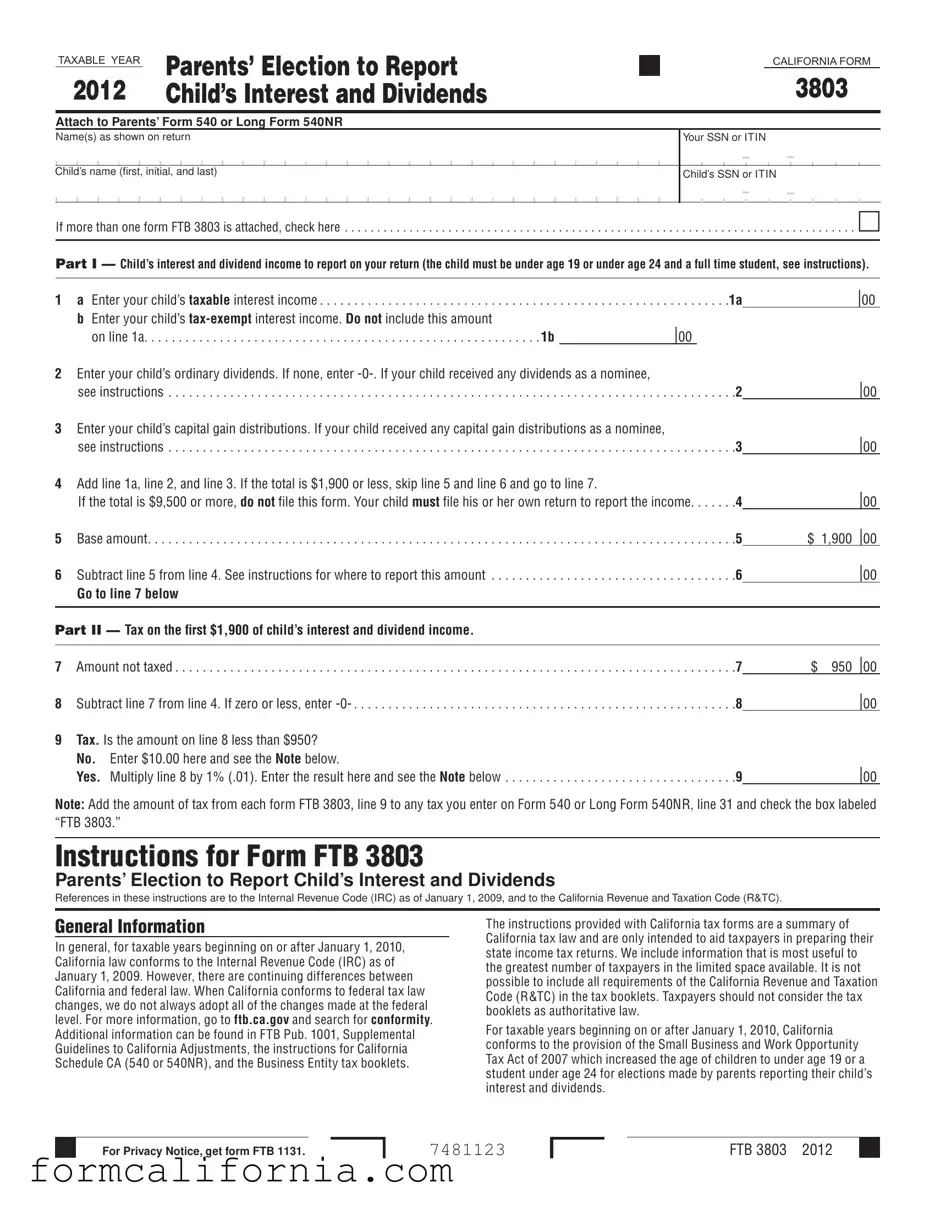

Blank California 3803 PDF Form

In California, the management of a child's financial assets, particularly when it comes to interest and dividends, can directly affect their tax obligations and those of their parents. The California 3803 form serves a crucial role in this context, allowing parents the option to include their child's income from these sources on their own tax returns, potentially simplifying the tax filing process and minimizing the need for the child to file a separate return. Specifically designed for the tax year 2012, this form is applicable under conditions where the child is either under 19 years of age or a full-time student under 24. It encapsulates various aspects of income, including taxable interest, tax-exempt interest, ordinary dividends, and capital gain distributions, with detailed instructions on how to accurately report and calculate these amounts. Additionally, this form touches on the nuanced differences between federal and state tax laws and how they apply to California residents, setting specific income thresholds and criteria for eligibility. It highlights the importance of understanding the interplay between parent and child tax liabilities and provides a structured approach to tax reporting that accommodates families' unique financial situations. Furthermore, the form 3803 also includes provisions related to Registered Domestic Partners (RDPs), thus acknowledging diverse familial structures and ensuring inclusivity in tax reporting practices.

Document Preview Example

TAXABLE YEAR |

Parents’ Election to Report |

|

|

CALIFORNIA FORM |

|

|

|

|

|

2012 |

Child’s Interest and Dividends |

3803 |

||

|

|

|

|

|

Attach to Parents’ Form 540 or Long Form 540NR

Name(s) as shown on return

Child’s name (first, initial, and last)

Your SSN or ITIN

Child’s SSN or ITIN

- -

If more than one form FTB 3803 is attached, check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part I — Child’s interest and dividend income to report on your return (the child must be under age 19 or under age 24 and a full time student, see instructions).

1 a Enter your child’s taxable interest income |

1a |

|00 |

bEnter your child’s

on line 1a |

1b |

|00 |

2Enter your child’s ordinary dividends. If none, enter

see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2

3Enter your child’s capital gain distributions. If your child received any capital gain distributions as a nominee,

see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3

4Add line 1a, line 2, and line 3. If the total is $1,900 or less, skip line 5 and line 6 and go to line 7.

If the total is $9,500 or more, do not file this form. Your child must file his or her own return to report the income. . . . . . .4

5 Base amount. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5

6 Subtract line 5 from line 4. See instructions for where to report this amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6

Go to line 7 below

|00

|00

|00

$1,900 |00 |00

Part II — Tax on the first $1,900 of child’s interest and dividend income.

7 |

Amount not taxed |

7 |

$ 950 |00 |

|

8 |

Subtract line 7 from line 4. If zero or less, enter |

8 |

|00 |

|

9 |

Tax. Is the amount on line 8 less than $950? |

|

|

|

|

No. |

Enter $10.00 here and see the Note below. |

|

|00 |

|

Yes. |

Multiply line 8 by 1% (.01). Enter the result here and see the Note below |

9 |

|

Note: Add the amount of tax from each form FTB 3803, line 9 to any tax you enter on Form 540 or Long Form 540NR, line 31 and check the box labeled “FTB 3803.”

Instructions for Form FTB 3803

Parents’ Election to Report Child’s Interest and Dividends

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and to the California Revenue and Taxation Code (R&TC).

General Information

In general, for taxable years beginning on or after January 1, 2010, California law conforms to the Internal Revenue Code (IRC) as of January 1, 2009. However, there are continuing differences between California and federal law. When California conforms to federal tax law changes, we do not always adopt all of the changes made at the federal level. For more information, go to ftb.ca.gov and search for conformity. Additional information can be found in FTB Pub. 1001, Supplemental Guidelines to California Adjustments, the instructions for California Schedule CA (540 or 540NR), and the Business Entity tax booklets.

The instructions provided with California tax forms are a summary of California tax law and are only intended to aid taxpayers in preparing their state income tax returns. We include information that is most useful to the greatest number of taxpayers in the limited space available. It is not possible to include all requirements of the California Revenue and Taxation Code (R&TC) in the tax booklets. Taxpayers should not consider the tax booklets as authoritative law.

For taxable years beginning on or after January 1, 2010, California conforms to the provision of the Small Business and Work Opportunity Tax Act of 2007 which increased the age of children to under age 19 or a student under age 24 for elections made by parents reporting their child’s interest and dividends.

For Privacy Notice, get form FTB 1131.

7481123

FTB 3803 2012

Registered Domestic Partners (RDP)

For purposes of California income tax, references to a spouse, husband, or wife also refer to a California RDP, unless otherwise specified.

When we use the initials RDP they refer to both a California registered domestic “partner” and a California registered domestic “partnership,” as applicable. For more information on RDPs, get FTB Pub. 737, Tax Information for Registered Domestic Partners.

A Purpose

Parents may elect to report their child’s income on their California income tax return by completing form FTB 3803, Parents’ Election to Report Child’s Interest and Dividends. If you make this election, the child will not have to file a return. You may report your child’s income on your California income tax return even if you do not do so on your federal income tax return. You may make this election if your child meets all of the following conditions:

•Was under age 19 or a student under age 24 at the end of 2012. A child born on January 1, 1994, is considered to be age 19 at the end of 2012. A child born on January 1, 1989, is considered to be age 24 at the end of 2012.

•Is required to file a 2012 income tax return.

•Had income only from interest and dividends.

•Had gross income for 2012 that was less than $9,500.

•Made no estimated tax payments for 2012.

•Did not have any overpayment of tax shown on his or her 2011 return applied to the 2012 estimated taxes.

•Had no state income tax withheld from his or her income (backup withholding).

As a parent, you must also qualify as explained in Section B.

B Parents Who Qualify to Make the Election

You qualify to make this election if you file Form 540, California Resident Income Tax Return, or Long Form 540NR, California Nonresident or Part- Year Resident Income Tax Return, and if any of the following applies to you:

•You and the child’s other parent were married to each other or in a registered domestic partnership and you file a joint return for 2012.

•You and the child’s other parent were married to each other or in a registered domestic partnership but you file separate returns for 2012 AND you had the higher taxable income. If you do not know if you had the higher taxable income, get federal Publication 929, Tax Rules for Children and Dependents.

•You were unmarried, treated as unmarried for state income tax purposes, or separated from the child’s other parent by a divorce, separate maintenance decree, or termination of a domestic partnership and you had custody of your child for most of the year (you were the custodial parent). If you were the custodial parent and you remarried or entered into another registered domestic partnership, you may make the election on a joint return with your new spouse/RDP (your child’s stepparent). But if you and your new spouse/RDP do not file a joint return, you qualify to make the election only if you had higher taxable income than your new spouse/RDP.

If you and the child’s other parent were not married or in a registered domestic partnership but you lived together during the year with the child, you qualify to make the election only if you are the parent with the higher taxable income.

If you elect to report your child’s income on your return, you may not reduce that income by any deductions that your child would be entitled to claim on his or her own return, such as the penalty on early withdrawal of child’s savings or any itemized deductions. For more information, get the instructions for federal Form 8814, Parents’ Election to Report Child’s Interest and Dividends.

C How to Make the Election

To make the election, complete and attach form FTB 3803 to your Form 540 or Long Form 540NR and file your return by the due date (including extensions).

File a separate form FTB 3803 for each child whose income you choose to report.

Specific Line Instructions

Use Part I to figure the amount of the child’s income to report on your return. Use Part II to figure any additional tax that must be added to your tax.

Name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Enter your name as shown on your tax return. If filing a joint return, include your spouse’s/RDP’s name but enter the SSN or ITIN of the person whose name is shown first on the return.

For more information about interest, dividends, and capital gain distributions taxable by California, get the instructions for Schedule CA (540), California Adjustments — Residents, or Schedule CA (540NR), California Adjustments — Nonresidents or

Part I Child’s Interest and Dividend Income to Report on Your Return

Line 1a

Enter all interest income taxable by California and received by your child in 2012. If, as a nominee, your child received interest that actually belongs to another person, write the amount and the initials “ND” (for “nominee distribution”) on the dotted line to the left of line 1a. Do not include amounts received by your child as a nominee in the total entered on line 1a.

If your child received Form

Line 1b

If your child received any interest income exempt from California tax, such as interest on United States savings bonds or California municipal bonds, enter the total

Line 2

Enter ordinary dividends received by your child in 2012. Ordinary dividends should be shown on Form

If your child received, as a nominee, ordinary dividends that actually belong to another person, enter the amount and the initials “ND” on the dotted line to the left of line 2. Do not include amounts received as a nominee in the total for line 2.

Line 3

Enter the capital gain distributions taxable by California and received by your child in 2012. Capital gain distributions should be shown on Form

Line 6

If the total amount on line 6 of all form(s) FTB 3803 is less than the total amount on line 6 of all your federal Form(s) 8814, enter the difference on Schedule CA (540 or 540NR), line 21f, column B and write “FTB 3803” on line 21f.

If the total amount on line 6 of all form(s) FTB 3803 is more than the total amount on line 6 of all your federal Form(s) 8814, enter the difference on Schedule CA (540 or 540NR), line 21f, column C and write “FTB 3803” on line 21f.

If you did not file federal Form 8814, enter the amount from form

FTB 3803, line 6, on Schedule CA (540 or 540NR), line 21f, column C and write “FTB 3803” on line 21f.

If your child received capital gain distributions (shown on Form

Part II Tax on the First $1,900 of Child’s Interest and Dividend Income

Line 9

Add the amount of tax from each form FTB 3803, line 9 to any tax you enter on Form 540 or Long Form 540NR, line 31 and check the box labeled “FTB 3803.”

Page 2 FTB 3803 2012

Document Specs

| Fact | Details |

|---|---|

| Form Number and Title | California Form 3803: Parents’ Election to Report Child’s Interest and Dividends |

| Purpose | To allow parents to report their child’s interest and dividend income on their own tax return, eliminating the need for the child to file a separate return. |

| Eligibility Criteria | The child must be under age 19, or under age 24 and a full-time student; and have income only from interest and dividends that is less than $9,500. |

| Governing Laws | California Revenue and Taxation Code (R&TC); aligns partially with the Internal Revenue Code (IRC) as of January 1, 2009, with specific adaptations for California. |

| Important Lines on the Form | Part I aggregates the child's interest, dividends, and capital gain distributions. Part II calculates the tax on the first $1,900 of the child’s income to be added to the parent's tax liability. |

Detailed Instructions for Writing California 3803

Filling out the California Form 3803, the Parents’ Election to Report Child’s Interest and Dividends, allows parents to report their child's income on their own tax returns. This could be a convenient option if your child is under age 19, or under age 24 and a full-time student, and meets other specific requirements. It's a way to streamline your tax filing process, but to do it correctly, you need to follow a series of steps. Here’s a breakdown of those steps.

- Name(s) as shown on return: Fill in your name(s) as it appears on your California tax return. If it’s a joint return, include both names but only the SSN or ITIN of the primary taxpayer.

- Child’s Name: Enter your child’s first name, initial, and last name.

- Your SSN or ITIN and Child’s SSN or ITIN: Provide both your Social Security Number (SSN) or Individual Tax Identification Number (ITIN) and that of your child.

- Check the box if more than one Form FTB 3803 is attached to your tax return.

- In Part I, Child’s interest and dividend income to report on your return:

- To enter your child's taxable interest income, fill in line 1a.

- For tax-exempt interest income, use line 1b. Remember, this amount shouldn't be included in line 1a.

- Input your child's ordinary dividends in line 2. If there are no dividends, enter "-0-".

- If your child received any capital gain distributions, report them on line 3.

- Add the total of lines 1a, line 2, and line 3 on line 4. Note that if this total is $1,900 or less, you can skip line 5 and line 6 and go directly to line 7.

- In Part II, Tax on the first $1,900 of child’s interest and dividend income:

- Enter the non-taxed amount ($950) on line 7.

- Subtract line 7 from line 4 and enter the result on line 8.

- Calculate the tax based on the instructions for line 9 and record your calculation.

- Combine the tax calculated on Form FTB 3803, line 9 with any tax on your Form 540 or Long Form 540NR, line 31. Make sure to check the box labeled "FTB 3803".

After you've filled out the form, attach it to your California Form 540 or Long Form 540NR when you file your return. This allows the income and any applicable taxes from your child's interest and dividends to be processed together with your return, simplifying your filing obligations. Remember, each child will require a separate Form FTB 3803 if you're reporting for more than one child.

Things to Know About This Form

What is the California Form 3803?

Form 3803, known as "Parents’ Election to Report Child’s Interest and Dividends," is a California tax form for parents who choose to report their child's interest and dividend income on their own tax returns instead of having the child file a separate return. This can be done if the child's income meets certain criteria and the parents qualify under specific conditions outlined by the state.

Who can file Form 3803?

Parents can file Form 3803 if their child was under age 19, or under age 24 and a full-time student, at the end of the tax year. The child must not be required to file their own return, should only have income from interest and dividends, and their income should be less than $9,500. Additionally, the child should not have made any estimated tax payments, had no income tax withheld, and not be subject to backup withholding.

What are the benefits of using Form 3803?

Filing Form 3803 can simplify your tax preparation by consolidating your child's interest and dividend income onto your own California income tax return. It can also potentially save money on tax preparation fees and reduce paperwork. However, parents should consider whether using this form is the most tax-efficient choice for their situation.

How do I qualify to make the election to file Form 3803?

To qualify, parents must file either Form 540 or Long Form 540NR and meet one of the following criteria: married and filing jointly, married filing separately with the higher taxable income, unmarried or treated as unmarried and had custody for most of the year, or were the parent with a higher taxable income if living together but not married or in a registered domestic partnership.

Can Form 3803 be filed if the child has other types of income?

No, Form 3803 can only be used if the child's income exclusively consists of interest and dividends. If the child has earned income from employment, capital gains, or any other sources, they must file their own tax return.

What are the income limits for filing Form 3803?

The child's gross income for the year must be less than $9,500 to qualify for reporting using Form 3803. If the child's income exceeds this amount, they will need to file their own tax return.

How is the tax calculated on the child’s income using Form 3803?

Form 3803 includes a calculation to determine the tax on the first $1,900 of the child's interest and dividend income. Part II of the form guides you through calculating any tax owed, which will then be added to the tax on the parents' return. If the child's income falls below a certain threshold, part or all of it may not be taxed.

What if I have more than one child with interest and dividend income?

You must file a separate Form 3803 for each child whose income you are reporting on your California tax return. Ensure you meet the qualification criteria for each child you are including.

Where do I attach Form 3803?

Form 3809 should be attached to your California Form 540 or Long Form 540NR when you file your state income tax return. This ensures that the child’s income is properly reported and taxed if applicable.

Can registered domestic partners (RDPs) file Form 3803?

Yes, references to a spouse in California tax forms also apply to a California Registered Domestic Partner (RDP), unless noted otherwise. Qualifying RDPs filing a joint return may elect to report their child’s interest and dividends on their return using Form 3803.

Common mistakes

Not confirming the child's age eligibility: To use Form 3803, children must be under age 19 or under age 24 if a full-time student by the end of the year. Filling out the form without checking these age criteria is a common mistake.

Incorrectly reporting interest and dividend income: Parents might mistakenly include their child's tax-exempt interest income on line 1a instead of line 1b, or forget to report nominee distributions correctly.

Overlooking capital gain distributions: Failing to report capital gain distributions on line 3, especially if received as a nominee, is another frequent oversight. This misstep can result in underreporting taxable income.

Entering the wrong social security numbers (SSNs) or individual taxpayer identification numbers (ITINs): Accurately entering both the parent's and child's SSN or ITIN is crucial for processing the form. Mistakes here can lead to processing delays.

Not attaching to the correct parent's tax return: If parents are filing separately, Form 3803 must be attached to the return of the parent with the higher taxable income, a detail often missed.

Failure to sign and date the form: Just like the main tax return, Form 3803 must be signed and dated. This step is sometimes overlooked, resulting in an incomplete submission.

Remember: Carefully reading the instructions and double-checking entries can prevent these common mistakes, ensuring accurate reporting of a child's interest and dividends on a parent's tax return.

Documents used along the form

When parents decide to use California Form 3803 to report their child's interest and dividends on their own tax returns, it may streamline the process of managing a minor’s financial responsibilities. However, to ensure full compliance with tax laws and regulations, there may be other forms and documents that are often used in conjunction with Form 3803. Understanding these documents can help parents navigate the process more effectively.

- Form 540/540NR: California Resident or Nonresident Income Tax Return. This is the primary state income tax form for individuals, to which Form 3803 is attached.

- Schedule CA (540): California Adjustments - Residents. This schedule is used to make adjustments to federally adjusted gross income and deductions based on California law.

- Form 1099-INT: Interest Income Statement. This document reports interest earned, which is necessary for completing Form 3803.

- Form 1099-DIV: Dividends and Distributions. This form reports dividend income and is used to complete Form 3803.

- Form 8814: Parents' Election to Report Child's Interest and Dividends on their own tax return for federal purposes. While not attached to the California return, it provides relevant information for completing Form 3803.

- Schedule D: Capital Gains and Losses. May be necessary if the child has received capital gain distributions that the parents need to report.

- Form 1099-OID: Original Issue Discount. This form reports interest income that may not be fully taxable and could influence the completion of Form 3803.

- Form W-2G: Certain Gambling Winnings. If a child has gambling winnings, they are not eligible for reporting on Form 3803 but could affect the parents' overall tax situation.

- Form 540-ES: Estimated Tax for Individuals. Parents who choose to include their child’s income may need to adjust their estimated tax payments accordingly.

- FTB Pub. 929: Tax Rules for Children and Dependents. While not a form, this publication provides detailed instructions and scenarios that can help in accurately completing Form 3803 and related tax documentation.

Each of these documents plays a crucial role in ensuring the accuracy and compliance of a tax return when electing to report a child's income on a parent’s return. Proper attention to detail and thorough documentation can prevent mistakes and potential issues with tax filings. As always, consulting a tax professional can provide personalized advice based on specific financial situations.

Similar forms

The California Form 540 is one document that shares similarities with the California Form 3803. Specifically, both forms deal with reporting income for tax purposes in the state of California, with Form 540 serving as the primary individual income tax return for state residents and Form 3803 allowing parents to report their child's interest and dividends on their own return. The use of Form 3803 is contingent upon attaching it to the Form 540 or Long Form 540NR, symbolizing their interlinked roles in the tax filing process.

Similar to the California Form 3803, the Federal Form 8814, "Parents’ Election to Report Child’s Interest and Dividends," serves a parallel purpose on the federal level. Parents use this form to report their child’s interest and dividends on their federal income tax return, which can simplify the filing process by eliminating the need for a separate tax return for the child. Both forms require the child's income to consist only of interest and dividends and impose income thresholds to qualify for this simplified reporting method.

The Long Form 540NR, "California Nonresident or Part-Year Resident Income Tax Return," is analogous to Form 3803 in that it is used by taxpayers to report income to the state of California. While Form 3803 focuses on a specific type of income (a child's interest and dividends) reported on a parent's return, Form 540NR addresses the broader income reporting requirements of individuals who are not full-year residents of California but still have income subject to California state tax.

Also related to Form 3803 is the Schedule CA (540), "California Adjustments – Residents," which is used alongside the California Form 540. This schedule allows taxpayers to adjust their federal adjusted gross income and deductions to account for differences between federal and state tax law. While Schedule CA (540) addresses adjustments to income and deductions more broadly, Form 3803 specifically adjusts a child’s interest and dividends to be reported on a parent's tax return, reflecting the nuanced differences between federal and state tax treatments.

Similarly, the Schedule D, "California Capital Gain or Loss Adjustment," is necessary when dealing with capital gains that might be reported on a child’s behalf via Form 3803, under specific circumstances. If a child receives capital gain distributions that are required to be reported on a parent's tax return and the parent also has other gains or losses to report, the Schedule D would be used in conjunction to ensure correct taxation of capital gains at the state level, demonstrating their interconnected tax reporting functionalities.

The federal Form 1040, "U.S. Individual Income Tax Return," while broadly focused on federal tax reporting, is conceptually related to Form 3803 in its facilitation of tax reporting for individuals, including options for parents to report their child's income. Both forms are integral to the respective tax systems they operate within, providing mechanisms for taxpayers to fulfill their reporting obligations while taking advantage of specific tax benefits or simplifications, such as reporting a child’s income on a parent’s return to potentially lower the overall tax obligation.

The FTB Publication 1001, "Supplemental Guidelines to California Adjustments," though not a form, is closely linked to the practical application of the California Form 3803. This publication offers additional guidance on the differences between California and federal tax law and helps taxpayers, including those using Form 3803, navigate the specifics of adjusting their income and deductions for California tax purposes. It provides essential context and support, aiding in the accurate completion of Form 3803 and related documentation.

Dos and Don'ts

When completing the California Form 3803, it's crucial to understand the do's and don'ts to ensure accuracy and compliance. Following are key points to keep in mind:

Do's:

Review the General Information section carefully to understand the eligibility criteria, especially the age and income requirements for the child.

Ensure all names and Social Security Numbers (SSN) or Individual Taxpayer Identification Numbers (ITIN) are entered accurately for both the parent(s) and the child.

Accurately report your child’s taxable interest income and ordinary dividends in Part I of the form, making sure not to overlook any potential sources of income.

Correctly calculate the tax on the first $1,900 of your child’s interest and dividend income in Part II, following the instructions provided.

Attach Form 3803 to your Form 540 or Long Form 540NR when filing your California income tax return.

Verify if you need to file a separate Form 3803 for each child whose income you elect to report on your return.

Don'ts:

Do not attempt to file Form 3803 if your child’s gross income exceeds the specified limit for the tax year or if they have income types other than interest and dividends.

Avoid making the election to report your child’s income on your return if any estimated tax payments were made or any tax overpayment from the previous year was applied to the current year for the child.

Do not include tax-exempt interest income in the total reported on Part I, line 1a; it should be reported separately on line 1b, if applicable.

Refrain from reducing the child’s income by any deductions that he or she would be entitled to on an individual return, such as the penalty on early withdrawal of savings.

Avoid inaccuracies by not overlooking the nominee distributions; report these properly as instructed.

Do not forget to consider differences between California and federal law when completing the form, especially if you are also filing a federal Form 8814.

Misconceptions

When it comes to tax forms and elections, it's easy to get tangled in myths and misunderstandings, especially with forms like the California 3803 form. Here are six common misconceptions about this form that need clarification:

- Only for federal returns: There’s a belief out there that the California 3803 form is a federal document. This form is actually a California-specific form used by parents to report their child’s interest and dividends on their state return.

- Any level of income can be reported: Some people think they can use Form 3803 for children with any amount of income. However, the child's interest and dividends must be less than $9,500 for the year to use this form.

- Mandatory for all parents: Another misconception is that all parents must fill out this form for their children. Filing the California 3803 form is actually an election, not a mandate. It’s an option for parents if the child’s income meets the criteria.

- Estimates and withholdings don't matter: There’s also a rumor that estimated tax payments or withholdings do not affect eligibility. The truth is, children who made estimated tax payments or had taxes withheld are not eligible to have their income reported on their parents' returns using this form.

- One form per family is enough: Some families believe they need to submit only one Form 3803, regardless of how many children they have. In practice, you need to complete and attach a separate Form 3803 for each child whose income you wish to report on your return.

- It simplifies tax for all children: There’s an assumption that Form 3803 is a boon for simplifying taxes for all children. Actually, it applies only to children who were under age 19—or under age 24 if a full-time student—at the end of the tax year and whose income falls within specific guidelines.

Understanding the actual requirements and limitations of the California 3803 form helps ensure that parents make the best use of this form for their situation. It’s about making informed choices that align with California’s tax laws to streamline your tax filing process.

Key takeaways

- The California Form 3803 allows parents to report their child's interest and dividends on their own tax return, avoiding the need for the child to file separately.

- To use Form 3803, the child must be under age 19, or under age 24 if a full-time student, at the end of the taxable year.

- Children’s income reported on Form 3803 must only come from interest and dividends, and their total gross income must be less than $9,500 for the year.

- If the child's total interest, dividends, and capital gain distributions are $1,900 or less, additional calculations for tax are skipped, simplifying the process.

- The form must be attached to the parents' Form 540 or Long Form 540NR when filed.

- Parents can elect to report their child’s income on their tax return even if they do not do so on their federal return, given all eligibility criteria are met.

- If electing to use Form 3803, no deductions that the child would qualify for on a separate return can be applied.

- To qualify to make the election, parents must file a Form 540 or Long Form 540NR and meet additional criteria regarding their filing status and income.

- Separate Form 3803 must be completed and attached for each child whose income parents choose to report.

- If the child received income as a nominee, meaning income that actually belongs to someone else, this must be indicated on the form and not included in total income calculations.

- Any difference between the child's income reported on federal Form 8814 and California Form 3803 must be reconciled on Schedule CA (540 or 540NR), taking into consideration California's specific adjustments and exemptions.

- The tax calculated on the first $1,900 of the child's interest and dividend income must be added to the parents' tax liability on Form 540 or Long Form 540NR, with a specific box checked to indicate the inclusion of Form 3803.

Discover More PDFs

Db-9 Connector Used for - For businesses without payroll in a given quarter, the DE 9 form ensures their ongoing compliance with state reporting requirements.

California Form 3800 - Parents' information, including SSN and filing status, is crucial for completing Form 3800 accurately.