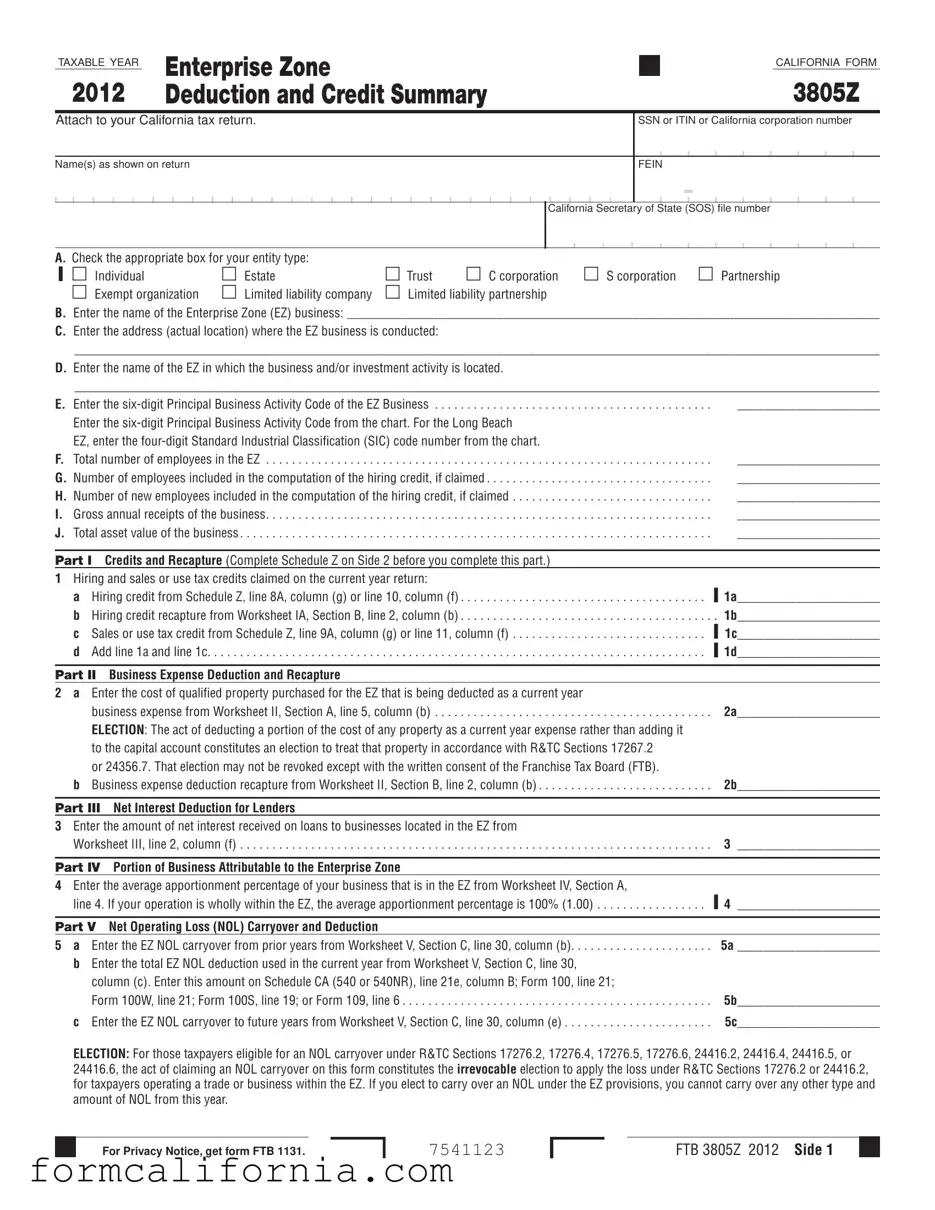

Blank California 3805Z PDF Form

The California 3805Z form, an integral document for businesses operating within designated Enterprise Zones (EZs), serves a critical role in the state's tax code by offering a structured way for entities to claim various deductions and credits aimed at fostering economic growth and job creation in underserved areas. Within this comprehensive form, businesses articulate their eligibility for a spectrum of tax incentives, including but not limited to hiring credits, sales or use tax credits, business expense deductions, net interest deductions for lenders, and intricate calculations related to Net Operating Loss (NOL) Carryover and Deduction. Specific sections of the form facilitate the detailed reporting of a business's engagement within the EZ, such as the number of employees contributing to the hiring credit claim, gross annual receipts, and total asset value. Moreover, the form makes provisions for entities to document their enterprise zone business’s name, location, and the principal business activity code, underlining the economic impact within the zone. Tailored to accomplish the dual goals of compliance and benefit maximization, the form demands careful attention to detail, ensuring businesses accurately capture the extent of their investment in EZs, thus leveraging the tax advantages designed to stimulate economic vitality in these areas.

Document Preview Example

TAXABLE YEAR |

Enterprise Zone |

|

|

CALIFORNIA FORM |

|

|

|

||

2012 |

Deduction and Credit Summary |

|

|

3805Z |

|

|

Attach to your California tax return.

SSN or ITIN or California corporation number

Name(s) as shown on return

FEIN

California Secretary of State (SOS) file number

A.Check the appropriate box for your entity type:

▐ Individual |

Estate |

Trust |

C corporation |

S corporation Partnership |

Exempt organization |

Limited liability company |

Limited liability partnership |

|

|

B.Enter the name of the Enterprise Zone (EZ) business: __________________________________________________________________________________

C.Enter the address (actual location) where the EZ business is conducted:

____________________________________________________________________________________________________________________________

D.Enter the name of the EZ in which the business and/or investment activity is located.

____________________________________________________________________________________________________________________________

E. Enter the |

______________________ |

|

|

Enter the |

|

|

EZ, enter the |

|

F. |

Total number of employees in the EZ |

______________________ |

G. |

Number of employees included in the computation of the hiring credit, if claimed |

______________________ |

H. |

Number of new employees included in the computation of the hiring credit, if claimed |

______________________ |

I. |

Gross annual receipts of the business |

______________________ |

J. |

Total asset value of the business |

______________________ |

Part I Credits and Recapture (Complete Schedule Z on Side 2 before you complete this part.)

1Hiring and sales or use tax credits claimed on the current year return:

a |

Hiring credit from Schedule Z, line 8A, column (g) or line 10, column (f) |

▐ 1a______________________ |

|

b |

Hiring credit recapture from Worksheet IA, Section B, line 2, column (b) |

.▐. |

1b______________________ |

c |

Sales or use tax credit from Schedule Z, line 9A, column (g) or line 11, column (f) |

1c______________________ |

|

d |

Add line 1a and line 1c |

▐ |

1d______________________ |

Part II Business Expense Deduction and Recapture

2 |

a Enter the cost of qualified property purchased for the EZ that is being deducted as a current year |

|

|

business expense from Worksheet II, Section A, line 5, column (b) |

2a______________________ |

|

ELECTION: The act of deducting a portion of the cost of any property as a current year expense rather than adding it |

|

|

to the capital account constitutes an election to treat that property in accordance with R&TC Sections 17267.2 |

|

|

or 24356.7. That election may not be revoked except with the written consent of the Franchise Tax Board (FTB). |

|

|

b Business expense deduction recapture from Worksheet II, Section B, line 2, column (b) |

2b______________________ |

|

|

|

Part III Net Interest Deduction for Lenders |

|

|

3 |

Enter the amount of net interest received on loans to businesses located in the EZ from |

|

|

Worksheet III, line 2, column (f) |

3 ______________________ |

Part IV Portion of Business Attributable to the Enterprise Zone

4Enter the average apportionment percentage of your business that is in the EZ from Worksheet IV, Section A,

line 4. If your operation is wholly within the EZ, the average apportionment percentage is 100% (1.00) |

▐ 4 ______________________ |

Part V Net Operating Loss (NOL) Carryover and Deduction |

|

5 a Enter the EZ NOL carryover from prior years from Worksheet V, Section C, line 30, column (b) |

. 5a ______________________ |

bEnter the total EZ NOL deduction used in the current year from Worksheet V, Section C, line 30, column (c). Enter this amount on Schedule CA (540 or 540NR), line 21e, column B; Form 100, line 21;

Form 100W, line 21; Form 100S, line 19; or Form 109, line 6 |

5b______________________ |

c Enter the EZ NOL carryover to future years from Worksheet V, Section C, line 30, column (e) |

5c______________________ |

ELECTION: For those taxpayers eligible for an NOL carryover under R&TC Sections 17276.2, 17276.4, 17276.5, 17276.6, 24416.2, 24416.4, 24416.5, or 24416.6, the act of claiming an NOL carryover on this form constitutes the irrevocable election to apply the loss under R&TC Sections 17276.2 or 24416.2, for taxpayers operating a trade or business within the EZ. If you elect to carry over an NOL under the EZ provisions, you cannot carry over any other type and amount of NOL from this year.

For Privacy Notice, get form FTB 1131.

7541123

FTB 3805Z 2012 Side 1

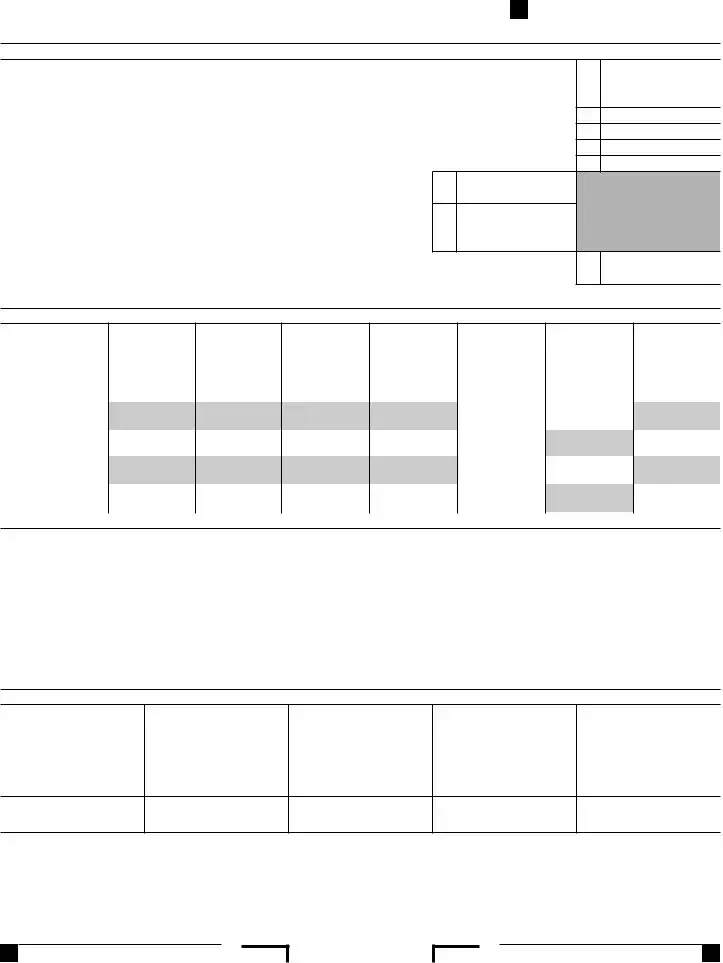

Schedule Z Computation of Credit Limitations – Enterprise Zones

Part I Computation of Credit Limitations. See instructions.

1Trade or business income. Individuals: Enter the amount from the Worksheet IV, Section C, line 14, column (c) on this line and on line 3 (skip line 2). See instructions. Corporations filing a combined report, enter the

|

taxpayer’s business income apportioned to California. See instructions for Part IV |

▐ |

1 |

2 |

Corporations: Enter the average apportionment percentage from Worksheet IV, Section A, line 4. See instructions |

. |

2 |

3 |

Multiply line 1 by line 2 |

. |

3 |

4 |

Enter the EZ NOL deduction from Worksheet V, Section C, line 30, column (c) |

. |

4 |

5 |

EZ taxable income. Subtract line 4 from line 3 |

▐ |

5 |

6a Compute the amount of tax due using the amount on line 5.

See instructions |

▐ 6a |

b Enter the amount of tax from Form 540, line 35; Long Form 540NR, line 42; |

|

Form 541, line 21; Form 100, line 24; Form 100W, line 24; Form 100S, line 22; |

|

or Form 109, line10. Corporations and S corporations, see instructions |

6b |

7Enter the smaller of line 6a or line 6b. This is the limitation based on the EZ business income.

Go to Part II, Part III, or Part IV. See instructions |

▐ 7 |

Part II Limitation of Credits for Corporations, Individuals, Estates, and Trusts. See instructions.

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

(g) |

(h) |

Credit |

Credit |

Total |

Total credit |

Total credit |

Limitation |

Credit used on |

Total credit |

name |

amount |

prior year |

assigned from |

sum of col. (b) |

based on |

Sch. P |

carryover |

|

|

carryover |

form FTB 3544 |

plus col. (c), |

EZ business |

Can never be |

col. (e) minus |

|

|

|

col. (g) |

minus col. (d) |

income |

greater than col. (e) |

col. (f) |

|

|

|

|

|

|

or col. (f) |

|

8 |

Hiring credit |

A |

|

|

|

|

▌ |

▌ |

|

|

|

|

|

|

|||||

B |

▌ |

▌ |

▌ |

▌ |

▌ |

▌ |

|||

|

|

||||||||

9 |

Sales or use |

A |

|

|

|

|

▌ |

▌ |

|

|

|

|

|

|

|||||

|

tax credit |

B |

▌ |

▌ |

▌ |

▌ |

▌ |

▌ |

|

|

|

Part III Limitation of Credits for S corporations Only. See instructions.

|

(a) |

(b) |

(c) |

(d) |

|

(e) |

|

(f) |

(g) |

|

Credit |

Credit |

S corporation |

Total |

|

Total credit |

|

Credit used |

Carryover |

|

name |

amount |

credit col. (b) |

prior year |

|

col. (c) |

|

this year by |

col. (e) minus |

|

|

|

multiplied by 1/3 |

carryover |

|

plus col. (d) |

|

S corporation |

col. (f) |

|

|

|

|

|

|

|

|

|

|

10 |

Hiring |

▌ |

▌ |

▌ |

▌ |

|

▌ |

|

▌ |

|

credit |

|

|

||||||

11 |

Sales or use |

▌ |

▌ |

▌ |

▌ |

|

▌ |

|

▌ |

|

tax credit |

|

|

Part IV Limitation of Credits for Corporations and S Corporations Subject to Paying Only the Minimum Franchise Tax. See instructions.

(a) |

(b) |

(c) |

(d) |

(e) |

Credit |

Credit |

Total prior |

Total credit assigned |

Total credit carryover |

name |

amount |

year carryover |

from form FTB 3544 |

sum of col. (b) plus |

|

|

|

col. (g) |

col. (c), minus col. (d) |

|

|

|

|

|

12 Hiring credit |

▌ |

▌ |

▌ |

▌ |

|

13Sales or use

tax credit |

▌ |

▌ |

▌ |

▌ |

|

|

|

|

Refer to page 4 for information on how to claim deductions and credits.

Side 2 FTB 3805Z 2012

7542123

Document Specs

| Fact | Detail |

|---|---|

| Form Number | 3805Z |

| Title | Enterprise Zone Deduction and Credit Summary |

| Tax Year | 2012 |

| Purpose | Attach to your California tax return to claim deductions and credits related to business activities within an Enterprise Zone (EZ). |

| Sections Included | Credits and Recapture, Business Expense Deduction and Recapture, Net Interest Deduction for Lenders, Business Apportionment in EZ, Net Operating Loss Carryover and Deduction |

| Governing Law | California Revenue and Taxation Code (R&TC) Sections 17267.2, 24356.7 for business expense deductions and Sections 17276.2, 24416.2, among others, for NOL carryover. |

| Who Can File | Individual, Estate, Trust, C corporation, S corporation, Partnership, Exempt organization, Limited liability company, Limited liability partnership |

Detailed Instructions for Writing California 3805Z

Filling out the California Form 3805Z, the Deduction and Credit Summary, is a process that requires careful attention to detail. This document is essential for entities that are looking to claim various deductions and credits related to business activities within an Enterprise Zone (EZ). Below, you'll find clear, step-by-step guidance to help you complete the form accurately.

- Start by entering the taxpayer's Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or California corporation number in the designated space at the top of the form.

- Next, fill in the taxpayer's name(s) as shown on the tax return.

- Include the Federal Employer Identification Number (FEIN), if applicable.

- For California Secretary of State (SOS) file number, enter it in the space provided if this applies to your entity.

- In section A, check the box that corresponds to the entity type (e.g., Individual, C corporation, S corporation, etc.).

- In the space provided in section B, enter the name of the Enterprise Zone business.

- Section C requires the address where the EZ business is conducted; fill this in accordingly.

- For section D, enter the name of the Enterprise Zone where the business and/or investment activity is located.

- In section E, specify the six-digit Principal Business Activity Code of the EZ Business. If the business is in the Long Beach EZ, include the four-digit Standard Industrial Classification (SIC) code number instead.

- Fill in the total number of employees working in the EZ in section F.

- In sections G and H, provide the number of employees included in the computation of the hiring credit, specifying the number of new employees if applicable.

- Report the gross annual receipts of the business in section I.

- In section J, state the total asset value of the business.

- Complete Part I, Credits and Recapture, after finishing Schedule Z on Side 2, which will include detailed computations related to hiring and sales or use tax credits, among other details.

- For Parts II through V, refer to the corresponding worksheets for calculations related to business expense deductions, net interest deduction for lenders, portion of business attributable to the EZ, and net operating loss carryovers and deductions.

- Lastly, review the entire form to ensure accuracy and completeness before attaching it to your California tax return.

After the form is filled out, ensure all computations are correct and supporting documentation is ready, as this will support your claims and facilitate any potential review by tax authorities. California Form 3805Z is designed to encourage and support businesses operating within designated Enterprise Zones, providing valuable tax benefits that can significantly impact a business's tax liability. Proper completion and submission of this form are critical steps in securing these benefits.

Things to Know About This Form

What is the California 3805Z Form?

The California 3805Z Form, titled "Enterprise Zone Deduction and Credit Summary," is a document that businesses operating within designated Enterprise Zones (EZs) in California must complete and attach to their state tax return. This form enables qualifying businesses to claim various deductions and credits, including hiring credits, sales or use tax credits, and business expense deductions, all aimed at encouraging business investment and growth within these zones.

Who needs to fill out the Form 3805Z?

This form is necessary for a wide range of entities if they conduct business activities within an Enterprise Zone. Applicable entities include:

- Individuals

- Estate or trusts

- C corporations

- S corporations

- Partnerships

- Exempt organizations

- Limited liability companies

- Limited liability partnerships

How do you determine if your business is in an Enterprise Zone?

To determine if your business is located within an Enterprise Zone, you should start by checking the official list of designated zones provided by the California Department of Housing and Community Development (HCD). Each Enterprise Zone has specific geographic boundaries. Once you’ve identified a potential zone, verify the exact location of your business against the defined boundaries to ensure eligibility.

What kinds of credits and deductions can be claimed on the 3805Z Form?

Several types of credits and deductions can be claimed using the 3805Z Form, primarily focused on encouraging investment and employment within Enterprise Zones. These include:

- Hiring Credits - for hiring qualified employees within the zone.

- Sales or Use Tax Credits - for purchasing certain business property used within the zone.

- Business Expense Deductions - for qualifying property purchased for use within the zone.

- Net Operating Loss (NOL) Carryover and Deduction - for businesses operating at a loss within the zone.

Can you amend a previously filed 3805Z Form if you made an error?

Yes, if you made an error on a previously filed 3805Z Form, you have the option to amend your California tax return to correct it. This involves filling out the form again with the correct information and submitting it as part of your amended tax return. Keep in mind that there might be penalties or interest charges if the error resulted in underpaid taxes. It is always recommended to consult with a tax professional to ensure the amendment process is completed correctly.

Common mistakes

Filling out the California Form 3805Z, also known as the Deduction and Credit Summary for Enterprise Zones, can easily lead to mistakes if not done with careful attention to detail. To help navigate through this important document, let's go through some common missteps individuals often make. Avoiding these errors can streamline your tax filing process and ensure you're getting all the benefits you're entitled to.

- Not checking the correct box for the entity type in section A can lead to improper processing of the form.

- Failing to correctly enter the name of the Enterprise Zone (EZ) business or the address where the EZ business is conducted can invalidate your claim.

- Incorrectly entering the six-digit Principal Business Activity Code or using an outdated Standard Industrial Classification (SIC) code for the Long Beach EZ could result in the rejection or delay of your application.

- Overlooking to report the total number of employees or incorrectly counting the number of employees eligible for the hiring credit calculation.

- Miscalculating gross annual receipts or total asset value of the business, which could lead to discrepancies during an audit.

- Errors in the computation of credits and recapture in Part I due to misunderstood instructions or calculation mistakes.

- Not correctly entering the cost of qualified property purchased for the EZ, or the business expense deduction recapture, which affects your current year business expense deductions.

- Misunderstanding the election rules around Net Operating Loss (NOL) carryovers and deductions, possibly leading to forfeited tax advantages.

- Incorrectly reporting the net interest deduction for lenders, affecting Part III of the form.

- Errors in determining the portion of business attributable to the Enterprise Zone, potentially impacting the tax benefits received.

When working on the California Form 3805Z, it's crucial to have all relevant data at hand and to consult with a professional if any part of the form is unclear. This careful approach can help avoid the common pitfalls listed above and ensure that your filing accurately reflects your EZ business activities.

Documents used along the form

When businesses in California take advantage of the benefits associated with operating in an Enterprise Zone (EZ) by using Form 3805Z, several other forms and documents often come into play. These supporting documents are vital for accurately claiming deductions and credits, guiding businesses through the intricacies of the EZ program.

- Form 540 or 540NR (California Resident or Nonresident Tax Return): This is where individuals report their income, deductions, and credits to the California Franchise Tax Board. Form 3805Z credits and deductions are ultimately reported on these returns.

- Form 100 (California Corporation Franchise or Income Tax Return): Similar to Form 540/540NR for individuals, this form is for C corporations operating in California, where they report income, deductions, and credits, including those from EZ activities.

- Form 100S (California S Corporation Franchise or Income Tax Return): S Corporations use this form to report income and deductions. Form 3805Z credits that apply to S Corporations will also be reported here.

- Form 109 (California Exempt Organization Business Income Tax Return): Nonprofit and other exempt organizations that engage in business activities report income and claim applicable credits through this form.

- Schedule CA (540 or 540NR): This schedule is essential for adjusting federal income to California state income, a critical step before applying EZ benefits on individual tax returns.

- Worksheet IA (Hiring Credit Recapture): If an EZ credit needs to be recaptured due to specific circumstances, this worksheet helps calculate the amount that needs to be added back to taxable income.

- Worksheet II (Business Expense Deduction and Recapture): This worksheet helps businesses calculate the cost of qualified property purchased for use in an EZ that they can deduct as a current year business expense. It also calculates any recapture amount if applicable.

- Form FTB 3544 (Credit Assignment Form): This form is used by businesses to assign credits to other members within a combined reporting group, enabling them to maximize the utilization of available EZ credits.

Together, these forms and worksheets create a comprehensive toolkit for businesses to navigate the tax incentives offered to those operating within California's Enterprise Zones. Understanding and correctly utilizing each document ensures businesses can effectively claim their entitled benefits while maintaining compliance with state tax laws.

Similar forms

The California 3805Z form is closely related to other tax forms that facilitate the reporting of various tax credits and deductions across different jurisdictions and tax circumstances. Each of these forms plays a vital role in enabling taxpayers, whether individuals or businesses, to navigate the complexities of tax regulations, ensure compliance, and maximize their financial benefits under the law. The similarities between the 3805Z form and these other documents largely lie in their purpose, structure, and the kind of information they collect, though each is tailored to specific tax benefits or geographic regions.

First, the Federal Form 1040, the U.S. Individual Income Tax Return, shares commonalities with California's 3805Z, particularly in its function to compile various income sources, deductions, and credits to calculate the tax owed or refund due to an individual. While Form 1040 covers federal tax liabilities, the 3805Z is specific to California's tax incentives related to enterprise zones, highlighting how both serve as crucial end-of-year summaries for taxpayers.

Second, the California Form 540, the state’s individual income tax return, is similar to the 3805Z as it is the primary document used by California residents to report their income to the state taxation authorities. Both forms are integral to California’s tax regime, with Form 540 being broader in scope, while 3805Z deals specifically with enterprise zone credits and deductions.

Third, the Federal Form 3800, General Business Credit, parallels the 3805Z form in its collection and calculation of various business-specific tax credits. Form 3800 is used by businesses to compile credits from multiple sources at the federal level; contrastingly, form 3805Z consolidates credits within the niche of California enterprise zones, illustrating how both forms aid in reducing taxable income through different incentives.

Fourth, the California Form 3544, Election to Aggregate Credits, operates in tandem with the 3805Z by allowing businesses and individuals to manage and maximize state tax credits. While Form 3544 organizes the application of multiple credits across various parts of a business or multiple enterprises, Form 3805Z focuses on capturing the specifics of enterprise zone benefits, showcasing the interplay between broad credit management and specific tax incentive claims in California.

Fifth, another document that has parallels with the 3805Z form is the New York State Empire Zone Credits form. Though specific to New York, this form functions similarly by offering tax incentives for businesses and investments within designated Empire Zones. It underscores a common approach among states to stimulate economic development in targeted areas through tax benefits, reflecting the 3805Z's purpose within California’s landscape.

Sixth, the Texas Margin Tax Report, while distinct in its focus on Texas's franchise tax, shares the concept of incentivizing certain business activities through tax advantages. Like the 3805Z, it involves detailed reporting of business income and activities to calculate tax liabilities, indicating how different states enact specific forms to administer their unique tax incentive programs.

Seventh, the Federal Form 8826, Disabled Access Credit, is an example of a more targeted tax incentive document, similar to sections of the 3805Z form that focus on specific credits. This form allows businesses to claim credits for expenditures made to improve access for disabled individuals, highlighting the targeted nature of tax credits in addressing particular policy objectives.

Eighth, the Oregon Enterprise Zone Tax Credit form mirrors the 3805Z in offering incentives for investments and employment within designated enterprise zones. It showcases the similarities in objectives across state lines, where local governments utilize tax forms like these to foster economic growth in underserved regions, hence demonstrating a common framework for regional economic stimulation through tax policy.

Through these examples, it becomes evident that the California 3805Z form is part of a broader tapestry of tax documents across different levels of government, each designed to capture the nuances of various tax credits and deductions. While the specifics of each form may vary, their collective goal remains to encourage economic activities aligned with policy goals, whether through stimulating business investments, rewarding job creation, or facilitating targeted improvements, thereby reinforcing the importance of understanding and utilizing these forms effectively within the tax preparation process.

Dos and Don'ts

When approaching the task of filling out the California Form 3805Z, a Deduction and Credit Summary for Enterprise Zone businesses, certain practices should be adopted to ensure accuracy and compliance with the state's tax laws. Equally, some pitfalls must be avoided to prevent common errors. Below are four recommendations on what to do and not do when completing this form.

-

Do:

- Verify the Enterprise Zone (EZ) location and ensure your business qualifies for the specified credits and deductions. The EZ designation impacts eligibility and benefits, so it's essential to confirm this at the outset.

- Meticulously enter the six-digit Principal Business Activity Code accurately, as it directly relates to the specific nature of your business operations within the Enterprise Zone. For businesses in the Long Beach EZ, the four-digit Standard Industrial Classification (SIC) code is required.

- Accurately report the total number of employees working within the EZ (Part I, section G and H) to properly calculate the hiring credit, if claiming. This information is crucial for determining eligibility for certain tax incentives.

- Double-check all mathematical computations, especially in the Credits and Recapture section (Part I), and the Business Expense Deduction and Recapture (Part II). Mistakes in these calculations could significantly impact the tax benefits received.

-

Don't:

- Overlook the Election sections related to the Business Expense Deduction (Part II) and Net Operating Loss (NOL) Carryover and Deduction (Part V). Making these elections is a crucial decision that affects how certain costs and losses are treated for tax purposes.

- Forget to attach the form to your California tax return. The Form 3805Z is an attachment and not a standalone document; failing to include it with your tax return could delay processing or result in the forfeiture of eligible benefits.

- Leave any applicable sections blank, especially concerning Credit Limitations (Schedule Z) and the limitations for S corporations (Part III) if applicable. Incomplete information could lead to unnecessary delays or audits.

- Misinterpret the number of employees eligible for inclusion in the hiring credit computation (sections G and H) as this could lead to inaccurately claimed credits and possible penalties.

Misconceptions

Understanding the California Form 3805Z is crucial for taxpayers who wish to accurately claim deductions and credits related to enterprise zones. However, several misconceptions often lead to confusion and errors in filing. Addressing these misconceptions is essential for anyone looking to maximize their benefits under the California tax code while maintaining compliance.

Misconception #1: The Form 3805Z is only for large corporations.

This is not true. Various types of entities, including individuals, estates, trusts, partnerships, exempt organizations, and different kinds of corporations, can utilize Form 3805Z, provided they engage in qualified activities within an enterprise zone.

Misconception #2: Only employees working in the enterprise zone count for the hiring credit.

While the primary focus is on hiring individuals who work within an enterprise zone, the key eligibility criterion is hiring employees who meet certain qualifications, such as veterans or the long-term unemployed, who reside or work in the enterprise zone.

Misconception #3: You can claim credits and deductions for any business activity within an enterprise zone.

Only specific business activities qualify for credits and deductions under the enterprise zone program. Businesses need to ensure their principal activity aligns with the eligible codes outlined by the state.

Misconception #4: There's no limit to the amount of credit you can claim.

In reality, there are limitations and caps on the amount of credit a business can claim in a year. These limitations are determined based on the business's income and the specific calculations provided in the Form 3805Z instructions.

Misconception #5: The sales or use tax credit is available for all purchases made by a business.

The sales or use tax credit applies only to purchases of qualified property used within the enterprise zone. Not all purchases by a business qualify for this credit.

Misconception #6: Once you file Form 3805Z, you cannot amend it.

If mistakes are discovered after filing, taxpayers are allowed to amend their Form 3805Z to correct errors or claim overlooked deductions and credits, subject to certain statutory limitations and requirements.

Misconception #7: Filing Form 3805Z is voluntary if you qualify for credits.

While taxpayers might think filing this form is optional, submitting Form 3805Z is required for anyone wishing to claim the enterprise zone credits and deductions. Failing to do so could result in missing out on significant tax benefits.

Misconception #8: The enterprise zone credits are automatically applied to your taxes.

Taxpayers must actively claim these credits by accurately completing and attaching Form 3805Z to their California tax return. The process is not automatic, and proper documentation is essential for claiming these benefits.

Correcting these misunderstandings is vital for taxpayers aiming to benefit from the enterprise zone incentives effectively. It's recommended to consult with a tax advisor or the Franchise Tax Board directly for guidance tailored to specific situations.

Key takeaways

Filling out the California 3805Z form is significant for businesses operating within Enterprise Zones (EZ) to ensure they fully benefit from available state income tax incentives. Here are 10 key takeaways:

- The California 3805Z form is designated for businesses to summarize deductions and credits related to operating within an Enterprise Zone.

- Businesses of various types including individuals, estates, trusts, C corporations, S corporations, partnerships, exempt organizations, limited liability companies, and limited liability partnerships are eligible to file this form.

- It's critical to accurately indicate the Enterprise Zone in which the business and/or investment activity is located by entering its name and address on the form.

- Understanding and correctly entering the six-digit Principal Business Activity Code is necessary for the Long Beach EZ, with specific instructions to use the four-digit Standard Industrial Classification (SIC) code number.

- The form requires detailed information regarding employment within the EZ, including the total number of employees, how many are considered in hiring credit computations, and the number of new employees.

- Businesses must report gross annual receipts and the total asset value to provide a comprehensive overview of their operation within the EZ.

- Credits and recapture, including the hiring and sales or use tax credits claimed for the current year, must be carefully documented in Part I of the form.

- Eligibility for business expense deductions and recaptures related to qualified property purchases within the EZ is outlined, requiring precise documentation of costs and any applicable recapture amounts.

- Net interest deductions for lenders who extend credit to businesses within the EZ are acknowledged, emphasizing the importance of supporting local enterprise growth.

- The form also lays out guidelines for calculating and reporting the portion of business attributable to the Enterprise Zone, crucial for determining the apportionment and ensuring accurate tax benefits.

Correct and thorough completion of the California 3805Z form enables businesses to take full advantage of tax incentives offered within Enterprise Zones, supporting both the growth of the business and the economic development of these areas. Carefully reviewing instructions and potentially seeking professional advice when filling out this form can help avoid common pitfalls and maximize the benefits available.

Discover More PDFs

What Is Form 100 - Form 3540 facilitates California taxpayers in reporting and utilizing carryovers from certain repealed credits to lower tax liabilities.

Employee Policy Acknowledgement - This form is a testament to the procedural meticulousness required in legal document handling, emphasizing the significance of each step in the acknowledgment process.

How to Fill Out California State Tax Form - Adjusted gains or losses are considered for AMTI.