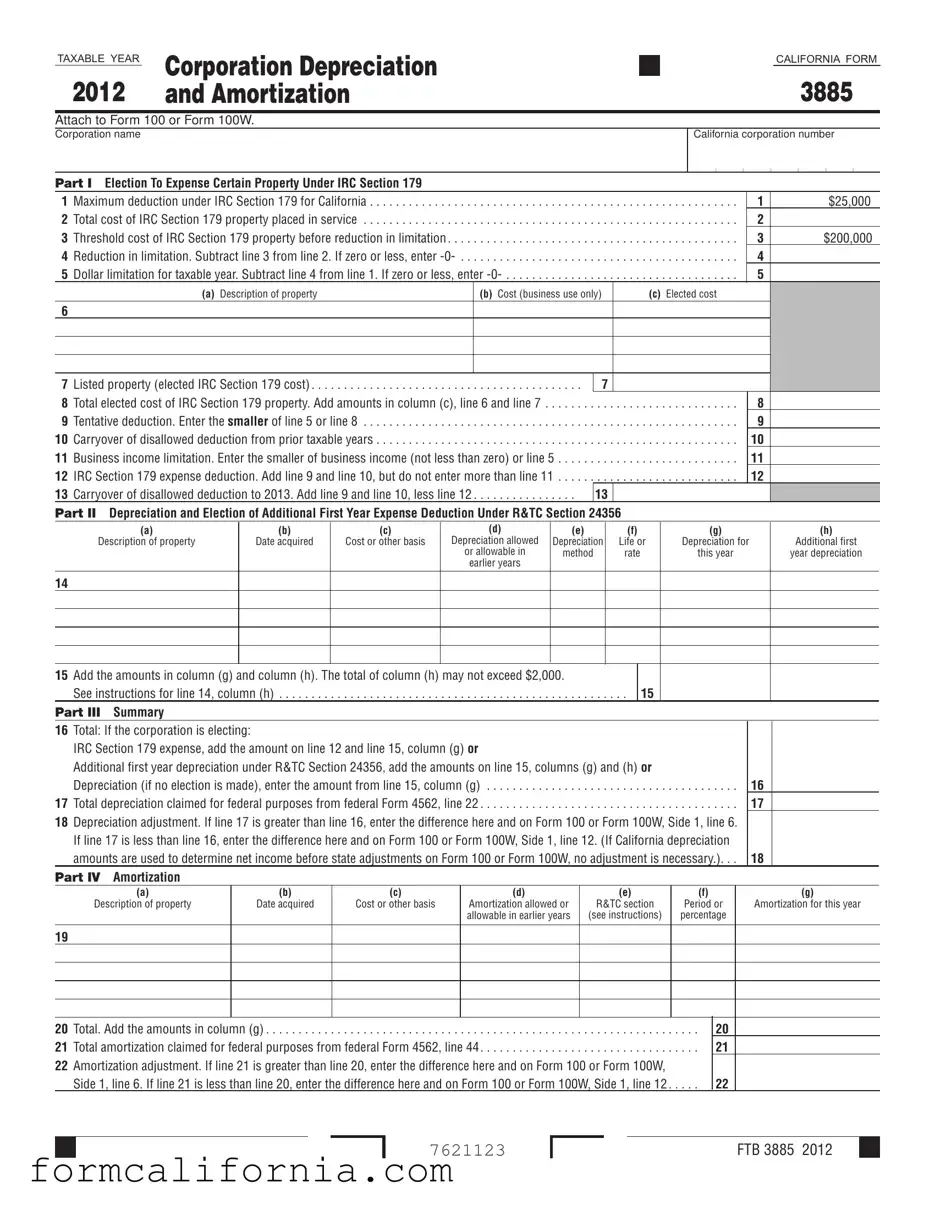

Blank California 3885 PDF Form

Navigating the intricacies of business accounting and taxation can often feel overwhelming for corporations in California, but understanding the California Form 3885 for Corporation Depreciation and Amortization can significantly ease this burden. As a crucial document that must be attached to Form 100 or Form 100W, it details the procedures for reporting depreciation and the amortization of assets. This form enables businesses to navigate the fiscal landscape by providing a structured way to calculate and report the yearly depreciation of their property and amortization expenses, which in turn affects their taxable income. The form is divided into distinct parts, covering the election to expense certain property under IRC Section 179, depreciation and election of additional first-year expense deduction under R&TC Section 24356, and a summary of total depreciation, including adjustments for federal and state differences. It heralds specific caps on deductions, thresholds for property costs, and detailed instructions on how to calculate depreciation or amortization for various types of properties, all while highlighting the ever-present differences between federal and California state law. Given the ongoing changes in tax law and the critical nature of this form in the corporate tax filing process, understanding its components is essential for any corporation aiming for compliance and optimal tax positioning.

Document Preview Example

TAXABLE YEAR |

Corporation Depreciation |

|

|

|

|

|

|

|

|

|

|

CALIFORNIA FORM |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2012 |

and Amortization |

|

|

|

|

|

|

|

|

|

3885 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Attach to Form 100 or Form 100W. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Corporation name |

|

|

|

|

California corporation number |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

PART I Election To Expense Certain Property Under IRC Section 179 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1 |

Maximum deduction under IRC Section 179 for California |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

1 |

$25,000 |

|||||||||||||||

2 |

. . . . . . . . . . . . . . . . .Total cost of IRC Section 179 property placed in service |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

2 |

|

|

|

|

|

|

|

|

||||||||

3 |

Threshold cost of IRC Section 179 property before reduction in limitation . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

3 |

$200,000 |

|||||||||||||||

4 |

. .Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

4 |

|

|

|

|

|

|

|

|

||||||||

5 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Dollar limitation for taxable year. Subtract line 4 from line 1. If zero or less, enter |

5 |

|

|

|

|

|

|

|

|

|||||||||

|

|

(a) Description of property |

(b) Cost (business use only) |

(c) Elected cost |

|

|

|

|

|

|

|

|

|||||||

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Listed property (elected IRC Section 179 cost) |

7 |

|

|

|

8 |

Total elected cost of IRC Section 179 property. Add amounts in column (c), line 6 and line 7 |

. . . |

. . . . . . . . . . . . . . . . . . . |

8 |

|

9 |

Tentative deduction. Enter the smaller of line 5 or line 8 |

. . . |

. . . . . . . . . . . . . . . . . . . |

9 |

|

10 |

Carryover of disallowed deduction from prior taxable years |

. . . |

. . . . . . . . . . . . . . . . . . . |

10 |

|

11 |

Business income limitation. Enter the smaller of business income (not less than zero) or line 5 |

. . . |

. . . . . . . . . . . . . . . . . . . |

11 |

|

12 |

IRC Section 179 expense deduction. Add line 9 and line 10, but do not enter more than line 11 |

. . . |

. . . . . . . . . . . . . . . . . . . |

12 |

|

13 |

Carryover of disallowed deduction to 2013. Add line 9 and line 10, less line 12 |

13 |

|

|

|

PART II Depreciation and Election of Additional First Year Expense Deduction Under R&TC Section 24356

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

(g) |

(h) |

Description of property |

Date acquired |

Cost or other basis |

Depreciation allowed |

Depreciation |

Life or |

Depreciation for |

Additional first |

|

|

|

or allowable in |

method |

rate |

this year |

year depreciation |

|

|

|

earlier years |

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15Add the amounts in column (g) and column (h). The total of column (h) may not exceed $2,000.

|

See instructions for line 14, column (h) |

15 |

PART III Summary |

|

|

16 |

Total: If the corporation is electing: |

|

|

IRC Section 179 expense, add the amount on line 12 and line 15, column (g) or |

|

|

Additional first year depreciation under R&TC Section 24356, add the amounts on line 15, columns (g) and (h) or |

|

|

Depreciation (if no election is made), enter the amount from line 15, column (g) |

. . . . . . . . . . . . . . . 16 |

17 |

Total depreciation claimed for federal purposes from federal Form 4562, line 22 |

. . . . . . . . . . . . . . . 17 |

18Depreciation adjustment. If line 17 is greater than line 16, enter the difference here and on Form 100 or Form 100W, Side 1, line 6. If line 17 is less than line 16, enter the difference here and on Form 100 or Form 100W, Side 1, line 12. (If California depreciation

amounts are used to determine net income before state adjustments on Form 100 or Form 100W, no adjustment is necessary.). . . 18

PART IV Amortization

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

(g) |

Description of property |

Date acquired |

Cost or other basis |

Amortization allowed or |

R&TC section |

Period or |

Amortization for this year |

|

|

|

allowable in earlier years |

(see instructions) |

percentage |

|

19

20 |

Total. Add the amounts in column (g) |

20 |

21 |

Total amortization claimed for federal purposes from federal Form 4562, line 44 |

21 |

22 |

Amortization adjustment. If line 21 is greater than line 20, enter the difference here and on Form 100 or Form 100W, |

|

|

Side 1, line 6. If line 21 is less than line 20, enter the difference here and on Form 100 or Form 100W, Side 1, line 12 |

22 |

7621123

FTB 3885 2012

2012 Instructions for Form FTB 3885

Corporation Depreciation and Amortization

References in these instructions are to the Internal Revenue Code (IRC) as of JANUARY 1, 2009, and to the California Revenue and Taxation Code (R&TC).

General Information

In general, for taxable years beginning on or after January 1, 2010, California law conforms to the Internal Revenue Code (IRC) as of January 1, 2009. However, there are continuing differences between California and federal law. When California conforms to federal tax law changes, we do not always adopt all of the changes made at the federal level. For more information, go to ftb.ca.gov and search for conformity. Additional information can be found

in FTB Pub. 1001, Supplemental Guidelines to California Adjustments, the instructions for California Schedule CA (540 or 540NR), and the Business Entity tax booklets.

The instructions provided with California tax forms are a summary of California tax law and are only intended to aid taxpayers in preparing their state income tax returns. We include information that is most useful to the greatest number of taxpayers in the limited space available. It is not possible to include all requirements of the California Revenue and Taxation Code (R&TC) in the tax booklets. Taxpayers should not consider the tax booklets as authoritative law.

A Purpose

Use form FTB 3885, Corporation Depreciation and Amortization, to calculate California depreciation and amortization deduction for corporations, including partnerships and limited liability companies (LLCs) classified as corporations.

S corporations must use Schedule B (100S), S Corporation Depreciation and Amortization.

Depreciation is the annual deduction allowed to recover the cost or other basis of business or income producing property with a determinable useful life of more than one year. Generally, depreciation is used in connection with tangible property.

Amortization is an amount deducted to recover the cost of certain capital expenses over a fixed period. Generally amortization is used for intangible assets.

For amortizing the cost of certified pollution control facilities, use form FTB 3580, Application and Election to Amortize Certified Pollution Control Facility.

B Federal/State Differences

Differences between federal and California laws affect the calculation of depreciation and amortization. The following lists are not intended to be

California law conforms to federal law for the following:

•The sport utility vehicles (SUVs) and minivans built on a truck chassis are included in the definition of trucks and vans when applying the 6,000 pound gross weight limit. See federal Rev. Proc.

•The additional

•The federal Class Life Asset Depreciation Range (ADR) System provisions, which specifies a useful life for various types of property. However, California law does not allow the corporation to choose a depreciation period that varies from the specified asset guideline system.

California law does not conform to federal law for the following:

•The enhanced IRC Section 179 expensing election for assets placed in service in 2010 through 2012 taxable year.

•The

•The IRC Section 613A(d)(4) relating to the exclusion of certain refiners. See R&TC Section 24831.3 for more information.

•The IRC Section 168(k) relating to the 50% bonus depreciation deduction for assets acquired in tax years 2008 through 2012 and placed in service before 2013 (or before 2014 for certain qualifying property). For property acquired and placed in service after September 8, 2010, and before 2012 (before 2013 in the case of certain qualifying property), the bonus depreciation deduction is 100%.

•The additional

•The accelerated recovery period for depreciation of smart meters and smart grid systems.

•The

•The federal special class life for gas station convenience stores and similar structures.

•The depreciation under Modified Accelerated Cost Recovery System (MACRS) for corporations, except to the extent such depreciation is passed through from a partnership or LLC classified as a partnership.

C Depreciation Calculation Methods

Depreciation methods are defined in R&TC Sections 24349 through 24354. Depreciation calculation methods, described in R&TC Section 24349, are as follows:

Declining Balance. Under this method, depreciation is greatest in the first year and smaller in each succeeding year. The property must have a useful life of at least three years. Salvage value is not taken into account in determining the basis of the property, but the property may not be depreciated below a reasonable salvage value.

The amount of depreciation for each year is subtracted from the basis of the property and a uniform rate of up to 200% of the

For example, the annual depreciation allowances for property with an original basis of $100,000 are:

|

|

Declining |

|

|

Remaining |

balance |

Depreciation |

Year |

basis |

rate |

allowance |

First. . . . . . $100,000 |

20% |

$20,000 |

|

Second . . . |

80,000 |

20% |

16,000 |

Third |

64,000 |

20% |

12,800 |

Fourth . . . . |

51,200 |

20% |

10,240 |

remaining in the useful life of the property. Therefore, the numerator changes each year as the life of the property decreases. The denominator of the fraction is the sum of the digits representing the years of useful life. The denominator remains constant every year.

Other Consistent Methods. Other depreciation methods may be used as long as the total accumulated depreciation at the end of any taxable year during the first 2/3 of the useful life of the property is not more than the amount that would have resulted from using the declining balance method.

D Period of Depreciation

Under Cal. Code Regs., tit. 18, section 24349(l), California conforms to the federal useful lives of property.

Use the following information as a guide to determine reasonable periods of useful life for purposes of calculating depreciation. Actual facts and circumstances will determine useful life. However, the figures listed below represent the normal periods of useful life for the types of property listed as shown in IRS Rev. Proc.

•Office furniture, fixtures, machines,

and equipment . . . . . . . . . . . . . . . . . . . . . . 10 yrs.

This category includes furniture and fixtures (that are not structural components of a building) and machines and equipment used in the preparation of paper or data.

Examples include: desks; files; safes; typewriters, accounting, calculating, and data processing machines; communications equipment; and duplicating and copying equipment.

•Computers and peripheral

equipment (printers, etc.) . . . . . . . . . . . . . . . 6 yrs.

•Transportation equipment and

automobiles (including taxis) . . . . . . . . . . . . 3 yrs.

•

Light (unloaded weight less than

13,000 lbs.) . . . . . . . . . . . . . . . . . . . . . . . . . 4 yrs. Heavy (unloaded weight 13,000 lbs.

or more) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 yrs.

•Buildings

This category includes the structural shell of a building and all of its integral parts that service normal heating, plumbing, air conditioning, fire prevention and power requirements, and equipment such as elevators and escalators.

Type of building:

Apartments . . . . . . . . . . . . . . . . . . . . . . . . . 40 yrs. Dwellings (including rental residences) . . . 45 yrs. Office buildings. . . . . . . . . . . . . . . . . . . . . . 45 yrs. Warehouses . . . . . . . . . . . . . . . . . . . . . . . . 60 yrs.

EDepreciation Methods to Use

Corporations may use the

|

Maximum |

Property description |

depreciation method |

Real estate acquired 12/31/70 or earlier

New (useful life 3 yrs. or more) . . . . . 200% Declining balance Used (useful life 3 yrs. or more) . . . . . 150% Declining balance

Real estate acquired 1/1/71 or later Residential rental:

New. . . . . . . . . . . . . . . . . . . . . . . . . . 200% Declining balance Used (useful life 20 yrs. or more) . . . 125% Declining balance Used (useful life less than 20 yrs.) . .

FTB 3885 Instructions 2012 Page 1

Commercial and industrial:

New (useful life 3 yrs. or more) . . . . 150% Declining balance Used . . . . . . . . . . . . . . . . . . . . . . . . .

Personal property

New (useful life 3 yrs. or more) . . . . . 200% Declining balance Used (useful life 3 yrs. or more) . . . . . 150% Declining balance

See “Other Consistent Methods” information on page 1.

The Class Life ADR System of depreciation may be used for designated classes of assets placed in service after 1970.

The Guideline Class Life System of depreciation may be used for certain classes of assets placed in service before 1971.

FElection To Expense Certain Property Under IRC

Section 179

For taxable years beginning on or after January 1, 2005, corporations may elect IRC Section 179 to expense part or all of the cost of depreciable tangible property used in the trade or business and certain other property described in federal Publication 946, How to Depreciate Property. To elect IRC Section 179, the corporation must have purchased property, as defined in the IRC Section 179(d)(2), and placed it in service during the taxable year. If the corporation elects this deduction, the corporation must reduce the California depreciable basis by the IRC Section 179 expense. See the instructions for federal Form 4562, Depreciation and Amortization, for more information.

California does not allow IRC Section 179 expense election for

California conforms to the federal changes made to the deduction of business

2005. Exceptions: California does not conform to the federal increase in the deduction for

Limitations. Federal limitation amounts are different than California limitation amounts. For California purposes, the maximum IRC Section 179 expense deduction allowed is $25,000. This amount is reduced if the cost of all IRC Section 179 property placed in service during the taxable year is more than $200,000. The total IRC Section 179 expense deduction cannot exceed the corporation’s business income.

G Amortization

California conforms to the IRC Section 197 amortization of intangibles for taxable years beginning on or after January 1, 1994. Generally, assets that meet the definition under IRC Section 197 are amortized on a

Amortization of the following assets is governed by California law:

Bond premiums |

R&TC 24360 |

– |

24363.5 |

Research expenditures |

R&TC 24365 |

|

|

Reforestation expenses |

R&TC 24372.5 |

|

|

Organizational expenditures |

R&TC 24407 |

– |

24409 |

R&TC 24414 |

|

|

|

Other intangible assets may be amortized if it is approved with reasonable accuracy that the asset has an ascertainable value that diminishes over time and has a limited useful life.

Specific Line Instructions

For properties placed in service during the taxable year, the corporation may complete Part I if the corporation elects to expense qualified property under IRC Section 179, or Part II if the corporation elects additional first year expense deduction for qualified property under R&TC Section 24356. The corporation may only elect IRC Section 179 or the additional first year expense deduction for the same taxable year. The election must be made on a timely filed tax return (including extension). The election may not be revoked except with the Franchise Tax Board‘s consent.

Part II is also used to calculate depreciation for property (with or without the above elections).

Part I Election To Expense Certain Property Under IRC Section 179

Complete Part I if the corporation elects IRC Section 179 expense. Include all assets qualifying for the deduction since the limit applies to all qualifying assets as a group rather than to each asset individually. The total IRC Section 179 expense for property, which the election may be made, is figured on line 5. The amount of IRC Section 179 expense deductions for the taxable year cannot exceed the corporation’s business income on line 11. See

the instructions for federal Form 4562 for more information.

Line 2

Enter the cost of all IRC Section 179 qualified property placed in service during the taxable year including the cost of any listed property. See General Information F, Election To Expense Certain Property Under IRC Section 179, for information regarding qualified property. See line 7 instructions for information regarding listed property.

Line 5

If line 5 is zero, the corporation cannot elect to expense any IRC Section 179 property. Skip line 6 through line 11, enter zero on line 12.

Line 6

Do not include any listed property on line 6. Enter the elected IRC Section 179 cost of listed property on line 7.

Column (a) – Description of property. Enter a brief description of the property the corporation elects to expense.

Column (b) – Cost (business use only). Enter the cost of the property. If the corporation acquired the property through a

Column (c) – Elected cost. Enter the amount the corporation elects to expense. The corporation does not have to expense the entire cost of the property. The corporation can depreciate the amount it does not expense.

Line 7

Use a format similar to federal Form 4562, Part V, line 26 to determine the elected IRC Section 179 cost of listed property. Listed property generally includes the following:

•Passenger automobiles weighing 6,000 pounds or less.

•Any other property used for transportation if the nature of the property lends itself to personal use, such as motorcycles,

•Any property used for entertainment or recreational purposes (such as photographic, phonographic, communication, and video recording equipment).

•Cellular telephones (and other similar telecommunications equipment). Note: California does not conform to the federal exclusion of these

items from being treated as listed property for taxable years beginning on or after January 1, 2010.

•Computers or peripheral equipment.

Exception. Listed property generally does not include:

•Photographic, phonographic, communication, or video equipment used exclusively in the corporation’s trade or business.

•Any computer or peripheral equipment used exclusively at a regular business.

•An ambulance, hearse, or vehicle used for transporting persons or property for hire.

Listed property used 50% or less in business activity does not qualify for the IRC Section 179 expense deduction. For more information regarding listed property, see the instructions for federal Form 4562.

Line 11

The total cost the corporation can deduct is limited to the corporation’s business income. For the purpose of IRC Section 179 election, business income is the net income derived from the corporation’s active trade or business, Form 100 or Form 100W, line 18, before the IRC Section 179 expense deduction (excluding items not derived from a trade or business actively conducted by the corporation).

Part II Depreciation and Election of

Additional First Year Expense

Deduction Under R&TC

Section 24356

Line 14

Corporations may enter each asset separately or group assets into depreciation accounts. Figure the depreciation separately for each asset or group of assets. The basis for depreciation is the cost or other basis reduced by a reasonable salvage value (except when using the declining balance method), additional

If the Guideline Class Life System or Class Life ADR System is used, enter the total amount from the corporation’s schedule showing the computation on form FTB 3885, column (g), and identify as such.

Line 14, Column (h), Additional

Corporations may elect to deduct up to 20% of the cost of “qualifying property” in the year acquired in addition to the regular depreciation deduction. The maximum additional

“Qualifying property” is tangible personal property used in business and having a useful life of at least six years. Land, buildings, and structural components do not qualify. Property converted from personal use, acquired by gift, inheritance, or from related parties also does not qualify.

See R&TC Section 24356 and the applicable regulations for more information.

An election may be made to expense up to 40% of the cost of property described in R&TC Sections 24356.6, 24356.7, and 24356.8.

For more information, get form FTB 3809, Targeted Tax Area Deduction and Credit Summary; form FTB 3805Z, Enterprise Zone Deduction and Credit Summary; or form FTB 3807, Local Agency Military Base Recovery Area Deduction and Credit Summary.

Part IV Amortization

Line 19, Column (e) – R&TC section. Enter the correct R&TC section for the type of amortization. See General Information G, Amortization, for a list of the R&TC sections.

Page 2 FTB 3885 Instructions 2012

Document Specs

| Fact | Detail |

|---|---|

| Purpose | Used to calculate California depreciation and amortization deductions for corporations. |

| Form Number | California Form 3885 |

| Relevant Tax Year | 2012 |

| Attachment | Attach to Form 100 or Form 100W. |

| IRC Section 179 | Allows for electing to expense certain qualified property with limitations and thresholds. |

| Governing Law | Governed by the Internal Revenue Code as of January 1, 2009, and California Revenue and Taxation Code (R&TC). |

| Federal/State Differences | There are several key differences between federal and California laws on depreciation and amortization calculations. |

| Depreciation Methods | Includes methods such as Straight-Line, Declining Balance, and Sum-of-the-Years-Digits. |

| Amortization | California conforms to the IRC Section 197 amortization of intangibles with some specific exceptions. |

Detailed Instructions for Writing California 3885

Filling out the California 3885 form is a structured process that requires careful attention to the specific instructions provided. This document enables corporations to calculate their depreciation and amortization deductions, reflecting the wear and tear, or obsolescence of property and certain costs over time. Understanding and accurately completing this form is crucial for corporations to ensure they are compliant with California tax laws while maximizing their allowable deductions. Here’s how to systematically fill out the form:

- Part I - Election To Expense Certain Property Under IRC Section 179:

- Enter the maximum deduction under IRC Section 179 for California - $25,000 in line 1.

- Sum up the total cost of IRC Section 179 property placed in service during the taxable year and input this amount in line 2.

- Input the threshold cost of IRC Section 179 property before reduction in line 3 - $200,000.

- Calculate the Reduction in limitation by subtracting line 3 from line 2. If the result is zero or less, enter '-0-' in line 4.

- Compute the Dollar limitation for the taxable year by subtracting line 4 from line 1. Insert '-0-' if the result is zero or less in line 5.

- Under the columns for line 6 (Description of property, Cost (business use only), Elected cost), list down the relevant details for each property.

- For Listed property, calculate the elected IRC Section 179 cost and input in line 7.

- Sum the total elected cost of IRC Section 179 property from line 6 and line 7, recording it in line 8.

- Enter the Tentative deduction, which is the smaller of line 5 or line 8, in line 9.

- Note the Carryover of disallowed deduction from prior years on line 10.

- Calculate the Business income limitation, choosing the smaller between business income or line 5, recording in line 11.

- Add lines 9 and 10 but do not enter more than line 11 to find the IRC Section 179 expense deduction, noted in line 12.

- Carryover of disallowed deduction to the next taxable year is the addition of line 9 and line 10, less line 12, input on line 13.

- Part II - Depreciation and Additional First-Year Expense Deduction:

- For each property, enter detailed information in columns (a) through (h), including Description of property, Date acquired, Cost, and Depreciation details.

- Add amounts in column (g) and (h) to calculate the total in line 15.

- Part III - Summary:

- Combine the appropriate amounts as instructed to calculate the Total in line 16.

- Transcribe the Total depreciation claimed for federal purposes from federal Form 4562, line 22, to line 17.

- Determine the Depreciation adjustment by comparing lines 16 and 17, noting the difference in line 18.

- Part IV - Amortization:

- Fill in the details for each amortizable property in the provided columns (a) through (g).

- Total the amounts in column (g) for the total amortization in line 20.

- Write the Total amortization claimed for federal purposes from federal Form 4562, line 44, in line 21.

- Calculate the Amortization adjustment, considering the difference between line 21 and line 20, noting it in line 22.

Completing the California 3885 form accurately is essential for all corporations to ensure compliance and optimization of their tax benefits related to property usage over time. Careful entry of detailed information and adherence to the California-specific instructions will assist in the correct filing of this form.

Things to Know About This Form

What is the purpose of California Form 3885?

California Form 3885, Corporation Depreciation and Amortization, is used by corporations, including partnerships and limited liability companies classified as corporations, to calculate California depreciation and amortization deductions. S corporations must use a different form, specifically Schedule B (100S). This form helps entities to recover the cost or other basis of business or income-producing property over its useful life, as well as amortizing certain capital expenses over a fixed period.

How do federal and California laws differ in the treatment of depreciation and amortization?

There are significant differences between federal and California laws regarding the calculation of depreciation and amortization. While California law conforms with federal law in certain aspects, such as including SUVs and minivans built on a truck chassis in the definition of trucks and vans for the 6,000 pound gross weight limit, there are notable areas where it does not. For instance, California does not conform to the enhanced IRC Section 179 expensing election for assets placed in service from 2010 through 2012 or the first-year depreciation deduction allowed for new luxury autos within the same period. California also does not conform to the IRC Section 168(k) regarding 50% bonus depreciation deduction for assets acquired and placed in service from 2008 through 2012.

What are the major differences in the limitations of IRC Section 179 between federal and state law?

One of the significant differences between federal and California state law pertaining to IRC Section 179 is the expense deduction limit. For California purposes, the maximum IRC Section 179 expense deduction a corporation can claim is $25,000, contrasting with higher federal limits. This state limit is subject to reduction if the total cost of Section 179 property placed in service during the taxable year exceeds $200,000. Moreover, the total IRC Section 179 expense deduction cannot exceed the corporation's business income for the taxable year in California, indicating a more restrictive approach compared to federal guidelines.

Can you elect IRC Section 179 for off-the-shelf computer software in California?

No, California does not allow the election of IRC Section 179 expense for off-the-shelf computer software. This stands as a notable deviation from federal law, where such an election might be possible under certain conditions. Entities must carefully adjust their tax planning concerning the cost recovery of computer software to align with California's specific regulations.

What are the depreciation calculation methods available under California law?

Under California law, corporations can choose from several depreciation methods, including the Straight-Line method, where the cost or other basis of the property, minus its estimated salvage value, is equally divided over its estimated useful life. The Declining Balance method enables higher depreciation rates in earlier years, decreasing over time without considering the salvage value until a reasonable salvage value is reached. The Sum-of-the-Years-Digits Method and Other Consistent Methods could also be used, provided they align with California Revenue and Taxation Code sections. These methods offer flexibility in how businesses can recover the cost or other basis of their depreciable assets over time.

Common mistakes

Filling out California Form 3885, which deals with Corporation Depreciation and Amortization, can sometimes lead to errors if not done carefully. This document is paramount for businesses in determining their depreciation and amortization deductions accurately. Let’s explore some common mistakes individuals make when completing this form that could potentially impact their tax obligations.

Overlooking the differences between California and federal law: While California conforms to federal laws as of a specific point in time, there remain distinct differences that can significantly affect depreciation calculations. Ignoring these differences or assuming both sets of laws are identical can lead to incorrect deduction amounts.

Incorrectly calculating the maximum deduction under IRC Section 179: A critical step is determining the correct maximum deduction which, for California, has specific limits. Mistakes in this calculation can stem from misinterpreting the cost of IRC Section 179 property or not accurately applying the limitation reductions.

Misclassifying property under Part II for depreciation: Proper classification of property, understanding its correct basis for depreciation, and applying accurate life expectancy are fundamental. Errors often occur when individuals improperly group assets or misinterpret the type of property and its corresponding depreciation schedule.

Not adjusting the basis for depreciation correctly: The basis used for computing depreciation must reflect any adjustments including prior year deductions and the salvage value. Failing to account for these adjustments may lead to incorrect depreciation amounts.

Overlooking eligible amortization expenses under Part IV: Certain costs and expenses are eligible for amortization over their useful life. Neglecting to include qualified expenses or misapplying the rules governing the amortization period can result in losing out on legitimate deductions.

Failure to properly account for listed property: Special rules apply to listed property, including restrictions on depreciation if the use does not meet business-use thresholds. Misunderstanding these rules can lead to disallowed deductions or penalties.

Educating oneself on these common pitfalls and taking the time to review the form thoroughly can save individuals from potential errors and ensure they maximize their legal deductions appropriately.

Documents used along the form

When navigating the complexities of corporate taxation in California, understanding the pivotal documents that complement the California Form 3885 can significantly streamline your compliance process. The Form 3885, utilized for reporting Corporation Depreciation and Amortization, plays a crucial role in detailing a corporation's depreciation and amortization expenses for the year. Equally important are additional forms and documents that often accompany Form 3885, each serving a distinct purpose in the broader landscape of tax preparation and filing. Here, we'll delve into some of these essential documents to provide a clearer picture of their functions.

- Form 100 or Form 100W: Essential for all corporations operating in California, these forms serve as the primary income tax returns for C corporations and S corporations, respectively. Form 3885 attaches to whichever of these is applicable, ensuring that the corporates' depreciation and amortization figures are correctly factored into their overall tax computation.

- Form 4562: This federal form, Depreciation and Amortization, parallels the state-specific Form 3885. It allows for the detailed reporting of depreciation and amortization for federal tax purposes, encompassing both the calculation methods and the amounts applicable under the Internal Revenue Code.

- Schedule CA (540 or 540NR): These schedules are vital for individuals, estates, and trusts to adjust income and deductions reported on a federal tax return to California figures. Though primarily non-corporate, they are essential in situations where individuals report depreciation from corporate entities.

- Form FTB 3580: Geared towards corporations aiming to amortize certified pollution control facilities, this form allows businesses to spread out the costs of these environmentally friendly investments over several years, thus reducing taxable income in the manner similar to standard depreciation.

- Form 3805Z, Form 3809, and Form 3807: These forms pertain to various special zones like Enterprise Zones, Targeted Tax Areas, and Local Agency Military Base Recovery Areas. Corporations operating within these designated areas may qualify for additional depreciation deductions or credits, making these documents crucial for maximizing tax benefits.

- FTB Pub. 1001: This publication, "Supplemental Guidelines to California Adjustments," is an invaluable resource offering detailed guidelines on the adjustments necessary when California law diverges from Federal tax provisions. It aids in clarifying when and how to make adjustments associated with depreciation and amortization.

- Business Entity Tax Booklets: Published by the Franchise Tax Board, these booklets provide comprehensive instructions and information tailored to business entities. They contain the necessary guidelines for filling out various tax forms, including Form 3885, and understanding the underlying tax laws.

Collectively, these forms and documents form a cohesive network that supports the accurate and efficient preparation of Form 3885. By familiarizing yourself with these additional resources, corporations can ensure a smoother process in navigating the intricacies of California's taxation landscape, thereby facilitating compliance, maximizing deductions, and minimizing tax liabilities. Remember, each document plays a specific role in the broader context of tax preparation and planning, making it essential to understand their purposes and requirements fully.

Similar forms

The California 3885 form is closely related to the federal Form 4562, "Depreciation and Amortization." Both forms are designed to calculate depreciation and amortization deductions for tax purposes. The main difference lies in their jurisdictional application, with Form 3885 tailored for California's tax regulations, which may diverge from federal laws. Federal Form 4562 provides a foundation for understanding how depreciation and amortization work on a national level, while California's 3885 adapts these concepts to fit state-specific tax codes.

Similarly, the Schedule B (100S), "S Corporation Depreciation and Amortization," is a document that parallels the purpose and structure of Form 3885 but is specifically used by S corporations operating in California. It allows these corporations to report depreciation and amortization deductions in a way that aligns with California's tax requirements, ensuring that S corporations comply with state tax laws while managing their taxable income.

Form FTB 3580, "Application and Election to Amortize Certified Pollution Control Facility," also shares similarities with the California 3885 form. While Form 3885 focuses broadly on depreciation and amortization deductions for corporations, Form FTB 3580 is specialized, targeting companies looking to amortize costs associated with pollution control. This specificity demonstrates how various forms cater to different aspects of taxation while maintaining a core focus on facilitating tax deductions for businesses.

The California Schedule CA (540 or 540NR) is another document related to Form 3885 in that it deals with adjustments between California and federal tax codes. While Schedule CA is used by individuals to adjust income reported on the federal return for California tax purposes, including any differences in depreciation and amortization rules, it embodies the process of reconciling state and federal tax regulations, a principle central to the function of Form 3885.

Form 100 or Form 100W, to which Form 3885 is attached, directly interacts with the depreciation and amortization calculations completed on Form 3885. These forms serve as the corporate income tax returns for California, and the information from Form 3885 helps to accurately determine the taxable income by accounting for depreciation and amortization deductions. This connection underscores how different tax documents interlink to complete the tax filing process.

Form 3805Z, "Enterprise Zone Deduction and Credit Summary," though distinct in its focus on tax credits and deductions specific to enterprise zones, shares a foundational concept with Form 3885—providing tax incentives to businesses. Both forms aim to lower taxable income, albeit through different mechanisms, highlighting their roles in encouraging economic activities within California.

Form FTB 3809, "Targeted Tax Area Deduction and Credit Summary," like the previously mentioned forms, offers tax benefits to businesses but focuses on targeted tax areas. Its similarity to Form 3885 lies in its goal of reducing the tax burden on businesses, thereby promoting growth and investment within specific regions or sectors of California's economy.

Form 100S, the California S Corporation Franchise or Income Tax Return, though more general, is an essential document for S corporations in California. It interacts with various specialized forms like Schedule B (100S) and, indirectly, with Form 3885, as it encompasses the overall tax responsibilities of S corporations, including accounting for depreciation and amortization.

Form FTB 3807, "Local Agency Military Base Recovery Area Deduction and Credit Summary," offers parallels to Form 3885 by providing fiscal incentives designed to promote redevelopment and business investment in areas affected by military base closures. Unique in its focus, this form nonetheless aligns with Form 3885's broader purpose of facilitating tax deductions and credits for businesses.

Lastly, the General Information section of California tax instructions, such as those provided with Form 3885, often references publications like FTB Pub. 1001, "Supplemental Guidelines to California Adjustments." These publications offer additional information and guidance on navigating differences between state and federal tax laws, including those related to depreciation and amortization, further illuminating the contextual backdrop against which Form 3885 operates.

Dos and Don'ts

When filling out the California Form 3885 for Corporation Depreciation and Amortization, attention to detail is crucial to ensure compliance and accuracy. Below are key dos and don’ts to guide you through this process:

- Do ensure that the form is attached to Form 100 or Form 100W, as it is a requisite document for declaring depreciation and amortization.

- Do accurately calculate the maximum deduction under IRC Section 179 for California, which is set at $25,000, to avoid overstating your deduction.

- Do include the total cost of IRC Section 179 property placed in service within the taxable year to ensure that deduction limits are correctly applied.

- Do take into account the threshold cost of IRC Section 179 property before reduction in limitation, which is $200,000, to properly assess deduction eligibility.

- Do review and include any carryover of disallowed deduction from prior taxable years to accurately report available deductions.

- Don't overlook the business income limitation when calculating the IRC Section 179 expense deduction to ensure that deductions do not exceed the limit set by business income.

- Don't forget to assess and enter depreciations under Part II for both this year and any allowable depreciations from previous years to maintain consistency and compliance with California laws.

- Don't fail to adjust for depreciation claimed for federal purposes against the total calculated for California purposes, as differences may arise due to varying laws and regulations.

- Don't ignore the specific lines for amortization of intangible assets, ensuring correct R&TC section references are used and the costs are accurately reported.

Following these guidelines can help in avoiding common mistakes and ensure that the California Form 3885 is filled out correctly and in accordance with state and federal regulations. Always review the form carefully before submission to catch any inaccuracies or omissions.

Misconceptions

Understanding the California Form 3885 can be tricky, and there are several misconceptions that need clarification. Here’s a breakdown of the nine most common misunderstandings:

Form 3885 is only for large corporations. In reality, this form is utilized by a variety of businesses, including small ones, as long as they're classified as corporations, partnerships, or LLCs treated as corporations in California. S corporations have a specific form, Schedule B (100S).

Section 179 deductions are unlimited. The fact is, California caps the Section 179 expense deduction at $25,000, with specific limitations based on the property's total cost placed in service within the tax year.

Depreciation calculation methods are the same for federal and state returns. While California conforms to federal guidelines for depreciation methods like Straight-Line and Declining Balance, differences in federal and state law can lead to varied depreciation calculations.

Amortization is automatically aligned with federal rules. Although California generally conforms to the IRC Section 197 for amortization, there are differences, especially for intangible assets acquired before 1994. It's crucial to check for California-specific rules.

All forms of property qualify for Section 179 deductions. Actually, California has specific qualifications for which property types are eligible for Section 179 deductions, including limitations on listed properties like certain vehicles and computer equipment.

There is no cap on the bonus depreciation. Contrary to this belief, California does not conform to the federal laws for bonus depreciation for properties acquired and placed in service during certain periods, affecting the amount of depreciation that can be claimed.

Computers and software always qualify for deductions. California specifically disallows the IRC Section 179 expense election for "off-the-shelf" computer software, different from federal provisions.

The depreciation method chosen doesn’t matter. The choice of depreciation method can significantly impact the amount deducted each year, and California offers guidance on which methods may be used based on property type and acquisition date.

Filing Form 3885 is optional if you’ve already done federal depreciation. Despite similarities in federal and state depreciation calculations, filing Form 3885 is necessary for California tax returns to adjust for differences between state and federal laws.

Correctly understanding and applying the rules of Form 3885 can greatly affect a corporation’s tax liabilities and benefits in California.

Key takeaways

Filling out and using the California Form 3885, dealing with Corporation Depreciation and Amortization, requires a careful understanding of both the specifics of this form and the broader tax regulations it interacts with. Here are key takeaways:

- The form is used to calculate and report depreciation and amortization deductions for corporations, including partnerships and limited liability companies (LLCs) treated as corporations in California. S corporations should use Schedule B (100S) instead.

- It attaches to Form 100 or Form 100W and is critical for entities looking to deduct the cost or other basis of business or income-producing property over its useful life.

- Significant federal and California law differences may affect depreciation and amortization calculations. While there is conformity in several areas, such as the definition and treatment of SUVs and the election to expense certain property under IRC Section 179, key divergences remain. For example, California does not conform to the enhanced IRC Section 179 expensing election for assets placed in service in specified years.

- For IRC Section 179 properties, the election to expense is limited to $25,000, with a phase-out threshold starting at $200,000 in total property placed in service. This deduction cannot exceed the corporation's business income.

- Amortization rules under California law generally align with federal guidelines for assets defined under IRC Section 197, with amortization spread evenly over 15 years for qualifying intangible assets. However, certain assets, including those related to pollution control or smart meters, may be governed by specific state provisions.

- The form details specific calculation methods for both depreciation (including Straight-Line, Declining Balance, Sum-of-the-Years-Digits, and other consistent methods as allowed under California law) and amortization (focusing on assets with an ascertainable value diminishing over time).

- Depreciation methods and periods of depreciation for various types of property are outlined, with hints provided for determining reasonable periods of useful life in alignment with federal guidelines where California conforms. These include guidelines for office furniture, computers, transportation equipment, and buildings, among others.

When completing this form, it's crucial for corporations to carefully follow the instructions and ensure proper calculation of depreciation and amortization deductions, considering the specifics of their assets and operations. Missteps can lead to discrepancies and potential issues with tax filings, emphasizing the value of detailed attention and, if necessary, professional guidance in navigating these requirements.

Discover More PDFs

Ftb 3588 - Form 3581 aids taxpayers in California with the reallocation of their tax deposits, ensuring their money is where they need it most.

California Fl 145 - Provides a structured yet flexible framework for the interrogation process, accommodating the unique aspects of each family law case.

Ca Dmv Address Change - Navigate your professional responsibilities with ease by keeping your address current, avoiding any misdirected official correspondence.