Blank California 51 055A PDF Form

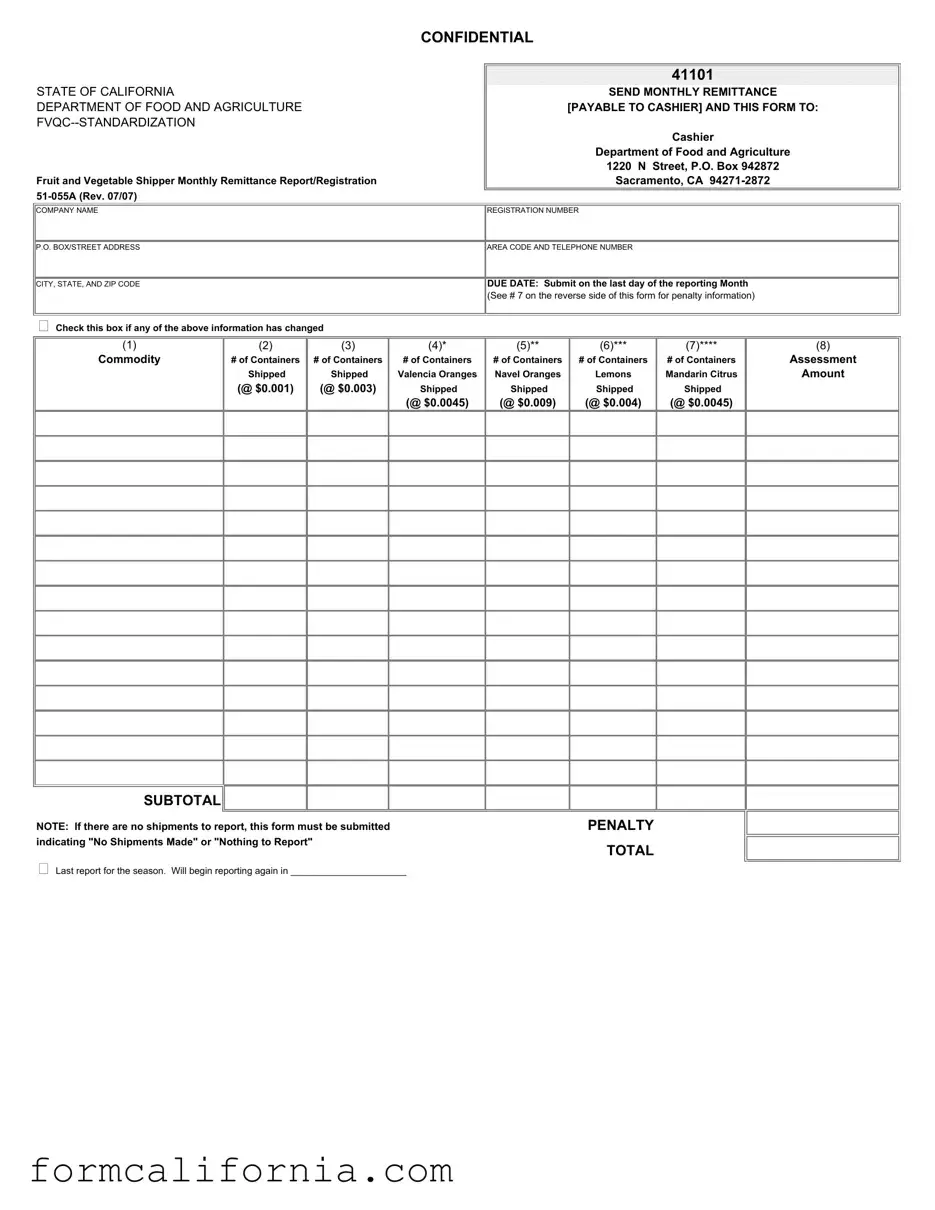

Navigating the agricultural and regulatory landscape of California requires attention to detail and a commitment to staying informed about the necessary documentation. Among these critical documents is the California 51 055A form, a fundamental piece required by the Department of Food and Agriculture. This confidential document serves a vital role for fruit and vegetable shippers within the state. Essentially, it is a monthly remittance report and registration form that ensures compliance with the standardization efforts overseen by the Fruit and Vegetable Quality Control (FVQC) Division. The form, updated last in July 2007, mandates shippers to submit detailed information about their shipments, including the type and quantity of commodities shipped, such as Valencia oranges, Navel oranges, lemons, and Mandarin citrus. Moreover, it calls for an assessment based on the shipped quantities, aiming to maintain the quality and standards of produce circulated within the market. Compliance hinges on timely monthly submissions, accompanied by the corresponding remittance payable to the Cashier at the Department's office in Sacramento. Additionally, it carries a provision for penalties in cases of non-compliance or late submissions, underlining the seriousness with which these regulations are enforced. As a beacon guiding shippers through their monthly reporting obligations, the form serves not just as a record-keeping tool but as a testament to the collaborative effort between the agricultural sector and regulatory bodies in upholding the quality of California's rich bounty.

Document Preview Example

CONFIDENTIAL

STATE OF CALIFORNIA

DEPARTMENT OF FOOD AND AGRICULTURE

Fruit and Vegetable Shipper Monthly Remittance Report/Registration

41101

SEND MONTHLY REMITTANCE

[PAYABLE TO CASHIER] AND THIS FORM TO:

Cashier

Department of Food and Agriculture

1220 N Street, P.O. Box 942872

Sacramento, CA

COMPANY NAME

P.O. BOX/STREET ADDRESS

CITY, STATE, AND ZIP CODE

REGISTRATION NUMBER

AREA CODE AND TELEPHONE NUMBER

DUE DATE: Submit on the last day of the reporting Month

(See # 7 on the reverse side of this form for penalty information)

Check this box if any of the above information has changed

(1)

Commodity

(2) |

(3) |

(4)* |

# of Containers |

# of Containers |

# of Containers |

Shipped |

Shipped |

Valencia Oranges |

(@ $0.001) |

(@ $0.003) |

Shipped |

|

|

(@ $0.0045) |

(5)** |

(6)*** |

# of Containers |

# of Containers |

Navel Oranges |

Lemons |

Shipped |

Shipped |

(@ $0.009) |

(@ $0.004) |

(7)****

#of Containers Mandarin Citrus

Shipped

(@ $0.0045)

(8)

Assessment

Amount

SUBTOTAL

NOTE: If there are no shipments to report, this form must be submitted |

PENALTY |

indicating "No Shipments Made" or "Nothing to Report" |

TOTAL |

|

Last report for the season. Will begin reporting again in ______________________

Document Specs

| # | Fact |

|---|---|

| 1 | The form is known as the California 51 055A form. |

| 2 | It serves as a Fruit and Vegetable Shipper Monthly Remittance Report/Registration. |

| 3 | Governed by the California Department of Food and Agriculture. |

| 4 | It requires shippers to report and pay monthly remittances based on the commodities shipped, including Valencia oranges, Navel oranges, Lemons, and Mandarin Citrus. |

| 5 | Payment and the form should be sent to the Cashier at the Department of Food and Agriculture located in Sacramento, CA. |

| 6 | Reports and payments are due on the last day of the reporting month. |

| 7 | Penalties are applied for late submissions, as detailed in section 7 on the reverse side of the form. |

Detailed Instructions for Writing California 51 055A

Once you've filled out the California 51 055A form, which is essential for fruit and vegetable shippers in California, the process doesn't stop there. This form helps the Department of Food and Agriculture keep track of shipments and ensures that all necessary fees are collected to support the industry's standardization efforts. After completing and submitting this form, it's important to keep copies for your records. You should also prepare for the next reporting period by keeping accurate and up-to-date records of all shipments. Monitoring updates or changes to fees or reporting requirements is also crucial to remain compliant. Now, let's focus on how to properly fill out the form.

- Start by writing the company name in the designated space.

- Enter the P.O. Box/Street address below the company name.

- Fill in the city, state, and ZIP code in the corresponding fields.

- Provide the registration number associated with your company.

- Include the area code and telephone number of your company.

- If any of the information has changed, make sure to check the box indicating this.

- In the section labeled (1) Commodity, list each type of fruit or vegetable shipped during the reporting period.

- For each commodity listed, fill in the number of containers shipped in the columns under (2), (3), and (4)* as applicable based on the rate per container.

- Fill in the number of containers for Valencia Oranges, Navel Oranges, Lemons, and Mandarin Citrus in their respective sections (5)**, (6)***, and (7)****, according to the specified rates.

- Calculate the Assessment Amount for each type of commodity and enter the values in the subtotal section (8).

- Add up the subtotal amounts and write the total in the TOTAL line at the bottom of the form.

- If there are no shipments to report for the month, clearly mark the form with "No Shipments Made" or "Nothing to Report."

- For the last report of the season, indicate the month you will begin reporting again in the provided space.

- Review the form to ensure all information is accurate and complete.

- Send the form with the required monthly remittance to the Cashier Department of Food and Agriculture at the address provided on the form, ensuring it arrives by the due date noted at the top of the page.

Remember, it's important to stay diligent and submit this form on a monthly basis. Accurate and timely submissions not only keep you compliant but also contribute to the overall health and standardization of California's fruit and vegetable industry.

Things to Know About This Form

What is the California 51 055A form?

The California 51 055A form, also known as the Fruit and Vegetable Shipper Monthly Remittance Report/Registration, is a document issued by the California Department of Food and Agriculture. It's designed for fruit and vegetable shippers to report and remit monthly assessments based on their shipments. This document helps in the standardization and tracking of agricultural produce within the state.

Who needs to fill out this form?

Any entity involved in the shipping of certain fruits and vegetables within California must complete this form. This includes farmers, distributors, and businesses that deal with the shipping of commodities such as oranges, lemons, and mandarins, among others.

How is the assessment amount calculated?

The assessment amount is calculated based on the number of containers shipped and the corresponding rate per container for each commodity type. The form lists different commodities along with a per container rate for them. To calculate the total, multiply the number of containers shipped by the rate per container for each listed item, then sum up these amounts to get the subtotal. Any penalties or adjustments can be added to this subtotal to reach the total amount due.

Where and when should the form be submitted?

This form should be mailed to the Cashier at the Department of Food and Agriculture, at the address provided on the form. It's due on the last day of the reporting month. For instance, if reporting for July, the form and any payment due must be submitted by July 31st.

What happens if the information on the form changes?

If any of the pre-filled information, such as your company name or address, has changed, it's important to check the designated box on the form indicating these changes. This ensures that your records are updated accordingly with the Department of Food and Agriculture.

What if there are no shipments to report for a month?

Even if there are no shipments to report for a particular month, you are still required to submit the form. In such cases, you should indicate "No Shipments Made" or "Nothing to Report" on the form to fulfill your reporting obligations without making a payment.

What penalties are associated with this form?

Penalties may apply for late submissions or incorrect payments. Specific details about penalties are provided on the reverse side of the form, under Section 7. It's critical to review these details to understand the potential consequences of not complying with the submission guidelines or deadlines.

Can I begin reporting again after a break?

Yes, if you stop shipments and therefore stop reporting for a season, you can indicate the month you plan to begin reporting again at the bottom of the form. This lets the Department of Food and Agriculture know when to expect your future reports.

Is there a digital version of this form available?

While this document primarily exists in a paper format for mailing, it's advisable to contact the Department of Food and Agriculture directly to inquire about any available digital submission options. As technology and processes evolve, digital reporting may become an alternative to or replace traditional mail-in methods for convenience and efficiency.

Common mistakes

Not updating contact information when it changes: It's crucial that businesses remember to check the box indicating changed contact information on the California 51 055A form. This ensures that all communication and documentation from the Department of Food and Agriculture are correctly directed and received.

Failing to submit the form on time: The form is due on the last day of the reporting month. Late submissions can result in penalties, as detailed in the instructions on the reverse side of the form.

Incorrectly reporting the number of containers: Each commodity listed requires a precise count of containers shipped. Accurately recording these numbers is essential for proper remittance calculation.

Overlooking the assessment amounts for different commodities: Each commodity—Valencia oranges, Navel oranges, lemons, and mandarin citrus—has a specific assessment rate per container. It's a frequent mistake to apply the wrong rate, leading to incorrect subtotal and total amounts.

Not indicating "No Shipments Made": If no shipments were made during the reporting period, the form still must be submitted with this status clearly indicated. This oversight can cause confusion and unnecessary follow-up from the department.

Miscalculating the subtotal and total dues: The assessment amounts need to be correctly totaled. Errors in addition can lead to underpayment or overpayment.

Submitting incomplete forms: Each section of the form needs to be fully completed. Missing information can lead to processing delays or the form being returned for correction.

Forgetting to sign the form: The form requires a signature for verification and processing, and forgetting to sign is a common mistake.

Using outdated forms: The form's revision date is July 2007 (Rev. 07/07). Using an outdated version of the form can lead to incorrect processing, as policies and rates may have changed.

To avoid these common mistakes, thoroughly read the instructions on the form and the Department of Food and Agriculture’s guidance. By paying close attention to detail and ensuring that all information is current, accurate, and complete, businesses can help streamline the submission process and remain in good standing.

Documents used along the form

When managing agricultural exports or shipments in California, particularly for fruits and vegetables, businesses often are required to fill out and submit several forms in addition to the California 51-055A form (Fruit and Vegetable Shipper Monthly Remittance Report/Registration). Familiarizing oneself with these documents can streamline the regulatory compliance process, ensuring timely submissions and adherence to state regulations.

- CDFA-232: Market Enforcement Branch License Application - This form is crucial for businesses that need to obtain or renew their license to operate within the California food and agriculture market, certifying that they meet the state's business standards.

- ORG-100: Organic Processor/Handler Certification Application - For businesses that deal with organic produce, this form is necessary to certify that their products meet California's organic production and handling standards.

- SCM-101: Certified Farmers' Market Application - This application is required for organizations seeking to create or operate a certified farmers' market, ensuring the market complies with state regulations for direct-to-consumer sales of produce.

- PEST-100: Pest Exclusion Branch Form - Entities that import or transport agricultural commodities into California must submit this form to prevent the introduction and spread of pests and diseases within the state.

- AWM-001: Application for Weighmaster License - For businesses involved in the weighing of goods for commercial transactions, this license application ensures adherence to the state's accuracy standards.

- EGG-101: Egg Handlers Registration Form - Firms that handle, grade, pack, or sell eggs in California are required to register using this form to verify compliance with health and safety regulations.

Each of these forms serves a specific purpose, from licensing and certifications to pest control and market operation, ensuring the integrity and compliance of agricultural business practices in California. By diligently completing and submitting these documents alongside the 51-055A form, businesses can maintain good standing with the Department of Food and Agriculture and contribute to the state's health, safety, and economic well-being.

Similar forms

The California Form 51-055A is closely related to the U.S. Department of Agriculture's (USDA) "Market News Service Fruit and Vegetable Daily Report." Both forms deal with the fruit and vegetable sector, compiling and reporting data crucial for market analysis and regulation. The USDA form collects daily prices and market conditions for various produce, serving a broader spectrum of stakeholders in the industry. Similarly, the California 51-055A form gathers monthly remittance information specifically from shippers, focusing on regulatory compliance and industry oversight. Both documents play a pivotal role in maintaining transparency and facilitating informed decision-making within the agricultural sector.

Another document that bears similarity to the California 51-055A form is the "Sales and Use Tax Return" used by the California Department of Tax and Fee Administration. This tax return document also requires businesses to report and remit taxes on a regular basis, similar to how fruit and vegetable shippers report and remit assessments on shipped commodities. While the tax form applies to a broad range of businesses for sales and use tax, the 51-055A specifically targets fruit and vegetable shippers for standardization fees, reflecting the government's role in both regulating specific industries and collecting revenue for public purposes.

The "Quarterly Federal Excise Tax Return" (Form 720), filed with the Internal Revenue Service (IRS), also parallels the California 51-055A form. It requires entities to report and pay taxes on specific goods, services, and activities. Like the California form, it is designed for regular submissions (quarterly in the case of Form 720) and is purposed towards a specific subset of transactions or operations - namely those subject to federal excise taxes. The 51-055A targets a niche within the agricultural sector, emphasizing the regulatory and financial obligations entities must fulfill at different governmental levels.

Last but not least, the "Employment Development Department Quarterly Contribution Return and Report of Wages" (Form DE 9) is akin to the 51-055A form in that businesses in California use it to report and remit employee-related payments. While DE 9 focuses on payroll taxes and wages, providing essential information for worker benefits and tax collection, the 51-055A form concentrates on the agricultural industry's shipment and remittance data. Both are critical for compliance with state regulations, ensuring businesses contribute appropriately to state funds and adhere to industry-specific regulations.

Dos and Don'ts

Filling out the California 51 055A form, a crucial document required by the State of California Department of Food and Agriculture, involves precision and attention to detail. To ensure that this form is accurately completed and meets all compliance standards, here are some essential do's and don'ts.

- Do ensure all information is current. If any company details have changed, such as address or phone number, remember to check the designated box.

- Do accurately report the number of containers shipped for each commodity listed. This includes Valencia Oranges, Navel Oranges, Lemons, and Mandarin Citrus.

- Do carefully calculate the assessment amount for each commodity by multiplying the number of containers by the specified rate.

- Do check for any penalties under section 7 on the reverse side of the form and include these in your calculations if applicable.

- Do submit the form and your remittance payable to "Cashier" at the provided address before the due date, which is the last day of the reporting month.

- Don't leave any sections blank. If you have no shipments to report for the month, indicate this by writing "No Shipments Made" or "Nothing to Report."

- Don't forget to include your registration number. This crucial piece of information ensures that your submission is correctly accounted for.

By following these guidelines, you can submit the California 51 055A form confidently, knowing it's complete and accurate. This not only fulfills your regulatory obligations but also helps maintain the integrity of the state's agricultural reporting system.

Misconceptions

Misunderstandings about the California 51 055A form can lead to errors in compliance, resulting in potential fines or delays. It's vital to dispel these misconceptions to ensure that fruit and vegetable shippers remain in good standing with the Department of Food and Agriculture. Here are five common misconceptions and the truths behind them.

- The form is only for citrus fruits: While the example commodities listed are primarily citrus (Valencia oranges, Navel oranges, lemons, and mandarin citrus), this form actually applies to all fruit and vegetable shippers regulated under the FVQC--STANDARDIZATION rules. It’s important for all shippers to verify which commodities are covered and report accordingly.

- Submission is only required when shipments are made: There's a section that must be filled even if no shipments have been made, indicating "No Shipships Made" or "Nothing to Report". This confuses some into thinking that submission is only required when there are shipments, but in reality, the form must be submitted monthly regardless of shipping activity to avoid penalties.

- Reporting is based solely on volume: While the form requires the number of containers shipped, there's also a financial component where assessment amounts per commodity are calculated. This dual requirement of physical and financial reporting ensures comprehensive oversight by the Department of Food and Agriculture.

- Any changes in company information do not need to be reported immediately: There is a specific box to check if any of the company information has changed since the last report. This checkbox facilitates prompt updates to the Department and helps maintain accurate records, which is crucial for compliance and communication.

- Penalties are flat or easily predictable: The note regarding penalties on the reverse side suggests that fines for late or incorrect submissions can vary based on factors not specified on the main side of the form. Assuming penalties are either non-existent or uniformly applied is a mistake. Compliance with the due date and accurate completion of the form are critical to avoid variable penalties.

Understanding the California 51 055A form isn't just about filling out the right boxes; it’s about ensuring that agricultural businesses operate smoothly within the guidelines set by the Department of Food and Agriculture. Correcting these misconceptions is the first step in fostering a compliance culture that supports the sector's economic health and regulatory integrity.

Key takeaways

When dealing with the California 51 055A form, used by shippers of fruit and vegetables for monthly remittance reports and registration with the Department of Food and Agriculture, there are several key takeaways to remember:

- Ensure all company information is accurately filled in, including company name, address (P.O. Box/Street), city, state, zip code, registration number, and telephone number.

- This form is due on the last day of each reporting month. Adhering to this deadline is crucial to avoid potential penalties.

- If any company information has changed since the last submission, it's necessary to indicate this by checking the appropriate box on the form.

- It's important to accurately report the number of containers shipped for each commodity listed, such as Valencia Oranges, Navel Oranges, Lemons, and Mandarin Citrus, with the corresponding assessment rate applied.

- Do not overlook the assessment amount section, where the total due based on shipments must be calculated and reported.

- If no shipments were made during the reporting period, the form must still be submitted. Indicate "No Shipments Made" or "Nothing to Report" on the form to comply with reporting requirements.

- Check the reverse side of the form for detailed instructions and information regarding penalty for late submissions. Understanding the penalty structure is vital.

- Payments should be made payable to the Cashier at the Department of Food and Agriculture and sent to the address provided on the form, ensuring both payment and form reach the department in a timely manner.

- At the end of the shipping season, mark the last report accordingly and specify when reporting will resume.

By paying close attention to these details, shippers can ensure compliance with the Department of Food and Agriculture's requirements, avoiding unnecessary penalties and disruptions in their operations.

Discover More PDFs

California Forms - Initiates a legal process to reassess and possibly adjust the amount of money taken from an individual's earnings for support.

Covid Workers Compensation - Facilitates a clear record of the injury event through witness statements included within the form.

262 Dmv Form - The REG 262 form is not the ownership certificate but is essential in the ownership transfer process.