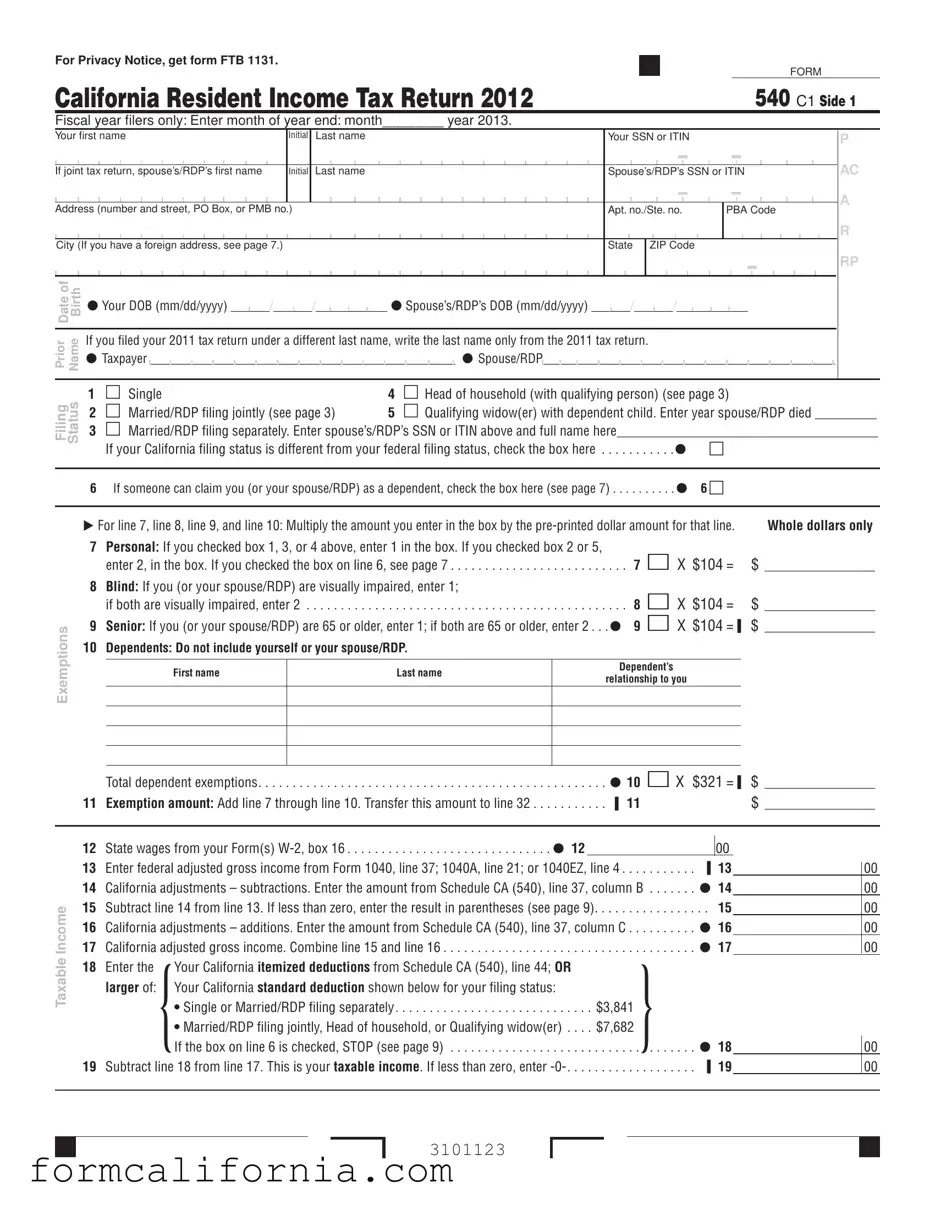

Blank California 540 C1 PDF Form

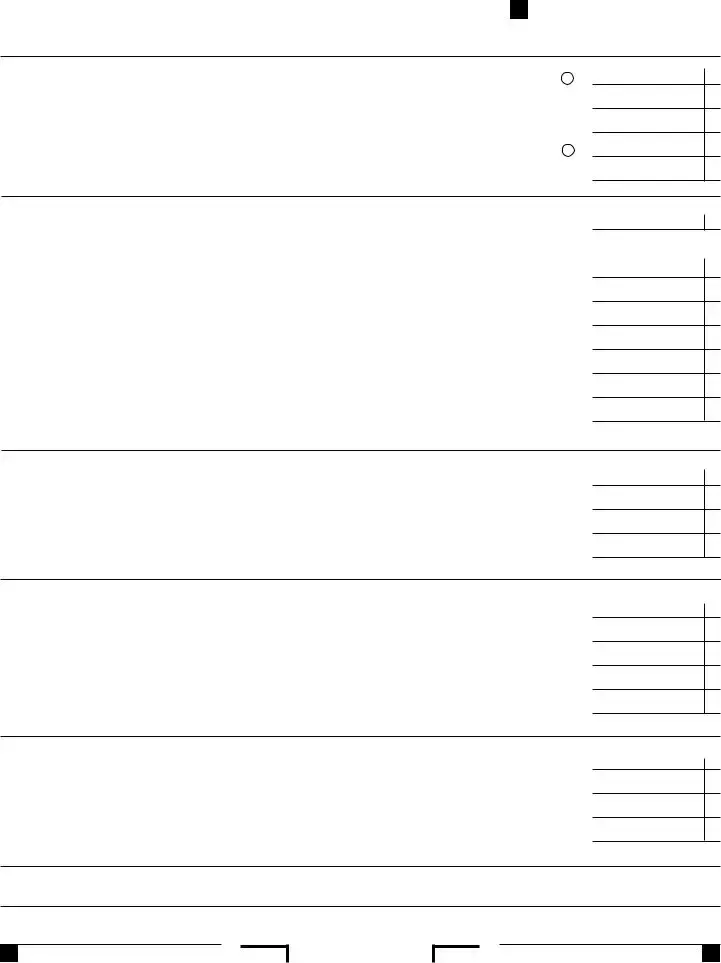

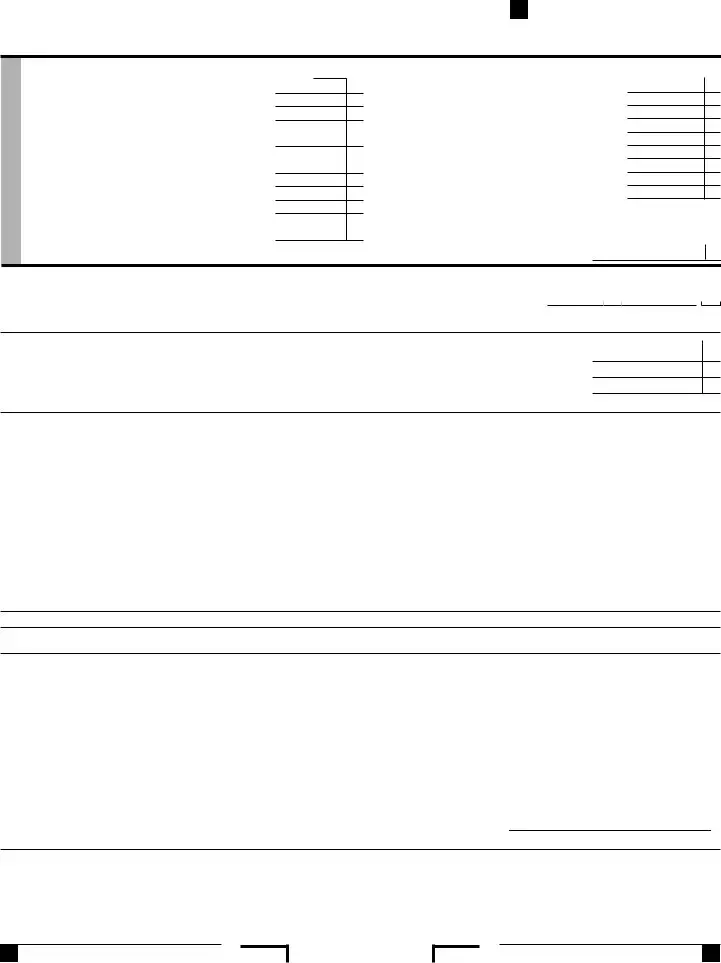

The California 540 C1 form, serving as the primary vehicle for residents to report their annual income tax, encapsulates various significant sections critical for accurate tax return filing for the year 2012. This extensive document not only begins with basic identification elements such as names, social security numbers (SSNs) or individual taxpayer identification numbers (ITINs), and addresses but also extends towards more complex financial specifics including exemptions, incomes, adjustments, credits, and taxes owed or refunds due. Set against the backdrop of California's tax codes, the form meticulously outlines various filing statuses, empowering taxpayers to tailor their tax returns according to personal circumstances such as marriage, widowhood, or head of household. Moreover, it probes into exemptions applicable for personal scenarios, blindness, seniority, or dependents, directly influencing the tax outcome. Importantly, the form navigates through the calculation labyrinth of taxable income, adjusted gross income, and itemized or standard deductions, laying the groundwork for determining the precise tax liability or refund. Additionally, the inclusion of sections on credits ranging from nonrefundable child and dependent care expenses to new jobs credit, alongside a segment addressing alternative minimum tax and mental health services tax, underscores the comprehensive nature of the tax reporting process. Lastly, payment sections, interest and penalties, alongside direct deposit information for refunds, crown this tax return form, making it an indispensable tool for California residents navigating the tax year of 2012.

Document Preview Example

For Privacy Notice, get form FTB 1131.

FORM

California Resident Income Tax Return 2012

540 C1 Side 1

Fiscal year filers only: Enter month of year end: month________ year 2013.

Your first name |

Initial |

Last name |

Your SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If joint tax return, spouse’s/RDP’s first name |

Initial |

Last name |

Spouse’s/RDP’s SSN or ITIN |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (number and street, PO Box, or PMB no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt. no./Ste. no. |

|

PBA Code |

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If you have a foreign address, see page 7.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dateof Birth |

Your DOB (mm/dd/yyyy) ______/______/ |

|

___________ Spouse’s/RDP’s DOB (mm/dd/yyyy) ______/______/ |

|

___________ |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prior Name |

If you filed your 2011 tax return under a different last name, write the last name only from the 2011 tax return. |

||||||||||||||||||||

Taxpayer |

|

|

|

_______________________________________________ |

|

|

|

Spouse/RDP |

|

|

|

_____________________________________________ |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

P

AC

A

R

RP

Filing Status

1 |

Single |

4 |

Head of household (with qualifying person) (see page 3) |

2 |

Married/RDP filing jointly (see page 3) |

5 |

Qualifying widow(er) with dependent child. Enter year spouse/RDP died _________ |

3 Married/RDP filing separately. Enter spouse’s/RDP’s SSN or ITIN above and full name here______________________________________

If your California filing status is different from your federal filing status, check the box here |

|

|

6 If someone can claim you (or your spouse/RDP) as a dependent, check the box here (see page 7) |

6 |

|

|

Exemptions

For line 7, line 8, line 9, and line 10: Multiply the amount you enter in the box by the |

Whole dollars only |

|

7 Personal: If you checked box 1, 3, or 4 above, enter 1 in the box. If you checked box 2 or 5, |

7 X $104 = |

|

enter 2, in the box. If you checked the box on line 6, see page 7 |

$ _________________ |

|

8Blind: If you (or your spouse/RDP) are visually impaired, enter 1;

|

if both are visually impaired, enter 2 |

. . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . |

. . . 8 |

X $104 |

= |

|

$ _________________ |

|

9 |

Senior: If you (or your spouse/RDP) are 65 or older, enter 1; if both are 65 or older, enter 2 . . . |

9 |

X $104 |

=▐ |

$ _________________ |

||||

10 |

Dependents: Do not include yourself or your spouse/RDP. |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

First name |

|

Last name |

|

Dependent’s |

|

|

|

|

|

|

|

relationship to you |

|

|

|

|||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable Income

|

Total dependent exemptions |

. . . . . |

. . . 10 X $321 =▐ |

$ _________________ |

|||||

11 |

Exemption amount: Add line 7 through line 10. Transfer this amount to line 32 . . . |

. . . . . |

. . . ▐ 11 |

|

|

|

$ _________________ |

||

12 |

State wages from your Form(s) |

12 |

|

|

|

|

|||

|

00 |

|

|

|

|||||

13 |

Enter federal adjusted gross income from Form 1040, line 37; 1040A, line 21; or 1040EZ, line 4 |

▐ 13 |

|

|

00 |

||||

|

|||||||||

14 |

California adjustments – subtractions. Enter the amount from Schedule CA (540), line 37, column B |

14 |

|

00 |

|||||

15 |

Subtract line 14 from line 13. If less than zero, enter the result in parentheses (see page 9) |

. . 15 |

|

|

00 |

||||

16 |

California adjustments – additions. Enter the amount from Schedule CA (540), line 37, column C |

16 |

|

|

00 |

||||

17 |

California adjusted gross income. Combine line 15 and line 16 |

. . . . . |

. . . . . . . . . . . . . . . . |

17 |

|

00 |

|||

18 |

Enter the |

Your California itemized deductions from Schedule CA (540), line 44; OR |

|

|

|

|

|

||

|

larger of: |

Your California standard deduction shown below for your filing status: |

|

|

|

|

|

||

•Single or Married/RDP filing separately |

$3,841 |

{ |

|

|

|

•Married/RDP filing jointly, Head of household, or Qualifying widow(er) . . . . |

$7,682 |

|

|

|

|

{If the box on line 6 is checked, STOP (see page 9) |

|

18 |

|

||

. . . . . . . |

|

00 |

|||

19 Subtract line 18 from line 17. This is your taxable income. If less than zero, enter |

. . . . . . . |

. . . . . . . . |

▐ 19 |

|

00 |

3101123

Your name: __________________________________ Your SSN or ITIN: ____________________________

|

|

31 |

Tax. Check the box if from: Tax Table |

Tax Rate Schedule |

FTB 3800 FTB 3803 |

|

. . |

31 |

|||

|

|

32 |

Exemption credits. Enter the amount from line 11. If your federal AGI is more than $169,730 (see page 10) . . |

▐ |

32 |

||||||

Tax |

|

33 |

Subtract line 32 from line 31. If less than zero, enter |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

▐ |

33 |

||

|

|

34 |

Tax (see page 11). Check the box if from: |

Schedule |

|

. . |

34 |

||||

|

|

35 |

Add line 33 and line 34 |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

▐ |

35 |

|

|

|

40 |

Nonrefundable Child and Dependent Care Expenses Credit (see page 11). Attach form FTB 3506 |

|

. . |

40 |

|||||

|

|

41 |

New jobs credit, amount generated (see page 11) |

41 |

|

|

|

|

|||

|

|

|

00 |

|

|

||||||

Credits |

|

42 |

. . . . . . . . . . . . . . . . .New jobs credit, amount claimed (see page 11) |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

42 |

|||

|

43 |

Enter credit name▐_______________________________code number________ and amount |

|

|

43 |

||||||

|

|

|

. . |

||||||||

Special |

|

44 |

Enter credit name▐_______________________________code number________ and amount |

|

. . |

44 |

|||||

|

45 |

To claim more than two credits (see page 12). Attach Schedule P (540) |

|

|

45 |

||||||

|

|

|

. . |

||||||||

|

|

46 |

Nonrefundable renter’s credit (see page 12) |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

46 |

||

|

|

47 |

Add line 40 and line 42 through line 46. These are your total credits . |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

▐ |

47 |

||

|

|

48 |

Subtract line 47 from line 35. If less than zero, enter |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

▐ |

48 |

||

Taxes |

|

61 |

Alternative minimum tax. Attach Schedule P (540) |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

61 |

|||

|

62 |

Mental Health Services Tax (see page 13) . |

|

|

|

|

|

|

62 |

||

Other |

|

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

|||||

|

63 |

Other taxes and credit recapture (see page 13) |

|

|

|

|

|

63 |

|||

|

|

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

||||||

|

|

64 |

Add line 48, line 61, line 62, and line 63. This is your total tax |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

64 |

|||

|

|

71 |

California income tax withheld (see page 13) |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

71 |

|||

Payments |

|

72 |

2012 CA estimated tax and other payments (see page 13) |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

72 |

|||

|

73 |

Real estate and other withholding (see page 13) |

|

|

|

|

|

73 |

|||

|

|

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

||||||

|

|

74 |

Excess SDI (or VPDI) withheld (see page 13) |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

74 |

|||

|

|

75 |

Add line 71, line 72, line 73, and line 74. These are your total payments (see page 14) |

|

. . |

▐ |

75 |

||||

OverpaidTax/ |

TaxDue |

91 |

Overpaid tax. If line 75 is more than line 64, subtract line 64 from line 75 |

|

. . |

▐ |

91 |

||||

94 |

Tax due. If line 75 is less than line 64, subtract line 75 from line 64. . |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

▐ |

94 |

||||

|

|

92 |

Amount of line 91 you want applied to your |

2013 estimated tax . . . . |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

|

92 |

|

|

|

93 |

Overpaid tax available this year. Subtract line 92 from line 91 |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

93 |

|||

Use |

Tax |

95 |

Use Tax. This is not a total line (see page 14) |

. . . . . . 95 |

|

|

00 |

|

|

||

|

|

|

|||||||||

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

Side 2 Form 540 C1 2012

3102123

Your name: __________________________________ Your SSN or ITIN: ____________________________

Contributions

|

Code |

Amount |

California Seniors Special Fund (see page 23) . . . |

. 400 |

00 |

Alzheimer’s Disease/Related Disorders Fund . . . . |

. 401 |

00 |

California Fund for Senior Citizens |

. 402 |

00 |

Rare and Endangered Species |

|

|

Preservation Program |

. 403 |

00 |

State Children’s Trust Fund for the Prevention |

|

|

of Child Abuse |

. 404 |

00 |

California Breast Cancer Research Fund |

. 405 |

00 |

California Firefighters’ Memorial Fund |

. 406 |

00 |

Emergency Food for Families Fund |

. 407 |

00 |

California Peace Officer Memorial |

|

|

Foundation Fund |

. 408 |

00 |

Code

California Sea Otter Fund . . . . . . . . . . . . . . . . . . . . 410 Municipal Shelter

Amount

00

00

00

00

00

00

00

00

00

110 Add code 400 through code 423. This is your total contribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 110

00

Amount |

YouOwe |

|

Pay online – Go to ftb.ca.gov for more information. |

|

|

|

|

|

|

|

111 |

AMOUNT YOU OWE. Add line 94, line 95, and line 110 (see page 15). Do not send cash. |

111 |

|

|

|

|

andInterest |

Penalties |

. . . . . . . . . .Mail to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA |

|

|

|

, |

||

Interest, late return penalties, and late payment penalties |

|

|

|

|

|

|||

|

|

112 |

112. . . . |

|||||

|

|

113 |

Underpayment of estimated tax. Check the box: FTB 5805 attached FTB 5805F attached |

. . . . . |

|

. . 113 |

||

|

|

114 |

Total amount due (see page 17). Enclose, but do not staple, any payment |

114. . . . |

||||

,

. 00

. 00

00

00

00

Refund and Direct Deposit

115REFUND OR NO AMOUNT DUE. Subtract line 95 and line 110 from line 93 (see page 17).

Mail to: FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA |

115 |

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

. |

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fill in the information to authorize direct deposit of your refund into one or two accounts. Do not attach a voided check or a deposit slip (see page 17). Have you verified the routing and account numbers? Use whole dollars only.

All or the following amount of my refund (line 115) is authorized for direct deposit into the account shown below:

Checking

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

|

00 |

|

|

|

|

|

Routing number |

|

|

|

|

|

|

|

Type |

|

Account number |

|

|

116 Direct deposit amount |

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

The remaining amount of my refund (line 115) is authorized for direct deposit into the account shown below:

Checking

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

|

00 |

|

|

|

|

Routing number |

|

|

|

|

|

|

|

Type |

|

Account number |

|

|

117 Direct deposit amount |

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

IMPORTANT: See the instructions to find out if you should attach a copy of your complete federal tax return.

Under penalties of perjury, I declare that I have examined this tax return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

Sign Here

Your signature |

Spouse’s/RDP’s signature |

Daytime phone number (optional) |

||||||||||||||||||||||||||||||||||||||

|

(if a joint tax return, both must sign) |

( |

|

|

|

|

|

|

|

|

|

|

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X |

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your email address (optional). Enter only one email address. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

It is unlawful to forge a spouse’s/RDP’s signature.

Joint tax return? (see page 17)

|

|

|

|||||||||||||||||||

Paid preparer’s signature (declaration of preparer is based on all information of which preparer has any knowledge) |

PTIN |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s name (or yours, if |

Firm’s address |

FEIN |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you want to allow another person to discuss this tax return with us? (see page 17) . . . . . . . . . Yes No

__________________________________________________________________ |

( |

) |

Print Third Party Designee’s Name |

Telephone Number |

|

3103123

Form 540 C1 2012 Side 3

Document Specs

| Fact | Detail |

|---|---|

| Purpose of Form 540 C1 | Used by California residents to file their state income tax return for the year 2012. |

| Filing Options | Includes options for different filing statuses, such as Single, Married/RDP filing jointly, and Head of household, enhancing taxpayers' flexibility based on their personal situation. |

| Exemptions and Deductions | Provides fields for personal, blind, senior, and dependent exemptions, in addition to standard or itemized deductions, to accurately determine the taxable income. |

| Special Credits and Other Taxes | Includes sections for applying nonrefundable credits like Child and Dependent Care Expenses Credit and calculating other taxes, including Alternative Minimum Tax and Mental Health Services Tax. |

| Governing Laws | Complies with California Revenue and Tax Code, ensuring that the tax calculations and credits align with state-specific tax laws and regulations. |

Detailed Instructions for Writing California 540 C1

Filing your California Resident Income Tax Return, Form 540 C1, can seem daunting at first. However, by following a step-by-step approach, you can complete the form accurately and ensure your tax obligations are met. It's essential to give yourself enough time, gather all necessary documents such as W-2s or 1099s, and carefully follow instructions to avoid common mistakes. Here is a guide to help you through the process.

- Start by entering your personal information, including your first name, initial, last name, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). If you're filing jointly with a spouse or Registered Domestic Partner (RDP), include their information as well.

- Fill in your address details, including street number, street name, apartment or suite number, city, state, and ZIP code. For taxpayers with a foreign address, refer to page 7 of the instruction booklet.

- Enter your Date of Birth (DOB) and, if applicable, your spouse's/RDP's DOB in the format mm/dd/yyyy.

- If you filed under a different last name in 2011, provide the last name from your 2011 tax return for both you and your spouse/RDP, if necessary.

- Choose your filing status by checking the appropriate box.

- For exemptions, start with personal exemptions. Check the right box and multiply by the pre-printed dollar amount.

- If you or your spouse/RDP are visually impaired, indicate this by entering "1" for one or "2" if both are visually impaired. Multiply by the pre-printed dollar amount.

- Indicate if you or your spouse/RDP are 65 or older and calculate senior exemptions.

- For dependents, list their first names, last names, and relationship to you, then calculate total dependent exemptions.

- Add the amounts from lines 7 through 10 to get your total exemption amount.

- Enter your state wages from your W-2 forms.

- Fill in your federal adjusted gross income from your federal tax return.

- Report any California adjustments, subtractions, and additions as necessary.

- Calculate your California adjusted gross income by combining lines 15 and 16.

- Determine your deductions — either itemize or use the California standard deduction based on your filing status.

- Subtract your deductions from your California adjusted gross income to find your taxable income.

- Refer to the tax table or rate schedule to figure your tax, and enter the amount.

- Calculate and enter your exemption credits.

- Deduce your exemption credits from your tax to find out what you owe or your refund amount.

- Fill in the nonrefundable tax credits, if applicable.

- Finish by calculating your total payments, any overpaid tax, and the amount due or refundable.

- If applicable, include information for direct deposit of your refund.

- Review the form for accuracy, sign and date it. If filing jointly, ensure your spouse/RDP also signs.

After completing these steps, double-check your work to ensure all information is accurate and no section has been overlooked. Remember, accuracy is crucial in tax filing to avoid potential issues or audits down the line. If you're due a refund or owe additional taxes, prepare to submit your payment or look forward to your refund. Finally, mail your Form 540 C1 to the address provided for your specific situation, or consider e-filing as a faster, more secure option.

Things to Know About This Form

What is the purpose of Form 540 C1?

Form 540 C1, designated for California residents, is utilized for the computation and reporting of the state's income tax for the year 2012. It accommodates various filing statuses and personal exemptions, calculating adjustments to the federal adjusted gross income so it aligns with state regulations. Furthermore, it helps taxpayers in identifying their due taxes or potential refunds, taking into account personal, blind, senior exemptions, and dependent deductions, along with credits such as the nonrefundable child and dependent care expenses credit.

Who needs to file Form 540 C1?

This form is specifically for individuals who are California residents for the entirety of the tax year 2012. Residents must report all income, including that from other states or countries. Additionally, if you have varying California and federal filing statuses, or if there are adjustments required to your federal taxable income to adhere to California's tax laws, you should use Form 540 C1.

Can I file jointly with my spouse on Form 540 C1?

Yes, married couples or Registered Domestic Partners (RDPs) have the option to file a joint return using Form 540 C1. The "Married/RDP filing jointly" filing status allows couples to combine their income and adjustments, which can simplify the filing process and, in some cases, reduce their total tax liability. However, it's important to note that both individuals' social security numbers (or ITINs) and full names must be clearly listed on the form.

Where can I find guidance on exemptions and credits on Form 540 C1?

- For personal, blind, or senior exemptions, refer to the instructions on line 7 through line 10 of the form. These lines allow you to calculate exemptions based on your filing status, age, and visual impairment status, if any.

- Credits such as the child and dependent care expenses credit, new jobs credit, and nonrefundable renter's credit are detailed starting from line 40. Specific instructions and eligibility criteria can be found on the respective pages indicated next to each credit.

What should I do if I overpay my taxes according to Form 540 C1?

If the total payments you've made exceed your total tax liability on Form 540 C1, you may be eligible for a refund. The "Overpaid tax" line (line 91) allows you to calculate the amount overpaid. You have the option to apply this overpayment towards your next year's estimated tax or request a refund. To initiate a direct deposit, provide your banking details in the designated section at the end of the return, ensuring faster access to your refund.

Common mistakes

When individuals fill out the California 540 C1 form, they occasionally make mistakes that can potentially lead to issues with their tax returns. It's important to be meticulous and attentive to avoid these common errors:

- Incorrect Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs): Accurately entering your SSN or ITIN, as well as your spouse’s/RDP's if filing jointly, is crucial because mismatches can lead to processing delays.

- Filing Status Errors: Selecting the wrong filing status can affect your tax obligations and the credits you're eligible for. Ensure you understand the criteria for each status before making your choice.

- Inaccurate Exemption Calculations: People often make mistakes when calculating personal, blind, senior, or dependent exemptions, leading to incorrect exemption amounts being reported.

- Incorrectly Reported Income: Not accurately reporting your state wages, federal adjusted gross income, or making errors in calculating your California adjustments can impact the accuracy of your taxable income calculation.

- Misunderstanding Deductions: Failing to choose the larger option between your itemized deductions and the standard deduction for your filing status, or making errors in these calculations, can result in an incorrect taxable income amount.

- Errors in Tax Credits and Payments: Overlooking or inaccurately claiming tax credits (such as the nonrefundable child and dependent care expenses credit), and errors in reporting tax payments, including estimated tax payments or withholding, can affect your total payments or tax dues.

It’s advisable to review your form thoroughly or seek assistance if you’re unsure about any section to ensure your California Resident Income Tax Return is accurately filed.

Documents used along the form

Filing a California 540 C1 form, also known as the California Resident Income Tax Return, is an important step for residents to comply with state tax regulations. To ensure accuracy and completeness, filers often need additional documents during this process. The following briefly outlines other forms and supporting documents typically used alongside the California 540 C1 form to provide required information and claim specific tax benefits.

- Form FTB 1131: Provides a Privacy Notice to filers outlining how personal information is handled and protected by the tax authority.

- Schedule CA (540): Adjustments – Residents form, used for reporting income adjustments that can affect taxable income in California differently than on the federal return.

- Form W-2: Wage and Tax Statement, issued by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck.

- Form 1040: U.S. Individual Income Tax Return, the standard federal income tax form used to report an individual’s gross income.

- Form FTB 3506: Child and Dependent Care Expenses Credit form, allows taxpayers to claim a credit for child and dependent care expenses.

- Schedule P (540): Alternative Minimum Tax and Credit Limitations – Residents, used to calculate the alternative minimum tax owed by California residents.

- Form FTB 3800: Tax Computation for Certain Children with Unearned Income, for calculating the tax on a child's investment income.

- Form FTB 3803: Parents’ Election to Report Child’s Interest and Dividends, allows parents to report a child’s interest and dividends on their own return.

- Form 1099: Various forms are used to report various types of income other than wages, such as independent contractor income, dividends, and interest.

Completing the California 540 C1 form accurately often necessitates detailed income information and tax calculations. The proper use and submission of these supporting documents and supplementary forms ensure that taxpayers comply with state tax laws, claim all entitled deductions and credits, and accurately report their income and taxes. Consulting with a tax professional or the California Franchise Tax Board directly can provide further guidance tailored to an individual's specific tax situation.

Similar forms

The California 540 C1 form shares notable similarities with the Federal 1040 form, primarily in their purpose as fundamental tools for individuals to report their annual income and calculate owed taxes. Both forms cater to residents—540 C1 for Californians and 1040 for U.S. citizens or residents for tax purposes. They require detailed income information, allow deductions and credits to lower tax liability, and calculate either the tax due to the government or a refund owed to the filer. These forms also adjust for personal exemptions and standard or itemized deductions, emphasizing their role in personalizing the tax experience to individual financial situations.

Similarly, the California 540 C1 form mirrors the 1040 Schedule A form, used for itemizing deductions on the federal level. Just as Schedule A provides a means to reduce taxable income through various deductions beyond the standard deduction, the 540 C1 form includes sections for California-specific adjustments and deductions. These might encompass state-specific tax benefits, charitable contributions, medical expenses, or mortgage interest, allowing taxpayers to reduce their taxable income by detailing eligible expenses not covered under the standard deduction.

Another document akin to the California 540 C1 form is the 540 Schedule CA, which performs the function of adjusting federal income and deductions to comply with California's tax codes. This schedule is necessary because some federal tax provisions do not apply under California law, requiring taxpayers to add or subtract income and deductions to accurately calculate their state tax liability. This process ensures that the state-specific fiscal policy and regulations are correctly applied to a taxpayer's circumstances, reflecting variations between federal and state tax law.

The 540 ES form, designed for estimated tax payments, parallels the California 540 C1 in its objective to facilitate accurate tax payments to the California Franchise Tax Board. This form is particularly relevant for individuals who do not have taxes withheld from their income, such as self-employed individuals or those with significant investment income. Through the 540 ES form, taxpayers can make quarterly estimated payments to avoid underpayment penalties, highlighting the state's system for managing tax obligations throughout the year, akin to the federal estimated tax payment system.

Dos and Don'ts

When filling out the California 540 C1 form, meticulously providing accurate and complete information is essential. Here are eight tips—things you should and shouldn't do—to keep in mind:

- Do review the Privacy Notice by obtaining form FTB 1131 to know how your personal information is used.

- Don't leave any fields blank that apply to you. If a section does not apply, indicate with "N/A" or "0", where appropriate.

- Do report your and if applicable, your spouse's/RDP's correct Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) to avoid processing delays or potential mistakes.

- Don't estimate numbers. Report exact figures from your supporting documents, such as Form(s) W-2 for state wages.

- Do follow instructions for specific lines closely. For instance, on lines 7 through 10, properly calculate the exemptions by following the instructions and using the pre-printed dollar amount.

- Don't forget to sign and date the form at the end. An unsigned tax return can lead to unnecessary delays and could be considered invalid.

- Do attach all required documents. For example, if you're claiming any credits like the Nonrefundable Child and Dependent Care Expenses Credit, make sure to attach Form FTB 3506 as indicated.

- Don't improperly adjust your federal adjusted gross income for California specific adjustments without using Schedule CA (540), ensuring that you're applying the state-specific additions and subtractions correctly.

Following these guidelines helps to ensure the accurate and timely processing of your California 540 C1 form. Remember, attention to detail can prevent processing delays and ensure you comply with California tax laws.

Misconceptions

Understanding the California 540 C1 form can sometimes be challenging, leading to a mix of interpretations and errors. Below are some common misconceptions about this form:

- It's only for individuals. While the 540 C1 form is primarily designed for individual taxpayers, it's equally relevant for married couples or Registered Domestic Partners (RDPs) filing jointly or separately. The form accommodates different filing statuses, including single, head of household, and qualifying widow(er) with a dependent child.

- You must itemize deductions if you file with 540 C1. People often think itemizing deductions is mandatory when using this form. However, taxpayers have the option to take the standard deduction if it's more beneficial. The form helps determine the larger benefit between California itemized deductions and the California standard deduction based on the taxpayer's filing status.

- Error if your California filing status differs from your federal filing status. It's a misconception that your California filing status must match your federal filing status. There are cases where they may differ, and the 540 C1 form includes a section to acknowledge this difference, ensuring you're not penalized for discrepancies that are legitimate.

- Dependency exemptions are unlimited. There is a common belief that you can claim an unlimited number of dependents. However, the form has specific calculations and limits for personal, blind, senior, and dependent exemptions, tying the exemption amount directly to a pre-printed dollar value multiplied by the number of exemptions you're eligible for.

- The form doesn't accommodate unique tax situations. Some people think the 540 C1 form is too generic to handle unique or complex tax situations. Yet, it includes sections for nonrefundable child and dependent care expenses credits, new jobs credit, and other special credits and adjustments. It allows for exemptions and credits tailored to specific situations, highlighting its flexibility to accommodate a wide array of taxpayer circumstances.

Understanding these misconceptions can help taxpayers approach the California 540 C1 form with clarity, ensuring they maximize their tax benefits and comply correctly with state tax laws.

Key takeaways

Filling out and submitting the California 540 C1 form, also known as the California Resident Income Tax Return, requires careful attention to detail and understanding of the specific instructions to ensure compliance and accuracy in reporting one’s income taxes. Here are four key takeaways to consider:

-

Ensure accuracy with personal information: It's crucial to double-check the accuracy of personal details such as full name, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and address. Incorrect or incomplete information can lead to processing delays or problems with the tax return.

-

Understand your filing status and exemptions: The form allows taxpayers to choose their filing status and claim exemptions for dependents, blindness, age, etc. Understanding and correctly applying these sections can significantly impact the taxable income and potentially reduce the amount owed.

-

Differentiate between federal and state adjustments: Taxpayers must account for California-specific adjustments by subtracting certain amounts from or adding them to their federal adjusted gross income. This step requires careful consideration of state-specific tax law differences from federal rules.

-

Take advantage of direct deposit for refunds: When expecting a refund, opting for direct deposit can expedite the receipt of funds. Taxpayers should ensure the routing and account numbers are correct to avoid any delays.

It's important for taxpayers to review the entire form and accompanying schedules carefully. Mistakes or omissions can lead to processing delays or additional scrutiny by the Franchise Tax Board. Additionally, staying informed about annual updates to tax laws and rates is crucial for accurate reporting and to maximize potential refunds or minimize liabilities.

Discover More PDFs

Judicial Council Form - Can be used in conjunction with any paper filed with the court, underscoring its flexibility and universal application.

Application to Rent California - An informative document for landlords in California to understand the financial and rental history of applicants, aiming to ensure a good landlord-tenant match.