Blank California 3832 PDF Form

Managing tax obligations for limited liability companies (LLCs) with nonresident members in California involves navigating through specific legal requirements, one of which includes the completion of California Form 3832, known officially as "Limited Liability Company Nonresident Members' Consent." This critical document serves as a bridge for LLCs to comply with state tax regulations, ensuring that nonresident members consent to California's jurisdiction over their distributable income generated within the state. Form 3832, required to be attached to Form 568 and distributed among nonresident members, plays a pivotal role in tax administration by listing nonresident members and obtaining their agreement to be taxed by California on their income from state sources. Furthermore, the form highlights the conditions under which nonresident members must file a California tax return, emphasizing the significance of their consent for correct tax processing and avoiding penalties for the LLC and its members. Given the complexities of state tax regulations, understanding the nuances of Form 3832 underscores the importance of meticulous tax planning and compliance for LLCs operating with a nonresident membership structure.

Document Preview Example

TAXABLE YEAR |

Limited Liability Company Nonresident |

|

|

CALIFORNIA FORM |

|

|

|

|

|

||

2012 |

3832 |

||||

Members’ Consent |

|||||

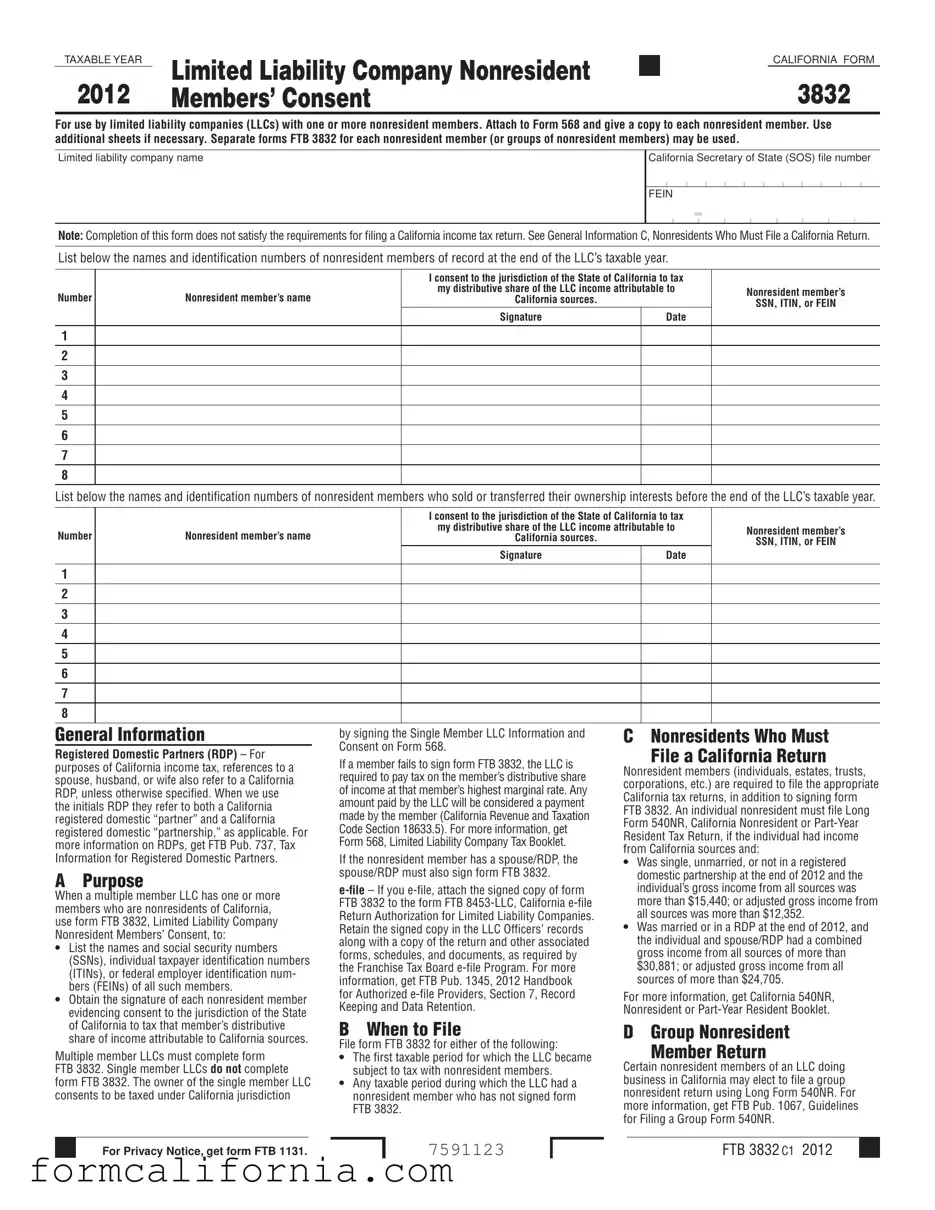

For use by limited liability companies (LLCs) with one or more nonresident members. Attach to Form 568 and give a copy to each nonresident member. Use additional sheets if necessary. Separate forms FTB 3832 for each nonresident member (or groups of nonresident members) may be used.

Limited liability company name

California Secretary of State (SOS) file number

FEIN

-

Note: Completion of this form does not satisfy the requirements for filing a California income tax return. See General Information C, Nonresidents Who Must File a California Return.

List below the names and identification numbers of nonresident members of record at the end of the LLC’s taxable year.

Number

1

2

3

4

5

6

7

8

Nonresident member’s name

I consent to the jurisdiction of the State of California to tax

my distributive share of the LLC income attributable to

California sources.

Signature |

Date |

|

|

Nonresident member’s

SSN, ITIN, or FEIN

List below the names and identification numbers of nonresident members who sold or transferred their ownership interests before the end of the LLC’s taxable year.

|

|

I consent to the jurisdiction of the State of California to tax |

|

|

Number |

Nonresident member’s name |

my distributive share of the LLC income attributable to |

Nonresident member’s |

|

California sources. |

|

|||

|

SSN, ITIN, or FEIN |

|||

|

|

|

|

|

|

|

Signature |

Date |

|

|

|

|

|

|

1 |

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

General Information |

|

by signing the Single Member LLC Information and |

C |

Nonresidents Who Must |

|||||||

Registered Domestic Partners (RDP) – For |

Consent on Form 568. |

|

|

File a California Return |

|||||||

If a member fails to sign form FTB 3832, the LLC is |

|

|

|||||||||

purposes of California income tax, references to a |

Nonresident members (individuals, estates, trusts, |

||||||||||

required to pay tax on the member’s distributive share |

|||||||||||

spouse, husband, or wife also refer to a California |

|||||||||||

corporations, etc.) are required to file the appropriate |

|||||||||||

of income at that member’s highest marginal rate. Any |

|||||||||||

RDP, unless otherwise specified. When we use |

|||||||||||

California tax returns, in addition to signing form |

|||||||||||

amount paid by the LLC will be considered a payment |

|||||||||||

the initials RDP they refer to both a California |

|||||||||||

FTB 3832. An individual nonresident must file Long |

|||||||||||

made by the member (California Revenue and Taxation |

|||||||||||

registered domestic “partner” and a California |

|||||||||||

Form 540NR, California Nonresident or |

|||||||||||

Code Section 18633.5). For more information, get |

|||||||||||

registered domestic “partnership,” as applicable. For |

|||||||||||

Resident Tax Return, if the individual had income |

|||||||||||

Form 568, Limited Liability Company Tax Booklet. |

|||||||||||

more information on RDPs, get FTB Pub. 737, Tax |

|||||||||||

from California sources and: |

|||||||||||

|

|

|

|||||||||

Information for Registered Domestic Partners. |

If the nonresident member has a spouse/RDP, the |

||||||||||

• Was single, unmarried, or not in a registered |

|||||||||||

A Purpose |

spouse/RDP must also sign form FTB 3832. |

|

|

domestic partnership at the end of 2012 and the |

|||||||

|

|

individual’s gross income from all sources was |

|||||||||

When a multiple member LLC has one or more |

|

|

|||||||||

FTB 3832 to the form FTB |

|

|

more than $15,440; or adjusted gross income from |

||||||||

members who are nonresidents of California, |

|

|

|||||||||

Return Authorization for Limited Liability Companies. |

|

|

all sources was more than $12,352. |

||||||||

use form FTB 3832, Limited Liability Company |

|

|

|||||||||

Retain the signed copy in the LLC Officers’ records |

• Was married or in a RDP at the end of 2012, and |

||||||||||

Nonresident Members’ Consent, to: |

|||||||||||

along with a copy of the return and other associated |

|

|

the individual and spouse/RDP had a combined |

||||||||

• List the names and social security numbers |

|

|

|||||||||

forms, schedules, and documents, as required by |

|

|

gross income from all sources of more than |

||||||||

(SSNs), individual taxpayer identification numbers |

|

|

|||||||||

the Franchise Tax Board |

|

|

$30,881; or adjusted gross income from all |

||||||||

(ITINs), or federal employer identification num- |

|

|

|||||||||

information, get FTB Pub. 1345, 2012 Handbook |

|

|

sources of more than $24,705. |

||||||||

bers (FEINs) of all such members. |

|

|

|||||||||

for Authorized |

For more information, get California 540NR, |

||||||||||

• Obtain the signature of each nonresident member |

|||||||||||

evidencing consent to the jurisdiction of the State |

Keeping and Data Retention. |

Nonresident or |

|||||||||

of California to tax that member’s distributive |

B When to File |

D |

Group Nonresident |

||||||||

share of income attributable to California sources. |

|||||||||||

File form FTB 3832 for either of the following: |

|

|

Member Return |

||||||||

|

|

|

|

|

|

||||||

Multiple member LLCs must complete form |

• The first taxable period for which the LLC became |

|

|

||||||||

FTB 3832. Single member LLCs do not complete |

subject to tax with nonresident members. |

Certain nonresident members of an LLC doing |

|||||||||

form FTB 3832. The owner of the single member LLC |

• Any taxable period during which the LLC had a |

business in California may elect to file a group |

|||||||||

consents to be taxed under California jurisdiction |

nonresident member who has not signed form |

nonresident return using Long Form 540NR. For |

|||||||||

|

|

|

|

FTB 3832. |

more information, get FTB Pub. 1067, Guidelines |

||||||

|

|

|

|

for Filing a Group Form 540NR. |

|||||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

For Privacy Notice, get form FTB 1131. |

|

7591123 |

|

|

|

FTB 3832 C1 2012 |

|

|||

Document Specs

| Fact | Detail |

|---|---|

| Purpose | Form 3832 is used by LLCs with nonresident members to obtain consent for California to tax their distributive share of income. |

| Attachments | It must be attached to Form 568 and provided to each nonresident member. |

| Requirement for Nonresident Members | Nonresident members must file appropriate California tax returns in addition to signing Form 3832. |

| Consequences of Non-compliance | If a nonresident member fails to sign, the LLC must pay the tax on the member’s behalf at their highest marginal rate. |

| Governing Law | California Revenue and Taxation Code Section 18633.5 governs the consent requirement and implications of Form 3832. |

Detailed Instructions for Writing California 3832

Filling out California Form 3832 is a critical step for Limited Liability Companies (LLCs) operating with nonresident members in the Golden State. This document, vital for tax compliance, acts as a consent form for nonresident members, agreeing to the state's jurisdiction over their share of the LLC's income sourced in California. It’s an attachment to Form 568, alongside which it should be filed, ensuring that each nonresident member’s consent is officially documented. Let’s navigate through the filling process to make sure all necessary steps are followed accurately.

- Start by writing the taxable year at the top of the form to specify the financial year this consent covers.

- Enter the Limited Liability Company name as officially registered.

- Fill in the California Secretary of State (SOS) file number, ensuring accuracy as it's a crucial identifier.

- Provide the company's Federal Employer Identification Number (FEIN) in the designated space.

- Under the section asking for the names and identification numbers of nonresident members of record at the end of the taxable year, list all pertinent details. This includes the nonresident member's name and their Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or FEIN, accordingly. If the space provided is insufficient, attach additional sheets as necessary.

- Each nonresident member listed must sign and date the form to consent to California's jurisdiction over their distributive share of LLC income attributable to California sources. If a member is married or in a registered domestic partnership (RDP), their spouse or RDP must also sign.

- In the case that any nonresident member sold or transferred their ownership interest before the end of the LLC's taxable year, their information should be listed in the subsequent section. Include their name, identification number (SSN, ITIN, or FEIN), and have them sign and date the form as well.

- For additional consent and signature requirements, use separate forms for each nonresident member or groups of members, ensuring all involved parties’ consent is accurately recorded.

Once the form is filled out and signatures are collected, attach it to Form 568 before filing. Additionally, distribute copies to each nonresident member for their records. This form doesn’t negate the members' responsibility to file individual tax returns with the state, if applicable. Remember, this consent ensures compliance with California tax laws, reflecting the nonresident members' agreement to report and pay taxes on income earned within the state.

Things to Know About This Form

What is Form 3832 and who needs to use it?

Form 3832, also known as the Limited Liability Company Nonresident Members’ Consent form, is a document required by the state of California for limited liability companies (LLCs) that have one or more nonresident members. This form is necessary for such LLCs to comply with state tax regulations. It serves to list the nonresident members of the LLC and obtain their consent to be taxed by California on their distributive share of income from California sources. It must be attached to Form 568 and a copy given to each nonresident member.

When should Form 3832 be filed?

Form 3832 should be filed in two scenarios:

- The first taxable period for which the LLC became subject to California tax with nonresident members.

- Any taxable period during which the LLC had new nonresident members who have not previously signed Form 3832.

What happens if a nonresident member refuses to sign Form 3832?

If a nonresident member fails to sign Form 3832, the LLC is required to pay tax on the member’s distributive share of income at that member’s highest marginal rate. Any amount paid by the LLC on behalf of the member is considered as a payment made by the member, as specified by California Revenue and Taxation Code Section 18633.5.

Can Form 3832 be filed electronically?

Yes, Form 3832 can be filed electronically as part of the e-file process for Form 568. When e-filing, the signed copy of Form 3832 should be attached to the Form FTB 8453-LLC, California e-file Return Authorization for Limited Liability Companies. The LLC should retain the signed copy in their records along with a copy of the return and other relevant documents as required by the Franchise Tax Board e-file Program.

Do nonresident members need to file individual California tax returns?

Yes, nonresident members are required to file their own California tax returns, in addition to the LLC filing Form 3832. The type of tax return a nonresident member must file depends on their individual circumstances, such as their total income and residency status for the tax year. Generally, nonresidents who have income from California sources must file a California Nonresident or Part-Year Resident Tax Return (Form 540NR).

What are the consequences for the LLC if it fails to obtain and file Form 3832?

If the LLC fails to obtain and file Form 3832 for its nonresident members, the state of California may impose penalties and interest on the LLC for failing to comply with state tax filing requirements. Additionally, the LLC may be held responsible for paying taxes on behalf of the noncompliant members at their highest marginal tax rate, leading to potential financial liabilities for the LLC.

Common mistakes

One common error is not attaching the form to the Form 568, as required. This attachment is crucial since it reflects the consent of all nonresident members of the LLC and failing to attach it could result in incomplete submission.

Another mistake involves not providing a copy of California Form 3832 to each nonresident member. It's essential for maintaining transparency and ensuring all members are aware of their tax obligations in California.

People often forget to use additional sheets when necessary. The form is designed to include all nonresident members, and overlooking the need for extra space can lead to omission errors.

Failing to complete separate forms for each nonresident member (or groups of nonresident members) is a frequent oversight. This ensures clear and accountable records for both the LLC and the members involved.

Incorrectly listing the names and identification numbers of nonresident members or providing incomplete information can lead to processing delays. Accuracy in this section is paramount.

Not obtaining the signature of a nonresident member or their spouse/RDP when required can invalidate the consent. Each signature is a legal acknowledgement of the tax obligations to the state of California.

Many neglect the requirement for the nonresident member's spouse/RDP to also sign the form when applicable. This oversight can lead to issues with the form's acceptance by tax authorities.

Omitting to keep a signed copy in the LLC’s records as stipulated for those who e-file. Retaining these records is necessary for compliance and future reference.

Underestimating the importance of the Privacy Notice and not obtaining form FTB 1131 for detailed privacy information. Being aware of privacy policies is crucial in handling personal information appropriately.

Finally, a significant error is misunderstanding that completion of Form 3832 does not suffice for filing a California income tax return. All nonresident members must also file the appropriate California tax returns, in addition to signing Form 3832.

Documents used along the form

When it comes to managing the intricacies of tax and consent forms for limited liability companies (LLCs) with nonresident members in California, the Form 3832 is a critical document. This form stands as one of the many necessary documents to ensure compliance with state tax obligations. Alongside Form 3832, there are several other documents that often play a crucial role in the tax filing and organizational processes for LLCs in California. These documents serve various purposes, from tax reporting to detailing the operations of the LLC.

- Form 568: This is the Limited Liability Company Return of Income. It provides a comprehensive report of the LLC's income, deductions, and tax liability for the year. Form 3832 is attached to Form 568 to indicate nonresident members' consent.

- Form 540NR: The California Nonresident or Part-Year Resident Income Tax Return. Nonresident members of the LLC need to file this form to report their California-sourced income and calculate their California tax liability.

- Form 8453-LLC: California e-file Return Authorization for Limited Liability Companies. If filing electronically, this form authorizes the e-file and confirms the authenticity of the electronic submission.

- Form 1065: U.S. Return of Partnership Income. While this is a federal form, it's essential for LLCs classified as partnerships for tax purposes. It details the income, gains, losses, deductions, credits, etc., of the partnership.

- Schedule K-1 (Form 1065): This schedule is part of Form 1065. It outlines each partner's share of the partnership's income, deductions, credits, etc., which they need to report on their individual tax returns.

- Operating Agreement: Though not a form, the operating agreement is a crucial document for any LLC. It outlines the LLC's financial and functional decisions including rules, regulations, and provisions for the business's operation.

- Articles of Organization (Form LLC-1): Required for the formation of an LLC in California. It officially registers the LLC with the California Secretary of State.

- FTB Pub. 1067: Guidelines for Filing a Group Form 540NR. This publication provides detailed instructions for certain LLC nonresident members looking to file a combined nonresident income tax return.

In sum, alongside Form 3832, these documents together create a suite of tools that help LLCs with nonresident members navigate their tax obligations, organizational structure, and operations within California. They support both compliance and organizational clarity for LLCs operating in this complex legal and financial landscape.

Similar forms

The California Form 540NR, which serves as the Nonresident or Part-Year Resident Income Tax Return, is notably similar to Form 3832 in its focus on nonresident individuals. While Form 3832 is specifically designed for LLCs with nonresident members, consenting to California's tax jurisdiction over their income, Form 540NR is geared towards individual nonresidents or those residing in California for only a part of the year. Both forms deal with the tax implications of income sourced from California and require detailed information about the taxpayer's income to appropriately assess tax obligations within the state.

Form 568, the Limited Liability Company Tax Booklet, parallels Form 3832 by catering to LLCs operating within California. It outlines the state tax filing requirements for all types of LLCs, emphasizing the need for nonresident members to consent to the state's jurisdiction via Form 3832. This requirement underscores the interconnectedness of these forms, as Form 568 provides the broader tax guidelines under which Form 3832 operates, ensuring that LLCs and their nonresident members understand and comply with California's tax regulations.

The California e-file Return Authorization for Limited Liability Companies, Form FTB 8453-LLC, shares a procedural connection with Form 3832. Both forms facilitate compliance with tax obligations in an electronic framework, with Form FTB 8453-LLC serving as the authorization for e-filing LLC tax returns. When used alongside Form 3832, it ensures that the electronic submission of LLC tax information, including the consent of nonresident members, is properly documented and authorized by the state.

Form FTB 1067, Guidelines for Filing a Group Form 540NR, complements Form 3832 by offering a collective filing option for nonresidents who are members of the same LLC or similar entity. It allows for the streamlined processing of tax obligations for groups of nonresidents, reducing individual filing burdens while ensuring that each member fulfills their tax duties to California. This form emphasizes the group aspect, while Form 3832 ensures individual nonresident members' consent to tax jurisdiction on their share of LLC income.

Form FTB 1345, the 2012 Handbook for Authorized e-file Providers, is instrumental for those navigating the electronic filing of tax documents including Form 3832. While it is designed as a comprehensive guide for e-file providers, ensuring conformity with California's digital submission requirements, it complements Form 3832 by outlining the procedural aspects of electronic submission. This ensures that the consent obtained via Form 3832 is properly recorded and retained in electronic tax filings.

FTB Publication 737, Tax Information for Registered Domestic Partners (RDPs), subtly connects to Form 3832 through its detailing of tax obligations for domestic partners in California. Although not a form, this publication informs RDPs about their state tax responsibilities, intersecting with Form 3832's domain when RDPs are members of an LLC. In scenarios where RDPs are involved, this publication clarifies how their unique status affects tax obligations, mirroring Form 3832’s role in delineating tax jurisdiction consent for nonresident LLC members.

Each of these documents plays a critical role in the infrastructure of California’s tax system for nonresident LLC members and similar entities. While varying in specifics, they collectively ensure compliance, clarify obligations, and facilitate the tax filing process within the state. Whether directly connecting through required consent forms or providing essential tax information and filing guidelines, they function in concert to uphold California's tax laws and regulations for nonresident businesses and individuals.

Dos and Don'ts

When completing the California Form 3832, it's important to approach the task with diligence and accuracy to ensure compliance with state requirements. Here are essential do's and don'ts to guide you through the process:

- Do ensure that each nonresident member’s name and their corresponding Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or Federal Employer Identification Number (FEIN) are correctly listed on the form.

- Do obtain the signature of each nonresident member, including any spouses or registered domestic partners if applicable, indicating their consent to be taxed by the State of California on any income attributable to California sources.

- Do attach Form 3832 to Form 568 and retain a copy for the LLC's records, ensuring that a copy is also provided to each nonresident member.

- Do not neglect the requirement to use additional sheets if the space provided on Form 3832 is insufficient to list all nonresident members or their information.

- Do not overlook the necessity for the spouse or registered domestic partner of a nonresident member to also sign the form, as their consent is equally required.

- Do not use Form 3832 for members who are not nonresidents; this form is specifically designed for nonresident members’ consent

Accuracy in completing the form not only complies with taxation laws but also prevents potential issues with the state’s taxation authority. Double-check each entry for accuracy and completeness to maintain the smooth operation of your business in California and protect the interests of its members.

Misconceptions

Misconceptions about the California Form 3832 often stem from a lack of understanding about its specific requirements and implications for limited liability companies (LLCs) and their nonresident members. Clearing up these misunderstandings is crucial for ensuring compliance with California's tax laws and avoiding potential penalties.

Form 3832 is only for multi-member LLCs: This is a common misconception. While it's true that Form 3832 is used by LLCs with nonresident members, it incorrectly implies that single-member LLCs are excluded. The reality is that a single-member LLC with a nonresident member who has income from California sources also needs to use this form to document the consent of the nonresident member to California's tax jurisdiction over their distributive share.

All nonresident members are aware of the need to sign Form 3832: Many LLCs assume that their nonresident members know they must sign Form 3832, but this is not always the case. It is the responsibility of the LLC to inform and ensure that each nonresident member signs the form to consent to California's taxation of their income from California sources.

Signing Form 3832 satisfies all filing requirements for nonresident members: Another misconception is that once a nonresident member signs Form 3832, no further action is required on their part. However, signing this form does not exempt them from the need to file a California tax return if they receive income from California sources that meets the state’s filing thresholds.

Form 3832 is the only form needed for LLC tax compliance in California: Some LLCs mistakenly believe that submitting Form 3832 with the required signatures of all nonresident members is all that’s needed for compliance. While it's a critical component, it’s just one part of the overall compliance with California tax law, including filing Form 568 and potentially other relevant tax documents.

Electronic signatures are acceptable for Form 3832: In the era of digital transactions, it's often assumed that electronic signatures are valid for all forms of documentation, including tax forms like FTB 3832. However, the California Franchise Tax Board requires a wet signature on this form, and if filing electronically, the signed form must be attached to Form 8453-LLC.

There are no consequences if a nonresident member refuses to sign Form 3832: Some LLCs may not realize the severity of a nonresident member's refusal to sign Form 3832. If a nonresident member does not consent to be taxed by California, the LLC is required to pay the tax on that member's distributive share at the highest marginal rate. This amount is then considered a payment made by the member.

A spouse's signature is not necessary if one signs: A misconception exists that if one spouse or registered domestic partner (RDP) is a nonresident member and signs Form 3832, the other does not need to. In fact, if the nonresident member has a spouse/RDP, both must sign the form to indicate their consent to California’s tax jurisdiction, ensuring full compliance.

Addressing these misconceptions promptly and effectively is essential for any LLC operating with nonresident members in California to ensure they meet all regulatory obligations and avoid potential penalties for non-compliance.

Key takeaways

Filling out and using the California Form 3832, Limited Liability Company Nonresident Members’ Consent, requires attention to detail and an understanding of the intent behind the form. The key takeaways include:

- The primary use of Form 3832 is to list the nonresident members of a Limited Liability Company (LLC) who consent to the jurisdiction of California for taxation of their distributive share of income from sources within the state. This form must be attached to Form 568 and distributed to each nonresident member.

- Each nonresident member, or their spouse/Registered Domestic Partner (RDP) if applicable, is required to sign the Form 3832 to indicate their consent to be taxed by California on their share of the LLC's income. If this consent is not given, the LLC is responsible for paying the tax on the member’s share at the highest marginal rate.

- It's important for LLCs with nonresident members to remember that completing and signing the Form 3832 does not exempt these members from the requirement to file the appropriate California tax returns. Nonresident members need to file their tax returns if they have income from California sources and meet certain income thresholds.

- Form 3832, along with any additional documentation required by the Franchise Tax Board, should be retained in the LLC’s records. If the LLC elects to e-file, a signed copy of Form 3832 must be attached to the Form FTB 8453-LLC, California e-file Return Authorization for Limited Liability Companies, thereby fulfilling e-file recordkeeping requirements.

Discover More PDFs

California 461 - The form is designed to aggregate contributions and expenditures for transparency in campaign finance.

Ca Court Forms Fillable - Used to seek information or actions from opposing counsel or parties, facilitating communication and negotiation in the case.

Ddq Meaning - A critical legal document in California, from a process server detailing their unsuccessful endeavors to serve legal documents, ensuring transparency in legal proceedings.