than zero, enter |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. . 9 |

|

|

|

|

|

|

|

|

9 |

|

|||||||||||||||||||

10 |

Tax from Schedule |

. . |

. 10 |

|

|

|

|

|

|

|

|

|

10 |

|||||||||||||||||||||||||

11 |

. . . . . .Add line 9 and line 10 |

. |

. . . . |

. . . |

. . . . |

|

. . . . |

. . . . . |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 11 |

|

|

|

|

|

|

|

|

|

11 |

|

|||||||||||

12 |

Special credits and nonrefundable renter’s credit. See instructions |

. |

. . |

. 12 |

|

|

|

|

|

|

|

|

|

12 |

||||||||||||||||||||||||

13 |

Subtract line 12 from line 11 |

. |

. . . . |

. . . |

. . . . |

|

. . . . |

. . . . . |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 13 |

|

|

|

|

|

|

|

|

|

13 |

|

|||||||||||

14 |

Other taxes (alternative minimum tax, credit recapture, etc.). See instructions |

. |

. . |

. 14 |

|

|

|

|

|

|

|

|

|

14 |

||||||||||||||||||||||||

15 |

Mental Health Services Tax, see instructions . . . . |

. . . . . |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 15 |

|

|

|

|

|

|

|

|

|

15 |

||||||||||||||||||

16 |

Total tax. Add line 13, line 14, and line 15. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

||||||||||||||

|

If amending Form 540NR, see instructions |

. . . . . |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 16 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

17 |

California income tax withheld. See instructions . |

. . . . . |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 17 |

|

|

|

|

|

|

|

|

|

17 |

||||||||||||||||||

18 |

Real estate and other withholding (Forms(s) |

. |

. . |

. 18 |

|

|

|

|

|

|

|

|

|

18 |

||||||||||||||||||||||||

19 |

Excess California SDI (or VPDI) withheld. See instructions |

. 19 |

|

|

|

|

|

|

|

|

|

19 |

||||||||||||||||||||||||||

20 |

Estimated tax payments and other payments. See instructions |

. . |

. 20 |

|

|

|

|

|

|

|

|

|

20 |

|||||||||||||||||||||||||

21 |

Child and Dependent Care Expenses or Other Refundable Credits. See instructions. 21 |

|

|

|

21 |

|||||||||||||||||||||||||||||||||

|

|

- |

|

- |

|

|

|

|

|

|

|

- |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

22 |

|

|

|

__________________________________ |

|

|

|

|

|

23 |

|

|

|

|

_________________________________ |

|

|

|

|

|

24 $ ____________________ |

|

||||||||||||||

25 |

Tax paid with original tax return plus additional tax paid after it was filed . . . . |

. |

. . . . |

. . |

. |

. . . . |

|

. . . . |

. . |

. . . . . . |

. . . . . . . . . . . . . . . . . |

25 |

||||||||||||||||||||||||||

26 |

. . . . . . . . . .Total payments. Add lines 17, 18, 19, 20, 21, and 25 of column C |

. |

. . . . |

. . |

. |

. . . . |

|

. . . . |

. . |

. . . . . . |

. . . . . . . . . . . . . . . . . |

26 |

|

|||||||||||||||||||||||||

For Privacy Notice, get form FTB 1131.

3151103

Form 540X C1 2010 Side 1

Your name: |

Your SSN or ITIN: |

26a Enter the amount from Side 1, line 26 |

. 26a |

|

27 |

Overpaid tax, if any, as shown on original tax return or as previously adjusted by the FTB. See instructions |

27 |

28 |

Subtract line 27 from line 26a. If line 27 is more than line 26a, see instructions |

. . 28 |

29 |

Use tax payments as shown on original tax return. See instructions |

29 |

30 |

Voluntary contributions as shown on original tax return. See instructions |

30 |

31 |

Subtract line 29 and line 30 from line 28 |

. . 31 |

32AMOUNT YOU OWE. If line 16, column C is more than line 31, enter the difference

|

and see instructions |

32 |

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

|

|

|

|

||||||

33 |

Penalties/Interest. See instructions: Penalties 33a______________________ Interest 33b______________________________ 33c |

|

|||||||||||

34 |

REFUND. If line 16, column C is less than line 31, enter the difference. See instructions |

34 |

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

|

|

|

|||||||

Part I Nonresidents or

. 00

. 00

Taxable years 2003 and after, enter amounts from your revised Short or Long Form 540NR. Your amended tax return cannot be processed without this |

||

information. For all taxable years attach your revised Short or Long Form 540NR and Schedule CA (540NR). |

|

|

1 |

Exemption amount from Short or Long Form 540NR, line 11 |

1 |

2 |

Federal adjusted gross income from Short or Long Form 540NR, line 13 |

2 |

3 |

Adjusted gross income from all sources from Short or Long Form 540NR, line 17 |

3 |

4 |

Itemized deductions or standard deduction from Short or Long Form 540NR, line 18 |

4 |

5 |

California adjusted gross income from Short or Long Form 540NR, line 32 |

5 |

6 |

Tax from Schedule |

6 |

7Special credits (from Long Form 540NR, lines 58, 59, or 60) and nonrefundable renter’s credit from Short and

Long Form 540NR, line 61 (Combine) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Alternative minimum tax from Long Form 540NR, line 71 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 9 Mental Health Services Tax (taxable years 2005 and after) from Long Form 540NR, line 72 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 10 Other taxes and credit recapture from Long Form 540NR, line 73 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Part II Explanation of Changes

1Enter name(s) and address as shown on original return below (if same as shown on this tax return, write “Same”). If changing from

separate tax returns to a joint tax return, enter names and addresses from original tax returns._________________________________________________

_______________________________________________________________________________________________________________________

2 |

Are you filing this Form 540X to report a final federal determination? |

Yes |

No |

|

If “Yes,” attach a copy of the final federal determination and all supporting schedules and data. |

Yes |

No |

3 |

Have you been advised that your original California tax return has been, is being, or will be audited? |

||

4 |

Did you file an amended tax return with the Internal Revenue Service on a similar basis? See General Information E |

Yes |

No |

5Explanation and Attachments. Explain your changes below. Attach a separate sheet if needed (see instructions).

Explain in detail each change made. Include: |

Attach: |

||

• |

Item being changed. |

• |

Revised California tax return including all forms and schedules. |

• |

Amount previously reported and corrected amount. |

• |

Include federal schedules if you made a change to your federal tax return. |

• |

Reason the change was needed. |

• |

Documents supporting each change, such as corrected |

• |

List of supporting documents you have attached. |

|

escrow statements, court documents, contracts, etc. |

Be sure to include your name and SSN or ITIN on each attachment. Refer to the tax booklet for the year you are amending.

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

Sign

Here

It is unlawful to forge a spouse’s/RDP’s signature.

Where to File Form 540X

Under penalties of perjury, I declare that I have filed an original tax return and that I have examined this amended tax return including accompanying schedules and statements and to the best of my knowledge and belief, this amended tax return is true, correct, and complete.

|

Your signature |

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s signature (if filing jointly, both must sign) |

Daytime phone number (optional) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

X |

|

|

|

|

|

|

|

|

|

X |

( |

|

|

|

|

|

|

|

|

|

|

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid preparer’s signature (declaration of preparer is based on all information of which preparer has any knowledge) |

|

|

|

|

|

|

|

Paid preparer’s PTIN/SSN |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s name (or yours if |

|

|

|

|

|

|

|

|

|

Firm’s address |

|

|

|

|

|

|

|

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

– |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do not file a duplicate amended tax return unless one is requested. This may cause a delay in processing your amended tax return and any claim for refund.

If you are due a refund, have no amount due, or paid electronically, |

|

|

mail your tax return to |

FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA |

|

If you owe, mail your return and check or money order to: |

FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA |

Side 2 Form 540X C1 2010

3152103

Document Specs

| Fact | Detail |

|---|---|

| Form Type | California Form 540X: Amended Individual Income Tax Return |

| Purpose | Used by individuals to amend a previously filed California Form 540 or 540NR |

| Audience | Residents, part-year residents, or non-residents of California who need to correct information on their original tax return |

| Sections to Complete | Includes information on taxpayer's income, deductions, tax liability, and payments already made |

| Amendment Reasons | Common reasons for amending include correcting income, changing filing status, or claiming additional deductions or credits. |

| Documentation | Requires attachment of supporting documents for the changes made, such as corrected W-2s, 1099s, and any relevant schedules |

| Governing Law | Administered under California Revenue and Taxation Code |

Detailed Instructions for Writing California 540X

Filing an amended return can be seen as rectifying your tax record with the California Franchise Tax Board. It's important when circumstances have changed or errors were discovered after the original filing. The California Form 540X allows taxpayers to make corrections to a previously filed Form 540 or Form 540NR. The following steps are designed to guide you through the process of completing the 540X form accurately.

- Enter the taxable year you are amending at the top of the form.

- Provide your first name, initial, last name, and Social Security Number or Individual Taxpayer Identification Number (SSN or ITIN). If this is a joint return, also include your spouse’s/RDP's first name, initial, last name, and SSN or ITIN.

- Fill in your address, including the number and street, apartment or suite number, city, state, and ZIP code.

- Answer whether your original federal tax return was audited or not by marking the appropriate box.

- Indicate the filing status on the original return and on this amended return.

- If applicable, mark the circle if you or your spouse/RDP can be claimed as a dependent on someone else’s return for the year you are amending.

- If claiming head of household, enter the name and relationship of the qualifying person for both the original and amended returns, if this information has changed.

- Carefully fill out Sections A, B, and C, as originally reported/adjusted, the net change, and the correct amount, respectively.

- This includes state wages, federal adjusted gross income, California adjustments, adjusted gross income, deductions, taxable income, tax calculation, exemptions, credits, and other taxes.

- Under Part II, provide a detailed explanation of the changes you are making. Attach all necessary documentation to support these changes, such as corrected W-2s, 1099s, court documents, etc.

- Ensure that your name and SSN or ITIN are on each attached document.

- Review the entire form and attached documents to ensure accuracy and completeness.

- Sign and date the form. If filed jointly, both spouses/RDPs must sign. Provide a daytime phone number where you can be reached.

- If you worked with a paid preparer, have them sign and provide their information in the designated section.

- Refer to the "Where to File" section at the bottom of Form 540X for the correct mailing address, which differs depending on whether you are due a refund or owe additional tax.

Mailing your amended return to the correct address helps expedite the processing time and ensures that any adjustments are made to your tax record promptly. Remember to only mail the amended return once unless specifically requested by the California Franchise Tax Board, as duplicate filings can delay the processing of your amendment.

Things to Know About This Form

What is Form 540X and when should it be used?

Form 540X is the Amended Individual Income Tax Return for California. It's used to correct or update information on your original filed Form 540, 540NR, or 540 2EZ California tax returns. Situations that might necessitate filing a Form 540X include reporting additional income, claiming additional deductions or credits not claimed on the original return, or changing your filing status. It should be filed after you have filed your original tax return and have discovered errors or received new information that changes your tax calculation.

How do I complete Form 540X?

To correctly complete Form 540X, start by providing your personal information at the top of the form. Then, in Part I, list the amounts from your original California tax return (as originally reported or adjusted by the California Franchise Tax Board), the net change (increase or decrease), and the correct amount after amendment. For Part II, provide a detailed explanation of the changes being made. Ensure to attach any supporting documents such as W-2s, 1099s, K-1s, or any other relevant materials to substantiate the adjustments. Carefully review the instructions for each line item affected by your amendments, as some may require additional forms or schedules to be completed and attached.

What documents do I need to attach with Form 540X?

When filing Form 540X, attach all documents that support the changes made on your amended return. These include, but are not limited to:

- Corrected W-2s or 1099s if you're reporting changes in income,

- Schedules or forms that have new or corrected amounts,

- Any federal schedules if changes were also made to your federal return, and

- Documentation that supports any new deductions or credits you are claiming.

Where and how do I file Form 540X?

Where you send Form 540X depends on whether you owe additional taxes or are expecting a refund. If you are due a refund, have no additional amount due, or paid electronically, send your Form 540X to the FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA 94240-0002. If you owe additional taxes with your amended return, mail it with your payment to the FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0001. Before mailing, double-check that you have signed the form and included all necessary documents. Do not file a duplicate amended return unless specifically requested as it may delay processing.

Common mistakes

Filling out tax forms can be a daunting task. The California 540X form, used to amend individual income tax returns, is no exception. Mistakes can delay processing and affect the accuracy of your tax liabilities or refunds. Here are six common errors people make when completing this form:

- Incorrect information: One of the simplest yet most common mistakes is entering incorrect information. This includes misspelled names, wrong Social Security numbers, or inaccurate address details. It's crucial to double-check all entries against official documents.

- Missing signatures: An unsigned form is like an unanswered call—it goes nowhere. Both the taxpayer and the spouse or Registered Domestic Partner (RDP), if filing jointly, must sign the form. Failure to do so will result in the rejection of the amended return.

- Failing to attach supporting documents: When making changes to your tax return, you must explain the reasons for these changes and attach any relevant supporting documents, such as corrected W-2s, 1099s, or court documents. Not including these can lead to delays and questions from the FTB (Franchise Tax Board).

- Omitting the explanation of changes: Part II of the form requires a detailed explanation of the changes being made. Some filers forget to fill out this section or provide insufficient details, which can result in processing delays or the FTB not accepting the changes.

- Mixing up the figures: Another common mistake is confusing the columns for ‘As originally reported’ and ‘Correct amount’. It's important to carefully fill out the correct amounts in the corresponding columns to avoid discrepancies.

- Not using the updated forms: Tax laws and forms can change from year to year. Using an outdated form can mean missing critical updates or making errors based on old information. Always ensure you're using the most current form for the tax year you are amending.

By avoiding these errors and taking the time to review your California 540X form carefully, you can ensure a smoother process in amending your tax returns.

Documents used along the form

The completion and amendment of the California Form 540X, being a critical process for adjusting an individual income tax return, inevitably involve the integration of several other forms and documents to ensure accuracy and compliance with state regulations. This comprehensive collaboration of documents ensures that any adjustments made to an individual’s tax records are clear, rational, and supported by the appropriate evidence. Outlined below is a list of other forms and documents that are frequently used in conjunction with Form 540X to facilitate this complex adjustment process.

- Form 540 or 540NR: These are the original California Resident or Nonresident Income Tax Return forms. They are essential because they provide the baseline figures that the 540X form seeks to adjust.

- Schedule CA (540): This schedule is used to make California adjustments to the taxpayer's federal adjusted gross income. It plays a crucial role in reconciling differences between federal and state tax laws.

- Schedule D (540): For those who need to report capital gains or losses, this form is often required. It details the transactions that led to capital gains or losses, impacting the total taxable income.

- Form W-2: Wage and Tax Statements from employers are vital. They substantiate the earnings and tax withholdings declared on the tax return.

- Form 1099: Various 1099 forms report different types of income, such as interest, dividends, and independent contractor income. These documents are necessary to verify income sources not subject to regular wage withholding.

- Form 592-B or 593: These forms relate to real estate or other withholding tax documents. They are crucial for taxpayers who have undergone transactions requiring state income tax to be withheld.

- Form FTB 3519: This form is used for making estimated tax payments for individuals. If adjustments to a tax return impact estimated payments, this form may need to accompany the 540X.

- Form FTB 3885: Depreciation and Amortization Adjustments are documented here, necessary for calibrating the tax implications of depreciating assets or amortizing expenses.

- Supporting Schedules or Documents: Depending on the nature of the amendment, additional schedules or documents—like corrected W-2s, escrow statements, court documents, or other evidential paperwork—may be necessary to support changes made on the amended return.

Form 540X and its accompanying documents constitute a framework designed to ensure the taxpayer's records accurately reflect their fiscal activity and comply with California tax laws. By meticulously compiling and reviewing these documents, taxpayers and professionals can navigate the complexities of tax amendment with confidence, ensuring that every adjustment is substantiated and clearly communicated to the California Franchise Tax Board. This diligent approach aids in minimizing errors and maximizing the efficiency of the tax amendment process.

Similar forms

The California Form 540X serves a purpose similar to the federal IRS Form 1040X, which is an Amended U.S. Individual Income Tax Return. Both forms are designed to correct or update information reported on an original tax return. Taxpayers may need to amend their returns for various reasons, including reporting additional income, correcting credits or deductions, or changing their filing status. While the 540X pertains to California state taxes, the 1040X addresses federal tax obligations, paralleling each other in function and goal.

Another document that shares similarities with the California Form 540X is the IRS Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. Although the latter is specifically for extending the filing deadline, both forms demonstrate the notion of modifying one's tax filing obligations after the original due date. Whereas Form 4868 extends the filing period, Form 540X amends the actual content of the tax return once filed, highlighting both forms’ roles in providing taxpayers with flexibility in managing their tax responsibilities.

The Form 8822, Change of Address, by the IRS, while not directly related to amending tax return information, complements the purpose behind Form 540X by facilitating updates to personal information that could impact tax administration. When taxpayers move and change their addresses, updating this information ensures they receive crucial tax correspondence. Similar to how the 540X allows Californians to correct or update return details, Form 8822 ensures the IRS has current personal information, both forms aiding in maintaining accurate tax records.

California's Form 3522, LLC Tax Voucher, is akin to Form 540X in that it deals with specific tax obligations for certain entities—in this case, limited liability companies (LLCs) paying the annual state LLC tax. Both documents are integral to the state’s tax system, with Form 3522 focusing on advance payments for LLCs and Form 540X addressing amendments to previously filed individual returns. This demonstrates the diverse mechanisms through which taxpayers can fulfill or correct their tax liabilities in California.

The Schedule CA (540), California Adjustments - Residents, is another form closely related to the 540X, as it specifically addresses adjustments to federal adjusted gross income and deductions that affect California taxpayers. It's a complementary form that often accompanies the 540X when there are discrepancies between federal and state tax obligations that necessitate amendments. The relationship between these forms emphasizes the customization of federal tax information to adhere to California's tax laws.

Similarly, the California Form 3506, Child and Dependent Care Expenses Credit, relates to the 540X when taxpayers need to amend their returns to correct or include information about child and dependent care expenses eligible for credit. Mistakes or updates to this information can lead to amended returns via Form 540X, illustrating how specific tax benefits are claimed or corrected on state tax returns.

For business entities, the California Form 568, Limited Liability Company Return of Income, parallels the 540X in its role for LLCs adjusting their income reports or claiming deductions after initially filing. Though 540X is for individuals, the concept of amending a tax return to correct or update information remains consistent across different types of taxpayers, including businesses.

On a broader scale, the Form 1099-MISC, Miscellaneous Income, issued by the IRS, indirectly relates to the need for a 540X when taxpayers receive corrected or additional 1099s after filing their original tax returns. If new or corrected information impacts taxable income, filing an amended return with Form 540X becomes necessary, showcasing how external documents can trigger adjustments in already filed tax returns.

Last, the Form W-2C, Corrected Wage and Tax Statement, shares a functional similarity with the 540X, as it serves to correct wage and tax information employers report to the IRS and Social Security Administration. For employees, receiving a Form W-2C may necessitate amending their tax returns using Form 540X if the corrected information alters their tax liability, highlighting the interconnectedness of tax documentation and the importance of accurate filing.

Dos and Don'ts

Filling out the California 540X form, an Amended Individual Income Tax Return, requires careful attention to detail and an understanding of your tax situation. Whether correcting errors or reporting changes to your income, deductions, or credits, the following guidelines can help ensure that the process goes smoothly and your amended return is accurate.

What You Should Do:

Review your original tax return alongside the 540X form to identify all changes that need to be made. This ensures accuracy in reporting and reduces the risk of further amendments.

Gather and attach all necessary documentation to support the amendments you are making, such as corrected W-2s, 1099s, or court documents. Thorough documentation will substantiate the changes and facilitate a smoother review process by the tax authority.

Explain each change made on the return clearly in Part II, indicating what was reported originally, the corrected amounts, and the reason for each correction. Clear explanations help the processing team understand the context and reason behind each amendment.

Ensure that all necessary sections of the form are signed. If filing jointly, both spouses or registered domestic partners must sign the form, confirming the accuracy of the amended return.

What You Should Not Do:

Do not overlook the importance of double-checking your calculations and the completion of all relevant fields. Errors can delay the processing of your amendment and may lead to additional queries from the tax authority.

Avoid submitting the amended return without the required attachments or supporting documentation. Failing to include these can result in processing delays or even the rejection of your amendment.

Resist the temptation to file another amended return before receiving confirmation that the first has been processed. This can complicate the processing of your returns and may lead to unnecessary delays.

Do not forget to update your address or contact information if it has changed since the original return was filed. Accurate info ensures that you receive all correspondence related to your amendment in a timely manner.

By adhering to these dos and don'ts, you can navigate the process of amending your California tax return more efficiently and with greater confidence.

Misconceptions

There are several misconceptions surrounding the California Form 540X, which is used for amending an individual's state income tax return. Clearing up these misunderstandings can help taxpayers accurately navigate the process of amending their tax returns.

Misconception 1: Form 540X is only for correcting errors on the original tax return.

While it's commonly believed that Form 540X is solely for correcting errors, it actually serves a broader purpose. Taxpayers can use this form to adjust their income, deductions, or credits due to overlooked information, changes in tax status, or in response to federal tax return adjustments. This includes adding previously unreported income or claiming deductions and credits not originally claimed.

Misconception 2: Amending a tax return with Form 540X will trigger an audit.

Many taxpayers hesitate to file an amended return out of fear it will automatically lead to an audit. However, filing a 540X does not inherently increase the odds of an audit. The form is designed to correct or update tax return information, and if used appropriately, simply reflects the taxpayer's intent to comply with tax laws fully.

Misconception 3: If you expect a refund from your original return, you must wait for the refund before filing Form 540X.

It's a common belief that taxpayers must wait for their original return's refund before amending their tax return. However, there's no need to wait to receive the original refund. Taxpayers should file Form 540X as soon as they discover discrepancies or changes that need to be made to their state return. Refunds or additional taxes owed are processed separately from the original return.

Misconception 4: A separate Form 540X is needed for each year you wish to amend.

Some taxpayers mistakenly believe they can use a single Form 540X to amend returns for multiple years. In truth, a separate Form 540X must be completed for each tax year that requires amendment. Each form is specific to the year it amends and ensures the correct processing and application of changes to that year's tax liability.

In conclusion, understanding the true purpose and procedures related to Form 540X can significantly ease the process of amending a California tax return. Taxpayers are encouraged to seek accurate information and consider professional advice if uncertain about how to proceed with their tax amendments.

Key takeaways

When you need to correct your previously filed California personal income tax return, the California 540X form is your go-to document. Understanding the proper way to fill out and utilize this form is crucial to ensure accuracy and avoid common pitfalls. Here are eight key takeaways to guide you through this process:

- The 540X form is used to amend a previously filed California individual income tax return. It's essential when changes to income, deductions, credits, or filing status need to be reflected after the original filing.

- Before starting the amendment process, you must have already filed an original tax return. The 540X form serves as a correction to that original return and cannot be used as an initial filing.

- Documentation is key: Attach all necessary supporting documents that validate the changes made on your amended return. This could include W-2s, 1099s, receipts, or other relevant financial documents.

- For those who have altered their federal tax return or who have been audited by the IRS, disclosing this information on the 540X form is necessary. It ensures consistency between federal and state tax information.

- If amending returns that involve special filing statuses such as "Head of Household" or adjustments specific to nonresidents, follow the detailed instructions provided for those situations to accurately convey the changes.

- Thoroughly explain the reason for each amendment in the designated section. Clarity here can prevent delays or questions from the tax board.

- Both sides of the form must be completed. The front side focuses on numerical adjustments, while the reverse side is designated for explanations and specific details regarding the changes.

- After finishing the form, review it carefully for accuracy and completeness. Signing the form attests under penalty of perjury that everything stated is true to the best of your knowledge.

Remember, the goal of the 540X form is to correct inaccuracies or report additional information not included in your original California tax return. Taking the time to fill it out correctly ensures compliance with state tax laws and can help avoid issues with the Franchise Tax Board.

Discover More PDFs

California Jv 445 - The JV-445 is designed to protect the child's interests by documenting the legal basis for all decisions made regarding their permanency planning and care.

Deadline to File Notice of Appeal California - By specifying the date and type of judgment or order being appealed, the form helps streamline the appellate review process.