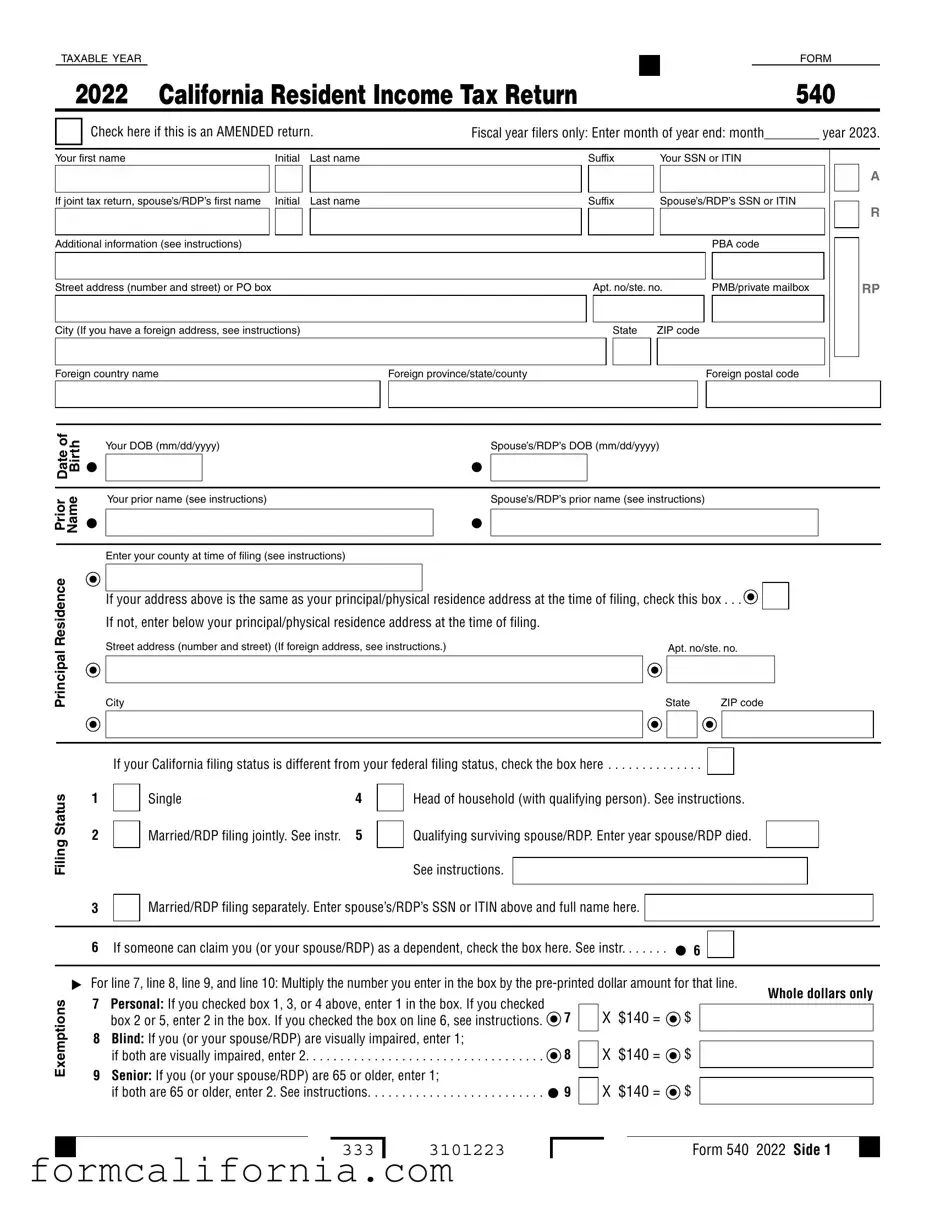

Blank California 540 V PDF Form

Every year, countless individuals navigate the complexities of tax filings, and for those in California, understanding the California 540 V form is crucial. Introduced to enhance the efficiency and accuracy of processing payments, the 1997 California Form 540-V, Return Payment Voucher for Individuals, serves as a bridge between taxpayers and the modernized payment system of the Franchise Tax Board. This form, designed to accompany payments made by check or money order, plays a pivotal role in ensuring that individuals’ tax payments are correctly attributed to their accounts. Individuals are urged to use this voucher when submitting their payments, although its omission attracts no penalty. Simplicity marks the steps of its preparation: writing a check or money order payable to the Franchise Tax Board, completing the voucher with personal and payment information, and mailing it alongside the tax return to a specified address. However, it's noteworthy that its requirement is waived if the taxpayer's return indicates a refund or no tax liability. With sections dedicated to personal information, payment amount, and specific instructions for attachment and mailing, Form 540-V embodies a straightforward yet vital component of the tax filing process in California.

Document Preview Example

TAXABLE YEAR |

|

|

FORM |

|

|||

2022 California Resident Income Tax Return |

|

540 |

|

|

|||

Check here if this is an AMENDED return.

Your first name |

|

Initial |

|

Last name |

|

|

|

|

|

If joint tax return, spouse’s/RDP’s first name |

|

Initial |

|

Last name |

|

|

|

|

|

Additional information (see instructions) |

|

|

|

|

Street address (number and street) or PO box

City (If you have a foreign address, see instructions)

Foreign country name

of |

|

Your DOB (mm/dd/yyyy) |

|||

Date Birth |

• |

||||

|

|

|

|||

|

|

|

|||

Prior Name |

|

|

Your prior name (see instructions) |

||

• |

|

|

|||

|

|||||

|

|

Enter your county at time of filing (see instructions) |

|||

Fiscal year filers only: Enter month of year end: month________ year 2023.

|

|

Suffix |

|

Your SSN or ITIN |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Suffix |

|

Spouse’s/RDP’s SSN or ITIN |

|

|

|

R |

|||||||

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PBA code |

|

|

|

RP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt. no/ste. no. |

|

PMB/private mailbox |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Foreign province/state/county |

|

|

|

Foreign postal code |

|

|

|

|

|||||||

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s DOB (mm/dd/yyyy)

•

Spouse’s/RDP’s prior name (see instructions)

•

Principal Residence

Filing Status

If your address above is the same as your principal/physical residence address at the time of filing, check this box . . .

If not, enter below your principal/physical residence address at the time of filing.

If not, enter below your principal/physical residence address at the time of filing.

Street address (number and street) (If foreign address, see instructions.) |

|

Apt. no/ste. no. |

|

||

|

|

|

|

|

|

City |

State |

ZIP code |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

If your California filing status is different from your federal filing status, check the box here . . . . . . . . . . . . . .

1 |

|

Single |

4 |

|

Head of household (with qualifying person). See instructions. |

|

|

|||

2 |

|

Married/RDP filing jointly. See instr. |

5 |

|

Qualifying surviving spouse/RDP. Enter year spouse/RDP died. |

|

|

|

||

|

|

|

|

|

||||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

3 |

|

Married/RDP filing separately. Enter spouse’s/RDP’s SSN or ITIN above and full name here. |

|

|

|

|

||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

. . . . . .6 If someone can claim you (or your spouse/RDP) as a dependent, check the box here. See instr. |

• 6 |

|

|

|

|

|

|

Exemptions

▶ For line 7, line 8, line 9, and line 10: Multiply the number you enter in the box by the |

Whole dollars only |

||||||

7 Personal: If you checked box 1, 3, or 4 above, enter 1 in the box. If you checked |

|

|

|

|

|

||

7 |

|

X $140 = |

• $ |

|

|

||

|

|

|

|||||

|

box 2 or 5, enter 2 in the box. If you checked the box on line 6, see instructions. |

|

|

|

|||

8 |

Blind: If you (or your spouse/RDP) are visually impaired, enter 1; |

8 |

|

X $140 = |

$ |

|

|

|

|

|

|||||

|

if both are visually impaired, enter 2 |

|

|

|

|||

9 |

Senior: If you (or your spouse/RDP) are 65 or older, enter 1; |

• 9 |

|

X $140 = |

$ |

|

|

|

|

|

|||||

|

|

|

|||||

|

if both are 65 or older, enter 2. See instructions |

|

|

|

|||

333

3101223

Form 540 2022 Side 1

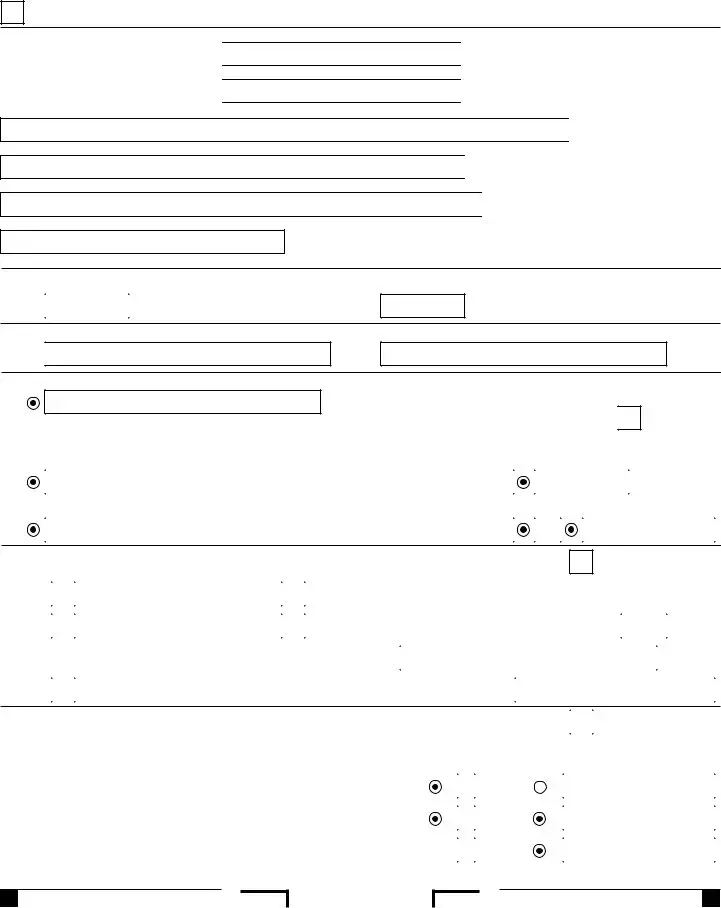

Your name: |

|

Your SSN or ITIN: |

|

|

|

|

|

|

|

||

|

|

|

|

Exemptions

10 Dependents: Do not include yourself or your spouse/RDP.

|

Dependent 1 |

Dependent 2 |

First Name |

|

|

Last Name |

|

|

SSN. See |

• |

• |

instructions. |

||

Dependent’s |

|

|

relationship |

|

|

to you |

|

|

Dependent 3

•

. . . . . . . . . . . . . . . . . . . . . .Total dependent exemptions |

. . . . . . |

. . . . . . . . . . . • 10 |

|

X $433 = |

$ |

||||

11 |

Exemption amount: Add line 7 through line 10. Transfer this amount to line 32 |

. . . 11. . . . |

$ |

||||||

12 State wages from your federal |

• 12 |

|

|

|

. |

|

|

|

|

|

|

|

00 |

|

|

||||

|

Form(s) |

|

|

|

|

|

|||

13 |

Enter federal adjusted gross income from federal Form 1040 or |

. . . 13 |

|

||||||

|

|||||||||

14 |

California adjustments – subtractions. Enter the amount from Schedule CA (540), |

|

. • 14 |

|

|||||

|

|

||||||||

|

Part I, line 27, column B |

. . . . . . . |

. . . . . . . . . . . . . . . . . |

. . . . . |

. . . |

|

|||

|

|

|

|

|

|||||

15Subtract line 14 from line 13. If less than zero, enter the result in parentheses.

Income |

|

See instructions |

. 15 |

|

||

16 |

Part I, line 27, column C |

. • 16 |

|

|||

Taxable |

California adjustments – additions. Enter the amount from Schedule CA (540), |

|

|

|||

17 |

California adjusted gross income. Combine line 15 and line 16 |

. • 17 |

{ |

|||

|

18 |

Enter the |

{ |

Your California itemized deductions from Schedule CA (540), Part II, line 30; OR |

||

|

|

larger of |

Your California standard deduction shown below for your filing status: |

|

||

|

|

|

• Single or Married/RDP filing separately |

$5,202 |

||

|

|

|

• Married/RDP filing jointly, Head of household, or Qualifying surviving spouse/RDP. $10,404 |

|||

|

|

|

|

If Married/RDP filing separately or the box on line 6 is checked, STOP. See instructions |

• 18 |

|

19Subtract line 18 from line 17. This is your taxable income.

If less than zero, enter  19

19

31 Tax. Check the box if from: |

|

Tax Table |

|

|

Tax Rate Schedule |

|

|

|

|

|

|

|

|

• |

|

FTB 3800 |

• |

|

. . . . . . . . .FTB 3803 |

• 31 |

|

|

32Exemption credits. Enter the amount from line 11. If your federal AGI is more than

Tax |

|

$229,908, see instructions |

. . . . . |

. . . |

. |

. . . |

. . . . . . . . |

. . . . |

. . |

. |

. |

. . . . |

. . . . . . . . |

32 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

33 |

Subtract line 32 from line 31. If less than zero, enter |

. . . . |

. . . . . . . . |

33 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

34 |

Tax. See instructions. Check the box if from: • |

|

|

Schedule |

|

|

. .FTB 5870A |

• 34 |

|||||||

|

|

35 |

Add line 33 and line 34 |

|

|

|

|

|

|

|

|

|

|

|

. |

35 |

|

|

|

. . . . . |

. . . |

. |

. . . |

. . . . . . . . |

. . . . |

. . |

. |

. |

. . . . |

. . . . . . . |

|||||

Credits |

40 |

Nonrefundable Child and Dependent Care Expenses Credit. See instructions |

|

|

. |

• 40 |

|||||||||||

|

|

. |

. . . . |

. . . . . . . |

|||||||||||||

Special |

43 |

Enter credit name |

|

|

|

|

|

|

code • |

|

|

|

. . .and amount |

• 43 |

|||

44 |

Enter credit name |

|

|

|

|

|

|

code • |

|

|

|

and amount |

• 44 |

||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Side 2 Form 540 2022 |

333 |

3102223 |

|

|

|

|

|

|||||||

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

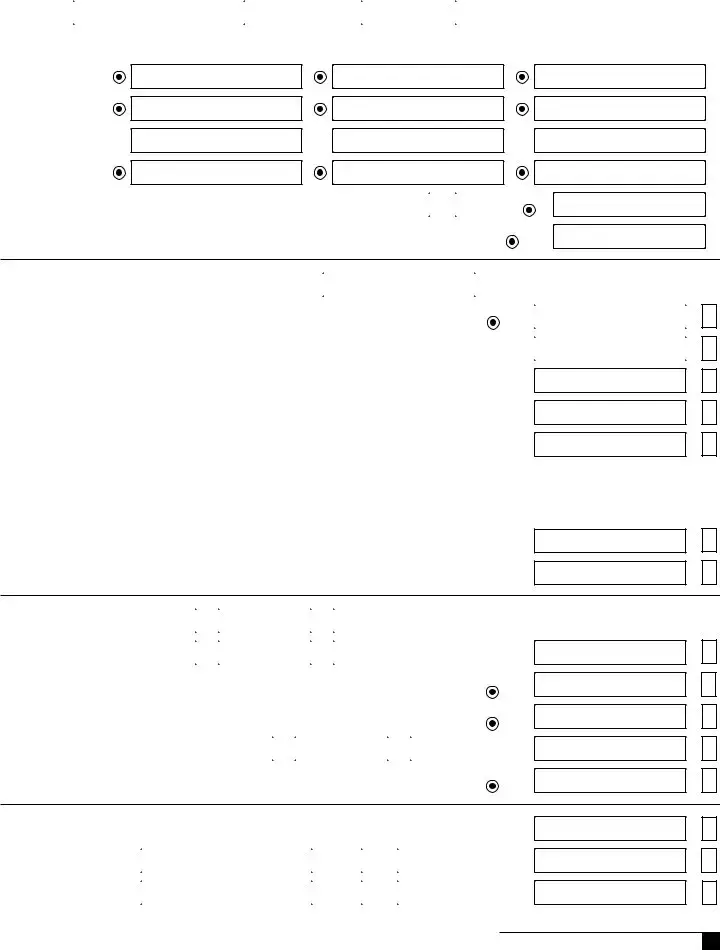

Your name: |

|

|

|

Your SSN or ITIN: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Credits |

45 |

. . . . . . . . . . . . . .To claim more than two credits. See instructions. Attach Schedule P (540) |

|

|

|

|

|

||||||||||||||||

46 |

Nonrefundable Renter’s Credit. See instructions |

|

|

|

|

• 46 |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Special |

|

. |

. . . . |

|

|

|

|||||||||||||||||

47 |

Add line 40 through line 46. These are your total credits |

|

|

|

|

|

47 |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

. |

. . . . |

|

|

|

|

|

|

|

|

||||||||||||

|

48 |

Subtract line 47 from line 35. If less than zero, enter |

|

|

|

|

|

48 |

|

|

|

|

|

|

|

||||||||

|

|

. |

. . . . |

|

|

|

|

|

|

|

|

||||||||||||

Taxes |

61 |

Alternative Minimum Tax. Attach Schedule P (540) |

|

|

|

|

• 61 |

|

|

|

|

|

|

||||||||||

|

. |

. . . . |

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||

62 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Mental Health Services Tax. See instructions |

|

. |

. . . . |

• 62 |

|

|

|

|

|

|

||||||||||||

Other |

|

|

|

|

|

|

|

|

|

||||||||||||||

63 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . .Other taxes and credit recapture. See instructions |

|

. |

. . . . |

• 63 |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

64 |

. . . . . . . . . . . . . . . . . . .Add line 48, line 61, line 62, and line 63. This is your total tax |

|

. |

. . . . |

• 64 |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

71 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .California income tax withheld. See instructions |

|

. |

. . . . |

• 71 |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

72 |

. . . . . . . . . . . . . .2022 California estimated tax and other payments. See instructions |

|

. |

. . . . |

• 72 |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Payments |

73 |

. . . . . . . . . . . . . . . . . . .Withholding (Form |

|

. |

. . . . |

• 73 |

|

|

|

|

|

|

|||||||||||

75 |

Earned Income Tax Credit (EITC). See instructions |

|

|

|

|

• |

75 |

|

|

|

|

|

|

|

|||||||||

|

. |

. . . . |

|

|

|

|

|

|

|

||||||||||||||

|

74 |

Excess SDI (or VPDI) withheld. See instructions |

|

. |

. . . . |

• |

74 |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .76 Young Child Tax Credit (YCTC). See instructions |

|

. |

. . . . |

• 76 |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

77 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .Foster Youth Tax Credit (FYTC). See instructions |

|

. |

. . . . |

• 77 |

|

|

|

|

|

|

|||||||||||

|

78 |

Add line 71 through line 77. These are your total payments. |

|

|

|

|

|

78 |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Tax |

|

See instructions |

. . . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . . . |

. |

.. .. . •. . .91 |

. |

. . . . |

|

|

|

|

|

|

|

|

||||

91 |

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Use Tax. Do not leave blank. See instructions |

|

|

|

|

|

|

00 |

|

|||||||||||||||

Use |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

If line 91 is zero, check if: |

|

No use tax is owed. |

|

|

|

You paid your use tax obligation directly to CDTFA. |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

92 If you and your household had |

• |

|

|

|

|

|

|

|

|

|

||||||||||||

Penalty |

|

See instructions. Medicare Part A or C coverage is qualifying health care coverage |

|

|

|

|

|

|

|

|

|||||||||||||

ISR |

|

If you did not check the box, see instructions.. |

. . • 92 |

|

|

|

|

|

|

|

|

|

. |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Individual Shared Responsibility (ISR) Penalty. See instructions |

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

Due |

93 |

Payments balance. If line 78 is more than line 91, subtract line 91 from line 78 |

|

93 |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

94 |

Use Tax balance. If line 91 is more than line 78, subtract line 78 from line 91 |

|

94 |

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||

Tax/Tax |

|

|

|

|

|

|

|

||||||||||||||||

95 |

. .subtract line 92 from line 93 |

. . . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . . |

. . . . . . . . . . . . |

|

. |

. . . . |

|

95 |

|

|

|

|

|

|

|

||||

Overpaid |

Payments after Individual Shared Responsibility Penalty. If line 93 is more than line 92, |

|

|

|

|

|

|

|

|

|

|

||||||||||||

96 |

Individual Shared Responsibility Penalty Balance. If line 92 is more than line 93, |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

. .subtract line 93 from line 92 |

. . . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . . |

. . . . . . . . . . . . |

|

. |

. . . . |

|

96 |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

97 Overpaid tax. If line 95 is more than line 64, subtract line 64 from line 95 |

|

97 |

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

333

3103223

Form 540 2022 Side 3

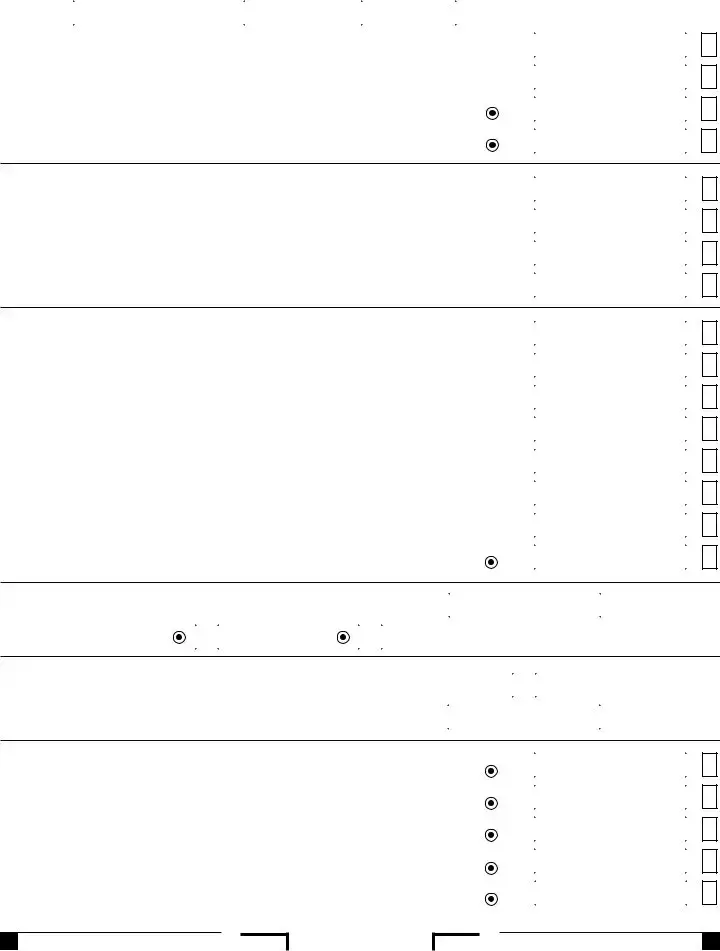

|

Your name: |

|

Your SSN or ITIN: |

. |

. . . . • |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

||||||

|

Due |

98 Amount of line 97 you want applied to your 2023 estimated tax |

98 |

|

|

|

|

|||||||

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Overpaid |

|

|

|

|

. |

. . . . • |

|

|

|

|

|

|

||

|

Tax/Tax |

99 |

Overpaid tax available this year. Subtract line 98 from line 97 |

99 |

|

|

|

|

||||||

|

100 |

. . . . . . . . . . . . . . . . . . .Tax due. If line 95 is less than line 64, subtract line 95 from line 64 |

100 |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

Code Amount |

|||||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

California Seniors Special Fund. See instructions. |

. . . . • 400 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

Alzheimer’s Disease and Related Dementia Voluntary Tax Contribution Fund . |

. . . . • 401 |

|

|

|||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

Rare and Endangered Species Preservation Voluntary Tax Contribution Program . |

. . . . • 403 |

|

|

|||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

California Breast Cancer Research Voluntary Tax Contribution Fund. |

. . . . • 405 |

|

|

|||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

California Firefighters’ Memorial Voluntary Tax Contribution Fund. |

. . . . • 406 |

|

|

|||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

Emergency Food for Families Voluntary Tax Contribution Fund. |

. . . . • 407 |

|

|

|||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

California Peace Officer Memorial Foundation Voluntary Tax Contribution Fund . |

. . . . • 408 |

|

|

|||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

California Sea Otter Voluntary Tax Contribution Fund. |

. . . . • 410 |

|

|

|||||||

|

|

|

|

|

|

|||||||||

|

Contributions |

|

|

California Cancer Research Voluntary Tax Contribution Fund. |

. . . . • 413 |

|

|

|||||||

|

|

|

|

|

||||||||||

|

|

|

School Supplies for Homeless Children Voluntary Tax Contribution Fund. . . . . • 422 |

|

||||||||||

|

|

|

|

|||||||||||

|

|

|

|

State Parks Protection Fund/Parks Pass Purchase. |

. . . . • 423 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

Protect Our Coast and Oceans Voluntary Tax Contribution Fund. |

. . . . • 424 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

Keep Arts in Schools Voluntary Tax Contribution Fund. |

. . . . • 425 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

Prevention of Animal Homelessness and Cruelty Voluntary Tax Contribution Fund . |

. . . . • 431 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

California Senior Citizen Advocacy Voluntary Tax Contribution Fund. |

. . . . • 438 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

Native California Wildlife Rehabilitation Voluntary Tax Contribution Fund. |

. . . . • 439 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

Rape Kit Backlog Voluntary Tax Contribution Fund. |

. . . . • 440 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

Suicide Prevention Voluntary Tax Contribution Fund. |

. . . . • 444 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

|

||||||||||

|

|

|

|

Mental Health Crisis Prevention Voluntary Tax Contribution Fund. |

. . . . • 445 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

|

||||||||||

|

|

|

|

California Community and Neighborhood Tree Voluntary Tax Contribution Fund . |

. . . . • 446 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

110 Add amounts in code 400 through code 446. This is your total contribution . |

. . . . • 110 |

|

|

||||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

Amount You Owe

111AMOUNT YOU OWE. If you do not have an amount on line 99, add line 94, line 96, line 100, and line 110. See instructions. Do not send cash.

Mail to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA |

|

. |

00 |

Pay Online – Go to ftb.ca.gov/pay for more information. |

|

|

|

|

Side 4 Form 540 2022 |

|

333 |

3104223

Your name:

Your SSN or ITIN:

Interest and Penalties

Refund and Direct Deposit

Voter Info.

112 |

. . . . . . . . . . . . . . . . . . . . . . . . . . .Interest, late return penalties, and late payment penalties |

112 |

|

. |

00 |

||||

113 |

Underpayment of estimated tax. |

|

|

|

|

|

|

||

|

Check the box: • |

|

FTB 5805 attached • |

|

|

• 113 |

|

. |

|

|

|

|

FTB 5805F attached |

|

00 |

||||

|

|

|

|

|

|||||

114 |

Total amount due. See instructions. Enclose, but do not staple, any payment |

114 |

|

. |

00 |

||||

|

|

||||||||

115REFUND OR NO AMOUNT DUE. Subtract the sum of line 110, line 112, and line 113 from line 99. See instructions.

Mail to: FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA |

|

. |

00 |

Fill in the information to authorize direct deposit of your refund into one or two accounts. Do not attach a voided check or a deposit slip. See instructions. Have you verified the routing and account numbers? Use whole dollars only.

All or the following amount of my refund (line 115) is authorized for direct deposit into the account shown below:

|

• Routing number |

• Type |

• Account number |

|

• 116 |

Direct deposit amount |

||||

|

|

|

Checking |

|

||||||

|

|

|

|

Savings |

|

|

|

|

. |

00 |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

The remaining amount of my refund (line 115) is authorized for direct deposit into the account shown below: |

|

|

|

|||||||

|

• Routing number |

• Type |

• Account number |

|

• 117 |

Direct deposit amount |

||||

|

|

|

Checking |

|

||||||

|

|

|

|

Savings |

|

|

|

|

. |

00 |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For voter registration information, check the box and go to sos.ca.gov/elections. See instructions . . . . . . . . . . . . . . . .

IMPORTANT: See the instructions to find out if you should attach a copy of your complete federal tax return.

Our privacy notice can be found in annual tax booklets or online. Go to ftb.ca.gov/privacy to learn about our privacy policy statement, or go to ftb.ca.gov/forms and search for 1131 to locate FTB 1131

Under penalties of perjury, I declare that I have examined this tax return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

Your signature |

Date |

Spouse’s/RDP’s signature (if a joint tax return, both must sign) |

||

|

|

|

|

|

Your email address. Enter only one email address. |

|

|

Preferred phone number |

|

Sign Here

It is unlawful to forge a spouse’s/ RDP’s signature.

Joint tax return? See instructions.

Paid preparer’s signature (declaration of preparer is based on all information of which preparer has any knowledge)

Firm’s name (or yours, if |

|

|

|

|

• PTIN |

|

||

|

|

|

|

|

|

|

|

|

Firm’s address |

|

|

|

|

• Firm’s FEIN |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you want to allow another person to discuss this tax return with us? See instructions . . . . . . .• |

|

Yes |

|

|

|

No |

|

|

Print Third Party Designee’s Name |

|

Telephone Number |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

333

3105223

Form 540 2022 Side 5

Document Specs

| Fact | Detail |

|---|---|

| Form Name | California Form 540-V |

| Purpose | Return Payment Voucher for Individuals |

| Tax Year | 1997 |

| Usage | Used to make a payment with your tax return |

| Penalty for Not Using | No penalty for not using Form 540-V |

| Payment Making | Make payable to Franchise Tax Board, include SSN and tax return type |

| Mailing Address | FRANCHISE TAX BOARD PO BOX 942867 SACRAMENTO CA 94267-0001 |

| Payable To | Franchise Tax Board |

| Modernization Effort | Part of the Franchise Tax Board's efforts to modernize its payment system |

Detailed Instructions for Writing California 540 V

The California Form 540-V is a return payment voucher designed for individuals to use when submitting their tax payments by check or money order. It ensures that the Franchise Tax Board can accurately and efficiently process payments. In the following steps, we break down how to correctly fill out and submit this form alongside your tax return, if you owe taxes for the year. It's crucial to follow these guidelines carefully to ensure your payment is processed without any issues.

- Prepare Your Check or Money Order:

Make it payable to "Franchise Tax Board". Ensure the full amount you owe is included. On the check or money order, write your social security number and the type of return you are filing (for example, ‘‘1997 Form 540’’). - Complete the Return Payment Voucher (Form 540-V):

Use blue or black ink to fill in your name(s), address, and social security number(s) in the designated spaces. Specify the payment amount you're sending. If including payments for penalties or interest, add these to the total amount on the voucher. Following that, detach the voucher along the dotted line. - Attach the Return Payment Voucher and Check or Money Order to Your Return:

Position the check or money order on top of the voucher. Then, attach both to the front of your tax return where indicated. Make sure they are visible and not obscured by Form(s) W-2 or any other documents. - Mail Your Documents:

Send your tax return, the attached voucher, and your payment to:

FRANCHISE TAX BOARD

PO BOX 942867

SACRAMENTO, CA 94267-0001

By following these steps, you are assisting the Franchise Tax Board in modernizing its payment system, which benefits everyone by making the process more efficient. Remember, accuracy in filling out the voucher and ensuring all documents are correctly attached is key to a smooth processing of your payment.

Things to Know About This Form

Do I Need To Use This Form?

The simple answer is, it's encouraged but not mandatory. The California Franchise Tax Board introduced Form 540-V to make payment processing more efficient. If you owe taxes for the year 1997, you're encouraged to use this form when sending your payment. However, if your 1997 tax return indicates that you're due a refund or you don't owe any taxes, there's no need to use this voucher.

How Do I Prepare and Mail My Payment?

Preparing and mailing your payment with Form 540-V is straightforward. Here's a step-by-step guide:

- Prepare Your Check or Money Order: Write a check or money order payable to the Franchise Tax Board. Make sure to write your social security number and the type of return you are filing (for example, "1997 Form 540") on the check or money order.

- Complete Form 540-V: Fill out the form using blue or black ink, including your name, address, social security number(s), and the amount you're paying. If you're also paying penalties or interest, include these amounts in your total payment on the form.

- Attach the Voucher and Payment: Place your check or money order on top of Form 540-V and attach them to the front of your tax return. Ensure they aren't covered by other documents, like your W-2 forms.

- Mail Everything: Send your tax return, Form 540-V, and payment to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0001.

What Should I Write on My Check or Money Order?

When preparing your check or money order, it's important to get the details right. Write the payable to "Franchise Tax Board" and clearly write your social security number and tax year on it. Indicate the type of return you're filing as well, such as "1997 Form 540", "1997 Form 540A", "1997 Form 540EZ", or "1997 Form 540NR". This helps ensure your payment is processed smoothly.

Where Do I Mail My Payment?

All payments using Form 540-V for the tax year 1997 should be mailed to:

- FRANCHISE TAX BOARD

- PO BOX 942867

- SACRAMENTO, CA 94267-0001

Make sure to include your completed return, the payment, and the Form 540-V voucher in your mailing.

Common mistakes

Filling out the California Form 540-V may seem straightforward, but mistakes can easily happen. These errors can lead to delays in processing payments or even result in unnecessary penalties. Here are eight common mistakes people make when completing this form:

- Not writing the check or money order to the correct entity. It must be made payable to the Franchise Tax Board, not any other name or organization.

- Omitting the social security number and the type of the return (e.g., ‘‘1997 Form 540’’) on the check or money order. This information is critical for correctly associating your payment with your return.

- Using ink colors other than blue or black to fill out the form. These are the only colors guaranteed to be accepted.

- Failing to enter the correct payment amount on Form 540-V, especially when including additional payments for penalties or interest. This total must match the amount of the check or money order.

- Not cutting off the voucher on the dotted line or attaching it incorrectly to the return. The voucher and payment should be placed on top of your tax return, visible and not covered by any other documents.

- Providing incomplete or inaccurate taxpayer information, such as names or social security numbers. Both the taxpayer's and the spouse's information, if filing jointly, must be correctly filled out.

- Ignoring the requirement to attach the voucher and payment to the front of the tax return where indicated. This ensures your payment is processed efficiently.

- Sending the return, voucher, and payment to the wrong address. The correct mailing address is listed on the form and must be followed exactly to avoid delays.

Ensuring that these common errors are avoided can help in making your tax payment process smoother and more efficient. Taking the time to review your Form 540-V before mailing can save you time and potential hassle.

Documents used along the form

When completing your tax responsibilities in California, particularly with the Form 540-V, a range of other documents might be necessary to ensure a full and accurate tax filing process. From forms that assist with deductions to those that handle additional income or adjustments, understanding each document's use can simplify your tax season. Here's a breakdown of other forms and documents potentially used alongside Form 540-V.

- Form 540: Main income tax return form for California residents, detailing income, deductions, and tax credits.

- Form 540 2EZ: A simplified tax form for certain filers with straightforward tax situations.

- Schedule CA (540): Used for adjusting federal income and deductions to conform with California's tax laws.

- Form 540NR: Nonresident or part-year resident tax return form for reporting income earned from California sources.

- Form 540-ES: Estimated tax for individuals, used if you are self-employed or do not have sufficient taxes withheld from your income.

- Form 3506: Child and Dependent Care Expenses Credit, which allows for tax relief for certain care expenses.

- Form 3519: Payment for Automatic Extension for Individuals, used if more time is needed to file a tax return.

- Form 3885A: Depreciation and Amortization Adjustments, for items used in a business or income-producing activity.

While each of these forms serves a distinct purpose, their use alongside Form 540-V can vary based on individual tax situations. From residents with simple tax returns to those with more complex financial landscapes, ensuring the right documents are prepared and filed can aid in accurate processing and potentially faster refunds. Always consult with a tax professional or the California Franchise Tax Board if you’re unsure which forms apply to your circumstances.

Similar forms

The Internal Revenue Service (IRS) Form 1040-V is a payment voucher very similar to the California Form 540-V. Both are used to submit a payment for the taxes owed when filing the individual's tax return. Form 1040-V is for federal tax payments, while Form 540-V is specifically for California state tax payments. Both require the taxpayer's personal information, the amount being paid, and instructions for mailing with a check or money order.

Form 1040-ES is used for estimated tax payments by individuals, similar to how Form 540-V is used for final tax payments. While 540-V is utilized alongside an annual tax return to cover any owed tax, Form 1065-ES is for those who need to make quarterly tax payments throughout the year. Both forms require taxpayers to provide personal information and the amount of payment.

Form 4868 is the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. This form and the 540-V share the purpose of being supplements to the primary tax return process. Form 4868 is used when more time is needed to file, and if taxes are owed, a payment is recommended to be made with the extension request, similarly to how a payment is made with Form 540-V.

Another similar document, the Sales and Use Tax Return (varies by state), like California's Form 540-V, is used to report and remit taxes owed. The Sales and Use Tax Return is applicable to businesses selling goods and services, requiring detailed sales information and tax calculations. Both forms serve the purpose of ensuring taxes owed are paid to the respective tax authority.

California Form 3522, the LLC Tax Voucher, is akin to Form 540-V but for limited liability companies (LLCs). Both are payment vouchers directed at different taxpayers - Form 540-V for individuals and Form 3522 for LLCs. Each form facilitates the payment of taxes owed and requires similar types of information, including the tax year and amount of payment.

Form 8809, Application for Extension of Time to File Information Returns, is in the same family as Form 540-V insofar as they both relate to filing extensions. However, Form 8809 is used for information returns like W-2s and 1099s, not tax payments. Where they converge is in their facilitation of alignment with fiscal responsibilities, albeit on different fronts.

Form W-4V, Voluntary Withholding Request, is utilized by taxpayers who want taxes withheld from certain payments, such as Social Security benefits, similar to how individuals use Form 540-V to pay their taxes with their return. Both forms are involved in the process of managing tax payments, though W-4V is for withholding and 540-V is for direct payment.

Form IT-201-V, Payment Voucher for Income Tax Returns, is New York's counterpart to California's Form 540-V, designed for individuals to make payments on owed state income tax. Both serve as a method for taxpayers to submit payments with their tax returns, ensuring the correct amount is applied to their accounts. Each requires similar information, such as the taxpayer's name, social security number, and the amount being paid.

Form CA-1100V, Payment Voucher for Corporation Income Tax, is a document similar to Form 540-V but tailored for corporations. Though one is designed for use by individuals and the other by corporations, both aim to simplify the tax payment process. Each voucher requires taxpayer identification and details about the tax year and amount owed.

Finally, the Property Tax Payment Voucher, which varies by county across the United States, shares its core purpose with the Form 540-V. Both are used to remit payments to a tax authority, with the Property Tax Payment Voucher focusing on real estate taxes. Each document requires essential information for ensuring the tax payment is processed properly for the taxpayer.

Dos and Don'ts

When you're filling out the California Form 540-V for your tax payment, there are several important steps to ensure your payment is processed correctly. Here’s a breakdown of what you should and shouldn't do:

Things You Should Do

- Use blue or black ink: When completing the Form 540-V, make sure to use blue or black ink to ensure that the information is legible and can be processed accurately.

- Include all required information: Fill in your name(s), address, and social security number(s) in the designated spaces. Also, ensure the amount of payment you're sending with your return is clearly written on the Form 540-V.

- Attach the voucher and payment correctly: Place your check or money order on top of the completed voucher and attach both to the front of your return where indicated. This helps the Franchise Tax Board to identify your payment and apply it correctly.

- Write specific details on your check or money order: Make your payment out to the Franchise Tax Board and include your social security number, the tax return type, and the tax year (e.g., ‘‘1997 Form 540’’) on your check or money order. This information is crucial for the correct processing of your payment.

Things You Shouldn't Do

- Avoid using pens with colors other than blue or black: Colored inks other than blue or black might not be recognized by processing machines, leading to delays and potential inaccuracies in processing your payment.

- Don't leave out essential information: Failing to include your name, address, or social security number can result in your payment not being properly applied to your tax liability.

- Don't forget to attach your payment to the front of your return: Payments that are not correctly attached with the Form 540-V to your return might get misplaced, leading to potential processing errors or delays.

- Don't send cash or incomplete checks: Ensure that your check is fully completed, with the correct amount and signed. Sending cash or an improperly filled out check can result in your payment not being processed.

Misconceptions

There are several misconceptions about the California Form 540-V and its usage. Understanding these misconceptions can help taxpayers navigate their tax obligations more efficiently. Below are six common misunderstandings and the correct information:

- Use of Form 540-V is mandatory: Many believe that using the California Form 540-V is required when making a payment with your tax return. However, while the form is strongly encouraged to ensure accurate and efficient processing, there is no penalty for not using it if you're submitting a payment.

- Applicability for all taxpayers: A common misconception is that all taxpayers must use Form 540-V. In reality, this form is not needed if your tax return indicates a refund or if no tax is due. It's specifically designed for those who owe tax and are making a payment.

- Payment methods: Some might think that payments with Form 540-V can only be made through checks or money orders. While these are the prominent methods mentioned, the instructions emphasize making it payable to the Franchise Tax Board, hinting at the board's openness to received payments through these methods for accurate processing.

- Specific ink color requirement: There's a belief that completing Form 540-V requires the use of a specific ink color. The form instructions do specify using blue or black ink, which is more about ensuring the information is clearly and permanently visible rather than a strict compliance issue.

- Attachment instructions: Another misunderstanding involves how to attach the payment voucher to your return. The instructions clearly state to place the check or money order on top of the voucher and then attach both to the front of your return. Ignoring these steps might not necessarily invalidate your payment, but following them helps in the accurate and efficient processing of your tax return.

- Mailing address specifics: Lastly, some might be confused about where to mail the Form 540-V. The form specifies the exact mailing address for the Franchise Tax Board in Sacramento, CA. It's crucial to use this address as it ensures your payment is processed correctly and avoids delays that could occur if sent to an incorrect address.

By understanding these misconceptions and their realities, taxpayers can better navigate their obligations and avoid common pitfalls when using the California Form 540-V.

Key takeaways

When using the California Form 540-V for the tax year 1997, there are important steps and considerations taxpayers must keep in mind to ensure their payment is processed correctly and efficiently. Here are four key takeaways regarding the preparation and use of the form:

- Eligibility for Using Form 540-V: The Form 540-V is designed for individuals who owe taxes on their 1997 return. If taxpayers are due a refund or have no tax liability, they do not need to utilize this voucher. However, the Franchise Tax Board encourages its use to modernize the payment process.

- Preparation of Payment: Taxpayers should prepare a check or money order payable to the "Franchise Tax Board" for the exact amount owed. It's crucial to write the taxpayer's social security number and the type of return (e.g., "1997 Form 540") on the payment to ensure proper processing and attribution of the funds.

- Completing the Form 540-V: The voucher requires taxpayers to enter their name(s), address, and social security number(s) using blue or black ink. Additionally, the total amount paid, including any penalties or interest, should be recorded on the form. After completing, the voucher should be detached along the dotted line for submission.

- Mailing Instructions: Taxpayers need to attach the check or money order and the completed Form 540-V to the front of their tax return without covering any important information such as Form(s) W-2. The entire package is then mailed to the Franchise Tax Board at the address provided, ensuring that the return, voucher, and payment are securely attached.

Following these steps can streamline the tax payment process for individuals owing taxes, helping to avoid errors and delays in the processing of their tax returns and payments.

Discover More PDFs

How Do I Get a Death Certificate in California - If a coroner's report is made, a copy must be sent to the licensing agency within 30 days.

California 3500 - Demands a high level of detail regarding the organization’s governance and operational practices.

Request for Entry of Default - Contains declarations and certifications to validate the service of summons under penalty of perjury.