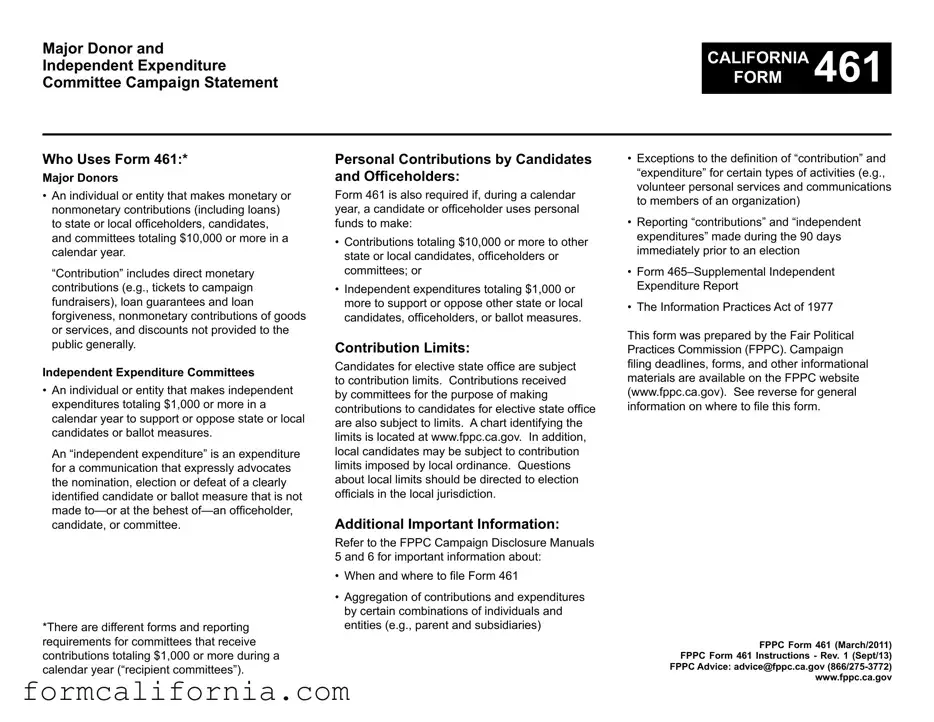

Blank California 461 PDF Form

Navigating the intricacies of political campaign finance in California can indeed seem daunting, yet understanding the California Form 461 is crucial for major donors and independent expenditure committees. This form, dedicated to ensuring transparency and accountability in political funding, is a cornerstone of regulatory compliance for those contributing significantly to state or local campaigns. It catanates to individuals or entities that contribute $10,000 or more in a calendar year, whether through direct financial contributions, loans, or non-monetary gifts, as well as those making independent expenditures of $1,000 or more to advocate for or against candidates or ballot measures. Moreover, the form obliges candidates or officeholders who use personal funds above these thresholds for contributions or independent expenditures to adhere to its requirements. There are nuanced contribution limits and diverse filing mandates depending on the nature of the committee and the geographical focus of its contributions or expenditures. The form also outlines specific guidelines for electronic filing, precious for committees reaching or exceeding a total of $25,000 in contributions or independent expenditures within a calendar year. Alongside detailing the procedural aspects of filing, from the types of contributions and expenditures to report to the verification process, Form 461 synthesizes the essence of campaign finance stewardship, enforcing the principle that transparency is paramount in upholding the integrity of democratic processes.

Document Preview Example

Major Donor and

Independent Expenditure

Committee Campaign Statement

CALIFORNIAFORM 461

Who Uses Form 461:*

Major Donors

•An individual or entity that makes monetary or nonmonetary contributions (including loans) to state or local oficeholders, candidates, and committees totaling $10,000 or more in a calendar year.

“Contribution” includes direct monetary contributions (e.g., tickets to campaign fundraisers), loan guarantees and loan forgiveness, nonmonetary contributions of goods or services, and discounts not provided to the public generally.

Independent Expenditure Committees

•An individual or entity that makes independent expenditures totaling $1,000 or more in a calendar year to support or oppose state or local candidates or ballot measures.

An “independent expenditure” is an expenditure for a communication that expressly advocates the nomination, election or defeat of a clearly identiied candidate or ballot measure that is not made

*There are different forms and reporting requirements for committees that receive contributions totaling $1,000 or more during a calendar year (“recipient committees”).

Personal Contributions by Candidates and Oficeholders:

Form 461 is also required if, during a calendar year, a candidate or oficeholder uses personal funds to make:

•Contributions totaling $10,000 or more to other state or local candidates, oficeholders or committees; or

•Independent expenditures totaling $1,000 or more to support or oppose other state or local candidates, oficeholders, or ballot measures.

Contribution Limits:

Candidates for elective state ofice are subject to contribution limits. Contributions received by committees for the purpose of making contributions to candidates for elective state ofice are also subject to limits. A chart identifying the limits is located at www.fppc.ca.gov. In addition, local candidates may be subject to contribution limits imposed by local ordinance. Questions about local limits should be directed to election oficials in the local jurisdiction.

Additional Important Information:

Refer to the FPPC Campaign Disclosure Manuals

5 and 6 for important information about:

•When and where to ile Form 461

•Aggregation of contributions and expenditures by certain combinations of individuals and entities (e.g., parent and subsidiaries)

•Exceptions to the deinition of “contribution” and “expenditure” for certain types of activities (e.g., volunteer personal services and communications to members of an organization)

•Reporting “contributions” and “independent expenditures” made during the 90 days immediately prior to an election

•Form

•The Information Practices Act of 1977

This form was prepared by the Fair Political Practices Commission (FPPC). Campaign iling deadlines, forms, and other informational materials are available on the FPPC website (www.fppc.ca.gov). See reverse for general information on where to ile this form.

FPPC Form 461 (March/2011) FPPC Form 461 Instructions - Rev. 1 (Sept/13)

FPPC Advice: advice@fppc.ca.gov

Instructions for Major Donor and Independent Expenditure Committee Campaign Statement

CALIFORNIAFORM 461

Where to File:

State Elections and Committees Active in More Than One County: If more than 50% of your contributions or independent expenditures were made to support or oppose state candidates, measures and committees, or to support or oppose local candidates and measures being voted on in more than one county. File in the following place:

•Secretary of State (original and one copy) Political Reform Division

1500 11th Street, Room 495 Sacramento, CA 95814 Phone (916)

County Elections: If you are not a state committee and more than 50% of your contributions or independent expenditures were made to support or oppose candidates and measures being voted on in a single county, file with the election offi cial in that county (original and one copy).

This fi ling requirement also applies to contributions or independent expenditures made to support or oppose candidates and measures on the ballot in more than one jurisdiction located within a single county.

City Elections: If you are not a state committee and more than 50% of your contributions or independent expenditures were made to support or oppose candidates and measures being voted on in a single city, fi le with the city clerk in that city (original and one copy).

Electronic Filing:

Major donor and independent expenditure committees that are required to fi le reports with the Secretary of State must fi le Form 461 electronically if they make contributions or independent expenditures totaling $25,000 or more in a calendar year. Paper reports are also required. Some local jurisdictions also require reports to be electronically filed.

FPPC Form 461 (March/2011) FPPC

Major Donor and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAJOR DONOR AND INDEPENDENT EXPENDITURE |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMITTEE STATEMENT |

|||||||||||||

Independent Expenditure Committee |

|

|

Type or print in ink. |

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

Date Stamp |

|

CALIFORNIAFORM |

461 |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Campaign Statement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

(Government Code sections |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

Statement covers period |

Date of election if applicable: |

|

|

|

|

|

Page |

|

|

|

|

of |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

(Month, Day, Year) |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

from |

|

|

|

|

|

|

|

|

|

|

|

|

|

For Offi cial Use Only |

|

|||||||||||

SEE INSTRUCTIONS ON REVERSE |

|

through |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

1. Name and Address of Filer |

|

|

|

|

|

|

|

3. Summary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

NAME OF FILER |

|

|

|

|

|

|

|

|

(Amounts may be rounded to whole dollars.) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

1. |

Expenditures and contributions |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

(including loans) of $100 or more |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

made this period. (Part 5.) |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||

|

RESIDENTIAL OR MAILING ADDRESS |

(NO. AND STREET) |

|

|

................................................ |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

2. |

Unitemized expenditures and |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

contributions (including loans) under |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

CITY |

STATE |

|

|

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

$100 made this period |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

3. Total expenditures and contributions |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

RESPONSIBLE OFFICER |

AREA CODE/DAYTIME PHONE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

(If fi ler is other than an individual) |

|

|

|

|

|

|

|

|

|

made this period. (Add Lines 1 + 2.) |

SUBTOTAL |

$ |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

4. Total expenditures and contributions |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

made from prior statement. (Enter |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

2. Nature and Interests of Filer (Complete each applicable section.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

amount from Line 5 of last statement |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

A FILER WHO IS AN INDIVIDUAL MUST LIST THE NAME, ADDRESS, AND BUSINESS INTERESTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

fi led. If this is the fi rst statement for |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

OF EMPLOYER OR, IF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

the calendar year, enter zero.) |

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

NAME OF EMPLOYER/BUSINESS |

|

|

|

BUSINESS INTERESTS |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

5. Total expenditures and contributions |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

(including loans) made since |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

ADDRESS OF EMPLOYER/BUSINESS |

|

|

|

|

|

|

|

|

|

January 1 of the current calendar year. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

(Add Lines 3 + 4.) |

|

|

TOTAL |

$ |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

A FILER THAT IS A BUSINESS ENTITY MUST DESCRIBE THE BUSINESS ACTIVITY IN WHICH IT IS |

4. Verification |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

ENGAGED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I have used all reasonable diligence in preparing this statement. I have |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

reviewed the statement and to the best of my knowledge the information |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

contained herein is true and complete. I certify under penalty of perjury under |

|||||||||||||||||||

|

|

A FILER THAT IS AN ASSOCIATION MUST PROVIDE A SPECIFIC DESCRIPTION OF ITS INTERESTS |

|

|||||||||||||||||||||||||||

|

|

|

the laws of the State of California that the foregoing is true and correct. |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Executed on |

|

|

By |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

A FILER THAT IS NOT AN INDIVIDUAL, BUSINESS ENTITY, OR ASSOCIATION MUST DESCRIBE THE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

SIGNATURE OF INDIVIDUAL DONOR OR |

||||||||||||||||||||

|

|

COMMON ECONOMIC INTEREST OF THE GROUP OR ENTITY |

|

|

|

|

|

|

|

DATE |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

RESPONSIBLE OFFICER, IF OTHER THAN AN INDIVIDUAL |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amendment (Explain): |

|

FPPC Form 461 (March/2011) |

|

FPPC |

|

|

|

|

|

|

|

Instructions for Major Donor and Independent Expenditure Committee Campaign Statement

CALIFORNIAFORM 461

For defi nitions and detailed information about completing Form 461, refer to the FPPC Campaign Disclosure Manuals 5 and 6.

Period Covered by a Statement:

The “period covered” by a campaign statement begins the day after the closing date of the last campaign statement you fi led. For example, if the closing date of the last statement was June 30, the beginning date of the next statement will be July 1.

If this is the fi rst campaign statement for the calendar year, begin with January 1.

The closing date of the statement depends on the type of statement you are filing.

Date of Election:

Enter the date of the election if you are filing Form 461 as a city or a county major donor or independent expenditure committee and the city or county’s election will be held this year.

1. Name and Address of Filer:

Enter the legal name of the individual or entity

filing the statement. If the fi ler is commonly known to the public by another name, that name may be used. When a person directs and controls the making of contributions and independent expenditures by a related entity (e.g., a parent and subsidiaries or a majority shareholder of a

corporation) that must be aggregated and reported on Form 461, list as the “Name of Filer” the name of the individual or entity that directs and controls the making of the contributions and independent expenditures. In addition, you must:

•Indicate that the campaign statement includes the contributions and independent expenditures of other entities. For example, “ABC Corporation, including aggregated contributions/ independent expenditures.”

•Identify any entities added to this report that were not included in a prior report fi led for the current calendar year, as well as any entities included in a prior report for the current calendar year that are no longer required to aggregate under the name of filer.

•Identify both names if the “Name of Filer” listed on a previous report filed for the current calendar year is different than the name identified on this report. For example, “John Lewis, formerly identifi ed as Lewis Construction.”

Enter the name of the responsible offi cer of an entity or organization fi ling the statement.

2. Nature and Interests of Filer:

When more than one person or entity is listed under “Name of Filer,” identify the nature and interests of each. (Use appropriately labeled continuation sheets if necessary.)

3. Summary:

Summary totals are calculated from the information itemized in Part 5 of the Form 461 and unitemized payments of less than $100. If this is the first report being filed for a calendar year, enter a zero on line 4 of the summary.

4. Verification:

A responsible offi cer of an entity or an entity filing jointly with any number of affi liates must sign the Form 461. An attorney or a certified public accountant may sign on behalf of the entity or entities. A statement fi led by an individual must be signed by the individual.

Amendments:

To amend previously fi led Form 461, check the “Amendment” box, enter the period covered by the statement you are amending, and complete Part

1.Disclose the amended information, including Part 3, if applicable, and complete the Verification.

FPPC Form 461 (March/2011) FPPC

Major Donor and |

|

|

|

MAJOR DONOR AND INDEPENDENT EXPENDITURE |

||||||||

|

|

|

|

|

COMMITTEE STATEMENT |

|||||||

Independent Expenditure Committee |

Type or print in ink. |

Statement covers period |

CALIFORNIA |

461 |

||||||||

Amounts may be rounded |

|

|

|

|

||||||||

Campaign Statement |

|

|

|

|

FORM |

|||||||

to whole dollars. |

from |

|

|

|

||||||||

|

|

|

through |

|

|

|

|

|

|

|

|

|

|

SEE INSTRUCTIONS ON REVERSE |

|

|

|

Page |

|

|

of |

|

|

||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME OF FILER |

|

|

|

|

|

|

|

|

|

|

|

5. Contributions (Including Loans, Forgiveness of Loans, and Loan Guarantees) and Expenditures Made

(If more space is needed, use additional copies of this page for continuation sheets.)

|

NAME, STREET ADDRESS, CITY, STATE AND ZIP CODE |

|

DESCRIPTION OF |

CANDIDATE AND OFFICE, |

AMOUNT THIS |

CUMULATIVE AMOUNT |

||

DATE |

TYPE OF PAYMENT |

PAYMENT |

MEASURE AND JURISDICTION, |

RELATED TO THIS |

||||

OF PAYEE |

PERIOD |

|||||||

|

|

(IF OTHER THAN MONETARY |

OR COMMITTEE |

CANDIDATE, MEASURE, |

||||

|

(IF COMMITTEE, ALSO ENTER I.D. NUMBER) |

|

|

|||||

|

|

CONTRIBUTION OR LOAN) |

|

|

|

OR COMMITTEE |

||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Monetary |

|

|

|

|

|

|

|

|

Contribution |

|

|

|

|

|

|

|

|

Loan |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Contribution |

|

|

|

|

|

|

|

|

Independent |

|

|

|

|

|

|

|

|

|

Support |

Oppose |

|

|

||

|

|

Expenditure |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Monetary |

|

|

|

|

|

|

|

|

Contribution |

|

|

|

|

|

|

|

|

Loan |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Contribution |

|

|

|

|

|

|

|

|

Independent |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Expenditure |

|

Support |

Oppose |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Monetary |

|

|

|

|

|

|

|

|

Contribution |

|

|

|

|

|

|

|

|

Loan |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Contribution |

|

|

|

|

|

|

|

|

Independent |

|

|

|

|

|

|

|

|

|

Support |

Oppose |

|

|

||

|

|

Expenditure |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Monetary |

|

|

|

|

|

|

|

|

Contribution |

|

|

|

|

|

|

|

|

Loan |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Contribution |

|

|

|

|

|

|

|

|

Independent |

|

|

|

|

|

|

|

|

|

Support |

Oppose |

|

|

||

|

|

Expenditure |

|

|

|

|||

|

|

|

|

|

|

|

|

|

SUBTOTAL $

FPPC Form 461 (March/2011) FPPC

Instructions for Major Donor and

Independent Expenditure Committee Campaign Statement

CALIFORNIAFORM 461

5. Contributions and Expenditures:

When itemizing contributions and expenditures made by more than one entity (e.g., a parent and subsidiaries), note which entity made each payment.

Date of Contribution

A monetary contribution is made on the date it is mailed, delivered, or otherwise transmitted to the candidate or committee. A nonmonetary contribution is made on the earlier of the following: 1) the date you made an expenditure for goods or services at the behest of the candidate or committee; or 2) the date the candidate or committee or an agent of the candidate or committee obtained possession or control of the goods or services.

Name and Address of Payee

If a total of $100 or more is contributed or expended during a calendar year to support or oppose a single candidate, committee or measure, disclose the name and address of the payee. If the payee is a committee, also disclose the identification number assigned to that committee by the Secretary of State. If no ID number has been assigned to a committee, provide the name and address of that committee’s treasurer.

Contributions and expenditures of less than $100 to support or oppose a single candidate, committee or measure during a calendar year are totaled and reported as a lump sum on Line 2 of the Summary.

Candidate, Measure or Committee

Identify the candidate, measure or committee supported or opposed by the contribution or expenditure. Disclose the name of the candidate and the offi ce sought or held; the name of the ballot measure and its jurisdiction; or the name of

the committee if a nonmonetary contribution was made to a general purpose committee. Check the appropriate box to indicate whether the payment was made to support or oppose the candidate or measure listed.

Amount/Cumulative Amount

Disclose the amount of the contribution or expenditure made this period.

If a single payment supports or opposes more than one candidate or measure, provide the name and address of the vendor. Enter the amount paid to the vendor in the “Description of Payment” column. Identify each candidate or measure, and enter the amount of the contribution or expenditure attributable to each in the “Amount this Period” column.

For each contribution, also disclose the cumulative amount contributed to the candidate (including all of the candidate’s controlled election committees) or to the committee (in the case of a ballot measure or other type of committee) since January 1 of the current calendar year. For each independent expenditure, disclose the cumulative amount of independent expenditures made since January 1 of the current calendar year related to the candidate or ballot measure supported or opposed by the expenditure.

Reporting Loans:

Check the “loan” box under “Type of Payment” if you make, forgive, or guarantee a loan. You need not report loan repayments received. If you make and forgive a loan during the same calendar year, report the amount of the forgiveness under “Description of Payment.” The same is true if you guarantee a loan and you make payments to the lender during the same calendar year.

Loans to state candidates are subject to contribution limits. If the candidate repays all or a portion of a loan, the lender may make additional contributions subject to the applicable contribution limit.

Report the fair market value of

Reporting Subvendors:

If an agent (including an independent contractor) makes payments on your behalf (“subvendor payments”), disclose those payments in addition to the payments made to the agent. For example, you pay a public relations fi rm, which pays for an advertisement supporting a ballot measure. In addition to disclosing the payment(s) made to the public relations fi rm, itemize payments of $500 or more made by the firm related to the advertisement. Do not include payments that are not for the purpose of making contributions or independent expenditures (e.g., for overhead or operating expenses).

Report the name and address of the agent followed by the name and address of each subvendor. Disclose amounts paid to the agent and subvendor in the “Description of Payment” column.

FPPC Form 461 (March/2011) FPPC

Document Specs

| Fact | Detail |

|---|---|

| Form Name | California Form 461 |

| Title | Major Donor and Independent Expenditure Committee Campaign Statement |

| Who Uses Form 461 | Major Donors and Independent Expenditure Committees |

| Criteria for Major Donors | Individuals or entities contributing $10,000 or more in a calendar year to state or local officeholders, candidates, and committees. |

| Criteria for Independent Expenditure Committees | Individuals or entities making independent expenditures totaling $1,000 or more in a calendar year to support or oppose state or local candidates or ballot measures. |

| Governing Laws | Government Code sections 84200-84216.5, regulated by the Fair Political Practices Commission (FPPC) |

Detailed Instructions for Writing California 461

Once you've decided to participate in California's political landscape as a major donor or independent expenditure committee, completing Form 461 correctly is a crucial next step. This form documents your financial contributions to candidates, officeholders, and committees, ensuring transparency and adherence to regulations. Here's a straightforward guide to help you fill out Form 461 accurately.

- Start by determining where to file. If your contributions or independent expenditures primarily support state-wide issues or multiple counties, file with the Secretary of State. For contributions within a single county or city, file with the respective county election official or city clerk.

- Ensure you meet electronic filing requirements if your contributions or expenditures reach $25,000 or more in a calendar year.

- On the form, begin with the Campaign Statement section, stating the period your contributions cover. If applicable, include the date of the upcoming election relevant to your contributions.

- Under 1. Name and Address of Filer, provide the legal name of the individual or entity making the contributions. Include your address and, if the filer is an entity, the name of the responsible officer.

- In the 2. Nature and Interests of Filer section, describe the business or personal interests related to your contributions, ensuring transparency about your motivations and potential affiliations.

- Move to the 3. Summary section, where you'll report expenditures and contributions, both itemized and unitemized, made during the reporting period. Add previous contributions for the calendar year to calculate your total contributions.

- Complete the 4. Verification part, which must be signed by a responsible officer if the filer is not an individual. This certifies the accuracy of the information provided under penalty of perjury.

- If you're amending a previously filed Form 461, mark the Amendment box, clearly stating the changes in the amended sections and re-complete the verification area.

- Finally, detail your contributions and expenditures in Part 5. Include the names, addresses, and amounts pertaining to each contribution or expenditure, specifying the type (monetary, loan, non-monetary, etc.), and whether it supports or opposes a candidate, measure, or committee.

After completing Form 461, review it for accuracy and completeness. Remember to file it by the required deadline to avoid possible penalties. Keeping a copy for your records is also a good practice. This step is an essential part of engaging in California's political finance system, ensuring your contributions are transparent and within legal frameworks.

Things to Know About This Form

What is the California Form 461?

California Form 461 is a campaign statement used by major donors and independent expenditure committees. It's required for individuals or entities that make contributions (monetary or nonmonetary) totaling $10,000 or more in a calendar year to state or local officeholders, candidates, and committees, or independent expenditures of $1,000 or more to support or oppose state or local candidates or ballot measures.

Who needs to file Form 461?

The following entities need to file Form 461:

- Major Donors: Any individual or entity contributing $10,000 or more in a calendar year to candidates, officeholders, or committees.

- Independent Expenditure Committees: Any individual or entity spending $1,000 or more in a calendar year to support or oppose candidates or ballot measures independently.

- Candidates and Officeholders: Those using personal funds to make contributions or independent expenditures above certain thresholds.

What qualifies as a contribution under Form 461?

Contributions include all forms of monetary support, loan guarantees, forgiveness of loans, nonmonetary contributions of goods or services, and discounts not available to the public generally.

Are there contribution limits detailed in Form 461?

Yes, candidates for elective state office and committees making contributions to those candidates are subject to contribution limits. A chart detailing these limits is provided by the Fair Political Practices Commission (FPPC) on their website. Local jurisdictions may have additional limits.

Where should Form 461 be filed?

Where you file depends on the nature of your contributions or expenditures:

- State Elections and Multi-County Issues: File with the Secretary of State.

- County Elections: File with the county election official if activities are focused in a single county.

- City Elections: File with the city clerk if activities are focused in a single city.

What information must be reported on Form 461?

The form requires detailed information about the filer, including the name and address, nature and interests of the filer, summary of expenditures and contributions, and a verification section signed by a responsible officer or the individual donor.

How are contributions and expenditures summarized on Form 461?

Summaries include detailed itemizations of expenditures and contributions of $100 or more, as well as a record of smaller contributions or expenditures that are less than $100.

What are the deadlines for filing Form 461?

Deadlines vary based on the election cycle and the specific activities of the filer. It's important to consult with the FPPC or relevant local election officials to determine specific filing deadlines.

Is electronic filing mandatory for Form 461?

Yes, for major donor and independent expenditure committees that make contributions or independent expenditures totaling $25,000 or more in a calendar year and are required to file with the Secretary of State. Local jurisdictions might also require electronic filing.

Can Form 461 be amended after filing?

Yes, to amend a previously filed Form 461, you must check the "Amendment" box, specify the period covered by the amendment, disclose the amended information, and complete the verification section.

Common mistakes

When filling out the California Form 461, people often make mistakes that can lead to potential compliance issues. Understanding these common errors can help ensure the form is completed accurately and in accordance with state regulations.

Omitting the filer's legal name or using a name that is not widely recognized by the public. It's crucial to use the exact legal name or the name under which the filer is commonly known.

Failing to accurately detail the nature and interests of the filer, especially when the form is being filed by more than one entity or individual. The specific interests of each party must be clearly stated to avoid any ambiguity.

Incorrectly calculating summary totals in the Summary section. It's essential to accurately report all itemized and unitemized contributions and expenditures to ensure total transparency.

Not signing the form. A responsible officer of the entity or the individual themselves must sign Form 461 to certify the accuracy and completeness of the information provided.

Forgetting to list out detailed information about contributions and expenditures in Part 5 of the form. Each itemized transaction should be clearly described, including the nature of the payment and relevant dates.

Ignoring the electronic filing requirement. Entities that make contributions or independent expenditures totaling $25,000 or more in a calendar year must file Form 461 electronically with the Secretary of State.

Not carefully reading the instructions provided in the FPPC Campaign Disclosure Manuals 5 and 6 before completing the form. These instructions contain vital details that can prevent mistakes during the filing process.

By avoiding these common errors, filers can ensure they meet all required legal obligations and maintain the integrity of their financial disclosures.

Documents used along the form

When managing the complexities of campaign finance requirements in California, those handling major donor and independent expenditure committee campaign statements, as codified in the California Form 461, often need to coordinate with multiple additional forms and documents. These items are essential for ensuring compliance with the Fair Political Practices Commission’s (FPPC) regulations and facilitate accurate reporting and transparency in political contributions and expenditures.

- Form 460 - Campaign Statement: This comprehensive document is required for recipient committees to detail contributions received and expenditures made. It is a primary form used alongside Form 461 for tracking financial activities over a specified reporting period.

- Form 450 - Recipient Committee Campaign Statement - Short Form: For committees that neither raise nor spend $2,000 or more in a calendar year, Form 450 provides a simplified report of campaign finances, easing the reporting burden on smaller entities.

- Form 497 - Late Contribution Report: When a committee receives or makes contributions of $1,000 or more in the 90 days before an election, Form 497 must be used to report these contributions within 24 hours, ensuring timely public disclosure of significant financial activity close to an election.

- Form 700 - Statement of Economic Interests: This form is required for candidates, elected officials, and certain public employees to disclose their financial interests, providing transparency about potential conflicts of interest in governmental decision-making. Although not exclusive to campaign activities, it often accompanies the filing process for individuals involved in political campaigns.

- Form 501 - Candidate Intention Statement: Before soliciting or receiving any contributions, or spending any personal funds for a candidacy, individuals must file Form 501, declaring their intention to run for office. This form sets the stage for campaign financial activities regulated under forms like 461.

Accurately preparing and filing these forms is crucial for active participation in California’s political landscape. They work together to create a framework for transparency, allowing for public scrutiny and trust in the political process. Whether for a major donor or an independent expenditure committee, understanding each document’s role enhances the efficacy of campaign finance reporting and adheres to the foundational principles of campaign finance law.

Similar forms

The California Form 461 shares similarities with a range of documents important in the political and campaign finance context. One such document is the Schedule A of Form 460, used for reporting detailed contributions to a campaign. Both forms require detailed information about the donor, the amount contributed, and the recipient, ensuring transparency in campaign financing. While Form 461 is specifically for major donors and independent expenditure committees, Schedule A of Form 460 is utilized by recipient committees to itemize contributions received, marking a complementary role in the broader campaign finance reporting ecosystem.

The IRS Form 527 is another document with a common purpose, designed for political organizations to report their contributions and expenditures. Although it serves a federal reporting requirement and Form 461 is state-specific, both documents play crucial roles in promoting transparency within political financing. They require detailed information about contributions and expenditures, helping to keep the electoral process open and accountable.

Another related document is the Federal Election Commission (FEC) Form 3X used by political committees to report receipts and disbursements. Like California's Form 461, FEC Form 3X is critical for revealing the financial activities of entities involved in political campaigns. Although they cater to different jurisdictions—federal for FEC Form 3X and state for Form 461—their function in ensuring transparency in political funding binds them closely together.

Form 700 is California's Statement of Economic Interests, a declaration for public officials to disclose their assets and income that may be affected by their official duties. While it focuses on potential conflicts of interest rather than campaign finance, the ethos of transparency and accountability is a thread that connects it with Form 461. Both forms are tools designed to prevent corruption and promote trust in the political process by providing clear records of financial interests and activities.

The California Form 497, also known as the 24-Hour Contribution Report, is necessitated for reporting large contributions close to an election. The immediacy and significance of these disclosures align with the spirit of Form 461, although targeting a different aspect of campaign finance. The quick reporting turnaround time for Form 497 emphasizes the critical nature of transparency in the final stages of an electoral campaign, complementing the annual or semi-annual disclosure rhythm of Form 461.

The "Statement of Organization" (Form 410) required for political committees in California to officially declare their intention to raise funds is another related document. While Form 410 deals with the establishment of a committee, Form 461 deals with the reporting of its activities, illustrating different stages in the lifecycle of political and campaign finance activities. Both are essential for a comprehensive understanding of campaign finance structure and flow.

The Lobbying Disclosure Act (LDA) Reports, mandated at the federal level, bear resemblance in their goal of promoting transparency, this time in the realm of lobbying activities. Though not directly related to campaign contributions like Form 461, LDA reports and Form 461 share a commonality in their aim to illuminate the financial interactions between politics and external interests.

Lastly, the Form 450, or the Short Form of California's Statement of Economic Interests, caters to certain public officials with less significant financial dealings. While it's narrower in scope compared to Form 461, both forms underscore the importance of disclosing financial information to uphold integrity and trust in public office and the political process.

Dos and Don'ts

When filling out the California 461 form, it is important to pay attention to details and follow guidelines to ensure accurate and compliant submission. Here are some essential dos and don’ts:

- Do ensure that all information provided is accurate and complete. This includes checking the details of contributions and expenditures, as well as personal or entity information.

- Do round amounts to whole dollars as instructed on the form to maintain consistency and avoid discrepancies in reporting.

- Do use additional copies of page 5 or continuation sheets if more space is needed to report all contributions (including loans, forgiveness of loans, and loan guarantees) and expenditures.

- Do verify and sign the form to certify that the information is correct. The responsible officer or individual must do this under penalty of perjury according to California law.

- Do file electronically if the contributions or independent expenditures total $25,000 or more in a calendar year, as required for reports filed with the Secretary of State. Remember to also submit paper reports if necessary.

- Do check the “Amendment” box and provide the appropriate period covered by the statement you are amending if you need to make any changes to a previously filed Form 461.

- Don't leave any required fields incomplete, as this can lead to the rejection of the form or the necessity for amendments later.

- Don't underestimate the importance of specifying the nature and interests of the filer, especially when more than one person or entity is listed under "Name of Filer". Use continuation sheets if necessary.

- Don't overlook the need to identify any entities added to the report that were not included in a prior report filed for the current calendar year, as well as any entities no longer required to aggregate under the name of the filer.

- Don't ignore the specific filing requirements based on the percentage of contributions or expenditures made to support or oppose state candidates, measures and committees, or local candidates and measures. It determines whether to file with the Secretary of State, a county election official, or a city clerk.

- Don't assume all jurisdictions have the same electronic filing requirements. Verify if local jurisdictions require electronic filing in addition to state mandates.

- Don't neglect to review the FPPC Campaign Disclosure Manuals 5 and 6 for detailed instructions and important information about completing Form 432. This includes when and where to file, aggregation of contributions and expenditures, and exceptions to the definition of “contribution” and “expenditure”.

Misconceptions

Understanding the complexities of campaign finance reporting is crucial for maintaining transparency and fairness in political processes. The California Form 461, pertaining to Major Donor and Independent Expenditure Committee Campaign Statements, often faces misconceptions which could complicate compliance. Addressing these misconceptions head-on can aid individuals and entities in navigating their reporting responsibilities more effectively.

One common misconception is that Form 461 is only for entities or organizations. In reality, this form is also required from individuals if their contributions or independent expenditures exceed the specified thresholds within a calendar year. This includes both monetary and non-monetary contributions, highlighting the inclusive definition of what constitutes a major donor.

Another misunderstanding is about the $1,000 and $10,000 reporting thresholds. Some may incorrectly think that these amounts apply to the cumulative total of contributions to a single candidate or measure. However, these thresholds refer to the total contributions or independent expenditures made in support of or opposition to one or more state or local candidates, officeholders, or measures within a calendar year, across all supported or opposed parties.

Many assume that personal contributions by candidates and officeholders do not need to be reported on Form 461. Contrary to this belief, if a candidate or officeholder uses personal funds to make contributions or independent expenditures meeting the thresholds, they must report these on Form 461.—highlighting the importance of transparency, even in personal contributions.

There is also a false belief that only monetary contributions count towards the thresholds. The definition of "contribution" includes non-monetary contributions, such as goods, services, and discounts not provided to the public generally. This broad definition ensures that all forms of financial support are transparently reported.

Another area of confusion lies in the assumption that filing Form 461 exempts filers from other reporting requirements. This is incorrect; specific activities may trigger additional reporting obligations under other forms and schedules. Form 461 complements, rather than replaces, the comprehensive campaign disclosure framework.

Lastly, the misconception that all filers must submit their reports directly to the California Secretary of State overlooks the nuanced filing requirements based on the geographic scope of a filer's activities. Where more than 50% of contributions or independent expenditures are focused determines whether a filer submits to the Secretary of State, a county election official, or a city clerk, ensuring local oversight where it is most applicable.

Demystifying these misunderstandings about Form 461 not only aids compliance efforts but also reinforces the overarching goal of campaign finance laws: to bring transparency and trust to the electoral process. Entities and individuals engaged in political contributions or expenditures should familiarize themselves with these aspects to contribute positively and responsibly to democratic engagements.

Key takeaways

Understanding the California 461 form is crucial for major donors and independent expenditure committees engaging in political campaign contributions or expenditures in the state. Here are four key takeaways to ensure compliance and accurate reporting:

- The California Form 461 is specifically designed for major donors—those individuals or entities contributing $10,000 or more in a calendar year—and independent expenditure committees that spend $1,000 or more to support or oppose state or local candidates, measures, or committees. It's essential to recognize whether your contributions or expenditures fall into these categories to determine your filing obligations under this form.

- Detailed reporting on Form 461 includes not only direct monetary contributions but also loan guarantees, loan forgiveness, nonmonetary contributions, and discounts not available to the general public. This comprehensive approach to defining contributions ensures transparency in campaign financing and requires filers to carefully account for all forms of support provided.

- Filing requirements vary based on the geographic scope of the contributions or independent expenditures. If activities are statewide or affect more than one county, filings are made with the Secretary of State. For actions focused within a single county or city, filings are directed to the relevant local election official. This distinction emphasizes the need to understand where your contributions or expenditures are directed to ensure they are filed correctly and comply with all relevant jurisdictional requirements.

- For major donor and independent expenditure committees engaging in significant financial activities, electronic filing with the Secretary of State is mandated once contributions or independent expenditures total $25,000 or more within a calendar year. This requirement underscores the importance of maintaining detailed records and staying informed about the thresholds that trigger different filing obligations.

By paying close attention to these guidelines, individuals and entities can navigate the complexities of campaign finance reporting in California effectively, ensuring their contributions and expenditures are fully and accurately disclosed. Keeping abreast of the specific requirements and deadlines for Form 461 filings is a fundamental part of participating responsibly in the political process.

Discover More PDFs

California 100s Instructions - Describes the election timeline, starting from the first day of the taxable year for effectiveness.

Landlord Eviction Notice Letter - For California tenants, this notice signifies a critical juncture to either rectify lease breaches or prepare to vacate the property.

Covid Workers Compensation - Enumerates the benefits available under the Federal Employees' Compensation Act (FECA), offering comprehensive coverage for injured workers.